TIDMBBH

RNS Number : 5758G

Bellevue Healthcare Trust PLC

20 July 2023

BELLEVUE HEALTHCARE TRUST PLC

LEGAL ENTITY IDENTIFIER ('LEI'): 213800HQ3J3H9YF2UI82

HALF-YEARLY REPORT

FOR THE SIX MONTHSED 31 MAY 2023

INVESTMENT OBJECTIVE

The investment objective of the Company is to provide

Shareholders with capital growth and income over the long term,

through investment in listed or quoted global healthcare companies.

The Company's specific return objectives are: (i) to beat the total

return of the MSCI World Healthcare Index ("Index") (in sterling)

on a rolling 3 year period (the index total return including

dividends reinvested on a net basis); and (ii) to seek to generate

a double-digit total shareholder return per annum over a rolling 3

year period.

FINANCIAL INFORMATION

As at 31 May As at 30 November

2023 2022

Net asset value ("NAV") per Ordinary Share

(cum income) 159.62p 171.16p

------------ -----------------

Ordinary Share price 147.40p 158.20p

------------ -----------------

Ordinary Share price discount to NAV1 -7.7% -7.6%

------------ -----------------

Ongoing charges ratio ("OCR")1 1.02% 1.04%

------------ -----------------

PERFORMANCE SUMMARY

% change 2,3 % change 2,3

For the six months ended 31 May 2023 2022

Share price total return per Ordinary

Share1 -4.9% -16.1%

------------ ------------

NAV total return per Ordinary Share1 -4.9% -17.3%

------------ ------------

MSCI World Healthcare Index total return

(GBP) -6.9% +4.5%

------------ ------------

1 These are Alternative Performance Measures.

2 Total returns in sterling for the six months period, including dividends reinvested.

3 Source: Bloomberg.

ALTERNATIVE PERFORMANCE MEASURES ('APMS')

The financial information and performance summary data

highlighted in the footnote to the above tables represent APMs of

the Company. Definitions of these APMs together with how these

measures have been calculated can be found in the Interim

Report.

CHAIRMAN'S STATEMENT

Dear Shareholders

This is the seventh semi-annual report of your Company.

In this post-Covid world, we face numerous challenges - many of

which are interlinked. Coming out of Covid we have seen a 'reset'

of global supply chains and a backlog of healthcare demand. The

shortage of workforce has been particularly acute in the healthcare

sector so the 'demand - supply' balance appears to be particularly

out of balance in this sector. The consequences of the invasion of

Ukraine include rising energy prices, rising fertiliser costs and

consequently rising food prices. This has perhaps exacerbated the

inflation we would have seen coming out of Covid - and the

healthcare sector has, in particular, faced increased wage costs.

Inevitably rising interest rates, as central banks seek to tame

demand and hence inflation, has impacted valuations.

Performance review

The Company's specific objective is to beat the benchmark and to

deliver double digit annual returns over a rolling three year

period. We have had what might be called a 'rocky ride' over the

last couple of years and in 2022, we clearly failed on both counts

(indeed I discussed this in our last Annual Report). Though the six

months to 31 May 2023 have seen performance beat the MSCI World

Healthcare Index, it is clearly far too early to extrapolate. The

table below provides more details, showing total returns on a

fiscal year basis.

(Fiscal year ends 2023

30 Nov) 2018 2019 2020 2021 2022 HY

Share price total

return 21.6% 6.9% 22.5% 11.4% (11.9%) (4.9%)

------ ----- ------ ------ -------- -------

NAV total return 24.0% 6.6% 24.6% 10.3% (4.1%) (4.9%)

------ ----- ------ ------ -------- -------

MSCI World Healthcare

Index total return 18.0% 8.1% 10.3% 15.8% 14.1% (6.9%)

------ ----- ------ ------ -------- -------

The Investment Manager's report provides discussion on the

contributors and detractors to performance.

As a reminder, the relatively concentrated portfolio comprises

innovative companies which the Investment Manager anticipates will

grow faster and hence generate superior returns over the longer

term because they deliver tangible benefits to patients and / or

healthcare systems. Nonetheless, adoption is never smooth, and

indeed the challenges I mention, at the beginning of this

statement, contribute to short-term unpredictability e.g. a

hospital short of workforce is going to be less likely to adopt new

technologies or innovations immediately. However, the same stresses

and strains which are impediments in the short term will ensure the

inevitability of change in the long term.

Dividends

In line with Company policy, for the financial year ending 30

November 2023, we will be paying two dividends (interim and final)

of 2.995p each in August 2023 and April 2024, again funded from our

distributable reserves.

Scrip dividends

In our Annual Report for the year ended 30 November 2022, I

mentioned that the Board was monitoring the cost-effectiveness of

the scrip programme.

We had proposed to continue it for this year, however analysis

shows falling take-up since we introduced the facility in 2019.

There are a variety of reasons for this - some of which are

structural in the UK e.g. many investors hold shares via aggregated

nominee accounts and not all such accounts allow individual

selection for scrip dividends. Currently we are trading at a

discount to NAV - since we fulfil the scrip via newly issued shares

at NAV, our current mechanism can lead to the situation where

investors would be better off receiving a cash dividend and then

buying shares in the market rather than receiving newly issued

shares at NAV.

Thus, reluctantly the Board has decided to suspend the scrip

dividend option for the time being. We appreciate that some

shareholders will be disappointed by this but given the low uptake

it is hard to justify the cost for the Company.

Gearing

As of 31 May 2023, the Company's net gearing was GBP8.0 million,

equivalent to 0.9% of the gross exposure. The low figure reflects

caution on the part of the Investment Manager relating to the US

Federal debt ceiling negotiations which were ongoing at the time;

the net gearing is likely to rise in H2 2023.

Discount and share buybacks

During the six months to 31 May 2023, our shares have traded at

an average of 6.6% discount to net asset value ('NAV'). Hence, we

commenced a share buyback programme which is managed at arm's

length by the Company's Broker using parameters set by the Board.

These parameters are regularly reviewed; the Board recognises the

benefits of a robust 'discount management' mechanism but also has

to be mindful of the current discounts in the wider investment

trust market, trading volumes and regulatory requirements.

We purchased 7,490,560 Ordinary Shares in the six months to 31

May 2023 and we anticipate continuing the discount management

programme. Our current shareholder authority (from the last AGM)

permits the Board to repurchase a maximum of 82,516,203 Ordinary

Shares.

Annual Redemption facility

In the Prospectus issued when the Company was first listed the

redemption facility was explained in great detail. The Directors

have absolute discretion to operate the annual redemption facility

which allows for three possible ways that the facility might

operate: matched bargains, from cash resources, or via a redemption

pool. The first two methods referred to allowed for the basis of

the redemption price to be by reference to the Dealing Value per

ordinary share.

In the first five years since inception the uptake for

redemptions was low and the Directors managed the facility by

"matched bargains" where any shares redeemed were matched with

buyers in the market by our Broker. In November 2022 however, we

saw a markedly higher uptake of the redemption facility (30,577,550

Ordinary Shares representing 5.21% of our share capital at that

time). In these circumstances the Directors managed the redemption

uptake using the cash resources and debt facilities available - all

of which were redeemed and cancelled by the Company.

Given current market conditions, and that we continue to trade

at a discount to NAV, were there to be material redemption

requests, the Directors may exercise the redemption pool

method.

Utilising this option sets the basis for the redemption price

that shareholders receive by reference to a separate Redemption

Pool. Were this to be exercised, the costs of establishing the pool

and liquidating proportions of the portfolio to fund the

redemptions would be directly ascribed to the Redemption Pool and

thus borne by shareholders wishing to redeem. Shareholders who wish

to understand this further are referred to the Prospectus published

in November 2016.

