0001514991--12-312024Q2false0.0785083http://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.amcnetworks.com/20240630#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.amcnetworks.com/20240630#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.amcnetworks.com/20240630#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.amcnetworks.com/20240630#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.amcnetworks.com/20240630#OperatingandFinanceLeaseLiabilityNoncurrenthttp://www.amcnetworks.com/20240630#OperatingandFinanceLeaseLiabilityNoncurrenthttp://www.amcnetworks.com/20240630#OperatingandFinanceLeaseLiabilityNoncurrenthttp://www.amcnetworks.com/20240630#OperatingandFinanceLeaseLiabilityNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureamcx:segmentamcx:networkutr:Damcx:legal_matteramcx:defendantamcx:claim00015149912024-01-012024-06-300001514991us-gaap:CommonClassAMember2024-08-020001514991us-gaap:CommonClassBMember2024-08-0200015149912024-06-3000015149912023-12-310001514991us-gaap:CommonClassAMember2023-12-310001514991us-gaap:CommonClassAMember2024-06-300001514991us-gaap:CommonClassBMember2024-06-300001514991us-gaap:CommonClassBMember2023-12-3100015149912024-04-012024-06-3000015149912023-04-012023-06-3000015149912023-01-012023-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001514991us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001514991us-gaap:AdditionalPaidInCapitalMember2024-03-310001514991us-gaap:RetainedEarningsMember2024-03-310001514991us-gaap:TreasuryStockCommonMember2024-03-310001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001514991us-gaap:ParentMember2024-03-310001514991us-gaap:NoncontrollingInterestMember2024-03-3100015149912024-03-310001514991us-gaap:RetainedEarningsMember2024-04-012024-06-300001514991us-gaap:ParentMember2024-04-012024-06-300001514991us-gaap:NoncontrollingInterestMember2024-04-012024-06-300001514991us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001514991us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-06-300001514991us-gaap:AdditionalPaidInCapitalMember2024-06-300001514991us-gaap:RetainedEarningsMember2024-06-300001514991us-gaap:TreasuryStockCommonMember2024-06-300001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001514991us-gaap:ParentMember2024-06-300001514991us-gaap:NoncontrollingInterestMember2024-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001514991us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001514991us-gaap:AdditionalPaidInCapitalMember2023-03-310001514991us-gaap:RetainedEarningsMember2023-03-310001514991us-gaap:TreasuryStockCommonMember2023-03-310001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001514991us-gaap:ParentMember2023-03-310001514991us-gaap:NoncontrollingInterestMember2023-03-3100015149912023-03-310001514991us-gaap:RetainedEarningsMember2023-04-012023-06-300001514991us-gaap:ParentMember2023-04-012023-06-300001514991us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001514991us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-012023-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-06-300001514991us-gaap:AdditionalPaidInCapitalMember2023-06-300001514991us-gaap:RetainedEarningsMember2023-06-300001514991us-gaap:TreasuryStockCommonMember2023-06-300001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001514991us-gaap:ParentMember2023-06-300001514991us-gaap:NoncontrollingInterestMember2023-06-3000015149912023-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001514991us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001514991us-gaap:AdditionalPaidInCapitalMember2023-12-310001514991us-gaap:RetainedEarningsMember2023-12-310001514991us-gaap:TreasuryStockCommonMember2023-12-310001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001514991us-gaap:ParentMember2023-12-310001514991us-gaap:NoncontrollingInterestMember2023-12-310001514991us-gaap:RetainedEarningsMember2024-01-012024-06-300001514991us-gaap:ParentMember2024-01-012024-06-300001514991us-gaap:NoncontrollingInterestMember2024-01-012024-06-300001514991us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001514991us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001514991us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001514991us-gaap:AdditionalPaidInCapitalMember2022-12-310001514991us-gaap:RetainedEarningsMember2022-12-310001514991us-gaap:TreasuryStockCommonMember2022-12-310001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001514991us-gaap:ParentMember2022-12-310001514991us-gaap:NoncontrollingInterestMember2022-12-3100015149912022-12-310001514991us-gaap:RetainedEarningsMember2023-01-012023-06-300001514991us-gaap:ParentMember2023-01-012023-06-300001514991us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001514991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001514991us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001514991us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-06-300001514991amcx:A10.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A4.25ConvertibleSeniorNotesDue2029Memberus-gaap:ConvertibleDebtMember2024-06-300001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:SeniorNotesMember2024-01-012024-06-300001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:SeniorNotesMember2023-01-012023-06-300001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-01-012024-06-300001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-01-012023-06-3000015149912023-10-012023-10-310001514991us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300001514991us-gaap:ConvertibleDebtSecuritiesMember2024-04-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300001514991us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300001514991us-gaap:CommonClassAMember2023-04-012023-06-300001514991us-gaap:CommonClassAMember2024-01-012024-06-300001514991us-gaap:CommonClassAMember2024-04-012024-06-300001514991us-gaap:CommonClassAMember2023-01-012023-06-300001514991amcx:A2022PlanMember2024-04-012024-06-300001514991amcx:A2022PlanMember2024-01-012024-06-300001514991amcx:A2022PlanMember2023-04-012023-06-300001514991amcx:A2022PlanMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberamcx:DomesticOperationsMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberamcx:DomesticOperationsMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberamcx:DomesticOperationsMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberamcx:DomesticOperationsMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberamcx:InternationalMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberamcx:InternationalMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberamcx:InternationalMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberamcx:InternationalMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMember2023-01-012023-06-300001514991us-gaap:EmployeeSeveranceMember2023-12-310001514991amcx:ContentImpairmentsAndOtherMember2023-12-310001514991us-gaap:EmployeeSeveranceMember2024-01-012024-06-300001514991amcx:ContentImpairmentsAndOtherMember2024-01-012024-06-300001514991us-gaap:EmployeeSeveranceMember2024-06-300001514991amcx:ContentImpairmentsAndOtherMember2024-06-300001514991us-gaap:AccruedLiabilitiesMember2024-06-300001514991us-gaap:AccruedLiabilitiesMember2023-12-310001514991us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001514991us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-01-012024-06-300001514991us-gaap:OtherNoncurrentAssetsMember2024-01-012024-06-300001514991us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-01-012023-12-310001514991us-gaap:OtherNoncurrentAssetsMember2023-01-012023-12-310001514991amcx:DomesticOperationsMember2023-12-310001514991amcx:InternationalMember2023-12-310001514991amcx:DomesticOperationsMember2024-01-012024-06-300001514991amcx:InternationalMember2024-01-012024-06-300001514991amcx:DomesticOperationsMember2024-06-300001514991amcx:InternationalMember2024-06-300001514991us-gaap:CustomerRelationshipsMember2024-06-300001514991us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-06-300001514991us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-06-300001514991amcx:AdvertiserRelationshipsMember2024-06-300001514991amcx:TradeNamesAndOtherMember2024-06-300001514991amcx:TradeNamesAndOtherMembersrt:MinimumMember2024-06-300001514991amcx:TradeNamesAndOtherMembersrt:MaximumMember2024-06-300001514991us-gaap:CustomerRelationshipsMember2023-12-310001514991amcx:AdvertiserRelationshipsMember2023-12-310001514991amcx:TradeNamesAndOtherMember2023-12-310001514991amcx:DomesticOperationsMember2024-04-012024-06-300001514991amcx:InternationalMember2023-04-012023-06-300001514991amcx:TermAFacilityMemberus-gaap:SecuredDebtMember2024-06-300001514991amcx:TermAFacilityMemberus-gaap:SecuredDebtMember2023-12-310001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:SeniorNotesMember2023-12-310001514991amcx:A10.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-12-310001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-12-310001514991amcx:A4.25ConvertibleSeniorNotesDue2029Memberus-gaap:ConvertibleDebtMember2023-12-310001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-06-012024-06-300001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-06-210001514991amcx:A4.25ConvertibleSeniorNotesDue2029Memberus-gaap:ConvertibleDebtMember2024-06-210001514991amcx:A4.25ConvertibleSeniorNotesDue2029Memberus-gaap:ConvertibleDebtMember2024-06-212024-06-210001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2024-06-210001514991us-gaap:CommonClassAMember2024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMemberamcx:DebtConversionTermsOneMember2024-06-212024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMemberamcx:DebtConversionTermsTwoMembersrt:MinimumMember2024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMemberamcx:DebtConversionTermsTwoMembersrt:MaximumMember2024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMemberamcx:DebtConversionTermsThreeMember2024-06-212024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMember2024-06-212024-06-210001514991amcx:A4.25ConvertibleSeniorNotesMemberus-gaap:ConvertibleDebtMembersrt:MinimumMember2024-06-212024-06-210001514991amcx:TermAFacilityMemberus-gaap:SecuredDebtMember2024-04-092024-04-090001514991amcx:TermAFacilityMemberus-gaap:SecuredDebtMember2024-04-090001514991us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-04-090001514991amcx:TermAFacilityMaturityOnApril92028Memberus-gaap:SecuredDebtMember2024-04-090001514991amcx:TermAFacilityMaturityOnFebruary82026Memberus-gaap:SecuredDebtMember2024-04-0900015149912024-04-092024-04-090001514991amcx:TermAFacilityMemberus-gaap:SecuredDebtMember2024-06-012024-06-300001514991amcx:TermAFacilityMemberus-gaap:SecuredDebtMember2024-03-012024-03-310001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMember2024-04-092024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-04-092024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2024-04-092024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2024-04-092024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodFourMember2024-04-092024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodFiveMember2024-04-092024-04-090001514991amcx:A10.25SeniorSecuredNotesDue2029Memberus-gaap:SeniorNotesMemberamcx:DebtInstrumentRedemptionPeriodSixMember2024-04-092024-04-090001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:SeniorNotesMember2024-04-220001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:SeniorNotesMember2024-04-222024-04-220001514991us-gaap:FairValueInputsLevel1Member2024-06-300001514991us-gaap:FairValueInputsLevel2Member2024-06-300001514991us-gaap:FairValueInputsLevel3Member2024-06-300001514991us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeForwardMember2024-06-300001514991us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2024-06-300001514991us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeForwardMember2024-06-300001514991us-gaap:ForeignExchangeForwardMember2024-06-300001514991us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeForwardMember2023-12-310001514991us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeForwardMember2023-12-310001514991us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeForwardMember2023-12-310001514991us-gaap:ForeignExchangeForwardMember2023-12-310001514991amcx:TermAFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001514991amcx:TermAFacilityMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001514991amcx:A10.25SeniorNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A10.25SeniorNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300001514991amcx:A4.25ConvertibleNotesDueFebruary2029Memberus-gaap:ConvertibleDebtMember2024-06-300001514991amcx:A4.25ConvertibleNotesDueFebruary2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-06-300001514991amcx:A4.25ConvertibleNotesDueFebruary2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConvertibleDebtMember2024-06-300001514991us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001514991us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001514991amcx:TermAFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001514991amcx:TermAFacilityMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001514991amcx:A4.75SeniorNotesDue2025Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001514991amcx:A4.25SeniorNotesDue2029Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001514991us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001514991us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-06-300001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherAssetsMember2024-06-300001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherAssetsMember2023-12-310001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2024-06-300001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2023-12-310001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberamcx:CurrentPortionOfProgramRightsObligationsMember2024-06-300001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberamcx:CurrentPortionOfProgramRightsObligationsMember2023-12-310001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherLiabilitiesMember2024-06-300001514991us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OtherLiabilitiesMember2023-12-310001514991us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2024-04-012024-06-300001514991us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2023-04-012023-06-300001514991us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-06-300001514991us-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-06-300001514991us-gaap:ForeignCountryMember2024-06-300001514991amcx:CaliforniaActionMember2020-07-220001514991amcx:CaliforniaActionMember2021-01-200001514991amcx:CaliforniaActionMember2023-01-260001514991amcx:CaliforniaActionMember2024-03-122024-03-120001514991amcx:MFNLitigationMember2022-11-142022-11-140001514991us-gaap:RestrictedStockUnitsRSUMember2024-04-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001514991us-gaap:RestrictedStockUnitsRSUMembersrt:ExecutiveOfficerMemberus-gaap:CommonClassAMember2024-04-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-04-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMembersrt:ExecutiveOfficerMemberus-gaap:CommonClassAMember2024-01-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-300001514991us-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-01-012024-06-300001514991us-gaap:RestructuringChargesMember2023-01-012023-06-300001514991us-gaap:RestructuringChargesMember2023-04-012023-06-300001514991us-gaap:RelatedPartyMember2024-04-012024-06-300001514991us-gaap:RelatedPartyMember2023-04-012023-06-300001514991us-gaap:RelatedPartyMember2024-01-012024-06-300001514991us-gaap:RelatedPartyMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:DomesticOperationsMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:InternationalMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:SubscriptionAndCirculationMember2024-04-012024-06-300001514991us-gaap:SubscriptionAndCirculationMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:DomesticOperationsMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:InternationalMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:LicenseMember2024-04-012024-06-300001514991us-gaap:LicenseMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:DomesticOperationsMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:InternationalMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:EntertainmentMember2024-04-012024-06-300001514991us-gaap:EntertainmentMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:DomesticOperationsMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:InternationalMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:AdvertisingMember2024-04-012024-06-300001514991us-gaap:AdvertisingMember2024-04-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:DomesticOperationsMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:InternationalMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:SubscriptionAndCirculationMember2023-04-012023-06-300001514991us-gaap:SubscriptionAndCirculationMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:DomesticOperationsMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:InternationalMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:LicenseMember2023-04-012023-06-300001514991us-gaap:LicenseMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:DomesticOperationsMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:InternationalMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:EntertainmentMember2023-04-012023-06-300001514991us-gaap:EntertainmentMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:DomesticOperationsMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:InternationalMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:AdvertisingMember2023-04-012023-06-300001514991us-gaap:AdvertisingMember2023-04-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:DomesticOperationsMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:InternationalMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:SubscriptionAndCirculationMember2024-01-012024-06-300001514991us-gaap:SubscriptionAndCirculationMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:DomesticOperationsMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:InternationalMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:LicenseMember2024-01-012024-06-300001514991us-gaap:LicenseMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:DomesticOperationsMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:InternationalMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:EntertainmentMember2024-01-012024-06-300001514991us-gaap:EntertainmentMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:DomesticOperationsMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:InternationalMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:AdvertisingMember2024-01-012024-06-300001514991us-gaap:AdvertisingMember2024-01-012024-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:DomesticOperationsMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:SubscriptionAndCirculationMemberamcx:InternationalMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:SubscriptionAndCirculationMember2023-01-012023-06-300001514991us-gaap:SubscriptionAndCirculationMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:DomesticOperationsMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:LicenseMemberamcx:InternationalMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:LicenseMember2023-01-012023-06-300001514991us-gaap:LicenseMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:DomesticOperationsMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:EntertainmentMemberamcx:InternationalMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:EntertainmentMember2023-01-012023-06-300001514991us-gaap:EntertainmentMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:DomesticOperationsMember2023-01-012023-06-300001514991us-gaap:OperatingSegmentsMemberus-gaap:AdvertisingMemberamcx:InternationalMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMemberus-gaap:AdvertisingMember2023-01-012023-06-300001514991us-gaap:AdvertisingMember2023-01-012023-06-300001514991amcx:SVODServicesMember2024-04-012024-06-300001514991amcx:SVODServicesMember2023-04-012023-06-300001514991amcx:SVODServicesMember2024-01-012024-06-300001514991amcx:SVODServicesMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:DomesticOperationsMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:DomesticOperationsMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:DomesticOperationsMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:DomesticOperationsMember2023-01-012023-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:InternationalMember2024-04-012024-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:InternationalMember2023-04-012023-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:InternationalMember2024-01-012024-06-300001514991us-gaap:IntersegmentEliminationMemberamcx:InternationalMember2023-01-012023-06-300001514991srt:NorthAmericaMember2024-04-012024-06-300001514991srt:NorthAmericaMember2023-04-012023-06-300001514991srt:NorthAmericaMember2024-01-012024-06-300001514991srt:NorthAmericaMember2023-01-012023-06-300001514991srt:EuropeMember2024-04-012024-06-300001514991srt:EuropeMember2023-04-012023-06-300001514991srt:EuropeMember2024-01-012024-06-300001514991srt:EuropeMember2023-01-012023-06-300001514991amcx:OtherGeographicLocationsMember2024-04-012024-06-300001514991amcx:OtherGeographicLocationsMember2023-04-012023-06-300001514991amcx:OtherGeographicLocationsMember2024-01-012024-06-300001514991amcx:OtherGeographicLocationsMember2023-01-012023-06-300001514991amcx:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-06-300001514991amcx:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-04-012024-06-300001514991amcx:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-06-300001514991amcx:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-04-012023-06-300001514991srt:NorthAmericaMember2024-06-300001514991srt:NorthAmericaMember2023-12-310001514991srt:EuropeMember2024-06-300001514991srt:EuropeMember2023-12-310001514991amcx:OtherGeographicLocationsMember2024-06-300001514991amcx:OtherGeographicLocationsMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☑ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2024

