Allarity Therapeutics Reports Third Quarter 2024 Financial Results and Provides Recent Operational Highlights

14 Noviembre 2024 - 7:00AM

- Cash

balance at $18.5 million

-

Strengthened leadership team with new members driving stenoparib

development

- NASDAQ

compliance regained

Boston (November 14, 2024)—Allarity

Therapeutics, Inc. (“Allarity” or the “Company”) (NASDAQ: ALLR), a

Phase 2 clinical-stage pharmaceutical company dedicated to

developing personalized cancer treatments using its proprietary,

drug-specific patient selection technology, today reported

financial results for the third quarter ended September 30, 2024,

and provided an update on recent operational highlights.

“This quarter’s progress marks a steady period of advancement

for Allarity as we have maintained a strong cash position, achieved

record patient duration on stenoparib treatment, and welcomed new

members to our leadership team who bring the expertise needed to

shape a successful future for the Company," said Thomas Jensen, CEO

of Allarity Therapeutics. "We continue to drive the development of

our promising, novel dual PARP/tankyrase inhibitor, stenoparib,

forward, and we remain optimistic that our efforts will ultimately

bring new hope to ovarian cancer patients, especially those who

currently have few or no treatment options.”

Third Quarter 2024 and Recent Operational

Highlights

- Encouraging Patient Outcomes in Phase 2 Stenoparib

Trial: On September 16, 2024, the Company announced that

two patients in its Phase 2 trial for stenoparib in advanced

ovarian cancer had exceeded one year on treatment, demonstrating

durable clinical benefit in this heavily pre-treated population and

highlighting the potential of stenoparib as a meaningful treatment

option for patients with limited or no alternatives.

- New Leadership to Drive Clinical Development:

The Company, led by President and Chief Development Officer Jeremy

R. Graff, Ph.D., and Consultant Chief Medical Officer Jose

Iglesias, M.D., both appointed in October 2024, is working closely

with its scientific advisors to prepare a follow-on trial aimed at

FDA regulatory intent. Dr. Graff—a distinguished oncology expert

with over 25 years in drug development who previously served as a

consultant to Allarity—and Dr. Iglesias—a seasoned leader in

oncology clinical trials and former Celgene executive—bring

invaluable experience and strategic insight to advance Allarity’s

clinical trial efforts.

- Appointment of New CFO: In September 2024,

Allarity appointed Alexander Epshinsky as Chief Financial Officer.

With nearly a decade of financial leadership experience in the

biotech sector, Mr. Epshinsky brings valuable expertise to support

the Company’s financial strategy as it advances the development of

stenoparib.

- European Patent Secured for Stenoparib

DRP®: The Company was granted a European

patent in October 2024 for its proprietary DRP® companion

diagnostic specific to stenoparib, strengthening Allarity’s market

position by securing critical IP protection for this unique

diagnostic in an important market. Patent applications are also

pending in other key regions, including the U.S., Japan, and

China.

- Regained NASDAQ Compliance: In October 2024,

the Company received formal notice from The Nasdaq Stock Market LLC

confirming that it had regained compliance with the minimum bid

price requirement under Nasdaq Listing Rule 5550(a)(2) for

continued listing on the Nasdaq Capital Market, effectively

concluding the previously disclosed listing matter.

Third Quarter 2024 Financial

HighlightsCash Position: As of September

30, 2024, Allarity had cash and cash equivalents of $18.5 million,

compared to $0.2 million at December 31, 2023. The Company

maintains a financial runway extending into 2026.

R&D Expenses: Research and development

expenses for the third quarter of 2024 were $1.0 million, compared

to $1.9 million for the third quarter of 2023. Additionally, the

Company recorded a $9.7 million intangible asset impairment charge

(non-cash) for the third quarter of 2024.

G&A Expenses: General and administrative

expenses for the third quarter of 2024 were $1.6 million, compared

to $2.5 million for the third quarter of 2023.

Net Loss: Net loss attributable to common

stockholders for the third quarter of 2024 was $12.2 million

(primarily due to the aforementioned $9.7 million intangible asset

impairment charge), compared to a net loss of $5.6 million for the

third quarter of 2023.About the Drug Response Predictor –

DRP® Companion DiagnosticAllarity uses its drug-specific

DRP® to select those patients who, by the gene expression signature

of their cancer, are found to have a high likelihood of benefiting

from a specific drug. By screening patients before treatment, and

only treating those patients with a sufficiently high,

drug-specific DRP score, the therapeutic benefit rate may be

significantly increased. The DRP method builds on the comparison of

sensitive vs. resistant human cancer cell lines, including

transcriptomic information from cell lines combined with clinical

tumor biology filters and prior clinical trial outcomes. DRP is

based on messenger RNA expression profiles from patient biopsies.

The DRP® platform has proven its ability to provide a statistically

significant prediction of the clinical outcome from drug treatment

in cancer patients dozens of clinical studies (both retrospective

and prospective). The DRP platform, which can be used in all cancer

types and is patented for more than 70 anti-cancer drugs, has been

extensively published in the peer-reviewed literature.

