UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 6, 2024

AROGO CAPITAL ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41179 |

|

87-1118179 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

848 Brickell Avenue,

Penthouse 5, Miami, FL 33131

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (786) 442-1482

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

AOGOU |

|

OTC Markets |

| Class A Common Stock, $0.0001 par value per share |

|

AOGO |

|

OTC Markets |

| Redeemable Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

AOGOW |

|

OTC Markets |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into

a Material Definitive Agreement.

On December 6, 2024, Arogo Capital Acquisition

Corp., a Delaware corporation (“Arogo”), entered into a binding letter of intent (the “LOI”) with Bangkok Tellink

Co., Ltd (“Tellink”) in connection with a proposed business combination between Arogo and Tellink. Tellink is a provider of

innovative telecommunications and Internet-of-Things solutions.

The LOI contains an exclusivity period, which

may be extended by the mutual written consent of the parties, that runs from the date of the execution of the LOI through forty-five (45)

calendar days (the “Exclusivity Period”). The LOI also contemplates that the definitive business combination agreement (“BCA”)

will be entered into on or before February 28, 2025. The LOI may be terminated as follows: (a) by the mutual written agreement of the

parties; (b) by Arogo in its sole discretion, at any time after the execution of the LOI; (c) by Tellink after the expiration of the Exclusivity

Period; or (d) upon execution and delivery of the BCA.

The LOI is binding on the parties, but the material

terms of the proposed business combination remain subject to completion of due diligence, the negotiation of the BCA and the approval

thereof by the respective boards of directors of Arogo and Tellink. The LOI is subject to customary confidentiality provisions and the

terms of a mutual nondisclosure agreement entered into by the parties concurrently with the execution of the LOI.

The foregoing description of the LOI and related

matters does not purport to be complete and is qualified in its entirety by reference to the full text of the LOI, a copy of which is

attached hereto as Exhibit 10.1 to this Current Report on Form 8-K.

Item 7.01 Regulation

FD Disclosure.

On December 10, 2024, Arogo issued a press release

announcing the execution of the LOI, a copy of which is furnished with this Current Report on Form 8-K as Exhibit 99.1. This information

is furnished pursuant to Item 7.01 “Regulation FD Disclosure,” and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AROGO CAPITAL ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Suradech Taweesaengsakulthai |

| |

|

Name: |

Suradech Taweesaengsakulthai |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

| Dated: December 10, 2024 |

|

|

2

Exhibit 10.1

AROGO CAPITAL ACQUISITION CORP.

848 Brickell Avenue, Penthouse 5, Miami, FL 33131

CONFIDENTIAL

6 December 2024

Bangkok Tellink Co., Ltd.

89/2 Building 6,

2nd Floor, Room 6203,

Chaengwattana Road, Thung Song Hong,

Laksi, Bangkok 10210, Thailand

c/o: Nusttanakit Sasianon, Founder & Chief Executive Officer

| Re: | Binding Letter of Intent |

Dear Nusttanakit:

We have enjoyed learning about

Bangkok Tellink Co., Ltd. (the “Company”) and getting to know you over the past several weeks. We are pleased to submit

this letter of intent (this “LOI”) relating to a potential business combination (the “Proposed Transaction”)

involving Arogo Capital Acquisition Corp., an OTC-listed company incorporated in the State of Delaware (OTC: AOGOU, AOGO, AOGOW) (the

“Public Entity”), and the Company (the Public Entity and the Company together shall be referred to as the “Parties”

and each as a “Party”).

An overview of certain key

terms and conditions of the Proposed Transaction is set forth in Exhibit A hereto (the “Term Sheet”).

Due to the experience of the

Public Entity’s management team and Board of Directors, we recognize that a public market transaction with a SPAC is more nuanced

than a traditional sale of the Company, and as such, we would like to request a meeting with the Company’s Board of Directors to

introduce the Public Entity and discuss the nuances of the SPAC market environment, and also to further discuss the merits of this Proposed

Transaction.

As part of the process, we

will be performing due diligence of the Company. Key diligence items will be focused on, without limitation, matters of financial due

diligence, commercial due diligence (customer calls, etc.), legal due diligence (regulatory risks, contracts, employee issues), the competitive

landscape, and M&A strategy.

1.

