Press Release

October 4, 2024

Shell plc Announces Final Results of

Exchange Offers

Shell plc (“Shell”) (LSE: SHEL) (NYSE: SHEL)

(EAX: SHELL) today announced the final results of its previously

announced offers to exchange (the “Exchange Offers” and each, an

“Exchange Offer”) up to a maximum aggregate principal amount of $12

billion (the “Maximum Amount”) of any and all validly tendered (and

not validly withdrawn) and accepted notes of twelve series issued

by Shell International Finance B.V. (“Shell International Finance”

and such notes, the “Old Notes”) for a combination of cash and a

corresponding series of new notes to be issued by Shell Finance US

Inc. (“Shell Finance US”) and fully and unconditionally guaranteed

by Shell plc (the “New Notes”). A Registration Statement on Form

F-4 (File Nos. 333-281941 and 333-281941-01) (the “Registration

Statement”), including a prospectus, dated September 19, 2024 (the

“Prospectus”), relating to the issuance of the New Notes was filed

with the Securities and Exchange Commission (the “SEC”) and was

declared effective by the SEC on September 30, 2024.

As announced on September 5, 2024, Shell is

conducting the Exchange Offers to migrate the existing Old Notes

from Shell International Finance B.V. to Shell Finance US Inc. in

order to optimize the Shell Group's capital structure and align

indebtedness with its U.S. business.

The total aggregate principal amount of Old

Notes that were validly tendered (and not validly withdrawn) and

accepted for exchange in the Exchange Offers was

$11,462,980,000. The aggregate principal amount of each

series of Old Notes that was accepted for exchange was based on the

order of acceptance priority for such series as set forth in the

table below (the “Acceptance Priority Levels”), with Acceptance

Priority Level 1 being the highest and Acceptance Priority Level 12

being the lowest, subject to the applicable Minimum Size Condition

and the Maximum Amount Condition (each as described in the

Prospectus). Because the total aggregate principal amount of Old

Notes that were validly tendered (and not validly withdrawn) as of

5:00 p.m., New York City time, on October 3, 2024 (the “Expiration

Time”) exceeded the Maximum Amount, we did not accept for exchange

all such Old Notes and only accepted for exchange those Old Notes

as set forth in the table below under the heading “Aggregate

Principal Amount Accepted.” All Old Notes validly tendered (and not

validly withdrawn) as of the Expiration Time in Acceptance Priority

Levels 1 through 8 satisfied the applicable Minimum Size Condition

and the Maximum Amount Condition and were accepted for exchange. No

Old Notes tendered in Acceptance Priority Levels 9 through 12 were

accepted for exchange.

The following table, based on information

provided by D.F. King & Co. Inc., the exchange agent and

information agent for the Exchange Offers, indicates, among other

things, the total aggregate principal amount of Old Notes and the

aggregate principal amount of each series of Old Notes validly

tendered (and not validly withdrawn) and accepted for exchange in

the Exchange Offers.

