TIDMTLW

RNS Number : 2186V

Tullow Oil PLC

30 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON LOCATED OR RESIDENT IN, OR AT ANY ADDRESS IN, THE UNITED

STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS (INCLUDING

PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE

ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF THE UNITED

STATES OF AMERICA OR THE DISTRICT OF COLUMBIA (THE "UNITED STATES")

OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S OF THE UNITED

STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT")),

OR IN OR INTO ANY JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE,

PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION ONLY AND IS NOT AN OFFER TO

PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ANY NOTES.

Tullow Oil plc

Result of the Offer for 2026 Notes

November 30, 2023 - Tullow Oil plc (the "Company" or "Tullow")

announces the results of its offer to purchase a portion of its

outstanding 10.25% Senior Secured Notes due 2026 bearing ISIN :

USG91237AB60 and CUSIP: G91237AB6 (the " Reg S Notes ") for cash

(the "Offer"), which was announced on November 15, 2023, on the

terms and subject to the conditions set out in the Offer to

Purchase dated November 15, 2023 (the "Offer to Purchase") prepared

in accordance with the Offer. Capitalized terms used and not

otherwise defined in this announcement have the meanings ascribed

to them in the Offer to Purchase.

Tullow has increased the aggregate Tender Consideration to

$102,515,736.25.

The Final Acceptance Amount, representing the final aggregate

principal amount of Reg S Notes accepted for purchase by the

Company pursuant to the Offer, is $ 114,755,000.

Tullow will use approximately $102.5 million of cash on balance

sheet to fund the purchase of $114,755,000 in aggregate principal

amount of Reg S Notes, excluding Accrued Interest. This transaction

delivers a value accretion of $ 41.1 million from a combination of

$ 12.2 million net debt reduction and coupon savings to maturity of

$ 28.9 million.

Tullow elects to set the Maximum Purchase Price, as determined

pursuant to the Unmodified Dutch Auction Procedure, at 90.500%,

achieving a weighted average purchase price of 89.334%.

Richard Miller, Chief Financial Officer, commented today:

"Deploying cash from our balance sheet to buy back the 2026

Notes demonstrates our confidence in the business and our ongoing

cash flow generation. Through this transaction we are reducing

gross debt by $114.8 million and we will be saving $28.9 million on

coupon payments. Together with the $100 million annual repayment of

2026 Notes in May and the purchase of $166.5 million of 2025 Notes

in June this brings our total debt reduction this year to $381.3

million and marks the next step in our objective to be a low-debt

business by 2025."

Full details of the results of the Offer are as follows:

Description of the Final Acceptance

Reg S Notes CUSIP / ISIN Amount

------------------------------ --------------------------- ------------------

10.25% Senior Secured

Notes due 2026 represented

by the Regulation

S Global Notes G91237AB6 / USG91237AB60 $114,755,000.00

As the aggregate principal amount of the Reg S Notes validly

tendered up to and including the Maximum Purchase Price is equal to

the Final Acceptance Amount, the Company has accepted for purchase

Reg S Notes tendered at the Maximum Purchase Price without

proration.

The Settlement Date for the Offer will be December 1, 2023.

Notes accepted for purchase by the Company pursuant to the Offer

will be retired and cancelled.

Investor Contact Information

For further details, please read the Offer to Purchase, which is

available, subject to eligibility and registration, on the Tender

Offer Website: https://projects.morrowsodali.com/tullowoilSSN .

Questions about the terms of the Offer should be directed to the

Lead Dealer Managers.

Beneficial owners of the Notes may also contact their brokers,

dealers, commercial banks, trust companies or other nominee for

assistance concerning the Offer.

LEAD DEALER MANAGERS

ING BANK N.V., LONDON BRANCH STANDARD CHARTERED BANK

8-10 Moorgate 1 Basinghall Avenue

London EC2R 6DA London EC2V 5DD

United Kingdom United Kingdom

Attention: Liability Management Attention: Liability Management

Group

Telephone: +44 20 7885 5739 /

Telephone: +44 20 7767 6784 +65 655 78286 / +852 398 38658

Email: liability_management@sc.com

Email: liability.management@ing.com

CO-DEALER MANAGERS

Absa Bank DNB Markets, J.P. Morgan Securities Nedbank The Standard

Limited Inc. plc Limited Bank of

( acting (acting South Africa

through through Limited

its Corporate its Nedbank

and Investment Corporate

Banking and Investment

Division) Banking

Division)

INFORMATION AND TENDER AGENT

MORROW SODALI LIMITED

In Hong Kong: In London:

29/F. No 28 Stanley Street 103 Wigmore Street

Central Hong Kong London W1U 1QS

United Kingdom

Telephone: +852 2319 4130 Telephone: +44 20 4513 6933

Email: tullowoil@investor.morrowsodali.com

Tender Offer Website: https://projects.morrowsodali.com/tullowoilSSN

This announcement contains inside information for the purposes

of Article 7 of Regulation 2014/596/EU which is part of domestic UK

law pursuant to the Market Abuse (Amendment) (EU Exit) Regulations

(SI 2019/310) ("UK MAR"). Upon the publication of this

announcement, this inside information (as defined in UK MAR) is now

considered to be in the public domain. This announcement is being

made on behalf of Tullow by Adam Holland, Company Secretary.

DISCLAIMER

This announcement must be read in conjunction with the Offer to

Purchase distributed separately. This announcement and the Offer to

Purchase contain important information which should be read

carefully before any decision is made with respect to the Offer.

The contents of this announcement and the Offer to Purchase are not

to be construed as legal, business or tax advice. Each Holder is

recommended to seek its own financial and legal advice, including

in respect of any tax consequences, immediately from its

stockbroker, bank manager, solicitor, accountant or other

independent financial, tax or legal adviser. None of the Company,

the Lead Dealer Managers, the Co-Dealer Managers, the Information

and Tender Agent and any of their respective affiliates or agents

makes any recommendation in this announcement or otherwise as to

whether Eligible Holders should tender Reg S Notes pursuant to the

Offer and, if given or made, any such recommendation may not be

relied upon as authorized by the Company, the Lead Dealer Managers,

the Co-Dealer Managers, the Information and Tender Agent or any of

their respective affiliates or agents.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTEWPGGAGUPWUBU

(END) Dow Jones Newswires

November 30, 2023 05:00 ET (10:00 GMT)

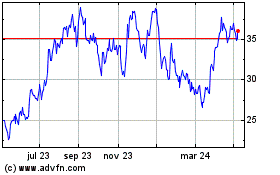

Tullow Oil (LSE:TLW)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

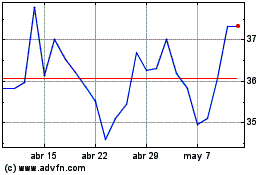

Tullow Oil (LSE:TLW)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024