Binding Commitment. No agreement providing for any Proposed Transaction or any other transaction shall be deemed to exist unless and

until the Definitive Agreements (as defined below) have been executed and delivered by the Public Entity, the Company and any other parties

thereto, if any. Promptly after the execution of this LOI, the Parties will begin negotiation of a Definitive Agreement (as defined below)

related to the Proposed Transaction, with such negotiations to be completed as soon as reasonably practicable, but in no event later than

the end of the Exclusivity Period (as defined below), which may be extended by the mutual written consent of the Parties. The provisions

of this LOI shall be legally binding upon the Parties (the “Binding Matters”) for the duration of this LOI. Each Party

reserves the right, in its sole discretion, to reject any and all proposals made by the other Party or its affiliates or any of their

respective officers, directors, employees, consultants, contractors, accountants, agents, representatives and financial and legal advisors

(collectively with such affiliates, such Party’s “Representatives”) with regard to the Proposed Transaction.

Neither Party will have (and each Party hereby irrevocably waives) any claims against the other Party or any of its Representatives arising

out of or relating to the Proposed Transaction other than those, if any, that either such Party may in the future have with respect to

the Binding Matters or pursuant to the Definitive Agreements (if executed and delivered by the Public Entity, the Company and any other

parties thereto). Upon the execution of this LOI, the Company shall immediately commence the requisite PCAOB audit procedures, if it has

not already done so, and shall make available to the Public Entity such due diligence materials as the Public Entity shall require.

2.

Definitive Agreements. The obligations of the Public Entity and the Company to consummate the Proposed Transaction are subject to

and conditioned upon the negotiation and execution of definitive agreements, including a business combination agreement (the “Business

Combination Agreement”) and other documents (collectively, the “Definitive Agreements”), containing such

terms and provisions as are mutually agreed to by the Parties. The closing of the Proposed Transaction contemplated hereby (the “Closing”)

will be subject to the satisfaction of all conditions precedent to Closing as identified in the Business Combination Agreement.

3.

Confidentiality Agreement. The Parties acknowledge and affirm the terms of the separate Mutual Nondisclosure Agreement, dated as of

December 2nd, 2024 (the “NDA”), between the Public Entity and the Company, which is incorporated by reference

as if set forth herein. The Parties acknowledge and agree that the existence and terms of this LOI and the Proposed Transaction are and

shall be treated as Confidential Information in accordance with the NDA. Notwithstanding the foregoing, the Company understands and acknowledges

that after each Party executes this LOI until the end of the Exclusivity Period (as defined below) or such longer period of time mutually

agreed to by the Parties, the Public Entity may disclose the existence and terms of this LOI (i) in accordance with the applicable rules

and regulations of the U.S. Securities and Exchange Commission (the “SEC”) (ii) and certain confidential information

about the Company that is approved in advance in writing by the Company to certain of Public Entity’s significant existing public

stockholders and other selected potential investors who, in each case, are informed of the confidential nature of this LOI and such other

confidential information and have agreed to keep the existence and terms of this LOI and such other confidential information confidential

in order to gauge their support of the Proposed Transaction.

4.

Exclusivity. In consideration of the time, effort and expense to be undertaken by the Public Entity in connection with the Proposed

Transaction, the Company agrees that during the period from the execution of this LOI and ending at 5:00 p.m., New York Time, on the date

that is 45 calendar days thereafter (the “Exclusivity Period”), which date may be extended by the mutual written consent

of the Parties, (i) the Company will not, and the Company will cause its Representatives not to, solicit or initiate, engage in or enter

into discussions, negotiations or transactions with, or knowingly encourage, or provide any information to, any other person or entity

concerning any merger, share exchange, asset acquisition, share purchase, financing transaction, reorganization or similar transaction

involving the Company with such other person or entity (the transactions described shall be referred to as “Competing Transactions”

or each a “Competing Transaction”), and (ii) the Company will not, and shall cause its Representatives not to, enter

into any agreement in principle, letter of intent or definitive agreement, or make any filing with the SEC or other governmental authority,

with respect to a Competing Transaction, unless required by applicable law. The Company shall, upon execution of this LOI, immediately

suspend any pre-existing discussion with all parties other than the respective other Party regarding any Competing Transaction. During

the Exclusivity Period, the Company will cooperate with the Public Entity and its Representatives regarding due diligence matters and

will, upon advance notice and during normal business hours, afford the Public Entity and its Representatives with reasonable access (to

the extent reasonably practicable) to the Company’s and its subsidiaries’ respective books and records and personnel. Upon

request by the Public Entity, the Company agrees to make its management reasonably available to participate in a “testing the waters”

process in order to determine general interest and market enthusiasm for the Proposed Transaction. For the avoidance of doubt, nothing

in the foregoing does or shall be deemed to obligate the Public Entity or its Representatives to conduct any due diligence other than

diligence which the Public Entity may, in its sole discretion, determine to conduct.

