Anika Therapeutics, Inc. (NASDAQ: ANIK), a global joint

preservation company in early intervention orthopedics, today

reported financial results for its second quarter ended June 30,

2024.

Second Quarter 2024 Financial Summary (compared

to the second quarter of 2023)

- Revenue $41.9 million, decreased 5%

- OA Pain Management revenue $26.7 million, decreased 9%

- Joint Preservation and Restoration revenue $13.5 million,

increased 7%

- Non-Orthopedic revenue $1.7 million, decreased 26%

- Gross margin 65%; Adjusted gross margin1 66%

- Net loss ($0.1) million, ($0.01) per share

- Adjusted net income1 $2.5 million, $0.17 per diluted share

- Adjusted EBITDA1 $6.3 million

- Cash used for operating activities $1.1 million

- Cash balance $62.8 million

1 See description of non-GAAP financial information contained in

this release.

“We are pleased with our financial performance in Q2 as we made

meaningful progress on our re-focused business strategy and path to

profitability,” commented Cheryl R. Blanchard, Ph.D., Anika’s

President and CEO. “In July, as planned, we announced the full

market release of our Integrity Implant System. This marks an

important step in the continued expansion of our differentiated

Regenerative Solutions portfolio. In the first half of 2024 during

the limited market release, we completed more than double the

number of cases than initially anticipated, demonstrating the

significant surgeon pull for this transformational product.

Integrity will be a true game changer for the future of rotator

cuff and other tendon repairs. Our HA-based Regenerative Solutions

portfolio, including Integrity, represents a key enabler for

Anika’s growth as we prepare for the US launch of Hyalofast by 2026

and file the first PMA module this year.”

Dr. Blanchard continued, “OA Pain Management remains a strong,

foundational element of our business and represents a key aspect of

total company profitability. Outside the US, Cingal, together with

Monovisc and Orthovisc, grew 17% in the first half of 2024 as we

gained market share and expanded into new countries. In the US, we

continue to drive progress towards Cingal’s FDA approval. In

addition, we continue to hold the market-leading position in the US

with both Monovisc and Orthovisc, despite softer pricing dynamics

as our US sales and marketing partner works to improve market

access.”

“In 2024, we have re-focused our business strategy to accelerate

profitability and deploy capital towards our highest returning

programs, while also continuing to explore strategic alternatives

to generate shareholder value. We announced a new $40 million share

repurchase program during the second quarter and executed cost

restructuring initiatives to enable investments into our highest

growth areas in OA Pain Management and Regenerative Solutions.

These actions focus our investments on the highest value building

opportunities and position Anika to maximize shareholder value in

the future.”

Strategic Updates

- Full Market Release of Integrity Implant System Expands

Growing Regenerative Solutions Portfolio

- Entered full market release of the Integrity Implant System, an

HA-based regenerative scaffold with arthroscopic instrumentation,

in July 2024, with over 300 successful cases completed by more than

60 surgeons in the shoulder and foot/ankle during limited market

release. Integrity will drive near-term growth for Anika’s

regenerative solutions portfolio and provides a platform to further

expand our regenerative HA offerings with new products that will

deliver long-term shareholder value.

- Remain on track to file the first Hyalofast modular PMA

submission in 2024 with the final clinical module filing expected

in 2025 to support the US product launch by 2026.

- Leadership in OA Pain Management Driven by

International Growth

- Grew international OA Pain Management revenue 17% in the first

half of 2024 with growth in all three brands of Cingal, Monovisc,

and Orthovisc driven by market share gains and new country

expansion.

- Maintained US market leadership with Monovisc and Orthovisc as

we work with the FDA to bring Cingal to the US market, doubling our

US OA Pain market opportunity to $2 billion.

- Executing on Re-focused Business Strategy and Enhancing

Capital Allocation

- Completed the previously announced cost reduction initiatives

to reduce expenses by $10 million annualized which has contributed

to the $8.8 million in year-to-date adjusted EBITDA, up 73%

compared to the same period in 2023.

