TIDMMUT

RNS Number : 9834M

Murray Income Trust PLC

20 September 2023

Murray Income Trust PLC

Annual Report 30 June 2023

Investment Objective

The Company aims for a high and growing income combined with

capital growth through investment in a portfolio principally of UK

equities.

Performance Highlights

Net asset value total return(ABC) Share price total return(AB)

+8.8% +4.9%

2022: (3.5)% 2022: (0.7)%

Benchmark total return(AD) Ongoing charges(B)

+7.9% 0.50%

2022: +1.6% 2022: 0.48%

Earnings per share (revenue) Dividend per share

38.7p 37.50p

2022: 40.5p 2022: 36.00p

Discount to net asset value(BC) Dividend yield(B)

8.2% 4.5%

2022: 4.5% 2022: 4.3%

(A) Total return.

(B) Considered to be an Alternative Performance Measure.

(C) With debt at fair value.

(D) The Company's benchmark is the FTSE All-Share Index.

Chair's Statement

Highlights

-- We are celebrating both Murray Income's centenary and our

record of 50 consecutive years of dividend growth

-- Our objective is to achieve a high and growing income

combined with capital growth from a portfolio principally of UK

equities

-- The dividend yield is 4.5%, based on the year end share price

of 837p

-- Total dividends per share increased by 4.2% to 37.5p, the

50th consecutive year of dividend growth

-- NAV per share total return (AB) was +8.8%, ahead of the FTSE

All-Share Index at +7.9% but the share price total return was +4.9%

as the discount widened

(A) Total return

(B) With debt at fair value

Introduction

Welcome to the 100th annual report of Murray Income Trust. In my

last year as Chair, it is a pleasure to be able to report that the

Company is in good health and has had a good year. In this report

we will review the year just ended, look back over our 100-year

history, look forward to our centenary events and assess the

long-term outlook.

First, the headline numbers for the year to 30 June 2023. Helped

by a strong second half, NAV (net asset value per share, with debt

at fair value) total return was 8.8% over the year, outperforming

the FTSE All-Share Index total return of 7.9%. Your share price

total return at 4.9% lagged the NAV as the discount (based on NAV

with debt at fair value) widened from 4.5% to 8.2% over the year.

We announced on 2 August 2023 a fourth interim dividend of 12.75p

which takes the full year dividend up 4.2% to 37.5p per share,

marking the 50(th) consecutive year of dividend increases, and

representing a dividend yield of 4.5% at the 30 June 2023 share

price.

Centenary and History

Your Company was founded in Glasgow on 8 June 1923 as The Second

Scottish Western Investment Company, Limited with an initial share

capital of GBP500,000. The Company's NAV at 30 June 2023 was nearly

GBP1bn. That's quite some appreciation over 100 years although we

don't know the exact figures for shares issued and cancelled over

the early years so we cannot calculate a reliable annual return.

Back in 1923, the Company's objective was to invest in shares,

stocks, debentures, bonds, mortgages, obligations and securities of

any kind, issued or generated by any company, corporation or

undertaking of whatever nature, constituted or carrying on business

in the United Kingdom or in any colony or dependency or province

thereof, or in the United States of America or in any other foreign

country. That investment remit was exceptionally broad and similar

to many other generalist investment trusts of the era. The

portfolio was mainly invested into bonds and preference shares. The

move into equities or ordinary shares appears to have started in

the 1930s, probably prompted by rising defaults on bond holdings

during the 1930s depression.

The Company changed its name to The Caledonian Trust Company

Limited in 1960 and was administered by Brown, Fleming and Murray,

Glasgow chartered accountants, until the formation of Murray

Johnstone in 1968. In 1979 the Company added its Manager's name to

become Murray Caledonian Investment Trust Limited but remained a

generalist equity trust. With discounts wide and reflecting a

shareholder desire for investment trusts to specialise, in 1984 it

changed to its current name of Murray Income Trust PLC and to its

remit of investing for a high and growing income from a portfolio

predominantly of UK equities. Murray Johnstone was taken over by

Aberdeen Asset Management in 2000 and Murray Income has been part

of the abrdn stable ever since. Most of the older records were

destroyed by a serious flood in Murray Johnstone's offices in the

late 1970s. Facsimile records at Companies' House are in many cases

illegible so, sadly, it is not possible to construct any long term

performance records with a sufficient level of confidence.

One thing that we can confirm is the now fifty-year record of

consecutive dividend increases. It was the autumn of 1973 when your

Company last did not raise its dividend; the year of the miners'

strike and three-day week, the Arab-Israeli war and the oil price

shock. The Company's dividend per share has grown from 0.47p then

to 37.5p in 2023, representing a compound annual growth rate of

9.2%. A more realistic comparison is the 6.0% compound annual

growth rate since the change to a UK equity income remit in

1984.

The Association of Investment Companies (the "AIC") accords

Dividend Hero status to investment trusts which have raised their

annual dividend consecutively for twenty years or more. Maintaining

that Dividend Hero status and with a starting dividend yield level

of over 4% is both a source of pride for the Board and a priority

for the future.

Dividend

As outlined above, the Board announced on 2 August 2023 its

50(th) consecutive increase in the annual dividend to 37.5p.

Revenue per share for the year was 38.7p, down 4.4% from the

previous year's 40.5p. However, the 37.5p dividend was 103% covered

by net income earned during the year and the Company was able to

transfer the excess to bolster its revenue reserves, taking them

from 17.5p per share to 20.2p, equivalent to 54% (2022: 48%) of the

current annual dividend of 37.5p (2022: 36.0p). The Board gave

extensive consideration to how much to grow the dividend and how

much to add to reserves. Two factors influenced us in our decision.

First is that we prefer revenue reserves per share to be in the

range of one-half to a full year's dividend per share. Second is

that although our Manager projects that revenue per share may fall

for another year, dividend cover for UK companies has already

recovered to a very healthy 2.0x for calendar 2023 from 1.5x in

calendar 2021.

Investment Performance

Over the twelve months ended 30 June 2023, the Company's NAV per

share (with debt at fair value) rose 8.8% in total return terms, as

compared to the FTSE All-Share Index (the "Benchmark") return of

7.9%. The share price total return was 4.9% reflecting the discount

widening from 4.5% to 8.2% (measured based on NAV with debt at fair

value).

Positive contributors over the year included the Company's

long-term borrowings, sector allocation and individual holdings

such as Aveva and Sage. The largest positive contributor was the

favourable movement in the fair (or market) value of the Company's

long-term gearing: as interest rates rose, the market value of this

liability fell. The main negative contributors over the year were

stock-specific; Watkin Jones, Marshalls and Direct Line. Charles

Luke and Iain Pyle discuss performance in more detail in the

Investment Manager's Report.

Looking over longer periods ended 30 June 2023, the annualised

NAV (debt at fair value) performance is behind the Benchmark over

three years but ahead over five and ten years.

3 years ended 5 years ended 10 years ended

30 June 2023 30 June 2023 30 June 2023

(annualised) (annualised)

(annualised)

=============================== =============== =============== ================

Performance (total return) % % %

=============================== =============== =============== ================

Share price(A) (B) 7.3 5.6 5.7

=============================== =============== =============== ================

Net asset value per Ordinary

share(A) (BC) 8.3 5.3 6.4

=============================== =============== =============== ================

FTSE All-Share 10.0 3.1 5.9

=============================== =============== =============== ================

Source: abrdn & Morningstar

(A) Total return..