5.

Expenses. Except as set forth in any Definitive Agreements entered into by the Parties, each of the Parties will pay its own costs

and expenses (including legal, financial advisory, consulting and accounting fees and expenses) incurred at any time in connection with

pursuing or consummating the Proposed Transaction; provided that if the transaction closes, the surviving entity shall pay all fees and

expenses of each party, including legal, accounting and advisory fees.

6.

Termination. This LOI can be terminated as follows: (a) by the mutual written agreement of the Parties to terminate this LOI; (b)

by the Public Entity in its sole discretion, at any time after the execution hereof; (c) by the Company after the expiration of the Exclusivity

Period; or (d) upon execution and delivery of the Definitive Agreements. Any termination of this LOI pursuant to clauses (b) or (c) above

shall be pursuant to a written notice provided by the terminating Party to the other Party and, any termination in accordance with this

Section 6 shall be effective upon receipt of such written notice by the non-terminating Party. Upon termination of this LOI, this

LOI will be deemed null and void and of no further force or effect, and all obligations and liabilities of the Parties under this LOI

or otherwise related to the Proposed Transaction will terminate, except for the respective continuing obligations of the Parties relating

to the Binding Matters, which will, except in the case of a termination of this Agreement pursuant to clause (d), survive any termination

of this LOI indefinitely (unless a lesser period is expressly contemplated by their terms). The termination of this LOI will not relieve

any of the Parties of liability for such Party’s pre-termination willful and material breach of any of the Binding Matters.

All notices, requests, claims,

demands and other communications hereunder shall be in writing and shall be given (and shall be deemed to have been duly given upon receipt)

by delivery in person, by e-mail (unless the sender of such electronic mail receives a non-delivery message (but not other automated replies,

such as an out-of-office notification)), or by registered or certified mail (postage prepaid, return receipt requested) (upon receipt

thereof) to the other Parties as follows:

(a) If to Public Entity, to:

Arogo Capital Acquisition Corp.

848 Brickell Ave. Penthouse 5

Miami, FL 33131

| |

Attention: |

Suradech Taweesaengsakulthai |

| |

Email: |

suradech@cho.co.th |

with copies (which shall

not constitute notice) to:

Brown Rudnick LLP

601 13th Street N.W.

Washington, DC 20005

| |

Attention: |

Andrew J. Sherman |

| |

Email: |

asherman@brownrudnick.com |

(b) If to the Company, to:

Bangkok Tellink Co., Ltd.

89/2 Building 6, 2nd Floor, Room No. 5203

Chaeng Wattana Road, Thung Song Hong Sub-District

Lak Si District, Bangkok 10002, Thailand

| Attention: | Mr. Nusttanakit Sasianon |

| Email: | nusttanakit.sa@bangkoktellink.co.th |

with copies (which shall

not constitute notice) to:

S1Win Consultant Co., Ltd.

88 Soi Nak Niwat 6, Nak Niwat Road

Lat Phrao Sub-District, Lat Phrao District

Bangkok 10230, Thailand

Attention: Mr. Sawin Laosethakul

Email: sawim@s1winconsultant.com

| Attention: | Mr. Daniel Fong |

| Email: | daniel@s1winconsultant.com |

7.

Governing Law; Jurisdiction; Waiver of Jury Trial. This LOI and the rights and obligations

of the Parties hereunder will be governed by and construed under and in accordance with the laws of the state of Delaware, without giving

effect to any choice of law or conflict of law provision or rule that would cause the application of the laws of any jurisdictions other

than the State of Delaware. Each Party consents and submits to the exclusive jurisdiction of the Chancery Court of the State of Delaware

(or, if the Chancery Court of the State of Delaware declines to accept jurisdiction, any state or federal court within the State of Delaware)

for the adjudication of any action or legal proceeding relating to or arising out of this agreement and the transactions contemplated

hereby (and each Party agrees not to commence any action or legal proceeding relating thereto except in any such court). Each Party hereby

irrevocably and unconditionally waives any objection which it may now or hereafter have to the laying of venue in such courts and agrees

not to plead or claim in any such court that any such action or legal proceeding brought in any such court has been brought in an inconvenient

forum. Each Party hereby agrees that service of any process, summons, notice or document by U.S. certified mail addressed to such Party

at the address set forth above (or such other address as notified by either party to the other Party in writing) shall be effective service

of process for any such suit, action or proceeding brought against such Party in any such court. Each Party agrees that a final judgment

in any such suit, action or proceeding brought in any such court shall be conclusive and binding upon such Party and may be enforced in

any other courts to whose jurisdiction such Party is or may be subject by suit upon such judgment.