The Board has also considered the timeframe for operating the

Redemption process. It was prescribed in the Prospectus that

shareholders wishing to redeem had to finalise instructions to

redeem 20 business days prior to the Redemption Point. With the

Redemption Point of 30 November, the required date for shareholder

instruction is 2 November 2023. For practical reasons the Company

wishes to introduce a record date of 2 September 2023, shareholders

therefore have to be registered as owning Company shares by this

date.

The Directors, in their review on the Redemption requests will

act in the best interest of the Company and shareholders as a

whole.

This should have no practical impact on our long-standing

investors.

Outlook

Covid-19 had a profound impact on healthcare. As backlogs are

processed, and the focus of healthcare systems changes from crisis

management to more strategic issues it is likely that we will see

improved adoption of the products and technologies of the companies

the portfolio is invested in. Indeed, one might argue that the

pressures we have seen on healthcare systems makes this

inevitable.

Your Board remains fully supportive of the approach to

healthcare investing adopted by the Manager and considers that the

Portfolio is well positioned to benefit in the long term.

Randeep Grewal

Chairman

19 July 2023

INVESTMENT MANAGER'S REPORT

Macro environment

Few things irk the portfolio manager more than continued

recourse to superlatives when describing the macro backdrop

influencing the behaviour of the wider equity market. We can say

with some asperity that we are beyond bored with living in

'interesting times'. Nonetheless, we are compelled to record the

reality of another epoch that seems without precedent.

To recapitulate: calendar 2022 witnessed a combination of rising

interest rates and attendant concerns over both the availability

and affordability of credit. This, allied to perceptions that

primary and secondary equity raises will be challenged in these

market conditions, prompted investors to shy away from smaller

companies with negative operating cashflows or those that might

need additional funding on an 18-month+ view. Throughout this

period, sectoral sagacity was of limited value; it was a sub-sector

and macro-led market where 'big' was best and 'boring' was better

still.

Longer duration stories were heavily discounted at much higher

rates than would be imputed by base rate rises. This backdrop

proved very challenging for funds like ours with a bias to

small/mid-cap companies. It also led to a historical disconnect

between the valuations of SMID vs. Large/Meg-Cap companies.

The past six months offered little respite on the novelty front,

throwing a 'mini' US Regional banking crisis reminiscent of 2008/9

in March 2023 and an AI-driven technology mania that began in

November 2022, with many echoes of 1999/2000 on top of the

continuing geopolitical and macroeconomic uncertainties.

Depending on who you believe, AI will either usher in the

much-needed productivity boon that will allow us to overcome the

demographic burden of a rising dependency ratio or result in the

destruction of the human race. As with all these things, the

reality will be much less extreme and take much longer to come to

fruition than anyone currently wishes to speculate, but the market

loves a narrative.

The consequence of this new cocktail of market factors was the

rather unexpected outcome of an equity market that rose (MSCI World

Index sterling total return of +0.2% over the period in review and

the US S&P500 Index total return of -0.4%) as interest rates

rose and the Damoclean declivity of recession hung over the market.

The S&P500 eventually tipped into 'bull market' territory by

mid-June i.e. a rise of >20% from the recent low, which was in

October 2022, albeit via a rally driven predominantly by a handful

of AI-linked technology stocks.

On closer inspection, the remarkable thing about this period has

been the robustness of corporate earnings. Companies have managed

to pass on higher input costs to end customers, preserving profit

margins even as consumer sentiment and discretionary spending power

seemed to come under pressure. Aggregate S&P500 earnings

expectations for 2024-2025 have not fallen during this period, and

instead rose very modestly. Labour markets remain tight and the

cost of living crisis can seem ethereal in big financial centres,

surrounded as they are by packed bars and restaurants and bustling

airports.

The consumer seems indefatigable. As children of the 1970s, your

managers are minded to recall the Asterix comics of their youth

when thinking about current market sentiment. In those books, the

potion-powered and thus undefeatable Gauls have only one fear: that

the sky may fall on their heads tomorrow. But "tomorrow never

comes" urges their Chief, Vitalstatistix.

Investors remain worried that something is going to tip the

market into a sell-off and there are plenty of candidates to choose

from in today's uncertain geopolitical climate. That said, these

same investors aren't really that worried because these threats

don't feel tangible enough or close enough to pull further capital

away. As a consequence, we are living in an era of surprisingly low

volatility and little overall price direction (excluding the

relentless rise of Technology shares).

Even odder in a historical context was to see healthcare

materially underperform the wider market, during this period and

for it to do so to a degree not seen since that same 1999/2000

period despite precisely the sort of uncertain negative economic

backdrop that usually supports a positive relative performance for

a sector with inherent defensive characteristics.

Healthcare Performance review

As noted previously, the MSCI World Healthcare Index generated a

sterling total return of -6.9% over the period in review. The

reasons for this material underperformance have been much debated

by equity strategy types and the most compelling but wholly

unsatisfactory answer would appear to have been positioning:

healthcare was seen as less exciting than technology during this

period and was a source of capital to speculate (and we chose that

word deliberately and judiciously) on AI-linked stocks.

Coming back to fundamentals, it is worth noting that healthcare

has not seen any significant regulatory developments over the

period in review that would prompt a reconsideration of the

longer-term earnings power. It is also worth noting that the

healthcare sub-indices of the S&P500, NASDAQ and Russell 2000

series have outperformed their parent on earnings revisions for

2024-2025 period during our fiscal H1 23 period (which is as one

would expect during a period of negative economic developments

adversely impacting equities as a broad asset class). In addition

to being largely non-cyclical and non-discretionary, early 2023

finally saw the long-hoped for post-COVID 'return to normal'

regarding elective procedures and routine physician

appointments.

Accepting that healthcare did not "work" for investors in the

broadest sense over this period, what worked best within the

sector? The performance by sub-sector is summarised in Figure 1

below:

Figure 1: Performance by sub-sector for the period to 31 May

2023

Weighting Perf (USD) Perf (GBP)

--------- ----------

Dental 0.4% 36.8% 31.9%

Services 2.1% 8.6% 4.7%

Med-Tech 12.6% 6.3% 2.5%

Facilities 1.0% 6.1% 2.2%

Other HC 1.3% -1.9% -1.9%

Distributors 1.6% 0.7% -2.9%

Diversified Therapeutics 37.2% -1.1% -4.7%

Healthcare Technology 0.9% -2.0% -5.6%

Diagnostics 1.5% -2.2% -5.7%

Focused Therapeutics 8.4% -6.6% -9.9%

Tools 8.3% -12.5% -15.6%

Generics 0.4% -12.8% -15.9%

Conglomerate 11.9% -13.3% -16.4%

Managed Care 12.0% -14.4% -17.4%

Healthcare IT 0.6% -17.5% -20.5%

------------------------- --------- ---------- ----------

Index perf -4.3% -7.7%

------------------------- --------- ---------- ----------

This is not such an easy question to answer in a generalised

manner. Intuiting from the comment above regarding normalisation,

one might expect procedural volume beneficiaries to have fared best

(Med-Tech companies and Facilities, i.e. hospital operators) and

those who pay for these procedures (i.e. Managed Care, the US

insurers) to have fared worst. If you are going to hang on to some

healthcare exposure, you might have wanted those defensive

qualities, which applies most to Distributors, Diversified

Therapeutics and Conglomerates, but there is no clear picture

there. If one remains concerned about the impact of rising rates on

asset duration and funding opportunities, then one might eschew the

'biotechnology' companies (Focused Therapeutics) and those

companies providing services to them (Tools and Services), but

again the picture looks more complex than such a reductive,

simplistic top-down approach would suggest.

Dental remains the confounder. This is surely the most consumer

discretionary of all the healthcare sub-sectors and yet continues

to hang on to the material re-rating that it enjoyed at the turn of

the year.