About Allarity TherapeuticsAllarity

Therapeutics, Inc. (NASDAQ: ALLR) is a clinical-stage

biopharmaceutical company dedicated to developing personalized

cancer treatments. The Company is focused on development of

stenoparib, a novel PARP/tankyrase inhibitor for advanced ovarian

cancer patients, using its DRP® companion diagnostic for patient

selection in the ongoing phase 2 clinical trial, NCT03878849.

Allarity is headquartered in the U.S., with a research facility in

Denmark, and is committed to addressing significant unmet medical

needs in cancer treatment. For more information, visit

www.allarity.com.

Follow Allarity on Social MediaLinkedIn:

https://www.linkedin.com/company/allaritytx/X:

https://twitter.com/allaritytx

Forward-Looking Statements This press release

contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements provide the Company’s current expectations or forecasts

of future events. The words “anticipates,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predicts,” “project,” “should,” “would”

and similar expressions may identify forward-looking statements,

but the absence of these words does not mean that a statement is

not forward-looking. These forward-looking statements include, but

are not limited to, the impact of recent financial and operational

achievements on future quarterly performance, potential future

financings, and the anticipated regulatory progress of stenoparib

following the final outcome of our Phase 2 clinical trial. Any

forward-looking statements in this press release are based on

management’s current expectations of future events and are subject

to multiple risks and uncertainties that could cause actual results

to differ materially and adversely from those set forth in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to the risks associated

with maintaining compliance with Nasdaq's continued listing

requirements, obtaining regulatory approval for stenoparib, and

potential market fluctuations that could impact our financial

stability and the drug's market entry. For a discussion of other

risks and uncertainties, and other important factors, any of which

could cause our actual results to differ from those contained in

the forward-looking statements, see the section entitled “Risk

Factors” in our Form S-1/A registration statement filed on April

17, 2024, our Form 10-K annual report on file with the Securities

and Exchange Commission (the “SEC”) and our Form 10-Q quarterly

report filed with the SEC on November 14, 2024, available at the

SEC’s website at www.sec.gov, and as well as discussions of

potential risks, uncertainties and other important factors in the

Company’s subsequent filings with the SEC. All information in this

press release is as of the date of the release, and the Company

undertakes no duty to update this information unless required by

law.

ALLARITY

THERAPEUTICS, INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited)(U.S. dollars in

thousands, except for share and per share data)

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

18,463 |

|

|

$ |

166 |

|

|

Other current assets |

|

|

100 |

|

|

|

209 |

|

|

Prepaid expenses |

|

|

151 |

|

|

|

781 |

|

|

Tax credit receivable |

|

|

1,652 |

|

|

|

815 |

|

|

Total current assets |

|

|

20,366 |

|

|

|

1,971 |

|

| |

|

|

|

|

|

|

|

|

| Property, plant and

equipment, net |

|

|

12 |

|

|

|

20 |

|

| Intangible

assets |

|

|

— |

|

|

|

9,871 |

|

| Total

assets |

|

$ |

20,378 |

|

|

$ |

11,862 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,693 |

|

|

$ |

8,416 |

|

|

Accrued liabilities |

|

|

1,322 |

|

|

|

1,309 |

|

|

Warrant derivative liability |

|

|

2 |

|

|

|

3,083 |

|

|

Income taxes payable |

|

|

60 |

|

|

|

59 |

|

|

Convertible promissory notes and accrued interest, net of debt

discount |

|

|

1,337 |

|

|

|

1,300 |

|

|

Total current liabilities |

|

|

7,414 |

|

|

|

14,167 |

|

| |

|

|

|

|

|

|

|

|

| Deferred tax |

|

|

— |

|

|

|

446 |

|

| Total

liabilities |

|

|

7,414 |

|

|

|

14,613 |

|

| |

|

|

|

|

|

|

|

|

| Commitments

and contingencies (Note 15) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

|

Series A Preferred stock $0.0001 par value (500,000 and 20,000

shares designated at September 30, 2024 and December 31, 2023,

respectively) shares issued and outstanding at September 30, 2024

and December 31, 2023 were 0 and 1,417, respectively |

|

|

— |

|

|

|

1,742 |

|

| Common stock,

$0.0001 par value (250,000,000 and 750,000,000 shares authorized,

at September 30, 2024 and December 31, 2023, respectively); shares

issued and outstanding at September 30, 2024 and December 31, 2023

were 2,759,070 and 9,812, respectively |

|

|

— |

|

|

|

— |

|

| Additional paid-in

capital |

|

|

125,170 |

|

|

|

90,369 |

|

| Accumulated other

comprehensive loss |

|

|

(693 |

) |

|

|

(411 |

) |

| Accumulated

deficit |

|

|

(111,513 |

) |

|

|

(94,451 |

) |

| Total stockholders’

equity (deficit) |

|

|

12,964 |

|

|

|

(2,751 |

) |

| Total

liabilities and stockholders’ equity |

|

$ |

20,378 |

|

|

$ |

11,862 |

|

| |

All common share data has been retroactively adjusted to effect the

reverse stock splits in 2024. |

ALLARITY

THERAPEUTICS, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(Unaudited)(U.S. dollars in

thousands, except for share and per share data)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

