3i Group PLC Update on portfolio and Capital Markets Seminar

24 Septiembre 2024 - 1:00AM

RNS Regulatory News

RNS Number : 3270F

3i Group PLC

24 September 2024

3i Group plc

Update on portfolio and Capital

Markets Seminar

3i Group plc ("3i" or "the Group")

will be holding a Capital Markets Seminar via webcast today,

involving presentations on our Services and Software sector

approach and on Audley Travel. In addition, Simon Borrows, our

Chief Executive, will provide an update on the portfolio more

broadly, the key elements of which are outlined below. The seminar

will start at 10:00 and the joining details are provided at the end

of this press release. The presentation materials and a recording

of the webcast will also be made available on our

website.

We have completed our September

semi-annual portfolio company reviews for Private Equity and

Infrastructure against a weak macroeconomic backdrop across the UK

and continental Europe. We are seeing good overall performance

across both the Private Equity and Infrastructure

portfolios.

Action's impressive performance has continued

with very strong sales and EBITDA growth. Year-to-date sales (at 22

September 2024) of €9.3 billion are 21% ahead of the same period

last year. Like-for-like ("LFL") sales growth over the same period

was 9.6%. The LFL sales growth was driven by customer transactions

and strong sales of everyday necessities. We expect operating

EBITDA for the 12 months to the end of P9 2024 to be circa €1,880

million compared to €1,530 million at the end of September 2023, an

increase of 23%. Cash generation has continued to be strong, with

cash balances at 22 September 2024 at €779 million. Action has now

added 179 net new stores in the year to date and remains on track

to deliver or exceed 330 net new stores in 2024.

In the broader Private Equity

portfolio, Royal Sanders and European Bakery Group continue to

perform well. Customer demand is also driving a recovery across the

healthcare assets. Audley has continued to see very strong growth

and the software and IT related assets in the portfolio are showing

positive momentum. We are also seeing an improving trend across

some of the discretionary consumer assets and MPM continues to

perform well. A number of the assets which experienced challenging

operating conditions last year have been returning to improving

trading trajectories. WilsonHCG has however yet to see any material

upturn in the recruitment process outsourcing market.

To

register for the webcast, please visit

https://www.3i.com/investor-relations/

- Ends -

For further

information, contact:

Notes to

editors:

About 3i

Group

3i is a leading international investment manager

focused on mid-market Private Equity and Infrastructure. Our core

investment markets are northern Europe and North

America.

For further information, please visit:

www.3i.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

MSCEAPNDAFSLEFA

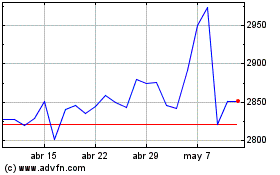

3i (LSE:III)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

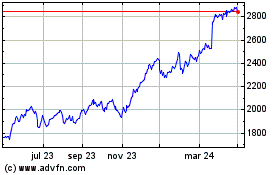

3i (LSE:III)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024