TIDMJCH

RNS Number : 8291S

JPMorgan Claverhouse IT PLC

14 March 2023

LONDON STOCK EXCHANGE ANNOUNCEMENT

JPMORGAN CLAVERHOUSE INVESTMENT TRUST PLC

FINAL RESULTS FOR THE YEARED 31ST DECEMBER 2022

Legal Entity Identifier : 549300NFZYYFSCD52W53

Information disclosed in accordance with the DTR 4.1.3

The Directors of JPMorgan Claverhouse Investment Trust plc (the

"Company") announce the Company's results for the year ended 31st

December 2022.

CHAIRMAN'S STATEMENT

Performance and Manager Review

2022 proved to be another very challenging year in general for

investors. Just as it seemed that the worst of the pandemic was

behind us, and the way was clear for economies to recover from the

virus' severe economic impact, Russia's invasion of Ukraine in

February 2022 dealt a fresh blow to the economic outlook and

investor confidence. As well as escalating geopolitical tensions to

post WWII highs, the war added to upward pressures on energy and

commodity prices, driving already rising inflation even higher.

Markets were shocked by central banks' aggressive policy response

and fears that high and still rising rates would push the major

economies, including the UK, into recession this year now seem more

likely to be realised.

These developments weighed heavily on financial markets. The

MSCI Word Index closed the year down 17.7%, and the FTSE All Share

Index also dropped sharply during the first half of the year. UK

domestic political instability was an additional source of

uncertainty during this period, but the appointment of Rishi Sunak

as Prime Minister in October calmed investors' jitters and the UK

market experienced a steep recovery, outperforming other major

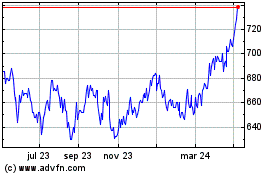

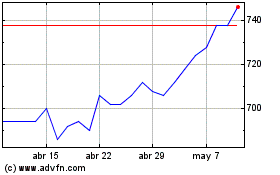

markets, to close the year up slightly +0.3%. The Company

underperformed its benchmark over the 12 months to end December

2022, declining by 4.6% on a net asset value ('NAV') basis (with

debt at fair value), and 5.1% in share price terms over the period,

compared to a positive return of 0.3% for the benchmark.

This is clearly a disappointing result; however, it is important

to understand that this underperformance occurred in the first half

of the year, during the worst of the financial turmoil. Portfolio

performance improved in the second half of the year and the Company

outperformed its benchmark in this six-month period, recouping some

of its underperformance, as market conditions steadied, and the

portfolio changes implemented by the Portfolio Managers to

strengthen its resilience to the year's challenges began to pay

off.

The year was also characterised by a small percentage of stocks

outperforming the relevant index. For example, only 23% of stocks

outperformed the FTSE All Share Index over the year. This made it

particularly challenging for active managers operating for risk

management reasons within agreed investment guidelines and

restrictions. These are summarised in the Strategic Report in the

full annual report. During the year, the Board reviewed these

guidelines with the Portfolio Managers, in particular the range of

60 to 80 stocks, and confirmed that they remained appropriate.

Shareholders should also bear in mind that the Portfolio

Managers invest for the long-term, so they should be judged by

their performance over a longer timeframe. Over the ten years to

31st December 2022, the Company achieved an average annual return

of 7.9% on an NAV basis and 9.1% in share price terms,

outperforming the benchmark return of 6.5% on the same basis.

The Investment Manager's report below provides more detail on

performance during 2022, and how the Portfolio Managers have

adapted the Company's portfolio in light of the new lower growth,

higher inflation environment. They also discuss the outlook for

2023.

As at 10th March 2023, the Company's NAV per share (with debt at

fair value) was 722.54p and the share price was 684.00p.

Revenue and Dividends

The Directors have declared a fourth quarterly interim dividend

of 10.5p per share for the year ended 31st December 2022, to be

paid on 17th March 2023, which brought the total dividend per share

for the year to 33.0p (2021 total: 30.5p), an increase of 8.2% on

the year. I am very pleased to say that this is the 50th successive

year in which the dividend has been raised - a record which very

few investment trusts have achieved. The dividend has grown each

year from 0.48p per share in 1972 to 33.0p per share in 2022, a

compound dividend growth of 8.8% per annum, comfortably exceeding

inflation and UK dividend growth.

At a time when rising inflation is making dramatic inroads into

household budgets, I am sure shareholders will be equally

appreciative of the fact that following payment of the fourth

quarterly interim dividend, the Company will have continued to pay

dividends in excess of inflation over each of the past 3, 5 and 10

year periods, and above the dividend growth of the UK market as a

whole (as measured by the constituents of the FTSE All-Share Index)

as illustrated in the chart in the full annual report and table

below.

Source: Bloomberg.

Claverhouse UK Market

CPI DPS Growth Dividend Growth

(% per annum) (% per annum) (% per annum)

--------- -------------- -------------- ----------------

3 Year 4.1% 4.4% -7.1%

--------- -------------- -------------- ----------------

5 Year 3.3% 4.9% -1.2%

--------- -------------- -------------- ----------------

10 year 2.4% 5.7% 2.5%

--------- -------------- -------------- ----------------

Source: Office of National Statistics.

The Board's dividend policy remains to seek to increase the

dividend each year and, taking a run of years together, to increase

dividends at a rate close to or above the rate of inflation. With

UK inflation now at a 30 year high, the Board will continue to

monitor carefully the outlook for dividend income. However, given

the Company's revenue reserves, built up over a number of years,

and its ability, as an investment trust, to utilise these reserves

if necessary to support the dividend, the Board currently expects

future dividend increases to enable the Company to continue to meet

its dividend policy objectives. The Board intends to increase the

first three quarterly interim dividends in 2023 to 8.0p per share

from 7.5p per share in the previous financial year.

Premium/Discount and Share Issuance/Repurchases

During 2022, the discount to NAV at which the shares traded

ranged from a premium of +3.7% to a discount of -3.6%. As a result,

in the year to 31st December 2022, the Company issued 710,000 new

shares at times when the shares were trading at a premium. The

Company did not repurchase any of its shares during the year. The

Board's objective is to use the repurchase and allotment

authorities to manage imbalances between the supply and demand of

the Company's shares, with the intention of reducing the volatility

of the discount or premium, in normal market conditions.

As at 31st December 2022, the Company's discount (to its

cum-income, debt at fair value, NAV) was -0.3%, and at the time of

writing it currently stands at -5.33%.

At this year's Annual General Meeting ('AGM'), to be held on

28th April 2023, the Company will be seeking renewed authority from

shareholders to sell shares from Treasury at a small discount, to

issue new shares and to repurchase its own shares.

Since the year end, the Company's discount at which its shares

trade has widened, the Board has deemed it necessary to utilise the

Company's buy back authority, buying in a total of 465,000 shares

as at the date of this report.

The comparison between the debt at par and fair value NAV

reflects the difference between the interest paid on the Company's

long-term debt (the 3.22% GBP30 million private placement loan) and

current interest rates. The two calculations of NAV will therefore

vary in accordance with prevailing interest rates and will change

over the life of the long-term debt. At present, the difference

between the two methods of calculation is approximately 2%. The

Investment Manager's contribution to NAV performance should be

assessed without regard to the long-term debt interest rate, over

which it has no control; the cum income NAV with debt at par will

therefore continue to be reported in the annual and interim

reports. However, as mentioned above, the cum income NAV, with debt

at fair value, will be used for the purposes of decisions on share

buybacks and issues, as it is the basis upon which the NAV is

announced to the market.