- Announced a new $40 million stock repurchase program with $15

million being executed under a 10b5-1 plan initiated in May 2024

and to be completed by June 2025, with remainder to be executed in

open market purchases through June 2026.

Fiscal 2024 GuidanceAnika continues to expect

that revenue for fiscal 2024 will be in the range of $168 to $173

million, representing growth of 1% to 4% compared to 2023.

Revenue ranges by product family are:

- OA Pain Management of $102 to $104 million, up 0% to 2%

- Joint Preservation and Restoration of $58 to $60.5 million, up

6% to 10%

- Non-Orthopedic of $8 to $8.5 million, down 14% to 19%

The Company expects 2024 adjusted EBITDA1 to be towards the

lower end of the previously provided range of $25 to $30 million,

approximately 15% adjusted EBITDA1 margin, as a result of the

expected mix of OA Pain Management revenue with modestly lower US

sales offset by stronger International growth.

Conference Call and Webcast InformationAnika’s

management will hold a conference call and webcast to discuss its

financial results and business highlights today, Thursday, August

8, 2024, at 5:00 pm ET. The conference call can be accessed by

dialing 1-800-717-1738 (toll-free domestic) or 1-646-307-1865

(international) and providing the conference ID number 1679035. A

live audio webcast will be available in the Investor Relations

section of Anika’s website, www.anika.com. A slide presentation

with highlights from the conference call will be available in the

Investor Relations section of the Anika website. A replay of the

webcast will be available on Anika’s website approximately two

hours after the completion of the event.

About AnikaAnika Therapeutics, Inc. (NASDAQ:

ANIK), is a global joint preservation company that creates and

delivers meaningful advancements in early intervention orthopedic

care. Leveraging our core expertise in hyaluronic acid and implant

solutions, we partner with clinicians to provide minimally invasive

products that restore active living for people around the world.

Our focus is on high opportunity spaces within orthopedics,

including Osteoarthritis Pain Management, Regenerative Solutions,

Sports Medicine and Arthrosurface Joint Solutions, and our products

are efficiently delivered in key sites of care, including

ambulatory surgery centers. Anika’s global operations are

headquartered outside of Boston, Massachusetts. For more

information about Anika, please visit www.anika.com.

ANIKA, ANIKA THERAPEUTICS, CINGAL, HYALOFAST, INTEGRITY,

MONOVISC, ORTHOVISC, and the Anika logo are trademarks of Anika

Therapeutics, Inc. or its subsidiaries or are licensed to Anika

Therapeutics, Inc. for its use.

Non-GAAP Financial InformationNon-GAAP

financial measures should be considered supplemental to, and not a

substitute for, the Company’s reported financial results prepared

in accordance with GAAP. Furthermore, the Company’s definition of

non-GAAP measures may differ from similarly titled measures used by

others. Because non-GAAP financial measures exclude the effect of

items that will increase or decrease the Company’s reported results

of operations, Anika strongly encourages investors to review the

Company’s consolidated financial statements and publicly filed

reports in their entirety. The Company presents these non-GAAP

financial measures because it uses them as supplemental measures in

internally assessing the Company’s operating performance, and, in

the case of Adjusted EBITDA, it is set as a key performance metric

to determine executive compensation. The Company also recognizes

that these non-GAAP measures are commonly used in determining

business performance more broadly and believes that they are

helpful to investors, securities analysts, and other interested

parties as a measure of comparative operating performance from

period to period.

Adjusted Gross MarginAdjusted gross margin is defined by the

Company as adjusted gross profit divided by total revenue. The

Company defines adjusted gross profit as GAAP gross profit

excluding amortization of certain acquired assets and non-cash

product rationalization charges.

