TIDMTLOU

RNS Number : 6840A

Tlou Energy Ltd

24 January 2024

24 January 2024

Tlou Energy Limited

("Tlou" or "the Company")

Quarterly Activities Report for the quarter ended 31 December

2023

Highlights

Ø First gas flared from the Lesedi 6 production pod

Ø Lesedi 4 pod is dewatering in line with expectations

Ø The 66kV overhead transmission line is effectively

complete

Ø Electrical substations are approximately 37% complete

Activities

Tlou Energy has three project areas referred to as the:

-- Lesedi Project - focused on gas-to-power development as well

as exploration and evaluation.

-- Mamba Project - focused on exploration and evaluation.

-- Boomslang Project - focused on exploration and

evaluation.

Lesedi Project

The Lesedi project is Tlou's most advanced. At Lesedi the

Company is developing a proposed 10MW gas-to-power project.

Gas to Power Project

The first electricity to be generated at Lesedi is planned to go

towards satisfying the 10MW Power Purchase Agreement (PPA) with

Botswana Power Corporation (BPC) the national power utility. The

Lesedi project currently has several components of the development

process underway including the construction of transmission lines,

substations, a field operations facility and generation site as

well as production wells.

Transmission Line Construction

The Lesedi project is approximately 100km from the nearest BPC

substation connection in Serowe. To connect to the national grid,

the Company is undertaking the construction and installation of a

100km 66kV transmission line. This, together with associated

infrastructure and gas production wells should enable the Company

to connect and provide electricity into Botswana's power

network.

Construction of the 66kV transmission line has been effectively

completed by the contractor Zismo Engineering Pty Ltd (Zismo).

Final works including site clean-up and dismantling of equipment is

underway. We are extremely grateful to Zismo for their quality of

work, professionalism and expertise.

The line will remain under Zismo's care and maintenance until it

is taken over upon energisation which is expected around

mid-2024.

Substation Construction

The planned substation at Lesedi was designed for an initial 5MW

of power, however the Company is working on options that may allow

the substation design to be adapted to facilitate expansion beyond

10MW.

A new substation is required at the Lesedi end of the

transmission line whereas at the opposite end, it will tie into the

existing BPC substation at Serowe. Including the additional work

required to expand capacity beyond 10MW, the substations are

approximately 37% complete. It is currently anticipated that the

project will be completed around mid-2024.

Gas production

The Company has two gas production pods, Lesedi 4 and Lesedi 6

currently flaring gas. During the quarter Lesedi 6 experienced a

rapid increase in casing pressure in both lateral wells with first

gas production to surface occurring soon thereafter.

The rapid build-up of casing pressure and production of first

gas to surface in a relatively short time was very encouraging.

This was the fastest gas to surface in the Lesedi field to date.

Following the initial gas production, the aim is allow the gas flow

to develop and obtain a sustained flow rate.

Dewatering at the Lesedi 4 pod also continued during the period

with gas now flowing to surface as well. It was expected that

dewatering of Lesedi 4 would be longer than Lesedi 6 due to the

well design. The Company will continue production testing at both

Lesedi 4 and Lesedi 6 and update the market in due course. A short

video of the Lesedi 6 gas flare is available on the following link:

https://youtube.com/shorts/jzOjrA-xCrE

Lesedi project licences

The project area has four Prospecting Licenses (PL) and a

Production Licence which is the focus area for the development of

Tlou's independently certified gas reserves and contingent

resources. The table below summarises the status of the Lesedi

licences:

Licence Expiry Status

Production Licence Aug-42 Current

2017/18L

------- ------------------------------

PL001/2004 TBA Awaiting renewal confirmation

------- ------------------------------

PL003/2004 TBA Awaiting renewal confirmation

------- ------------------------------

PL035/2000 Mar-25 Current

------- ------------------------------

PL037/2000 Mar-25 Current

------- ------------------------------

PL renewal applications are submitted three months prior to

expiration. Renewal applications were submitted for PL001/2004 and

PL003/2004 in June 2023 and the Company is awaiting confirmation of

renewal. The Company has been informed that there have been delays

to renewals as the process is moving to an online system.

