TIDMTRIN

RNS Number : 9149Z

Trinity Exploration & Production

26 May 2021

RNS ANNOUNCEMENT: This announcement contains inside information

as stipulated under the UK version of the Market Abuse Regulation

No 596/2014 which is part of English Law by virtue of the European

(Withdrawal) Act 2018, as amended. On publication of this

announcement via a Regulatory Information Service, this information

is considered to be in the public domain.

Trinity Exploration & Production plc

("Trinity" or "the Group" or "the Company")

Proposed Capital Reorganisation, Publication of Annual Report

& Accounts and Notice of Annual General Meeting

Trinity, the independent E&P company focused on Trinidad and

Tobago, announces that its Annual Report and Accounts for the year

ended 31 December 2020 has been published and will be posted to

shareholders today.

A circular (the "Circular") to shareholders in connection with a

proposed capital reorganisation by the Company (the "Capital

Reorganisation"), and containing the notice convening the Company's

Annual General Meeting ("Annual General Meeting" or "AGM"), will

also be posted to shareholders today. Copies of the Annual Report

and Accounts and the notice of AGM (which forms part of the

Circular to Shareholders) are available on the Company's website at

www.trinityexploration.com . Capitalised terms in this announcement

have the same meaning as in the Circular.

Bruce Dingwall, CBE, Executive Chairman of Trinity,

commented:

"We are pleased to put the opportunity to shareholders to

approve a simplification of the Company's share capital, including

a capital reduction which would technically enable dividends to be

paid, or share buybacks to be undertaken, when it is considered

prudent to do so. Furthermore, the share consolidation aspect of

the reorganisation would reduce the current high number of shares

in issue, making investing in Trinity shares accessible to a wider

pool of investors."

Annual General Meeting

The AGM is to be held on Friday 18 June 2021 at 11.00 a.m.

outside the offices of Pinsent Masons LLP, Princes Exchange, 1 Earl

Grey Street, Edinburgh EH3 9AQ.

In light of the ongoing COVID-19 pandemic and current UK

Government and Scottish Government restrictions and public health

guidance, it is currently envisaged that the AGM will be run as a

closed meeting with the minimum number of Shareholders present to

ensure that the meeting is quorate. Shareholders are strongly

requested not to attend the meeting in person and Shareholders or

others attempting to attend the AGM in person may not be permitted

entry. Accordingly, all Shareholders are strongly encouraged to

submit their proxy vote, appointing the Chairman of the meeting as

their proxy, to ensure that their votes are registered.

The Company will continue to monitor the situation and issue

updates as necessary.

Investor Presentation

Following the AGM, the Company will be hosting a presentation

and Q&A through the digital platform Investor Meet Company at

14.00 on Friday 18 June 2021.

Investors can sign up to Investor Meet Company for free and add

to meet Trinity Exploration via the following link

https://www.investormeetcompany.com/trinity-exploration-production-plc/register-investor.

Capital Reorganisation (Capital Reduction following a Share

Consolidation and Sub-Division)

At the AGM, as detailed in the Circular, Shareholders will be

invited to approve a Capital Reorganisation that will simplify the

share capital structure of the Company. The proposals are subject,

inter alia, to Shareholder approval and, following their

implementation, will result in the Company having a single class of

Ordinary Shares in issue and distributable reserves which will

enable the Company to pay dividends, or effect share buybacks, when

it is considered prudent to do so.

The Capital Reorganisation will consist of three elements:

i. a Consolidation of every 10 Existing Ordinary Shares into one

Consolidated Ordinary Share;

ii. an immediate Sub-Division of each of those Consolidated

Ordinary Shares into one New Ordinary Share and one New Deferred

Share; and

iii. a Capital Reduction by way of both the cancellation of the

Existing Deferred Shares and the New Deferred Shares and the

cancellation of the Company's Share Premium Account.

Further details regarding the Share Consolidation, Sub-Division

and Capital Reduction

Share Consolidation and Sub-Division

The Company's issued share capital currently consists of

388,794,303 Existing Ordinary Shares and 94,799,986 Existing

Deferred Shares.

The proposed Consolidation seeks to reduce the high number of

Existing Ordinary Shares that are currently in issue. The Board

believes that the Consolidation will reduce the volatility and

spread of the Company's shares and make investing in the Company's

shares more attractive to a broader range of institutional

investors and other members of the investing public. The purpose of

the subsequent Sub-Division is to retain the nominal value of $0.01

each per New Ordinary Share, which is the current nominal value of

each of the Existing Ordinary Shares.

Accordingly, holders of Existing Ordinary Shares who are

registered on the Company's register of members at 6.00 p.m. on 18

June 2021 will, on the implementation of the Consolidation, hold

one Consolidated Ordinary Share of $0.10 each for every 10 Existing

Ordinary Shares of $0.01 each. Each Consolidated Ordinary Share

will then immediately be sub-divided into one New Ordinary Share of

$0.01 each and one New Deferred Share of $0.09 each.

It is proposed that the New Deferred Shares will then be

cancelled (as part of the Capital Reduction described below) whilst

the New Ordinary Shares will continue to remain in existence as the

voting share capital of the Company. As well as retaining the same

nominal value, each New Ordinary Share will carry the same rights

as set out in the Company's articles of association that currently

attach to the Existing Ordinary Shares.

As all Existing Ordinary Shares will be consolidated, each

Shareholder's percentage holding in the total issued voting share

capital of the Company immediately before and after the

implementation of the Consolidation and Sub-Division will (save in

respect of fractional entitlements) remain unchanged.

