TIDMCMH

RNS Number : 9995N

Chamberlin PLC

26 January 2023

THIS ANNOUNCEMENT (THE "ANNOUNCEMENT"), AND THE INFORMATION

CONTAINED IN IT, IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION,

DISTRIBUTION OR FORWARDING, IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA,

JAPAN, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER STATE

OR JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION. PLEASE SEE THE

IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN CHAMBERLIN PLC OR ANY OTHER ENTITY

IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF CHAMBERLIN PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE MARKET ABUSE REGULATION (EU NO. 596/2014) AS IT FORMS

PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 (AS AMED) ("MAR").

26 January 2023

Chamberlin plc

("Chamberlin", the "Company" or the "Group")

Placing and Subscription

Chamberlin plc (AIM: CMH.L), the specialist castings and

engineering group, is pleased to announce that it has conditionally

raised approximately GBP550,000 (before expenses), pursuant to a

placing of 16,666,970 new Ordinary Shares of 0.1p each (the

"Placing Shares") at a placing price of 3.3 pence per share (the

"Placing Price") with existing institutional and other investors

(the "Placing"). Trevor Brown, Executive Director, has also

conditionally subscribed for 3,030,000 new Ordinary Shares (the

"Subscription Shares") at the Placing Price raising an additional

GBP100,000 (the Subscription Shares together with the Placing

Shares, the "New Ordinary Shares", and the Subscription and the

Placing, together, the "Fundraising").

Cenkos Securities plc ("Cenkos") and Peterhouse Capital Limited

("Peterhouse") acted as joint bookrunners to the Placing ("Joint

Bookrunners").

The Placing Price represents a discount of 7.0 per cent. to the

closing mid-market price of 3.55 pence per Ordinary Share on 25

January 2023 (being the last practicable date before the release of

this Announcement).

The net proceeds from the Fundraising will provide working

capital to support the continued delivery of the Group's growth

strategy and strengthen the Group's balance sheet.

The Company has the authority to issue and allot the New

Ordinary Shares pursuant to certain existing shareholder

authorities granting such powers to the directors at the Company's

Annual General Meeting held on 30 November 2022.

Enquiries:

Chamberlin plc T: 01922 707100

Kevin Price, Chief Executive Officer

Alan Tomlinson, Finance Director

Cenkos Securities plc (Nominated Adviser T: 020 7397 8900

and Joint Broker)

Katy Birkin

Stephen Keys

George Lawson

Peterhouse Capital Limited (Joint Broker) T: 020 7469 0930

Lucy Williams

Duncan Vasey

This Announcement is released by Chamberlin plc and contains

inside information for the purposes of Article 7 of MAR, and is

disclosed in accordance with the Company's obligations under

Article 17 of MAR.

Market soundings (as defined in MAR) were taken in respect of

the Placing with the result that certain persons became aware of

inside information (as defined in MAR), as permitted by MAR. This

inside information is set out in this Announcement. Therefore,

those persons that received inside information in a market sounding

are no longer in possession of such inside information relating to

the Company and its securities.

For the purposes of MAR, Article 2 of Commission Implementing

Regulation (EU) 2016/1055 and the UK version of such implementing

regulation (as amended), the person responsible for arranging for

the release of this Announcement on behalf of the Company is Kevin

Price, Chief Executive Officer.

1. Background and Reasons for the Fundraising and Use of Proceeds

Background and Reasons for the Fundraising

The Group continues to diversify away from its reliance on the

automotive sector and has undertaken an extensive restructuring

programme to align the cost base with revenue, invest in new

capacity and improve margins. The Group has demonstrated its

ability to deliver on its turnaround strategy, most notably

evidenced by:

-- Launching two new E-commerce brands, Iron Foundry Weights

("IFW"), and Emba, a cookware brand ("Emba");

-- Reporting a 79 per cent. increase in adjusted EBITDA, and a

full-year profit after tax for the 12 months ended 31 May 2022 ("FY

2022"), for the first time in five years;

-- Undertaking a GBP1.25 million sale and leaseback of the

foundry held by Russell Ductile Castings Ltd ("RDC") in May 2022

following a review of the use of its substantial property

assets;

-- Completing a capacity expansion project at RDC in November

2022 which increased RDC's ability to produce large castings over

three tons by 30 per cent; and

-- Protecting the Group from medium-term energy price increases

following the agreement of a 5-year fixed price for its electricity

in March 2020.

