Moneysupermarket.com Group PLC Q3 2023 Update (2789Q)

17 Octubre 2023 - 1:00AM

UK Regulatory

TIDMMONY

RNS Number : 2789Q

Moneysupermarket.com Group PLC

17 October 2023

17 October 2023

Q3 2023 update

Moneysupermarket.com Group PLC trading update for the quarter

ended 30 September 2023

Growth led by insurance switching; confident in delivering full

year expectations

Revenue for the 3 months Revenue for the 9 months

ended 30 September 2023 ended 30 September 2023

GBPm Growth (-) GBPm Growth (1)

(1) % %

Insurance 62.3 38 167.9 28

Money 25.2 (10) 77.1 (5)

Home Services 10.3 (1) 28.9 (1)

Travel 6.1 31 17.7 38

---------------- --------- ---------------- --------- ----------------

Cashback 13.9 (3) 43.0 -

Inter-vertical

eliminations (2.2) 181 (5.2) 138

--------- ---------

Total 115.6 14 329.4 12

--------- ---------

Revenue in the quarter up 14%, driven by strong growth in

Insurance and Travel.

-- Continued strong growth in all core Insurance channels. High

levels of switching in car and home insurance has continued,

supported by ongoing premium inflation and rebounding volumes post

the FCA General Insurance Pricing regulations introduced last

year.

-- In Money, robust banking performance was assisted by several

promotions in current accounts, although we were lapping a period

of very strong savings and current account deals last year. The

high interest rate environment continues to impact conversion for

borrowing products.

-- Home Services saw continued softness in broadband switching,

partially but not fully offset by strong growth in mobile

switching. We continue to see no material switching in energy.

-- Travel continued to grow as the wider market recovers, with strength in package holidays.

-- Cashback has continued to face headwinds in retail and telecoms in the period.

Outlook

Our resilient business model, combined with ongoing strategic

progress gives the Board continued confidence that the Group will

deliver in line with market expectations for the full year.

Peter Duffy, CEO of Moneysupermarket Group, said:

"We help millions of people save money on their bills. While

headwinds in some of our markets persist, we're making progress on

our strategy - expanding our offering while attracting and

retaining customers more efficiently. We're particularly excited to

have launched a rewards and loyalty programme under the

MoneySuperMarket brand, the SuperSaveClub. It's very simple - if we

help customers save more, we will drive profitable growth for the

Group."

Notes: Adjusted EBITDA is operating profit before depreciation,

amortisation and impairment and adjusted for other non-underlying

costs. Market expectations of adjusted EBITDA for 2023 from the

analyst consensus on our investor website are in a range of

GBP128.6m to GBP132.2, with an average of GBP129.5m.

(1) Growth has been updated to reflect re-statement of revenues

for the inter-vertical eliminations revenue line for transactions

where revenue in Cashback and Travel has also been recorded as cost

of sales in other verticals.

For further information, contact:

Niall McBride, Chief Financial Officer niall.mcbride@moneysupermarket.com / 0203 826 4688

Emma Darke, Head of IR emma.darke@moneysupermarket.com / 0203 846 2524

William Clutterbuck, H/Advisors Maitland wclutterbuck@h-advisors.global / 07785 292617

This statement may include statements that are forward looking

in nature. Forward looking statements involve known and unknown

risks, assumptions, uncertainties and other factors which may cause

the actual results, performance or achievements of the Group to be

materially different from any future results, performance or

achievements expressed or implied by such forward looking

statements. Except as required by the Listing Rules and applicable

law, the Group undertakes no obligation to update, revise or change

any forward-looking statements to reflect events or developments

occurring after the date such statements are published. The

information in this release is based on management information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTEQLFFXBLXFBF

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

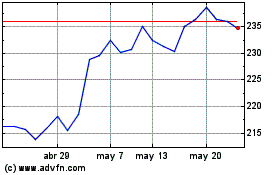

Mony (LSE:MONY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Mony (LSE:MONY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025