|

Series of Old Notes Offered for Exchange |

Old CUSIP/ISINNo. |

Acceptance Priority Level |

Aggregate Principal Amount Outstanding

($MM) |

Aggregate Principal Amount Tendered |

Aggregate Principal Amount Accepted |

New CUSIP/ISIN No. |

|

4.375% Guaranteed Notes due 2045 |

822582BF8/ US822582BF88 |

1 |

$3,000 |

$2,446,755,000 |

|

$2,446,755,000 |

822905AA3 / US822905AA35 |

|

|

2.750% Guaranteed Notes due 2030 |

822582CG5/ US822582CG52 |

2 |

$1,750 |

$1,355,391,000 |

|

$1,355,391,000 |

822905AB1 / US822905AB18 |

|

|

4.125% Guaranteed Notes due 2035 |

822582BE1/ US822582BE14 |

3 |

$1,500 |

$1,192,346,000 |

|

$1,192,346,000 |

822905AC9 / US822905AC90 |

|

|

4.550% Guaranteed Notes due 2043 |

822582AY8/ US822582AY86 |

4 |

$1,250 |

$960,281,000 |

|

$960,281,000 |

822905AD7 / US822905AD73 |

|

|

4.000% Guaranteed Notes due 2046 |

822582BQ4/ US822582BQ44 |

5 |

$2,250 |

$1,764,084,000 |

|

$1,764,084,000 |

822905AE5 / US822905AE56 |

|

|

2.375% Guaranteed Notes due 2029 |

822582CD2/ US822582CD22 |

6 |

$1,500 |

$1,075,279,000 |

|

$1,075,279,000 |

822905AF2 / US822905AF22 |

|

|

3.250% Guaranteed Notes due 2050 |

822582CH3/ US822582CH36 |

7 |

$2,000 |

$1,664,464,000 |

|

$1,664,464,000 |

822905AG0 / US822905AG05 |

|

|

3.750% Guaranteed Notes due 2046 |

822582BY7/ US822582BY77 |

8 |

$1,250 |

$1,004,380,000 |

|

$1,004,380,000 |

822905AH8 / US822905AH87 |

|

|

3.125% Guaranteed Notes due 2049 |

822582CE0/ US822582CE05 |

9 |

$1,250 |

$1,037,100,000 |

|

$0 |

— |

|

|

3.000% Guaranteed Notes due 2051 |

822582CL4/ US822582CL48 |

10 |

$1,000 |

$888,919,000 |

|

$0 |

— |

|

|

2.875% Guaranteed Notes due 2026 |

822582BT8/ US822582BT82 |

11 |

$1,750 |

$987,472,000 |

|

$0 |

— |

|

|

2.500% Guaranteed Notes due 2026 |

822582BX9/ US822582BX94 |

12 |

$1,000 |

$622,831,000 |

|

$0 |

— |

|

| |

|

|

|

|

|

|

|

|

|

Total amount tendered and accepted in the Exchange

Offers |

|

|

|

$11,462,980,000 |

|

|

Settlement and issuance of the New Notes to be

issued in exchange for Old Notes validly tendered (and not validly

withdrawn) and accepted for exchange is expected to occur on

October 8, 2024.

The dealer managers for the Exchange Offers

were:

|

Deutsche Bank Securities Inc. 1 Columbus

Circle New York, New York 10019 Attention: Liability Management

Group Telephone: (U.S. Toll-Free): +1 (866) 627-0391 Telephone

(U.S. Collect): +1 (212) 250-2955 Telephone (London): +44 207 545

8011 |

Goldman Sachs & Co. LLC 200 West Street

New York, New York 10282 Attention: Liability Management Group

Telephone (U.S. Toll-Free): +1 (800) 828-3182 Telephone (U.S.

Collect): +1 (212) 902-6351 Telephone (London): +44 207 774 4836

Email: gs-lm-nyc@ny.email.gs.com |

Wells Fargo Securities, LLC 550 South Tryon

Street, 5th Floor Charlotte, North Carolina 28202 Attention:

Liability Management Group Telephone (U.S. Toll-Free): +1 (866)

309-6316 Telephone (U.S. Collect): +1 (704) 410-4235 Telephone

(Europe): +33 1 85 14 06 62 Email:

liabilitymanagement@wellsfargo.com |

The exchange agent and information agent for the

Exchange Offers was:

D.F. King & Co., Inc.

48 Wall Street, 22nd FloorNew York, NY 10005Banks

and Brokers call: +1 (212) 269-5550Toll-free (U.S. only): +1 (877)

783-5524Email: Shell@dfking.comBy Facsimile (for eligible

institutions only): +1 (212) 709-3328Confirmation: +1 (212)

269-5552Attention: Michael HorthmanWebsite:

www.dfking.com/shell

This press release is not an offer to sell or a

solicitation of an offer to buy any of the securities described

herein. The Exchange Offers were made solely pursuant to the terms

and conditions of the Prospectus, which forms a part of the

Registration Statement.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities nor

will there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction.