8.

Trust Account Waiver. The Company hereby acknowledges that the Public Entity has established a trust account (the “Trust

Account”) containing the proceeds of its initial public offering (the “IPO”) and from certain private placements

occurring simultaneously with the IPO (including interest accrued from time to time thereon) for the benefit of the Public Entity’s

public stockholders. For and in consideration of the Public Entity’s entering into this LOI, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Company hereby agrees on behalf of itself and its affiliates that, notwithstanding

anything to the contrary herein, as a result of this LOI, neither the Company nor any of its affiliates does now or shall at any time

have any right, title, interest or claim of any kind in or to any monies in the Trust Account or distributions therefrom, or make any

claim against the Trust Account (including any distributions therefrom), regardless of whether such claim arises as a result of, in connection

with or relating in any way to, this LOI or any proposed or actual business relationship between the Public Entity or the Public Entity’s

Representatives, on the one hand, and the Company or its Representatives, on the other, or any other matter, and regardless of whether

such claim arises based on contract, tort, equity or any other theory of legal liability (any and all such claims are collectively referred

to hereafter as the “Released Claims”). The Company hereby irrevocably waives (on its own behalf and on behalf of its

related parties) any Released Claims that it may have against the Trust Account (including any distributions therefrom) now or in the

future as a result of, or arising out of, any discussions, contracts or agreements with the Public Entity or this LOI and will not seek

recourse against the Trust Account (including any distributions therefrom) relating to this LOI or for any reason whatsoever. The Company

agrees and acknowledges that such irrevocable waiver is material to this LOI and specifically relied upon by the Public Entity and the

Public Entity’s affiliates to induce the Company to enter in this LOI, and the Company further intends and understands such waiver

to be valid, binding and enforceable against the Company and each of its affiliates under applicable law.

9.

Miscellaneous. This LOI supersedes any prior written or oral understanding or agreements between the Parties related to the subject

matter hereof (other than the NDA). This LOI may be amended, modified or supplemented only by written agreement of the Parties. The headings

set forth in this LOI are for convenience of reference only and shall not be used in interpreting this LOI. In this LOI, the term: (x)

“including” and “include” mean including without limiting the generality of any description preceding or following

such term and shall be deemed in each case to be followed by the words “without limitation;” (y) “person” shall

refer to any individual, corporation, partnership, trust, limited liability company or other entity or association, including any governmental

or regulatory body, whether acting in an individual, fiduciary or any other capacity; and (z) “affiliate” shall mean, with

respect to any specified person, any other person or group of persons acting together that, directly or indirectly, through one or more

intermediaries controls, is controlled by or is under common control with such specified person. This LOI may be executed in any number

of counterparts (including by facsimile, pdf or other electronic document transmission), each of which shall be deemed to be an original,

but all such counterparts shall together constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic

mail (including via www.docusign.com, PDF and any other electronic signature covered by the U.S. Federal ESIGN Act of 2000, Uniform Electronic

Transactions Act, the Electronic Signatures and Records Act or other applicable law) or other transmission method and any counterpart

so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[Remainder of Page Intentionally Left Blank;

Signature Pages Follow]

Please acknowledge your acceptance

of and agreement to the foregoing by signing and returning to the undersigned as soon as possible a counterpart of this LOI.

| |

Sincerely, |

| |

|

| |

AROGO CAPITAL acquisition corp. |

| |

|

| |

By: |

/s/ Suradech Taweesaengsakulthai |

| |

Name: |

Suradech Taweesaengsakulthai |

| |

Title: |

Chief Executive Officer |

Accepted and agreed as of the date first written above.

| Bangkok Tellink Co., Ltd. |

|

| |

|

| By: |

/s/ Nusttanakit Sasianon |

|

| Name: |

Nusttanakit Sasianon |

|

| Title: |

Founder & Chief Executive Officer |

|

| |

|

| |

|

| By: |

/s/ Sawin Laosethakul |

|

| Name: |

Sawin Laosethakul |

|

| Title: |

Director |

|

Exhibit

A

Term

Sheet

This

Term Sheet is intended solely for discussion purposes and does not create a binding obligation or represent or constitute an offer, undertaking

or commitment on the part of either Party to consummate or negotiate the contemplated transactions, and any such obligation will be created

only by the execution and delivery of the Definitive Agreements, the provisions of which will supersede this Term Sheet and all other

understandings between the Parties. Without limiting the generality of the foregoing, all terms and conditions contained in this Term

Sheet are subject to further change and refinement as the Parties shall mutually agree, as shall be set forth in the Definitive Agreements.