or

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number: 1-35106

AMC Networks Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 27-5403694 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| | |

| 11 Penn Plaza, | |

| New York, | NY | 10001 |

| (Address of principal executive offices) | (Zip Code) |

(212) 324-8500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | AMCX | The | NASDAQ | Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company (as defined in Exchange Act Rule 12b-2). | | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | þ |

| | | |

| Non-accelerated filer | ¨ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of shares of common stock outstanding as of August 2, 2024: | | | | | |

| Class A Common Stock par value $0.01 per share | 32,613,713 |

| Class B Common Stock par value $0.01 per share | 11,484,408 |

AMC NETWORKS INC. AND SUBSIDIARIES

FORM 10-Q

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

AMC NETWORKS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 802,553 | | | $ | 570,576 | |

Accounts receivable, trade (less allowance for doubtful accounts of $9,329 and $9,488) | 643,278 | | | 664,396 | |

| Current portion of program rights, net | 7,089 | | | 7,880 | |

| Prepaid expenses and other current assets | 264,848 | | | 380,518 | |

| Total current assets | 1,717,768 | | | 1,623,370 | |

Property and equipment, net of accumulated depreciation of $434,044 and $403,708 | 141,803 | | | 159,237 | |

| Program rights, net | 1,790,978 | | | 1,802,653 | |

| Intangible assets, net | 233,371 | | | 268,558 | |

| Goodwill | 553,775 | | | 626,496 | |

| Deferred tax assets, net | 12,522 | | | 11,456 | |

| Operating lease right-of-use assets | 63,658 | | | 71,163 | |

| Other assets | 358,845 | | | 406,854 | |

| Total assets | $ | 4,872,720 | | | $ | 4,969,787 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 109,672 | | | $ | 89,469 | |

| Accrued liabilities | 319,112 | | | 385,838 | |

| Current portion of program rights obligations | 257,232 | | | 301,221 | |

| Deferred revenue | 57,768 | | | 65,736 | |

| Current portion of long-term debt | 32,500 | | | 67,500 | |

| Current portion of lease obligations | 31,461 | | | 33,659 | |

| Total current liabilities | 807,745 | | | 943,423 | |

| Program rights obligations | 165,177 | | | 150,943 | |

| Long-term debt, net | 2,351,356 | | | 2,294,249 | |

| Lease obligations | 74,983 | | | 87,240 | |

| Deferred tax liabilities, net | 156,017 | | | 160,383 | |

| Other liabilities | 55,285 | | | 74,306 | |

| Total liabilities | 3,610,563 | | | 3,710,544 | |

| Commitments and contingencies | | | |

| Redeemable noncontrolling interests | 180,065 | | | 185,297 | |

| Stockholders' equity: | | | |

Class A Common Stock, $0.01 par value, 360,000 shares authorized, 66,730 and 66,670 shares issued and 32,614 and 32,077 shares outstanding, respectively | 667 | | | 667 | |

Class B Common Stock, $0.01 par value, 90,000 shares authorized, 11,484 shares issued and outstanding | 115 | | | 115 | |

Preferred stock, $0.01 par value, 45,000 shares authorized; none issued | — | | | — | |

| Paid-in capital | 374,353 | | | 378,877 | |

| Accumulated earnings | 2,335,526 | | | 2,321,105 | |

Treasury stock, at cost (34,117 and 34,593 shares Class A Common Stock, respectively) | (1,408,832) | | | (1,419,882) | |

| Accumulated other comprehensive loss | (248,120) | | | (232,831) | |

| Total AMC Networks stockholders' equity | 1,053,709 | | | 1,048,051 | |

| Non-redeemable noncontrolling interests | 28,383 | | | 25,895 | |

| Total stockholders' equity | 1,082,092 | | | 1,073,946 | |

| Total liabilities and stockholders' equity | $ | 4,872,720 | | | $ | 4,969,787 | |

See accompanying notes to condensed consolidated financial statements.