Adjusted EBITDA Adjusted EBITDA is defined by the Company as

GAAP net income (loss) excluding depreciation and amortization,

interest and other income (expense), income taxes, stock-based

compensation expense, acquisition related expenses, non-cash

charges related to goodwill impairment, non-cash product

rationalization charges, severance costs and shareholder activism

costs.

Adjusted Net Income (Loss) and Adjusted EPS Adjusted net income

(loss) is defined by the Company as GAAP net income excluding

acquisition related expenses, inclusive of the impact of purchase

accounting, on a tax effected basis, non-cash charges related to

goodwill impairment, non-cash product rationalization charges,

stock-based compensation and charges related to discontinuation of

a software project. Adjusted diluted EPS is defined by the Company

as GAAP diluted EPS excluding acquisition related expenses and the

impact of purchase accounting, each on a tax-adjusted per share

basis, non-cash product rationalization charges, stock-based

compensation, severance costs and shareholder activism costs.

Beginning in the first quarter of 2024, adjusted net income (loss)

and adjusted EPS were revised to exclude stock-based compensation,

net of tax, and this revised calculation is reflected for all

periods presented.

A reconciliation of adjusted gross profit to gross profit (and

the associated adjusted gross margin calculation), adjusted EBITDA

to net income (loss), adjusted net income (loss) to net income

(loss) and adjusted diluted EPS to diluted EPS, the most directly

comparable financial measures calculated and presented in

accordance with GAAP, is shown in the tables at the end of this

release.

Forward-Looking Statements This press release

may contain forward-looking statements, within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, concerning

the Company's expectations, anticipations, intentions, beliefs or

strategies regarding the future which are not statements of

historical fact, including statements in Dr. Blanchard’s quote and

in the section titled Strategic Updates about the potential impact

of Integrity in the market, the timing of the regulatory pathway

and launch of Hyalofast and the US approval of Cingal, and in the

section titled Fiscal 2024 Guidance. These statements are based

upon the current beliefs and expectations of the Company's

management and are subject to significant risks, uncertainties, and

other factors. The Company's actual results could differ materially

from any anticipated future results, performance, or achievements

described in the forward-looking statements as a result of a number

of factors including, but not limited to, (i) the Company's ability

to successfully commence and/or complete clinical trials of its

products on a timely basis or at all; (ii) the Company's ability to

obtain pre-clinical or clinical data to support domestic and

international pre-market approval applications, 510(k)

applications, or new drug applications, or to timely file and

receive FDA or other regulatory approvals or clearances of its

products; (iii) that such approvals will not be obtained in a

timely manner or without the need for additional clinical trials,

other testing or regulatory submissions, as applicable; (iv) the

Company's research and product development efforts and their

relative success, including whether we have any meaningful sales of

any new products resulting from such efforts; (v) the cost

effectiveness and efficiency of the Company's clinical studies,

manufacturing operations, and production planning; (vi) the

strength of the economies in which the Company operates or will be

operating, as well as the political stability of any of those

geographic areas; (vii) future determinations by the Company to

allocate resources to products and in directions not presently

contemplated; (viii) the Company's ability to successfully

commercialize its products, in the U.S. and abroad; (ix)

the Company's ability to provide an adequate and timely supply of

its products to its customers; and (x) the Company's ability to

achieve its growth targets. Additional factors and risks are

described in the Company's periodic reports filed with

the Securities and Exchange Commission, and they are available

on the SEC's website

at www.sec.gov. Forward-looking statements

are made based on information available to the Company on the date

of this press release, and the Company assumes no obligation to

update the information contained in this press release.

