TIDMSFT

RNS Number : 4522K

Sinosoft Technology plc

20 April 2010

SINOSOFT TECHNOLOGY PLC

("Sinosoft" or the "Company" or the "Group")

PRELIMINARY RESULTS FOR THE YEAR ENDING 31 DECEMBER 2009

Sinosoft, the China based developer and provider of e-Government software and

other IT services, announces its preliminary results for the year ended 31

December 2009.

Financial Highlights

l Turnover up 20% to US$14.5m (2008: US$12.1m)

l Gross profit up 12% to US$9.6m (2008: US$8.6m)

l Operating profit maintained at US$3.3m (2008: US$3.3m)

l Profit before tax increased by 16% to US$4.4m (2008: US$3.8m)

l Dividend to be maintained at FY2008 payout of 0.31 pence per share

Operating Highlights

l Strong growth in Tax Software and System Integration division

l Continuing strong cashflow

l Acquired Jiangsu Skyinformation Co., Ltd.

l Integrated 3M's RFID technology with our software

Commenting on the results, Mark Greaves, the newly appointed Chairman of

Sinosoft said: "What started out as a difficult year, improved considerably in

the second half. I am pleased to announce that the Group's revenue and profit

before tax have continued to grow. Our cash position remains strong and we are

in a position to propose a meaningful dividend to shareholders."

-ends-

For further information please contact:

+---------------------+----------------------+--------------------------------+

| Sinosoft Technology | Mr. Yifa Yu |yuyifa@sinosoft-technology.com |

| plc | | |

+---------------------+----------------------+--------------------------------+

| | | |

+---------------------+----------------------+--------------------------------+

| Westhouse | Tim Metcalfe/Richard | 020 7601 6100 |

| Securities Limited | Baty/Zhining Xu | |

| | | |

+---------------------+----------------------+--------------------------------+

| Tavistock | Simon Compton | 020 7920 3150 |

| Communications | | |

+---------------------+----------------------+--------------------------------+

Chairman's Statement

Results

It gives me great pleasure to present my first report as incoming Chairman of

the Company and to reflect on what has been a challenging year, but a year in

which Sinosoft has made significant progress. The Chinese economy has not been

immune to recent financial turmoil and in the face of tightened trading

conditions Sinosoft has been required to adapt.

The difficult trading environment was evidenced by our FY2009 first half

results, when, for the first time in our history we recorded lower revenues than

the comparable period of the previous year. Despite this initial setback the

Group was able to recover lost ground during the second half of the year thanks

in part to the PRC government's stimulus package. The Group's performance

benefited from our strategy of adopting a broadly-based business model that is

not dependent on any one income stream. This strategy enabled Sinosoft to

redeploy staff and to focus the business on sectors where sales continued to

exist.

I am pleased to report that for the full year, the Group was able to report

growth in turnover and net profit. However, gross profit margin was lower due

to the higher proportion of revenue contributed by System Integration, a

traditionally lower margin division. Operating expenses were higher due to

increased spending on R&D, marketing and administration.

We continued to record growth in sales of our export tax software. Whilst the

economic slowdown has exacerbated the delays suffered in the roll-out of the

Company's SAT product outside of Jiangsu, we have continued to generate revenues

through the sale of our value-added products to existing customers. We are

pleased that we are continuing to develop bolt on products that enable us to

leverage from our established customer base and believe that this demonstrates

the inherent value of Sinosoft's export tax products to our clients.

e-Government was the key performer during the year in terms of revenue growth.

This division benefitted from the government restating previously postponed or

delayed projects and increasing its discretionary spending activity in its bid

to stimulate the economy. In addition, the PRC government has been taking

measures to develop the country's IT infrastructure and to improve on the level

of government online services that it provides to its citizens. With our proven

past track record in this field, we have managed to secure an increasing number

of such government contracts. We have bid for and won an e-government project

in Nan An, a city in the Chongqing municipality that was previously dominated by

local software companies. We are hopeful that the Group's first move into South

West China should bring about greater potential for the Group's e-government

business.

As expected, the Group's Information Integration division recorded a decline in

revenues. This division is highly dependent on corporate IT projects and the

economic slowdown has greatly reduced the IT budgets of most corporate clients

and the number of new projects available for tender. To overcome the expected

decline in this division, the Group actively looked for innovative ways to

develop new services. As a first step, the Group has integrated 3M's Radio

Frequency Identification (RFID) tracking technology with the Group's own

software system and has won a project with the Nanjing Library. This contract

made a significant contribution to the revenue for this division. Whilst there

is still uncertainty surrounding the economic recovery, we are not anticipating

a substantial improvement in this division in the near term.