(B) Considered to be an Alternative Performance Measure..

(C) With debt at fair value.

Investment Process

Our Manager's investment process is best summarised as a search

for good quality companies at attractive valuations. The Manager

defines a quality company as one capable of strong and predictable

cash generation, sustainably high returns on capital and with

attractive growth opportunities. These typically result from a

sound business model, a robust balance sheet, good management and

strong environmental, social and governance characteristics. These

qualities helped avoid the worst of the dividend shocks during the

pandemic.

Investment People

abrdn is our appointed investment management company. Charles

Luke has been our lead portfolio manager since 2006 and works

alongside Rhona Millar and Co-Manager Iain Pyle, as members of

abrdn's 43-strong Developed Markets Equities team.

Driving Environmental, Social and Governance ("ESG") Change

ESG considerations are deeply embedded into the company analysis

carried out by our Manager which is able to draw on the expertise

of more than 60 in-house ESG specialists. The aim is to mitigate

risk and enhance returns and this results in frequent dialogue with

investee companies and helps to ensure that the companies in the

portfolio are acting in the best long-term interests of their

shareholders and society at large. The objective is to drive ESG

change.

It is important to note that the policy pursued by our Manager

on our behalf is dynamic rather than static. ESG conclusions change

if the inputs change: For example, one might look at Russia's

invasion of Ukraine and conclude that the social factor of security

and safety is more important now than previously considered.

Similarly, one might consider energy security be given a higher

weight relative to carbon dioxide emissions and come to a different

conclusion on holding an oil or gas stock.

The Investment Manager's Report contains further information on

how ESG factors are incorporated into the Managers' investment

approach. For more detailed information we would refer you to the

Sustainable Investment Report on our website at:

murray-income.co.uk .

Share Buybacks and Discount

Discounts across the investment trust sector have widened in the

past twelve months, including within the UK equity income sector.

The Board has thus decided to make more extensive use of its

buyback capability. Over the year, the discount widened from 4.5%

to 8.2% while the average discount was 7.4% and the range was

between 4.5% and 12.2% (all based on NAV with debt at fair value).

The Company bought back 5.0m shares during the year, representing

4.3% of shares in issue at the start of the year. No shares were

issued or sold from treasury.

The Board monitors the discount level closely and will again be

requesting shareholders' approval at the AGM to renew the Company's

buyback and issuance powers. As at 30 June 2023, there were

111,720,001 (2022: 116,690,472) Ordinary 25p shares in issue with

voting rights and 7,809,531 (2022: 2,839,060) shares held in

Treasury.

Ongoing Charges

Our largest cost is the investment management fee payable to

abrdn which is calculated on a sliding scale with a marginal rate

of 0.25% on assets over GBP450m. The effect of expanding the

Company in 2020 and keeping tight control of costs generally has

resulted in an overall ongoing charges rate of 0.50%, which the

Board considers good value compared to past history and also to

other funds in the closed- and open-ended industry.

Gearing

The Company has GBP100m of long-term borrowings with GBP40m due

in 2027 and GBP60m due in 2029 at a blended cost of 3.6%. Together

with a GBP50m short-term multicurrency facility with Bank of Nova

Scotia Limited, the Company has up to GBP150m of borrowing

facilities available representing 15.0% of net asset value. With

the beta of the investment portfolio (its sensitivity to changes in

the Benchmark) currently running at 0.9 (typical of the Investment

Manager's style), the Board believes that the appropriate neutral

gearing rate is 10%. At the year end the actual gearing rate was

10.4% (2022: 9.4%). The annualised cost of the Company's current

borrowings was 0.26% of NAV (2022: 0.23%).

Board Composition

As previously announced and after completing nearly ten full

years of service, I shall be retiring from the Board at the

conclusion of the centenary Annual General Meeting ("AGM"). Peter

Tait, currently Senior Independent Director, will take over as

Chair. Alan Giles will replace Peter as Senior Independent

Director. The other senior board position is Audit Committee Chair,

a post held by Stephanie Eastment since 2018.

Merryn Somerset Webb has informed us that she does not wish to

stand for re-election as a Director and so will retire from the

Board at the end of the AGM. This is to allow her to be able to

pursue conference hosting roles with interactive investor and

others. We will miss her knowledge of private investors and

marketing and markets in general. She leaves with our thanks and

best wishes.

The remaining Board members have started a recruitment exercise.

Sadly, I have to report that Jean Park passed away in May - Jean

was a much loved colleague and a former Director of this Company

until 2021.

Online Shareholder Presentation

The Company will hold an online shareholder presentation for

shareholders and other interested parties at 11.00am on 3 November

2023. This will feature your Chair and Investment Manager

discussing the outlook for the Company and answering your questions

live. Please submit questions in advance to murray.income@abrdn.com

or on the day via the event page which is also where you may

register:

https://www.workcast.com/register?cpak=6223673361069891

Centenary Annual General Meeting

The Company will hold its centenary AGM in the city of our

incorporation, at 12.30pm on Tuesday 7 November 2023 in The Glasgow

Royal Concert Hall. We hope to mark our centenary in style. One of

the advantages of investing via investment trusts is that all

shareholders have the opportunity to meet their Manager and the

Directors at the AGM. This year's meeting will commence with a

presentation on the Company and market outlook from Charles Luke.

There will then be the formal part of the AGM where shareholders

get to ask questions about the AGM resolutions and thereafter cast

their votes via a poll. After this will be a centenary lunch at

which shareholders will be able to chat to the Manager and

Directors. Shareholders may bring a guest with them to the

meeting.

Action to be Taken

If you wish to attend and are unsure how to register, please

send an email to: murray.income@abrdn.com .

Shareholders will find enclosed with this Annual Report an

Invitation Card and Form of Proxy for use in relation to the AGM.

Whether or not you propose to attend the AGM, you are encouraged to

complete the Form of Proxy in accordance with the instructions

printed on it and return it, with the Invitation Card if you wish,

in the prepaid envelope as soon as possible but in any event so as

to be received no later than 12.30pm on 3 November 2023. Completion

of a Form of Proxy does not prevent you from attending and voting

in person at the AGM if you wish to do so.

If you hold your shares in the Company via a share plan or a

platform and would like to attend and/or vote at the AGM, then you

will need to make arrangements with the administrator of your share

plan or platform. For this purpose, investors who hold their shares

in the Company via the abrdn Investments Plan for Children, the

abrdn Share Plan and/or the abrdn Investments Trust ISA will find a

Letter of Direction and Invitation Card enclosed. Shareholders are

encouraged to complete and return both the Letter of Direction and

Invitation Card in accordance with the instructions printed

thereon.

Further details on how to attend and vote at company meetings

for holders of shares via share plans and platforms can be found

at: www.theaic.co.uk/aic/how-to-vote-your-shares

I always welcome questions from our shareholders at the AGM.

