TIDMCUSN

RNS Number : 2648O

Cornish Metals Inc.

02 October 2023

CORNISH METALS CHANGE IN FINANCIAL YEAR AND GRANT OF STOCK

OPTIONS

Vancouver, October 1, 2023

Cornish Metals Inc. (TSX-V/AIM: CUSN) ("Cornish Metals" or the

"Company"), a mineral exploration and development company focused

on its South Crofty tin project in Cornwall, United Kingdom,

announces that it is changing its financial year end from 31

January to 31 December and that it has granted 800,000 incentive

stock options over common shares without par value in the Company

(the "options") to Executive Management.

Change of Year-End

The Company has decided to change its financial year end to 31

December to better align the Company's financial reporting periods

to that of its peer group in the mineral resources sector. In

addition, the calendar year end coincides with traditional

financial, taxation and operational cycles.

As a result of the change of the financial year end, key dates

in the Company's future reporting calendar will be as follows:

-- Publication of unaudited accounts for the nine month period

ending 31 October 2023 no later than 1 January 2024;

-- Publication of audited accounts for the eleven month period

ending 31 December 2023 no later than 29 April 2024;

-- Publication of unaudited accounts for the three month period

ending 31 March 2024 no later than 30 May 2024; and

-- Publication of unaudited accounts for the six month period

ending 30 June 2024 no later than 29 August 2024.

Further details on the Company's reporting periods required

pursuant to the Company's listing on the TSX-V are set out in the

Notice filed on Sedar.

PDMR Option Grant

The Board of Directors has approved the issuance of 800,000

options to Fawzi Hanano, Chief Development Officer. To ensure

alignment with the Company's shareholders, the options granted

herein have an exercise price of GBP0.18 per share, the same as the

options granted earlier this year (see news release dated July 17,

2023 ) and as the investment price paid by Vision Blue Resources

when the Company raised GBP40.5M (C$65M) in May 2022 (see news

release dated May 23, 2022 ). These options have a five-year term,

whereby the options vest over a three-year period, with one third

of the options vesting at the end of each year. The options will

expire on September 30, 2028.

The Company's Stock Option Plan allows for the issuance of up to

10% of the Issued Capital of the Company. Prior to this grant, the

Company had 16,150,000 options issued, representing 3.02% of the

Issued Capital of the Company (535,270,712). The current issuance

of 800,000 options takes the total number of options granted to

16,950,000, representing 3.17% of the Issued Capital.

Fawzi Hanano was granted the following options:

Name Position Number of shares Total Share options

subject to the Held

options granted

Chief Development

Fawzi Hanano Officer 800,000 800,000

------------------- ----------------- -------------------

The notification below, made in accordance with the requirements

of the UK Market Abuse Regulation, provides further detail.

Details of the person discharging managerial

1 responsibilities / person closely associated

a) Name 1. Fawzi Hanano

---------------------- -----------------------------------------

Reason for the notification

2

-----------------------------------------------------------------

a) Position/status 1. Chief Development Officer

---------------------- -----------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------- -----------------------------------------

Details of the issuer, emission allowance

3 market participant, auction platform, auctioneer

or auction monitor

-----------------------------------------------------------------

a) Name Cornish Metals Inc.

---------------------- -----------------------------------------

b) LEI 8945007GJ5APA9YDN221

---------------------- -----------------------------------------

Details of the transaction(s): section to

4 be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------

a) Description options over common shares without

of the financial par value

instrument,

type of instrument

Identification CA21948L1040

code

b) Nature of Grant of options pursuant to the

the transaction Company LTIP

---------------------- -----------------------------------------

c) Price(s)

and volume(s)

------------------ ------------------

Price(s) Volume(s)

------------------ ------------------

1. 18.00 pence 1. 800,000

---------------------------------------------- ------------------

d) Aggregated N/A

information

- Aggregated N/A

volume

- Price 18 pence

e) Date of the 30 September 2023

transaction

---------------------- -----------------------------------------

f) Place of Outside of a trading venue

the transaction

---------------------- -----------------------------------------

ABOUT CORNISH METALS

Cornish Metals is a dual-listed company (AIM and TSX-V: CUSN)

focused on advancing the South Crofty high-grade, underground tin

Project through to delivery of a Feasibility Study, as well as

exploring its additional mineral rights, all located in Cornwall,

United Kingdom. Cornish Metals has a growing team of skilled

people, local to Cornwall. The former producing South Crofty tin

mine is located beneath the towns of Pool and Camborne, and closed

in 1998 following over 400 years of continuous production.