The Diagnostics sector, long a favourite of ours on the basis of

its ability to transform the care paradigm has been a mixed bag,

with a significant dispersion of winners and losers due to a

disparate series of company-specific occurrences. Some of the

valuations currently on offer in this sub-sector are bewilderingly

low.

Trust Performance review

The Bellevue Healthcare strategy is centred around owning

companies that are operationally geared into the adoption of a

selected group of products, technologies and services that we

believe are critical to the evolution of the healthcare delivery

paradigm. Because our approach is 'bottom up' and focused around

this theme of healthcare change, we never expected it to deliver

correlated returns to the wider healthcare sector or the wider

equity market.

By virtue of their focused and innovative nature, the holdings

in the Company's portfolio tend to be more small/mid-cap than

large/mega-cap. This gives us a size factor profile that is the

inverse of the MSCI World Healthcare Index and this, independent of

company specific news flow, has been a significant negative drag on

performance through late 2021 to late 2022, as was discussed in the

interim and annual reports for the previous fiscal year.

As noted in the previous section, this was a challenging period

for the healthcare sector and, whilst we cannot report a positive

absolute development for the Company's net asset value ("NAV")

total return, which declined 4.9% over H1 2022 to 159.62p, this

represented a positive relative performance and glimmers of a more

constructive market dynamic were evident; one that leaves us more

optimistic for the second half of the year.

Although our strategy is unconstrained, we utilise the MSCI

World Healthcare Index in sterling as an internal comparator and

external reference point; its parent index is the MSCI World Index

and our preferred internal metric is rolling three-year annualised

performance, which is also presented in Figure 2 below:

Figure 2: Bellevue Healthcare Trust Financial Performance

Summary for the period to 31 May 2023

(All figures in GBP, to Six months Rolling three Since Inception

31 May 2023) year (ann.)

Return Diff. Return Diff. Return Diff.

(1) vs. Comparator (1) vs. Comparator (1) vs. Comparator

------- ---------------- ------- ---------------- ------- ----------------

Bellevue Healthcare Trust

NAV (inc. dividends from

capital) -4.9% +203bp +3.4% -330bp +94.2% -382bp

------- ---------------- ------- ---------------- ------- ----------------

Bellevue Healthcare Trust

Total Shareholder return -4.9% +207bp +0.7% -606bp +79.3% -1868bp

------- ---------------- ------- ---------------- ------- ----------------

MSCI World Healthcare (GBP)

- Comparator -6.9% n/a +6.7% n/a +98.0%

------- ---------------- ------- ---------------- ------- ----------------

MSCI World Index (GBP) +0.2% +714bp +14.3% +402bp +86.5% -1153bp

------- ---------------- ------- ---------------- ------- ----------------

FTSE All Share Index +0.1% +700bp +12.0% +340bp +39.6% -5843bp

------- ---------------- ------- ---------------- ------- ----------------

(1) Note - the stated total shareholder return assumes the

reinvestment of dividends.

Although we are pleased to report a positive relative

performance during the period, the rolling three-year and 'since

inception' performance highlights how much ground has been lost

since the H1 report for the 2021 fiscal year, when our 'since

inception' total return was 40.1% ahead of the MSCI comparator.

Indeed, it is fair to say that we are rather disappointed by the

overall performance, since we experienced an unexpected setback

around the 'mini' US Regional bank crisis that began with the

collapse of Silicon Valley Bank on 8 March 2023 and from which we

have yet to fully recover, despite there being no consequences for

any depositors nor any of our companies (none of whom held any

material amounts with the lender). The portfolio gave up almost

700bp of relative performance in those few days. The evolution of

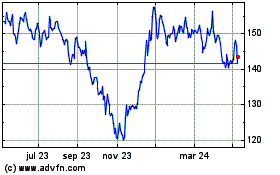

the NAV is illustrated in Figure 3 below.

Figure 3: Bellevue Healthcare Trust NAV evolution for the period

to 31 May 2023

We would offer two observations from the portfolio performance

during the first half of fiscal 2023. Firstly, the relative

performance versus the MSCI World Healthcare Index in the period

from 30 November 2022, to the beginning of the 'mini' banking

crisis on 6 March 2023 (+991bp) attests to the relative valuation

opportunity inherent in our portfolio.

Secondly, as we gradually move to more stable market conditions

with a flatter yield curve and cooling inflation, the 'quality

growth' characteristics of our portfolio companies should again

shine through. There are few places where one can be so confident

in the medium-to long-term demand outlook as healthcare.

P ortfolio evolution

The evolution of the portfolio over the period-in-review is

summarised in Figure 4 and reflects the impact of two major

considerations; firstly the normalisation of procedure volume

trends (positive for Med-Tech, more negative for Managed Care) and

secondly, a shift away from pharmaceuticals and biotechnology

(Diversified and Focused Therapeutics respectively) towards what we

saw as more compelling risk-adjusted returns in the Tools and

Healthcare IT sub-sectors. The total number of holdings has

declined from 29 positions to 28, with one addition and two

exits.

Figure 4: Bellevue Healthcare Trust Portfolio evolution for the

period to 31 May 2023

Subsectors Subsectors Change

end May end May

22 23

----------------------- ----------- ----------- ----------

Dental 0.7% 0.9% Increased

Diagnostics 11.9% 11.4% Decreased

Diversified

Therapeutics 8.1% 4.0% Decreased

Focused Therapeutics 24.5% 21.3% Decreased

Healthcare IT 4.9% 8.8% Increased

Healthcare Technology 3.5% 3.0% Decreased

Managed Care 9.8% 7.2% Decreased

Med-Tech 15.2% 18.8% Increased

Services 15.8% 14.9% Decreased

Tools 5.6% 9.6% Increased

----------------------- ----------- ----------- ----------

100.0% 100.0%

----------------------- ----------- ----------- ----------

Figure 5 : Market capitalisation Figure 6 : Geographical breakdown

breakdown (operational HQ)

Mega-Cap 12.6% Europe 0.9%

Large-Cap 14.1% Asia 2.6%

Mid-Cap 53.2% United States 96.5%

Small-Cap 20.1%

----------------------------------

Source: Bellevue Asset Management UK.