Alternatively, shareholders may submit questions to the Board prior

to the meeting by sending an email to: murray.income@abrdn.com

.

Update

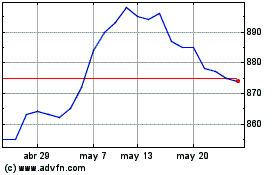

From 30 June 2023 to 15 September 2023, being the latest

practicable date prior to approval of this Report, the NAV per

share (with debt at fair value) returned 2.6% underperforming the

FTSE All-Share Index which returned 3.3%, both figures on a total

return basis.

A personal outlook

Over my term as a Director, I have invested around the same

amount buying Murray Income shares as I have been paid in

Directors' remuneration. I intend to keep the shares for the

long-term. Why? Firstly, the starting yield is important to me. My

long-term financial planning targets an overall compound annual

growth rate of 4%-5%. If I can achieve most of that from the

starting yield of 4.5% then the rest of the decision-making becomes

easier. If the dividend payments grow every year, that's even

better. How about inflation protection? If inflation remains high,

the value of my future income will be eroded. That's one reason I

favour Murray Income over long-term bonds. Bonds, by definition, do

not increase their dividend payments. Equities can, and abrdn's

quality bias means that I would expect Murray Income's holdings to

be more resilient in such a scenario. Not total protection, but

enough to keep me from worrying.

What about the outlook for capital growth? Obviously, this is

harder to predict given the number and scale of known and unknown

scenarios. But as Charles and Iain argue in their Investment

Manager's Report, UK equity valuations currently look unusually

cheap in absolute terms and relative to both their own history and

to world markets. The factors that have depressed UK valuations

(take your pick from politics, Covid, Brexit, productivity,

austerity, banks, quantitative easing and inflation) are not

necessarily permanent. The quality companies within the UK market

are to some extent insulated from these factors and have, in

certain cases, been going from strength to strength, helping

explain why so many have been taken over by foreign companies. If

these quality companies in the portfolio can keep on achieving

revenue growth, the outlook for capital growth is much

improved.

In closing I'll just focus on the investment numbers: the Murray

Income portfolio is presently trading on a price to earnings

multiple of 13.9x current year earnings. Average dividend cover for

those holdings is 2.0x. The current dividend yield for the Company

is 4.5% with that dividend having increased every year for the past

50 years. All this for an annual ongoing charges rate of around

0.50%.

May I thank you all for your support to me as Chair and for your

loyalty to the Company. It has been a great pleasure and privilege

to serve the Company. Murray Income will be in good hands under

Peter's leadership and I trust that you will share in its ongoing

success.

Neil Rogan

Chair

19 September 2023

Investment Manager's Report

Background

For the UK economy, the year to 30 June 2023 ("the Year") has

been characterised by high levels of inflation, monetary policy

tightening and concerns around a potential recession. Equity

markets have generally been more robust than might have been

expected against this backdrop. The UK equity market ended the year

+7.9% higher on a total return basis, although with the path to

that level less than smooth. In September 2022, it was UK politics

that influenced domestic market performance. The new Chancellor

Kwarteng's "mini budget" sparked a wave of selling of UK gilts and

a substantial weakening of the pound which led to the Bank of

England ("BoE") stepping in with emergency measures to stabilise

markets. UK government bond prices rose and the pound recovered

somewhat as first Chancellor Kwarteng and then Prime Minister Truss

resigned and many of their previously announced tax cut proposals

were reversed. Then, in March 2023, the banking sector created

volatility, first in the US when Silicon Valley Bank collapsed and

later in the month when concerns grew over the viability of Credit

Suisse which was ultimately acquired by UBS.

Less transitory than these events have been the persistently

high level of inflation and the ongoing response from central

banks. UK inflation, as measured by the Consumer Prices Index,

reached 11.1% in October, the highest level in more than four

decades. Annual inflation fell below 10% for the first time since

the summer of 2022 in April when the reading was 8.7%, but data for

May showed that core inflation, which excludes volatile fuel and

unprocessed food costs, continued to rise. The BoE acted to control

inflation by raising interest rates multiple times over the period,

with the policy rate increasing from 1.25% at the start of the Year

to 4.5% by the end of June 2023. After the year end, the BoE

subsequently surprised markets by hiking a further 0.5% in July,

and then again by an additional 0.25% in August, as inflation

exceeded expectations, although maintaining their forecast that

inflation will fall rapidly in the second half of 2023.

Despite rising interest rates, the UK has so far avoided a

technical recession (defined as two consecutive quarters of

negative growth in real GDP) and updated forecasts at the start of

the calendar year from the UK's Office for Budget Responsibility

showed they now expect the country to avoid a recession in 2023.

Economic data for the UK has been mixed over the period. GDP fell

by -0.3% in the quarter to September, followed by 0.1% increases in

the subsequent quarters to December and March. Purchasing Managers'

Index data continued to show the Services sector performing better

than Manufacturing. Labour markets have remained tight and there

was widespread strike action across multiple sectors. Consumer

confidence was reported to be at its lowest level since records

began in 1974, albeit retail sales remained relatively robust.

This picture of high inflation and interest rate rises is

generally consistent across other developed markets. Compared to

the UK, inflation has softened more in the US and the Eurozone in

recent months and our view is that we are nearing the end of hiking

cycles in those economies. In the US, although growth has so far

fared better than anticipated in the face of rate tightening and

banking sector concerns, we continue to forecast negative GDP

growth in 2024. China moved away from their zero-covid policy in

the final quarter of 2022. The policy change initially led to a

rise in covid cases which weighed on growth, followed by a benefit

to activity from the reopening of the economy. However, the

reopening tailwind faded quicker than had been widely expected,

which prompted the government in Beijing to introduce new measures

intended to stimulate the economy. Oil and other commodity prices

declined over the Year over fears of weakening demand. European gas

prices fell sharply from the mid-2022 highs reached following the

Russian invasion of Ukraine.

Global equity markets performed well over the Year, with the

MSCI World Index returning 19.2% over the period on a total return

basis in US dollar terms. In the UK, the FTSE All-Share index (the

Company's "Benchmark") lagged global markets, rising by 7.9% with

the FTSE 100 Index which has more international exposure increasing

by 8.9% and outperforming the 3.0% rise in the FTSE 250 Index which

has more domestic exposure. From a factor perspective,

broadly-speaking 'Value' and 'Momentum' outperformed while

'Quality' and 'Growth' stocks underperformed on a relative

basis.

Although a relatively small sector, the technology sector

performed strongly over the year mostly for individual stock

specific reasons. On the other hand the weakest performance was

seen in the telecoms sector as its main constituents BT and

Vodafone struggled operationally. In a broad reversal of the prior

year's performance, some of the more defensive areas of the market

such as healthcare and consumer staples underperformed while

perhaps surprisingly a number of the more cyclical,

economically-sensitive areas of the market such as consumer

discretionary and industrials outperformed.

Performance

The Company generated a positive Net Asset Value per share total

return of 8.8% for the Year (based on debt at fair value)

outperforming the benchmark FTSE All-Share Index which returned

7.9% over the Year. Changes in the fair value of the Company's long

term debt aided performance by approximately 1.3% reflecting the

favourable movement in the fair (or market) value of the Company's

long-term gearing; as interest rates rose, the market value of this

liability fell. On a total return basis, the Company's share price

increased by 4.9% which reflected a widening of the discount to Net

Asset Value (debt at fair value) at which the shares traded from

4.5% to 8.2%.