For System Integration, revenue growth and overall contribution to Group

turnover was significantly higher compared to the prior year. Pleasingly this

is mainly due to repeat business from existing clients. The division also

benefited from provincial and national government's increased spending on IT

infrastructure as well as our continued effort to secure new customers. The

Group continues to adopt the strategy of expanding the customer base of this

division as it believes that this will continue to play a vital role in helping

to bring in revenue for our other divisions.

During the year, we have also collaborated with a Singaporean IT company to

outsource our engineers to help them with programming and coding work for their

projects. From this collaboration, we hope to seek new opportunities to expand

our outsourcing business outside of the PRC.

For the year, the Group experienced an overall net cash inflow, taking our cash

position from US$12.9m to US$14.9m. We continue to be cash generative from our

operations. Cash generated from operations increased by US$3.0m to US$7.0m. Our

main cash outflow during the year related to our continuing investment in R&D.

Trade receivables increased significantly due to increased activity in the

latter months of the year.

In July 2009, we acquired SkyInformation Co. Ltd, a PRC registered software

company. Although this acquisition did not contribute materially to our

performance this year, we expect to use its software license in the future to

further develop new products and apply for government grants that are only

available to PRC registered companies. In addition, this acquisition will allow

the Group to be better placed to win government mandates that were otherwise not

accessible to foreign owned companies.

Dividend

At the operation level the Group has continued to be cash generative. A

resolution proposing a dividend of 0.31 pence per ordinary share (2008: 0.31p

per share) will be proposed at the forthcoming AGM.

Board

On 1 May 2010, Mr Mao Ning will retire from the board and will step down from

his position as Chairman of the Company. Mr Mao Ning has held the position

since Sinosoft's admission to AIM in March 2006 and the Board would like to

thank him for his contribution and unfailing commitment to the Group. I am

honoured to have been asked to take on the role of Chairman, building on my four

years of service as an independent non-executive director of the Company.

What began as a difficult start to the year has ended with reasonably pleasing

results. I believe our strategy of continuously expanding our four core

business areas and yet not being totally dependent on any one revenue stream has

helped us to overcome the recent difficult economic climate. The Group has been

resilient to a difficult trading period and we are cautiously optimistic that as

the economy begins to recover we are well positioned to capitalise from our

investment in our staff, R&D and product development and established customer

base.

On behalf of the Board, I extend my sincere appreciation and thanks for the

support of all our stakeholders, including our shareholders, customers, staff

and advisers. With your continuing support, we look forward to the further

development and success of Sinosoft Technology plc.

Mark Greaves

Non Executive Director and incoming Chairman

19 April 2010

Chief Executive Officer's Report

Group turnover registered a 20% growth from FY2008 to achieve total sales of

US$14.5m (FY2008: US$12.1m). However, gross profit grew by a smaller 12% to

US$9.6m (FY2008: US$8.6m) due to the higher percentage of revenue contributed by

System Integration, a traditionally low margin division. Operating expenses

continued to increase as we increase the number of our staff and increase our

spending to secure and service customers in new provinces.

For FY2009, the sales split across the Group's four divisions, of System

Integration, e-Government, Tax Software and Information Integration, was 37%,

27%, 24% and 12%, respectively (FY2008: 31%, 22%, 26% and 21%).

Tax Software

In tandem with the global economy, China's export industry suffered substantial

slowdown in 2009. The knock on effect was a marked decline in the number of

newly set up export enterprises; prospective customers for our sales of export

tax rebate software. The roll out of our SAT product outside of Jiangsu also

suffered further delay as the central tax bureau amended the timetable in

response to the wider slow down in export levels. To overcome these setbacks,

we have been focusing on the development and sales of value added software to

our existing export tax rebate software users. We are pleased that despite the

difficult market conditions sales from this division increased by 14%. A new

value added product developed in FY2009 which generated revenue during the same

year is our Sinosoft Portable Reporting Software. Stored on a thumb drive, it

allows users to connect to their office computer where the tax rebate software

is located and allow them access to their tax rebate data. This is useful for

users who need to make last minute amendments at the tax office or need remote

access to their tax rebate data.

e-Government

Sales growth was very strong for this division in FY2009 with a 43% increase in

turnover recorded from the previous year. Discretionary spending by the PRC

government picked up pace with the release of the stimulus package during the

early part of FY2009. Our Group was able to benefit greatly from this increase

government spending as we have a well proven track record with both local,

provisional and national government agencies. In addition, with the launch of

six new products in FY2008, we were able to offer a wider suite of functionality

to suit our customers' needs.

Our strategy of continuously investing in R&D and offering new products based on

client requirements has proven to be successful as was demonstrated during the

year with our maiden contract win in Nan An. The division beat other software

companies to secure our first e-government contract in this region.

During the latest Chinese People's Political Consultative Conference (CPPCC)

meeting held in March 2010, the government communicated its intention to improve

the level of IT services that it provides to its citizens in the coming years.

