Anika Therapeutics, Inc. (NASDAQ: ANIK), a global joint

preservation company in early intervention orthopedics, today

reported financial results for its third quarter ended September

30, 2024.

Third Quarter 2024 Results

Anika announced third quarter revenue of $38.8 million declining

7% compared to the same period in 2023. U.S. OA Pain Management

revenue was down 5% in the quarter. This decline was primarily due

to reduced market access and competitive pricing pressures faced by

the Company’s U.S. OA Pain Management partner, J&J Medtech, and

softer performance in the Arthrosurface and Parcus Medical

businesses, which Anika has exited and plans to exit, respectively.

Anika’s Monovisc® and Orthovisc® products remain the leader in the

U.S. viscosupplement market and J&J is taking steps to

stabilize this revenue channel. The decreased U.S. OA Pain

Management revenue, which will be included in the OEM Channel going

forward, was offset by 7% growth in international OA Pain

Management revenue, which will be included in the Commercial

Channel going forward.

As expected, the revenue from Anika’s Regenerative Solutions

business was strong, increasing 17% in the quarter, led by more

than 40% sequential growth in the Integrity Implant System. In the

quarter, Integrity was implanted in approximately 200 surgeries,

with over 20% of the surgeons new to Anika. More than 500 cases

have been performed globally since the launch of this flagship

Regenerative Solutions product. Anika is actively developing new

line extensions of Integrity for use in additional tendon

applications. To support the growth of Integrity, Anika will

continue to invest in and expand its commercial sales force within

its Commercial Channel. These investments will build the

infrastructure needed to launch new near-term Regenerative

Solutions products and Hyalofast, Anika’s single stage, off the

shelf hyaluronic acid (HA) cartilage repair product, in the U.S. by

2026.

Third Quarter 2024 Financial Summary (compared

to the third quarter of 2023)

- Revenue $38.8 million, decreased 7%

- OA Pain Management revenue $24.4 million, decreased 2%

- Joint Preservation and Restoration revenue $12.0 million,

decreased 11%

- Regenerative Solutions revenue $2.7 million, increased 17%

(included within Joint Preservation and Restoration)

- Non-Orthopedic revenue $2.4 million, decreased 24%

- Net loss ($29.9) million, ($2.03) per share

- Adjusted net income1 ($3.8) million, ($0.25) per diluted

share

- Adjusted EBITDA1 $5.4 million

- Cash provided by operating activities $5.0 million

- Cash balance $62.4 million

1 See description of non-GAAP financial information contained in

this release.

New Revenue Classifications – Commercial Channel and OEM

Channel

Starting in the fourth quarter, as a result of the strategic

updates, revenue classification will be delineated to provide the

investment community with a clear view to Anika’s value drivers.

Revenue will be split between the Commercial Channel and the OEM

Channel. In the Commercial Channel, Anika has full responsibility

for sales, marketing, and pricing of products through our

commercial leaders, direct sales representatives, and independent

distributors. Revenue from Anika’s Regenerative Solutions and

international OA Pain Management businesses is included in the

Commercial Channel. In the OEM Channel, Anika is responsible for

development and manufacturing of products for OEM partners governed

by long-term agreements, but does not control sales, marketing, or

pricing. The OEM Channel is high-margin and highly cash generative

and serves as a foundation of revenue that enables us to invest in

our HA-based product pipeline as well as our high-growth Commercial

Channel. Revenue from Anika’s U.S. OA Pain Management business and

the Non-Orthopedic business is included in the OEM Channel.

Management Commentary

Cheryl R. Blanchard, Ph.D., Anika’s President and CEO commented

“OA Pain Management remains a strong, foundational component of our

business and is a key aspect of total company profitability.

Domestically we possess a market-leading position in the

viscosupplement market with Monovisc and Orthovisc. Outside the

U.S., where we manage our commercial sales process, we grew 14%

year to date as our teams increased the market share of Cingal,

Monovisc, and Orthovisc, and expanded into new countries. With

respect to Cingal in the U.S., we are making solid progress towards

the NDA filing. We recently acquired the Aristospan NDA to address

a newly imposed requirement by FDA. This provides the path to

access one of the critical reference drugs necessary to satisfy a

bioequivalence bridging study for Cingal. We are also scheduled to

commence the final non-clinical toxicology testing in the first

quarter of 2025. These developments address important hurdles as we

work to obtain U.S. approval for Cingal.”

