TIDMJOG

RNS Number : 3861U

Jersey Oil and Gas PLC

23 November 2023

23 November 2023

Jersey Oil and Gas plc

("Jersey Oil & Gas", "JOG" or the "Company")

GBA Farm-Out to Serica Energy

Jersey Oil & Gas (AIM: JOG), an independent upstream oil and

gas company focused on the UK Continental Shelf region of the North

Sea, is pleased to announce that it has agreed to farm-out a 30%

interest in the Greater Buchan Area ("GBA") licences to Serica

Energy (UK) Limited (the "Serica Farm-out"). Upon completion of the

Serica Farm-out, JOG will have a 20% interest in the GBA licences

and a full carry on the capital expenditure required to bring the

Buchan field into production.

Highlights :

-- Fully Funded : The transaction delivers material value to JOG

and results in the Company having a fully funded 20% interest in

the on-going Buchan redevelopment project

-- Strong industry partner : Serica is a leading mid-tier UK oil

and gas company producing more than 40,000 barrels of oil

equivalent per day, further strengthening the quality of the GBA

joint venture

-- Milestone payments : $18 million of the $38 million cash

payments attributable to the two GBA farm-outs will have been

received upon completion of the Serica transaction

-- Value creation : Clear path to development sanction and first

oil, with JOG's fully funded position meaning the Company is

underpinned by exposure to zero-capex flowing barrels

-- Future cash generation : Once onstream, JOG will be a

non-operated partner entitled to 20% of production from the Buchan

field

-- Low carbon development : redeployment of an existing floating

production, storage and offloading ("FPSO") vessel that is planned

for future connection to a nearby floating wind power development

makes the Buchan redevelopment solution the option with the lowest

full-cycle carbon footprint

Transaction Summary

The farm-out transaction with Serica is on identical pro-rata

terms to that previously completed with NEO Energy ("NEO") earlier

in the year. In aggregate, the two transactions result in JOG

retaining a 20% interest in the GBA licences, a full carry on the

capital expenditure required to bring the Buchan field into

production and a number of milestone cash payments. Upon completion

of the Serica Farm-out, the combined cash payments received from

the two farm-outs will be over $18 million, with a further $20

million due to be paid to JOG at Buchan Field Development Plan

("FDP") approval.

In exchange for entering into definitive agreements to divest a

30% working interest in the GBA licences, the Company is set to

receive from Serica:

-- 7.5% carry of the estimated $25 million cost to take the

Buchan field through to FDP approval

-- 7.5% carry of the Buchan field development costs, up to the

budget included in the approved FDP; equivalent to a 1.25 carry

ratio

-- $6.8 million cash payment on completion, which includes a

$5.6 million payment associated with the finalisation of the GBA

development solution and associated acquisition of the "Western

Isles" FPSO

-- $7.5 million cash payment on approval of the Buchan FDP by

the NSTA

-- $3 million cash payments on each FDP approval by the NSTA in

respect of the J2 and Verbier oil discoveries

The primary condition precedent to completing the Serica

Farm-out is receipt of approval from the NSTA for the

transaction.

Buchan Development Plan

Following the recent announcement regarding the acquisition of

the "Western Isles" FPSO, all the main components of the Buchan

redevelopment plan have now been defined. The field is to be

produced through the use of up to five subsea production wells,

supported by two water injection wells. These will be tied back to

the FPSO, which will be modified to be "electrification-ready"

prior to redeployment to the field. This will enable the vessel to

have the potential to be connected to one of the anticipated

third-party floating wind power developments that are intended to

be located in close proximity to the GBA following the recent

Innovation and Targeted Oil & Gas ("INTOG") licence awards made

by Crown Estate Scotland.

Work is progressing on the Front End Engineering and Design

("FEED") studies that require completion ahead of FDP approval and

the development moving into the execution phase of activities. The

total capital expenditure forecast for the Buchan redevelopment is

estimated by the Operator, NEO, to be approximately GBP850-950

million (gross cost) to bring into production over 70 million

barrels of oil equivalent (95% oil), with peak production rates of

approximately 35,000 barrels of oil equivalent per day. This

estimate will be refined as part of completing FEED and the

contract tendering activities that precede finalisation of the FDP.

As a result of the farm-out transactions, the Company's share of

the capital expenditure included in the approved FDP work programme

and budget will be fully carried by NEO and Serica. The

transactions unlock the route to monetising total estimated GBA

resources in excess of 100 million barrels of oil equivalent.