Gearing/Long Term Borrowing

The Portfolio Managers can use FTSE 100 index futures to effect

reductions in the level of gearing by reducing the portfolio's

market exposure. The Company's gearing policy (excluding the effect

of any futures) is to operate within a range of 5% net cash and 20%

geared in normal market conditions. The Investment Manager has

discretion from the Board to vary the gearing level between 5% net

cash and 17.5% geared (including the effect of any futures). The

Board believes that over the long-term a moderate level of gearing

is an efficient way to enhance shareholder returns.

In order that the Portfolio Managers could retain the

flexibility to maintain gearing up to the maximum permitted level,

in May 2022 the Company secured a new two-year revolving credit

facility of GBP80 million with Mizuho Bank following the expiry of

the Company's loan facility with the National Australia Bank.

Taking into account borrowings, net of cash balances held and

the effect of futures, the Company ended 2022 approximately 7.2%

geared. During the year gearing varied between 1.8% net cash and

9.7% geared. Gearing is currently 8.0%. The Company has a GBP30

million 3.22% private placement loan, maturing in March 2045. In

addition, GBP10 million of the Mizuho revolving credit facility was

drawn down as at 31st December 2022. See note 13 in the full annual

report.

Environmental, Social and Governance ('ESG')

ESG considerations are integrated into the Investment Manager's

investment process and within the broader decision making

framework. This annual report includes a separate Environmental,

Social and Governance Report from the Investment Manager in the

full annual report. During the year, the Investment Manager became

a new signatory to the UK Stewardship Code.

Investment Management Fees and Manager Evaluation

Since the year end, the Board has agreed with the Manager to

amend the Company's investment management fees.

With effect from 1st July 2023, the investment management fee

will be charged on a tiered basis at an annual rate of 0.45% of the

Company's net assets on the first GBP400 million and at 0.40% of

net assets above that amount. The fee will continue to be

calculated and paid monthly.

During the year under review, the Management Engagement

Committee undertook a formal review of the Manager and Investment

Manager, covering the investment management, performance of the

Portfolio Managers and company secretarial, administrative and

marketing services provided to the Company. The review took into

account the Investment Manager's investment performance record,

management processes, investment style, resources and risk control

mechanisms. I am pleased to report that the Board agreed with the

Committee's recommendation that the continued appointment of the

Manager is in the interests of shareholders.

Keeping in Touch

The Board would like to increase dialogue with the Company's

existing shareholders. Investors holding their shares through

online platforms will shortly receive a letter inviting them to

sign up to receive email updates from the Company. These updates

will deliver regular news and views, as well as the latest

performance statistics. If shareholders wish to sign up to receive

these communications, please visit

https://web.gim.jpmorgan.com/emea_investment_trust_subscription/welcome?targetFund=JCH.

Annual General Meeting

We are planning to hold this year's AGM in person at JPMorgan's

offices at 60 Victoria Embankment, London EC4Y 0JP, on Friday, 28th

April 2023 at 12 noon. The Company's Portfolio Managers; William

Meadon and Callum Abbot will give a presentation to shareholders,

review the past year and comment on the outlook for the current

year. The meeting will be followed by a sandwich lunch and provide

shareholders with the opportunity to meet the Directors and

representatives of the Manager. We look forward to welcoming as

many shareholders as possible at the AGM.

For shareholders wishing to follow the AGM proceedings but

choosing not to attend, we will be able to welcome you through

conferencing software. Details on how to register, together with

access details, will be available on the Company's website:

www.jpmclaverhouse.co.uk, or by contacting the Company Secretary at

invtrusts.cosec@jpmorgan.com.

As is normal practice, all voting on the resolutions will be

conducted by a poll. Shareholders viewing the meeting via

conferencing software will not be able to vote on the poll and we

therefore encourage all shareholders, and particularly those who

cannot physically attend, to exercise their votes in advance of the

meeting by completing and submitting their form of proxy.

If you have any detailed or technical questions, it would be

helpful if you could raise them in advance with the Company

Secretary at 60 Victoria Embankment, London EC4Y 0JP or via the

'Ask a Question' link on the Company's website. Shareholders who

are unable to attend the AGM are encouraged to use their proxy

votes.

If there are any changes to the arrangements for the AGM, the

Company will update shareholders through the Company's website and,

if appropriate, through an announcement on the London Stock

Exchange.

Board Succession

This is my first Annual Report since becoming Chairman following

the retirement of Andrew Sutch at the conclusion of the AGM on 29th

April 2022. Andrew had served as a Director of the Company since

2013, holding the position of Chairman from 2015. I would like to

once again take this opportunity, on behalf of the entire Board, to

thank him for all his hard work and his effective stewardship of

the Board and the Company during his tenure.

At the time of Andrew's retirement, Jill May became the Senior

Independent Director, Nicholas Melhuish took over as Audit

Committee Chair and Victoria Stewart became Chair of the

Remuneration Committee. Led by the Nomination Committee, following

a search for a suitably qualified candidate to replenish the Board

after Andrew's departure, I am delighted to welcome Joanne Fintzen

as a Non-Executive Director of the Company with effect from 3rd

October 2022. Joanne brings a wealth of experience to her new role,

and my Board colleagues and I look forward to working with her. The

Board therefore recommend that shareholders vote in favour of her

appointment at the forthcoming AGM.

Outlook

While it has been very challenging over recent months and years,

I share the Portfolio Managers' cautious optimism regarding the

outlook for UK equity markets. The likelihood of recession in 2013

is already well-discounted by investors at current market levels

and should sentiment continue to improve substantially investors

may be further tempted by the attractive valuations of many UK

stocks relative to their foreign peers.

We are also positive about the Company's prospects. It is

invested predominantly in large, high-quality, well-diversified

FTSE 100 stocks, many of which are continuing to pay growing

dividends. Attributable in part to the portfolio adjustments

implemented by the Portfolio Managers, the portfolio's holdings

began to recover in the second half of 2022 once equity market

conditions stabilised, and in the new lower growth, higher

inflation environment, stocks offering high, predictable and rising

income should continue to do especially well, benefitting our

shareholders over coming years.

We are pleased to have experienced Portfolio Managers who are

working hard to preserve and grow shareholders' assets and their

success in doing so is evident in their long-term record of

outperformance.

David Fletcher

Chairman 13th March 2023

INVESTMENT MANAGER'S REPORT

Investment Approach

Claverhouse is a diversified portfolio of JPMorgan's best UK

ideas, comprising both quality growth and value stocks. A handful

of very large stocks, which represent a significant part of the

benchmark, are held for risk-control reasons.

We adopt a long-term, patient investment perspective and we

believe that this approach will produce outperformance of the index

in a steady, consistent manner, irrespective of market conditions.

We also aim to maintain Claverhouse's multi-decade dividend growth

record.

Market Review

2022 was a significant and sobering year in many ways. Asset

prices tumbled as a veritable witches' brew of unexpected global

challenges were thrown at investors and policy makers alike.