Data as of 31 May 2023

Mega Cap >$50bn, Large Cap >$10bn, Small-Cap <$2bn

Full investment portfolio as of 31 May 2023

% of

Company Sub-sector classification gross portfolio

----------------------- ------------------------- ----------------

1 EXACT SCIENCES Diagnostics 6.9

----------------------- ------------------------- ----------------

2 OPTION CARE HEALTH Services 6.1

----------------------- ------------------------- ----------------

3 AXONICS Med-Tech 5.7

----------------------- ------------------------- ----------------

4 INSMED Focused Therapeutics 5.6

----------------------- ------------------------- ----------------

5 PACIFIC BIOSCIENCES Tools 5.4

----------------------- ------------------------- ----------------

6 CHARLES RIVER Services 5.1

----------------------- ------------------------- ----------------

7 EVOLENT HEALTH Healthcare IT 5.1

----------------------- ------------------------- ----------------

8 APELLIS PHARMACEUTICALS Focused Therapeutics 4.5

----------------------- ------------------------- ----------------

9 BIO-RAD LABORATORIES Tools 4.3

----------------------- ------------------------- ----------------

10 UNITED HEALTH GROUP Managed Care 4.2

----------------------- ------------------------- ----------------

Total Top 10 52.9

----------------------- ------------------------- ----------------

11 JAZZ PHARMACEUTICALS Diversified Therapeutics 4.0

----------------------- ------------------------- ----------------

12 ACCOLADE Healthcare IT 3.8

----------------------- ------------------------- ----------------

13 OUTSET MEDICAL Med-Tech 3.7

----------------------- ------------------------- ----------------

14 AMEDISYS Services 3.7

----------------------- ------------------------- ----------------

15 SILK ROAD MEDICAL Med-Tech 3.5

----------------------- ------------------------- ----------------

16 AXSOME THERAPEUTICS Focused Therapeutics 3.3

----------------------- ------------------------- ----------------

17 TANDEM DIABETES CARE Health Tech 3.0

----------------------- ------------------------- ----------------

18 ELEVANCE HEALTH Managed Care 2.9

----------------------- ------------------------- ----------------

19 VERTEX PHARMACEUTICALS Focused Therapeutics 2.9

----------------------- ------------------------- ----------------

20 ATRICURE Med-Tech 2.8

----------------------- ------------------------- ----------------

21 INTUITIVE SURGICAL Med-Tech 2.5

----------------------- ------------------------- ----------------

22 CAREDX Diagnostics 2.4

----------------------- ------------------------- ----------------

23 SAREPTA THERAPEUTICS Focused Therapeutics 2.1

----------------------- ------------------------- ----------------

24 CASTLE BIOSCIENCES Diagnostics 2.1

----------------------- ------------------------- ----------------

25 HUTCHMED Focused Therapeutics 1.9

----------------------- ------------------------- ----------------

26 VERONA PHARMACEUTICALS Focused Therapeutics 1.0

----------------------- ------------------------- ----------------

27 STRAUMANN HOLDINGS Dental 0.9

----------------------- ------------------------- ----------------

28 VENUS MEDTECH Med-Tech 0.6

----------------------- ------------------------- ----------------

Total portfolio 100.0

----------------------- ------------------------- ----------------

Gross exposure GBP883.8 million

----------------------- ------------------------- ----------------

Net value of assets GBP876.1 million

----------------------- ------------------------- ----------------

Paul Major and Brett Darke

Bellevue Asset Management (UK) Ltd

19 July 2023

PORTFOLIO

TOP TEN HOLDINGS

% of net

As at 31 May 2023 asset value

------------------------- --------------

Exact Sciences 6.9

Option Care Health 6.2

Axonics 5.8

Insmed 5.6

Pacific Biosciences 5.4

Charles River 5.2

Evolent Health 5.1

Apellis Pharmaceuticals 4.5

Bio-Rad Laboratories 4.3

UnitedHealth Group 4.3

------------------------- --------------

Top ten holdings 53.3

Other holdings 47.6

Other net liabilities (0.9)

------------------------- --------------

Total 100.0

------------------------- --------------

SUB SECTOR EXPOSURE

% of net

Allocation as at 31 May 2023 asset value

------------------------------ -------------

Focused Therapeutics 21.4

Medical Technology 19.0

Services 15.0

Diagnostics 11.5

Tools 9.7

Healthcare IT 8.9

Managed Care 7.3

Diversified Therapeutics 4.0

Health Technology 3.0

Dental 0.9

Other net liabilities (0.9)

------------------------------ -------------

Total 100.0

------------------------------ -------------

INTERIM MANAGEMENT REPORT

The Directors are required to provide an Interim Management

Report in accordance with the Financial Conduct Authority ("FCA")

Disclosure Guidance and Transparency Rules ("DTR"). The Chairman's

Statement and the Investment Manager's Report in this half-yearly

report provide details of the important events which have occurred

during the period and their impact on the financial statements. The

following statements on principal and emerging risks and

uncertainties, related party transactions, going concern and the

Directors' Responsibility Statement, together constitute the

Interim Management Report of the Company for the six months ended

31 May 2023. The outlook for the Company for the remaining six

months of the year ending 30 November 2023 is discussed in the

Chairman's Statement and the Investment Manager's Report.

PRINCIPAL AND EMERGING RISKS AND UNCERTAINTIES

The Board is responsible for the management of risks faced by

the Company and delegates this role to the Audit and Risk Committee

(the "Committee"). The Committee carries out, at least annually, a

robust assessment of principal and emerging risks and uncertainties

and monitors the risks on an ongoing basis.

The Committee has a dynamic risk management programme in place

to help identify key risks in the business and oversee the

effectiveness of internal controls and processes. The principal

risks and uncertainties facing the Company are as follows:

-- Market risks, including risks associated with the economy, healthcare companies and sectoral diversification

-- Financial risks;

-- Corporate governance and internal control risks;

-- Regulatory risks;

-- Key person risk;

-- Business interruption;

-- Geopolitical risk and

-- ESG and climate change

A detailed explanation of the principal and emerging risks and

uncertainties facing the Company can be found in the Company's most

recent Annual Report and Accounts for the year ended 30 November

2022, which can be found on the Company's website at

www.bellevuehealthcaretrust.com

Since the publication of the 2022 Annual Report and Accounts on

6 March 2023, there continues to be increased risk levels within

the global economy. The ongoing conflict in Ukraine, the subsequent

impact on global economies, deteriorating international relations

and increasing levels of inflation worldwide have undoubtedly

raised investment risk. Rising interest rates and mismatches in

asset liability pricing have led to the failure of three US banks

and created fears of global contagion. The Board closely monitors

and assesses these continued uncertainties as to how they could

impact and effect the Company's trading position with regards our

investment objective, portfolio and thus our Shareholders and where

appropriate endeavour to mitigate the risk.

RELATED PARTY TRANSACTIONS

The Company's Investment Manager is Bellevue Asset Management

(UK) Ltd ('Bellevue UK'). In its role as Alternative Investment

Fund Manager ('AIFM') of the Company, Bellevue UK carry out

portfolio management services and risk management services are

delegated to Bellevue Asset Management AG.

Bellevue UK is considered a related party under the FCA's

Listing Rules. Bellevue UK is entitled to receive management fees

payable monthly in arrears calculated at the rate of one-twelfth of

0.95% (excluding VAT) per calendar month of the market

capitalisation of the Company. There is no performance fee payable

to Bellevue UK. Details of the Investment Manager's fees during the

six months ended 31 May 2023 can be found in the Condensed

Unaudited Statement of Comprehensive Income. There have been no

changes to the related party transactions that could have a

material effect on the financial position or performance of the

Company since the year ended 30 November 2022.

GOING CONCERN

The Board has a reasonable expectation that the Company has

adequate resources to continue in operational existence for at

least the following twelve-month period from the date of this

report. In reaching this conclusion, the Directors have considered

the liquidity of the Company's portfolio of investments as well as

its cash position, income and expense flows. The Company's net

assets as at 31 May 2023 were GBP 876.1 million (31 May 2022:

GBP881.5 million). As at 31 May 2023, the Company held GBP 883.8

million (31 May 2022: GBP987.3 million) in quoted investments and

had cash of GBP49.6million (31 May 2022: GBP15.7million). The total

expenses (excluding finance costs and taxation) for the six months

ended 31 May 2023 were GBP 4.6 million (31 May 2022: GBP5.4

million). As of 31 May 2023, the Company's net gearing was

GBP8.0million (31 May 2022: GBP110million), equivalent to 0.9% of

the gross exposure (31 May 2022: 12.5%).

As part of their assessment, the Board have fully considered and

assessed the Company's portfolio of investments, giving careful

consideration to the consequences for the Company of continuing

uncertainties in the global economy. The Russian invasion of

Ukraine created significant supply chain disruption and

exacerbating inflationary pressures worldwide. A prolonged and deep

stock market decline would lead to falling values in the Company's

investments or interruptions to cash flow. However, the Company

currently has more than sufficient liquidity available to meet any

future obligations.

STATEMENT OF DIRECTORS' RESPONSIBILITIES FOR THE HALF-YEARLY

REPORT

The Directors confirm to the best of their knowledge that:

-- The condensed set of interim financial statements contained

within the Half-yearly report has been prepared in accordance with

IAS 34 Interim Financial Reporting.