AMC NETWORKS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Revenues, net | $ | 625,934 | | | $ | 678,628 | | | $ | 1,222,395 | | | $ | 1,396,075 | |

| Operating expenses: | | | | | | | |

Technical and operating (excluding depreciation and amortization) | 280,727 | | | 321,961 | | | 552,303 | | | 648,690 | |

Selling, general and administrative | 208,176 | | | 194,298 | | | 397,057 | | | 379,904 | |

| Depreciation and amortization | 26,493 | | | 25,745 | | | 52,319 | | | 51,620 | |

| Impairment and other charges | 96,819 | | | 24,882 | | | 96,819 | | | 24,882 | |

| Restructuring and other related charges | 2,931 | | | 6,041 | | | 2,931 | | | 11,974 | |

| Total operating expenses | 615,146 | | | 572,927 | | | 1,101,429 | | | 1,117,070 | |

| Operating income | 10,788 | | | 105,701 | | | 120,966 | | | 279,005 | |

| Other income (expense): | | | | | | | |

| Interest expense | (43,216) | | | (38,930) | | | (76,057) | | | (76,547) | |

| Interest income | 9,292 | | | 7,342 | | | 18,177 | | | 15,258 | |

| Gain on extinguishment of debt, net | 247 | | | — | | | 247 | | | — | |

| Miscellaneous, net | 1,493 | | | 10,140 | | | (3,697) | | | 14,729 | |

| Total other expense | (32,184) | | | (21,448) | | | (61,330) | | | (46,560) | |

| Income (loss) from operations before income taxes | (21,396) | | | 84,253 | | | 59,636 | | | 232,445 | |

| Income tax expense | (10,893) | | | (22,155) | | | (34,542) | | | (59,054) | |

| Net income (loss) including noncontrolling interests | (32,289) | | | 62,098 | | | 25,094 | | | 173,391 | |

| Net (income) loss attributable to noncontrolling interests | 3,055 | | | 8,141 | | | (8,525) | | | 458 | |

| Net income (loss) attributable to AMC Networks' stockholders | $ | (29,234) | | | $ | 70,239 | | | $ | 16,569 | | | $ | 173,849 | |

| | | | | | | |

Net income (loss) per share attributable to AMC Networks' stockholders: |

| Basic | $ | (0.66) | | | $ | 1.60 | | | $ | 0.37 | | | $ | 3.98 | |

| Diluted | $ | (0.66) | | | $ | 1.60 | | | $ | 0.37 | | | $ | 3.97 | |

| | | | | | | |

| Weighted average common shares: | | | | | | | |

| Basic | 44,466 | | | 43,842 | | | 44,267 | | | 43,702 | |

| Diluted | 44,466 | | | 43,900 | | | 45,443 | | | 43,835 | |

See accompanying notes to condensed consolidated financial statements.

AMC NETWORKS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) including noncontrolling interests | $ | (32,289) | | | $ | 62,098 | | | $ | 25,094 | | | $ | 173,391 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustment | (2,269) | | | 9,826 | | | (15,566) | | | 21,644 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Comprehensive income (loss) | (34,558) | | | 71,924 | | | 9,528 | | | 195,035 | |

Comprehensive (income) loss attributable to noncontrolling interests | 3,007 | | | 7,509 | | | (8,248) | | | (664) | |

Comprehensive income (loss) attributable to AMC Networks' stockholders | $ | (31,551) | | | $ | 79,433 | | | $ | 1,280 | | | $ | 194,371 | |

See accompanying notes to condensed consolidated financial statements.

AMC NETWORKS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common

Stock | | Class B

Common

Stock | | Paid-in

Capital | | Accumulated Earnings | | Treasury

Stock | | Accumulated

Other

Comprehensive

Loss | | Total AMC Networks Stockholders’

Equity | | Non-redeemable Noncontrolling Interests | | Total Stockholders' Equity |

| Balance, March 31, 2024 | $ | 667 | | | $ | 115 | | | $ | 369,877 | | | $ | 2,365,524 | | | $ | (1,410,105) | | | $ | (245,803) | | | $ | 1,080,275 | | | $ | 26,630 | | | $ | 1,106,905 | |

| Net loss attributable to AMC Networks’ stockholders | — | | | — | | | — | | | (29,234) | | | — | | | — | | | (29,234) | | | — | | | (29,234) | |

| Net income attributable to non-redeemable noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 7,898 | | | 7,898 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distribution to noncontrolling member | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,193) | | | (6,193) | |

| Redeemable noncontrolling interest adjustment to redemption fair value | — | | | — | | | (2,807) | | | — | | | — | | | — | | | (2,807) | | | — | | | (2,807) | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | — | | | (2,317) | | | (2,317) | | | 48 | | | (2,269) | |

| Share-based compensation expenses | — | | | — | | | 8,457 | | | — | | | — | | | — | | | 8,457 | | | — | | | 8,457 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Common stock issued under employee stock plans | — | | | — | | | (509) | | | (764) | | | 1,273 | | | — | | | — | | | — | | | — | |

| Tax withholding associated with shares issued under employee stock plans | — | | | — | | | (665) | | | — | | | — | | | — | | | (665) | | | — | | | (665) | |

| Balance, June 30, 2024 | $ | 667 | | | $ | 115 | | | $ | 374,353 | | | $ | 2,335,526 | | | $ | (1,408,832) | | | $ | (248,120) | | | $ | 1,053,709 | | | $ | 28,383 | | | $ | 1,082,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common

Stock | | Class B

Common

Stock | | Paid-in

Capital | | Accumulated Earnings | | Treasury

Stock | | Accumulated

Other

Comprehensive

Loss | | Total AMC Networks Stockholders’

Equity | | Non-redeemable Noncontrolling Interests | | Total Stockholders' Equity |

| Balance, March 31, 2023 | $ | 665 | | | $ | 115 | | | $ | 360,117 | | | $ | 2,209,251 | | | $ | (1,419,882) | | | $ | (228,470) | | | $ | 921,796 | | | $ | 47,246 | | | $ | 969,042 | |

| Net income attributable to AMC Networks’ stockholders | — | | | — | | | — | | | 70,239 | | | — | | | — | | | 70,239 | | | — | | | 70,239 | |

| Net loss attributable to non-redeemable noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (14,941) | | | (14,941) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions to noncontrolling member | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (352) | | | (352) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | — | | | 9,194 | | | 9,194 | | | 632 | | | 9,826 | |

| | | | | | | | | | | | | | | | | |

| Share-based compensation expenses | — | | | — | | | 7,648 | | | — | | | — | | | — | | | 7,648 | | | — | | | 7,648 | |

| | | | | | | | | | | | | | | | | |

| Tax withholding associated with shares issued under employee stock plans | 1 | | | — | | | (1,212) | | | — | | | — | | | — | | | (1,211) | | | — | | | (1,211) | |

| Balance, June 30, 2023 | $ | 666 | | | $ | 115 | | | $ | 366,553 | | | $ | 2,279,490 | | | $ | (1,419,882) | | | $ | (219,276) | | | $ | 1,007,666 | | | $ | 32,585 | | | $ | 1,040,251 | |

See accompanying notes to condensed consolidated financial statements.