1,021 |

|

|

$ |

1,948 |

|

|

$ |

4,249 |

|

|

$ |

4,480 |

|

|

Impairment of intangible assets |

|

|

9,703 |

|

|

|

— |

|

|

|

9,703 |

|

|

|

— |

|

|

General and administrative |

|

|

1,589 |

|

|

|

2,478 |

|

|

|

5,972 |

|

|

|

7,770 |

|

| Total operating

expenses |

|

|

12,313 |

|

|

|

4,426 |

|

|

|

19,924 |

|

|

|

12,250 |

|

| Loss from

operations |

|

|

(12,313 |

) |

|

|

(4,426 |

) |

|

|

(19,924 |

) |

|

|

(12,250 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

261 |

|

|

|

12 |

|

|

|

314 |

|

|

|

19 |

|

|

Interest expense |

|

|

(50 |

) |

|

|

(34 |

) |

|

|

(578 |

) |

|

|

(268 |

) |

|

Foreign exchange (losses) gains |

|

|

121 |

|

|

|

(156 |

) |

|

|

69 |

|

|

|

(87 |

) |

|

Fair value of New September Warrants |

|

|

— |

|

|

|

(4,189 |

) |

|

|

— |

|

|

|

(4,189 |

) |

|

Fair value of modification to April & July 2023 Warrants |

|

|

— |

|

|

|

(591 |

) |

|

|

— |

|

|

|

(591 |

) |

|

Change in fair value of derivative and warrant liabilities |

|

|

14 |

|

|

|

4,937 |

|

|

|

2,676 |

|

|

|

7,187 |

|

| Total other income

(expense) |

|

|

346 |

|

|

|

(21 |

) |

|

|

2,481 |

|

|

|

2,071 |

|

| Net loss before tax

benefit |

|

|

(11,967 |

) |

|

|

(4,447 |

) |

|

|

(17,443 |

) |

|

|

(10,179 |

) |

| Income tax

benefit |

|

|

377 |

|

|

|

— |

|

|

|

381 |

|

|

|

— |

|

| Net

loss |

|

|

(11,590 |

) |

|

|

(4,447 |

) |

|

|

(17,062 |

) |

|

|

(10,179 |

) |

| Deemed dividend on

Series A Preferred Stock |

|

|

— |

|

|

|

(1,105 |

) |

|

|

(299 |

) |

|

|

(8,392 |

) |

| Deemed dividend on

Series A Convertible Preferred Stock |

|

|

(562 |

) |

|

|

— |

|

|

|

(562 |

) |

|

|

— |

|

| Gain on

extinguishment of Series A Convertible Preferred Stock |

|

|

— |

|

|

|

— |

|

|

|

222 |

|

|

|

— |

|

| Deemed dividend on

Series C Preferred Stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(123 |

) |

| Net loss

attributable to common stockholders |

|

$ |

(12,152 |

) |

|

$ |

(5,552 |

) |

|

$ |

(17,701 |

) |

|

$ |

(18,694 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted

net loss per common stock |

|

$ |

(7.71 |

) |

|

$ |

(1,346.09 |

) |

|

$ |

(25.33 |

) |

|

$ |

(11,630.75 |

) |

| Weighted-average

number of common stock outstanding, basic and diluted |

|

|

1,575,762 |

|

|

|

4,125 |

|

|

|

698,877 |

|

|

|

1,607 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

loss, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(11,590 |

) |

|

$ |

(4,447 |

) |

|

$ |

(17,062 |

) |

|

$ |

(10,179 |

) |

|

Change in cumulative translation adjustment |

|

|

(163 |

) |

|

|

(92 |

) |

|

|

(282 |

) |

|

|

(37 |

) |

| Total comprehensive

loss attributable to common stockholders |

|

$ |

(11,753 |

) |

|

$ |

(4,539 |

) |

|

$ |

(17,344 |

) |

|

$ |

(10,216 |

) |

| |

All common share data has been retroactively adjusted to effect the

reverse stock splits in 2024. |

###

Company Contact:

investorrelations@allarity.com

Media

Contact: Thomas

Pedersen Carrotize

PR &

Communications +45

6062

9390 tsp@carrotize.com

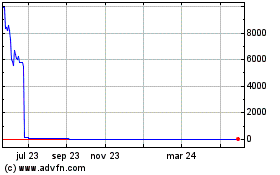

- Allarity Therapeutics Q3 Report Press Release

Allarity Therapeutics (NASDAQ:ALLR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

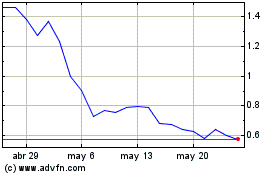

Allarity Therapeutics (NASDAQ:ALLR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024