Non-U.S. Distribution

Restrictions

European Economic Area

The New Notes are not intended to be offered,

sold or otherwise made available to and should not be offered, sold

or otherwise made available to any retail investor in the European

Economic Area (“EEA”). For these purposes, a retail investor means

a person who is one (or more) of: (i) a retail client as defined in

point (11) of Article 4(1) of Directive 2014/65/EU (as amended,

“MiFID II”); or (ii) a customer within the meaning of Directive

2002/92/EC (as amended, the “Insurance Mediation Directive”), where

that customer would not qualify as a professional client as defined

in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified

investor as defined in Directive 2003/71/EC (as amended, the

“Prospectus Directive”). Consequently no key information document

required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs

Regulation”) for offering or selling the New Notes or otherwise

making them available to retail investors in the EEA has been

prepared and therefore offering or selling the New Notes or

otherwise making them available to any retail investor in the EEA

may be unlawful under the PRIIPs Regulation. The Prospectus has

been prepared on the basis that any offer of New Notes in any

Member State of the EEA will be made pursuant to an exemption under

the Prospectus Directive from the requirement to publish a

prospectus for offers of New Notes. The Prospectus is not a

prospectus for the purposes of the Prospectus Directive.

MiFID II product governance / Professional

investors and ECPs only target market—In the EEA and solely for the

purposes of the product approval process conducted by any Dealer

Manager who is a manufacturer with respect to the New Notes for the

purposes of the MiFID II product governance rule under EU Delegated

Directive 2017/593 (each, a “manufacturer”), the manufacturers’

target market assessment in respect of the New Notes has led to the

conclusion that: (i) the target market for the New Notes is

eligible counterparties and professional clients only, each as

defined in MiFID II; and (ii) all channels for distribution of the

New Notes to eligible counterparties and professional clients are

appropriate. Any person subsequently offering, selling or

recommending the New Notes (a “distributor”) should take into

consideration the manufacturers’ target market assessment; however,

a distributor subject to MiFID II is responsible for undertaking

its own target market assessment in respect of the New Notes (by

either adopting or refining the manufacturers’ target market

assessment) and determining appropriate distribution channels.

Belgium

Neither the Prospectus nor any other documents

or materials relating to the Exchange Offers have been submitted to

or will be submitted for approval or recognition to the Belgian

Financial Services and Markets Authority (“Autorité des services et

marchés financiers”/”Autoriteit voor Financiële Diensten en

Markten”). The Exchange Offers are not being, and may not be, made

in Belgium by way of a public offering, as defined in Articles 3,

§1, 1° and 6, §1 of the Belgian Law of April 1, 2007 on public

takeover bids (“loi relative aux offres publiques

d’acquisition”/”wet op de openbare overnamebiedingen”) (the

“Belgian Takeover Law”) or as defined in Article 3, §1 of the

Belgian Law of June 16, 2006 on the public offer of investment

instruments and the admission to trading of investment instruments

on a regulated market (“loi relative aux offres publiques

d’instruments de placement et aux admissions d’instruments de

placement à la négociation sur des marchés réglementés”/”wet op de

openbare aanbieding van beleggingsinstrumenten en de toelating van

beleggingsinstrumenten tot de verhandeling op een gereglementeerde

markt”) (the “Belgian Prospectus Law”), both as amended or replaced

from time to time. Accordingly, the Exchange Offers may not be, and

are not being, advertised and the Exchange Offers will not be

extended, and neither the Prospectus nor any other documents or

materials relating to the Exchange Offers (including any

memorandum, information circular, brochure or any similar

documents) has been or shall be distributed or made available,

directly or indirectly, to any person in Belgium other than (i) to

persons which are “qualified investors” (“investisseurs

qualifiés”/”gekwalificeerde beleggers”) as defined in Article 10,

§1 of the Belgian Prospectus Law, acting on their own account, as

referred to in Article 6, §3 of the Belgian Takeover Law or (ii) in

any other circumstances set out in Article 6, §4 of the Belgian

Takeover Law and Article 3, §4 of the Belgian Prospectus Law. The

Prospectus has been issued only for the personal use of the above

qualified investors and exclusively for the purpose of the Exchange

Offers. Accordingly, the information contained in the Prospectus or

in any other documents or materials relating to the Exchange Offers

may not be used for any other purpose or disclosed or distributed

to any other person in Belgium.

