Advantage Solutions Inc. (NASDAQ: ADV) (“Advantage,” “Advantage

Solutions,” the “Company,” “we,” or “our”), a leading business

solutions provider to consumer goods manufacturers and retailers,

today reported financial results for the three and nine months

ended September 30, 2024.

Unless otherwise noted, results presented in

this release are on a continuing operations basis. Revenues for the

three months ended September 30, 2024, were $939.3 million,

compared with $1,019.7 million a year ago. Net loss from continuing

operations was $37.3 million, compared to a net loss of $29.6

million for the third quarter of 2023.

2024 Third Quarter Financial

Highlights

- Organic revenues(1) increased by approximately 2% driven by

strength in Experiential Services.

- Adjusted EBITDA was $101 million, an 8.1% increase compared to

the prior year.

- Management remains focused on disciplined capital allocation

with debt and share repurchases of approximately $80 million and

$13 million, respectively.

“We continued to execute on our operational

priorities, which resulted in organic revenue and Adjusted EBITDA

growth in the quarter,” said Advantage CEO Dave Peacock. “At the

same time, we are making progress on our transformation initiatives

to enhance Advantage's core capabilities and maximize operating

efficiencies across the business. We remain committed to achieving

our 2024 guidance and relentlessly serving our clients through our

broad range of interconnected services.”

| |

|

|

|

Consolidated Financial Summary from Continuing

Operations |

|

|

(amounts in thousands) |

Three Months Ended September 30, |

|

|

Change (Reported) |

|

|

Organic(1) |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

$ |

|

% |

|

|

% |

|

|

|

|

Total Revenues |

$ |

939,270 |

|

|

$ |

1,019,706 |

|

|

$ |

(80,436 |

) |

|

(7.9 |

%) |

|

|

2.4 |

% |

|

|

|

Total

Net Loss |

$ |

(37,320 |

) |

|

$ |

(29,632 |

) |

|

$ |

(7,688 |

) |

|

(25.9 |

%) |

|

|

|

|

|

|

Total

Adjusted EBITDA |

$ |

100,920 |

|

|

$ |

93,317 |

|

|

$ |

7,603 |

|

|

8.1 |

% |

|

|

|

|

|

|

Adjusted

EBITDA Margin |

|

10.7 |

% |

|

|

9.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(amounts in thousands) |

Nine Months Ended September 30, |

|

|

Change (Reported) |

|

|

Organic(1) |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

$ |

|

% |

|

|

% |

|

|

|

|

Total

Revenues |

$ |

2,674,039 |

|

|

$ |

2,908,177 |

|

|

$ |

(234,138 |

) |

|

(8.1 |

%) |

|

|

2.2 |

% |

|

|

|

Total

Net Loss |

$ |

(200,469 |

) |

|

$ |

(78,549 |

) |

|

$ |

(121,920 |

) |

|

(155.2 |

%) |

|

|

|

|

|

|

Total

Adjusted EBITDA |

$ |

261,459 |

|

|

$ |

265,423 |

|

|

$ |

(3,964 |

) |

|

(1.5 |

%) |

|

|

|

|

|

|

Adjusted EBITDA Margin |

|

9.8 |

% |

|

|

9.1 |

% |

|

|

|

|

|

|

|

|

|

| |

|

| |

(1) Excludes ~$105 million and ~$299 million in 3Q’23 and YTD 2023,

respectively, related to the deconsolidation of the European JV,

which occurred in 4Q’23 |

| |

|

The complete earnings release can be found

here.

Media Contact: Peter Frost |

press@youradv.com

Investor Contact: Ruben Mella |

ruben.mella@youradv.com

About Advantage Solutions

Advantage Solutions

is the leading omnichannel retail solutions agency

in North America, uniquely positioned at the intersection

of consumer-packaged goods (CPG) brands and

retailers. With its data- and

technology-powered services, Advantage leverages its

unparalleled insights, expertise and scale to help brands and

retailers of all sizes generate demand and get products into the

hands of consumers, wherever they shop. Whether it’s creating

meaningful moments and experiences in-store and online, optimizing

assortment and merchandising, or accelerating e-commerce and

digital capabilities, Advantage is the trusted

partner that keeps commerce and life

moving. Advantage has offices throughout North America and

strategic investments and owned operations in

select international markets. For more information,

please visit YourADV.com.

Included with this press release are the

Company’s consolidated and condensed financial statements as of and

for the three months and nine months ended September 30, 2024.

These financial statements should be read in conjunction

with the information contained in the Company’s Quarterly

Report on Form 10-Q, to be filed with the Securities and Exchange

Commission (the "SEC") on or about Nov. 12, 2024.

Forward-Looking Statements

Certain statements in this press release may be

considered forward-looking statements within the meaning of the

federal securities laws, including statements regarding the

expected future performance of Advantage's business and projected

financial results. Forward-looking statements generally relate to

future events or Advantage’s future financial or operating

performance. These forward-looking statements generally are

identified by the words “may”, “should”, “expect”, “intend”,

“will”, “would”, “could”, “estimate”, “anticipate”, “believe”,

“predict”, “confident”, “potential” or “continue”, or the negatives

of these terms or variations of them or similar terminology. Such

forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to

risks, uncertainties and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward looking statements.