The Group is well positioned to continue its revenue growth and

is aiming to return to sustainable profitability in the financial

year to 31 May 2024 ("FY 2024"). The Board also continues to

evaluate further opportunities to strengthen the balance sheet,

including in relation to the Group's property assets.

Chamberlin & Hill Castings Ltd ("CHC")

Although the recovery in performance at CHC was slower than

anticipated in the first half of the financial year to 31 May 2023

("H1 2023") due to uneven demand in automotive volumes, as detailed

in the announcement on 30 November 2022, the Group has secured new

orders amounting to approximately GBP1.2 million within the

construction, cast iron radiator, power generation and commercial

vehicle markets demonstrating diversification away from the

automotive market. Despite this, underlying demand for turbocharger

components is recovering strongly from the downturn in the second

half of the financial year to 31 May 2022 ("H2 2022") and

conversion is more consistent.

In addition, new orders have been secured within CHC's machining

facility for an aggregated potential annualised revenue value of

approximately GBP0.85 million. The machining facility is now

running five out of six machines on single shift basis for the

first time in two years, expected to enable CHC to achieve further

revenue growth in FY 2024.

Finally, Emba's agreement to develop, market, and sell a jointly

branded cookware range with a well-established cookware company is

progressing well. The product range is currently in development and

is expected to be available for retail sale towards the end of

March 2023.

Consistent with the rest of the Group, CHC has undergone a

number of cost saving initiatives, and the Board believes the cost

base and margins are now the right size for CHC, with an

expectation that the subsidiary generates a modest profit as it

enters Q4 FY 2023.

Russell Ductile Castings Ltd ("RDC")

RDC delivered a record profit after tax in FY 2022 of GBP1.09

million and continued to perform well in H1 2023. Following the

increase in production capacity at the RDC foundry increasing RDC's

ability to produce large castings over three tons by around 30 per

cent., the business reported its best ever monthly revenue

performance in November 2022. The order book remained stable at

approximately GBP4 million in H1 FY 2023, and RDC secured a

significant order, expected to generate revenue of approximately

GBP0.6 million, within the renewable energy sector - a target

market for the Group's growth strategy. RDC now has the capacity,

enquiry pipeline and competitive market position to maintain its

revenue growth potential in FY 2023.

Petrel Ltd ("Petrel")

As announced on 30 November 2022, Petrel made a positive

contribution to the Group's results in H1 FY 2023. As well as

performing at a run rate consistent with FY 2022 and delivering an

operating profit averaging approximately 17 per cent. of revenue,

the order intake has remained elevated and includes a substantial

order in the defence sector.

Petrel's outlook is also positive; a new management team has

been implemented, and the subsidiary is also currently investing in

an upgrade to its manufacturing facility in Birmingham. These

initiatives are part of a wider strategy from the Group to

transform Petrel into the UK's leading independent manufacturer of

hazardous area lighting equipment.

Use of Proceeds

As outlined above, the Group has continued to deliver on its

turnaround strategy and management expects all business units to be

profitable by Q4 FY 2023 and is aiming to be cash generative in FY

2024 through a combination of revenue growth, profitable operating

performance and organic reduction in net debt.

In order to deliver on the Group's growth objectives, the

Company has conditionally raised approximately GBP650,000 (before

expenses) through the Fundraising in order to provide working

capital to support the continued delivery of the Group's growth

plans and strengthen the Group's balance sheet.

2. Details of the Placing and Subscription

The Company has conditionally raised, in aggregate,

approximately GBP650,000 (before expenses), pursuant to a placing

of 16,666,970 Placing Shares at the Placing Price with existing

institutional and other investors and a subscription for 3,030,000

Subscription Shares at the Placing Price by Trevor Brown, Executive

Director.

The Placing has not been underwritten and is conditional, inter

alia, upon:

a) the placing agreement between the Company, Cenkos and

Peterhouse (the "Placing Agreement") becoming unconditional in all

respects other than admission of the Placing Shares to trading on

AIM becoming effective in accordance with the AIM Rules for

Companies ("Admission") and not having been terminated in

accordance with its terms; and

b) Admission of the Placing Shares occurring by not later than

8.00 a.m. on 31 January 2023 (or such later time and/or date as the

Company, Cenkos and Peterhouse may agree, not being later than 8.00

a.m. on 14 February 2023).