All capitalized terms used in this Term Sheet and not otherwise defined herein shall have the respective meanings ascribed to such terms

in the binding letter of intent to which this Term Sheet is attached.

| Transaction:

|

A

business combination between the Company and the Public Entity, whose common stock and warrants are currently listed for trading

on the OTC, pursuant to which the Public Entity will directly or indirectly acquire 100% of the outstanding equity of the Company

in exchange for the consideration described below (the “Business Combination”). The legal transaction structure

(including any pre-closing reorganization) will be determined by the Parties based on business, legal, tax, accounting and other

considerations (and, in the event the transaction structure results in a person other than the Public Entity being the parent listed

company, references in this term sheet to the Public Entity will be deemed to mean such new parent company, as applicable). |

| Transaction

Consideration: |

The

total consideration provided to the Company’s equityholders (including holders of stock options) (the “Existing Equityholders”)

in the Business Combination will be between $300,000,000 to $1,000,000,000 (the “Transaction Consideration”),

calculated on a cash-free, debt-free basis and assuming normalized levels of working capital.

The

Transaction Consideration would be paid by the post business combination company (the “Surviving Company”) by

issuance of shares of common stock of the Surviving Company (the “Transaction Shares”), which would each be valued

at $10.00 per share with no minimum cash condition.

The

Transaction Consideration will consist of up to 100,000,000 shares of the Public Entity’s common stock issued to the Existing Equityholders

(the “Share Consideration”). In addition, the Business Combination will result in up to $19 million (assuming no redemptions

in accordance with the Public Entity’s certificate of incorporation, as amended, as in effect from time to time) of cash being

made available to the Surviving Company for use as working capital and for general corporate purposes (the “Primary Capital”). |

| Equity

Financing: |

The

Public Entity raised $105,052,500 in its IPO (with $19 million currently held in trust), which amount (net of redemptions) will be

released to the Public Entity at the Closing to pay the Cash Consideration, the Primary Capital and transaction expenses. |

| Debt

Financing |

None. |

| Additional

Financing: |

The

Public Entity and the Company will reasonably cooperate to seek a PIPE pursuant to customary and binding subscription agreements

with certain investors (to be agreed upon by the Company and the Public Entity) concurrently with the execution of the Definitive

Agreements (the “PIPE Financing”), of which Koo Dom Investment, LLC (the “Sponsor”)and its

affiliates (together with the Sponsor, the “Sponsor Group”) shall endeavor its reasonable best efforts to provide

or secure an amount to be mutually agreed based on budgets and inflection points to be discussed. The PIPE Financing will be contingent

upon, and close concurrently with, the Closing. The terms of any PIPE Financing will be negotiated and agreed to by both the Company

and the Public Entity, consistent with prevailing market terms. |

| Board

of Directors: |

The

board of directors of the Surviving Company at the Closing will consist of (i) 3 directors designated by the Company, one of whom

shall be considered an “independent director” in accordance with the rules and regulations of the applicable U.S. securities

exchange (e.g., the Nasdaq Stock Market, LLC, the New York Stock Exchange, or other U.S. stock exchange, the “Exchange”),

(ii) 1 independent director designated by the Sponsor, and, (iii) 1 independent director mutually acceptable to the Company and the

Sponsor. The composition of the board of directors of the Surviving Company shall comply with the director independence

rules as required the by the applicable Exchange. |

| Business

Combination Agreement: |

The

obligations of the Parties will be subject to execution of the Business Combination Agreement containing terms and conditions mutually

satisfactory to the Public Entity and the Company. The Business Combination Agreement will include representations, warranties and

covenants customary for a transaction of this nature.

The

execution of the Business Combination Agreement is also subject to satisfactory completion of mutual due diligence by the Public

Entity and the Company.

In

connection with the entry into the Business Combination Agreement, Company management will provide reasonable cooperation and participation

in roadshow presentations to help with Public Entity’s proxy solicitation and stockholder marketing efforts, and reasonably

make themselves available to assist in such efforts upon advance written notice.