-- The interim management report includes a fair review of the

information required by 4.2.7R and 4.2.8R of the FCA's DTR.

Randeep Grewal

Chairman

19 July 2023

CONDENSED UNAUDITED STATEMENT

OF COMPREHENSIVE

INCOME

FOR THE SIX

MONTHSED

31

MAY 2023

Six months ended 31 May Six months ended 31 Year ended 30 November

2023 May 2022 2022*

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Losses on

investments - (42,408) (42,408) - (171,500) (171,500) - (19,980) (19,980)

Losses on

currency

movements - (451) (451) - (5,493) (5,493) - (9,839) (9,839)

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

Net

investment

losses - (42,859) (42,859) - (176,993) (176,993) - (29,819) (29,819)

Income 4 1,067 - 1,067 1,328 - 1,328 2,186 - 2,186

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

Total income 1,067 (42,859) (41,792) 1,328 (176,993) (175,665) 2,186 (29,819) (27,633)

Investment

management

fees (824) (3,297) (4,121) (961) (3,845) (4,806) (1,877) (7,510) (9,387)

Other

expenses (542) - (542) (553) - (553) (1,069) - (1,069)

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

Loss before finance

costs and

taxation (299) (46,156) (46,455) (186) (180,838) (181,024) (760) (37,329) (38,089)

Finance

costs 5 (408) (1,635) (2,043) (179) (717) (896) (610) (2,440) (3,050)

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

Operating

loss before

taxation (707) (47,791) (48,498) (365) (181,555) (181,920) (1,370) (39,769) (41,139)

Taxation 6 (85) - (85) (199) - (199) (285) - (285)

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

Loss for the

period/year (792) (47,791) (48,583) (564) (181,555) (182,119) (1,655) (39,769) (41,424)

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

Return per

Ordinary

Share 7 (0.14)p (8.63)p (8.77)p (0.10)p (31.52)p (31.62)p (0.28)p (6.84)p (7.12)p

------------- ----- -------- --------- --------- -------- ---------- ---------- --------- --------- ---------

*Audited

There is no other comprehensive income and therefore the 'Loss

for the period/year' is the total comprehensive income for the

period.

The total column of the above statement is the statement of

comprehensive income of the Company. The supplementary revenue and

capital columns, including the earnings per Ordinary Shares, are

prepared under guidance from the Association of Investment

Companies.

All revenue and capital items in the above statement derive from

continuing operations.

The notes are an integral part of these financial

statements.

CONDENSED UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2023

31 May 2023 31 May 2022 30 November 2022*

Note GBP'000 GBP'000 GBP'000

Non-current assets

Investments held at fair value through profit or loss 3 883,801 987,306 1,043,349

------------------------------------------------------ ---- ----------- ----------- -----------------

Current assets

Cash and cash equivalents 49,633 15,651 46,368

Sales for future settlement - 3,882 855

Other receivables 175 314 392

49,808 19,847 47,615

------------------------------------------------------ ---- ----------- ----------- -----------------

Total assets 933,609 1,007,153 1,090,964

------------------------------------------------------ ---- ----------- ----------- -----------------

Current liabilities

Purchases for future settlement - (5,680) (1,395)

Bank loans payable 5 (56,513) (118,864) (83,731)

Other payables (906) (1,130) (1,512)

------------------------------------------------------ ---- ----------- ----------- -----------------

Total liabilities (57,419) (125,674) (86,638)

------------------------------------------------------ ---- ----------- ----------- -----------------

Net assets 876,190 881,479 1,004,326

------------------------------------------------------ ---- ----------- ----------- -----------------

Equity

Share capital 8 5,577 5,873 5,881

Share premium account 617,709 616,249 617,371

Special distributable reserve - 46,913 28,347

Capital reserve 254,986 212,231 354,017

Revenue reserve (2,082) 213 (1,290)

------------------------------------------------------ ---- ----------- ----------- -----------------

Total equity 876,190 881,479 1,004,326

------------------------------------------------------ ---- ----------- ----------- -----------------

Net asset value per Ordinary share 9 159.62p 150.41p 171.16p

------------------------------------------------------ ---- ----------- ----------- -----------------

*Audited

Approved by the Board of Directors on and authorised for issue

on 19 July 2023 and signed on their behalf by:

Randeep Grewal

Chairman

Registered in England and Wales with registered number

10415235.

The notes are an integral part of these financial

statements.

CONDENSED UNAUDITED STATEMENT OF CHANGES IN

EQUITY

FOR THE SIX MONTHSED 31

MAY 2023

Share Special

Share premium distributable Capital Revenue

Notes Capital account reserve reserve reserve Total

------------------------------- ------ -------- --------- -------------- ---------- -------- ----------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------ -------- --------- -------------- ---------- -------- ----------

Opening balance

as at 01 December

2022 5,881 617,371 28,347 354,017 (1,290) 1,004,326

Loss for the period - - - (47,791) (792) (48,583)

Issue of Ordinary

Shares 8 2 340 - - - 342

Redemption of ordinary

shares 8 (306) - (10,491) (39,454) - (50,251)

Buybacks of ordinary

shares held in

treasury - - - (11,786) - (11,786)

Share issue, Buybacks

and Redemption costs - (2) (81) - - (83)

Dividend paid - - (17,775) - - (17,775)

Closing balance as at

31 May 2023 5,577 617,709 - 254,986 (2,082) 876,190

--------------------------------------- -------- --------- -------------- ---------- -------- ----------

FOR THE SIX MONTHSED 31

MAY 2022

Share Special

Share premium distributable Capital Revenue

Capital account reserve reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------ -------- --------- -------------- ---------- -------- ----------

Opening balance as

at 01 December 2021 5,602 568,910 64,392 393,786 777 1,033,467

Loss for the period - - - (181,555) (564) (182,119)

Issue of Ordinary

Shares 8 271 47,720 - - - 47,991

Ordinary Share issue

costs - (381) - - - (381)

Dividend paid - - (17,479) - (17,479)

Closing balance as at

31 May 2022 5,873 616,249 46,913 212,231 213 881,479

--------------------------------------- -------- --------- -------------- ---------- -------- ----------

FOR THE YEARED 30 NOVEMBER

2022 (Audited)

Share Special

Share premium distributable Capital Revenue

Capital account reserve reserve reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening balance as

at 01 December 2021 5,602 568,910 64,804 393,786 365 1,033,467

Loss for the year - - - (39,769) (1,655) (41,424)

Issue of Ordinary

Shares 8 279 48,887 - - - 49,166

Ordinary Share issue costs - (426) - - - (426)

Dividend paid - - (36,457) - - (36,457)

------------------------------- ------ -------- --------- -------------- ---------- -------- ----------

Closing balance as at

30 November 2022 5,881 617,371 28,347 354,017 (1,290) 1,004,326

--------------------------------------- -------- --------- -------------- ---------- -------- ----------

The Company's distributable reserves consist of the special distributable

reserve, capital reserve attributable to realised profit and revenue

reserve.

The Company can use its distributable reserves to fund dividends, redemptions

of Ordinary Shares and share buy backs.

The notes are an integral part of these financial statements.

