false

0001859199

0001859199

2024-07-16

2024-07-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): July 16, 2024

reAlpha Tech Corp.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

6515 Longshore Loop, Suite 100, Dublin, OH 43017

(Address

of principal executive offices and zip code)

(707)

732-5742

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

On

July 16, 2024, the Company made available a corporate presentation on its website at ir.realpha.com containing information related to

the Company’s strategic focus, business developments, and recent trends. Representatives of the Company intend to present

some of or all of this presentation to investors at various conferences and meetings beginning on the date hereof. A copy of

the presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K. These materials should be read together with the information

included in the Company’s other filings with the Securities and Exchange Commission, including the Company’s Transition Report

on Form 10-KT for the eight-months ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

The

information set forth in and incorporated into this Item 7.01 of this Current Report on Form 8-K is being furnished pursuant to Item

7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after

the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific

reference in such a filing. The filing of this Item 7.01 of this Current Report on Form 8-K shall not be deemed an admission as to the

materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date: July 16, 2024 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri

Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

2

Exhibit

99.1

reAlpha Corporate Presentation JULY 2024

Table of Contents 2 Company Highlights reAlpha Overview Accretive Acquisition - led Growth Leadership and Board 4 5 17 21

Disclaimers 3 This presentation is made solely for information purposes and no representation or warranty, express or implied, is made by reAlpha Tech Corp . (“reAlpha,” “we,” “us,” “our,” and, together with our subsidiaries, the “Company”) or any of its representatives as to the information contained in these materials or disclosed during any related presentations or discussions . This presentation also contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , including, without limitation, statements relating to the reAlpha’s plans, strategies, objectives, expectations, intentions and adequacy of resources . These forward - looking statements involve known and unknown risks, uncertainties, and other factors that may cause reAlpha’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward - looking statements, such as reAlpha’s limited operating history and that reAlpha has not yet fully developed its artificial intelligence ("AI") based technologies ; reAlpha’s ability to commercialize its developing AI - based technologies ; whether reAlpha’s technology and products will be accepted and adopted by its customers and intended users ; reAlpha’s ability to integrate the business of Naamche into its existing business and the anticipated demand for Naamche’s services ; the inability to maintain and strengthen reAlpha’s brand and reputation ; the inability to accurately forecast demand for short - term rentals and AI - based real estate focused products ; the inability to execute business objectives and growth strategies successfully or sustain reAlpha’s growth ; the inability of reAlpha’s customers to pay for reAlpha’s services ; changes in applicable laws or regulations, and the impact of the regulatory environment and complexities with compliance related to such environment, and other risks and uncertainties further described in reAlpha's periodic reports filed with the Securities and Exchange Commission ("SEC"), including the Transition Report on Form 10 - KT for the eight - month period ended December 31 , 2023 , and other filings that may be filed with the SEC from time to time . Nothing contained herein is, or should be relied on as, a promise or representation as to the future . The information in this presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities referred to herein in any jurisdiction, including India, in which such offer, solicitation or sale would require preparation of a prospectus or other offer documentation, or be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction . This presentation includes our own trademarks, which are protected under applicable intellectual property laws, as well as trademarks, service marks, copyrights, and trade names of other companies, which are the property of their respective owners .

Company Highlights 4 ( 1) Statista Developed a commission - free AI agent to guide homebuyers through the entire process of buying a home Monetizing ancillary services in the residential real estate space (i.e. mortgage, title, insurance) Vertical programmatic acquisitions led growth in the real estate industry [1] Targeting $2.9 trillion US residential real estate market Strategically shifted from short - term rental syndications to developing AI - powered real estate technologies Seasoned management team with previous public market and AI technology experience

reAlpha Overview

Our Vision: Be the global leader in real estate technology. 6

Our Mission Mission: Accelerate the real estate industry’s transition to the digital era. 7

Black Swan Event - NAR Lawsuit Settlement [1] [2] [3] The Case Class - action lawsuit settlement against the National Association of Realtors (NAR) alleged that NAR rules violate antitrust laws and consequently inflate the fees paid to buy - side agents . Jury's verdict found that NAR and the system of cooperative compensation amounted to collusion . Damages will be distributed out amongst thousands of homeowners . Potential Settlement Effects: Marks the end of 6% total standard commission All commissions are now negotiable (buy - side expected to drop by 25 - 50%) Buy - side agents must sign separate agreement with buyer Prohibited agents’ compensation from being posted on MLS listings Terms expected to go into effect on August 17, 2024 $83.5M Anywhere Real Estate ($HOUS) settlement NAR settlement Keller Williams settlement RE/MAX settlement $418M $55M $70M Settled on 03/15/24 We anticipate that the NAR lawsuit settlement will significantly impact real estate and broker commissions . B y the Numbers [4] 8 ( 5) AJC ( 6) NP [5] [6] [7] [8] [9] ( 1) New York Times ( 2) McGuireWoods ( 3) New York Times ( 4) RealEstateNews ( 7) FOXLA ( 8) Financial Samurai ( 9) National Association of Realtors