AMC NETWORKS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common

Stock | | Class B

Common

Stock | | Paid-in

Capital | | Accumulated Earnings | | Treasury

Stock | | Accumulated

Other

Comprehensive

Loss | | Total AMC Networks Stockholders’

Equity | | Non-redeemable Noncontrolling Interests | | Total Stockholders' Equity |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, December 31, 2023 | $ | 667 | | | $ | 115 | | | $ | 378,877 | | | $ | 2,321,105 | | | $ | (1,419,882) | | | $ | (232,831) | | | $ | 1,048,051 | | | $ | 25,895 | | | $ | 1,073,946 | |

| Net income attributable to AMC Networks’ stockholders | — | | | — | | | — | | | 16,569 | | | — | | | — | | | 16,569 | | | — | | | 16,569 | |

| Net income attributable to non-redeemable noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 8,958 | | | 8,958 | |

| Redeemable noncontrolling interest adjustment to redemption fair value | — | | | — | | | (5,528) | | | — | | | — | | | — | | | (5,528) | | | | | (5,528) | |

| | | | | | | | | | | | | | | | | |

| Distributions to noncontrolling member | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,193) | | | (6,193) | |

| | | | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | — | | | (15,289) | | | (15,289) | | | (277) | | | (15,566) | |

| Share-based compensation expenses | — | | | — | | | 14,532 | | | — | | | — | | | — | | | 14,532 | | | — | | | 14,532 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Common stock issued under employee stock plans | — | | | — | | | (8,902) | | | (2,148) | | | 11,050 | | | — | | | — | | | — | | | — | |

| Tax withholding associated with shares issued under employee stock plans | — | | | — | | | (4,626) | | | — | | | — | | | — | | | (4,626) | | | — | | | (4,626) | |

| Balance, June 30, 2024 | $ | 667 | | | $ | 115 | | | $ | 374,353 | | | $ | 2,335,526 | | | $ | (1,408,832) | | | $ | (248,120) | | | $ | 1,053,709 | | | $ | 28,383 | | | $ | 1,082,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common

Stock | | Class B

Common

Stock | | Paid-in

Capital | | Accumulated Earnings | | Treasury

Stock | | Accumulated

Other

Comprehensive

Loss | | Total AMC Networks Stockholders’

Equity | | Non-redeemable Noncontrolling Interests | | Total Stockholders' Equity |

| Balance, December 31, 2022 | $ | 661 | | | $ | 115 | | | $ | 360,251 | | | $ | 2,105,641 | | | $ | (1,419,882) | | | $ | (239,798) | | | $ | 806,988 | | | $ | 46,825 | | | $ | 853,813 | |

| Net income attributable to AMC Networks’ stockholders | — | | | — | | | — | | | 173,849 | | | — | | | — | | | 173,849 | | | — | | | 173,849 | |

| Net loss attributable to non-redeemable noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (13,528) | | | (13,528) | |

| Distributions to noncontrolling member | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,834) | | | (1,834) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | — | | | 20,522 | | | 20,522 | | | 1,122 | | | 21,644 | |

| Share-based compensation expenses | — | | | — | | | 13,530 | | | — | | | — | | | — | | | 13,530 | | | — | | | 13,530 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Tax withholding associated with shares issued under employee stock plans | 5 | | | — | | | (7,228) | | | — | | | — | | | — | | | (7,223) | | | — | | | (7,223) | |

| Balance, June 30, 2023 | $ | 666 | | | $ | 115 | | | $ | 366,553 | | | $ | 2,279,490 | | | $ | (1,419,882) | | | $ | (219,276) | | | $ | 1,007,666 | | | $ | 32,585 | | | $ | 1,040,251 | |

See accompanying notes to condensed consolidated financial statements.

AMC NETWORKS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands) / (unaudited) | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income including noncontrolling interests | $ | 25,094 | | | $ | 173,391 | |

Adjustments to reconcile net income to net cash from operating activities: | | | |

| Depreciation and amortization | 52,319 | | | 51,620 | |

| Non-cash impairment and other charges | 96,819 | | | 24,882 | |

| Share-based compensation expenses related to equity classified awards | 14,532 | | | 13,293 | |

| | | |

| Amortization and write-off of program rights | 414,716 | | | 430,386 | |

| Amortization of deferred carriage fees | 10,762 | | | 10,992 | |

| Unrealized foreign currency transaction loss | 2,640 | | | 2,712 | |

| Amortization of deferred financing costs and discounts on indebtedness | 3,371 | | | 3,905 | |

| Gain on extinguishment of debt, net | (247) | | | — | |

| | | |

| Deferred income taxes | (5,705) | | | (725) | |

| | | |

| | | |

| Other, net | 1,316 | | | (1,131) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable, trade (including amounts due from related parties, net) | 16,489 | | | 54,221 | |

| Prepaid expenses and other assets | 143,856 | | | 127,342 | |

| Program rights and obligations, net | (435,471) | | | (644,114) | |

| | | |

| Deferred revenue | (8,047) | | | (59,828) | |

| | | |

| Accounts payable, accrued liabilities and other liabilities | (77,172) | | | (161,899) | |

| Net cash provided by operating activities | 255,272 | | | 25,047 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (15,958) | | | (21,450) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from sale of investments | — | | | 8,565 | |

| Other investing activities, net | 3,936 | | | (103) | |

| | | |

| Net cash used in investing activities | (12,022) | | | (12,988) | |

| Cash flows from financing activities: | | | |

Proceeds from the issuance of 10.25% Senior Secured Notes due 2029, net | 862,969 | | | — | |

Proceeds from the issuance of 4.25% Convertible Senior Notes due 2029, net | 139,437 | | | — | |

Tender and redemption of 4.75% Senior Notes due 2025 | (774,729) | | | — | |

| Principal payments on Term Loan A Facility | (190,625) | | | (16,875) | |

Repurchase of 4.25% Senior Notes due 2029 | (10,129) | | | — | |

| Payments for financing costs | (9,424) | | | (342) | |

| Deemed repurchases of restricted stock units | (4,626) | | | (7,223) | |

| | | |

| Principal payments on finance lease obligations | (2,275) | | | (1,946) | |

| | | |

| Distributions to noncontrolling interests | (16,520) | | | (27,087) | |

| Purchase of noncontrolling interests | — | | | (1,343) | |

| Net cash used in financing activities | (5,922) | | | (54,816) | |

| Net increase (decrease) in cash and cash equivalents from operations | 237,328 | | | (42,757) | |

| Effect of exchange rate changes on cash and cash equivalents | (5,351) | | | 6,125 | |

| Cash and cash equivalents at beginning of period | 570,576 | | | 930,002 | |

| Cash and cash equivalents at end of period | $ | 802,553 | | | $ | 893,370 | |

See accompanying notes to condensed consolidated financial statements.

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1. Description of Business and Basis of Presentation

Description of Business

AMC Networks Inc. ("AMC Networks") and its subsidiaries (collectively referred to as the "Company," "we," "us," or "our") own and operate entertainment businesses and assets. The Company is comprised of two operating segments:

•Domestic Operations: Includes our five national programming networks, our streaming services, our AMC Studios operation and our film distribution business. Our programming networks are AMC, WE tv, BBC AMERICA ("BBCA"), IFC, and SundanceTV. Our streaming services consist of AMC+ and our targeted subscription streaming services (Acorn TV, Shudder, Sundance Now, ALLBLK, and HIDIVE). Our AMC Studios operation produces original programming for our programming services and third parties and also licenses programming worldwide. Our film distribution business includes IFC Films, RLJ Entertainment Films and Shudder. The operating segment also includes AMC Networks Broadcasting & Technology, our technical services business, which primarily services the programming networks.