Encouraged by the final lifting of Covid-19 restrictions, the

new year started in good heart. Such optimism was, however, short

lived, as Russia shocked the world by its invasion of Ukraine in

February, and the economic consequences were immediate. Russian gas

pipelines to Europe closed, sparking the Continent's biggest ever

energy crisis. Inflation, which was already becoming a problem,

soon rose to multi decade highs, fuelled by increases in both

energy and commodity prices. This in turn precipitated the fastest

interest rate rises for decades, as central banks scrambled to curb

surging prices. The decade-long era of easy, cheap money came to an

abrupt and painful end. Such events were toxic for most assets.

Unusually, equities and bonds fell in tandem. For much of the year

there were no safe investment havens in which to hide.

To add to UK investors' woes, as the cost of living crisis

deepened, politicians struggled to maintain authority. In a surreal

three-month period, the UK had three Prime Ministers and four

Chancellors of the Exchequer! A badly judged mini-budget in

September triggered turmoil - bond prices plummeted and sterling

dropped to a historic low of $1.03 - forcing the Bank of England to

intervene to stabilise markets.

Global equities experienced their worst year since 2008, with US

tech stocks and emerging markets being particularly badly hit. Many

crypto currencies collapsed. The UK equity market, however, did

relatively well by comparison. Investors welcomed the appointment

of Rishi Sunak as Prime Minister in October, and a strong rally in

the final quarter saw the FTSE All-Share Index finish just ahead

for the year (+0.3%), led by a handful of large oil and mining

stocks which investors saw as being beneficiaries of surging

commodity prices. China maintained harsh lockdowns for most of the

year as it struggled to contain the spread of the Covid-19 virus.

The end of the year, however, saw some loosening of restrictions,

and an associated resumption of economic activity, which gave

further impetus to equities' year-end market rally.

Performance Review

We are bottom-up stock pickers. Developments at the sector and

macroeconomic levels generally have less influence on the portfolio

than our assessment of the companies themselves. For much of 2022,

geopolitical and macro issues were of much more concern to

investors than usual and this explains, in part, our

under-performance. The portfolio struggled in the first half of the

year as markets nose-dived in the wake of the unexpected Russian

invasion of Ukraine. It declined by 12.8% on an NAV basis, 8.2

percentage points below the benchmark decline of 4.6%. However,

some significant portfolio changes (discussed below), intended to

improve the Company's resilience to the year's many unexpected

challenges, combined with our risk-controlled approach to sizing

positions at both a stock and sector level, helped the portfolio

navigate the storm. Performance improved in the second half and the

portfolio clawed back some of its H1 underperformance. In sum, in

the year to 31st December 2022 as a whole, Claverhouse delivered a

total return on net assets (capital plus dividends re-invested) of

-4.6%, 4.3 percentage points weaker than the benchmark return of

+0.3%. With the Company's shares moving from a premium of +0.2% to

a small discount of -0.3% at the year end, the total annual return

for shareholders was -5.1%.

Further detail of Claverhouse's performance over the year is

given in the accompanying table below.

Performance attribution

Year ended 31st December 2022

% %

------------------------------------------------- ----- -----

Contributions to total returns

------------------------------------------------- ----- -----

Benchmark return 0.3

------------------------------------------------- ----- -----

Stock & Sector selection -7.1

------------------------------------------------- ----- -----

Gearing & cash 0.2

------------------------------------------------- ----- -----

Investment Manager contribution -6.9

------------------------------------------------- ----- -----

Cost of debt -0.2

------------------------------------------------- ----- -----

Portfolio total return -6.8

------------------------------------------------- ----- -----

Management fee/other expenses -0.7

------------------------------------------------- ----- -----

Share buyback/share issuance -

------------------------------------------------- ----- -----

Sub total -0.7

------------------------------------------------- ----- -----

Return on net assets with debt at par value(A) -7.5

------------------------------------------------- ----- -----

Change in the fair value of the long term

debt 2.9

------------------------------------------------- ----- -----

Return on net assets with debt at fair value(A) -4.6

------------------------------------------------- ----- -----

Source: JPMAM/Morningstar. All figures are on a total return

basis.

Performance attribution analyses how the Company achieved its

recorded performance relative to its benchmark.

(A) Alternative Performance Measure ('APM').

A list of APMs, with explanations and calculations, and a

glossary of terms are provided on pages 96 to 98 in the full annual

report.

The Company delivered a dividend increase for the 50th

consecutive year, a notable milestone. Dividends in respect of the

financial year ended 31st December 2022 (FY22) totalled 33.0p per

share, an 8.2% rise on the previous year's dividend of 30.5p per

share. The dividend yield in respect of the year is 4.7% (based on

the share price as at 9th March 2023).

Across the market, the year's outperformers were very limited,

mainly comprising commodity companies and traditionally defensive

names investors thought could benefit from, or at least cope with,

the challenging economic environment. By contrast, financials and

consumer stocks were particularly hard hit, as were very small

companies. Accordingly, the most significant positive contributors

to the Company's performance over the year included several energy

and commodity companies as illustrated in the table below.

Top Contributors and Detractors to Performance vs FTSE All-Share

Index

Top Five Contributors Top Five Detractors

JPMorgan UK Smaller Cos

Shell +1.5% IT -1.5%

BP +1.1% Intermediate Capital -1.3%

AstraZeneca +1.0% Watches of Switzerland -0.7%

Glencore +0.5% Dunelm -0.6%

Prudential +0.3% Impax Asset Management -0.6%

Source: JPMAM, as at 31st December 2022.

Oil stocks continued to outperform in all major markets, and BP

and Shell were no exception, making them the largest contributors

to returns over the year. The Russian invasion of Ukraine exposed

the fragility of global energy markets and caused oil and gas

prices to soar. Years of underinvestment has led to capacity

constrained supply issues which were compounded by the closure of

Russia's pipelines. The resultant supernormal cash flows generated

by BP and Shell are being returned to shareholders. Additionally,

management teams are investing in the energy transition and have

recently increased capex guidance for upstream oil and gas

projects. However, management teams are aware that investors want

to see strong returns on investment and will not tolerate

squandering of capital chasing volumes, as has been the case

historically. Focusing on shareholder returns rather than growing

volumes should provide a good outcome for shareholders over the

medium term.

Pharmaceutical companies, including portfolio holding

AstraZeneca, performed strongly as investors sought out companies

with reliable earnings streams. AstraZeneca is finally reaping the

reward of a decade long strategy shift towards improving R&D

efficacy in high margin areas such as oncology. A number of the

drugs developed as a result have proved extremely effective, and

earnings growth should be boosted for many years ahead as these

drugs come to market.

Glencore is a diversified mining company with substantial

exposure to metals such as copper, zinc and nickel which are

essential to the electrification of vehicles. Higher commodity

prices have led to an improvement in Glencore's trading division,

allowing the company to pay down debt and return excess capital to

shareholders. In addition, a change in the management team has seen

a substantial improvement in the company's ESG credentials, marking

a new, greener era for this miner. Many outstanding legal cases

against Glencore have been settled, including one involving the US

Department of Justice.

It was a tale of two halves for the Asian insurance company,

Prudential. For most of the year, China's harsh zero Covid-19

policies prevented Chinese nationals from travelling into Hong Kong

to buy insurance products. However, towards the end of the year,

when the Chinese government began to re-open the economy, we bought

shares in Prudential at a very depressed valuation and they have

since enjoyed a meaningful recovery.