France

The Exchange Offers are not being made, directly

or indirectly, to the public in the Republic of France. Neither the

Prospectus nor any other documents or materials relating to the

Exchange Offers have been or shall be distributed to the public in

France and only (i) providers of investment services relating to

portfolio management for the account of third parties (“personnes

fournissant le service d’investissement de gestion de portefeuille

pour compte de tiers”) and/or (ii) qualified investors

(“investisseurs qualifiés”) other than individuals, in each case

acting on their own account and all as defined in, and in

accordance with, Articles L.411-1, L.411-2, D.321-1 and D.411-1 of

the French Code Monétaire et Financier, are eligible to participate

in the Exchange Offers. The Prospectus and any other document or

material relating to the Exchange Offers have not been and will not

be submitted for clearance to nor approved by the Autorité des

marchés financiers.

Italy

None of the Exchange Offers, the Prospectus or

any other documents or materials relating to the Exchange Offers or

the New Notes have been or will be submitted to the clearance

procedure of the Commissione Nazionale per le Società e la Borsa

(“CONSOB”). The Exchange Offers are being carried out in the

Republic of Italy as exempted offers pursuant to article 101-bis,

paragraph 3-bis of the Legislative Decree No. 58 of 24 February

1998, as amended (the “Financial Services Act”) and article 35-bis,

paragraph 3, of CONSOB Regulation No. 11971 of 14 May 1999, as

amended (the “Issuers’ Regulation”) and, therefore, are intended

for, and directed only at, qualified investors (investitori

qualificati) (the “Italian Qualified Investors”), as defined

pursuant to Article 100, paragraph 1, letter (a) of the Financial

Services Act and Article 34-ter, paragraph 1, letter (b) of the

Issuers’ Regulation. Accordingly, the Exchange Offers cannot be

promoted, nor may copies of any document related thereto or to the

New Notes be distributed, mailed or otherwise forwarded, or sent,

to the public in Italy, whether by mail or by any means or other

instrument (including, without limitation, telephonically or

electronically) or any facility of a national securities exchange

available in Italy, other than to Italian Qualified Investors.

Persons receiving the Prospectus must not forward, distribute or

send it in or into or from Italy. Noteholders or beneficial owners

of the Old Notes that are resident or located in Italy can offer to

exchange the notes pursuant to the Exchange Offers through

authorized persons (such as investment firms, banks or financial

intermediaries permitted to conduct such activities in Italy in

accordance with the Financial Services Act, CONSOB Regulation No.

16190 of 29 October 2007, as amended from time to time, and

Legislative Decree No. 385 of 1 September 1993, as amended) and in

compliance with applicable laws and regulations or with

requirements imposed by CONSOB or any other Italian authority. Each

intermediary must comply with the applicable laws and regulations

concerning information duties vis-à-vis its clients in connection

with the Old Notes, the New Notes, the Exchange Offers or the

Prospectus.

United Kingdom

Each dealer manager has further represented and

agreed that:

- it has complied

and will comply with all the applicable provisions of the Financial

Services and Markets Act 2000 (the “FSMA”) with respect to anything

done by it in relation to the New Notes in, from or otherwise

involving the United Kingdom (the “U.K.”); and it has only

communicated or caused to be communicated and will only communicate

or cause to be communicated an invitation or inducement to engage

in investment activity (within the meaning of Section 21 of the

FSMA) received by it in connection with the issue or sale of any

New Notes in circumstances in which Section 21(1) of the FSMA does

not apply to Shell Finance US or Shell.

The Prospectus is only being distributed to and

is only directed at (i) persons who are outside the U.K. or (ii)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the “Order”) or (iii) high net worth entities, and other

persons to whom it may lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as “relevant persons”). The New Notes are only

available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire the New Notes will be engaged in only

with, relevant persons. Any person who is not a relevant person

should not act or rely on this document or any of its contents.