Our investment process encompasses a patient buy and hold

approach and longer term returns also remain very positive compared

to the Benchmark. For example, over five years, the share price and

Net Asset Value per share (based on debt at fair value) have

outperformed the FTSE All-Share Index by approximately 15% and 13%

respectively on a total return basis.

In absolute terms, taking account of the GBP60m of senior

secured fixed rate notes 2029, GBP40m of senior secured fixed rate

notes 2027, as well as GBP6.4m drawn down from an unsecured

multi-currency revolving credit loan facility agreement with The

Bank of Nova Scotia Limited, debt was GBP106.5m at the end of the

Year. The net gearing was 10.4% at the end of the Year as compared

to 9.4% at the end of the prior year.

Performance benefited from good stock selection in the

technology and consumer staples sectors offset by the underweight

exposure to energy and poor stock selection in the consumer

discretionary and industrials sectors.

Turning to the individual holdings, there were numerous

companies that demonstrated strong share price increases. The share

prices of VAT Group and Sage both increased by over 45% during the

Year. Non-held companies British American Tobacco and Vodafone, and

the holdings in technology companies Sage and Aveva generated the

greatest stock level outperformance. As we mentioned last year, we

believed the portfolio was vulnerable to corporate and takeover

activity and during the year bids were forthcoming for Euromoney,

Aveva, Industrials REIT, Dechra Pharmaceuticals and Countryside

Properties in aggregate benefiting relative performance.

The poorest share price performances were from domestic

companies exposed to higher inflation and/or rising interest rates

including Watkin Jones , Marshalls and Direct Line . Marshalls ,

Direct Line and non-held HSBC and Flutter provided the most

significant negative relative return over the Year.

Performance Attribution for the year ended 30 June 2023

%

======== ================================= =====

Net Asset Value total return

for year per Ordinary share

(fair value) +8.8

============================================ ====

FTSE All Share Index total return +7.9

============================================ ====

Relative return +0.9

------------------------------------------- -----

Relative return

=========================================== =====

Stock selection

================================== ====

Energy +0.1

=========================================== ====

Basic Materials -0.5

=========================================== ====

Industrials -1.5

=========================================== ====

Health Care +0.2

=========================================== ====

Consumer Staples +1.1

=========================================== ====

Consumer Discretionary -0.9

=========================================== ====

Telecommunications +0.5

=========================================== ====

Utilities +0.1

=========================================== ====

Technology +0.9

=========================================== ====

Financials -0.7

=========================================== ====

Real Estate +0.1

------------------------------------------- ----

Total stock selection (equities) -0.6

------------------------------------------- ----

Asset allocation (equities)

================================== ====

Energy -0.4

=========================================== ====

Industrials +0.5

=========================================== ====

Health Care +0.1

=========================================== ====

Consumer Staples +0.1

=========================================== ====

Telecommunications +0.1

=========================================== ====

Technology +0.5

=========================================== ====

Financials -0.1

=========================================== ====

Real Estate -0.2

------------------------------------------- ----

Total asset allocation (equities) 0.6

------------------------------------------- ----

Management fees -0.4

=========================================== ====

Administrative expenses -0.1

=========================================== ====

Tax -0.1

=========================================== ====

Cash & Options -0.5

=========================================== ====

Gearing - finance costs +0.5

=========================================== ====

Gearing - difference between

fair value and par value

returns +1.3

=========================================== ====

Share buybacks +0.3

=========================================== ====

Residual effect -0.1

=========================================== ====

Total +0.9

------------------------------------------- ----

Notes: Stock Selection - measures

the effect of equity selection relative

to the benchmark. Asset Allocation

- measures the impact of over or

underweighting each industry basket

in the equity portfolio, relative

to the benchmark weights. Cash &

options effect - measures the impact

on relative returns of these categories.

Gearing - measures the impact on

relative returns of net borrowings.

Management fees, administrative

expenses and tax - these reduce

total assets and therefore reduce

performance. Source - abrdn.

Portfolio Activity and Structure

Turnover of approximately 18% was the same as the prior year.

The pattern of trades reflected the ongoing desire to improve,

where possible, the quality of the portfolio and maintaining the

focus on attractive capital and dividend growth. Active share (the

proportion of the portfolio that differs from the benchmark)

remained stable at approximately 70%.

The portfolio added five new holdings in the Year. Two of these,

Games Workshop and Genus , were UK mid-cap company introductions.

Games Workshop is a hobby miniatures company which we see as a

unique asset with strong quality credentials and an attractive

dividend yield. Genus is a global leader in genetics and breeding,

contributing to improving sustainable food production. We see Genus

as having an attractive market position and long-term growth

potential from the development of virus-resistant pigs.

The Company can invest up to 20% of gross assets in overseas

listed companies. This has three main benefits: firstly, to provide

access to industries not available to UK-only investors; secondly,

to diversify risk in concentrated sectors in the UK market; and

thirdly, to enable investment in better quality proxies of UK

listed companies. During the year, three overseas holdings were

added to the portfolio. The first was Swiss-listed pharmaceutical

company, Roche , which has a healthy balance sheet and a pipeline

which we believe to be undervalued. The second was LVMH , the

luxury goods company listed in Paris which offers strong long-term

growth potential through its portfolio of well-known brands. The

final new overseas holding added to the portfolio was Paris-listed

cosmetics and skincare company L'Oréa l which we see as having

strong quality characteristics, in particular: well-known brands,

appealing market growth dynamics and attractive financial

characteristics.

We increased exposure to several of our existing holdings which

we believe have high quality characteristics with attractive growth

prospects at appealing valuations including Howden Joinery , Kone ,

Nestlé, Oversea-Chinese Banking Corp , Oxford Instruments , London

Stock Exchange Group , RELX , Sage , and Unilever .

Fifteen holdings were sold during the Year, of which five stocks

were exited following takeover bids: Aveva , Dechra Pharmaceuticals

, Euromoney , Industrials REIT and Countryside Partnerships (where

we continue to have a holding in the acquirer, Vistry ). In the

second half of 2022 we reduced the portfolio's exposure to the real

estate sector. Watkin Jones was sold following a profit warning

which led to a change in confidence in the company's business model

and concern about the risk of further downgrades. Concern around

high levels of leverage and potential risk to dividends given

rising discount rates and higher interest charges also resulted in

the sales of small holdings in Assura , Sirius Real Estate , and

Unite Group . The residual position in Haleon , the consumer

healthcare business which was spun-out from GSK, was exited. XP

Power was exited as the outlook appeared increasingly uncertain and

the company has high leverage. The small holding in Mowi was sold

as call options written over the holding were assigned. Finally,

the small positions in Ashmore , Bodycote and Weir were sold given

more attractive opportunities elsewhere.

In addition, we reduced the exposure to a number of holdings

where we have higher conviction in other names in their respective

sectors or to manage position sizes in the portfolio. Positions in

stocks including AstraZeneca , Novo Nordisk , BHP , M&G ,

Standard Chartered and TotalEnergies were trimmed.