Dr. Blanchard continued, “Earlier today, we announced the sale

of Arthrosurface and the planned divestiture of Parcus Medical.

These actions will enable us to concentrate our capital and

resources on our core HA technology, including our differentiated

Regenerative Solutions portfolio, and our Commercial Channel. Our

Commercial Channel, where we oversee sales, marketing, and pricing

of our products, is on track for another year of strong growth.

This channel grew 18% per year from 2021 through 2023 and is

estimated to grow 16% in 2024 driven by Integrity. The investments

in our Commercial Channel infrastructure position us to launch

near-term product line extensions that leverage the Integrity and

broader Hyaff platform, and prepare for the planned U.S. launch of

Hyalofast. We filed the first module of the Hyalofast PMA with the

FDA on October 28th and we remain on track for the U.S. launch of

our single stage, off the shelf HA cartilage repair product by 2026

with a $1 billion and growing addressable market.”

“Today’s announcements highlight our continued focus on

allocating capital towards our highest returning programs which we

expect will maximize shareholder value. To align with our strategy

of migrating resources to our highest value opportunities, we

announced the sale of Arthrosurface and the planned divestiture of

Parcus Medical. In addition, as of the end of the third quarter, we

have repurchased $5.3 million of shares as part of our $40 million

buyback program, through our previously announced 10b5-1 plan.

Lastly, we are realizing the benefits of our cost reduction efforts

announced in March, which have better positioned Anika for

long-term growth.”

“Looking forward, we see three phases to creating shareholder

value within our Commercial Channel. First, our near-term strategy

is to increase the percentage of revenue in the products sold

through our Commercial Channel including international sales of

Monovisc, Orthovisc, and Cingal; Integrity; Tactoset®; and our

rapidly advancing Regenerative Solutions pipeline. Second, in the

mid-term, we are intensely focused on launching Hyalofast by 2026

to treat the $1 billion U.S. addressable market. We filed the first

Hyalofast FDA PMA module on-time in October and the final module

will be filed in 2025. Third, longer-term, with recent progress,

we’ve never been more committed to bringing Cingal, a market

leading product outside the U.S., to the U.S. market which would be

a tremendous value driver for Anika.”

Announced Company Restructuring Initiative and Long-Term

Financial Targets

As a result of the developments announced today, Anika is

reducing personnel and operating expenses, aligning these actions

with the sale of Arthrosurface and the anticipated sale of Parcus.

The Company expects one-time cash restructuring and transaction

charges between $3 to 5 million and non-cash charges between $27 to

29 million related to these actions and the Arthrosurface

transaction. Anika is also announcing updated long-term guidance,

assuming Parcus Medical and Arthrosurface are within discontinued

operations beginning in the fourth quarter of 2024.

Revenue Guidance:

- Commercial Channel

- 2024: +14% to +19% growth from $36.1M in 2023, excluding

revenue from businesses disposed of, or to be disposed of, as they

are expected to be presented in discontinued operations beginning

in the fourth quarter of 2024

- 2025: +12% to +18% growth

- 2026-2027: +20% to +30% annual growth including modest

contributions from the planned U.S. launch of Hyalofast in the

fourth quarter of 2026 following anticipated FDA approval

- OEM Channel

- 2024: (8%) to (10%) decline from $84.6M in 2023

- 2025: (12%) to (18%) decline

- 2026-2027: flat to modestly lower annually, not including any

expected contributions from potential U.S. Cingal FDA approval

- Anika’s sales from the Commercial Channel expected be

approximately 50% of total Revenue by 2026

Adjusted EBITDA Guidance:

