SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

(Amendment No. __)

Check the appropriate box:

☒ Preliminary Information Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

☐ Definitive Proxy Statement

APPLIED DIGITAL CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11.

PRELIMINARY COPY SUBJECT TO COMPLETION DATED MAY 10, 2024

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

DEAR STOCKHOLDER:

This notice and the accompanying Information Statement are being distributed to the holders of record of the common stock, par value $0.001 per share (the “Common Stock”) of Applied Digital Corporation, a Nevada corporation (the “Company”), as of the close of business on May 8, 2024 (the “Record Date”), in accordance with Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act. The purpose of this notice and the accompanying Information Statement is to notify the stockholders of actions approved by our Board of Directors (the “Board”) and taken by written consent in lieu of a meeting by the holders of a majority of the voting power of the stockholders of the Company as of the Record Date (the “Written Consent”).

| | |

| Action approved by the Written Consent |

•Authorizing an amendment to the Company’s Articles of Incorporation increasing in the number of shares authorized for issuance thereunder from 166,666,667 to 300,000,000 (the “Amendment”). |

The Written Consent is the only stockholder approval required to effect the Amendment under the Nevada Revised Statutes, our Second Amended and Restated Articles of Incorporation and our Amended and Restated Bylaws, each as amended to date. No consent or proxies are being requested from our stockholders, and our Board is not soliciting your consent or proxy in connection with the Amendment. The Amendment, as approved by the Board and pursuant to the Written Consent, will only become effective if and when the Board determines to effect it but in any event not sooner than twenty (20) calendar days after the accompanying Information Statement is first mailed or otherwise delivered to the stockholders.

The accompanying Information Statement is first being mailed to the stockholders on or about May __, 2024.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Sincerely,

Wes Cummins

Chairman of the Board

PRELIMINARY COPY SUBJECT TO COMPLETION DATED MAY 10, 2024

INFORMATION STATEMENT

GENERAL

This Information Statement and the preceding notice are being distributed to the holders of record of the common stock, par value $0.001 per share (the “Common Stock”) of Applied Digital Corporation, a Nevada corporation (the “Company”), as of the close of business on May 8, 2024 (the “Record Date”), in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of the accompanying notice and this Information Statement is to notify the stockholders of actions approved by our Board of Directors (the “Board”) and taken by written consent in lieu of a meeting by holders of a majority of the voting power of the stockholders of the Company as of the Record Date (the “Written Consent”).

| | |

| The Written Consent approved the following action: |

•Authorizing an amendment to the Company’s Articles of Incorporation increasing in the number of shares authorized for issuance thereunder from 166,666,667 to 300,000,000 (the “Amendment”). |

The Written Consent is the only stockholder approval required to effect the Amendment under the Nevada Revised Statutes, our Second Amended and Restated Articles of Incorporation and our Amended and Restated Bylaws, each as amended to date. No consent or proxies are being requested from our stockholders, and our Board is not soliciting your consent or proxy in connection with the Amendment. The Amendment, as approved by the Board and by the Company’s stockholders pursuant to the Written Consent, will only become effective if and when the Board determines to effect it but in any event not sooner than twenty (20) calendar days after the accompanying Information Statement is first mailed or otherwise delivered to the stockholders. The form of the Amendment is attached hereto as Appendix A.

The accompanying Information Statement is first being mailed to the stockholders on or about May , 2024. The Information Statement is also available to stockholders:

•in our filings with the Securities and Exchange Commission (the “SEC”), which you can access electronically at the SEC’s website at http://www.sec.gov; and

•on the Company’s website at www.applieddigital.com.

As of the Record Date, 122,827,071 shares of Common Stock were issued and outstanding. Each holder of Common Stock is entitled to one vote for each share of Common Stock held.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

AMENDMENT TO INCREASE THE AUTHORIZED SHARES

The Company’s Second Amended and Restated Articles of Incorporation, as amended to date (the “Articles”), currently authorize the issuance of a total of 171,666,667 shares of capital stock. Of such shares, 166,666,667 are designated as Common Stock and 5,000,000 are designated as preferred stock. As of May 8, 2024, there were 122,827,071 shares of Common Stock issued and outstanding.