For Investor Inquiries:Anika Therapeutics,

Inc.Mark Namaroff, 781-457-9287Vice President, Investor Relations,

ESG and Corporate Communicationsinvestorrelations@anika.com

| Anika

Therapeutics, Inc. and Subsidiaries |

| Consolidated

Statements of Operations |

| (in

thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended June 30, |

|

For the Six

Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue |

$ |

41,921 |

|

|

$ |

44,302 |

|

|

$ |

82,444 |

|

|

$ |

82,226 |

|

|

Cost of Revenue |

|

14,556 |

|

|

|

15,330 |

|

|

|

30,451 |

|

|

|

30,411 |

|

|

Gross Profit |

|

27,365 |

|

|

|

28,972 |

|

|

|

51,993 |

|

|

|

51,815 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

7,398 |

|

|

|

8,914 |

|

|

|

15,562 |

|

|

|

17,314 |

|

|

Selling, general and administrative |

|

19,806 |

|

|

|

23,689 |

|

|

|

41,333 |

|

|

|

50,685 |

|

|

Total operating expenses |

|

27,204 |

|

|

|

32,603 |

|

|

|

56,895 |

|

|

|

67,999 |

|

|

Income (loss) from operations |

|

161 |

|

|

|

(3,631 |

) |

|

|

(4,902 |

) |

|

|

(16,184 |

) |

|

Interest and other income (expense), net |

|

595 |

|

|

|

561 |

|

|

|

1,187 |

|

|

|

1,100 |

|

|

Income (loss) before income taxes |

|

756 |

|

|

|

(3,070 |

) |

|

|

(3,715 |

) |

|

|

(15,084 |

) |

|

Provision for (benefit from) income taxes |

|

844 |

|

|

|

(329 |

) |

|

|

887 |

|

|

|

(1,993 |

) |

|

Net loss |

$ |

(88 |

) |

|

$ |

(2,741 |

) |

|

$ |

(4,602 |

) |

|

$ |

(13,091 |

) |

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.01 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.89 |

) |

|

Diluted |

$ |

(0.01 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.89 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

14,839 |

|

|

|

14,688 |

|

|

|

14,769 |

|

|

|

14,671 |

|

|

Diluted |

|

14,839 |

|

|

|

14,688 |

|

|

|

14,769 |

|

|

|

14,671 |

|

| Anika

Therapeutics, Inc. and Subsidiaries |

| Consolidated

Balance Sheets |

| (in

thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

June

30, |

|

December

31, |

|

ASSETS |

|

2024 |

|

|

|

2023 |

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

62,822 |

|

|

$ |

72,867 |

|

|

Accounts receivable, net |

|

33,773 |

|

|

|

35,961 |

|

|

Inventories, net |

|

51,464 |

|

|

|

46,386 |

|

|

Prepaid expenses and other current assets |

|

6,941 |

|

|

|

8,095 |

|

|

Total current assets |

|

155,000 |

|

|

|

163,309 |

|

|

Property and equipment, net |

|

47,685 |

|

|

|

46,198 |

|

|

Right-of-use assets |

|

27,765 |

|

|

|

28,767 |

|

|

Other long-term assets |

|

19,524 |

|

|

|

18,672 |

|

|

Deferred tax assets |

|

1,362 |

|

|

|

1,489 |

|

|

Intangible assets, net |

|

3,969 |

|

|

|

4,626 |

|

|

Goodwill |

|

7,350 |

|

|

|

7,571 |

|

|

Total assets |

$ |

262,655 |

|

|

$ |

270,632 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

9,994 |

|

|

$ |

9,860 |

|

|

Accrued expenses and other current liabilities |

|

16,127 |

|

|

|

21,199 |

|

|

Total current liabilities |

|

26,121 |

|

|

|

31,059 |

|

|

Other long-term liabilities |

|

407 |

|

|

|

404 |

|

|

Lease liabilities |

|

25,789 |

|

|

|

26,904 |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock, $0.01 par value |

|

148 |

|

|

|

147 |

|

|

Additional paid-in-capital |

|

93,156 |

|

|

|

90,009 |

|

|

Accumulated other comprehensive loss |

|

(6,416 |

) |

|

|

(5,943 |

) |

|

Retained earnings |

|

123,450 |

|

|

|

128,052 |

|

|

Total stockholders’ equity |

|

210,338 |

|

|

|

212,265 |

|

|

Total liabilities and stockholders’ equity |

$ |

262,655 |

|

|

$ |

270,632 |

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Gross Profit to Adjusted Gross