The Company's position in JPMorgan's Smaller Companies

Investment Trust, run by JPMAM's in-house small companies' team,

was the largest detractor from returns during the year. It

underperformed as investors sought the perceived safety of larger,

more liquid stocks. However, over the years, this fund has not only

contributed materially to the performance of Claverhouse, but as

stocks have grown out of the smaller companies' index and into the

FTSE 350, it has also provided a rich source of new direct

investment ideas for us. We therefore intend to maintain our

holding.

General market panic at the start of 2022, combined with rapidly

rising interest rates, led to a substantial sell off in many

financials such as private market specialist, Intermediate Capital

and ESG-focused asset manager, Impax. Intermediate Capital remains

in the portfolio as we continue to be happy with the company's

operational performance. However, we sold our holding in Impax as

we became concerned about the high level of the business's

operating leverage and the potential for outflows.

The sharp pickup in inflation led to a severe sell off in

consumer stocks, as the cost of living crisis limited discretionary

spending and investors began to fear an imminent recession. While

Dunelm and the retailer of luxury watches, Watches of Switzerland

sold off on these fears, both companies are coping well with this

challenging backdrop and remain holdings.

Highlighted Company: Natwest

Rising rates are beneficial for banks' net interest margins,

which have been severely depressed throughout the past decade of

low/zero interest rates. Higher rates should thus pave the way for

Natwest to deliver double digit returns on equity after years of

economic suppression. Accompanying this, stringent post GFC banking

regulations have left NatWest's balance sheet very well capitalised

and able to weather downturns in the macro environment.

Highlighted Company: Shell

This oil major is undergoing a significant restructuring to

position itself as a diversified energy company. Part of the

strategic shift involves returning surplus capital to shareholders,

rather than growing volumes through low return projects, as it has

done in previous cycles. This marks an important change to their

capital discipline and signals an improvement in the quality of the

business. In addition, the company has benefited from soaring

energy prices as years of underinvestment by the sector has led to

supply constraints which has been compounded by the closure of

Russia's pipelines. Shell trades at a significant discount to Exxon

Mobil, a US listed peer, and the broader UK market.

Portfolio Review

The portfolio held 63 stocks at the end of the year, towards the

lower end of our normal range, as we focused on the very limited

number of companies which could cope with the year's economic

storm. Indeed, less than a quarter of shares in the FTSE All Share

outperformed compared to a more normal year, where this number is

generally closer to 50%. While we are stock-focused, we do run a

sector-diversified portfolio, as the following discussion on the

year's portfolio activity illustrates.

Top Over and Under-weight positions vs FTSE All Share Index

Top Five Overweight Positions Top Five Underweight Positions

Glencore +2.2% Unilever -1.3%

SSE +2.2% Vodafone -0.9%

NatWest +2.1% Flutter -0.9%

AstraZeneca +2.1% Haleon -0.7%

BP +2.0% HSBC -0.7%

Source: JPMAM, as at 31st December 2022.

Purchases

Some significant portfolio changes were necessary to ensure it

was best-placed to weather the year's many challenges.

For the past three years, the Asian life insurance company

Prudential has been hamstrung by the covid-induced closure of

China's borders. As discussed above, this prohibited Chinese

nationals crossing into Hong Kong to take out insurance policies.

This business provides a significant portion of the revenues of

Prudential. Now the Chinese border has re-opened, there should be

plenty of pent-up demand for Prudential's products.

JD Sports is an international retailer of sports and leisure

wear. The company has exclusive relationships with big brands like

Nike, adidas and Levi Jeans which give them security of supply and

a strong competitive advantage versus peers. We sold out of the

shares at beginning of 2022 as consumer spending pressures loomed,

but after the sharp fall in the share price, we reopened the

position.

Oil and gas companies were some of the few beneficiaries of

events, due to the energy supply shock. We therefore added to our

existing holdings in BP and Shell, and opened new holdings in other

energy names such as Drax, SSE, Centrica and Serica, which we

thought would also benefit from higher gas and oil prices.

Glencore's exposure to copper, nickel and zinc also means it is

well positioned to benefit from the global transition to EVs and

other clean energy users and we opened a position/added to our

position.

As the economy turned down, we added to several defensive

businesses including Tesco, Imperial Brands and Unilever, which we

expected to be relatively resilient.

Higher defence budgets following the Russian invasion of Ukraine

will be beneficial for BAE and this prompted us to add a new

holding.

We added a new position in the catering services company Compass

Group, which struggled during the pandemic, however, its diverse

client base (offices, hospitals and sports venues, to name a few)

means revenues are relatively immune to normal economic slowdowns.

The company has emerged from the pandemic stronger than ever, and

recent results showed continued operational momentum.

We also added to several utilities names which have

inflation-linked, regulated asset bases. These included National

Grid and Severn Trent.

We also added a new position in Bunzl, a B2B distributor of

non-food consumable products such as food packaging and cleaning

and hygiene supplies, across a diverse range of end markets. Its

contracts are typically on a cost plus basis.

Man Group , a new position, is an alternative asset manager

which continues to deliver strong operational momentum, despite the

challenging backdrop. Its recent good performance in key strategies

has attracted new business, particularly in its higher fee absolute

return strategies. As a purely institutional manager, its asset

base is likely to be relatively sticky and we expect the company to

return significant amounts of excess cash to its shareholders if

performance remains strong.

4imprint , a new position, produces promotional merchandise and

is benefitting from the continuing shift away from physical

catalogues towards online merchandising.

The UK insurer, Aviva, has been on a multi-year restructuring to

sell off non-core assets and re-focus on markets where they have a

strong (top 3) market position. The disposals are now complete, and

the business is extremely well capitalised as a result, so we added

a new position.

Telecom Plus is a multiservice utilities provider to residential

and small business customers in the UK. The company can price at a

discount to the government price cap due to its scale and long-term

supply contracts with partners. The competitive environment has

greatly improved, as many of their smaller, aggressive competitors

have not survived the recent period of energy price volatility.

Sales

Even before the Russian invasion of Ukraine, we had, thankfully,

sold our holdings in Polymetal and EVRAZ both of which have

operations in Russia. EVRAZ shares have subsequently been

suspended.

After the Russian invasion, we sold a number of cyclicals as we

looked to position the portfolio more defensively. These companies

were either directly exposed to the economic cycle or lack the

pricing power to pass through cost inflation. They included

software company AVEVA, Breedon, a supplier of building materials,

fashion house Burberry, B&M, owner of variety stores, and

retailer Marks and Spencer.

In addition, we also closed our exposure to bus company National

Express, budget airline WIZZ Air, Synthomer, a producer of

specialist chemicals, Unite Group, a diversified REIT, and asset

managers Scottish Mortgage Investment Trust, Polar Capital and

Liontrust Asset Management, which have exposure to highly rated

growth names.

We sold several highly-rated companies where we grew concerned

about their expensive rating in a rising rate environment. These

included Ergomed, a biotech company, Games Workshop, which sells

toys and games, and Oxford Instruments, a producer of semiconductor

equipment and materials.

We also sold Rightmove, a provider of online information related

to UK residential real estate, Spirax-Sarco, a specialist

industrial machinery and Team 17, a video game designer.