CONDENSED UNAUDITED STATEMENT OF

CASH FLOWS

FOR THE SIX MONTHSED 31 MAY 2023

Six months Six months Year ended

ended 31 ended 31 30 November

May 2023 May 2022 2022*

GBP'000 GBP'000 GBP'000

Operating activities Cash flows

Income** 1,067 1,328 2,186

Management expenses (4,632) (5,752) (10,794)

Taxation (85) (199) (285)

----------------------------------------- ----------- ----------- -------------

Net cash flow used in operating

activities (3,650) (4,623) (8,893)

----------------------------------------- ----------- ----------- -------------

Investing activities Cash flows

Purchase of investments (113,101) (469,855) (599,039)

Sale of investments 229,701 387,110 610,527

----------------------------------------- ----------- ----------- -------------

Net cash flow from/(used in) investing

activities 116,600 (82,745) 11,488

----------------------------------------- ----------- ----------- -------------

Financing activities Cash flows

Bank loans drawn - 45,238 45,174

Bank loans repaid (24,071) - (44,885)

Finance costs paid (2,463) (628) (2,546)

Dividend paid (17,775) (17,479) (36,457)

Proceeds from issue of Ordinary Shares 342 47,991 49,166

Redemption of ordinary shares (50,251) - -

Buybacks of ordinary shares held (11,786) - -

in treasury

Share issue, Buybacks and Redemption

costs (83) (381) (426)

----------------------------------------- ----------- ----------- -------------

Net cash flow (used in)/from financing

activities (106,087) 74,741 10,026

----------------------------------------- ----------- ----------- -------------

(Decrease)/increase in cash and

cash equivalents (6,863) (12,627) 12,621

----------------------------------------- ----------- ----------- -------------

Cash and cash equivalents at start

of period 46,368 27,994 27,994

----------------------------------------- ----------- ----------- -------------

Effect of foreign currency movements (3,598) 284 5,753

----------------------------------------- ----------- ----------- -------------

Cash and cash equivalents at end

of period 46,633 15,651 46,368

----------------------------------------- ----------- ----------- -------------

*Audited

**Cash inflow from dividends for the financial period was

GBP359,000 (31 May 2022: GBP1,126,000 and 30 November 2022:

GBP1,618,000). Bank deposits interest income received during the

year was GBP623,000 (31 May 2022: GBPnil and 30 November 2022:

GBP283,000).

The table below shows the movement in borrowings

during the period.

Six months Year ended

Six months ended ended 31 May 30 November

31 May 2023 2022 2022*

GBP'000 GBP'000 GBP'000

Opening balance 83,731 67,850 67,850

Repayment of bank loans (24,071) - (44,885)

Proceeds from bank loans - 45,238 45,174

Foreign exchange movements (3,147) 5,776 15,592

-------------------------------- ----------------- ---------------- -------------

Closing balance 56,513 118,864 83,731

-------------------------------- ----------------- ---------------- -------------

The notes are an integral part of these financial

statements.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Reporting entity

Bellevue Healthcare Trust plc (the "Company"), is a closed-ended

investment company, registered in England and Wales on 7 October

2016. The Company's registered office is 6(th) Floor, 125 London

Wall, London, EC2Y 5AS. Business operations commenced on 2 December

2016 when the Company's Ordinary Shares were admitted to trading on

the London Stock Exchange. The financial statements of the Company

are presented for the period from 1 December 2022 to 31 May

2023.

The Company invests in a concentrated portfolio of listed or

quoted equities in the global healthcare industry. The Company may

also invest in American Depositary Receipts (ADRs), or convertible

instruments issued by such companies and may invest in, or

underwrite, future equity issues by such companies. The Company may

utilise contracts for differences for investment purposes in

certain jurisdictions where taxation or other issues in those

jurisdictions may render direct investment in listed or quoted

equities less effective.

The principal activity of the Company is that of an investment

trust company within the meaning of section 1158 of the Corporation

Tax Act 2010.

2. Basis of preparation

Statement of compliance

The condensed unaudited interim financial statements have been

prepared in accordance with IAS 34 Interim Financial Reporting and

the Disclosure Guidance and Transparency Rules ("DTRs") of the UK's

Financial Conduct Authority. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the financial statements of the

Company as at and for the year ended 30 November 2022. The

financial statements of the Company for the year ended 30 November

2022 were prepared in accordance with UK-adopted International

Accounting Standards and in conformity with the requirements of the

Companies Act 2006. The accounting policies used by the Company are

the same as those applied by the Company in its financial

statements for the year ended 30 November 2022. The financial

information for the year ended 30 November 2022 in the condensed

interim unaudited financial statements has been extracted from the

audited Annual Report and Accounts.

When presentational guidance set out in the Statement of

Recommended Practice ('SORP') for Investment Companies issued by

the Association of Investment Companies ('the AIC') in July 2022 is

consistent with the requirements of UK-adopted International

Accounting Standards, the Directors have sought to prepare the

financial statements on a basis compliant with the recommendations

of the SORP.

Going concern

The Directors have adopted the going concern basis in preparing

the financial statements.

The Directors have a reasonable expectation that the Company has

adequate operational resources to continue in operational existence

for at least twelve months from the date of approval of these

financial statements.

Use of estimates, assumptions and judgements

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. Actual results may differ

from these estimates.

Estimates and underlying assumptions are reviewed on an on-going

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected. There have been no estimates, judgements or assumptions,

which have had a significant impact on the financial statements for

the period.

Basis of measurement

The financial statements have been prepared on the historical

cost basis except for financial instruments at fair value through

profit or loss, which are measured at fair value.

Functional and presentation currency

The financial statements are presented in sterling, which is the

Company's functional currency. The Company's investments are

denominated in multiple currencies. However, the Company's shares

are issued in sterling and the majority of its investors are UK

based. In addition, all expenses are paid in GBP as are dividends.

All financial information presented in sterling has been rounded to

the nearest thousand pounds.

Investments

Upon initial recognition investments are designated by the

Company "at fair value through profit or loss". They are accounted

for on the date they are traded and are included initially at fair

value which is taken to be their cost. Subsequently quoted

investments are valued at fair value, which is the bid market

price, or if bid price is unavailable, last traded price on the

relevant exchange. Unquoted investments are valued at fair value by

the Board which is established with regard to the International

Private Equity and Venture Capital Valuation Guidelines by using,

where appropriate, latest dealing prices, valuations from reliable

sources and other relevant factors.

Changes in the fair value of investments held at fair value

through profit or loss and gains or losses on disposal are included

in the capital column of the Statement of Comprehensive Income

within "gains on investments".

Investments are derecognised on the trade date of their

disposal, which is the point where the Company transfers

substantially all the risks and rewards of the ownership of the

financial asset.

Adoption of new and revised standards

At the date of approval of these financial statements, there

were a number of new standards and amendments to standards are

effective for the annual periods beginning after 1 January 2022.

None of these have a significant effect on the measurement of the

amounts recognised in the financial statements of the Company for

the period ended 31 May 2023.

3. Investment held at fair value through

profit or loss

30 November

31 May 2023 31 May 2022 2022

As at GBP'000 GBP'000 GBP'000

------------------------- ----------------- ------------- ------------

Investments held at fair value through

profit or loss

- Quoted overseas 883,801 987,306 1,043,349

---------------------------

Closing valuation 883,801 987,306 1,043,349

--------------------------- ----------------- ------------- ------------

Under IFRS 13 'Fair Value Measurement', an entity is required to

classify investments using a fair value hierarchy that reflects the

significance of the inputs used in making the measurement

decision.

The following shows the analysis of financial assets recognised

at fair value based on:

Level 1

The unadjusted quoted price in an active market for identical

assets or liabilities that the entity can access at the measurement

date.

Level 2

Inputs other than quoted prices included within Level 1 that are

observable (i.e. developed using market data) for the asset or

liability, either directly or indirectly.

Level 3

Inputs are unobservable (i.e. for which market data is

unavailable) for the asset or liability.