An updated Mineral Resource was completed in September 2023 as

summarised below:

South Crofty Summary (JORC 2012) Mineral Resource Estimate

Area Classification Mass Grade Contained Tin

(kt) /

Tin Equivalent

(kt)

---------------- ------ ----------- ----------------

Lower Mine Indicated 2,896 1.50% Sn 43.6

---------------- ------ ----------- ----------------

Inferred 2,626 1.42% Sn 37.4

----------------------------- ------ ----------- ----------------

Upper Mine Indicated 260 0.99% SnEq 2.6

---------------- ------ ----------- ----------------

Inferred 465 0.91% SnEq 4.2

----------------------------- ------ ----------- ----------------

The Mineral Resource Estimate for South Crofty was updated in

September 2023 (see news release dated September 13, 2023 ). An

updated NI 43-101 Technical Report will be filed on SEDAR within 45

days of the September 13 news release.

The technical information in this news release has been compiled

by Mr. Owen Mihalop who has reviewed and takes responsibility for

the data and geological interpretation. Mr. Owen Mihalop (MCSM, BSc

(Hons), MSc, FGS, MIMMM, CEng) is Chief Operating Officer for

Cornish Metals Inc. and has sufficient experience relevant to the

style of mineralisation and type of deposit under consideration and

to the activity which he is undertaking to qualify as a Competent

Person as defined under the JORC Code (2012) and as a Qualified

Person under NI 43-101. Mr. Mihalop consents to the inclusion in

this announcement of the matters based on his information in the

form and context in which it appears .

ON BEHALF OF THE BOARD OF DIRECTORS

"Richard D. Williams"

Richard D. Williams, P.Geo

For additional information please contact:

In North America : Irene Dorsman at (604) 200 6664 or by e-mail

at irene@cornishmetals.com

SP Angel Corporate Finance Richard Morrison Tel: +44 203 470 0470

LLP Charlie Bouverat

(Nominated Adviser & Joint Grant Barker

Broker)

Hannam & Partners Matthew Hasson Tel: +44 207 907 8500

(Joint Broker) Andrew Chubb email: cornish@hannam.partners

Jay Ashfield

BlytheRay Tim Blythe Tel: +44 207 138 3204

(Financial PR/IR-London) Megan Ray email: tim.blythe@blytheray.com

megan.ray@blytheray.com

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release .

Caution regarding forward looking statements

This news release contains "forward-looking statements".

Forward-looking statements, while based on management's best

estimates and assumptions at the time such statements are made, are

subject to risks and uncertainties that may cause actual results to

be materially different from those expressed or implied by such

forward-looking statements, including but not limited to: risks

related to receipt of regulatory approvals, risks related to

general economic and market conditions; risks related to the

COVID-19 global pandemic and any variants of COVID-19 which may

arise; risks related to the availability of financing; the timing

and content of upcoming work programmes; actual results of proposed

exploration activities; possible variations in Mineral Resources or

grade; outcome of the current Feasibility Study; projected dates to

commence mining operations; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; changes in national and local

government regulation of mining operations, tax rules and

regulations.

Although Cornish Metals has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Cornish Metals undertakes no obligation or

responsibility to update forward-looking statements, except as

required by law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPGPWUUPWGRG

(END) Dow Jones Newswires

October 02, 2023 02:00 ET (06:00 GMT)

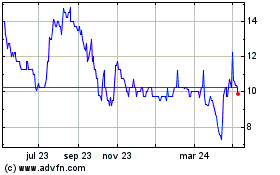

Cornish Metals (LSE:CUSN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

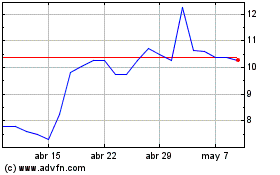

Cornish Metals (LSE:CUSN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024