These forward-looking statements are based upon

estimates and assumptions that, while considered reasonable by

Advantage and its management at the time of such statements, are

inherently uncertain. Factors that may cause actual results to

differ materially from current expectations include, but are not

limited to, market-driven wage changes or changes to labor laws or

wage or job classification regulations, including minimum wage; the

COVID-19 pandemic and other future potential pandemics or health

epidemics; Advantage’s ability to continue to generate significant

operating cash flow; client procurement strategies and

consolidation of Advantage’s clients’ industries creating pressure

on the nature and pricing of its services; consumer goods

manufacturers and retailers reviewing and changing their sales,

retail, marketing and technology programs and relationships;

Advantage’s ability to successfully develop and maintain relevant

omni-channel services for our clients in an evolving industry and

to otherwise adapt to significant technological change; Advantage’s

ability to maintain proper and effective internal control over

financial reporting in the future; potential and actual harms to

Advantage’s business arising from the Take 5 Matter; Advantage’s

substantial indebtedness and our ability to refinance at favorable

rates; and other risks and uncertainties set forth in the section

titled “Risk Factors” in the Annual Report on Form 10-K filed by

the Company with the SEC on March 1, 2024, and in its other filings

made from time to time with the SEC. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Advantage assumes

no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

Non-GAAP Financial Measures and Related

Information

This press release includes certain financial

measures not presented in accordance with generally accepted

accounting principles (“GAAP”), including Adjusted EBITDA from

Continuing Operations, Adjusted EBITDA from Discontinued

Operations, Adjusted EBITDA by Segment, Adjusted Unlevered Free

Cash Flow and Net Debt. These are not measures of financial

performance calculated in accordance with GAAP and may exclude

items that are significant in understanding and assessing

Advantage’s financial results. Therefore, the measures are in

addition to, and not a substitute for or superior to, measures of

financial performance prepared in accordance with GAAP, and should

not be considered in isolation or as an alternative to net income,

cash flows from operations or other measures of profitability,

liquidity or performance under GAAP. You should be aware that

Advantage’s presentation of these measures may not be comparable to

similarly titled measures used by other companies. Reconciliations

of historical non-GAAP measures to their most directly comparable

GAAP counterparts are included below.

Advantage believes these non-GAAP measures

provide useful information to management and investors regarding

certain financial and business trends relating to Advantage’s

financial condition and results of operations. Advantage believes

that the use of Adjusted EBITDA from Continuing Operations,

Adjusted EBITDA from Discontinued Operations, Adjusted EBITDA by

Segment, Adjusted Unlevered Free Cash Flow, and Net Debt provide an

additional tool for investors to use in evaluating ongoing

operating results and trends and in comparing Advantage’s financial

measures with other similar companies, many of which present

similar non-GAAP financial measures to investors. Non-GAAP

financial measures are subject to inherent limitations as they

reflect the exercise of judgments by management about which expense

and income are excluded or included in determining these non-GAAP

financial measures. Additionally, other companies may calculate

non-GAAP measures differently, or may use other measures to

calculate their financial performance, and therefore Advantage’s

non-GAAP measures may not be directly comparable to similarly

titled measures of other companies.

Adjusted EBITDA from Continuing Operations,

Adjusted EBITDA from Discontinued Operations and Adjusted EBITDA by

Segment are supplemental non-GAAP financial measures of our

operating performance. Adjusted EBITDA from Continuing Operations

and Adjusted EBITDA from Discontinued Operations mean net (loss)

income before (i) interest expense (net), (ii) provision for

(benefit from) income taxes, (iii) depreciation, (iv) amortization

of intangible assets, (v) impairment of goodwill, (vi) changes in

fair value of warrant liability, (vii) stock based compensation

expense, (viii) equity-based compensation of Karman Topco L.P.,

(ix) fair value adjustments of contingent consideration related to

acquisitions, (x) acquisition and divestiture related expenses,

(xi) (gain) loss on divestitures, (xii) restructuring expenses,

(xiii) reorganization expenses, (xiv) litigation expenses

(recovery), (xv) costs associated with COVID-19, net of benefits

received, (xvi) costs associated with (recovery from) the Take 5

Matter, (xvii) EBITDA for economic interests in investments and

(xviii) other adjustments that management believes are helpful in

evaluating our operating performance.

Adjusted EBITDA by Segment means, with respect

to each segment, operating income (loss) from continuing operations

before (i) depreciation, (ii) amortization of intangible assets,

(iii) impairment of goodwill, (iv) stock based compensation

expense, (v) equity-based compensation of Karman Topco L.P., (vi)

fair value adjustments of contingent consideration related to

acquisitions, (vii) acquisition and divestiture related expenses,

(viii) restructuring expenses, (ix) reorganization expenses, (x)

litigation expenses (recovery), (xi) costs associated with

COVID-19, net of benefits received, (xii) costs associated with

(recovery from) the Take 5 Matter, (xiii) EBITDA for economic

interests in investments and (xiv) other adjustments that

management believes are helpful in evaluating our operating

performance, in each case, attributable to such segment.