Although global media platform Future and ad agency WPP are

quite different businesses, they are both exposed to economic

cycles, as expenditure on marketing is one of the first areas to be

cut in a downturn. Commentary from several large US tech names

suggests that media budgets are already being cut and we expect

more to follow. As a result, we sold out of both.

We also closed positions in international gambling companies

Flutter and Entain. We still think that the US gambling market is

an attractive structural growth story. However, these are

consumer-exposed companies and they both have significant European

operations which may struggle in the current macroeconomic

environment.

Asset management is a highly operationally geared business, and

we grew increasingly concerned about the downside risk at Impax, as

poor performance may lead to outflows. Although we think they are

well-placed in the ESG space, we sold our position due to these

near term headwinds.

Hilton Food Group processes, packs and distributes meat and fish

products to international food retailers. We bought Hilton on the

premise that is had many long-dated, cost-plus contracts, which

should have given visibility of revenues and protection from

inflation. Management commentary in meetings and in shareholder

communications supported these beliefs. However, at the time of

their H1 results, management announced that they had been unable to

pass on rampant cost inflation in some of their contracts, and

interest costs had ballooned. This led to a material profit warning

and the shares sold off sharply. We sold the stock on the news,

together with our exposure to the producer of chicken and pork

products, Cranswick, which we expected to experience similar

issues.

We sold out of our residual holdings in Vodafone and BT, as

price competition in the telecoms industry intensified.

Reluctantly, we sold out of two good companies, BHP and

Ferguson, both of which delisted from the main UK stockmarket.

Claverhouse's portfolio was geared throughout the year, but much

less so than usual. We use FTSE 100 futures to manage gearing and,

to a slightly greater extent than usual, to protect income. At the

year-end the Company was 7.2% geared, compared to 8.8% at the end

of the previous year, but by the time of writing, this had risen to

8.0%.

Highlighted Company: Ashtead Group

Ashtead is a rental company servicing industrial and

construction end markets. We expect Ashtead to continue to benefit

from the structural trend of increased rental penetration, and to

win market share in what is a highly fragmented industry. Ashtead

current market share is only just over 10% and management is hoping

to double this over the medium term. The company's scale and

technology give it a competitive advantage over small operators, as

they have better equipment availability and utilisation rates are

better. This has allowed Ashtead to generate returns well ahead of

its cost of capital and it has a long runway for reinvestment of

that capital - the perfect recipe for the business to keep creating

value for shareholders.

Highlighted Company: 3i Group

3i is a private equity investor. It owns companies that operate

in four core sectors: Business and Technology Services, Consumer,

Healthcare and Industrial Technology. The company targets

investments which it believes can double in size over their holding

period, and it has an excellent track record of achieving this

goal. Its largest portfolio company is Action, a discount retailer,

which is rapidly rolling out its stores across Europe. Action has

been phenomenally successful, yet its expansion is still in its

early stages. While many private equity companies have been doing

bigger and more expensive deals, 3i has focused on smaller

transactions and bolt-on deals for existing portfolio companies.

This acute focus on valuation should enhance returns over the long

run. Current CEO, Simon Borrows, took over in 2012 and has

consistently grown the value of the portfolio.

Environmental, Social, and Governance ('ESG') factors

Whilst Claverhouse holds stocks based primarily on companies'

fundamentals, we also consider the potential impact of ESG factors

on a company's ability to deliver shareholder value. We assess each

company's strategy for dealing with these important matters and the

consequent risks arising from them. Our analysis helps determine

whether relevant ESG factors are financially material and, if so,

whether they are reflected in the valuation of the company. Such

analysis may influence not only our decision to own a stock but

also, if we do, the size of that position in the portfolio.

For example, we own several stocks in the mining, energy and

tobacco sectors, all of which face significant ESG challenges. Our

analysis suggests that the risks posed by these ESG challenges are

currently adequately reflected in most of those companies'

valuations and do not outweigh the investment attractions of the

shares. As owners of these companies, we strive to influence

management in their efforts to address these important issues and

we hold them accountable for their ESG targets.

We explained our case for holding mining companies in our 2020

annual report. Our view remains that many of the commodities that

miners' produce are not only the building blocks of economic growth

but are essential to facilitating electrification of the global

economy. Hence, while the sector undoubtedly faces many ESG

challenges, there are good reasons to believe it has a key role to

play in developing a more sustainable future.

Accordingly, we added Glencore to the portfolio in early 2022.

Whilst the company has had a chequered past, culminating in fines

from several regulators relating to corruption and bribery, it has

since undergone a significant transformation, including changes to

senior management. We are now observing much improved ESG

credentials. At a recent capital markets day, Glencore set itself

ambitious climate targets, including reaching net zero emissions

from its own activities (Scope 1 and 2 emissions) and emissions

generated indirectly by its actions (Scope 3 emissions) by 2050. At

the same event, the new CEO, Gary Nagle, committed to strengthening

the company's Value and Code of Conduct and firmly embedding its

principles in the business. In the years to come we will, of

course, closely monitor management's progress in reaching these

targets. With a much-improved approach to ESG considerations, the

production of metals essential for electrification of the global

economy and consequent exceptional cash generation, we now believe

Glencore to be an attractive investment.

Company meetings continue to be an important opportunity to

engage with our portfolio companies on ESG issues. As an example,

we recently engaged with both Lloyds Banking Group and NatWest

Group regarding their progress towards realising their climate

goals. The meetings provided us with the chance to understand the

challenges these two banks face in achieving their net zero

targets. Both companies are significant providers of mortgages.

Decarbonising the UK housing stock presents one of the greatest

challenges for the UK in reducing the country's carbon emissions

and will require commitment from multiple stakeholders.

Understanding the role that mortgage lenders can play in addressing

this challenge was insightful.

Market Outlook

We continue to observe a fragile world characterised by

heightened risks. Global growth will be slower in 2023 and some

economies, including the UK, may slip into recession. The end of

the decade-long era of cheap money will require investors to factor

in structurally higher inflation and interest rates than those they

have enjoyed for so long. In addition, the UK economy faces several

unique challenges (some of them self-inflicted!).

However, despite these negatives, a likely peaking of both

inflation and interest rates this year, combined with the

long-awaited re-opening of China, and the sheer depth of universal

investor pessimism, makes us more optimistic on markets than we

have been for some time. We are particularly attracted to large,

blue chip FTSE 100 stocks, many of which are genuinely global in

their operations, but whose shares continue to trade on significant

discounts to their international peers. Indeed, the attractive

valuations of many UK stocks could see the UK market continuing to

be one of the better performing global markets over the coming year

and beyond.

In a lower growth environment, dividend income is likely to

comprise a higher proportion of future total returns. Consequently,

stocks offering high, predictable income should be re-rated - as,

hopefully, will high income Investment Trusts like Claverhouse,

which have a long track record of dividend growth. This trend is

likely to be supported by investors' increased need for income

given the current cost of living crisis.

The dangerous 'get rich quick' era of recent years, which placed

crypto currencies, Nasdaq stocks and profitless technology names in

the ascendancy, is well and truly over. In this new, more

challenged world, investors will need to extend their time horizons

and re-learn to appreciate traditional investment virtues such as

slow, steady compounding and the certainty of access to their

money.