Given our history of successfully securing and completing such projects, this

division should be in a good position to capture a share of any such initiative.

During the year, the division developed two new products; Sinosoft Public

Resource Supervision Software and Sinosoft Integrity Software. The first

software allows the government to supervise the use of public resources such as

funds, manpower, materials etc in projects that they have awarded, to ensure

that resources are not misappropriated. The second software allows the

government to collect data from various agencies to set up a database on the

level of integrity of private contractors. Any government agency is then able

to conduct search on the integrity of any private contractor before a contract

is awarded to them. Both of these products are expected to start generating

revenue in FY2010.

Information Integration

This division is the only one to record a revenue decrease of 29%. Being highly

dependent on corporate IT spending, this decline was the direct outcome of the

decrease in most corporates' IT spending due to the financial crisis that began

in the last quarter of 2008. With the global economic recovery still patchy,

the outlook for this division will continue to be uncertain.

During the year, we developed two new products: Sinosoft RFID Integrated

Software and Sinosoft Export Enterprise Management Software. The first software

was used in our successful bid for Nanjing Library which integrated RFID

technology developed by 3M (www.3M.com) to provide a new archiving, cataloguing

and book borrowing system. The second software is a product that helps export

enterprises to integrate information from various departments into a single

interface. This product is expected to start generating revenue in FY2010.

Outsourcing

During the year, the Group entered into an outsourcing collaboration with a

Singaporean IT company whereby our engineers helped to provide coding and

programming services to the company. We hope that this collaboration will

further open doors to help the Group secure new contracts in Singapore.

Systems Integration

Revenue of Systems Integration increased significantly by 41% during the year.

Traditionally a lower margin division, it accounted for 37% of the Group's total

revenue as compared to 31% in FY2008. This has resulted in a lower overall gross

profit margin for the Group as compared to the prior year.

This growth in this business was primarily due to a higher number of our

existing and previous clients turning to us for their IT upgrade during FY2009.

In addition, this division also greatly benefitted from the government's

increased spending as a result of the stimulus package. Even though margin is

low for this division, we continued to pursue System Integration projects and

secure new clients. These new customers also helped to contribute to the higher

revenue during the whole year.

Management continues to maintain the view that active courting of new projects

in this low margin division is a necessary strategy because such projects are

highly effective in increasing the client's hardware compatibility with our

other products, thus making it easier to sell our proprietary software to them

in the future.

Other

Even though our operations were somewhat affected by the global downturn, the

crisis nevertheless also presented us with the opportunity to acquire Jiangsu

Skyinformation Co. Ltd at a competitive price. The acquisition has and will

enable the Group to secure government contracts that were otherwise not

available to our two foreign owned trading subsidiaries.

Towards the end of FY2010, the Company will be relocating to its new premises

located in Nanjing's Pukou District. With this new premise, the Company will

have the necessary space to continue its investment in R&D. During the year,

the number of R&D personnel employed increased from 230 in FY2008 to 270. Our

intangible assets of development cost and patents similarly increased to US$7.5m

(FY2008: US$5.1m). We expect part of this to start generating revenues in

FY2010 and beyond.

Xin Yingmei

Chief Executive Officer

19 April 2010

+-------------------------------+-------------+-------------+

| CONSOLIDATED INCOME STATEMENT | 2009 | 2008 |

| for the year ended 31 | | |

| December 2009 | | |

| | | |

| | | |

| | | |

+-------------------------------+-------------+-------------+

| | US$ | US$ |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Revenue | 14,513,309 | 12,078,124 |

+-------------------------------+-------------+-------------+

| Cost of sales | (4,919,180) | (3,494,992) |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Gross profit | 9,594,129 | 8,583,132 |

+-------------------------------+-------------+-------------+

| Other income | 866,233 | 620,974 |

+-------------------------------+-------------+-------------+

| Research and development cost | (2,206,895) | (1,986,680) |

+-------------------------------+-------------+-------------+

| Selling and distribution | (2,152,110) | (1,357,692) |

| expenses | | |

+-------------------------------+-------------+-------------+

| Administrative expenses | (3,242,317) | (2,566,871) |

+-------------------------------+-------------+-------------+

| Excess on acquisition of fair | | |

| value of | 445,573 | - |

| net assets of subsidiary over | | |

| cost | | |

+-------------------------------+-------------+-------------+

| Operating profit before | 3,304,613 | 3,292,863 |

| exceptional items | | |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Impairment losses | (6,049) | - |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Operating profit | 3,298,564 | 3,292,863 |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Finance cost | (1,147,509) | (20,791) |

+-------------------------------+-------------+-------------+

| Finance income | 2,256,244 | 515,632 |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Profit before tax | 4,407,299 | 3,787,704 |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Taxation | (752,486) | (358,014) |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Profit for the year | 3,654,813 | 3,429,690 |