The

Company will request any necessary third-party approvals from the requisite third parties in connection with execution of the letter

of intent, the Business Combination Agreement, and any other documents that may be required in connection with the proposed business

combination. |

| Timing: |

The

target date for signing the Business Combination Agreement and announcement thereof is no later than February 28, 2025. It

is understood that this date will be largely driven by the Company’s readiness to deliver requisite PCAOB compliant financial

statements to the Public Entity. |

| Closing

Conditions: |

The

Parties agree that the Business Combination Agreement shall not include a minimum cash requirement. The obligations of either Party

to consummate the transaction will remain subject to customary closing conditions for a transaction of this nature, including without

limitation:

(i) Completion

of due diligence including business, legal, tax, and financial (including a Quality of Earnings),

(ii) Completion

of any required stock exchange and regulatory review by the SEC and the Exchange, receipt of any required regulatory approvals, and

expiration of any waiting periods under HSR,

(iii) Approval

by the Public Entity’s stockholders of the Business Combination and related matters,

(iv) There

shall have not been a “material adverse effect” (to be defined by the Parties in the Business Combination Agreement)

following the date of signing the Business Combination Agreement (with respect to the Company), and

(v) The

Business Combination Agreement will contain mutually agreed customary termination rights for a transaction of this nature. |

| Lock-Up: |

All

Share Consideration to be issued in the Business Combination will be subject to a six-month lock-up (the “Lock-Up”),

subject to exceptions to be agreed upon. |

| Registration

Rights: |

The

Surviving Company will use commercially reasonable efforts to file a shelf registration statement with respect to resales of the

Share Consideration within 30 calendar days of Closing and will use its commercially reasonable efforts to cause such shelf registration

statement to be declared effective by the SEC as soon as practicable after the filing thereof to facilitate sales of Share Consideration

after the expiration of the Lock-Up.

Other

registration rights are to be set forth in a registration rights agreement providing for customary demand and piggyback registration

rights for a transaction of this nature. |

| Filings: |

As

soon as practicable following the execution of the Business Combination Agreement, the parties will file all required submissions

for stockholder, regulatory and governmental approval, including a proxy statement/prospectus on Form S-4 (or Form F-4, as applicable,

the “Proxy Statement”) with the SEC for the purpose of obtaining Public Entity stockholder approval and registering

the issuance of Public Entity’s common stock. The Proxy Statement will include audited annual financial statements of the Company

prepared in accordance with PCAOB standards as required by applicable U.S. federal securities laws. All costs associated with preparing

such audited financial statements shall be borne 100% by the Company. In accordance with Section 5 of the letter of intent,

the Company shall pay its own legal, financial, consulting, accounting, and any similar costs incurred at any time in connection

with pursuing or consummating the Proposed Transaction.

Any

HSR filing (or similar fees) with respect to any regulatory or governmental approval, including the Proxy Statement, shall be borne

by the Public Entity, and paid exclusively in a manner of Public Entity’s choice.

The Parties agree that:

(i) The

current HSR Filing Fee is $45,000 for a transaction consideration valued in excess of $92 million but less than $184 million; $125,000

for a transaction consideration valued at $184 million or greater but less than $919.9 million.

Notwithstanding

above, the Parties agree that the Public Entity shall pay 100% of the costs associated with respect to any SEC or Exchange listing fees.

The

Parties agree that:

(i) The

current SEC Filing Fee rate is $153.10 per $1,000,000. The fee is calculated by multiplying the aggregate amount by 0.00015310.

Acquisition companies (such as the Public Entity) intending to list securities on an Exchange are subject to certain entry and application

fees. For example, the current Nasdaq Capital Market entry fee ranges from $50,000 to $75,000, depending on the number of outstanding

shares. Additional Exchange-specific fees may apply, including, without limitation, non-refundable application fees.

|

| Governing

Law, Jurisdiction: |

The

Business Combination Agreement and other applicable Definitive Agreements will be governed by the laws of the State of Delaware,

with exclusive jurisdiction of the Chancery Court of the State of Delaware (or, if the Chancery Court of the State of Delaware declines

to accept jurisdiction, any state or federal court within the State of Delaware). |

A-3

Exhibit 99.1

Arogo Capital Acquisition Corp. Announces Binding

Letter of Intent with Bangkok Tellink Co., Ltd, a Provider of Innovative Telecommunications and IoT Solutions, in Connection with a Proposed

Business Combination Transaction

Miami, FL and Bangkok, Thailand – 10

December 2024 – Arogo Capital Acquisition Corp. (“Arogo Capital”) (OTC: AOGO) today announced that it has signed

a binding letter of intent (“LOI”) with Bangkok Tellink Co., Ltd (“Bangkok Tellink”), an emerging leader in advanced

telecommunications, mobile network technology, and Internet of Things (IoT) solutions. The LOI sets forth the preliminary terms and conditions

for a potential business combination that would be expected to result in Bangkok Tellink becoming a publicly traded company in the United

States.