****

Mamba Project

The Mamba project is in the exploration and evaluation phase

with further operations required on the licences. It consists of

five Prospecting Licences covering an area of approximately 4,500

Km(2) . The Mamba area is situated adjacent to Lesedi. In the event

of successful drilling results at Mamba, it is envisioned that this

area would be developed as a separate project from Lesedi. The

Mamba area provides the Company with flexibility and optionality.

The status of the Mamba licences is as follows:

Licence Expiry Status

PL 237/2014 Dec 2025 Current

--------- ------------------------------

PL 238/2014 Dec 2025 Current

--------- ------------------------------

PL 239/2014 Dec 2025 Current

--------- ------------------------------

PL 240/2014 Dec 2025 Current

--------- ------------------------------

PL 241/2014 TBA Awaiting renewal confirmation

--------- ------------------------------

PL renewal applications are submitted three months prior to

expiration. A renewal application for PL 241/2014 was submitted in

June 2023 and the Company is awaiting confirmation of renewal.

Further work on the Mamba project is proposed once the Lesedi

project is in production. The next stage of operations is likely to

include a seismic survey and the drilling of core-holes.

****

Boomslang Project

Prospecting Licence, PL011/2019 designated "Boomslang", is

approximately 1,000 Km(2) and is situated adjacent to the Company's

existing licences. To date, the Company has not carried out ground

operations in the Boomslang area. Like the Mamba project the first

stage of operations is likely to include a seismic survey following

by core-hole drilling.

The status of the Boomslang licence is as follows:

Licence Expiry Status

PL 011/2019 June 2024 Current

---------- --------

PL renewal applications are submitted three months prior to

expiration.

****

Cash Position

At the end of the quarter the Company had A$0.73m cash on hand

(unaudited). The aggregate value of payments to related parties and

their associates of A$109k for the quarter (shown in item 6.1 of

the Quarterly Cashflow Report) relates to directors' salaries and

fees (including tax and superannuation payments made on their

behalf) and office rent. The Company will need to raise sufficient

funds early in 2024, from the ongoing Entitlement Offer and the

Excess Application Facility and any subsequent placement (as

announcement on 15 December 2023) to support ongoing and planned

operations as set out in item 8.8 of the Quarterly Cashflow

Report.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

By Authority of the Board of Directors

Mr. Anthony Gilby

Managing Director

****

For further information regarding this announcement please

contact:

Tlou Energy Limited +61 7 3040 9084

Tony Gilby, Managing Director

----------------------

Solomon Rowland, General Manager

----------------------

Grant Thornton (Nominated Adviser) +44 (0)20 7383 5100

----------------------

Harrison Clarke, Colin Aaronson, Ciara Donnelly

----------------------

Zeus Capital (UK Broker) +44 (0)20 3829 5000

----------------------

Simon Johnson

----------------------

Investor Relations

----------------------

Ashley Seller (Australia) +61 418 556 875

----------------------

FlowComms Ltd - Sasha Sethi (UK) +44 (0) 7891 677 441

----------------------

About Tlou

Tlou is developing energy solutions in Sub-Saharan Africa

through gas-fired power and ancillary projects. The Company is

listed on the ASX (Australia), AIM (UK) and the BSE (Botswana). The

Lesedi Gas-to-Power Project ("Lesedi") is 100% owned and is the

Company's most advanced project. Tlou's competitive advantages

include the ability to drill cost effectively for gas, operational

experience and Lesedi's strategic location in relation to energy

customers. All major government approvals have been achieved.

Forward-Looking Statements

This announcement may contain certain forward-looking

statements. Actual results may differ materially from those

projected or implied in any forward-looking statements. Such

forward-looking information involves risks and uncertainties that

could significantly affect expected results. No representation is

made that any of those statements or forecasts will come to pass or

that any forecast results will be achieved. You are cautioned not

to place any reliance on such statements or forecasts. Those

forward-looking and other statements speak only as at the date of

this announcement. Save as required by any applicable law or

regulation, Tlou Energy Limited undertakes no obligation to update

any forward-looking statements.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

------------------------------------------------------

Tlou Energy Limited

ABN Quarter ended ("current quarter")

--------------- -----------------------------------

79 136 739 967 31 December 2023

-----------------------------------

Consolidated statement of cash Current quarter Year to date

flows (6 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers

1.2 Payments for

(a) exploration & evaluation

(b) development

(c) production

(d) staff costs (205) (551)