- 2024 Adjusted EBITDA: $16M to $18M driven by a lower mix of

U.S. OA Pain Management Revenue and impact from Arthrosurface and

Parcus Medical

- 2025 Adjusted EBITDA %: low double digits, excluding

divestiture-related expenses, which are expected to be complete

concurrent with the sale of Parcus in 2025

- 2026-2027 Adjusted EBITDA %: Opportunity for margin expansion

following the planned launch of Hyalofast by 2026

Conference Call and Webcast InformationAnika’s

management will hold a conference call and webcast to discuss its

financial results and business highlights today, Thursday, October

31, 2024, at 8:30 am ET. The conference call can be accessed by

dialing 1-800-717-1738 (toll-free domestic) or 1-646-307-1865

(international) and providing the conference ID number 31842. A

live audio webcast will be available in the Investor Relations

section of Anika’s website, www.anika.com. A slide presentation

with highlights from the conference call will be available in the

Investor Relations section of the Anika website. A replay of the

webcast will be available on Anika’s website approximately two

hours after the completion of the event.

About AnikaAnika Therapeutics, Inc. (NASDAQ:

ANIK), is a global joint preservation company that creates and

delivers meaningful advancements in early intervention orthopedic

care. Leveraging our core expertise in hyaluronic acid and implant

solutions, we partner with clinicians to provide minimally invasive

products that restore active living for people around the world.

Our focus is on high opportunity spaces within orthopedics,

including Osteoarthritis Pain Management, Regenerative Solutions,

and Sports Medicine, and our products are efficiently delivered in

key sites of care, including ambulatory surgery centers. Anika’s

global operations are headquartered outside of Boston,

Massachusetts. For more information about Anika, please visit

www.anika.com.

ANIKA, ANIKA THERAPEUTICS, CINGAL, HYALOFAST, INTEGRITY,

MONOVISC, ORTHOVISC, TACTOSET, and the Anika logo are trademarks of

Anika Therapeutics, Inc. or its subsidiaries or are licensed to

Anika Therapeutics, Inc. for its use.

Non-GAAP Financial

Information1Non-GAAP financial measures

should be considered supplemental to, and not a substitute for, the

Company’s reported financial results prepared in accordance with

GAAP. Furthermore, the Company’s definition of non-GAAP measures

may differ from similarly titled measures used by others. Because

non-GAAP financial measures exclude the effect of items that will

increase or decrease the Company’s reported results of operations,

Anika strongly encourages investors to review the Company’s

consolidated financial statements and publicly filed reports in

their entirety. The Company presents these non-GAAP financial

measures because it uses them as supplemental measures in

internally assessing the Company’s operating performance, and, in

the case of Adjusted EBITDA, it is set as a key performance metric

to determine executive compensation. The Company also recognizes

that these non-GAAP measures are commonly used in determining

business performance more broadly and believes that they are

helpful to investors, securities analysts, and other interested

parties as a measure of comparative operating performance from

period to period.

Adjusted Gross MarginAdjusted gross margin is defined by the

Company as adjusted gross profit divided by total revenue. The

Company defines adjusted gross profit as GAAP gross profit

excluding amortization of certain acquired assets and non-cash

product rationalization charges.

Adjusted EBITDA Adjusted EBITDA is defined by the Company as

GAAP net income (loss) excluding depreciation and amortization,

interest and other income (expense), income taxes, stock-based

compensation expense, acquisition related expenses, non-cash

charges related to goodwill impairment, non-cash product

rationalization charges, severance costs and shareholder activism

costs.

Adjusted Net Income (Loss) and Adjusted EPS Adjusted net income

(loss) is defined by the Company as GAAP net income excluding

acquisition related expenses, inclusive of the impact of purchase

accounting, on a tax effected basis, non-cash charges related to

goodwill impairment, non-cash product rationalization charges,

stock-based compensation and charges related to discontinuation of

a software project. Adjusted diluted EPS is defined by the Company

as GAAP diluted EPS excluding acquisition related expenses and the

impact of purchase accounting, each on a tax-adjusted per share

basis, non-cash product rationalization charges, stock-based

compensation, severance costs and shareholder activism costs.

Beginning in the first quarter of 2024, adjusted net income (loss)

and adjusted EPS were revised to exclude stock-based compensation,

net of tax, and this revised calculation is reflected for all

periods presented.