Accordingly, if any of the conditions are not satisfied or

waived (where capable of being waived), the Placing will not

proceed, the Placing Shares will not be issued and all monies

received by Cenkos and Peterhouse will be returned to the

applicants (at the applicants' risk and without interest) as soon

as possible thereafter.

Under the terms of the Placing Agreement, each of Cenkos and

Peterhouse has agreed to use its reasonable endeavours to procure

subscribers for the Placing Shares at the Placing Price. The

Placing Agreement contains certain warranties and indemnities from

the Company in favour of Cenkos and Peterhouse and either Cenkos or

Peterhouse may terminate the Placing Agreement in certain customary

circumstances.

Together, the total number of New Ordinary Shares to be issued

pursuant to the Placing and Subscription, being 19,696,970 New

Ordinary Shares, represent approximately 18.55 per cent. of the

Company's issued share capital as at the date of this

Announcement.

The New Ordinary Shares will, when issued, be credited as fully

paid up and will be issued subject to the Articles and rank pari

passu in all respects with the Company's existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid on or in respect of the

Ordinary Shares after the date of issue of the New Ordinary Shares,

and will on issue be free of all claims, liens, charges,

encumbrances and equities.

Application has been made to the London Stock Exchange for the

Admission of the New Ordinary Shares to trading on AIM. It is

expected that Admission will occur on or around 8.00 a.m. on 31

January 2023 (or such later time and/or date as Cenkos and

Peterhouse may agree with the Company, being not later than 8.00

a.m. on 14 February 2023).

Following Admission, the total number of Ordinary Shares in the

capital of the Company in issue will be 125,853,677 with each

Ordinary Share carrying the right to one vote. There are no

Ordinary Shares held in treasury and therefore the total number of

voting rights in the Company is 125,853,677 (the "Enlarged Share

Capital"). The above figure may be used by shareholders in the

Company as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the share capital of the Company under

the Financial Conduct Authority's Disclosure Guidance and

Transparency Rules.

3. Directors' Participation and Related Party Transaction

As at the date of this Announcement, Trevor Brown holds

31,306,915 Ordinary Shares representing 29.49 per cent. of the

Company's issued share capital and, following Admission, will hold

34,336,915 Ordinary Shares representing 27.28 per cent. of the

Enlarged Share Capital.

In addition, BW Family Limited, a person closely associated with

Keith Butler-Wheelhouse, Chairman, has agreed to subscribe for

275,118 Placing Shares at the Placing Price. Following Admission,

Keith Butler-Wheelhouse will beneficially hold 1,757,866 Ordinary

Shares representing 1.40 per cent. of the Enlarged Share

Capital.

The Subscription by Trevor Brown, as a substantial shareholder

(as defined in the AIM Rules for Companies) and director, and the

participation in the Placing by Keith Butler-Wheelhouse, as a

director, constitute a related party transaction pursuant to AIM

Rule 13. The Directors (other than Trevor Brown and Keith

Butler-Wheelhouse), having consulted with the Company's nominated

adviser, Cenkos, believe that the participation in the Fundraising

by Trevor Brown and Keith Butler-Wheelhouse is fair and reasonable

insofar as Shareholders are concerned.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Trevor Brown

------------------------------------------ ---------------------------------

2 Reason for the notification

-----------------------------------------------------------------------------

a) Position/status Executive Director

------------------------------------------ ---------------------------------

b) Initial notification/Amendment Initial Notification

------------------------------------------ ---------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------

a) Name Chamberlin plc

------------------------------------------ ---------------------------------

b) LEI 213800OS2SK73PPFO761

------------------------------------------ ---------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of 0.1p each

instrument, type of instrument

------------------------------------------ ---------------------------------

Identification code GB0001870228

------------------------------------------ ---------------------------------

b) Nature of the transaction Purchase of Ordinary Shares

pursuant to the Subscription

------------------------------------------ ---------------------------------

c) Price(s) and volumes(s) Price(s) Volume(s)

------------------------------------------ ---------------- ---------------

GBP0.033 3,030,000

---------------------------------------------------------------- ---------------

d) Aggregated information N/A (single transaction)

------------------------------------------ ---------------------------------

Aggregated volume N/A (single transaction)

------------------------------------------ --------------------------------------

Price N/A (single transaction)