(e) administration and corporate

costs (260) (964)

1.3 Dividends received (see note

3)

1.4 Interest received 2 11

1.5 Interest and other costs of

finance paid

1.6 Income taxes paid

1.7 Government grants and tax

incentives

Other (provide details if

1.8 material) (26) 134

---------------- -------------

Net cash from / (used in)

1.9 operating activities (488) (1,370)

----------------- ----------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities

(b) tenements

(c) property, plant and equipment (127) (127)

(d) exploration & evaluation (4,339) (8,112)

(e) investments

(f) other non-current assets

2.2 Proceeds from the disposal

of:

(a) entities

(b) tenements

(c) property, plant and equipment

(d) investments

(e) other non-current assets

2.3 Cash flows from loans to other

entities

2.4 Dividends received (see note

3)

2.5 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

2.6 investing activities (4,465) (8,239)

----------------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) 565 565

3.2 Proceeds from issue of convertible

debt securities

3.3 Proceeds from exercise of

options

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities (64) (64)

3.5 Proceeds from borrowings 3,000 3,000

3.6 Repayment of borrowings

3.7 Transaction costs related

to loans and borrowings

3.8 Dividends paid

3.9 Other (provide details if

material)

---------------- -------------

Net cash from / (used in)

3.10 financing activities 3,501 3,501

----------------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 1,871 6,851

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (488) (1,370)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (4,465) (8,239)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) 3,501 3,501

Effect of movement in exchange

4.5 rates on cash held 312 (12)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 730 730

----------------- ----------------------------------- ---------------- -------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 730 1,871

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 730 1,871

----------------- ------------------------------------ ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 109

----------------

6.2 Aggregate amount of payments to related

parties and their associates included in

item 2

----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments.

7. Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $A'000

arrangements available to $A'000

the entity. Add notes as necessary

for an understanding of the

sources of finance available

to the entity.

7.1 Loan facilities

------------------- ----------------

7.2 Credit standby arrangements

------------------- ----------------

7.3 Other (please specify)

------------------- ----------------

7.4 Total financing facilities

------------------- ----------------

7.5 Unused financing facilities available at

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ----------------------------------------------------------------------------

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) 488

8.2 (Payments for exploration & evaluation classified 4,339

as investing activities) (item 2.1(d))

8.3 Total relevant outgoings (item 8.1 + item 4,827

8.2)

8.4 Cash and cash equivalents at quarter end 730

(item 4.6)

8.5 Unused finance facilities available at quarter -

end (item 7.5)

--------

8.6 Total available funding (item 8.4 + item 730

8.5)

--------

Estimated quarters of funding available

8.7 (item 8.6 divided by item 8.3) 0.2

--------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

-----------------------------------------------------------------------

Answer: The net operating cash flow can fluctuate depending

on the level of operations in a specific quarter. Is it

expected that the coming quarter will be similar to the

level of net operating cash flows in this reporting period.

-----------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-----------------------------------------------------------------------

Answer: On 15 December 2023 the company launched an entitlement

offer to existing shareholders to raise up to $13.3 million.

The offer closes on 31 January 2024. Any entitlements

not taken up under the offer can be placed with new investors

during the three months following close of the entitlement

offer. While indications of participation and discussions

with potential investors to participate in any placement

have been positive, the company cannot guarantee that

sufficient capital will be raised from the entitlement

offer or that negotiations with investors will result

in a successful outcome.

-----------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

-----------------------------------------------------------------------

Answer: Yes, the company expects to be able to continue

operations and meet business objectives should sufficient

funds be received from the ongoing entitlement offer.

To ensure that all planned operations are conducted as

outlined in the Entitlement offer booklet all funds under

the offer would need to be raised. Otherwise the company

may have to delay or postpone planned operations until

sufficient capital is available.

-----------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of

questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

----------------- -----------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: .....24/01/2024...............................................................

Authorised by: ....By the

Board.............................................................

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLSESESDELSEFF

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

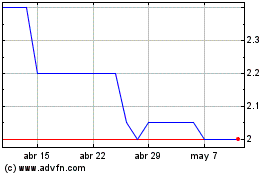

Tlou Energy (LSE:TLOU)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Tlou Energy (LSE:TLOU)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025