A reconciliation of adjusted gross profit to gross profit (and

the associated adjusted gross margin calculation), adjusted EBITDA

to net income (loss), adjusted net income (loss) to net income

(loss) and adjusted diluted EPS to diluted EPS, the most directly

comparable financial measures calculated and presented in

accordance with GAAP, is shown in the tables at the end of this

release.

Forward-Looking Statements This press release

may contain forward-looking statements, within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, concerning

the Company's expectations, anticipations, intentions, beliefs or

strategies regarding the future which are not statements of

historical fact, including statements about the potential growth

opportunity and expansion of our Commercial Channel, the timing of

the regulatory pathway and launch of Hyalofast and the US approval

of Cingal, statements around the actions that are being taken to

generate additional shareholder value, and in the section titled

“Announced Company Restructuring Initiative and Long-Term Financial

Targets”. These statements are based upon the current beliefs and

expectations of the Company's management and are subject to

significant risks, uncertainties, and other factors. The Company's

actual results could differ materially from any anticipated future

results, performance, or achievements described in the

forward-looking statements as a result of a number of factors

including, but not limited to, (i) the Company's ability to

successfully commence and/or complete clinical trials of its

products on a timely basis or at all; (ii) the Company's ability to

obtain pre-clinical or clinical data to support domestic and

international pre-market approval applications, 510(k)

applications, or new drug applications, or to timely file and

receive FDA or other regulatory approvals or clearances of its

products; (iii) that such approvals will not be obtained in a

timely manner or without the need for additional clinical trials,

other testing or regulatory submissions, as applicable; (iv) the

Company's research and product development efforts and their

relative success, including whether we have any meaningful sales of

any new products resulting from such efforts; (v) the cost

effectiveness and efficiency of the Company's clinical studies,

manufacturing operations, and production planning; (vi) the

strength of the economies in which the Company operates or will be

operating, as well as the political stability of any of those

geographic areas; (vii) future determinations by the Company to

allocate resources to products and in directions not presently

contemplated; (viii) the Company's ability to successfully

commercialize its products, in the U.S. and abroad; (ix)

the Company's ability to provide an adequate and timely supply of

its products to its customers; and (x) the Company's ability to

achieve its growth targets. Additional factors and risks are

described in the Company's periodic reports filed with

the Securities and Exchange Commission, and they are available

on the SEC's website

at www.sec.gov. Forward-looking statements

are made based on information available to the Company on the date

of this press release, and the Company assumes no obligation to

update the information contained in this press release.

For Investor Inquiries:Anika Therapeutics,

Inc.Matt Hall, 781-457-9554Director, Corporate Development and

Investor Relationsinvestorrelations@anika.com

| |

|

|

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

| Consolidated

Statements of Operations |

| (in

thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended September 30, |

|

For the Nine

Months Ended September 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Revenue |