Previously Commission Driven Industries Securities Tradin g Travel Advertisin g Tech Disruptor: Tech Disruptor: Tech Disruptor: New Revenue Model: Order routing, data subscriptions and bid/ask spreads New Revenue Model: Merchant model, bundling trips, and trip insurance New Revenue Model: Algorithmic based personalized advertising 9 *All product names, logos, and brands are property of their respective owners.

3% Buy - Side 3% Sell - Side Real estate commissions were established 111 y ears ago . [1] Instead of decreasing over time, standard commissions have INCREASED to 6% 12 Real Estate is Being Disrupted... 10 [2] We believe the NAR settlement will rapidly disrupt the traditional commission system . [3][4] ( 1) Stewardship ( 2) Stewardship ( 3) NewHomeStar ( 4) Worldwide ERC

NAR Lawsuit Effects on Transactions 3% Sell - Side Commissions 1.50 - 2.25% Sell - Side Commissions [3] 3% Buy - Side Commissions 1.20 - 2.47% Closing Costs 1.20 - 2.47% Closing Costs 1.50 - 2.25% Buy - Side Commissions [3] [1][2] Current Cost to Close (% of Purchase Price) Paid by Seller Paid by Seller Paid by Buyer Paid by Buyer 11 Estimated Post - Lawsuit Effects on Transactions ( 1) Real Estate Witch ( 2) Realty Magazine ( 3) Financial Samurai

Introducing Claire, reAlpha’s AI Buy - Side Agent In accordance with our NASDAQ ticker AIRE, we have named our product as: CLAIRE C ommission - l ess A rtificial I ntelligence for R eal E state Claire enables homebuyers to buy homes: 1. Through an AI - driven user experience available 24/7; 2. Completely commission free, 3. Still have support from reAlpha’s in - house licensed agents on no - obligation and no fee basis. 12

Budget Calculator 4) Get Accepted reAlpha Covers the Entire Transaction Process 3) Make an Offer 1) Understand your Budget 2) Find your Dream Home 5) Get House Inspected 6) Start Loan Process 8) Close the Deal 7) Get Clearance to Close 9) Move in AI Search & Recommendations Contract Builder AI Negotiation Helper AI Report Explainer 13 AI Report Explainer

Claire Features & Functionality 14 Personalized Experience AI - powered matching Simplified shortlisting

Claire Features & Functionality 15 24/7 available AI real estate agent Homebuying guidance One unified dashboard

1.20 - 2.47% Closing Costs reAlpha Revenue Model With Claire, users pay 0% buy - side commission. Instead, we will generate revenue from closing costs and services beyond the transaction. Potential revenue sources include: 1. Mortgage brokering - helping homebuyers find a mortgage that fits their unique situation 2. Title search & insurance - verifying title/ownership history and insurance to cover future claims or liens 3. Home insurance services - protecting homes in case of damage or accidental events 16 *Revenue will vary per transaction based on various factors such as, but not limited to: home price, transaction term, down payment percentage, mortgage usage, and market conditions. While we do not yet offer these services in - house, we anticipate that we will be able to capture revenue in a scenario such as the one depicted above once we acquire the title service, mortgage brokerage and home insurance companies, but there is no guarantee that we will.

Accretive Acquisition - Led Growth

Our Problem in Matrix Real Estate Process - Build vs. Acquire Acquire Build Build Acquire Acquire Front - End Search Form Contracts/Offers Inspections Title/Closing Insurance Services 18 Build Build Partner Acquire Acquire Lead Generation Showings Negotiations Mortgage Brokerage Back Office Service We either build in - house, acquire existing solutions, or forge strategic partnerships with the goal of providing services across the transaction lifecycle.