------------------------------------------ --------------------------------------

e) Date of the transaction 26 January 2023

------------------------------------------ ---------------------------------

f) Place of the transaction Outside of a trading venue

------------------------------------------ ---------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name BW Family Limited, a PCA of

Keith Butler-Wheelhouse

------------------------------------------ --------------------------------

2 Reason for the notification

----------------------------------------------------------------------------

a) Position/status PCA of Chairman

------------------------------------------ --------------------------------

b) Initial notification/Amendment Initial Notification

------------------------------------------ --------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name Chamberlin plc

------------------------------------------ --------------------------------

b) LEI 213800OS2SK73PPFO761

------------------------------------------ --------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------------

a) Description of the financial Ordinary Shares of 0.1p each

instrument, type of instrument

------------------------------------------ --------------------------------

Identification code GB0001870228

------------------------------------------ --------------------------------

b) Nature of the transaction Purchase of Ordinary Shares

pursuant to the Placing

------------------------------------------ --------------------------------

c) Price(s) and volumes(s) Price(s) Volume(s)

------------------------------------------ ---------------- --------------

GBP0.033 275,118

---------------------------------------------------------------- --------------

d) Aggregated information N/A (single transaction)

------------------------------------------ --------------------------------

Aggregated volume N/A (single transaction)

------------------------------------------ -------------------------------------

Price N/A (single transaction)

------------------------------------------ -------------------------------------

e) Date of the transaction 26 January 2023

------------------------------------------ --------------------------------

f) Place of the transaction Outside of a trading venue

------------------------------------------ --------------------------------

IMPORTANT NOTICES

Neither this Announcement, nor any copy of it, may be taken or

transmitted, published or distributed, directly or indirectly, in

whole or in part, in or into the United States, Australia, Canada,

Japan, New Zealand or the Republic of South Africa or to any

persons in any of those jurisdictions or any other jurisdiction

where to do so would constitute a violation of the relevant

securities laws of such jurisdiction (each, a "Restricted

Jurisdiction"). This Announcement is for information purposes only

and neither it, nor the information contained in it, shall

constitute an offer to sell or issue, or the solicitation of an

offer to buy, acquire or subscribe for any shares in the capital of

the Company in the United States, Australia, Canada, Japan, New

Zealand or the Republic of South Africa or any other state or

jurisdiction in which such offer or solicitation is not authorised

or to any person to whom it is unlawful to make such offer or

solicitation. Any failure to comply with these restrictions may

constitute a violation of securities laws of such

jurisdictions.

The Placing Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the "Securities

Act"), or with any securities regulatory authority or under any

securities laws of any state or other jurisdiction of the United

States and may not be offered, sold, resold, pledged, transferred

or delivered, directly or indirectly, in or into the United States

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with the securities laws of any

state or other jurisdiction of the United States.

No action has been taken by the Company, the Joint Bookrunners

or any of their respective directors, officers, partners, agents,

employees, affiliates, advisors, consultants or, in the case of

each of the Joint Bookrunners , persons connected with them as

defined in the Financial Services and Markets Act 2000, as amended

("FSMA") (together, "Affiliates") that would permit an offer of the

Placing Shares or possession or distribution of this Announcement

or any other publicity material relating to such Placing Shares in

any jurisdiction where action for that purpose is required. Persons

receiving this Announcement are required to inform themselves about

and to observe any restrictions contained in this Announcement.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

This Announcement has not been approved by the Financial Conduct

Authority or the London Stock Exchange.

No offering document or prospectus will be made available in

connection with the matters contained or referred to in this

Announcement and no such offering document or prospectus is

required to be published, in accordance with Regulation (EU)

2017/1129 (the "Prospectus Regulation") or Regulation (EU)

2017/1129, as amended and retained in UK law on 31 December 2020 by

the European Union (Withdrawal) Act 2018 (the "EUWA") (the "UK

Prospectus Regulation").

This Announcement is not being distributed by, nor has it been

approved for the purposes of section 21 of FSMA by, a person

authorised under FSMA. This Announcement is being distributed and

communicated to persons in the United Kingdom only in circumstances

in which section 21(1) of FSMA does not require approval of the

communication by an authorised person.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No responsibility or liability is

or will be accepted by, and no undertaking, representation or

warranty or other assurance, express or implied, is or will be made

or given by the Joint Bookrunners, or by any of their respective

Affiliates as to, or in relation to, the accuracy, fairness or

completeness of the information or opinions contained in this

Announcement or any other written or oral information made

available to or publicly available to any interested person or its

advisers, and any liability therefore is expressly disclaimed. The

information in this Announcement is subject to change.