Overall, the net effect of the purchases and sales has been to

reduce the number of holdings from 61 down to 52, providing a

sharper focus to the portfolio.

We continued our measured option-writing programme which is

based on our fundamental analysis of the holdings in the portfolio.

The option-writing strategy has been of benefit to the Company by

diversifying and increasing the level of income generated. It also

provides headroom to invest in companies with lower starting yields

but better dividend and capital growth prospects. Income from

writing options of GBP2.8m represented 5.6% of total income earned

in the Year.

Our aspiration in terms of portfolio construction is simple: to

invest in good quality companies with attractive growth prospects

through a sensibly diversified portfolio with appealing dividend

characteristics. Furthermore, the ability to invest up to 20% of

gross assets overseas is helpful in achieving these aims with 13

overseas-listed companies in the portfolio at the period end

representing approximately 18% of gross assets.

Environmental, Social and Governance

In line with our longer-term investment horizon, we continue to

put significant effort into engagement with the companies in the

portfolio to ensure that they are run in shareholders' best

interests. Examples of the subjects of our engagement during the

Year have included topics such as board composition, capital

allocation, mergers and acquisitions activity, and risk management

(including issues such as climate change, regulatory risk, and

management succession planning). We pursue these issues through

meetings with the executive management of the companies as well as

with the non-executives, particularly the chairs of the board and

remuneration committees. MSCI independently rate the portfolio as

AA for its ESG characteristics and further detailed information can

be found in the Sustainable Investment Report on the Company's

website at; murray-income.co.uk .

A small selection of examples include our engagements with Games

Workshop , Safestore and Hiscox outlined below.

Having relatively recently initiated a position in Games

Workshop we chose to engage with the company more actively on

ESG-related matters. Of particular note, we have flagged to the

company that we believe that enhancing diversity across the

business should help Games Workshop achieve a number of its goals,

including the sustaining of its strong culture and ambitions to

further develop their intellectual property and grow the customer

base through expanding geographically. We have written to the

company outlining our views and provided examples of practices to

support diversity we have observed among our investee

companies.

For a number of years we have voted against approval of

Safestore's Remuneration Report owing to concerns about a very

generous incentive scheme introduced in 2017. However, we are

supportive of the current board and therefore, as one of

Safestore's largest shareholders, this year we have engaged

actively with the board on the structure of a new remuneration

policy. We have provided feedback on multiple aspects of the policy

proposal, including striking a more balanced approach to base

salary and long-term incentives, incentivising and retaining

management of this high-performing company and avoiding base salary

growth for executive directors ahead of the wider workforce.

We engaged with Hiscox in order to gain additional insight into

the company's approach to ESG. The principal focus of our

engagement was the integration of climate-related risks into

underwriting. We were encouraged by the company's open dialogue on

the areas of strength and weakness in current datasets and

modelling with respect to climate-related risks and Hiscox's

approach to enhancing its capabilities and generating opportunities

for new products. We have asked the company to enhance disclosures

with regards to social indicators, in particular on human capital,

and suggested that Hiscox consider including social considerations

into its Exclusions Policy and set group sustainability targets

beyond Greenhouse Gas emissions reductions.

Income

For the Year, the Company witnessed a decrease in the level of

income due to lower dividends from the mining sector holdings and a

smaller amount of special dividends, partly offset by higher

interest income. Two special dividends (paid by TotalEnergies and

OSB Group ) were included in income from investments and were

treated as revenue items. We believe that this recognition is

appropriate given that, in each case, the return of cash was from a

build-up of profits generated by ongoing operations rather than

from a sale of assets.

The Company's earnings per share decreased by 4.4% from 40.5p to

38.7p. Paying a full year dividend of 37.5p per share has allowed

GBP2.2m to supplement the revenue reserves which now represent 54%

of the full year dividend. We view the portfolio's exposure to

attractive and enduring earnings trends as providing the potential

for appealing income growth over the long term.

Outlook

Recent data points provide a less than clear picture around

current conditions and future direction. However, in most developed

economies growth appears to be more robust than might be expected

in light of the meaningful monetary policy tightening over the past

12 months. On the other hand, the momentum of China's reopening has

faded and more stimulus is likely to feature. Underlying price

pressures have been sticky reflecting excess demand across various

sectors and economies prompting central banks to remain hawkish. We

believe that the current tightening cycle will ultimately restrict

economic growth with the resulting downturn in demand helping to

engineer a relatively rapid fall in inflationary pressures allowing

significant interest rate cuts over the next 18 months.

The portfolio is jam-packed with high quality, predominantly

global businesses capable of delivering appealing long term

earnings and dividend growth at a modest aggregate valuation. Our

focus on quality companies should provide protection through a

downturn: those companies with pricing power, high margins and

strong balance sheets are better placed to navigate a more

challenging economic environment and emerge in a strong position.

Furthermore, these quality characteristics are helpful in

underpinning the portfolio's income generation.

The valuations of UK-listed companies remain attractive on a

relative and absolute basis. Apart from the global financial

crisis, the UK's market multiple is nearing its lowest point for 30

years. It is cheap in absolute terms, relative to history and also

relative to global equities. Investors are benefitting from global

income at a knock-down price. Moreover, the dividend yield of the

UK market remains at an appealing premium to other regional equity

markets. In summary, we feel optimistic that our long-term focus on

investments in high quality companies with robust competitive

positions and strong balance sheets, which are led by experienced

management teams will be capable of delivering premium earnings and

dividend growth.

Charles Luke and Iain Pyle

Investment Manager

19 September 2023

Performance

Performance (total return, including reinvested dividends)

1 year return 3 year return 5 year return 10 year return

% % % %

=============================== ============== ============= ============= ==============

Share price(A) +4.9 +23.4 +31.6 +73.2

=============================== ============== ============= ============= ==============

Net asset value per Ordinary

share (debt at fair value)(A) +8.8 +26.9 +29.7 +85.7

=============================== ============== ============= ============= ==============

Net asset value per Ordinary

share (debt at par value)(A) +7.5 +24.5 +27.2 +82.3

=============================== ============== ============= ============= ==============

Benchmark(B) +7.9 +33.2 +16.5 +78.0

------------------------------- -------------- ------------- ------------- --------------

(A) Considered to be an Alternative Performance Measure.

(B) FTSE All-Share Index.

Source: abrdn & Morningstar

Ten Year Financial Record

Year end 30 June 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

Income (GBP'000) 23,926 25,476 24,838 26,667 25,987 25,597 22,804 35,979 51,018 48,879

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

Shareholders' funds

(GBP'000) 547,652 515,888 515,036 576,462 570,929 587,150 534,361 1,093,859 1,009,255 999,184

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

Per Ordinary share

(p)

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

Net revenue return 30.5 33.1 32.0 34.9 33.6 34.9 30.5 33.7 40.5 38.7

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

Dividends(A) 31.25 32.00 32.25 32.75 33.25 34.00 34.25 34.50 36.00 37.50

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

Net asset value (capital

only) 805.2 757.1 766.5 860.1 856.3 888.1 808.3 934.6 864.9 894.4

======================== ======= ======= ======= ======= ======= ======= ======= ========= ========= =======

(A) The figures for dividends per share reflect the years to which

their declaration relates and not the years they were paid.