Adjusted EBITDA Margin with means Adjusted

EBITDA from Continuing Operations divided by total

revenues.

Adjusted Unlevered Free Cash Flow represents net

cash provided by (used in) operating activities from continuing and

discontinued operations less purchase of property and equipment as

disclosed in the Statements of Cash Flows further adjusted by (i)

cash payments for interest, (ii) cash received from interest rate

derivatives, (iii) cash paid for income taxes; (iv) cash paid for

acquisition and divestiture related expenses, (v) cash paid for

restructuring expenses, (vi) cash paid for reorganization expenses,

(vii) cash paid for contingent earnout payments included in

operating cash flow, (viii) cash paid for costs associated with

COVID-19, net of benefits received, (ix) cash paid for costs

associated with the Take 5 Matter, (x) net effect of foreign

currency fluctuations on cash, and (xi) other adjustments that

management believes are helpful in evaluating our operating

performance. Adjusted Unlevered Free Cash Flow as a percentage of

Adjusted EBITDA means Adjusted Unlevered Free Cash Flow divided by

Adjusted EBITDA from Continuing Operations and Adjusted EBITDA from

Discontinued Operations.

Net Debt represents the sum of current portion

of long-term debt and long-term debt, less cash and cash

equivalents and debt issuance costs. With respect to Net Debt, cash

and cash equivalents are subtracted from the GAAP measure, total

debt, because they could be used to reduce the debt obligations. We

present Net Debt because we believe this non-GAAP measure provides

useful information to management and investors regarding certain

financial and business trends relating to the Company’s financial

condition and to evaluate changes to the Company's capital

structure and credit quality assessment.

|

Advantage Solutions Inc.Reconciliation of

Net Income (Loss) to Adjusted

EBITDA(Unaudited) |

| |

| Continuing

Operations |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| (in

thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net loss from continuing operations |

$ |

(37,320 |

) |

|

$ |

(29,632 |

) |

|

$ |

(200,469 |

) |

|

$ |

(78,549 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense, net |

|

38,969 |

|

|

|

42,275 |

|

|

|

114,484 |

|

|

|

119,883 |

|

| Benefit

from income taxes from continuing operations |

|

(4,866 |

) |

|

|

(6,577 |

) |

|

|

(38,042 |

) |

|

|

(15,994 |

) |

|

Depreciation and amortization |

|

51,866 |

|

|

|

52,415 |

|

|

|

152,931 |

|

|

|

157,436 |

|

|

Impairment of goodwill and indefinite-lived assets |

|

— |

|

|

|

— |

|

|

|

99,670 |

|

|

|

— |

|

| Changes in fair value of

warrant liability |

|

40 |

|

|

|

587 |

|

|

|

(359 |

) |

|

|

587 |

|

| Stock-based compensation

expense (a) |

|

8,143 |

|

|

|

8,983 |

|

|

|

24,225 |

|

|

|

29,400 |

|

| Equity-based compensation of

Karman Topco L.P. (b) |

|

(178 |

) |

|

|

209 |

|

|

|

(658 |

) |

|

|

(3,278 |

) |

| Fair value adjustments related

to contingent consideration related to acquisitions (c) |

|

— |

|

|

|

1,518 |

|

|

|

1,678 |

|

|

|

10,487 |

|

| Acquisition and divestiture

related expenses (d) |

|

127 |

|

|

|

332 |

|

|

|

(1,207 |

) |

|

|

3,064 |

|

| Restructuring expenses

(e) |

|

24,118 |

|

|

|

— |

|

|

|

24,118 |

|

|

|

— |

|

| Reorganization expenses

(f) |

|

18,637 |

|

|

|

21,372 |

|

|

|

73,980 |

|

|

|

38,304 |

|

| Litigation (recovery) expenses

(g) |

|

(1,713 |

) |

|

|

4,314 |

|

|

|

(2,422 |

) |

|

|

8,664 |

|

| Costs associated with

COVID-19, net of benefits received (h) |

|

— |

|

|

|

(49 |

) |

|

|

— |

|

|

|

3,285 |

|

| Costs associated with the Take

5 Matter, net of (recoveries) (i) |

|

385 |

|

|

|

53 |

|

|

|

1,081 |

|

|

|

(1,443 |

) |

| EBITDA for economic interests

in investments(j) |

|

2,712 |

|

|

|

(2,483 |

) |

|

|

12,449 |

|

|

|

(6,423 |

) |

| Adjusted EBITDA from

Continuing Operations |

$ |

100,920 |

|

|

$ |

93,317 |

|

|

$ |

261,459 |

|

|

$ |

265,423 |

|

| |

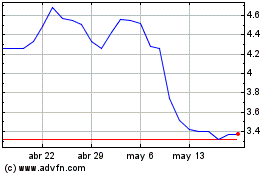

Advantage Solutions (NASDAQ:ADV)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

Advantage Solutions (NASDAQ:ADV)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025