Further tough economic times no doubt lie ahead. But the arrival

of a new, more cautious era should play to Claverhouse's strengths

- its long-term prudent approach of investing in good value,

dividend-paying, quality UK companies - and we are confident that

shareholders will be rewarded for their patience.

For and on behalf of the Investment Manager

William Meadon

Callum Abbot

Portfolio Managers 13th March 2023

PRINCIPAL AND EMERGING RISKS

The Board, through delegation to the Audit Committee, has

undertaken a robust assessment and review of the principal risks

facing the Company, together with a review of any new and emerging

risks that may have arisen during the year to 31st December 2022,

including those that would threaten its business model, future

performance, solvency or liquidity.

With the assistance of the Investment Manager, the Audit

Committee has drawn up a risk matrix, which identifies the key

risks to the Company, as well as emerging risks. The risk matrix,

including emerging risks, are reviewed formally by the Audit

Committee every six months or more regularly as appropriate. At

each meeting, the Board considers emerging risks which it defines

as potential trends, sudden events or changing risks which are

characterised by a high degree of uncertainty in terms of

occurrence probability and possible effects on the Company. As the

impact of emerging risks is understood, they may be entered on the

Company's risk matrix and mitigating actions considered as

necessary. In assessing the risks and how they can be mitigated,

the Board has given particular attention to those risks that might

threaten the viability of the Company. These key and emerging risks

are listed below, in alphabetical order:

Principal Description Mitigating activities

risk

Climate change Climate change can have a significant The Board receives ESG reports

impact on the business models, from the Investment Manager on

sustainability and viability the portfolio and how ESG considerations

of individual companies, whole are integrated into investment

sectors and even asset classes. decision making so as to mitigate

risk at the level of stock selection

and portfolio construction. The

analysis conducted by the Investment

Manager includes the approach

investee companies take to recognising

and mitigating climate change

risks.

The Board is also considering

the threat posed by the direct

impact on climate change on the

operations of the Manager, Investment

Manager and other major service

providers. As extreme weather

events become more common, the

resilience, business continuity

planning and the location strategies

of the Company's services providers

will come under greater scrutiny.

The Investment Manager is reviewing

the core disclosure elements of

the Task Force on Climate-related

Financial Disclosures ('TCFD')

reporting framework. As an investment

trust, the Company is not required

to provide information in compliance

with TCFD.

----------------------------------------- ----------------------------------------------

Cybersecurity Threat of cyber-attack, in all The Company benefits directly

its guises including threats or indirectly from all elements

from the work from home processes of JPMorgan's cyber security programme.

is regarded as at least as important The Board reviews the cyber security

as more traditional physical precautions taken by its third

threats to business continuity party suppliers on a regular basis.

and security. The controls around the physical

In addition to threatening the security of JPMorgan's data centres,

Company's operations, such an security of its networks and security

attack is likely to raise reputational of its trading applications are

issues which may damage the tested by independent reporting

Company's share price and reduce auditors and reported on every

demand for its shares. six months against the AAF 01/06

Standard.

----------------------------------------- ----------------------------------------------

Geopolitical There is an increasing risk The Investment Manager continuously

and macro-economic to market stability and investment monitors geopolitical developments

environment from geopolitical and societal issues relevant to

conflicts (for example, the its business. These are also considered

Russian invasion of the Ukraine as part of portfolio construction.

as well as growing tensions The Company is a closed-end vehicle

in Southeast Asia), which may and, unlike open-ended funds,

impact both investment performance does not have to sell investments

and/or the operating environment at low valuations in volatile

for the Company, Manager, Investment markets.

Manager or the Company's other

third party suppliers.

----------------------------------------- ----------------------------------------------

Investment Inappropriate investment strategy. The Board reviews investment strategy

and strategy For example, poorly calibrated at each board meeting.

asset allocation or inappropriate The Board manages these risks

levels of gearing, may lead by ensuring a diversification

to poor long-term investment of investments. The Investment

performance (significantly below Manager operates in accordance

agreed benchmark or market/industry with investment limits and restrictions

average) resulting in the Company's determined by the Board. The Board

shares trading at a wider discount reviews its investment limits

to NAV per share. and restrictions regularly and

the Manager confirms its compliance

with them each month.

The Investment Manager also provides

the directors with regular management

information, including risk and

performance reports as well as

competitor and shareholder analysis.

The Board monitors the implementation

and results of the investment

process with the Portfolio Managers,

who attend all board meetings.

The performance of the Company

relative to its benchmark and

its peers and the discount/ premium

to NAV per share are key performance

indicators measured by the Board

on a regular basis and are reported

on pages 31 and 32 in the full

annual report.

----------------------------------------- ----------------------------------------------

Legal and As an investment trust, the The Company has procedures to

Regulatory/ Company's operations are subject monitor the status of its compliance

Corporate to wide ranging regulations. with the relevant requirements

Governance The financial services sector to maintain its Investment Trust

continues to experience significant status, including receiving and

regulatory change at national reviewing information and reporting

and international levels. Failure from the Manager and Investment

to act in accordance with these Manager. The Depositary (The Bank

regulations could cause fines, of New York Mellon (International)

censure or other losses including Limited) reports regularly on

taxation or reputational loss. third party suppliers and their

Breach of Company Law or UK compliance with expected standards

Listing Rules resulting in suspension. of performance and these reports

are reviewed by the Audit Committee.

----------------------------------------- ----------------------------------------------

Loss of Investment Loss of key staff by the Investment The Board keeps the services of

Team Manager, such as the Portfolio the Manager, Investment Manager

Managers, could affect the performance and third-party suppliers under

of the Company. continual review. The Board obtains

assurances from the Investment

Manager that the team is suitably

resourced, and appropriately remunerated

and incentivised in its role.

The Board also considers the succession

plan for the portfolio management

team on an annual basis.

----------------------------------------- ----------------------------------------------

Market factors Market factors such as interest The Board considers asset allocation,

such as interest rates, inflation and equity stock selection and levels of

rates, inflation market performance may impact gearing on a regular basis and

and equity the value of investments and has set investment restrictions

market performance the performance of the Company. and guidelines, which are monitored

Government/Central Bank fiscal/monetary and reported on by the Investment

response to the high levels Manager.

of inflation in the UK affecting The Board monitors the implementation

economic growth directly or and results of the investment

valuation levels and a subsequent process and regularly discusses

increase in interest rates. portfolio positioning with the

portfolio management team.

The Board monitors the changing

risk landscape and potential threats

to the Company with the support

of regular reports and ad hoc

reports as required, the directors'

own experience and external insights

gained from industry and shareholder

events.

----------------------------------------- ----------------------------------------------

Operational Disruption to, or failure of, Details of how the Board monitors

the Manager's accounting, dealing the services provided by the Manager

or payments systems or the depositary's and its associates and the key

or custodian's records could elements designed to provide effective

prevent accurate reporting and internal control are included

monitoring of the Company's within the Risk Management and

financial position. Internal Control section of the

Corporate Governance report on

pages 52 and 53 in the full annual

report. The risk of fraud or other

control failures or weaknesses

within the Manager or other service

providers could result in losses

to the Company. The Audit Committee

receives independently audited

reports on the Manager's, the

Investment Manager's and other

service providers' internal controls,

as well as regular reporting from

the Manager's Compliance function.