Financial Highlights and Dividends

Financial Highlights

30 June 2023 30 June 2022 % change

===================================== ============ ============ ========

Shareholders' funds (GBP'000) 999,184 1,009,255 -1.0

===================================== ============ ============ ========

Net asset value ("NAV") per Ordinary

share - debt at fair value 911.7p 871.0p +4.7

===================================== ============ ============ ========

NAV per Ordinary share - debt at

par 894.4p 864.9p +3.4

===================================== ============ ============ ========

Market capitalisation (GBP'000) 935,096 970,865 -3.7

===================================== ============ ============ ========

Share price of Ordinary share 837.0p 832.0p +0.6

===================================== ============ ============ ========

Discount to NAV on Ordinary shares

- debt at fair value(A) 8.2% 4.5%

===================================== ============ ============ ========

Discount to NAV on Ordinary shares

- debt at par(A) 6.4% 3.8%

===================================== ============ ============ ========

Gearing (ratio of borrowing to

shareholders' funds)

===================================== ============ ============ ========

Net gearing(A) 10.4% 9.4%

===================================== ============ ============ ========

Dividends and earnings

===================================== ============ ============ ========

Revenue return per share 38.7p 40.5p -4.4

===================================== ============ ============ ========

Dividends per share(B) 37.50p 36.00p +4.2

===================================== ============ ============ ========

Dividend cover(A) 1.03 times 1.13 times

===================================== ============ ============ ========

Dividend yield(A) 4.5% 4.3%

===================================== ============ ============ ========

Revenue reserves (GBP'000)

===================================== ============ ============ ========

Prior to payment of fourth interim

dividend(C) 36,664 33,491

===================================== ============ ============ ========

After payment of fourth interim

dividend 22,576 20,363

===================================== ============ ============ ========

Operating costs

===================================== ============ ============ ========

Ongoing charges ratio(A) 0.50% 0.48%

===================================== ============ ============ ========

(A) Considered to be an Alternative Performance Measure.

(B) The figures for dividends per share reflect the years in which

they were earned (see note 7).

(C) Per the Statement of Financial Position.

Dividends

Rate XD date Record date Payment date

================ ====== =========== =========== ============

First interim 8.25p 17 Nov 2022 18 Nov 2022 15 Dec 2022

================ ====== =========== =========== ============

Second interim 8.25p 16 Feb 2023 17 Feb 2023 16 Mar 2023

================ ====== =========== =========== ============

Third interim 8.25p 18 May 2023 19 May 2023 15 Jun 2023

================ ====== =========== =========== ============

Fourth interim 12.75p 17 Aug 2023 18 Aug 2023 14 Sep 2023

---------------- ------ ----------- ----------- ------------

Total dividends 37.50p

---------------- ------ ----------- ----------- ------------

Overview of Strategy

Business Model

Murray Income Trust PLC (the "Company") is an investment trust

whose Ordinary shares are listed on the premium segment of the

London Stock Exchange.

The Company is governed by a Board of Directors (the "Board"),

all of whom are non-executive, and has no employees. The Board is

responsible for determining the Company's investment objective and

investment policy. Like other investment companies, the day-to-day

investment management and administration of the Company is

outsourced by the Board to an investment management group, abrdn,

and other third party providers. The Company has appointed abrdn

Fund Managers Limited (the "Manager") as its alternative investment

fund manager, which has in turn delegated certain functions,

including administration of the investment policy, to abrdn

Investments Limited (formerly Aberdeen Asset Managers Limited). The

Manager has delegated the company secretarial function to abrdn

Holdings Limited (formerly Aberdeen Asset Management PLC).

The Company complies with Section 1158 of the Corporation Tax

Act 2010 which permits the Company to operate as an investment

trust.

Investment Objective

The Company aims for a high and growing income combined with

capital growth through investment in a portfolio principally of UK

equities.

Investment Policy

In pursuit of the Company's investment objective, the Company's

investment policy is to invest in the shares of companies that have

potential for real earnings and dividend growth, while at the same

time providing an above-average portfolio yield. The emphasis is on

the management of risk and on the absolute return and yield from

the portfolio as a whole rather than the individual companies which

the Company invests in, which is achieved by ensuring an

appropriate diversification of stocks and sectors within the

portfolio, with a high proportion of assets in strong,

well-researched companies. The Company makes use of borrowing

facilities to enhance shareholder returns when appropriate.

Delivering the Investment Policy

The Company maintains a diversified portfolio of the equity

securities of UK and overseas companies with an emphasis on

investing in quality companies with good management, strong cash

flow, a sound balance sheet and which are generating a reliable

earnings stream.

The Investment Manager follows a bottom-up investment process

based on a disciplined evaluation of companies, including through

direct visits by its fund managers. Stock selection is the major

source of added value, concentrating on quality first, then price.

Top-down investment factors are secondary in the Investment

Manager's portfolio construction with diversification rather than

formal controls guiding stock and sector weights.

Board Investment Limits

The Board sets additional investment guidelines within which the

Investment Manager must operate :

-- the portfolio typically comprises between 40 and 70 holdings

(but without restricting the Company from holding a more or less

concentrated portfolio from time to time);

-- the Company may invest up to 100% of its gross assets in

UK-listed equities and other securities and is permitted to invest

up to 20% of its gross assets in other overseas-listed equities and

securities;

-- the Investment Manager may invest in any market sector,

however, the top five holdings may not exceed 40% of the total

value of the portfolio and the top three sectors represented in the

portfolio may not exceed 50%; and

-- the Company may invest no more than 15% of its gross assets

in other listed investment companies (including investment

trusts).

The Company may use derivatives for the purpose of enhancing

portfolio returns and for hedging purposes in a manner consistent

with the Company's broader investment policy. The Investment

Manager is permitted to invest in options and in structured

products, provided that any structured product issued in the form

of a note or bond has a minimum credit rating of "A".

Gearing

The Board is responsible for setting the gearing policy of the

Company and for the limits on gearing. The Manager is responsible

for gearing within the limits set by the Board. The Board has set

its gearing limit at a maximum of 25% of NAV at the time of draw

down. Gearing - borrowing money - is used selectively to leverage

the Company's portfolio in order to enhance returns where this is

considered appropriate. Particular care is taken to ensure that any

financial covenants permit maximum flexibility of investment

policy. Significant changes to gearing levels are communicated to

shareholders.

Key Performance Indicators

At each Board meeting, the Directors consider a number of Key

Performance Indicators ("KPIs") to assess the Company's success in

achieving its objectives, and these are described below, with those

also categorised as Alternative Performance Measures marked with an

asterisk:

KPI Description

======================= ==============================================================

NAV (total return) The Board considers the Company's NAV (total return),

* relative to the relative to the FTSE All-Share Index, to be the

Company's benchmark best indicator of performance over different time

periods. A graph showing NAV total return performance

against the FTSE All-Share Index over the past five

years is included in the published Annual Report.