Fractional entitlements arising from the Consolidation will be

aggregated and sold in the market on behalf of the relevant

Shareholders as explained in the Circular.

Capital Reduction

The Circular sets out a proposal for the entire share premium

account of the Company to be cancelled. In addition, the entire

deferred share capital of the Company (comprising the Existing

Deferred Shares and the New Deferred Shares to be created as a

result of the Consolidation and Sub-Division as described above) is

also proposed to be cancelled. The effect of the proposed Capital

Reduction, if approved, will be to create a pool of distributable

reserves of the Company. This would enable the Company to make

distributions or other returns of value to its Shareholders in the

future, when it is considered prudent to do so and subject to the

Company's financial performance and compliance with law.

If the Capital Reorganisation as a whole is approved by

Shareholders at the AGM, the Capital Reduction element of the

Capital Reorganisation will then require the approval of the High

Court of Justice in England and Wales prior to becoming

effective.

Full details of the Capital Reorganisation are included in the

Circular along with an explanation as to why the Directors consider

this to be in the best interests of the Company and its

Shareholders.

Expected Timetable of Principal Events

The expected timetable of principal events is set out below. The

dates and times are indicative only and subject to change. Any

changes to the indicative timetable information will be notified by

a regulatory announcement.

Publication of the Circular Wednesday, 26

May 2021

Latest time and date for receipt of proxy vote, CREST Proxy Instruction or electronic proxy 11.00 a.m. on

appointment for use at the Annual General Meeting Wednesday, 16

June 2021

Annual General Meeting 11.00 a.m. on

Friday, 18 June

2021

Consolidation and Sub-Division Record Date 6.00 p.m. on Friday,

18 June 2021

Expected effective date of the Consolidation and Sub-Division Friday, 18 June

2021

Expected date of admission of New Ordinary Shares to trading on AIM 8.00 a.m. on Monday,

21 June 2021

Expected date CREST accounts are to be credited with New Ordinary Shares As soon as practicable

after 8.00 a.m.

on Monday, 21

June 2021

Expected date share certificates in respect of New Ordinary Shares are to be despatched to Wednesday, 30

non-CREST Shareholders June 2021

Expected date for final hearing and confirmation of the Capital Reduction by the Court Tuesday, 13 July

2021

Expected date for registration of Court order and effective date of the Capital Reduction On or around Wednesday,

14 July 2021

Admission of New Ordinary Shares to trading on AIM; new ISIN

Code and SEDOL number

Assuming Shareholder approval in respect of the Capital

Reorganisation is given at the AGM, the current ISIN (GB00B8JG4R91)

and SEDOL (B8JG4R9) in respect of the Company's Existing Ordinary

Shares will be disabled in CREST as at 6.00 p.m. on 18 June

2021.

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM. The ISIN code for the New Ordinary

Shares is GB00BN7CJ686 and the SEDOL number is BN7CJ68, and will

come into effect at the time the New Ordinary Shares are admitted

to trading on AIM, which is expected to be at 8.00 a.m. on, or

about, 21 June 2021.

Recommendation

The Directors consider the Capital Reorganisation and the

matters set out in the Resolutions to be in the best interests of

the Company and its Shareholders as a whole. Accordingly, the

Directors unanimously recommend Shareholders to vote in favour of

the Resolutions to be proposed at the AGM as they intend to do in

respect of their beneficial holdings amounting, in aggregate, to

87,982,520 Existing Ordinary Shares, representing approximately

22.63 per cent. of the existing issued ordinary share capital of

the Company as at the date of this announcement.

Further announcements will be made as appropriate.

-END-

Enquiries:

Trinity Exploration & Production Tel: +44 (0)131 240

Bruce Dingwall CBE, Executive Chairman 3860

Jeremy Bridglalsingh, Managing Director

Tracy Mackenzie, Corporate Development Manager

SPARK Advisory Partners Limited (Nominated Tel: +44 (0)20 3368

Adviser and Financial Adviser) 3550

Mark Brady

James Keeshan

Cenkos Securities PLC (Broker) Tel: +44 (0)20 7397

Neil McDonald 8900

Derrick Lee +44(0)131 220 6939

Walbrook PR Limited Tel: +44 (0)20 7933

Nick Rome/ Nicholas Johnson 8780

trinityexploration@walbrookpr.com

About Trinity

Trinity is an independent oil and gas exploration and production

company focused solely on Trinidad and Tobago. Trinity operates

producing and development assets both onshore and offshore, in the

shallow water West and East Coasts of Trinidad. Trinity's portfolio

includes current production, significant near-term production

growth opportunities from low risk developments and multiple

exploration prospects with the potential to deliver meaningful

reserves/resources growth. The Company operates all of its nine

licences and, across all of the Group's assets, management's

estimate of 2P reserves as at the end of 2020 was 19.55 mmbbls.

Group 2C contingent resources are estimated to be 23.25 mmbbls. The

Group's overall 2P plus 2C volumes are therefore 42.80 mmbbls.

Trinity is quoted on the AIM market of the London Stock Exchange

under the ticker TRIN.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUUGAUPGGGQ

(END) Dow Jones Newswires

May 26, 2021 07:14 ET (11:14 GMT)

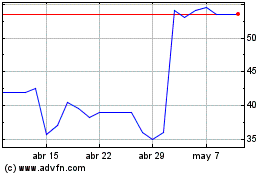

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024