•International: AMC Networks International ("AMCNI"), our international programming businesses consisting of a portfolio of channels distributed around the world.

In 2024, the Company updated the name of its previously titled "International and Other" operating segment to "International" due to the divestiture of the 25/7 Media business on December 29, 2023, which was the sole component of the operating segment that comprised “Other.” This update does not constitute a change in segment reporting, but rather an update in name only. Prior period segment information contained in this report includes the results of the 25/7 Media business through the date of divestiture.

Principles of Consolidation

The consolidated financial statements include the accounts of AMC Networks and its subsidiaries in which a controlling financial interest is maintained or variable interest entities ("VIEs") in which the Company has determined it is the primary beneficiary. All intercompany transactions and balances have been eliminated in consolidation.

Investments in business entities in which the Company lacks control but does have the ability to exercise significant influence over operating and financial policies are accounted for using the equity method of accounting.

Unaudited Interim Financial Statements

These condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles ("GAAP") for interim financial information and Article 10 of Regulation S-X of the Securities and Exchange Commission ("SEC"), and should be read in conjunction with the Company's consolidated financial statements and notes thereto for the year ended December 31, 2023 contained in the Company's Annual Report on Form 10-K (our "2023 Form 10-K") filed with the SEC. The condensed consolidated financial statements presented in this Quarterly Report on Form 10-Q are unaudited; however, in the opinion of management, such financial statements reflect all adjustments, consisting solely of normal recurring adjustments, necessary for a fair presentation of the results for the interim periods presented.

The results of operations for interim periods are not necessarily indicative of the results that might be expected for future interim periods or for the full year ending December 31, 2024.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at the date of the financial statements; and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates. Significant estimates and judgments inherent in the preparation of the consolidated financial statements include the useful lives and methodologies used to amortize and assess recoverability of program rights, the estimated useful lives of intangible assets and the valuation and recoverability of goodwill and intangible assets.

Reclassifications

Certain reclassifications were made to the prior period amounts to conform to the current period presentation.

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

Recently Issued Accounting Pronouncements

In December 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. ASU 2023-09 is intended to enhance the transparency and decision usefulness of income tax information through improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information. The Company will incorporate the required disclosure updates for the 2025 annual financial statements.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which expands disclosures about a public entity’s reportable segments and requires more enhanced information about a reportable segment’s expenses, interim segment profit or loss, and how a public entity’s chief operating decision maker uses reported segment profit or loss information in assessing segment performance and allocating resources. The Company will incorporate the required disclosure updates for the 2024 annual financial statements.

Note 2. Revenue Recognition

Transaction Price Allocated to Future Performance Obligations

As of June 30, 2024, other than contracts for which the Company has applied the practical expedients, the aggregate amount of transaction price allocated to future performance obligations was not material to our consolidated revenues.

Contract Balances from Contracts with Customers

The following table provides information about receivables, contract assets, and contract liabilities from contracts with customers. | | | | | | | | | | | | | | |

| (In thousands) | | June 30, 2024 | | December 31, 2023 |

| Balances from contracts with customers: | | | | |

| Accounts receivable (including long-term receivables within Other assets) | | $ | 722,715 | | | $ | 750,390 | |

| Contract assets, short-term (included in Prepaid expenses and other current assets) | | — | | | 2,364 | |

| | | | |

| Contract liabilities, short-term (Deferred revenue) | | 57,768 | | | 65,736 | |

| | | | |

Revenue recognized for the six months ended June 30, 2024 and 2023 relating to the contract liabilities at December 31, 2023 and 2022 was $38.8 million and $97.4 million, respectively.

For the three and six months ended June 30, 2024, we recognized revenues of $13.4 million for a one-time retroactive adjustment reported and paid by a third party, for which our performance obligation was satisfied in a prior period.

In October 2023, the Company entered into an agreement enabling it to sell certain customer receivables to a financial institution on a recurring basis for cash. The transferred receivables will be fully guaranteed by a bankruptcy-remote entity and the financial institution that purchases the receivables will have no recourse to the Company's other assets in the event of non-payment by the customers. The Company can sell an indefinite amount of customer receivables under the agreement on a revolving basis, but the outstanding balance of unpaid customer receivables to the financial institution cannot exceed the initial program limit of $125.0 million at any given time. As of June 30, 2024, the Company had not yet sold any customer receivables under this agreement.

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

Note 3. Net Income per Share

Net income (loss) per basic share is based upon net income (loss) attributable to AMC Networks' stockholders divided by the weighted average number of shares of Class A and Class B Common Stock outstanding during the period. Net income (loss) per diluted share reflects the dilutive effects of AMC Networks' outstanding equity-based awards and the assumed conversion of the 4.25% Convertible Senior Notes due 2029 (the "Convertible Notes") issued in June 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) attributable to AMC Networks' stockholders used for basic net income (loss) per share | $ | (29,234) | | | $ | 70,239 | | | $ | 16,569 | | | $ | 173,849 | |

| Add: Convertible Notes interest expense, net of tax | — | | | — | | | 116 | | | — | |

| Net income (loss) attributable to AMC Networks' stockholders used for diluted net income (loss) per share | $ | (29,234) | | | $ | 70,239 | | | $ | 16,685 | | | $ | 173,849 | |

| | | | | | | |

| Basic weighted average common shares outstanding | 44,466 | | | 43,842 | | | 44,267 | | | 43,702 | |

| Effect of dilution: | | | | | | | |

| Restricted stock units | — | | | 58 | | | 556 | | | 133 | |

| Convertible Notes | — | | | — | | | 620 | | | — | |

| Diluted weighted average common shares outstanding | 44,466 | | | 43,900 | | | 45,443 | | | 43,835 | |

| | | | | | | |

| Net income (loss) per share attributable to AMC Networks' stockholders: | | | | | | | |

| Basic | $ | (0.66) | | | $ | 1.60 | | | $ | 0.37 | | | $ | 3.98 | |

| Diluted | $ | (0.66) | | | $ | 1.60 | | | $ | 0.37 | | | $ | 3.97 | |

For the three months ended June 30, 2024, all 3.4 million of our restricted stock units and the weighted average impact of 11.3 million common shares related to the assumed conversion of the Company's Convertible Notes were excluded from the calculation of diluted net income (loss) per share because their inclusion would have been antidilutive since we reported a net loss.

For the six months ended June 30, 2024, 0.2 million of restricted stock units have been excluded from the diluted weighted average common shares outstanding, as their impact would have been antidilutive.

For the three and six months ended June 30, 2023, 2.1 million of restricted stock units have been excluded from diluted weighted average common shares outstanding, as their impact would have been antidilutive.

Stock Repurchase Program

The Company's Board of Directors previously authorized a program to repurchase up to $1.5 billion of its outstanding shares of common stock (the "Stock Repurchase Program"). The Stock Repurchase Program has no pre-established closing date and may be suspended or discontinued at any time. For the three and six months ended June 30, 2024 and 2023, the Company did not repurchase any shares of its Class A Common Stock. As of June 30, 2024, the Company had $135.3 million of authorization remaining for repurchase under the Stock Repurchase Program.