The Company's management agreement

obliges the Manager to report

on the detection of fraud relating

to the Company's investments and

the Company is afforded protection

through its various contracts

with suppliers, of which one of

the key protections is the Depositary's

indemnification for loss or misappropriation

of the Company's assets held in

custody.

----------------------------------------- ----------------------------------------------

Share price The shares of the Company are The Board seeks to narrow the

volatility traded freely and are therefore discount by undertaking measured

subject to the influences of buybacks of the Company's shares

supply and demand and investors' taking account of market conditions

perception to the markets the and having established explicit

Company invests in. The share guidelines.

price is therefore subject to The Company and Manager work with

fluctuations and like all investment the Corporate Broker to understand

trusts may trade at a discount demand for the Company's shares.

to the NAV.

----------------------------------------- ----------------------------------------------

Strategy Inappropriate investment strategy, The Board manages these risks

and Performance for example asset allocation by setting its objectives carefully

or the level of gearing, may and through diversification of

lead to underperformance against Investments. The Company operates

the Company's benchmark index various investment restrictions

and peer companies, resulting and guidelines designed to ensure

in the Company's shares trading that the mandate given to the

on a wider discount. Investment Manager is properly

executed and these guidelines

are monitored and reported on

by the Manager. JPMF provides

the Directors with timely and

accurate management information,

including performance data and

attribution analyses, revenue

estimates, liquidity reports and

shareholder analyses.

The Board monitors the implementation

and results of the investment

process with the Portfolio Managers,

who attend all Board meetings,

and reviews data which show statistical

measures of the Company's risk

profile. The Investment Manager

has been delegated powers from

the Board to determine appropriate

levels of gearing within a strategic

range set by the Board.

The Board holds a separate meeting

devoted to strategy each year

and also spends time considering

potential emerging risks which

might impact the Company in the

future.

----------------------------------------- ----------------------------------------------

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

Details of the management contract are set out in the Directors'

Report on page 44 in the full annual report. The management fee

payable to the Manager for the year was GBP2,222,000 (2021:

GBP2,206,000) of which GBPnil (2021: GBPnil) was outstanding at the

year end.

Included in administration expenses in note 6 on page 76 in the

full annual report are safe custody fees amounting to GBP8,000

(2021: GBP11,000) payable to JPMorgan Chase Bank N.A. of which

GBP2,000 (2021: GBP3,000) was outstanding at the year end.

The Manager may carry out some of its dealing transactions

through group subsidiaries. These transactions are carried out at

arm's length. The commission payable to JPMorgan Securities Limited

for the year was GBP31,000 (2021: GBP19,000) of which GBPnil (2021:

GBPnil) was outstanding at the year end.

The Company holds an investment in JPMorgan Smaller Companies

Investment Trust plc which is also managed by JPMAM. At the year

end this was valued at GBP13.3 million (2021: GBP20.4 million) and

represented 3.0% (2021: 3.7%) of the Company's investment

portfolio. During the year, the Company made GBPnil (2021: GBPnil)

purchases of this investment and sales with a total value of

GBP811,000 (2021: GBP8,940,000). Dividend income amounting to

GBP334,000 (2021: GBP292,000) was receivable during the year, of

which GBPnil (2021: GBPnil) was outstanding at the year end.

The Company also holds cash in the JPMorgan Sterling Liquidity

Fund, which is managed by JPMorgan. At the year end this was valued

at GBP9.4 million (2021: GBP4.7 million). Interest amounting to

GBP325,000 (2021: GBP6,000) was receivable during the year, of

which GBPnil (2021: GBPnil) was outstanding at the year end.

Handling charges on dealing transactions amounting to GBP8,000

(2021: GBP6,000) were payable to JPMorgan Chase Bank N.A. during

the year of which GBP1,000 (2021: GBP2,000) was outstanding at the

year end.

At the year end, total cash of GBP157,000 (2021: GBP2,188,000)

was held with JPMorgan Chase Bank N.A. A net amount of interest of

GBP14,000 (2021: GBPnil) was receivable by the Company during the

year from JPMorgan Chase Bank N.A. of which GBPnil (2021: GBPnil)

was outstanding at the year end.

Full details of Directors' remuneration and shareholdings can be

found on pages 56 to 57 in the full annual report and in note 6 on

page 76 in the full annual report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

and Financial Statements in accordance with applicable law and

regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have prepared the financial statements in accordance with United

Kingdom Generally Accepted Accounting Practice (United Kingdom

Accounting Standards, comprising FRS 102 'The Financial Reporting

Standard applicable in the UK and Republic of Ireland', and

applicable law).

Under company law, directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the company and of the profit or

loss of the company for that period. In preparing the financial

statements, the directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- state whether applicable United Kingdom Accounting Standards,

comprising FRS 102 have been followed, subject to any material

departures disclosed and explained in the financial statements;

-- make judgements and accounting estimates that are reasonable and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The Directors are responsible for safeguarding the assets of the

company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

The Directors are also responsible for keeping adequate

accounting records that are sufficient to show and explain the

company's transactions and disclose with reasonable accuracy at any

time the financial position of the company and enable them to

ensure that the financial statements and the Directors'

Remuneration Report comply with the Companies Act 2006.

The Directors are responsible for the maintenance and integrity

of the company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

The accounts are published on the www.jpmclaverhouse.co.uk

website, which is maintained by the Company's Manager. The

maintenance and integrity of the website maintained by the Manager

is, so far as it relates to the Company, the responsibility of the

Manager. The work carried out by the auditors does not involve

consideration of the maintenance and integrity of this website and,

accordingly, the auditors accept no responsibility for any changes

that have occurred to the accounts since they were initially

presented on the website. The accounts are prepared in accordance

with UK legislation, which may differ from legislation in other

jurisdictions.

The Strategic Report and Directors' Report include a fair review

of the development and performance of the business and the position

of the Company together with a description of the principal risks

and uncertainties that the Company faces.

Under applicable law and regulations the Directors are also

responsible for preparing a Directors' Report and Directors'

Remuneration Report that comply with that law and those

regulations.

Each of the directors, whose names and functions are listed on

page 43 in the full annual report, confirm that to the best of

their knowledge:

-- the Company financial statements, which have been prepared in

accordance with United Kingdom Accounting Standards, comprising FRS

102, give a true and fair view of the assets, liabilities,

financial position and return of the Company; and

-- the Strategic Report and Directors' Report includes a fair

review of the development and performance of the business and the

position of the Company, together with a description of the

principal risks and uncertainties that it faces.

The Board confirms that it is satisfied that the Annual Report

and Financial Statements taken as a whole are fair, balanced and

understandable and provide the information necessary for

shareholders to assess the performance, business model and strategy

of the Company.