In addition to the 122,827,071 shares of Common Stock outstanding as of May 8, 2024, the Company had reserved for issuance (i) 5,069,098 shares of Common Stock issued but not outstanding, which shares are held in treasury and are available for re-issuance by the Company, (ii) 13,572,810 shares of Common Stock under our 2022 Incentive Plan, as amended, (iii) 1,054,425 shares of Common Stock under our 2022 Non-Employee Director Stock Plan, as amended, (iv) 204,168 shares of Common Stock under restricted stock unit awards to certain consultants, (v) 24,532,449 shares of Common Stock which may be issued as payment of a certain outstanding promissory note made by us in favor of AI Bridge Funding LLC, (vi) 23,585,000 shares of Common Stock under to be issued upon the conversion of certain outstanding promissory notes issued by us to YA II PN, LTD, and (vii) 3,000,000 shares of Common Stock upon exercise of outstanding warrants.

The Company has no shares available for future issuances other than for reserved usages, unless reserved shares are released or waived. Such future issuances could include the sale of securities in order to raise capital, the payment of consideration for acquisitions, additional shares issued in connection with grants made to employees under new or expanded existing compensation plans or arrangements, and other uses not currently anticipated. The Board, and the Company’s stockholders having a majority of the voting power as of the Record Date pursuant to the Written Consent, have approved the Amendment, the form of which is attached hereto as Appendix A, to effect an increase in the number of authorized shares of Common Stock, so that the number of shares of Common Stock would increase by 133,333,333 shares to 300,000,000 shares. In order to effectuate the Amendment, the Company intends to file the Amendment with the Secretary of State of the State of Nevada promptly no earlier than, and promptly after, the twentieth (20th) calendar day after this Information Statement is first mailed or otherwise delivered to the stockholders, unless the Board determines otherwise.

The Company believes that such increase is in the best interests of the Company and its stockholders, as it would provide the Company with flexibility and alternatives in structuring future transactions, and that it would be detrimental to the Company and its stockholders if the Company were unable to issue shares of Common Stock at such times and upon terms as the Board deems necessary or appropriate. However, currently the Company has no specific plans for issuance of the additional shares of Common Stock that would become available pursuant to the Amendment.

The Amendment would not change any of the rights, restrictions, terms or provisions relating to the Common Stock or the preferred stock. Under the Nevada Revised Statutes, stockholders are not entitled to appraisal rights with respect to this amendment. The Company will not

independently provide stockholders with any such right. Additionally, holders of Common Stock do not have any preemptive rights with respect to the issuance of Common Stock.

Future issuances of Common Stock could affect stockholders. Any future issuance of Common Stock, other than on a pro-rata basis, would dilute the percentage ownership and voting interest of the then current stockholders.

SECURITY OWNERSHIP

The table below shows the beneficial ownership as of May 8, 2024 of our Common Stock held by each of the directors, nominees for director, named executive officers, all current directors and executive officers as a group and each person known to us to be the beneficial owner of more than 5% of our common stock. As of May 8, 2024, we had 122,827,071 shares of Common Stock outstanding.

| | | | | | | | |

Name | Number of Shares Beneficially Owned(1) | Percent of Common Stock |

| Wes Cummins | 23,585,688(2) | 19.2% |

| David Rench | 280,445 | * |

| Michael Maniscalco | 75,327 | * |

| Ella Benson | 101,460 | * |

| Chuck Hastings | 603,006 | * |

| Rachel H. Lee | 79,219 | * |

| Douglas Miller | 228,506 | * |

| Richard Nottenburg | 213,686 | * |

| Kate Reed | 57,160 | * |

| All current directors and executive officers as a group (9 persons) | 25,224,498 | 20.5% |

| | |

Hood River Capital Management LLC 2373 PGA Blvd., Suite 200 Palm Beach Gardens, FL 33410 | 8,584,355 | 7.0% |

Capital Research Global Investors 333 South Hope Street, 55th Floor Los Angeles, CA 90071 | 7,337,288 | 6.0% |

Oasis Investments II Master Fund Ltd. Ugland House, PO Box 309 Grand Cayman, KY1-1104, Cayman Islands | 7,097,890(3) | 5.8% |

Guo Chen Bo Dong c/o GMR Limited Trinity Chamber PO BOX 4301 Tortola, British Virgin | 6,370,009(4) | 5.2% |

______________________________* Less than 1% of outstanding shares.

Except as otherwise indicated, the address of each person named in this table is c/o Applied Digital Corporation, 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219.

