UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 21, 2024

AROGO CAPITAL ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41179 |

|

87-1118179 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

848 Brickell Avenue, Penthouse 5, Miami, FL

33131

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (786) 442-1482

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which

Registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

AOGOU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, $0.0001 par value per share |

|

AOGO |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

AOGOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material

Change to Rights of Security Holders.

As previously disclosed

in the Current Report on Form 8-K filed on July 10, 2024, by Arogo Capital Acquisition Corp., a Delaware corporation (the “Company”),

on July 5, 2024 the Company held a special meeting of its stockholders (the “Special Meeting”) during which the stockholders

approved the proposal to amend the Company’s amended and restated certificate of incorporation (as further amended on March 28,

2023 and September 28, 2023, the “Charter”) to provide for the right of a holder of the Company’s Class B common stock,

par value $0.0001 per share (the “Class B Common Stock”), to convert such Class B Common Stock into shares of Company’s

Class A common stock, par value $0.0001 per share (the “Class A Common Stock”), on a one-for-one basis at any time and from

time to time prior to the closing of an initial business combination at the election of the holder (the “Optional Conversion Election”).

In accordance with the

Company’s Charter, each holder of the Company’s Class B Common Stock exercised their Optional Conversion Election. On August

21, 2024, all 2,587,500 of the then issued and outstanding shares of the Company’s Class B Common Stock were automatically converted

into 2,587,500 shares of the Company’s Class A Common Stock (the “Conversion”). Following the Conversion, no shares

of the Company’s Class B Common Stock remained issued and outstanding, and there were 4,349,909 shares of the Company’s Class

A Common Stock issued and outstanding.

The Conversion had the

following effects, among others, on the holders of shares of Class B Common Stock:

Voting

Power

Prior to the Conversion,

holders of Class B Common Stock were entitled to one vote for each share held on all matters to be voted on by stockholders. As a result

of the Conversion, all former holders of shares of Class B Common Stock are now holders of an equal number of shares of Class A Common

Stock, which are entitled to cast one vote for each share held on all matters to be voted on by stockholders. Unless specified in our

Charter or bylaws, or as required by applicable provisions of the Delaware General Corporation Law or applicable stock exchange rules,

the affirmative vote of a majority of our shares of common stock that are voted is required to approve any such matter voted on by our

stockholders. Our board of directors are divided into three classes, each of which generally serve for a term of three years with only

one class of directors being elected in each year. There is no cumulative voting with respect to the election of directors, with the result

that the holders of more than 50% of the shares voted for the election of directors can elect all of the directors.

Economic

Interests

Our stockholders are

entitled to receive ratable dividends when, as and if declared by the board of directors out of funds legally available therefor.

Additional Information

and Where to Find It

In connection with the

previously announced proposed business combination transaction, the Company intends to file a registration statement on Form F-4, which

will include a proxy statement/prospectus, with the Securities and Exchange Commission (“SEC”). The Company’s stockholders

and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto

and the definitive proxy statement and documents incorporated by reference therein filed in connection with the proposed business combination

transaction, as these materials will contain important information about the Company, Ayurcann Holding Corp. and the proposed business

combination transaction. Promptly after the Form F-4 is declared effective by the SEC, the Company will mail the definitive proxy statement/prospectus

and a proxy card to each stockholder entitled to vote at the meeting relating to the approval of the business combination and other proposals

set forth in the proxy statement/prospectus. Before making any voting or investment decision, investors and security holders of the Company

and other interested parties are urged to read the proxy statement/prospectus, any amendments thereto and any other documents filed with

the SEC carefully and in their entirety, when they become available, because they will contain important information about the proposed

business combination and the parties to the business combination. The preliminary proxy statement/prospectus and the definitive proxy

statement/prospectus, when available, and other reports and filings made with the SEC by the Company are available free of charge through

the website maintained by the SEC at http://www.sec.gov, or by directing a request to Arogo Capital Acquisition Corp., 848 Brickell Avenue,

Penthouse 5, Miami, FL 33131.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements include those that express a belief, expectation or intention, as well as those that

are not statements of historical fact. Forward-looking statements include information regarding our future plans and goals, as well as

our expectations with respect to, without limitation: our ability to consummate the proposed business combination; availability and terms

of capital; and our ability to regain compliance with Nasdaq’s listing requirements.

Forward-looking statements

may be accompanied by words such as “expect,” “believe,” “estimate,” “intend,” “plan,”

“will,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative

of these terms or other comparable terminology, although not all forward-looking statements contain these words. Forward-looking statements

are not assurances of future performance and involve risks, uncertainties and assumptions which may cause actual results to differ materially

from those indicated or anticipated. Such risks and uncertainties include, but are not limited to: risks related to the expected timing

and likelihood of completion of the pending business combination; the risk that there may be a material adverse change with respect to

the financial position or prospects of the Company; and other important factors outlined under the caption “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as such factors may be updated from time to time

in the Company’s other filings with the SEC, which are available on the SEC’s website at www.sec.gov. Although the Company

believes that the expectations and assumptions reflected in its forward-looking statements are reasonable, it cannot guarantee future

results. These forward-looking statements speak only as of the date they were made and, except as otherwise required by law, the Company

undertakes no obligation to update, amend or ratify any forward-looking statements because of new information, future events or other

factors.

Participants in the Solicitation

The Company and Ayurcann

Holdings Corp. and their respective directors and certain of their respective executive officers and other members of management and employees

may be considered participants in the solicitation of proxies from the stockholders of the Company with respect to the proposed business

combination. Information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2023 filed with the SEC on May 10, 2024. Additional information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy

statement and/or prospectus and other relevant materials to be filed with the SEC regarding the proposed business combination, when they

become available. Stockholders, potential investors and other interested persons should read the proxy statement/prospectus carefully,

when it becomes available, before making any voting or investment decisions. When available, these documents can be obtained free of charge

from the sources indicated above.

No Offer or Solicitation

This Current Report on

Form 8-K shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the

proposed business combination. This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: September 6, 2024 |

AROGO CAPITAL ACQUISITION CORP. |

|

|

|

| |

By: |

/s/ Suradech Taweesaengsakulthai |

| |

|

Name: |

Suradech Taweesaengsakulthai |

| |

|

Title: |

Chief Executive Officer |

3

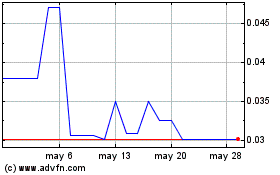

Arogo Capital Acquisition (NASDAQ:AOGOW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Arogo Capital Acquisition (NASDAQ:AOGOW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024