Profit |

| (in

thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended June 30, |

|

For the Six

Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Gross Profit |

$ |

27,365 |

|

|

$ |

28,972 |

|

|

$ |

51,993 |

|

|

$ |

51,815 |

|

|

Product rationalization related charges |

|

- |

|

|

|

- |

|

|

|

472 |

|

|

|

- |

|

|

Acquisition related intangible asset amortization |

|

154 |

|

|

|

1,561 |

|

|

|

311 |

|

|

|

3,123 |

|

|

Adjusted Gross Profit |

$ |

27,519 |

|

|

$ |

30,533 |

|

|

$ |

52,776 |

|

|

$ |

54,938 |

|

|

|

|

|

|

|

|

|

|

|

Unadjusted Gross Margin |

|

65 |

% |

|

|

65 |

% |

|

|

63 |

% |

|

|

63 |

% |

|

Adjusted Gross Margin |

|

66 |

% |

|

|

69 |

% |

|

|

64 |

% |

|

|

67 |

% |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Net Income to Adjusted

EBITDA |

| (in

thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended June 30, |

|

For the Six

Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

$ |

(88 |

) |

|

$ |

(2,741 |

) |

|

$ |

(4,602 |

) |

|

$ |

(13,091 |

) |

|

Interest and other (income) expense, net |

|

(595 |

) |

|

|

(561 |

) |

|

|

(1,187 |

) |

|

|

(1,100 |

) |

|

Provision for (benefit from) income taxes |

|

844 |

|

|

|

(329 |

) |

|

|

887 |

|

|

|

(1,993 |

) |

|

Depreciation and amortization |

|

1,889 |

|

|

|

1,764 |

|

|

|

3,755 |

|

|

|

3,528 |

|

|

Stock-based compensation |

|

3,891 |

|

|

|

4,150 |

|

|

|

7,481 |

|

|

|

7,867 |

|

|

Product rationalization |

|

- |

|

|

|

- |

|

|

|

472 |

|

|

|

- |

|

|

Arbitration settlement |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,250 |

|

|

Acquisition related intangible asset amortization |

|

169 |

|

|

|

1,787 |

|

|

|

366 |

|

|

|

3,574 |

|

|

Discontinuation of software development project |

|

(1,404 |

) |

|

|

- |

|

|

|

(1,404 |

) |

|

|

- |

|

|

Severance costs |

|

- |

|

|

|

- |

|

|

|

839 |

|

|

|

- |

|

|

Costs of shareholder activism |

|

1,584 |

|

|

|

2,202 |

|

|

|

2,185 |

|

|

|

3,033 |

|

|

Adjusted EBITDA |

$ |

6,290 |

|

|

$ |

6,272 |

|

|

$ |

8,792 |

|

|

$ |

5,068 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Net Income to Adjusted Net

Income |

| (in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

For the

Three Months Ended June 30, |

|

For the Six

Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

$ |

(88 |

) |

|

$ |

(2,741 |

) |

|

$ |

(4,602 |

) |

|

$ |

(13,091 |

) |

|

Product rationalization, tax effected |

|

- |

|

|

|

- |

|

|

|

514 |

|

|

|

- |

|

|

Arbitration settlement, tax effected |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,800 |