|

$ |

38,753 |

|

|

$ |

41,465 |

|

|

$ |

121,197 |

|

|

$ |

123,691 |

|

|

|

Cost of Revenue |

|

|

37,313 |

|

|

|

16,521 |

|

|

|

67,764 |

|

|

|

46,932 |

|

|

|

Gross Profit |

|

|

1,440 |

|

|

|

24,944 |

|

|

|

53,433 |

|

|

|

76,759 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

7,244 |

|

|

|

7,791 |

|

|

|

22,806 |

|

|

|

25,105 |

|

|

|

Selling, general and administrative |

|

|

19,112 |

|

|

|

24,827 |

|

|

|

60,445 |

|

|

|

75,512 |

|

|

|

Impairment of long-lived assets |

|

|

3,101 |

|

|

|

- |

|

|

|

3,101 |

|

|

|

- |

|

|

|

Total operating expenses |

|

|

29,457 |

|

|

|

32,618 |

|

|

|

86,352 |

|

|

|

100,617 |

|

|

|

Loss from operations |

|

|

(28,017 |

) |

|

|

(7,674 |

) |

|

|

(32,919 |

) |

|

|

(23,858 |

) |

|

|

Interest and other income (expense), net |

|

|

406 |

|

|

|

635 |

|

|

|

1,593 |

|

|

|

1,735 |

|

|

|

Loss before income taxes |

|

|

(27,611 |

) |

|

|

(7,039 |

) |

|

|

(31,326 |

) |

|

|

(22,123 |

) |

|

|

Provision for (benefit from) income taxes |

|

|

2,307 |

|

|

|

(463 |

) |

|

|

3,194 |

|

|

|

(2,456 |

) |

|

|

Net loss |

|

$ |

(29,918 |

) |

|

$ |

(6,576 |

) |

|

$ |

(34,520 |

) |

|

$ |

(19,667 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(2.03 |

) |

|

$ |

(0.45 |

) |

|

$ |

(2.34 |

) |

|

$ |

(1.34 |

) |

|

|

Diluted |

|

$ |

(2.03 |

) |

|

$ |

(0.45 |

) |

|

$ |

(2.34 |

) |

|

$ |

(1.34 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

14,768 |

|

|

|

14,635 |

|

|

|

14,769 |

|

|

|

14,659 |

|

|

|

Diluted |

|

|

14,768 |

|

|

|

14,635 |

|

|

|

14,769 |

|

|

|

14,659 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

| Consolidated

Balance Sheets |

| (in

thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

|

September

30, |

|

December

31, |

|

ASSETS |

|

2024 |

|

|

|

2023 |

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

62,368 |

|

|

$ |

72,867 |

|

|

Accounts receivable, net |

|

28,357 |

|

|

|

35,961 |

|

|

Inventories, net |

|

39,629 |

|

|

|

46,386 |

|

|

Prepaid expenses and other current assets |

|

5,752 |

|

|

|

8,095 |

|

|

Total current assets |

|

136,106 |

|

|

|

163,309 |

|

|

Property and equipment, net |

|

44,572 |

|

|

|

46,198 |

|

|

Right-of-use assets |

|

27,208 |

|

|

|

28,767 |

|

|

Other long-term assets |

|

11,310 |

|

|

|

18,672 |

|

|

Deferred tax assets |

|

1,472 |

|

|

|

1,489 |

|

|

Intangible assets, net |

|

3,081 |

|

|

|

4,626 |

|

|

Goodwill |

|

7,656 |

|

|

|

7,571 |

|

|

Total assets |

$ |

231,405 |

|

|

$ |

270,632 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

6,805 |

|

|

$ |

9,860 |

|

|

Accrued expenses and other current liabilities |

|

18,688 |

|

|

|

21,199 |

|

|

Total current liabilities |

|

25,493 |

|

|

|

31,059 |

|

|

Other long-term liabilities |

|

806 |

|

|

|

404 |

|

|

Lease liabilities |

|

25,242 |

|

|

|

26,904 |

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

Common stock, $0.01 par value |

|

147 |

|

|

|

147 |

|

|

Additional paid-in-capital |

|

91,886 |

|

|

|

90,009 |

|

|

Accumulated other comprehensive loss |

|

(5,701 |

) |

|

|

(5,943 |

) |

|

Retained earnings |

|

93,532 |

|

|

|

128,052 |

|

|

Total stockholders' equity |

|

179,864 |

|

|

|

212,265 |

|

|

Total liabilities and stockholders' equity |

$ |

231,405 |

|

|

$ |

270,632 |

|

| |

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Gross Profit to Adjusted Gross

Profit |

| (in

thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months EndedSeptember 30, |

|

For the Nine

Months EndedSeptember 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Gross Profit |

|

$ |

1,440 |

|

|

$ |

24,944 |

|

|

$ |

53,433 |

|

|

$ |

76,759 |

|

|

Product rationalization related charges |

|

|

- |

|

|

|

748 |

|

|

|

472 |

|

|

|

748 |

|

|

Writedown of inventories |

|

|

23,438 |

|

|

|

- |

|

|

|

23,438 |

|

|

|

- |

|

|

Acquisition related intangible asset amortization |

|

|

153 |

|

|

|

1,561 |

|

|

|

464 |

|

|

|

4,684 |

|

|

Adjusted Gross Profit |

|

$ |

25,031 |

|

|

$ |

27,253 |

|

|

$ |

77,807 |

|

|

$ |

82,191 |

|

|

|

|

|

|

|

|

|

|

|

|

Unadjusted Gross Margin |

|

|

4 |

% |

|

|

60 |

% |

|

|

44 |

% |

|

|

62 |

% |

|

Adjusted Gross Margin |

|

|

65 |

% |

|

|

66 |

% |

|

|

64 |

% |

|

|

66 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Net Income to Adjusted

EBITDA |

| (in

thousands) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months EndedSeptember 30, |

