1st Quarter Results

27 June 2023

Oxford Technology 2 VCT Plc (the "Company")

Legal Entity Identifier: 2138002COY2EXJDHWB30

1st Quarter Results

Oxford Technology 2 VCT Plc presents its quarterly update for

the 3 month period ending 31 May 2023. The Directors have reviewed

the valuation of its entire portfolio as at that date. The

unaudited net asset value (NAV) for each Class of ordinary share

(and other associated data) as at 31 May 2023 is shown in the table

below:

| |

Unaudited NAV p/share 31/05/23 |

Audited NAV p/share 28/02/23 |

Change

in NAV% |

Cumulative Dividends p/share to 31/05/23 |

Total

Return p/share |

Shares

in Issue |

| Share Class |

|

|

|

|

|

|

OT1 |

43.6 |

45.3 |

-3.8% |

55.0 |

98.6 |

5,431,655 |

|

OT2 |

25.0 |

25.1 |

-0.3% |

22.5 |

47.5 |

5,331,889 |

|

OT3 |

32.2 |

33.7 |

-4.6% |

42.0 |

74.2 |

6,254,596 |

|

OT4 |

30.8 |

29.7 |

3.6% |

48.0 |

78.8 |

10,826,748 |

The primary drivers of these changes are

movements in the share prices of the Company’s two significant AIM

holdings, and 3 months of running costs. The share price of

Scancell Holdings Plc has declined from 17.5p at 28 February to

14.5p at 31 May 2023, whereas the share price of Arecor

Therapeutics Plc has increased from 240p to 250p. The valuation STL

Management Limited (“Select Technology”) has been increased in line

with recent sales performance. The valuation of all the other

investments in the unquoted portfolios remain unchanged from those

at 28 February 2023..

During the period under review, no shares were

bought or sold in any the portfolio companies in any of the four

Share Classes.

As previously reported, following the merger

with the three other Oxford Technology VCTs last year, the Company

now owns 58.6% of Select Technology, and has a year to reduce the

level of control to 50% or less. The Directors are pleased to

confirm that the necessary changes have now been made to Select

Technology’s articles, after the period end but well within the

required 12 month period. The Company’s share of the nominal value,

voting rights, rights to dividends and rights on a return of

capital of have been reduced to 50% to ensure ongoing compliance

with VCT Rules.

The Directors are not aware of any other events

or transactions which have taken place between 31 May 2023 and the

publication of this statement which have had a material effect on

the financial position of the Company.

At 31 May 2023, the Company’s issued share

capital by Share Class is shown in the table above. The Company

holds no shares in treasury and the total voting rights in the

Company are 27,844,888. This figure of 27,844,888 may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Enquiries: Lucius Cary Oxford Technology

Management 01865 784466

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. Upon the publication of this announcement via

a Regulatory Information Service, this information is now

considered to be in the public domain.

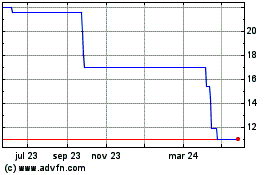

Oxford Technology 2 Vent... (LSE:OXH)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Oxford Technology 2 Vent... (LSE:OXH)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025