Our Problem in Matrix RESIDENTIAL Completed Acquisitions Acquired: March 24, 2023 Status: Post - acquisition integration Description: Rhove developed platform for real estate investment by retail and a SEC - qualified syndication institutional investors through exempted offerings, which is currently on hold . We believe that this platform, which handles investments internally without white - label technologies, will enable a seamless investment experience for real estate investors . Post - Acquisition Strategy 1. Combine Rhove technologies with the reAlpha App. 2. Begin Syndication offerings after macro environment conditions improve.* 3. In the interim, maintain SEC - qualified status. Overview 19 Acquired: May 6, 2024 Status: Post - acquisition integration Headcount: 43 (as of May 6, 2024) Description : Naamche is a Nepal based AI and product company we have worked with since March 2021 . Through the acquisition, we gained 43 engineers, analyst and designers . Post - Acquisition Strategy 1. Naamche team will design and build AI in a strategic way to current & future products, services, and processes. 2. Use Naamche’s expertise to perform technical due diligence on future acquisitions. 3. Expand Naamche to support US office for marketing, finance, strategy, and accounting. 4. Integrate Naamche values, vision, mission, and culture with reAlpha’s. Overview *Our rental business segment operations are currently on hold due to current macroeconomic conditions, such as escalating interest rates, inflation, and elevated property prices . We anticipate resuming operations within this segment through the acquisition of properties and Syndications when the prevailing interest rates and other macroeconomic factors align more favorably with such business model .

Our Problem in Matrix RESIDENTIAL Acquisitions In Progress Acquired: July 12, 2024 Status: Closing Description: AiChat is an award winning, revenue generating, Singapore - based company that develops AI - powered conversational customer experience solutions . AiChat provides enterprise customers with intelligent chatbots and automation tools that improve customer interactions and operational efficiency . 1. Integrate aspects of the technology that we expect will provide leveraging AiChat’s brand, expertise, and powerful domain authority (aichat.com). more robust and intelligent customer interaction tools for reAlpha, utilizing AiChat’s 250+ languages available. 2. Use AiChat’s already established sales channels to increase usage and visibility of our technologies and platforms. 3. Strengthen reAlpha brand and market position in the AI industry Post - Acquisition Strategy Overview 20

Leadership Team

Leadership Team 22 *All product names, logos, and brands are property of their respective owners. Giri Devanur CEO Ramesh Pathak CEO Kester Poh CEO Mike Logozzo President, COO & Interim CFO Saramsha Dotel CTO Dave Chuang CPO Jorge Aldecoa CPO Barun Pandey CMO Valerie Cheng VP Sales & Marketing Entrepreneur with Nasdaq IPO experience EY Entrepreneur of the Year (2017) Masters at Columbia University Managing Director at L Marks Former GM at BMW Financial Services - $32B portfolio, 1.2M Customers Former EY Consultant Former VP Operations for Transcendent Electra Led $1 Billon portfolio at Invitation Homes Former CIO for Firm Capital American Realty Partners Naamche: Subsidiaries of reAlpha AiChat:

Brian Cole Compensation Committee Chairman Managing Director, Baird Investment Bank Former Manager, PWC MBA, Kelly School of Business Monaz Karkaria Director Seasoned real estate executive Real Estate Coach & Mentor Buy Rehab Rent Refinance (BRRRR) strategist Bala Swaminathan Audit Committee Chairman Founder and CEO of SAIML Private Ltd Former President of Westpac Banking Corp. Former Vice Chairman and MD, Global Corporate and Investment Banking, for Bank of America Merrill Lynch Dimitrios Angelis Corporate Governance Committee Chairman Publicly listed CEO and public Board Director Co - founder of several startups, including Sparta Biomedical Managing Partner at Pharma Tech Law, NYU Law Degree Board of Directors Giri Devanur CEO and Chairman 23 Entrepreneur with Nasdaq IPO experience EY Entrepreneur of the Year (2017) Masters at Columbia University

Company Highlights 24 ( 1) Statista Developed a commission - free AI agent to guide homebuyers through the entire process of buying a home Monetizing ancillary services in the residential real estate space (i.e. mortgage, title, insurance) Vertical programmatic acquisitions led growth in the real estate industry [1] Targeting $2.9 trillion US residential real estate market Strategically shifted from short - term rental syndications to developing AI - powered real estate technologies Seasoned management team with previous public market and AI technology experience

Thank You. Phone +1 - 707 - 732 - 5742 Email InvestorRelations@realpha.com Locations 6515 Longshore Loop, Suite 100 Dublin, OH 43017 525 Washington Blvd 300, Jersey City, NJ 7310 3350 SW 148th Ave Suite 110, Miramar, FL 33027

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

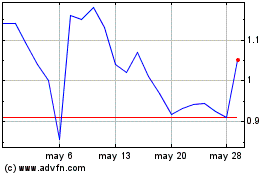

reAlpha Tech (NASDAQ:AIRE)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

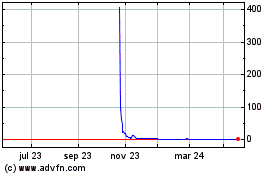

reAlpha Tech (NASDAQ:AIRE)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024