+-------------------------------+-------------+-------------+

| | | |

+-------------------------------+-------------+-------------+

| Earnings per ordinary share | | |

+-------------------------------+-------------+-------------+

| Basic | 0.0221 | 0.0207 |

+-------------------------------+-------------+-------------+

| Diluted | 0.0221 | 0.0207 |

+-------------------------------+-------------+-------------+

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 December 2009

+----------------------------------+----------+--------------+-+-------------+----------+

| | | | |

+----------------------------------+-------------------------+---------------+----------+

| | 2009 | 2008 |

+---------------------------------------------+----------------+------------------------+

| | US$ | US$ |

+---------------------------------------------+----------------+------------------------+

| | | |

+---------------------------------------------+----------------+------------------------+

| Profit for the year | 3,654,813 | 3,429,690 |

+---------------------------------------------+----------------+------------------------+

| Currency translation losses on foreign | (322,259) | (1,429,690) |

| operations | | |

+---------------------------------------------+----------------+------------------------+

| Total comprehensive income for the year | | |

| | 3,332,554 | 2,346,968 |

+---------------------------------------------+----------------+------------------------+

| | | | | | |

+----------------------------------+----------+--------------+-+-------------+----------+

CONSOLIDATED BALANCE SHEET

at 31 December 2009

+----------------------------+---------------+--------------+

| | 2009 | 2008 |

+----------------------------+---------------+--------------+

| | US$ | US$ |

+----------------------------+---------------+--------------+

| ASSETS | | |

+----------------------------+---------------+--------------+

| Non-current assets | | |

+----------------------------+---------------+--------------+

| Property, plant and | 802,919 | 979,087 |

| equipment | | |

+----------------------------+---------------+--------------+

| Intangible assets | 7,524,899 | 5,109,922 |

+----------------------------+---------------+--------------+

| Investments | 4,406,969 | 4,402,842 |

+----------------------------+---------------+--------------+

| Total non-current assets | 12,734,787 | 10,491,851 |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Current assets | | |

+----------------------------+---------------+--------------+

| Inventories | 716,392 | 643,877 |

+----------------------------+---------------+--------------+

| Trade receivables | 10,561,671 | 6,283,869 |

+----------------------------+---------------+--------------+

| Other receivables | 1,815,086 | 3,707,876 |

+----------------------------+---------------+--------------+

| Investments | 29,775 | 1,463,143 |

+----------------------------+---------------+--------------+

| Cash deposits | - | 460,276 |

+----------------------------+---------------+--------------+

| Cash and cash equivalents | 14,935,073 | 12,452,387 |

+----------------------------+---------------+--------------+

| Total current assets | 28,057,997 | 25,011,428 |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Total assets | 40,792,784 | 35,503,279 |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| LIABILITIES & EQUITY | | |

+----------------------------+---------------+--------------+

| Current liabilities | | |

+----------------------------+---------------+--------------+

| Short term loans | 1,171,612 | 1,170,515 |

+----------------------------+---------------+--------------+

| Trade payables | 3,412,871 | 973,835 |

+----------------------------+---------------+--------------+

| Other payables | 1,584,884 | 1,790,061 |

+----------------------------+---------------+--------------+

| Deferred income | - | - |

+----------------------------+---------------+--------------+

| Total current liabilities | 6,169,367 | 3,934,411 |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Non-current liabilities | | |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Deferred tax | 1,299,631 | 647,126 |

+----------------------------+---------------+--------------+

| Total non-current | 1,299,631 | 647,126 |

| liabilities | | |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Total liabilities | 7,468,998 | 4,581,537 |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Capital and reserves | | |

+----------------------------+---------------+--------------+

| Share capital | 424,023 | 424,023 |

+----------------------------+---------------+--------------+

| Share premium | 11,283,551 | 11,283,551 |

+----------------------------+---------------+--------------+

| Merger reserve | (1,118,051) | (1,118,051) |

+----------------------------+---------------+--------------+

| Other reserves | 7,649,913 | 7,785,172 |

+----------------------------+---------------+--------------+

| Retained earnings | 15,084,350 | 12,547,047 |

+----------------------------+---------------+--------------+

| Total shareholders' equity | 33,323,786 | 30,921,742 |

+----------------------------+---------------+--------------+

| | | |

+----------------------------+---------------+--------------+

| Total liabilities & equity | 40,792,784 | 35,503,279 |

+----------------------------+---------------+--------------+

COMPANY BALANCE SHEET

at 31 December 2009

+--------------------------+--------------+--------------+

| | 2009 | 2008 |

+--------------------------+--------------+--------------+

| | US$ | US$ |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| ASSETS | | |