None of the information in this Announcement has been

independently verified or approved by the Joint Bookrunners or any

of their respective Affiliates. Save for any responsibilities or

liabilities, if any, imposed on the Joint Bookrunners by FSMA or by

the regulatory regime established under it, no responsibility or

liability whatsoever whether arising in tort, contract or

otherwise, is accepted by the Joint Bookrunners or any of their

Affiliates whatsoever for the contents of the information contained

in this Announcement (including, but not limited to, any errors,

omissions or inaccuracies in the information or any opinions) or

for any other statement made or purported to be made by or on

behalf of either of the Joint Bookrunners or any of their

respective Affiliates in connection with the Company, the Placing

Shares or the Placing or for any loss, cost or damage suffered or

incurred howsoever arising, directly or indirectly, from any use of

this Announcement or its contents or otherwise in connection with

this Announcement or from any acts or omissions of the Company in

relation to the Placing. The Joint Bookrunners and their respective

Affiliates accordingly disclaim all and any responsibility and

liability whatsoever, whether arising in tort, contract or

otherwise (save as referred to above) in respect of any statements

or other information contained in this Announcement and no

representation or warranty, express or implied, is made by either

of the Joint Bookrunners or any of their respective Affiliates as

to the accuracy, completeness or sufficiency of the information

contained in this Announcement.

Cenkos, which is authorised and regulated in the United Kingdom

by the FCA, is acting solely for the Company and no-one else in

connection with the Placing and arrangements described in this

Announcement and will not regard any other person (whether or not a

recipient of this Announcement) as a client in relation to the

Placing or the transactions and arrangements described in this

Announcement. Cenkos is not responsible to anyone other than the

Company for providing the protections afforded to clients of Cenkos

or for providing advice in connection with the contents of this

Announcement, the Placing or the transactions and arrangements

described herein.

Peterhouse Capital Limited, which is authorised and regulated in

the United Kingdom by the FCA, is acting solely for the Company and

no-one else in connection with the Placing and arrangements

described in this Announcement and will not regard any other person

(whether or not a recipient of this Announcement) as a client in

relation to the Placing or the transactions and arrangements

described in this Announcement. Peterhouse is not responsible to

anyone other than the Company for providing the protections

afforded to clients of Peterhouse or for providing advice in

connection with the contents of this Announcement, the Placing or

the transactions and arrangements described herein.

Certain statements in this Announcement are forward-looking

statements, which include all statements other than statements of

historical fact and which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "could", "may",

"intend", "estimate", "expect" and words of similar meaning,

include all matters that are not historical facts. These

forward-looking statements involve risks, assumptions and

uncertainties that could cause the actual results of operations,

financial condition, liquidity and dividend policy and the

development of the industries in which the Company's businesses

operate to differ materially from the impression created by the

forward-looking statements. These statements are not guarantees of

future performance and are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. Given those risks and uncertainties,

prospective investors are cautioned not to place undue reliance on

forward-looking statements. Forward-looking statements speak only

as of the date of such statements and, except as required by the

FCA, the London Stock Exchange or applicable law, the Company, the

Joint Bookrunners and their respective Affiliates undertakes no

obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

No statement in this Announcement is intended to be a profit

forecast or estimate and no statement in this Announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

This Announcement does not identify or suggest, or purport to

identify or suggest, the risks (direct or indirect) that may be

associated with an investment in the Placing Shares. Any investment

decision to buy Placing Shares in the Placing must be made solely

on the basis of publicly available information, which has not been

independently verified by the Joint Bookrunners. This Announcement

is not intended to provide the basis for any decision in respect of

the Company or other evaluation of any securities of the Company or

any other entity and should not be considered as a recommendation

that any investor should subscribe for, purchase, otherwise

acquire, sell or otherwise dispose of any such securities.

Recipients of this Announcement who are considering acquiring

Placing Shares pursuant to the Placing are reminded that they

should conduct their own investigation, evaluation and analysis of

the business, data and property described in this Announcement. Any

indication in this Announcement of the price at which the Ordinary

Shares have been bought or sold in the past cannot be relied upon

as a guide to future performance. The price and value of securities

can go down as well as up.

