false000109897200010989722024-11-262024-11-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 26, 2024 |

AGENUS INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-29089 |

06-1562417 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3 Forbes Road |

|

Lexington, Massachusetts |

|

02421 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 781 674-4400 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value per share |

|

AGEN |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 26, 2024, a subsidiary of Agenus Inc. (the “Company”) entered into a promissory note (the “Note”) with Ocean 1181 LLC (the “Lender”) for a loan in an aggregate principal amount of $22,000,000 (the “Loan”). The Loan has a two (2) year term and is principally secured by the Company’s manufacturing facility in Berkeley, CA and parcels of land located in Vacaville, CA (collectively, the “Mortgaged Properties”). The Company will unconditionally guarantee to the Lender the payment and performance of the obligations under the Note.

The Loan will bear interest at a rate of 12% through November 30, 2025 and 13% from December 1, 2025 through November 30, 2026. Interest under the Note will be payable monthly, one half in cash and one half of the Company’s common stock. The Note also requires $2,000,000 of the Loan funds to be held back to serve as payment reserve for the Loan.

At the closing of the Loan, the Company paid the Lender 153,003 shares of the Company’s common stock, representing the first month of interest, a 1% origination fee, as well as certain transaction expenses.

The Note contains customary representations, warranties and covenants, including customary events of default, including failure to repay the Loan when due. Any event of default, if not cured or waived in a timely manner, could result in the acceleration of the Loan under the Note.

If the Company pays off or releases any of the Mortgaged Properties within 120 days of the closing of the Loan, then there will be a two percent payoff fee assessed on the released amount. In the event of a disposition of a Mortgaged Property, the loan is subject to prepayment in an amount equal to the amount of the Loan applicable to the disposed Mortgaged Property.

The foregoing summary is qualified by reference to the copy of the Note that will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2024.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure required by this item is included in Item 1.01 and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure required by this item is included in Item 1.01 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On November 27, 2024 the Company issued a press release announcing the Loan. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 (the “Section”) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

99.1 Press Release of Agenus Inc. dated November 27, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

November 27, 2024 |

By: |

/s/ Christine M. Klaskin |

|

|

|

Christine M. Klaskin, VP Finance |

Exhibit 99.1

Agenus Secures $22 Million Mortgage and Announces Strategic Operational Realignment

LEXINGTON, Mass.--(BUSINESS WIRE) -- Agenus Inc. (“Agenus” or the “Company”) (Nasdaq: AGEN), an immuno-oncology company focused on innovation has successfully secured a $22 million non-amortizing mortgage backed by its Berkeley-based Biologics CMC facility ("901 Heinz") and its 66-acre biomanufacturing-zoned property in Vacaville, California. Facilitated by L&L Capital, the transaction yields $20 million in net proceeds after closing costs and interest reserve, bolstering the company’s cash position ahead of anticipated additional cash infusions in the coming months. The mortgage, structured with a two-year term, carries interest payable in a 50% cash and 50% common stock arrangement, with rates set at 12% for Year 1 and 13% for Year 2.

Simultaneously, Agenus is executing a Strategic Operational Realignment Plan to sharpen its focus on botensilimab/balstilimab (BOT/BAL) in MSS colorectal cancer (CRC) while driving significant cost reductions. Key components of the plan include:

1.A projected 60% reduction in annual external expenditures.

2.Transitioning Agenus’ CMC capabilities into a fee-for-service biologics manufacturing business.

These measures, coupled with anticipated ongoing optimizations, are expected to lower the company’s FY 2025 cash burn to approximately $100 million, pending the finalization of additional strategic transactions.

BOT/BAL has exhibited exceptional clinical activity in MSS CRC and multiple other cancers resistant to existing therapies. Agenus is prepared to execute its late-stage development and regulatory strategy for MSS CRC, targeting both regional and global registration pathways.

The compelling clinical data from BOT/BAL in neoadjuvant, front-line metastatic, and late-line MSS CRC underscores its transformative potential for patients with limited treatment options. With this decisive financial and operational realignment, Agenus aims to revolutionize cancer care, delivering life-saving innovations while establishing a solid foundation for sustained growth and patient benefit.

About Agenus

Agenus is a leading immuno-oncology company targeting cancer with a comprehensive pipeline of immunological agents. The company was founded in 1994 with a mission to expand patient populations benefiting from cancer immunotherapy through combination approaches, using a broad repertoire of antibody therapeutics, adoptive cell therapies (through MiNK Therapeutics) and adjuvants (through SaponiQx). Agenus has robust end-to-end development capabilities, across commercial and clinical cGMP manufacturing facilities, research and discovery, and a global clinical operations footprint. Agenus is headquartered in Lexington, MA. For more information, visit www.agenusbio.com or @agenus_bio. Information that may be important to investors will be routinely posted on our website and social media channels.

About L&L Capital

L&L Capital Partners is a New York City & Palm Beach-based family office specializing in nationwide real estate lending. The firm provides tailored bridge financing solutions to high-quality companies looking to effectively monetize their real estate assets. Leveraging strong relationships with local New York-based lending institutions, L&L strategically sources and capitalizes its deals to grow with its borrower-partners.

About Botensilimab (BOT)

Botensilimab (BOT) is a human Fc enhanced CTLA-4 blocking antibody designed to boost both innate and adaptive anti-tumor immune responses. Its novel design leverages mechanisms of action to extend immunotherapy benefits to “cold” tumors which generally respond poorly to standard of care or are refractory to conventional PD-1/CTLA-4 therapies and investigational therapies. Botensilimab augments immune responses across a wide range of tumor types by priming and activating T cells, downregulating intratumoral regulatory T cells, activating myeloid cells and inducing long-term memory responses.

Approximately 1,100 patients have been treated with botensilimab in phase 1 and phase 2 clinical trials. Botensilimab alone, or in combination with Agenus’ investigational PD-1 antibody, balstilimab, has shown clinical responses across nine metastatic, late-line cancers. For more information about botensilimab trials, visit www.clinicaltrials.gov with the identifiers NCT03860272, NCT05608044, NCT05630183, and NCT05529316.

Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the federal securities laws, including statements regarding its botensilimab and balstilimab programs, expected regulatory timelines and filings, and any other statements containing the words "may," "believes," "expects," "anticipates," "hopes," "intends," "plans," "forecasts," "estimates," "will," “establish,” “potential,” “superiority,” “best in class,” and similar expressions are intended to identify

forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among others, the factors described under the Risk Factors section of our most recent Annual Report on Form 10-K for 2023, and subsequent Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. Agenus cautions investors not to place considerable reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this press release, and Agenus undertakes no obligation to update or revise the statements, other than to the extent required by law. All forward-looking statements are expressly qualified in their entirety by this cautionary statement.

Investors

917-362-1370

investor@agenusbio.com

Media

612-839-6748

communications@agenusbio.com

Source: Agenus Inc.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

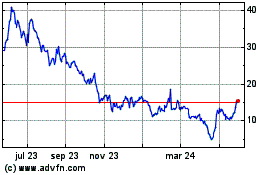

Agenus (NASDAQ:AGEN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

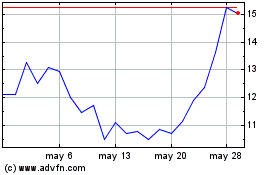

Agenus (NASDAQ:AGEN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025