|

|

Share-based compensation, tax effected |

|

2,393 |

|

|

|

3,712 |

|

|

|

8,154 |

|

|

|

6,779 |

|

|

Acquisition related intangible asset amortization, tax

effected |

|

103 |

|

|

|

1,598 |

|

|

|

398 |

|

|

|

3,080 |

|

|

Discontinuation of software development project, tax effected |

|

(864 |

) |

|

|

- |

|

|

|

(1,530 |

) |

|

|

- |

|

|

Severance costs, tax effected |

|

- |

|

|

|

- |

|

|

|

914 |

|

|

|

- |

|

|

Costs of shareholder activism, tax effected |

|

975 |

|

|

|

1,970 |

|

|

|

2,381 |

|

|

|

2,613 |

|

|

Adjusted net income |

$ |

2,519 |

|

|

$ |

4,539 |

|

|

$ |

6,229 |

|

|

$ |

2,181 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Diluted Earnings Per Share to

Adjusted Diluted Earnings Per Share |

| (in

thousands, except per share data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

For the

Three Months Ended June 30, |

|

For the Six

Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Diluted net loss per share |

$ |

(0.01 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.89 |

) |

|

Product rationalization, tax effected |

|

- |

|

|

|

- |

|

|

|

0.03 |

|

|

|

- |

|

|

Arbitration settlement, tax effected |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.19 |

|

|

Share-based compensation, tax effected |

|

0.16 |

|

|

|

0.25 |

|

|

|

0.55 |

|

|

|

0.46 |

|

|

Acquisition related intangible asset amortization, tax

effected |

|

0.01 |

|

|

|

0.11 |

|

|

|

0.03 |

|

|

|

0.21 |

|

|

Discontinuation of software development project, tax effected |

|

(0.06 |

) |

|

|

- |

|

|

|

(0.10 |

) |

|

|

- |

|

|

Severance costs, tax effected |

|

- |

|

|

|

- |

|

|

|

0.06 |

|

|

|

- |

|

|

Costs of shareholder activism, tax effected |

|

0.07 |

|

|

|

0.14 |

|

|

|

0.16 |

|

|

|

0.18 |

|

|

Adjusted diluted net income per share |

$ |

0.17 |

|

|

$ |

0.31 |

|

|

$ |

0.42 |

|

|

$ |

0.15 |

|

| Anika

Therapeutics, Inc. and Subsidiaries |

| Revenue by

Product Family |

| (in

thousands, except percentages) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the

Three Months Ended June 30, |

|

For the Six

Months Ended June 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

$ change |

|

% change |

|

|

2024 |

|

|

|

2023 |

|

|

$ change |

% change |

|

OA Pain Management |

$ |

26,658 |

|

|

$ |

29,334 |

|

|

$ |

(2,676 |

) |

|

|

-9 |

% |

|

$ |

50,976 |

|

|

$ |

51,967 |

|

|

$ |

(991 |

) |

|

|

-2 |

% |

|

Joint Preservation and Restoration |

|

13,554 |

|

|

|

12,660 |

|

|

|

894 |

|

|

|

7 |

% |

|

|

27,395 |

|

|

|

26,113 |

|

|

|

1,282 |

|

|

|

5 |

% |

|

Non-Orthopedic |

|

1,709 |

|

|

|

2,308 |

|

|

|

(599 |

) |

|

|

-26 |

% |

|

|

4,073 |

|

|

|

4,146 |

|

|

|

(73 |

) |

|

|

-2 |

% |

|

Revenue |

$ |

41,921 |

|

|

$ |

44,302 |

|

|

$ |

(2,381 |

) |

|

|

-5 |

% |

|

$ |

82,444 |

|

|

$ |

82,226 |

|

|

$ |

218 |

|

|

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

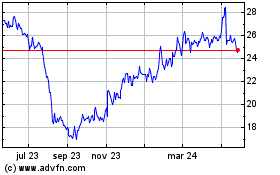

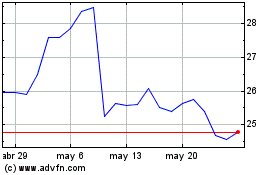

Anika Therapeutics (NASDAQ:ANIK)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Anika Therapeutics (NASDAQ:ANIK)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024