======================= ==============================================================

Share price (total The Board monitors share price performance relative

return) * to open-ended and closed-ended competitor products,

taking account of differing investment objectives

and policies pursued by those products.

The figures for share price (total return) for the

Year and for the past three, five and ten years,

as well as for the NAV (total return) per share,

are shown above. A graph showing share price total

return performance against the FTSE All-Share Index

over the past five years is included in the published

Annual Report.

======================= ==============================================================

Discount/premium The discount/premium at which the Company's share

to NAV * price trades relative to the NAV per share is closely

monitored by the Board. A graph showing the discount/premium

over the last five years is included in the published

Annual Report.

======================= ==============================================================

Earnings and dividends The Board aims to meet the 'high and growing' element

per share of the Company's investment objective by developing

revenue reserves sufficient to support the payment

of a growing dividend; figures may be found in Financial

Highlights and Dividends, above, in respect of earnings

and dividends per share, together with the level

of revenue reserves, for the Year and previous year.

======================= ==============================================================

Ongoing charges* The Board monitors the Company's operating costs

and their composition with a view to limiting increases

wherever possible. Ongoing charges are disclosed

above, for the Year and the previous year and include

look through costs. The increase in ongoing charges

from 0.48% to 0.50% reflects the lower average net

assets over the Year, as compared to the prior year.

======================= ==============================================================

Principal Risks and Uncertainties

There are a number of risks and uncertainties which, if

realised, could have a material adverse effect on the Company's

business model, future performance and solvency. The Board, through

the Audit Committee, has put in place a robust process to identify,

assess and monitor these by means of a risk assessment and internal

controls system. This system was reviewed during the year, as

explained in the Audit Committee Report in the published Annual

Report. As noted therein, the committee has a risk register and

uses a post-mitigation heat risk map to identify principal, and

emerging, risks.

Macroeconomic uncertainty has again been a significant risk

during the year due to rising interest rates and higher inflation.

The Board does not consider that the principal risks and

uncertainties identified have changed during the Year.

The Audit Committee and the Board both consider emerging risks

as part of their normal review of factors which could affect the

Company, both in the short and longer term. For example, the

emergence of negative climate change impacts, high inflation and

interest rates, and potential conflicts (China and Taiwan tension)

form a part of Directors' discussions with input from the Manager

and broker.

The following table sets out the Company's principal risks and

uncertainties and the Company's mitigating actions and comments if

the post-mitigation risk assessment has changed, together with the

reason why.

Principal Risk Mitigating Action

-------------------------------------------- ------------------------------------------

STRATEGIC AND MARKET

-------------------------------------------- ------------------------------------------

The Company's investment objective The Company's investment objective

and policy are no longer meeting and policy ("IOP") are reviewed

investors' requirements (unchanged) regularly by the Board to ensure

Lack of a robust strategic review, they remain appropriate and effective.

failure to understand the market/investor The Board holds an annual strategy

demand. Failure to analyse and react meeting at which strategy and approach

to changes or uncertainty, unclear is reviewed; this includes consideration

dividend policy. of distributions; both dividends

and share buy backs.

============================================ ==========================================

Discount control risk (unchanged) The Board monitors the discount

Investment trust shares tend to at which the Company's shares trade

trade at discounts to their underlying and will buy back or issue shares

NAVs, although they can also trade to try to minimise the impact of

at premium. Discounts and premiums any discount or premium volatility.

can fluctuate considerably leading Whilst these measures seek to reduce

to more volatile returns for shareholders. volatility, they are not guaranteed

to do this.

As was the case in the prior year,

the Board has assessed the discount

control risk as elevated due to

the discount at which the Company's

shares are trading as compared to

their underlying NAV.

============================================ ==========================================

Market risk (increased) The Company's investment policy

Market risk arises from the volatility and its approach to risk diversification

in prices of the Company's investments may be found above, both of which

and the potential loss the Company serve to mitigate the effect of

could suffer through realising investments market risk on the portfolio. The

following negative market movements. Board considers the diversification

Changes in general geopolitical, of the portfolio, asset allocation,

economic or market conditions, such stock selection and levels of gearing

as interest rates, exchange rates on a regular basis. The Board also

and rates of inflation, as well monitors the Company's relative

as global political events and trends performance as compared to peers

could substantially and adversely and the Company's benchmark.

affect the prices of securities The Board assesses climate change

and, as a consequence, the value as an emerging risk in terms of

of the Company's investment portfolio, how it develops, including how investor

its prospects and share price. sentiment is evolving towards climate

Current geopolitical risks include change within investment portfolios,

the ongoing Russian invasion of and will consider how the Company

Ukraine, rising tension between may mitigate this risk, any other

China and Taiwan. emerging risks, if and when they

The longer term emergence of the become material.

effects on investee companies of The Board engages with the Manager,

climate change, and the regulatory at each Board meeting, as part of

environment around this present its ESG oversight, to understand

a further risk. how climate change, and environmental

factors are being assessed . Both

are key considerations within the

Manager's investment process.

During the Year, the Board evaluated

market risk as elevated due to the

limit on the Company's ability to

mitigate the effect of external

factors such as the uncertainty

caused by geopolitical factors,

rising inflation and cost pressures.

============================================ ==========================================

Gearing risk (increased) Gearing is monitored and strict

The Company uses credit facilities. restrictions on borrowings are imposed:

These arrangements increase the gearing continues to operate within

funds available for investment. pre-agreed limits so as not to exceed

While this has the potential to 25% of NAV at the time of draw down.

enhance investment returns in rising The Board and the Manager monitors

markets, in falling markets the the lending market and will address

impact could be detrimental. at a germane time to enable the

Credit facilities may not be available availability of appropriate facility(ies)

at an acceptable rate, term or amount. if required.

The Company's three year GBP50 million

facility matures on 27 October 2024.

--------------------------------------------- ---------------------------------------------

INVESTMENT MANAGEMENT

--------------------------------------------- ---------------------------------------------

Underperformance risk (unchanged) The Board evaluates performance

Consistent underperformance by the at each board meeting on both an

Investment Manager over short, medium absolute and relative basis, against

and long term. the Company's benchmark and peers,

The Investment Manager's style may and across various periods: short,

result in the portfolio being significantly medium and long term. Performance

over or under weight positions in is also reviewed at the annual strategy

stocks and sectors compared to the meeting.

benchmark and the Company's performance The Company has a set of investment

may deviate significantly from that limits and Board guidelines which

of the benchmark and peers, possibly ensure diversification of the portfolio.

for extended periods.

============================================= =============================================

Risk of loss of key staff (increased) Charles Luke has been the lead portfolio

Loss of key staff though natural manager for the Company since 2006.

loss, or Manager reorganisation His co-manager is Iain Pyle who

and/or redundancy. Loss of investor has been with the Manager since

confidence if lead 2015, and Rhona Millar, with five

manager lost. years' experience, also works alongside

them. All work within the Manager's

43-strong Developed Markets Equities

team.

--------------------------------------------- ---------------------------------------------

MARKETING

--------------------------------------------- ---------------------------------------------

General marketing risk (increased) The Manager's investor relations

Failure to implement the Board's team works closely with the Board

marketing policy. Failure to address on institutional shareholder contact.

shareholder concerns or complaints, In addition, quarterly updates are

including of abrdn Investment Trust provided to the Board by the broker.

