TIDMERGO

RNS Number : 9893S

Ergomed plc

09 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

FOR IMMEDIATE RELEASE

9 November 2023

Recommended cash acquisition of

Ergomed plc

by

Eden AcquisitionCo Limited

(a newly incorporated company controlled and owned by funds

advised by Permira Advisers LLC)

to be implemented by means of a scheme of arrangement of Ergomed

plc under Part 26 of the Companies Act 2006

ISSUE OF EQUITY AND RULE 2.9 ANNOUNCEMENT

On 4 September 2023, the boards of directors of Eden

AcquisitionCo Limited ("Bidco") and Ergomed plc ("Ergomed" or the

"Company") announced that they had reached an agreement on the

terms of a recommended cash acquisition by Bidco for the entire

issued and to be issued ordinary share capital of Ergomed (the

"Acquisition"). The Acquisition is being implemented by means of a

Court-sanctioned scheme of arrangement under Part 26 of the

Companies Act 2006 (the "Scheme"). On 13 October 2023, Ergomed

announced that the Scheme was approved by the Scheme Shareholders

at the Court Meeting held on that date and the Special Resolution

relating to the implementation of the Scheme was approved by the

Ergomed Shareholders at the General meeting also held on that

date.

In connection with the Acquisition, and to satisfy awards held

by employees of Ergomed under the Company's share option plans,

which will vest and become exercisable upon Court sanction of the

Scheme, Ergomed announces that it has applied for 1,019,749

ordinary shares of 1p each in the capital of Ergomed to be admitted

to trading on AIM ("Admission"). Admission is expected to take

place at 8.00 a.m. on 10 November 2023.

In accordance with Rule 2.9 of the City Code on Takeovers and

Mergers (the "Code"), Ergomed confirms that, on the 10 November,

following the Admission, Ergomed will have 52,084,254 ordinary

shares of 1p each in issue. This figure may be used by shareholders

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the FCA's Disclosure

Guidance and Transparency Rules.

The International Securities Identification Number for Ergomed

Shares is GB00BN7ZCY67.

Ergomed

Miroslav Reljanović (Executive

Chairman)

Jonathan Curtain (Chief Financial Officer)

Keith Byrne (Senior Vice President, +44 (0) 1483 402

Capital Markets and Strategy) 975

Jefferies (Joint financial adviser

to Ergomed)

Michael Gerardi

Matthew Miller

Paul Bundred

James Umbers +44 (0) 20 7029 8000

Deutsche Numis (Joint financial adviser,

Nominated adviser and Joint Broker to

Ergomed)

Freddie Barnfield

Stuart Ord

Alexander Kladov

Euan Brown +44 (0) 20 7260 1000

Peel Hunt (Joint Broker to Ergomed)

James Steel

John Welch

Dr Christopher Golden +44 (0) 20 7418 8900

Consilium Strategic Communications

(PR adviser to Ergomed)

Chris Gardner

Matthew Neal +44 (0) 20 3709 5700

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law. Persons who are not

resident in the United Kingdom or who are subject to other

jurisdictions should inform themselves of, and observe, any

applicable requirements.

Jefferies International Limited ("Jefferies"), which is

authorised and regulated by the Financial Conduct Authority in the

United Kingdom, is acting exclusively for Ergomed and no one else

in connection with the matters set out in this announcement and

will not regard any other person as its client in relation to the

matters in this announcement and will not be responsible to anyone

other than Ergomed for providing the protections afforded to

clients of Jefferies nor for providing advice in relation to any

matter referred to in this announcement or any transaction or

arrangement referred to herein. Neither Jefferies nor any of its

affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Jefferies in connection with this announcement, any statement

contained herein, any transaction or arrangement referred to

herein, or otherwise.

Numis Securities Limited ("Deutsche Numis") which is authorised

and regulated by the Financial Conduct Authority in the United

Kingdom, is acting exclusively for Ergomed and no one else in

connection with the matters set out in this announcement and will

not regard any other person as its client in relation to the

matters in this announcement and will not be responsible to anyone

other than Ergomed for providing the protections afforded to

clients of Deutsche Numis nor for providing advice in relation to

any matter referred to in this announcement or any transaction or

arrangement referred to herein. Deutsche Numis is not responsible

for the contents of this announcement. Neither Deutsche Numis nor

any of its affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Deutsche Numis in connection with this

announcement, any statement contained herein, any transaction or

arrangement referred to herein, or otherwise.

Peel Hunt LLP ("Peel Hunt") which is authorised and regulated by

the Financial Conduct Authority in the United Kingdom, is acting

exclusively for Ergomed and no one else in connection with the

matters set out in this announcement and will not regard any other

person as its client in relation to the matters in this

announcement and will not be responsible to anyone other than

Ergomed for providing the protections afforded to clients of Peel

Hunt nor for providing advice in relation to any matter referred to

in this announcement or any transaction or arrangement referred to

herein. Peel Hunt is not responsible for the contents of this

announcement. Neither Peel Hunt nor any of its affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Peel Hunt in

connection with this announcement, any statement contained herein,

any transaction or arrangement referred to herein, or

otherwise.

About Ergomed plc

Ergomed provides specialist services to the pharmaceutical

industry spanning all phases of clinical development, post-approval

pharmacovigilance and medical information. Ergomed's fast-growing

services business includes an industry-leading suite of specialist

pharmacovigilance (PV) solutions, integrated under the

PrimeVigilance brand, a full range of high-quality clinical

research and trial management services under the Ergomed brand

(CRO) and mission-critical regulatory compliance and consulting

services under the ADAMAS brand. For further information, visit:

http://ergomedplc.com.

Dealing Disclosure Requirements

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKCBBQBDDPDK

(END) Dow Jones Newswires

November 09, 2023 09:27 ET (14:27 GMT)

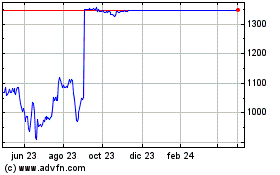

Ergomed (LSE:ERGO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Ergomed (LSE:ERGO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025