+--------------------------+--------------+--------------+

| Non-current assets | | |

+--------------------------+--------------+--------------+

| Investments | 287,786 | 258,755 |

+--------------------------+--------------+--------------+

| Total non-current assets | 287,786 | 258,755 |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| Current assets | | |

+--------------------------+--------------+--------------+

| Other receivables | 5,891,111 | 6,747,506 |

+--------------------------+--------------+--------------+

| Cash and cash | 8,841,131 | 8,126,015 |

| equivalents | | |

+--------------------------+--------------+--------------+

| Total current assets | 14,732,242 | 14,873,521 |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| Total assets | 15,020,028 | 15,132,276 |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| LIABILITIES & EQUITY | | |

+--------------------------+--------------+--------------+

| Current liabilities | | |

+--------------------------+--------------+--------------+

| Other payables | 148,580 | 114,625 |

+--------------------------+--------------+--------------+

| Total current | 148,580 | 114,625 |

| liabilities | | |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| Total liabilities | 148,580 | 114,625 |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| Capital and reserves | | |

+--------------------------+--------------+--------------+

| Share capital | 424,023 | 424,023 |

+--------------------------+--------------+--------------+

| Share premium | 11,283,551 | 11,283,551 |

+--------------------------+--------------+--------------+

| Other reserves | (1,922,214) | (2,300,985) |

+--------------------------+--------------+--------------+

| Retained earnings | 5,086,088 | 5,611,062 |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| Total shareholders' | 14,871,448 | 15,017,651 |