Note 4. Restructuring and Other Related Charges

Restructuring and other related charges were $2.9 million for the three and six months ended June 30, 2024, consisting primarily of content impairments in connection with WE tv shifting to a reduced originals strategy, and severance costs.

Restructuring and other related charges were $6.0 million and $12.0 million for the three and six months ended June 30, 2023, respectively, consisting primarily of severance and other personnel costs related to a restructuring plan (the "Plan") that commenced on November 28, 2022. The Plan was designed to achieve significant cost reductions in light of “cord cutting” and the related impacts being felt across the media industry as well as the broader economic outlook. The Plan encompassed initiatives that included, among other things, strategic programming assessments and organizational restructuring costs. The Plan was intended to improve the organizational design of the Company through the elimination of certain roles and centralization of certain functional areas of the Company. The programming assessments pertained to a broad mix of owned

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

and licensed content, including legacy television series and films that will no longer be in active rotation on the Company’s linear or streaming platforms.

The following table summarizes the restructuring and other related charges recognized by operating segment:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Domestic Operations | $ | 2,931 | | | $ | 3,905 | | | $ | 2,931 | | | $ | 4,723 | |

| International | — | | | 261 | | | — | | | 1,646 | |

| Corporate / Inter-segment eliminations | — | | | 1,875 | | | — | | | 5,605 | |

| Total restructuring and other related charges | $ | 2,931 | | | $ | 6,041 | | | $ | 2,931 | | | $ | 11,974 | |

The following table summarizes the accrued restructuring and other related costs:

| | | | | | | | | | | | | | | | | |

| (In thousands) | Severance and Employee-Related Costs | | Content Impairments and Other Exit Costs | | Total |

| Balance at December 31, 2023 | $ | 8,726 | | | $ | 5,008 | | | $ | 13,734 | |

| Charges | 1,317 | | | 1,614 | | | 2,931 | |

| Cash payments | (5,880) | | | (2,223) | | | (8,103) | |

| Non-cash adjustments | — | | | (2,199) | | | (2,199) | |

| Other | (902) | | | (102) | | | (1,004) | |

| Balance at June 30, 2024 | $ | 3,261 | | | $ | 2,098 | | | $ | 5,359 | |

Accrued restructuring and other related costs of $5.4 million are included in Accrued liabilities in the condensed consolidated balance sheet at June 30, 2024. Accrued restructuring and other related costs of $12.1 million and $1.6 million are included in Accrued liabilities and Other liabilities, respectively, in the condensed consolidated balance sheet at December 31, 2023.

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

Note 5. Program Rights

Total capitalized produced and licensed content by predominant monetization strategy is as follows:

| | | | | | | | | | | | | | | | | |

| June 30, 2024 |

| (In thousands) | Predominantly Monetized Individually | | Predominantly Monetized as a Group | | Total |

| Owned original program rights, net: | | | | | |

| Completed | $ | 97,148 | | | $ | 624,518 | | | $ | 721,666 | |

| In-production and in-development | — | | | 252,746 | | | 252,746 | |

| Total owned original program rights, net | $ | 97,148 | | | $ | 877,264 | | | $ | 974,412 | |

| | | | | |

| Licensed program rights, net: | | | | | |

| Licensed film and acquired series | $ | 532 | | | $ | 594,298 | | | $ | 594,830 | |

| Licensed originals | — | | | 143,918 | | | 143,918 | |

| Advances and other production costs | — | | | 84,907 | | | 84,907 | |

| Total licensed program rights, net | 532 | | | 823,123 | | | 823,655 | |

| Program rights, net | $ | 97,680 | | | $ | 1,700,387 | | | $ | 1,798,067 | |

| | | | | |

| Current portion of program rights, net | | | | | $ | 7,089 | |

| Program rights, net (long-term) | | | | | 1,790,978 | |

| | | | | $ | 1,798,067 | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| (In thousands) | Predominantly Monetized Individually | | Predominantly Monetized as a Group | | Total |

| Owned original program rights, net: | | | | | |

| Completed | $ | 139,363 | | | $ | 532,839 | | | $ | 672,202 | |

| In-production and in-development | — | | | 284,455 | | | 284,455 | |

| Total owned original program rights, net | $ | 139,363 | | | $ | 817,294 | | | $ | 956,657 | |

| | | | | |

| Licensed program rights, net: | | | | | |

| Licensed film and acquired series | $ | 973 | | | $ | 599,607 | | | $ | 600,580 | |

| Licensed originals | 1,555 | | | 169,489 | | | 171,044 | |

| Advances and other production costs | — | | | 82,252 | | | 82,252 | |

| Total licensed program rights, net | 2,528 | | | 851,348 | | | 853,876 | |

| Program rights, net | $ | 141,891 | | | $ | 1,668,642 | | | $ | 1,810,533 | |

| | | | | |

| Current portion of program rights, net | | | | | $ | 7,880 | |

| Program rights, net (long-term) | | | | | 1,802,653 | |

| | | | | $ | 1,810,533 | |

| | | | | |

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

Amortization, including write-offs, of owned and licensed program rights, included in Technical and operating expenses in the condensed consolidated statements of income (loss), is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 | | Six Months Ended June 30, 2024 |

| (In thousands) | Predominantly Monetized Individually | | Predominantly Monetized as a Group | | Total | | Predominantly Monetized Individually | | Predominantly Monetized as a Group | | Total |

| | | | | | | | | | | |

| Owned original program rights | $ | 17,313 | | | $ | 78,564 | | | $ | 95,877 | | | $ | 42,165 | | | $ | 138,670 | | | $ | 180,835 | |

| Licensed program rights | 201 | | | 116,086 | | | 116,287 | | | 1,832 | | | 232,049 | | | 233,881 | |

| Program rights amortization | $ | 17,514 | | | $ | 194,650 | | | $ | 212,164 | | | $ | 43,997 | | | $ | 370,719 | | | $ | 414,716 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 | | Six Months Ended June 30, 2023 |

| (In thousands) | Predominantly Monetized Individually | | Predominantly Monetized as a Group | | Total | | Predominantly Monetized Individually | | Predominantly Monetized as a Group | | Total |

| | | | | | | | | | | |

| Owned original program rights | $ | 59,528 | | | $ | 56,811 | | | $ | 116,339 | | | $ | 80,831 | | | $ | 101,747 | | | $ | 182,578 | |

| Licensed program rights | 471 | | | 126,503 | | | 126,974 | | | 2,135 | | | 245,673 | | | 247,808 | |

| Program rights amortization | $ | 59,999 | | | $ | 183,314 | | | $ | 243,313 | | | $ | 82,966 | | | $ | 347,420 | | | $ | 430,386 | |

For programming rights predominantly monetized individually or as a group, the Company periodically reviews the programming usefulness of licensed and owned original program rights based on several factors, including expected future revenue generation from airings on the Company's networks and streaming services and other exploitation opportunities, ratings, type and quality of program material, standards and practices, and fitness for exhibition through various forms of distribution. If events or changes in circumstances indicate that the fair value of a film predominantly monetized individually or a film group is less than its unamortized cost, the Company will write off the excess to technical and operating expenses in the condensed consolidated statements of income (loss). Program rights with no future programming usefulness are substantively abandoned resulting in the write-off of remaining unamortized cost. There were no significant program rights write-offs included in technical and operating expenses for the three and six months ended June 30, 2024 or 2023.