Hong Kong

The New Notes may not be offered or sold by

means of any document other than (i) in circumstances which do not

constitute an offer to the public within the meaning of the

Companies Ordinance (Cap.32, Laws of Hong Kong), or (ii) to

“professional investors” within the meaning of the Securities and

Futures Ordinance (Cap.571, Laws of Hong Kong) and any rules made

thereunder, or (iii) in other circumstances which do not result in

the document being a “prospectus” within the meaning of the

Companies Ordinance (Cap.32, Laws of Hong Kong), and no

advertisement, invitation or document relating to the New Notes may

be issued or may be in the possession of any person for the purpose

of issue (in each case whether in Hong Kong or elsewhere), which is

directed at, or the contents of which are likely to be accessed or

read by, the public in Hong Kong (except if permitted to do so

under the laws of Hong Kong) other than with respect to New Notes

which are or are intended to be disposed of only to persons outside

Hong Kong or only to “professional investors” within the meaning of

the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong)

and any rules made thereunder.

Japan

The New Notes have not been and will not be

registered under the Financial Instruments and Exchange Law of

Japan (the “Financial Instruments and Exchange Law”) and each

underwriter has agreed that it will not offer or sell any New

Notes, directly or indirectly, in Japan or to, or for the benefit

of, any resident of Japan (which term as used herein means any

person resident in Japan, including any corporation or other entity

organized under the laws of Japan), or to others for re-offering or

resale, directly or indirectly, in Japan or to a resident of Japan,

except pursuant to an exemption from the registration requirements

of, and otherwise in compliance with, the Financial Instruments and

Exchange Law and any other applicable laws, regulations and

ministerial guidelines of Japan.

Singapore

The Prospectus has not been registered as a

prospectus with the Monetary Authority of Singapore. Accordingly,

and if the Issuer has not notified the dealer(s) on the

classification of the New Notes under and pursuant to Section

309(B)(1) of the Securities and Futures Act, Chapter 289 Singapore

(the “SFA”), the Prospectus and any other document

or material in connection with the offer or sale, or invitation for

subscription or purchase, of the New Notes may not be circulated or

distributed, nor may the New Notes be offered or sold, or be made

the subject of an invitation for subscription or purchase, whether

directly or indirectly, to persons in Singapore other than (i) to

an institutional investor under Section 274 of Chapter 289 of the

SFA, (ii) to a relevant person, or any person pursuant to Section

275(1A), and in accordance with the conditions, specified in

Section 275 of the SFA or (iii) otherwise pursuant to, and in

accordance with the conditions of, any other applicable provision

of the SFA.

Where the New Notes are subscribed or purchased

under Section 275 of the SFA by a relevant person which is: (a) a

corporation (which is not an accredited investor) the sole business

of which is to hold investments and the entire share capital of

which is owned by one or more individuals, each of whom is an

accredited investor; or (b) a trust (where the trustee is not an

accredited investor) whose sole purpose is to hold investments and

each beneficiary is an accredited investor, shares, debentures and

units of shares and debentures of that corporation or the

beneficiaries’ rights and interest in that trust shall not be

transferable for six months after that corporation or that trust

has acquired the New Notes under Section 275 except: (1) to an

institutional investor under Section 274 of the SFA or to a

relevant person, or any person pursuant to Section 275(1A), and in

accordance with the conditions, specified in Section 275 of the

SFA; (2) where no consideration is given for the transfer; or (3)

by operation of law.

Singapore Securities and Futures Act Product

Classification—Solely for the purposes of its obligations pursuant

to sections 309B(1)(a) and 309B(1)(c) of the SFA, the Issuer has

determined, and hereby notifies all relevant persons (as defined in

Section 309A of the SFA) that the New Notes are “prescribed capital

markets products” (as defined in the Securities and Futures

(Capital Markets Products) Regulations 2018) and Excluded

Investment Products (as defined in MAS Notice SFA 04-N12: Notice on

the Sale of Investment Products and MAS Notice FAA-N16: Notice on

Recommendations on Investment Products).