| equity | | |

+--------------------------+--------------+--------------+

| | | |

+--------------------------+--------------+--------------+

| Total liabilities & | 15,020,028 | 15,132,276 |

| equity | | |

+--------------------------+--------------+--------------+

CONSOLIDATED CASHFLOW STATEMENT

for the year ended 31 December 2009

+-------------------------------------+--------------+--------------+

| | 2009 | 2008 |

+-------------------------------------+--------------+--------------+

| | US$ | US$ |

+-------------------------------------+--------------+--------------+

| Operating activities | | |

+-------------------------------------+--------------+--------------+

| Income before taxation from | 4,407,299 | 3,787,704 |

| continuing operations | | |

+-------------------------------------+--------------+--------------+

| Adjustments for: | | |

+-------------------------------------+--------------+--------------+

| Interest income | (422,972) | (671,089) |

+-------------------------------------+--------------+--------------+

| Interest expense | 19,567 | 2,303 |

+-------------------------------------+--------------+--------------+

| Exchange difference | 1,127,941 | 18,488 |

+-------------------------------------+--------------+--------------+

| Excess on acquisition of fair value | (445,573) | - |

| net assets of subsidiary over cost | | |

+-------------------------------------+--------------+--------------+

| Gain on disposal of quoted | - | (158,166) |

| securities | | |

+-------------------------------------+--------------+--------------+

| Impairment loss in receivables | (119,345) | 90,597 |

+-------------------------------------+--------------+--------------+

| Depreciation of property, plant and | 115,120 | 165,870 |

| equipment | | |

+-------------------------------------+--------------+--------------+

| Impairment of property, plant and | 6,052 | - |

| equipment | | |

+-------------------------------------+--------------+--------------+

| Amortisation for intangible assets | 2,957,106 | 1,592,818 |

+-------------------------------------+--------------+--------------+

| Share based payments | 23,142 | - |

+-------------------------------------+--------------+--------------+

| | | |

+-------------------------------------+--------------+--------------+

| Operating cash generated before | 7,668,337 | 4,828,525 |

| working capital changes | | |

+-------------------------------------+--------------+--------------+

| (Increase)/decrease in inventories | (72,515) | 904,621 |

+-------------------------------------+--------------+--------------+

| Increase in trade and other | (2,265,667) | (2,828,519) |

| receivables | | |

+-------------------------------------+--------------+--------------+

| Increase in trade and other | 1,873,203 | 1,178,229 |

| payables | | |

+-------------------------------------+--------------+--------------+

| | | |

+-------------------------------------+--------------+--------------+

| Cash generated by operations | 7,203,358 | 4,082,856 |

+-------------------------------------+--------------+--------------+

| Income taxes paid | (158,474) | (128,065) |

+-------------------------------------+--------------+--------------+

| Interest paid | (19,567) | (2,303) |

+-------------------------------------+--------------+--------------+

| NET CASH GENERATED FROM OPERATING | 7,025,317 | 3,952,488 |

| ACTIVITIES | | |

+-------------------------------------+--------------+--------------+

| | | |

+-------------------------------------+--------------+--------------+

| Investing activities | | |

+-------------------------------------+--------------+--------------+

| Interest received | 422,972 | 671,089 |

+-------------------------------------+--------------+--------------+

| Proceeds on disposal of trading | - | 463,730 |

| investment | | |

+-------------------------------------+--------------+--------------+

| Purchase of property, plant and | (55,201) | (418,824) |

| equipment | | |

+-------------------------------------+--------------+--------------+

| Proceeds on disposal of property, | 111,471 | - |

| plant and equipment | | |

+-------------------------------------+--------------+--------------+

| Purchase of intangible assets | (4,202,061) | (2,797,073) |

+-------------------------------------+--------------+--------------+

| Acquisition of subsidiary | (308,581) | - |

+-------------------------------------+--------------+--------------+

| Entrust loans received/ (made) | 1,433,369 | (5,865,985) |

+-------------------------------------+--------------+--------------+

| Purchase of investments for trading | - | (305,564) |

+-------------------------------------+--------------+--------------+

| (Decrease)/Increase in pledged bank | 460,276 | (177,182) |

| deposits | | |

+-------------------------------------+--------------+--------------+

| NET CASH USED IN INVESTING | (2,137,755) | (8,429,809) |

| ACTIVITIES | | |

+-------------------------------------+--------------+--------------+

| | | |

+-------------------------------------+--------------+--------------+

| Financing activities | | |

+-------------------------------------+--------------+--------------+

| Proceeds from short-term bank loans | - | 1,170,515 |

+-------------------------------------+--------------+--------------+

| Dividend paid | (953,653) | (1,027,075) |

+-------------------------------------+--------------+--------------+

| NET CASH GENERATED FROM FINANCING | (953,653) | 143,440 |

| ACTIVITIES | | |

+-------------------------------------+--------------+--------------+

| GROUP CASHFLOW STATEMENT-CONTINUED | | |

| for the year ended 31 December 2009 | | |

| | | |

| | | |

+-------------------------------------+--------------+--------------+

| | 2009 | 2008 |

| | US$ | US$ |

+-------------------------------------+--------------+--------------+

| NET (DECREASE)/INCREASE IN CASH AND | 3,933,909 | (4,33,881 |

| CASH EQUIVALENTS | | |

+-------------------------------------+--------------+--------------+

| Effect of exchange rate changes | (1,451,222) | (1,332,884) |

+-------------------------------------+--------------+--------------+

| CASH AND CASH EQUIVALENTS AT | 12,452,387 | 18,119,152 |

| BEGINNING OF YEAR | | |

+-------------------------------------+--------------+--------------+

| | | |

+-------------------------------------+--------------+--------------+

| CASH AND CASH EQUIVALENTS AT THE | 14,935,073 | 12,452,387 |

| END OF YEAR | | |

+-------------------------------------+--------------+--------------+

CONSOLIDATED STATEMENT OF SHAREHOLDERS'FUNDS AND STATEMENT OF CHANGES IN

SHAREHOLDERS'EQUITY

at 31 December 2009

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| | Share | Share | Merger | Other | Retained | Total |

| | capital | premium | reserve | reserves | earnings | |

+ +---------------+------------+-------------+-------------+-------------+-------------+

| | US$ | US$ | US$ | US$ | US$ | US$ |

+ +---------------+------------+-------------+-------------+-------------+-------------+

| | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Balance at 31 | 424,023 | 11,283,551 | (1,118,051) | 8,336,500 | 10,675,826 | 29,601,849 |

| December 2007 | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Profit for | - | - | - | - | 3,429,690 | 3,429,690 |

| the year | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Currency | | | | | | |

| translation | | | | | | |

| differences | - | - | - | (1,082,722) | - | (1,082,722) |

| on foreign | | | | | | |

| operations | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Total | | | | | | |

| comprehensive | - | - | - | (1,082,722) | 3,429,690 | 2,346,968 |

| income for | | | | | | |

| the year | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Transfer to | | | | | | |

| statutory | - | - | - | 531,394 | (531,394) | - |

| reserve | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Transfer to | | | | | | |

| capital | - | - | - | - | (1,027,075) | (1,027,075) |

| reserve | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Balance at 31 | 424,023 | 11,283,551 | (1,118,051) | 7,785,172 | 12,547,047 | 30,921,742 |

| December 2008 | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Profit for | - | - | - | - | 3,654,813 | 3,654,813 |

| the year | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Currency | | | | | | |

| translation | | | | | | |

| differences | - | - | - | (322,259) | - | (322,259) |

| on foreign | | | | | | |

| operations | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Total | | | | | | |

| comprehensive | - | - | - | (322,259) | 3,654,813 | 3,332,554 |

| income for | | | | | | |

| the year | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Transfer to | | | | | | |

| statutory | - | - | - | 163,857 | (163,857) | - |

| reserve | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Share based | | | | | | |

| payments | - | - | - | 23,142 | - | 23,142 |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Dividend | | | | | | |

| payable on | - | - | - | - | (953,653) | (953,653) |

| common stock | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

| Balance at 31 | 424,023 | 11,283,551 | (1,118,051) | 7,649,912 | 15,084,350 | 33,323,786 |

| December 2009 | | | | | | |

+---------------+---------------+------------+-------------+-------------+-------------+-------------+

NOTES TO THE FINANCIAL STATEMENTS

1 BASIS OF PREPARATION

This preliminary announcement has been prepared in accordance with International

Financial Reporting Standards (IFRS) as adopted by the European Union (EU), the

Companies Act 2006 applicable to companies reporting under IFRS and under the

historical cost convention.