The classification of the Company's investments held at fair

value is detailed in the table below:

As at 31 May 2023 As at 31 May 2022

Level Level Level Level Level Level

1 2 3 Total 1 2 3 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------- ------------------ ------------------- ------------- ------------- ------------------ -------------------

Investments

at fair

value

through

profit

and loss -

Quoted 883,801 - - 883,801 987,306 - - 987,306

------------- ------------- ------------------ ------------------- ------------- ------------- ------------------ ------------------- -------------

As at 30 November 2022

Level Level Level

1 2 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------- ------------------ ------------------- -------------

Investments

at fair

value

through

profit

and loss -

Quoted 1,043,349 - - 1,043,349

------------- ------------- ------------------ ------------------- -------------

Fair values of financial assets and financial liabilities

All financial assets and liabilities are recognised in the

financial statements at fair value, with the exception of

short-term assets and liabilities, which are held at nominal value

that approximates to fair value, and loans that are initially

recognised at the fair value of the consideration received, less

directly attributable costs, and subsequently recognised at

amortised cost. The carrying value of the loans approximates to the

fair value of the loans.

There were no transfers between levels during the period ended

31 May 2023 (2022: nil).

4. Income

Six months Six months Year ended

ended 31 ended 31 30 November

May 2023 May 2022 2022

GBP'000 GBP'000 GBP'000

Income from investments

Overseas dividends 444 1,325 1,903

Bank interest on deposits 623 3 283

------------------------------------------------- --------------------- ----------------------- -----------------------

Total income 1,067 1,328 2,186

------------------------------------------------- --------------------- ----------------------- -----------------------

5. Bank loans and finance

costs

The Company has a multi-currency revolving credit facility RCF with The

Bank of Nova Scotia, London Branch. On 16 June 2022, the Company renewed

and amended its RCF. Under the terms of the amended RCF, the Company

may draw down loans up to an aggregate value of USD 280 million (increased

from the previous limit of USD 235 million). The increased facility will

expire in December 2024.

As at 31 May 2023, the aggregate of loans draw down was USD 70,000,000

equivalent of GBP56,513,000 (31 May 2022: GBP118,864,000 and 30 November

2022: GBP83,731,000).

The table below shows the finance costs in relation to the Company's

loans draw down.

Six months ended 31 Six months ended 31

May 2023 May 2022

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Loan interest 405 1,621 2,026 172 689 861

Other finance costs 3 14 17 7 28 35

--------------------------- --------- --------- --------------------- ------------- ----------------- -------------------

Total 408 1,635 2,043 179 717 896

--------------------------- --------- --------- --------------------- ------------- ----------------- -------------------

Year ended 30 November

2022

Revenue Capital Total

GBP'000 GBP'000 GBP'000

=========================== ========= ========= =====================

Loan interest 597 2,389 2,986

Other finance costs 13 51 64

--------------------------- --------- --------- ---------------------

Total 610 2,440 3,050

--------------------------- --------- --------- ---------------------

6. Taxation

(a) Analysis of tax charge

for the period:

Six months ended 31 Six months ended 31

May 2023 May 2022

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Withholding tax expense 85 - 85 199 - 199

--------------------------- --------- --------- --------------------- ------------- ----------------- -------------------

Total tax charge for the

period 85 - 85 199 - 199

--------------------------- --------- --------- --------------------- ------------- ----------------- -------------------

Year ended 30 November

2022

Revenue Capital Total

GBP'000 GBP'000 GBP'000

Withholding tax expense 285 - 285

--------------------------- --------- --------- ---------------------

Total tax charge for the

year 285 - 285

--------------------------- --------- --------- ---------------------

7. Return per Ordinary

Share

Return per share is based on the weighted average number of Ordinary

Shares in issue during the six months ended 31 May 2023 of 553,461,838

(31 May 2022: 576,006,437 and 30 November 2022: 581,357,335).

As at 31 May 2023 As at 31 May 2022

Revenue Capital Total Revenue Capital Total

Loss for the period

(GBP'000) (792) (47,791) (48,583) (564) (181,555) (182,119)

--------------------------- --------- --------- --------------------- ------------- ----------------- -------------------

Return per Ordinary Share (0.14)p (8.63)p (8.77)p (0.10)p (31.52)p (31.62)p

--------------------------- --------- --------- --------------------- ------------- ----------------- -------------------

As at 30 November 2022

Revenue Capital Total

Loss for the year

(GBP'000) (1,655) (39,769) (41,424)

--------------------------- --------- --------- ---------------------

Return per Ordinary Share (0.28)p (6.84)p (7.12)p

--------------------------- --------- --------- ---------------------

8. Share capital

As at 31 May 2023 As at 31 May 2022

No. of GBP'000 No. of GBP'000

shares shares

Allotted, issued and fully

paid:

Redeemable Ordinary Shares of

1p each ('Ordinary Shares') 548,924,670 5,489 586,057,380 5,860

Shares held in treasury 7,490,560 75 - -

Management Shares of GBP1 each 50,001 13 50,001 13

-------------------------------- ------------- -------- ------------ --------

Total 556,465,231 5,577 586,107,381 5,873

-------------------------------- ------------- -------- ------------ --------

As at 30 November

2022

No. of GBP'000

shares

-------------------------------- ------------- --------

Allotted, issued and fully

paid:

Redeemable Ordinary Shares of

1p each ('Ordinary Shares') 586,783,083 5,868

Management Shares of GBP1 each 50,001 13

Total 586,833,084 5,881

-------------------------------- ------------- --------

Share Movement

During the six months to 31 May 2023, 7,490,560 Ordinary Shares

(31 May 2022: Nil and 30 November 2022: Nil) were bought back into

treasury through the Company's share buyback programme and

30,577,550 (31 May 2022: 514,135 and 30 November 2022: 514,135)

Ordinary Shares were redeemed and cancelled by the Company, in line

with the Company's annual redemption facility. On 5 May 2023, in

line with the Company's Scrip Dividend Scheme, 209,697 Ordinary

Shares were allotted and issued to Shareholders who elected for

their final dividend to be automatically subscribed on their behalf

for new Ordinary Shares.

Since 31 May 2023, a further 183,903 Ordinary Shares have been

bought back into treasury, with aggregate cost of GBP283,000.

9. Net assets per Ordinary Share

Net assets per Ordinary Share as at 31 May 2023 is based on

GBP876,190,000 of net assets of the Company attributable to the

548,924,670 Ordinary Shares in issue (excluding treasury shares) as

at 31 May 2023. The GBP12,500 of net assets as at 31 May 2023 is

attributable to the Management Shares.

10. Dividend

During the six months ended 31 May 2023, the Company paid a

dividend of 3.235p per Ordinary Share in respect of the year ended

30 November 2022.

The Directors have declared an interim dividend for the

six-month period ended 31 May 2023 of 2.995p per Ordinary Share.

The dividend will have an ex-dividend date of 27 July 2023 and will

be paid on 25 August 2023 to Shareholders on the register at 28

July 2023. The dividend will be funded from the Company's

distributable reserves.

11. Related party transactions

Fees payable to the Investment Manager are shown in the

Statement of Comprehensive Income. As at 31 May 2023, the fee

outstanding to the Investment Manager was GBP662,000 (31 May 2022:

GBP714,000 and 30 November 2022: GBP744,000).

Following the year end and with effect from 1 December 2022,

annual fees were increased, resulting in Directors' fees of

GBP67,000 per annum for the Chairman of the Board; GBP49,550 per

annum for the Chair of the Audit and Risk Committee and GBP39,250

per annum for the other Board members. An additional GBP1,000 per

annum is payable to the Senior Independent Director and an

additional GBP1,000 per annum is payable to the Chair of the

Management Engagement Committee. Net fees payable to the Directors

are settled in the Company's Ordinary Shares quarterly, using the

prevailing market price per Share at the relevant quarter end.

The Directors had the following shareholdings in the Company,

all of which are beneficially owned.