Contacts:

Media: International +44 (0) 207 934 5550; USA +1

832 337 4355

Cautionary Statement

The companies in which Shell plc directly and

indirectly owns investments are separate legal entities. In this

press release, “Shell” refers to Shell plc; “Shell Group” refers to

Shell and its subsidiaries; “Shell Finance US” or “Issuer” refers

to Shell Finance US Inc.; “Shell International Finance” refers to

Shell International Finance B.V.; the terms “we,” “us,” and “our”

refer to Shell or the Shell Group, as the context may require.

This press release contains certain forward-looking

statements. Forward-looking statements are statements of future

expectations that are based on management’s current expectations

and assumptions and involve known and unknown risks and

uncertainties that could cause actual results, performance or

events to differ materially from those expressed or implied in

these statements. Forward-looking statements include, among other

things, statements concerning the potential exposure of the Shell

Group to market risks and statements expressing management’s

expectations, beliefs, estimates, forecasts, projections and

assumptions. These forward-looking statements are identified by

their use of terms and phrases such as “aim”; “ambition”;

‘‘anticipate’’; ‘‘believe’’; “commit”; “commitment”; ‘‘could’’;

‘‘estimate’’; ‘‘expect’’; ‘‘goals’’; ‘‘intend’’; ‘‘may’’;

“milestones”; ‘‘objectives’’; ‘‘outlook’’; ‘‘plan’’; ‘‘probably’’;

‘‘project’’; ‘‘risks’’; “schedule”; ‘‘seek’’; ‘‘should’’;

‘‘target’’; ‘‘will’’; “would” and similar terms and phrases. There

are a number of factors that could affect the future operations of

the Shell Group and could cause those results to differ materially

from those expressed in the forward-looking statements included in

this press release (without limitation):

- price

fluctuations in crude oil and natural gas;

- changes in

demand for the Shell Group’s products;

- currency

fluctuations;

- drilling and

production results;

- reserves

estimates;

- loss of market

share and industry competition;

- environmental

and physical risks;

- risks

associated with the identification of suitable potential

acquisition properties and targets, and successful negotiation and

completion of such transactions;

- the risk of

doing business in developing countries and countries subject to

international sanctions;

- legislative,

judicial, fiscal and regulatory developments including regulatory

measures addressing climate change;

- economic and

financial market conditions in various countries and regions;

- political

risks, including the risks of expropriation and renegotiation of

the terms of contracts with governmental entities, delays or

advancements in the approval of projects and delays in the

reimbursement for shared costs;

- risks

associated with the impact of pandemics, such as the COVID-19

(coronavirus) outbreak, regional conflicts, such as the

Russia-Ukraine war, and a significant cybersecurity breach;

and

- changes in

trading conditions.

All forward-looking statements contained in this

press release are expressly qualified in their entirety by the

cautionary statements contained or referred to in this section.

Readers should not place undue reliance on forward-looking

statements. Additional risk factors that may affect future results

are contained in Shell’s Form 20-F for the year ended December 31,

2023 (available

at www.shell.com/investors/news-and-filings/sec-filings.html and

www.sec.gov).

These risk factors also expressly qualify all

forward-looking statements contained in this press release and

should be considered by the reader. Each forward-looking statement

speaks only as of the date of this press release, October 4, 2024.

Neither Shell nor any of its subsidiaries undertake any obligation

to publicly update or revise any forward-looking statement as a

result of new information, future events or other information. In

light of these risks, results could differ materially from those

stated, implied or inferred from the forward-looking statements

contained in this press release.

The contents of websites referred to in this

press release do not form part of this content.

Readers are urged to consider closely the

disclosure in our Form 20-F, File No 1-32575, available on the SEC

website www.sec.gov.

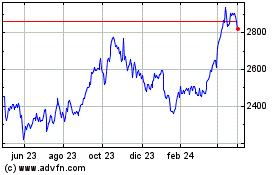

Shell (LSE:SHEL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

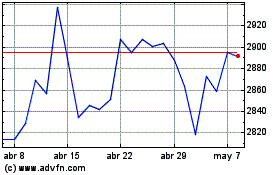

Shell (LSE:SHEL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024