In the normal course of business, the Company may qualify for tax incentives through eligible investments in productions. Receivables related to tax incentives earned on production spend as of June 30, 2024 consisted of $196.1 million recorded in Prepaid expenses and other current assets and $38.6 million recorded in Other assets. Receivables related to tax incentives earned on production spend as of December 31, 2023 consisted of $230.3 million recorded in Prepaid expenses and other current assets and $49.9 million recorded in Other assets.

Note 6. Investments

The Company holds several investments in and loans to non-consolidated entities which are included in Other assets in the condensed consolidated balance sheet.

Equity Method Investments

Equity method investments were $85.7 million and $83.1 million at June 30, 2024 and December 31, 2023, respectively.

Non-marketable Equity Securities

Investments in non-marketable equity securities were $42.6 million and $41.6 million at June 30, 2024 and December 31, 2023, respectively. No gains or losses were recorded on non-marketable equity securities for the three and six months ended June 30, 2024. During the three and six months ended June 30, 2023, the Company recognized impairment charges of $0.5 million and $1.7 million, respectively, on certain investments, which is included in Miscellaneous, net in the condensed consolidated statements of income (loss).

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

Note 7. Goodwill and Other Intangible Assets

The carrying amount of goodwill, by operating segment is as follows: | | | | | | | | | | | | | | | | | |

| (In thousands) | Domestic Operations | | International | | Total |

| December 31, 2023 | $ | 348,732 | | | $ | 277,764 | | | $ | 626,496 | |

| Impairment charge | — | | | (68,004) | | | (68,004) | |

| | | | | |

| | | | | |

| Foreign currency translation | — | | | (4,717) | | | (4,717) | |

| June 30, 2024 | $ | 348,732 | | | $ | 205,043 | | | $ | 553,775 | |

Impairment and other charges for the three and six months ended June 30, 2024 included a $68.0 million goodwill impairment charge at AMCNI, as further discussed below.

As of June 30, 2024 and December 31, 2023, accumulated impairment charges in the International segment totaled $253.5 million and $185.5 million, respectively, inclusive of the 25/7 Media impairment charges recorded in 2023 prior to divestiture.

The following tables summarize information relating to the Company's identifiable intangible assets:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | June 30, 2024 | | |

| Gross | | Accumulated Amortization | | Net | | Estimated Useful Lives |

| Amortizable intangible assets: | | | | | | | |

| Affiliate and customer relationships | $ | 614,743 | | | $ | (446,764) | | | $ | 167,979 | | | 6 to 25 years |

| Advertiser relationships | 46,282 | | | (46,282) | | | — | | | 11 years |

| Trade names and other amortizable intangible assets | 90,357 | | | (44,865) | | | 45,492 | | | 3 to 20 years |

| | | | | | | |

| Total amortizable intangible assets | 751,382 | | | (537,911) | | | 213,471 | | | |

| Indefinite-lived intangible assets: | | | | | | | |

| Trademarks | 19,900 | | | — | | | 19,900 | | | |

| Total intangible assets | $ | 771,282 | | | $ | (537,911) | | | $ | 233,371 | | | |

| | | | | | | |

| (In thousands) | December 31, 2023 | | |

| Gross | | Accumulated Amortization | | Net | | |

| Amortizable intangible assets: | | | | | | | |

| Affiliate and customer relationships | $ | 618,778 | | | $ | (421,968) | | | $ | 196,810 | | | |

| Advertiser relationships | 46,282 | | | (42,806) | | | 3,476 | | | |

| Trade names and other amortizable intangible assets | 91,134 | | | (42,762) | | | 48,372 | | | |

| | | | | | | |

| Total amortizable intangible assets | 756,194 | | | (507,536) | | | 248,658 | | | |

| Indefinite-lived intangible assets: | | | | | | | |

| Trademarks | 19,900 | | | — | | | 19,900 | | | |

| Total intangible assets | $ | 776,094 | | | $ | (507,536) | | | $ | 268,558 | | | |

Aggregate amortization expense for amortizable intangible assets for the three months ended June 30, 2024 and 2023 was $9.6 million and $10.5 million, respectively, and for the six months ended June 30, 2024 and 2023 was $18.2 million and $20.9 million, respectively.

AMC NETWORKS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(unaudited)

Excluding the $15.7 million impairment charge associated with BBCA recorded in the second quarter of 2024, as discussed below, estimated aggregate amortization expense for intangible assets subject to amortization for each of the following five years is:

| | | | | |

| (In thousands) | |

| Years Ending December 31, | |

| 2024 | $ | 33,864 | |

| 2025 | 30,491 | |

| 2026 | 29,556 | |

| 2027 | 24,886 | |

| 2028 | 22,759 | |

Impairment Test of Long-Lived Assets and Goodwill

Impairment and other charges of $96.8 million for the three and six months ended June 30, 2024 primarily consisted of a $68.0 million goodwill impairment charge at AMCNI and $29.2 million of long-lived asset impairment charges at BBCA. Impairment and other charges of $24.9 million for the three and six months ended June 30, 2023 consisted of goodwill and long-lived asset impairment charges at 25/7 Media.

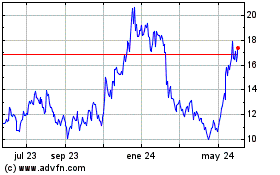

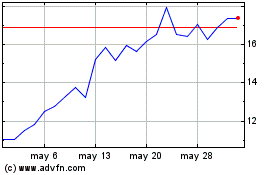

Goodwill is not amortized, but instead is tested for impairment at the reporting unit annually as of December 1, or more frequently upon the occurrence of certain events or substantive changes in circumstances. During the second quarter of 2024, the Company determined that a triggering event had occurred with respect to the Company's decline in stock price. Accordingly, the Company performed quantitative assessments for all reporting units. The fair values were determined using a combination of an income approach, using a discounted cash flow ("DCF") model and a market comparables approach. The DCF model includes significant assumptions about revenue growth rates, long-term growth rates, and enterprise specific discount rates. Additionally, the market comparables approach uses guideline company valuation multiples. Given the uncertainty in determining assumptions underlying the DCF approach, actual results may differ from those used in the valuations. Based on the valuations performed, the Company concluded that the estimated fair value of the AMCNI reporting unit declined to less than its carrying amount. As a result, the Company recognized an impairment charge of $68.0 million related to the AMCNI reporting unit, included in Impairment and other charges in the condensed consolidated statements of income (loss). No impairment charges were required for our other reporting unit.

Additionally during the second quarter of 2024, given continued market challenges and linear declines, the Company determined that sufficient indicators of potential impairment of long-lived assets existed at BBCA, and concluded that the carrying amount of the BBCA asset group was not recoverable. The carrying value of the BBCA asset group exceeded its fair value, and accordingly an impairment charge of $15.7 million was recorded for identifiable intangible assets and $13.5 million for other long-lived assets, which is included in Impairment and other charges in the condensed consolidated statements of income (loss) within the Domestic Operations operating segment. Fair values were determined using a market approach.