Approval of the Buchan FDP is scheduled for 2024, with first

production forecast for late 2026. Following the start-up of

production from Buchan, subsequent phases are expected to involve

the tie-back of the Verbier and J2 discoveries that lie within the

GBA licence area and the potential for regional third-party

discoveries to be tied back to the FPSO.

Andrew Benitz, CEO of Jersey Oil & Gas, commented :

"We are thoroughly delighted to announce the farm-out

transaction with Serica Energy. Not only does it bring a further

high-quality partner into the joint venture, but it unlocks

exceptional value for the Company and delivers upon our overall

objectives for the GBA farm-out strategy. The transaction provides

JOG with multiple cash payments, but most importantly, a fully

funded 20% working interest in the Buchan redevelopment project,

transforming the Company and providing us with the springboard from

which to realise long term shareholder value."

Enquiries :

Jersey Oil and Gas Andrew Benitz C/o Camarco: 020 3757

plc 4980

Strand Hanson Limited James Harris Tel: 020 7409 3494

Matthew Chandler

James Bellman

Zeus Capital Limited Simon Johnson Tel: 020 3829 5000

Cavendish Capital Neil McDonald Tel: 020 7220 0500

Markets Limited Leif Powis

Camarco Billy Clegg Tel: 020 3757 4980

Rebecca Waterworth

- Ends -

Additional Information

The Company's GBA interests comprise the P2498 and P2170

licences, which contain the Buchan oil field, the J2 and Verbier

oil discoveries and a number of exploration prospects.

The farm-out agreements contain representations, warranties and

indemnities given by the Company to Serica in relation to, amongst

other things, title and capacity to the GBA licences. The Company's

maximum aggregate liability under such warranties and indemnities

is limited to an amount equal to the aggregate of the cash payments

and costs carried by Serica under the agreement (to the extent such

amounts are received). The agreement is governed by English

law.

Notes to Editors :

Jersey Oil & Gas is a UK E&P company focused on building

an upstream oil and gas business in the North Sea. The Company

currently holds a 50% interest in each of licences P2498 (Blocks

20/5a, 20/5e and 21/1a) and P2170 (Blocks 20/5b and 21/1d) located

in the UK Central North Sea and referred to as the "Greater Buchan

Area." Licence P2498 contains the Buchan oil field and J2 oil

discovery and licence P2170 contains the Verbier oil discovery.

Following completion of the farm-out transaction with Serica Energy

(UK) Limited, the Company will retain a 20% interest in each of the

GBA licences.

JOG is focused on delivering shareholder value and growth

through creative deal-making, operational success and licensing

rounds. Its management is convinced that opportunity exists within

the UK North Sea to deliver on this strategy and the Company has a

solid track-record of tangible success.

About Serica Energy

Serica Energy is a British independent oil and gas exploration

and production company with a portfolio of UKCS assets and is

listed on the London Stock Exchange. Following the recent

acquisition of the entire issued share capital of Tailwind Energy

Investments Ltd, the Company has a balance of gas and oil

production and is responsible for about 5% of the natural gas

produced in the UK, a key element in the UK's energy

transition.

Serica's producing assets are focused around two main hubs: the

Bruce, Keith and Rhum fields in the

UK Northern North Sea, which it operates, and a mix of operated

and non-operated fields tied back to

the Triton FPSO. Serica also has operated interests in the

producing Columbus (UK Central North Sea)

and Orlando (UK Northern North Sea) fields and a non-operated

interest in the producing Erskine field

in the UK Central North Sea.

Forward-Looking Statements

This announcement may contain certain forward-looking statements

that are subject to the usual risk factors and uncertainties

associated with an oil and gas business. Whilst the Company

believes the expectations reflected herein to be reasonable in

light of the information available to it at this time, the actual

outcome may be materially different owing to factors beyond the

Company's control or otherwise within the Company's control but

where, for example, the Company decides on a change of plan or

strategy.

All figures quoted in this announcement are in US dollars,

unless stated otherwise.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPFAAFXDFFA

(END) Dow Jones Newswires

November 23, 2023 02:00 ET (07:00 GMT)

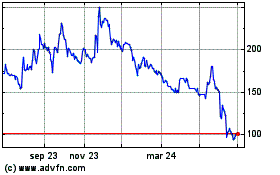

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

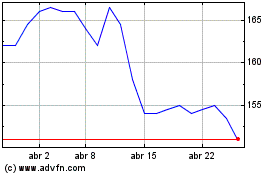

Jersey Oil And Gas (LSE:JOG)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025