2. REVENUE AND SEGMENT INFORMATION

The segment reporting format is determined to be business segments, as the

Group's principal activity is conducted in the People's Republic of China.

The Group's operations are organised into two operating divisions namely

software development and system integration.

The software segment provides export tax, e-government and information

integration software.

The system integration provides consultancy and the implementation of IT

solutions, which includes provision of hardware and peripherals.

+------------------------------+-------------+-------------+-------------+

| 2009 | Software | System | |

| | development | integration | Total |

+------------------------------+-------------+-------------+-------------+

| | US$ | US$ | US$ |

+------------------------------+-------------+-------------+-------------+

| Segment Revenue (excl. VAT | 8,305,265 | 5,305,044 | 13,610,309 |

| refund) | | | |

+------------------------------+-------------+-------------+-------------+

| VAT refund | 903,000 | - | 903,000 |

+------------------------------+-------------+-------------+-------------+

| Segment Revenue (incl. VAT | 9,208,265 | 5,305,044 | 14,513,309 |

| refund) | | | |

+------------------------------+-------------+-------------+-------------+

| Segment Cost of Sales | (100,673) | (4,818,507) | (4,919,180) |

+------------------------------+-------------+-------------+-------------+

| Segment gross profit | 9,107,592 | 486,537 | 9,594,129 |

+------------------------------+-------------+-------------+-------------+

| Other income | | | 866,233 |

+------------------------------+-------------+-------------+-------------+

| Excess on acquisition of | | | |

| fair value of net assets of | | | 445,573 |

| subsidiary over cost | | | |

+------------------------------+-------------+-------------+-------------+

| Research and development | | |(2,206,895) |

| cost | | | |

+------------------------------+-------------+-------------+-------------+

| Selling and distribution | | |(2,152,110) |

| expenses | | | |

+------------------------------+-------------+-------------+-------------+

| Administrative expenses | | |(3,242,317) |

+------------------------------+-------------+-------------+-------------+

| Impairment loss on Property, | | | |

| plant and equipment | | | (6,049) |

+------------------------------+-------------+-------------+-------------+

| Operating profit | | | 3,298,564 |

+------------------------------+-------------+-------------+-------------+

| Finance income | | | 2,256,244 |

+------------------------------+-------------+-------------+-------------+

| Finance cost | | |(1,147,509) |

+------------------------------+-------------+-------------+-------------+

| Profit before tax | | | 4,407,299 |

+------------------------------+-------------+-------------+-------------+

+----------------------------+-------------+-------------+-------------+

| 2008 | Software | System | |

| | development | integration | Total |

+----------------------------+-------------+-------------+-------------+

| | US$ | US$ | US$ |

+----------------------------+-------------+-------------+-------------+

| Segment Revenue (excl. VAT | 7,862,890 | 3,767,250 | 11,630,140 |

| refund) | | | |

+----------------------------+-------------+-------------+-------------+

| VAT refund | 447,984 | - | 447,984 |

+----------------------------+-------------+-------------+-------------+

| Segment Revenue (incl. VAT | 8,310,874 | 3,767,250 | 12,078,124 |

| refund) | | | |

+----------------------------+-------------+-------------+-------------+

| Segment Cost of Sales | (69,605) | (3,425,387) | (3,494,992) |

+----------------------------+-------------+-------------+-------------+

| Segment gross profit | 8,241,269 | 341,863 | 8,583,132 |

+----------------------------+-------------+-------------+-------------+

| Other income | | | 620,974 |

+----------------------------+-------------+-------------+-------------+

| Excess on acquisition of | | | |

| fair value of net assets | | | - |

| of subsidiary over cost | | | |

+----------------------------+-------------+-------------+-------------+

| Research and development | | |(1,986,680) |

| cost | | | |

+----------------------------+-------------+-------------+-------------+

| Selling and distribution | | |(1,357,692) |

| expenses | | | |

+----------------------------+-------------+-------------+-------------+

| Administrative expenses | | |(2,566,871) |

+----------------------------+-------------+-------------+-------------+

| Impairment loss on | | | |

| Property, plant and | | | - |

| equipment | | | |

+----------------------------+-------------+-------------+-------------+

| Operating profit | | | 3,292,863 |

+----------------------------+-------------+-------------+-------------+

| Finance income | | | 515,632 |

+----------------------------+-------------+-------------+-------------+

| Finance cost | | | (20,791) |

+----------------------------+-------------+-------------+-------------+

| Profit before tax | | | 3,787,704 |

+----------------------------+-------------+-------------+-------------+

The Group's revenue was all derived from its principal activity. All revenue

originates in the People's Republic of China.