As at As at As at

31 May 31 May 30 November

2023 2022 2022

----------------- --------- --------- -------------

Randeep Grewal 133,271 106,776 119,693

Josephine Dixon 106,159 90,170 98,466

Paul Southgate 88,408 77,034 83,084

Tony Young 25,266 13,968 20,018

Kate Bolsover 19,556 7,577 14,232

----------------- --------- --------- -------------

12. Post balance sheet events

There are no post balance sheet events, other than those

disclosed in this report.

13. Status of this report

These interim financial statements are not the Company's

statutory accounts for the purposes of section 434 of the Companies

Act 2006. They are unaudited. The unaudited Half-yearly report will

be made available to the public at the registered office of the

Company. The report will also be available in electronic format on

the Company's website, https://www.bellevuehealthcaretrust.com. The

information for the year ended 30 November 2022 has been extracted

from the last published audited financial statements, unless

otherwise stated. The audited financial statement has been

delivered to the Registrar of Companies. The Company's auditor

reported on those accounts and their report was unqualified, did

not draw attention to any matters by way of emphasis and did not

contain a statement under sections 498(2) or 498(3) of the

Companies Act 2006. The Half-yearly report was approved by the

Board of Directors on 19 July 2023.

ALTERNATIVE PERFORMANCE MEASURES ('APMs')

Discount

The amount, expressed as a percentage, by which the share price is lower

than the NAV per Ordinary Share. As at 31 May 2023 GBP'000

NAV per Ordinary Share (pence) a 159.62

Share price (pence) b 147.40

-------------------------------- --------------- --------

Discount (b÷a)-1 7.7%

-------------------------------- --------------- --------

The Company's average discount for the period ended 31 May 2023 was

6.6%.

Gearing

A way to magnify income and capital returns, but which can also magnify

losses. A bank loan is a common method of gearing. As at 31 May 2023 GBP'000

Total assets less cash/cash

equivalents a 883,976

Net assets b 876,190

----------------------------- --------------- --------

Gearing (net) (a÷b)-1 0.9%

----------------------------- --------------- --------

Leverage

An alternative word for "Gearing" (See gearing for calculations).

Under AIFMD, leverage is any method by which the exposure of an AIF

is increased through borrowing of cash or securities or leverage embedded

in derivative positions.

Under AIFMD, leverage is broadly similar to gearing, but is expressed

as a ratio between the assets (excluding borrowings) and the net assets

(after taking account of borrowing). Under the gross method, exposure

represents the sum of the Company's positions after deduction of cash

balances, without taking account of any hedging or netting arrangements.

Under the commitment method, exposure is calculated without the deduction

of cash balances and after certain hedging and netting positions are

offset against each other.

Ongoing charges

A measure, expressed as a percentage of average net assets, of the regular,

recurring annual costs of running an investment company. Six months ended 31 May 2023 GBP

------------------------------ ------------ ------------

Average NAV a 914,313,725

Annualised expenses b 9,326,000

Ongoing charges (b÷a) 1.02%

------------------------------ ------------- ------------

Total return

A measure of performance that includes both income and capital returns.

This takes into account capital gains and reinvestment of dividends

paid out by the Company into the Ordinary Shares of the Company on the

ex-dividend date. Six months ended 31 May 2023

(Unaudited) Share price NAV

Opening at 1 December 2022

(p) a 158.20 171.16

Closing at 31 May 2023 (p) b 147.40 159.62

Price movement (b÷a)-1 c -6.8% -6.7%

Dividend reinvestment d 1.9% 1.8%

------------------------------ -------- ------------ -------

Total return (c+d) -4.9% -4.9%

------------------------------ -------- ------------ -------

n/a = not applicable.

GLOSSARY

AIC Association of Investment Companies.

--------------------------- -----------------------------------------------------------

Alternative Investment An investment vehicle under AIFMD. Under AIFMD

Fund or "AIF" (see below) the Company is classified as an AIF.

--------------------------- -----------------------------------------------------------

Alternative Investment A European Union directive which came into force

Fund Managers Directive on 22 July 2013 and has been implemented in the

or "AIFMD" UK and remains in force post BREXIT.

--------------------------- -----------------------------------------------------------

American Depositary A negotiable certificate issued by a U.S. bank

Receipt or "ADR" representing a specified number of shares in a

foreign stock traded on a U.S. exchange.

--------------------------- -----------------------------------------------------------

Annual General Meeting A meeting held once a year which shareholders can

or "AGM" attend and where they can vote on resolutions to

be put forward at the meeting and ask Directors

questions about the company in which they are invested.

--------------------------- -----------------------------------------------------------

CFD or Contract for A financial instrument, which provides exposure

Difference to an underlying equity with the provider financing

the cost to the buyer with the buyer receiving

the difference of any gain or paying for any loss.

--------------------------- -----------------------------------------------------------

Custodian An entity that is appointed to safeguard a company's

assets.

--------------------------- -----------------------------------------------------------

Discount The amount, expressed as a percentage, by which

the share price is less than the net asset value

per share. The discount is calculated on the closing

share price.

--------------------------- -----------------------------------------------------------

Depositary Under AIFMD the depositary is appointed under a

strict liability regime to oversee inter alia,

those charged with safekeeping of the Company's

assets and cash monitoring.

--------------------------- -----------------------------------------------------------

Dividend Income receivable from an investment in shares.

--------------------------- -----------------------------------------------------------

ESG Environmental, social and governance.

--------------------------- -----------------------------------------------------------

Ex-dividend date The date from which you are not entitled to receive

a dividend which has been declared and is due to

be paid to shareholders.

--------------------------- -----------------------------------------------------------

Financial Conduct Authority The independent body that regulates the financial

or "FCA" services industry in the UK.

--------------------------- -----------------------------------------------------------

Gearing A term used to describe the extent that a portfolio

has increased in size as a way to magnify income

and capital returns, but which can also magnify

losses. A bank loan is a common method of gearing.

--------------------------- -----------------------------------------------------------

Gross assets The Company's total assets adjusted for any leverage

amount (outstanding bank loan).

--------------------------- -----------------------------------------------------------

Index An independent Market tool which is used to compare

performance across different investment companies

and funds. It quantifies performance of a basket

of stocks which is considered to replicate a particular

stock market or sector.

--------------------------- -----------------------------------------------------------

Investment company A company formed to invest in a diversified portfolio

of assets.

--------------------------- -----------------------------------------------------------

Investment Trust An investment company which is based in the UK

and which meets certain tax conditions which enables

it to be exempt from UK corporation tax on its

capital gains. The Company is an investment trust.

--------------------------- -----------------------------------------------------------

Large-Cap A Company with a market capitalisation above $10

billion.

--------------------------- -----------------------------------------------------------

Leverage An alternative word for "Gearing".

Under AIFMD, leverage is any method by which the

exposure of an AIF is increased through borrowing

of cash or securities or leverage embedded in derivative

positions.

Under AIFMD, leverage is broadly similar to gearing,

but is expressed as a ratio between the assets

(excluding borrowings) and the net assets (after

taking account of borrowing). Under the gross method,

exposure represents the sum of the Company's positions

after deduction of cash balances, without taking

account of any hedging or netting arrangements.

Under the commitment method, exposure is calculated

without the deduction of cash balances and after

certain hedging and netting positions are offset

against each other.

--------------------------- -----------------------------------------------------------

Liquidity The extent to which investments can be sold at

short notice.

--------------------------- -----------------------------------------------------------

Management Shares Non-redeemable preference shares of GBP1.00 each

in the capital of the Company.

--------------------------- -----------------------------------------------------------

Mega-Cap A Company with a market capitalisation above $50

billion.

--------------------------- -----------------------------------------------------------

Mid-Cap A Company with a market capitalisation between

$2 and $10 billion.

--------------------------- -----------------------------------------------------------

Net assets An investment company's assets less its liabilities.

--------------------------- -----------------------------------------------------------