Bangkok Tellink at a Glance

Established on January 24, 2019, Bangkok Tellink

specializes in comprehensive mobile phone signal systems across multiple frequencies (700MHz, 850MHz, 2100MHz, 2300MHz, and 26GHz). Operating

under its ‘INFINITE’ brand, the company provides a range of services including Smart Solutions, IoT Sim Cards, E-sim, SMPP

(virtual SMS), SIP trunk (voice virtual number), and software development. Through its offerings, Bangkok Tellink seeks to deliver integrated

telecommunications solutions with a goal of enhancing both professional and personal lives of its customers.

Bangkok Tellink’s commitment to innovation,

efficient operations, and strategic growth positions it as a versatile technology provider, poised to meet evolving connectivity demands

and contribute to sustainable development.

Strategic Rationale

The material terms of a definitive business combination

agreement are subject to ongoing negotiations, but if agreement is reached and the proposed business combination is completed, it is anticipated

to grant Bangkok Tellink enhanced access to U.S. capital markets. Bangkok Tellink believes that this proposed business combination could

accelerate the rollout of its next-generation telecommunication technologies, foster broader geographic expansion, and provide increased

financial flexibility to advance research and development efforts.

Management Commentary

“We believe that Bangkok Tellink has demonstrated

an impressive ability to innovate and deliver exceptional telecommunications and IoT solutions,” said Suradech Taweesaengsakulthai,

Chief Executive Officer of Arogo Capital. “The signing of this binding LOI marks an important first step in exploring a potential

business combination, and we look forward to conducting further due diligence and negotiating definitive terms. We believe that Bangkok

Tellink’s vision, coupled with Arogo’s strategic support, could create substantial long-term value for the proposed combined

company’s shareholders and customers worldwide.”

“We are excited to work with Arogo Capital

and move forward with negotiation of a potential business combination,” said Nusttanakit Sasianon, Founder and Chief Executive Officer

of Bangkok Tellink. “Our mission is to uplift lives through cutting-edge connectivity and innovative solutions. We believe that

partnering with Arogo could provide us with an opportunity to broaden our horizons, enhance our product and service offerings, and accelerate

growth. We are committed to making this potential milestone a reality and continuing to build on our progress.”

Next Steps

There is no assurance that the parties will enter

into a definitive agreement or ultimately consummate the proposed transaction. If and when a definitive business combination agreement

is executed, further details will be provided.

About Arogo Capital Acquisition Corp.

Arogo Capital Acquisition Corp. is a blank check

company. Arogo aims to acquire one and more businesses and assets, via a merger, capital stock exchange, asset acquisition, stock purchase,

and reorganization. For more information, visit www.arogocapital.com.

About Bangkok Tellink Co., Ltd

Bangkok Tellink Co., Ltd, established in 2019,

is at the forefront of Thailand’s telecommunications industry. By offering mobile network infrastructure, IoT devices, E-sim services,

and software development, Bangkok Tellink provides integrated solutions that foster connectivity and productivity. Bangkok Tellink invests

in innovation, operational efficiency, and sustainability to position itself as a prominent telecommunications and technology leader.

Additional Information and Where to Find It

For additional information regarding the LOI and

the proposed business combination, see Arogo Capital’s Current Report on Form 8-K, which was filed with the U.S. Securities and

Exchange Commission (“SEC”) concurrently with the issuance of this press release. In connection with the proposed business

combination, Arogo Capital intends to file with the SEC a Current Report on Form 8-K if and when the business combination agreement is

executed, and subsequently to prepare and file a registration statement on Form S-4 (or Form F-4, as applicable, the “Registration