|

For the Nine

Months EndedSeptember 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

|

$ |

(29,918 |

) |

|

$ |

(6,576 |

) |

|

$ |

(34,520 |

) |

|

$ |

(19,667 |

) |

|

Interest and other (income) expense, net |

|

|

(406 |

) |

|

|

(635 |

) |

|

|

(1,593 |

) |

|

|

(1,735 |

) |

|

Provision for (benefit from) income taxes |

|

|

2,307 |

|

|

|

(463 |

) |

|

|

3,194 |

|

|

|

(2,456 |

) |

|

Depreciation and amortization |

|

|

2,045 |

|

|

|

1,755 |

|

|

|

5,800 |

|

|

|

5,282 |

|

|

Stock-based compensation |

|

|

3,394 |

|

|

|

3,561 |

|

|

|

10,875 |

|

|

|

11,428 |

|

|

Product rationalization |

|

|

- |

|

|

|

748 |

|

|

|

472 |

|

|

|

748 |

|

|

Arbitration settlement |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,250 |

|

|

Acquisition related intangible asset amortization |

|

|

143 |

|

|

|

1,787 |

|

|

|

509 |

|

|

|

5,361 |

|

|

Impairment/writedown of assets |

|

|

27,401 |

|

|

|

- |

|

|

|

27,401 |

|

|

|

- |

|

|

Discontinuation of software development project |

|

|

- |

|

|

|

4,473 |

|

|

|

(1,404 |

) |

|

|

4,473 |

|

|

Non-recurring professional fees |

|

|

465 |

|

|

|

- |

|

|

|

465 |

|

|

|

- |

|

|

Severance costs |

|

|

- |

|

|

|

- |

|

|

|

839 |

|

|

|

- |

|

|

Costs of shareholder activism |

|

|

- |

|

|

|

- |

|

|

|

2,185 |

|

|

|

3,033 |

|

|

Adjusted EBITDA |

|

$ |

5,431 |

|

|

$ |

4,650 |

|

|

$ |

14,223 |

|

|

$ |

9,717 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Net Income to Adjusted Net

Income |

| (in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

For the

Three Months EndedSeptember 30, |

|

For the Nine

Months EndedSeptember 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

|

$ |

(29,918 |

) |

|

$ |

(6,576 |

) |

|

$ |

(34,520 |

) |

|

$ |

(19,667 |

) |

|

Product rationalization, tax effected |

|

|

- |

|

|

|

699 |

|

|

|

392 |

|

|

|

665 |

|

|

Arbitration settlement, tax effected |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,889 |

|

|

Share-based compensation, tax effected |

|

|

2,820 |

|

|

|

3,327 |

|

|

|

9,037 |

|

|

|

10,159 |

|

|

Acquisition related intangible asset amortization, tax

effected |

|

|

119 |

|

|

|

1,669 |

|

|

|

423 |

|

|

|

4,767 |

|

|

Impairment/writedown of assets, tax effected |

|

|

22,770 |

|

|

|

- |

|

|

|

22,770 |

|

|

|

- |

|

|

Discontinuation of software development project, tax effected |

|

|

- |

|

|

|

4,179 |

|

|

|

(1,167 |

) |

|

|

3,976 |

|

|

Non-recurring professional fees, tax effected |

|

|

386 |

|

|

|

- |

|

|

|

386 |

|

|

|

- |

|

|

Severance costs, tax effected |

|

|

- |

|

|

|

- |

|

|

|

697 |

|

|

|

- |

|

|

Costs of shareholder activism, tax effected |

|

|

- |

|

|

|

- |

|

|

|

1,816 |

|

|

|

2,696 |

|

|

Adjusted net income |

|

$ |

(3,822 |

) |

|

$ |

3,298 |

|

|

|

(165 |

) |

|

$ |

5,485 |

|

|

|

|

|

|

|

|

|

|

|

| |

| Anika

Therapeutics, Inc. and Subsidiaries |

|

Reconciliation of GAAP Diluted Earnings Per Share to

Adjusted Diluted Earnings Per Share |

| (in

thousands, except per share data) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months EndedSeptember 30, |