1. In determining the number and percentage of shares beneficially owned by each person, shares that may be acquired by such person pursuant to options exercisable or restricted stock units that vest within 60 days after May 8, 2024 are deemed outstanding for purposes of determining the total number of outstanding shares for such person and are not deemed outstanding for such purpose for all other stockholders. To our knowledge, except as otherwise indicated, beneficial ownership includes sole voting and dispositive power with respect to all shares.

2. Includes (i) 17,590,238 shares of Common Stock held by Cummins Family Ltd, of which Mr. Cummins is the CEO, (ii) 742,166 shares of Common Stock held by Wesley Cummins IRA Account, and (iii) 2,030,686 shares of Common Stock held by 272 Capital LP, of which Mr. Cummins is the President.

3. Oasis Management Company Ltd. is the investment manager of Oasis Investments II Master Fund Ltd. Seth Fischer is responsible for the supervision and conduct of all investment activities of Oasis Management Company Ltd., including all investment decisions with respect to the assets of Oasis Investments II Master Fund Ltd., with respect to the shares of Common Stock held by of Oasis Investments II Master Fund Ltd.

4. Guo Chen, as sole director of GMR Limited, has voting and dispositive power over the shares of our Common Stock held by GMR Limited. Mr. Chen disclaims beneficial ownership of such shares.

FURTHER INFORMATION

Available Information

We are required to file periodic reports, proxy statements and other information relating to our business, financial and other matters with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our filings are available to the public over the Internet at the SEC’s web site at http://www.sec.gov.

Householding

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of our Notice, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Notice, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of the Notice for your household, please contact our transfer agent, Computershare Trust Company, N.A., 150 Royall St., Suite 101, Canton, MA 02021, or by telephone at (800) 736-3001.

If you participate in householding and wish to receive a separate copy of the Notice, or if you do not wish to participate in householding and prefer to receive separate copies of the Notice in the future, please contact Computershare Trust Company, N.A. as indicated above. Beneficial stockholders can request information about householding from their nominee.

* * * * *

APPENDIX A

Form of Amendment to Articles of Incorporation

Article THIRD of the Second Amended and Restated Articles of Incorporation of Applied Digital Corporation, as amended, is amended in its entirety to read as follows:

The total number of shares of capital stock which this corporation shall have the authority to issue is three hundred five million (305,000,000) with a par value of $0.001 per share amounting to $305,000.00. Three hundred million (300,000,000) of those shares are Common Stock and five million (5,000,000) of those shares are Preferred Stock. Each share of Common Stock shall entitle the holder thereof to one vote, in person or by proxy, on any matter on which action of the stockholders of this corporation is sought. The holders of Preferred Stock shall have no right to vote such shares, except (i) as determined by the Board of Directors of this corporation in accordance with the provisions of Section (3) of Article FOURTH of these Second Amended and Restated Articles of Incorporation, as amended, or (ii) as otherwise provided by the Nevada General Corporation Law, as amended from time to time.

* * *

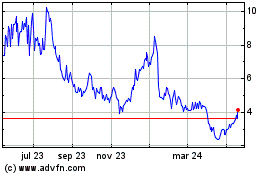

Applied Digital (NASDAQ:APLD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

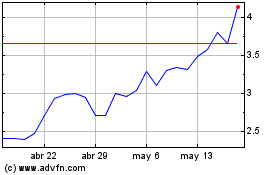

Applied Digital (NASDAQ:APLD)

Gráfica de Acción Histórica

De May 2023 a May 2024