Saving plans holders. All correspondence addressed to

Issues could arise from the lack the Board is circulated to Directors

of process ownership, poor procedures while any complaints relating to

or the failure to appropriately the Company's savings plans are

manage distribution, concerns or reviewed by the Board quarterly.

complaints of shareholders.

--------------------------------------------- ---------------------------------------------

OPERATIONAL

--------------------------------------------- ---------------------------------------------

Service provider risk (unchanged) Contracts with third party providers

In common with most other investment are entered into after appropriate

companies, the Company relies on due diligence. Thereafter the performance

the services provided by third parties of each provider is subject to an

and is dependent on the control annual review by the Audit Committee.

systems of the Manager (who acts The Depositary reports to the Audit

as investment manager, company secretary Committee at least annually, including

and maintains the Company's assets, on the Company's compliance with

dealing procedures and accounting AIFMD. The Manager also regularly

records); BNP Paribas Trust Corporation reviews the performance of the Depositary.

UK Limited (who acts as Depositary Global assurance reports are obtained

and Custodian); and the registrar. from the Manager, BNP Paribas Trust

The security of Corporation UK Limited and the registrar.

the Company's assets, dealing procedures, These are reviewed by the Audit

accounting records and adherence Committee. The reports include an

to regulatory and legal requirements independent assessment of the effectiveness

depend of risks and internal controls at

on the effective operation of the the service providers including

systems of these third party service their planning for business continuity

providers. and disaster recovery scenarios,

Failure by any service provider together with their policies and

to carry out its obligations could procedures designed to address the

have a material adverse effect on risks posed to the Company's operations

the Company's performance. Disruption, by cyber-crime. The Audit Committee

including that caused by information receives an annual update on the

technology breakdown or a cyber-related Manager's IT resilience.

issue, could prevent, for example, The Company's assets are subject

the functioning of the Company; to a strict liability regime and,

accurate reporting to the Board in the event of a loss of assets,

or shareholders; or payment of dividends the Depositary must return assets

in accordance with the announced of an identical type or the corresponding

timetable. amount, unless able to demonstrate

the loss was a result of an event

beyond its reasonable control.

The Board has assessed the risk

posed by cyber-crime as elevated,

despite the available mitigation,

reflecting the potential disruption

which might be caused to the Company's

operations by a cyber-attack.

--------------------------------------------- ---------------------------------------------

The following are other risks identified by the Board which

could have a major impact on the Company, but due to mitigation are

not deemed to be principal risks:

Other Risks Mitigating Action

=========================================== =============================================

Dividend risk The Board reviews estimates of revenue

There is a risk that the Company income and expenditure prepared

fails to generate sufficient income by the Manager.

from its investment portfolio to The Company's level of revenue reserves

meet the Company's dividend requirements. is monitored and can be added to

A cut in the dividend of the Company in years of surplus, or used to

would likely cause a support the dividend in years where

drop in the share price and would there is a revenue deficit. Dividends

end the Company's can also be paid from capital, though

"Dividend Hero" status. use of capital reserves for dividends

is expected to be rare.

=========================================== =============================================

Financial risk Details of these risks and the policies

The Company's investment activities and procedures for their monitoring

expose it to a variety of financial and mitigation are disclosed earlier

risks which include market risk in this section and in note 18.

(which is identified as a principal

risk and is covered earlier in this

section), liquidity risk and credit

risk (including counterparty risk).

=========================================== =============================================

Regulatory risk, including change The Manager provides investment,

of existing rules and regulation company secretarial, administration

The Company is required to comply and accounting services through

with relevant rules and regulations. qualified third

Failure to do so could result in party professional providers.

loss of investment trust status, The Board receives regular reports

fines, suspension of the Company's from its broker, depositary, registrar

shares, criminal proceedings or and Manager as well as the industry

financial or reputational damage. trade body (the Association of Investment

Companies ("AIC") on changes to

regulations which could impact the

Company and its industry.

=========================================== =============================================

Emerging risk The Board regularly reviews all

Failure to have in place procedures risks to the Company, including

that assist in identifying emerging emerging risks, which are identified

risks. This may cause reactive actions by a variety of means, including

rather than being pro-active and, advice from AIC, the Company's professional

in the worst case, could cause the advisors, Directors' knowledge of

Company to become unviable or otherwise markets, changes and events.

fail.

=========================================== =============================================

The principal risks associated with an investment in the

Company's shares can be found in the pre-investment disclosure

document ("PIDD") published by the Manager, which is available from

the Company's website: murray-income.co.uk .

Promotional Activities

The Board recognises the importance of promoting the Company to

existing and prospective investors both for improving liquidity and

enhancing the rating of the Company's shares. The Board believes

one effective way to achieve this is through subscription to, and

participation in, the promotional programme run by the Manager on

behalf of a number of investment trusts under its management. The

Company also supports the Manager's investor relations programme

which involves regional roadshows, promotional and public relations

campaigns. The Manager's promotional and investor relations teams

report to the Board on a quarterly basis giving analysis of their

activities as well as updates on the shareholder register and any

changes in the make-up of that register.

Communicating the long-term attractions of the Company is key.

The promotional programme includes commissioning independent paid

for research on the Company, most recently from Edison Investment

Research Limited; a copy may be found on the Company's website.

The UK Stewardship Code and Proxy Voting

The Company supports the UK Stewardship Code 2020, and seeks to

play its role in supporting good stewardship of the companies in

which it invests. Responsibility for actively monitoring the

activities of portfolio companies has been delegated by the Board

to the Manager which has sub-delegated that authority to the

Investment Manager.

The Manager is a tier 1 signatory of the UK Stewardship Code

2020 which aims to enhance the quality of engagement by investors

with investee companies in order to improve their socially

responsible performance and the long term investment return to

shareholders. The Manager's Annual Stewardship Report 2022 may be

found at abrdn.com . While delivery of stewardship activities has

been delegated to the Manager, the Board acknowledges its role in

setting the tone for the effective delivery of stewardship on the

Company's behalf.

The Board has also given discretionary powers to the Manager to

exercise voting rights on resolutions proposed by the investee

companies within the Company's portfolio. The Manager reports to

the Board on a six monthly basis on stewardship (including voting)

issues.

Global Greenhouse Gas Emissions and Streamlined Energy and

Carbon Reporting ("SECR")

All of the Company's activities are outsourced to third parties.

The Company therefore has no greenhouse gas emissions to report

from the operations of its business, nor does it have

responsibility for any other emissions producing sources under the

Companies Act 2006 (Strategic Report and Directors' Reports)

Regulations 2013. For the same reason as set out above, the Company

considers itself to be a low energy user under the SECR regulations

and therefore is not required to disclose energy and carbon

information. Further information on the Manager's obligatory

disclosures under the Taskforce on Climate-related Financial

Disclosures ("TCFD") may be found later in this section.

Viability Statement

The Company does not have a fixed period strategic plan but the

Board does formally consider risks and strategy on at least an

annual basis. The Board regards the Company, with no fixed life, as

a long term investment vehicle but for the purposes of this

viability statement has decided that a period of five years (the