Schroder BSC Social Impact Trust Debt Investment in Community Energy Together Ltd (2157X)

19 Diciembre 2023 - 1:01AM

UK Regulatory

TIDMSBSI

RNS Number : 2157X

Schroder BSC Social Impact Trust

19 December 2023

19 December 2023

Schroder BSC Social Impact Trust plc

Debt Investment in Community Energy Together Limited

Related Party Transaction

The Board of Schroder BSC Social Impact Trust plc (the

"Company"), which provides a unique investment opportunity to

address UK social challenges, is pleased to announce a GBP3.6

million debt investment (the "Debt Investment") in Community Energy

Together Limited ("CETL"), a community renewable energy project

company, which will contribute to 'Just Transition to Net Zero',

and re-deploy capital returned to the Company from recent debt

repayments and the partial exit from RLPF1 announced in the Interim

Report.

The Debt Investment is a direct junior loan to CETL ("Junior

Loan"), alongside two other junior lenders: Big Society Capital

("BSC"), the Company's portfolio manager; and Power to Change

("PtC"). The senior lender is abrdn ("abrdn"). The security and

loan agent for the Junior Loan is The Charity Bank Limited.

The Junior Loan has a five-year term and carries a fixed coupon

of 7 per cent. per annum plus payment-in-kind interest of 1.5 per

cent. per annum in years one to three and 2.5 per cent. per annum

in years four to five.

Community Energy Together Limited

CETL is a partnership of five community organisations that have

acquired seven cross-collateralised solar farm assets across the

UK. CETL has acquired these assets from Community Owned Renewable

Energy LLP ("CORE") by way of a corporate restructuring. CORE was

established in 2017 by BSC, PtC and Finance Earth to acquire and

optimise operational solar farms in England and Wales for transfer

to community ownership, whilst maximising positive impact within

the community.

CETL's portfolio consists of seven solar farms (3-7MW in size

each) that benefit from government backed subsidies (Feed in Tariff

and Renewables Obligations Certificate schemes), and the assets are

funded on a cross-collateralised basis for scale and

risk-sharing.

In addition to economic value creation and renewable energy

generation, any surplus cash flow after covering costs and debt

service obligations is allocated towards community benefit funds.

CETL is forecast to generate total community benefit funds in the

region of GBP20 million over the assets' lifetime of 20-25

years.

BSC and PtC funded their original investment in CORE via a mix

of senior debt and equity. The senior debt was refinanced by abrdn

in 2021, in a landmark first institutional investment in community

energy in the UK, which will be transferred to CETL. The equity has

been refinanced through a restructuring, effective on 15 December

2023, via a GBP1.8 million community equity raise by CETL and the

provision of a GBP11.7 million junior loan to CETL from BSC (GBP6.0

million) and PtC (GBP5.7 million).

The intention is that the senior and junior loans will be repaid

by surplus cash flow generated by the portfolio over the term, in

addition to further community equity and bond issuance.

The Debt Investment has been made by way of transfer from BSC of

GBP3.6 million of the Junior Loan to the Company. BSC retains a

GBP2.4m investment in the Junior Loan.

The Debt Investment is strongly aligned with the Company's

objectives:

-- Strong return expectations, with immediate deployment and no cash drag.

-- Investment into an asset with government-backed, inflation-linked cash flows.

-- Private debt investment on a held-to-maturity basis with low correlation to public markets.

-- Diversified exposure to renewable energy assets with clear

impact to underserved local communities.

Commenting on the Debt Investment, Jeremy Rogers, CIO of Big

Society Capital, Portfolio Manager, Schroder BSC Social Impact

Trust plc, said :

"There is a growing opportunity to invest in assets that can

support communities deliver on the Just Transition to Net Zero.

Community Energy Together Limited delivers local renewable energy

alongside supporting local projects such as in fuel poverty. The

investment has been sourced through BSC's platform and offers high

quality financial and impact returns for Company's shareholders,

with projected local benefit of GBP20 million over the assets'

lifetime."

T he Debt Investment is a smaller related party transaction for

the purposes of Listing Rule 11.1.10R and this announcement is

therefore made in accordance with Listing Rule 11.1.10R(2)(c).

For further information, please contact:

Schroders

Augustine Chipungu (Press) 0207 658 2016

Kerry Higgins Schroder Investment Management Limited, Company Secretary) 0207 658 6189

Big Society Capital Ehickinbotham@bigsocietycapital.com

Emma Hickinbotham,

Managing Director, Communications

Winterflood Securities Limited

Neil Langford 020 3100 0000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRDZMMZRRKGFZM

(END) Dow Jones Newswires

December 19, 2023 02:01 ET (07:01 GMT)

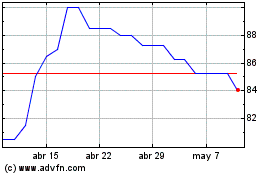

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024