|

For the Nine

Months EndedSeptember 30, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Diluted net loss per share |

|

$ |

(2.03 |

) |

|

$ |

(0.45 |

) |

|

$ |

(2.34 |

) |

|

$ |

(1.33 |

) |

|

Product rationalization, tax effected |

|

|

- |

|

|

|

0.05 |

|

|

|

0.03 |

|

|

|

0.05 |

|

|

Arbitration settlement, tax effected |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.20 |

|

|

Share-based compensation, tax effected |

|

|

0.19 |

|

|

|

0.23 |

|

|

|

0.61 |

|

|

|

0.69 |

|

|

Acquisition related intangible asset amortization, tax

effected |

|

|

0.01 |

|

|

|

0.11 |

|

|

|

0.03 |

|

|

|

0.32 |

|

|

Impairment/writedown of assets, tax effected |

|

|

1.55 |

|

|

|

- |

|

|

|

1.55 |

|

|

|

- |

|

|

Discontinuation of software development project, tax effected |

|

|

- |

|

|

|

0.29 |

|

|

|

(0.08 |

) |

|

|

0.27 |

|

|

Non-recurring professional fees, tax effected |

|

|

0.03 |

|

|

|

- |

|

|

|

0.02 |

|

|

|

- |

|

|

Severance costs, tax effected |

|

|

- |

|

|

|

- |

|

|

|

0.05 |

|

|

|

- |

|

|

Costs of shareholder activism, tax effected |

|

$ |

- |

|

|

|

- |

|

|

|

0.12 |

|

|

|

0.18 |

|

|

Adjusted diluted net income per share |

|

$ |

(0.25 |

) |

|

$ |

0.23 |

|

|

$ |

(0.01 |

) |

|

$ |

0.37 |

|

|

|

|

|

|

|

|

|

|

|

| Anika

Therapeutics, Inc. and Subsidiaries |

|

| Revenue by

Product Family |

|

| (in

thousands, except percentages) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the

Three Months Ended September 30, |

|

For the Nine

Months Ended September 30, |

|

| |

|

2024 |

|

|

|

2023 |

|

|

$ change |

|

% change |

|

|

2024 |

|

|

|

2023 |

|

|

$ change |

|

% change |

|

|

OA Pain Management |

$ |

24,428 |

|

|

$ |

24,888 |

|

|

$ |

(460 |

) |

|

-2 |

% |

|

$ |

75,404 |

|

|

$ |

76,855 |

|

|

$ |

(1,451 |

) |

|

-2 |

% |

|

|

Joint Preservation and Restoration |

|

11,950 |

|

|

|

13,470 |

|

|

|

(1,520 |

) |

|

-11 |

% |

|

|

39,345 |

|

|

|

39,583 |

|

|

|

(238 |

) |

|

-1 |

% |

|

|

Non-Orthopedic |

|

2,375 |

|

|

|

3,107 |

|

|

|

(732 |

) |

|

-24 |

% |

|

|

6,448 |

|

|

|

7,253 |

|

|

|

(805 |

) |

|

-11 |

% |

|

|

Revenue |

$ |

38,753 |

|

|

$ |

41,465 |

|

|

$ |

(2,712 |

) |

|

-7 |

% |

|

$ |

121,197 |

|

|

$ |

123,691 |

|

|

$ |

(2,494 |

) |

|

-2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

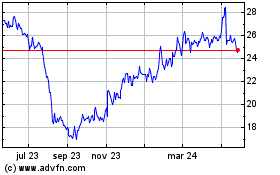

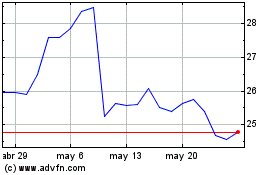

Anika Therapeutics (NASDAQ:ANIK)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Anika Therapeutics (NASDAQ:ANIK)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025