Statement”), and after the Registration Statement is declared effective by the SEC, Arogo Capital intends to mail a definitive proxy

statement/prospectus relating to the proposed transaction to its stockholders. This press release does not contain all the information

that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision

or any other decision in respect of the proposed business combination. Arogo Capital’s stockholders and other interested persons

are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus

and other documents filed in connection with the proposed business combination with the SEC by Arogo Capital, as these materials will

contain important information about Arogo Capital and Bangkok Tellink, and the proposed business combination. When available, the definitive

proxy statement/prospectus and other relevant materials for the proposed business combination will be mailed to stockholders of Arogo

Capital as of a record date to be established for voting on the proposed business combination. Such stockholders will also be able to

obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with

the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to Arogo Capital Acquisition

Corporation, 848 Brickell Ave, Penthouse 5, Miami, FL 33131.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section

21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on beliefs and assumptions

and on information currently available to Arogo Capital and Bangkok Tellink. In some cases, you can identify forward-looking statements

by the following words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing,” “target,” “seek”

or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although

not all forward-looking statements contain these words. Any statements that refer to expectations, projections or other characterizations

of future events or circumstances, including that the parties will enter into a definitive business combination agreement or will subsequently

consummate the proposed business combination, projections of market opportunity and market share, the capability of Bangkok Tellink’s

business plans including its plans to expand, the sources and uses of cash from the proposed business combination, the anticipated enterprise

value of the combined company following the consummation of the business combination, any perceived benefits of Bangkok Tellink’s

partnerships, strategies or plans as they relate to the proposed business combination, anticipated benefits of the business combination,

and expectations related to the terms and timing of the business combination are also forward-looking statements. These statements involve

risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially

different from those expressed or implied by these forward-looking statements. Although the management team of each of Arogo Capital

and Bangkok Tellink believes that it has a reasonable basis for each forward-looking statement contained in this press release, each

of Arogo Capital and Bangkok Tellink cautions you that these statements are based on assumptions made as of the date hereof and are subject

to risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such

forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not

limited to: the ability to complete the proposed business combination due to the failure to obtain approval from Arogo Capital’s

stockholders or satisfy other closing conditions in any future business combination agreement, the receipt of regulatory approvals, the

occurrence of any event that could give rise to the termination of a future business combination agreement, the ability to recognize

the anticipated benefits of the business combination, the amount of redemption requests made by Arogo Capital’s public stockholders,

costs related to the proposed business combination, the risk that the business combination disrupts current plans and operations as a

result of the announcement and consummation of the proposed business combination, the outcome of any potential litigation, government

or regulatory proceedings and other risks and uncertainties, including those included under the heading “Risk Factors”

and “Cautionary Note Regarding Forward-Looking Statements” in Arogo Capital’s Annual Report on Form 10-K for

the year ended December 31, 2023 and subsequent Forms 10-Q, in the proxy statement/prospectus relating to the proposed business combination

to be filed with the SEC, and in any subsequent filings with the SEC, including the definitive proxy statement relating to the proposed

business combination and other filings made by Arogo Capital with the SEC from time to time. There may be additional risks that neither

Arogo Capital or Bangkok Tellink presently know or that Arogo Capital and Bangkok Tellink currently believe are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements. Nothing contained herein should be regarded

as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which

speak only as of the date they are made. Neither Arogo Capital nor Bangkok Tellink undertakes any duty, and each of Arogo Capital and

Bangkok Tellink express disclaim any obligations, to update or alter any projections or forward-looking statements, whether as a result

of new information, future events or otherwise.

No Offer or Solicitation

This press release shall

not constitute a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of

the proposed business combination and does not constitute an offer to sell or a solicitation of an offer to buy any securities of Arogo

Capital or Bangkok Tellink, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Participants in Solicitation

Arogo Capital and Bangkok

Tellink, and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed

to be participants in the solicitation of proxies of Arogo Capital’s stockholders in connection with the proposed business combination.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Arogo Capital’s stockholders

in connection with the proposed business combination will be set forth in the Registration Statement, of which the proxy statement/prospectus

forms a part, when it is filed with the SEC.

Contacts:

For Arogo Capital Acquisition Corp.:

Nisachon Rattanamee

nisachon@arogocapital.com

For Bangkok Tellink Company Limited:

Daniel Fong

daniel@s1winconsultant.com

3

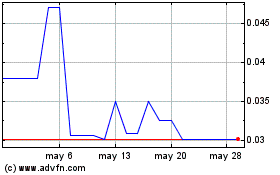

Arogo Capital Acquisition (NASDAQ:AOGOW)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Arogo Capital Acquisition (NASDAQ:AOGOW)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024