For and on behalf of the Board

David Fletcher

Chairman

13th March 2023

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31st December 2022

2022 2021

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- -------- --------- --------- -------- --------- ---------

(Losses)/gains on investments

and derivatives

held at fair value through

profit or loss - (53,403) (53,403) - 67,191 67,191

Net foreign currency gains/(losses) - 285 285 - (4) (4)

Income from investments 22,346 - 22,346 20,224 - 20,224

Interest receivable and similar

income 339 - 339 6 - 6

------------------------------------- -------- --------- --------- -------- --------- ---------

Gross return/(loss) 22,685 (53,118) (30,433) 20,230 67,187 87,417

Management fee (778) (1,444) (2,222) (772) (1,434) (2,206)

Other administrative expenses (716) - (716) (668) - (668)

------------------------------------- -------- --------- --------- -------- --------- ---------

Net return/(loss) before

finance costs

and taxation 21,191 (54,562) (33,371) 18,790 65,753 84,543

Finance costs (658) (1,222) (1,880) (589) (1,094) (1,683)

------------------------------------- -------- --------- --------- -------- --------- ---------

Net return/(loss) before

taxation 20,533 (55,784) (35,251) 18,201 64,659 82,860

Taxation credit/(charge) 3 - 3 (99) - (99)

------------------------------------- -------- --------- --------- -------- --------- ---------

Net return/(loss) after taxation 20,536 (55,784) (35,248) 18,102 64,659 82,761

------------------------------------- -------- --------- --------- -------- --------- ---------

Return/(loss) per share 34.27p (93.10)p (58.83)p 30.77p 109.92p 140.69p

------------------------------------- -------- --------- --------- -------- --------- ---------

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the year.

The 'Total' column of this statement is the profit and loss

account of the Company and the 'Revenue' and 'Capital' columns

represent supplementary information prepared under guidance issued

by the Association of Investment Companies.

Net return/(loss) after taxation represents the return/(loss)

for the year and also Total Comprehensive Income/(Expense).

STATEMENT OF CHANGES IN EQUITY

For the year ended 31st December 2022

Called Share Capital Total

up

share premium redemption Capital Revenue Shareholders'

capital account reserve reserves reserve(1) funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- --------- ----------- --------- ----------- --------------

At 31st December 2020 14,651 165,378 6,680 184,483 21,667 392,859

Issuance of the Company's

shares from Treasury - 412 - 3,247 - 3,659

Issue of ordinary shares 208 6,073 - - - 6,281

Repurchase of shares into

Treasury - - - (2,329) - (2,329)

Net return - - - 64,659 18,102 82,761

Dividends paid in the

year - - - - (18,209) (18,209)

--------------------------- -------- --------- ----------- --------- ----------- --------------

At 31st December 2021 14,859 171,863 6,680 250,060 21,560 465,022

Issue of ordinary shares 178 5,004 - - - 5,182

Net (loss)/return - - - (55,784) 20,536 (35,248)

Dividends paid in the

year - - - - (19,156) (19,156)

--------------------------- -------- --------- ----------- --------- ----------- --------------

At 31st December 2022 15,037 176,867 6,680 194,276 22,940 415,800

--------------------------- -------- --------- ----------- --------- ----------- --------------

(1) This reserve is distributable. The amount that is

distributable is not necessarily the full amount as disclosed in

these financial statements of GBP22,940,000 as at 31st December

2022. This reserve may be used to fund distributions to

shareholders.

STATEMENT OF FINANCIAL POSITION

At 31st December 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------------- --------- ----------

Fixed assets

Investments held at fair value through profit or loss 445,552 553,180

------------------------------------------------------- --------- ----------

Current assets

Debtors 1,098 1,403

Cash held at broker - 4,969

Cash and cash equivalents 9,556 6,886

------------------------------------------------------- --------- ----------

10,654 13,258

Current liabilities

Creditors: amounts falling due within one year (10,406) (70,480)

Derivative financial liabilities - (936)

------------------------------------------------------- --------- ----------

Net current assets/(liabilities) 248 (58,158)

------------------------------------------------------- --------- ----------

Total assets less current liabilities 445,800 495,022

Creditors: amounts falling due after more than one

year (30,000) (30,000)

------------------------------------------------------- --------- ----------

Net assets 415,800 465,022

------------------------------------------------------- --------- ----------

Capital and reserves

Called up share capital 15,037 14,859

Share premium account 176,867 171,863

Capital redemption reserve 6,680 6,680

Capital reserves 194,276 250,060

Revenue reserve 22,940 21,560

------------------------------------------------------- --------- ----------

Total shareholders' funds 415,800 465,022

------------------------------------------------------- --------- ----------

Net asset value per share 691.3p 782.4p

------------------------------------------------------- --------- ----------

STATEMENT OF CASH FLOWS

For the year ended 31st December 2022

2022 2021

GBP'000 GBP'000

------------------------------------------------------- ----------- -----------

Net cash outflow from operations before dividends and

interest (2,609) (2,888)

Dividends received 22,677 19,322

Interest received 316 6

Overseas tax recovered 1 -

Interest paid (1,971) (1,587)

------------------------------------------------------- ----------- -----------

Net cash inflow from operating activities 18,414 14,853

------------------------------------------------------- ----------- -----------

Purchases of investments (226,611) (191,662)

Sales of investments 280,403 156,615

Settlement of forward currency contracts - (1)

Settlement of futures contracts (504) (2,635)

Transfer of Company cash to be held at the broker 4,969 (4,969)

------------------------------------------------------- ----------- -----------

Net cash inflow/(outflow) from investing activities 58,257 (42,652)

------------------------------------------------------- ----------- -----------

Dividends paid (19,156) (18,209)

Issuance of the Company's shares from Treasury - 3,659

Repurchase of the Company's shares into Treasury - (2,329)

Issue of Ordinary shares 5,182 6,281

Repayment of bank loan (100,000) (25,000)

Drawdown of bank loan 40,000 45,000

------------------------------------------------------- ----------- -----------

Net cash (outflow)/inflow from financing activities (73,974) 9,402

------------------------------------------------------- ----------- -----------

Increase/(decrease) in cash and cash equivalents 2,697 (18,397)

------------------------------------------------------- ----------- -----------

Cash and cash equivalents at start of year 6,886 25,283

Exchange movements (27) -

------------------------------------------------------- ----------- -----------

Cash and cash equivalents at end of year 9,556 6,886

------------------------------------------------------- ----------- -----------

Cash and cash equivalents consist of:

------------------------------------------------------- ----------- -----------

Cash and short term deposits 157 2,188

Cash held in JPMorgan Sterling Liquidity Fund 9,399 4,698

------------------------------------------------------- ----------- -----------

Total 9,556 6,886

------------------------------------------------------- ----------- -----------

Reconciliation of net debt

As at Other non-cash As at

31st December Cash flows charges 31st December

2021 2022

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- -------------- ----------- --------------- --------------

Cash and cash equivalents

Cash 2,188 (2,004) (27) 157

Cash equivalents 4,698 4,701 - 9,399

-------------------------------- -------------- ----------- --------------- --------------

6,886 2,697 (27) 9,556

Borrowings

Debt due within one year (70,000) 60,000 - (10,000)

Debt due after one year

GBP30m 3.22% Private Placement

loan (30,000) - - (30,000)

(100,000) 60,000 - (40,000)

-------------------------------- -------------- ----------- --------------- --------------

Total (93,114) 62,697 (27) (30,444)

-------------------------------- -------------- ----------- --------------- --------------

NOTES TO THE FINANCIAL STATEMENTS

For the year ended 31st December 2022

1. Accounting policies

(a) Basis of accounting

The financial statements are prepared under historical cost

convention, modified to include fixed asset investments at fair

value, and in accordance with the Companies Act 2006, United

Kingdom Generally Accepted Accounting Practice ('UK GAAP'),

including FRS 102 'The Financial Reporting Standard applicable in

the UK and Republic of Ireland' and with the Statement of

Recommended Practice 'Financial Statements of Investment Trust