Major customers

During the year revenues of $3,483,733 (2008: $3,782,022) arose from three

customers from within the Software Development division. Within that figure,

revenue derived from Chinese government and companies within the control of the

Chinese government accounted for 59% (2008: 34%).

During the year revenues of $6,806,267 (2008: $7,310,193) arose from three

customers from within the System Integration division. Within that figure,

revenue derived from Chinese government and companies within the control of the

Chinese government accounted for 84% (2008: 53%).

The assets and liabilities of the Group cannot be allocated to the above

segments. For internal reporting purposes balance sheets are not split into

segments.

3. OTHER INCOME

+----------------------------------------+----------+----------+

| | Group |

+----------------------------------------+---------------------+

| | 2009 | 2008 |

+----------------------------------------+----------+----------+

| | US$ | US$ |

+----------------------------------------+----------+----------+

| | | |

+----------------------------------------+----------+----------+

| Gain on disposal of quoted securities | - | 158,166 |

+----------------------------------------+----------+----------+

| Government grants and rebates | 282,904 | 306,195 |

+----------------------------------------+----------+----------+

| Interest on entrusted loans | 422,972 | 155,457 |

+----------------------------------------+----------+----------+

| Other income | 160,357 | 1,156 |

+----------------------------------------+----------+----------+

| | 866,233 | 620,974 |

+----------------------------------------+----------+----------+

4. EARNINGS PER SHARE

+-----------------------------------------+--------------+-------------+

| | 2009 | 2008 |

+-----------------------------------------+--------------+-------------+

| | | |

+-----------------------------------------+--------------+-------------+

| Profit for the year | US$ | US$ |

| | 3,654,813 | 3,429,690 |

+-----------------------------------------+--------------+-------------+

| | | |

+-----------------------------------------+--------------+-------------+

| Number of shares - weighted average - | 165,582,189 |165,582,189 |

| basic | | |

+-----------------------------------------+--------------+-------------+

| Basic earnings per share | US$ 0.0221 | US$ 0.0207 |

+-----------------------------------------+--------------+-------------+

| | | |

+-----------------------------------------+--------------+-------------+

| Number of shares - weighted average - | 165,700,706 |165,582,189 |

| diluted | | |

+-----------------------------------------+--------------+-------------+

| Diluted earnings per share | US$ 0.0221 | US$ 0.0207 |

+-----------------------------------------+--------------+-------------+

5. DIVIDEND

Subject to approval at the forthcoming AGM, the Company will declare a dividend

of 0.31p per ordinary share. The dividend will be paid to shareholders on the

register on 18 June 2010. The Company's shares will trade 'Ex-dividend' on 16

June 2010 and the proposed payment date is 19 July 2010.

6. PUBLICATION OF NON-STATUTORY ACCOUNTS

The financial information in the preliminary statement of results does not

constitute the Company's statutory accounts for the years ended 31 December 2009

or 2008. Statutory accounts for 2008 have been delivered to the registrar of

companies, and those for 2009 will be delivered in due course. The auditors have

reported on those accounts; their reports were (i) unqualified, (ii) did not

include references to any matters to which the auditors drew attention by way of

emphasis without qualifying their reports and (iii) did not contain a statement

under section 237(2) or (3) of the Companies Act 1985 in respect of the accounts

for 2008, nor a statement under section 498(2) or (3) of the Companies Act 2006

in respect of the accounts for 2009.

The financial statements, and this preliminary statement, of the Group for the

year ended 31 December 2009 were authorised for issue by the Board of Directors

on 19 April 2010

7. TIMETABLE AND DISTRIBUTION OF ACCOUNTS

The report and financial statements together with the Notice of AGM and Proxy

form will be despatched to shareholders in May. The annual general meeting will

be held at 10 am on 25 May 2010 at the offices of the Tavistock Communications,

131 Finsbury Pavement, London, EC2A 1NT.

Additional copies of the Annual Report and Accounts, Notice of AGM and Proxy

Form may be requested directly from the Company and will be available following

distribution to shareholders on the Company's website

www.sinosoft-technology.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR KKKDPOBKKPQB

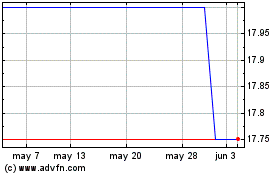

Software Circle (LSE:SFT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Software Circle (LSE:SFT)

Gráfica de Acción Histórica

De May 2023 a May 2024