The contents of this Announcement are not to be construed as

legal, business, financial or tax advice. Each shareholder or

prospective investor should consult with his or her or its own

legal adviser, business adviser, financial adviser or tax adviser

for legal, financial, business or tax advice.

In connection with the Placing, the Joint Bookrunners and any of

their respective affiliates, acting as investors for their own

account, may take up a portion of the Placing Shares in the Placing

as a principal position and in that capacity may retain, purchase,

sell, offer to sell for the own accounts or otherwise deal for

their own account in such Placing Shares and other securities of

the Company or related investments in connection with the Placing

or otherwise. Accordingly, references to Placing Shares being

offered, acquired, placed or otherwise dealt in should be read as

including any issue or offer to, or acquisition, placing or dealing

by, the Joint Bookrunners and any of their respective affiliates

acting in such capacity. In addition, the Joint Bookrunners and any

of their respective affiliates may enter into financing

arrangements (including swaps, warrants or contracts for

difference) with investors in connection with which the Joint

Bookrunners and any of their respective affiliates may from time to

time acquire, hold or dispose of shares. Neither of the Joint

Bookrunners intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligations to do so.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than AIM.

Each prospective placee has been offered Placing Shares at the

Placing Price and the Placing Shares have been conditionally

subscribed by such placees pursuant to irrevocable placing letters

issued by the Joint Bookrunners.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK Product Governance Rules"), and

disclaiming all and any liability, whether arising in tort,

contract or otherwise, which any 'manufacturer' (for the purposes

of the UK Product Governance Rules) may otherwise have with respect

thereto, the Placing Shares have been subject to a product approval

process, which has determined that the Placing Shares are: (i)

compatible with an end target market of (a) retail clients, as

defined in COBS 3.4.1R of the Conduct of Business Sourcebook in the

FCA Handbook ("COBS") , (b) investors who meet the criteria of

professional clients as defined in COBS 3.5.1R of COBS and (c)

eligible counterparties as defined in COBS 3.6.1R of COBS; and (ii)

eligible for distribution through all distribution channels as are

permitted by the UK Product Governance Rules (the "UK Target Market

Assessment"). Notwithstanding the UK Target Market Assessment,

distributors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

the Placing Shares offer no guaranteed income and no capital

protection; and an investment in the Placing Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The UK

Target Market Assessment is without prejudice to the requirements

of any contractual, legal or regulatory selling restrictions in

relation to the Placing. Furthermore, it is noted that,

notwithstanding the UK Target Market Assessment, the Joint

Bookrunners will only procure investors who meet the criteria of

professional clients and eligible counterparties. For the avoidance

of doubt, the UK Target Market Assessment does not constitute: (a)

an assessment of suitability or appropriateness for the purposes of

COBS; or (b) a recommendation to any investor or group of investors

to invest in, or purchase, or take any other action whatsoever with

respect to the Placing Shares. Each distributor is responsible for

undertaking its own target market assessment in respect of the

Placing Shares and determining appropriate distribution

channels.

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any 'manufacturer' (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that the Placing Shares are: (i) compatible

with an end target market of retail clients and investors who meet

the criteria of professional clients and eligible counterparties,

each as defined in MiFID II; and (ii) eligible for distribution

through all distribution channels as are permitted by MiFID II (the

"EU Target Market Assessment"). Notwithstanding the EU Target

Market Assessment, distributors should note that: the price of the

Placing Shares may decline and investors could lose all or part of

their investment; the Placing Shares offer no guaranteed income and

no capital protection; and an investment in the Placing Shares is

compatible only with investors who do not need a guaranteed income

or capital protection, who (either alone or in conjunction with an

appropriate financial or other adviser) are capable of evaluating

the merits and risks of such an investment and who have sufficient

resources to be able to bear any losses that may result therefrom.

The EU Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the placing. Furthermore, it is noted

that, notwithstanding the EU Target Market Assessment, the Joint

Bookrunners will only procure investors who meet the criteria of

professional clients and eligible counterparties.

For the avoidance of doubt, the EU Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEPPUUAGUPWGGQ

(END) Dow Jones Newswires

January 26, 2023 06:53 ET (11:53 GMT)

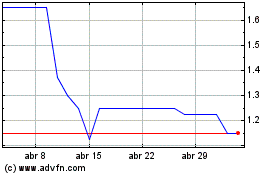

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Chamberlin (LSE:CMH)

Gráfica de Acción Histórica

De May 2023 a May 2024