false

0001808665

0001808665

2024-05-16

2024-05-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 16, 2024

ASSERTIO HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

01-39294 |

|

85-0598378 |

(State

or Other Jurisdiction of

Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

100

S. Saunders Road, Suite

300, Lake Forest, IL 60045

(Address of Principal Executive Offices; Zip Code)

(224) 419-7106

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| |

Title of each class: |

|

Trading Symbol(s): |

|

Name

of each exchange on which registered: |

|

| |

Common Stock, $0.0001 par value |

|

ASRT |

|

The

Nasdaq Stock Market LLC |

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Chief Executive Officer Transition

Effective May 29, 2024, the Board of

Directors (the “Board”) of Assertio Holdings, Inc. (the “Company”) appointed Brendan P. O’Grady to

serve as the Company’s Chief Executive Officer (and principal executive officer) and as a director. Heather L. Mason, who has served

as Interim Chief Executive Officer since January 2024, will transition back to her role as independent director.

Mr. O’Grady, age 57, most recently

served as CEO of the Global Formulations Business at Glenmark Pharmaceuticals Ltd. (India: NSE), a multinational pharmaceutical company,

from June 2022 to February 2024, where he was responsible for a P&L spanning six continents, driving new product launches,

growing key end markets and restoring profitability in underperforming markets. Prior to that, Mr. O’Grady served as Chief

Growth and Commercial Officer of American Well Corp. dba Amwell (NYSE: AMWL), an online healthcare services company, from August 2021

to June 2022, where he was responsible for building and overseeing a go-to-market strategy. Prior to that, he served in various positions

of increasing responsibility at Teva Pharmaceutical Industries Ltd. (NYSE: TEVA) from 2001 to 2021, most recently serving as CEO and

President, Teva USA and Executive Vice President, North America Commercial, from November 2017 to August 2021, where he was

responsible for leading Teva’s North America business, including specialty, generic and over-the-counter pharmaceuticals, and the

abbreviated new drug application drug distribution business. Prior to that, Mr. O’Grady served in various positions of increasing

responsibility at Sanofi (Nasdaq: SNY) from 1991 to 2001. Mr. O’Grady received a B.S. in Management Science, Marketing Concentration

from the State University of New York and an M.B.A. from Baker University.

On May 19, 2024, in connection with his appointment as Chief Executive

Officer, the Company entered into an offer letter with Mr. O’Grady, effective as of May 29, 2024 (the “Offer Letter”).

Pursuant to the terms of the Offer Letter, Mr. O’Grady’s base salary will be $850,000, with an annual target cash bonus

opportunity of 85% of his base salary. The Offer Letter also provides that, as a material inducement to Mr. O’Grady’s

commencement of employment, Mr. O’Grady will be awarded initial grants of (i) stock options to purchase 1,800,000 shares

of the Company’s common stock and (ii) 500,000 restricted stock units, each as part of the Company’s Inducement Award

Program, with one-third of each grant vesting each year over a three-year period commencing on May 29, 2024. Mr. O’Grady

will also be eligible to receive annual equity-based awards pursuant to the Company’s Amended and Restated 2014 Omnibus Incentive

Plan.

Mr. O’Grady also entered into a Management Continuity

Agreement (the “MCA”) with the Company, effective as of May 29, 2024. Pursuant to the terms of the MCA, upon

Mr. O’Grady’s termination other than for Cause, death or Disability, or Mr. O’Grady’s voluntary

termination for Good Reason (each as defined in the MCA) within the period beginning ninety days prior to a Change in Control (as

defined in the MCA) and ending twenty-four months following a Change in Control (the “Change in Control Period”),

subject to Mr. O’Grady’s execution and non-revocation of a release of claims in favor of the Company and continued

compliance with certain restrictive covenants, Mr. O’Grady will be entitled to (i) a lump sum cash payment in an

amount equal to two times the higher of (1) the base salary which Mr. O’Grady was receiving immediately prior to the

Change in Control or (2) the base salary which Mr. O’Grady was receiving immediately prior to his termination of

employment, payable on the 60th day following Mr. O’Grady’s termination of employment or, if his

termination of employment is prior to the Change in Control, on the date of the Change in Control; (ii) a lump sum cash payment

in an amount equal to two times Mr. O’Grady’s target annual bonus, payable on the 60th day following

Mr. O’Grady’s termination of employment or, if his termination of employment is prior to the Change in Control, on

the date of the Change in Control; (iii) payment of the full cost of the health insurance benefits provided to

Mr. O’Grady and his spouse and dependents through the earlier of the end of the 24 month period following the date of

termination or the date upon which Mr. O’Grady is no longer eligible for such COBRA or other benefits under applicable

law; (iv) payment of any earned but unpaid annual bonus for the year immediately preceding the year of termination, to be paid

at the time the Company pays bonuses with respect to such year to its executives generally; (v) up to three consecutive months

of outplacement services, not to exceed $5,000 per month and (vi) 100% of Mr. O’Grady’s unvested option

shares, restricted stock, restricted stock units, other equity-based awards and other long-term incentive awards will become

immediately vested, provided that any performance-based awards will be calculated as set forth in the applicable award agreement or,

if not specified therein, based on achieving the target level of performance. Notwithstanding the foregoing, in the event that a

termination as described in this paragraph occurs prior to the date of the Change in Control, then if any of

Mr. O’Grady’s unvested option shares, restricted stock, restricted stock units, other equity-based awards and other

long-term incentive awards are forfeited as the result of such termination of employment, Mr. O’Grady will be entitled to

receive a lump sum cash payment equal to the value of all such awards that were forfeited as the result of such termination of

employment.

In addition, pursuant to the terms of the MCA, upon Mr. O’Grady’s

termination other than for Cause, death or Disability or due to a voluntary termination for Good Reason that occurs outside of the Change

in Control Period, subject to Mr. O’Grady’s execution and non-revocation of a release of claims in favor of the Company

and continued compliance with certain restrictive covenants, Mr. O’Grady will be entitled to receive severance benefits as

follows: (i) continuation of his base salary in effect immediately prior to his termination for 18 months after the effective date

of the termination, payable in accordance with the Company’s standard payroll practices; (ii) payment of the full cost of the

health insurance benefits provided to Mr. O’Grady and Mr. O’Grady’s spouse and dependents, as applicable,

immediately prior to the termination of employment pursuant to the terms of COBRA or other applicable law through the earlier of the end

of the 18 month period following the date of termination or the date upon which Mr. O’Grady is no longer eligible for such

COBRA or other benefits under applicable law; (iii) payment of any earned but unpaid annual bonus for the year immediately preceding

the year of termination, to be paid at the time the Company pays bonuses with respect to such year to its executives generally; and (iv) up

to three consecutive months of outplacement services, not to exceed $5,000 per month.

The foregoing descriptions of the Offer Letter and the MCA do not purport

to be complete and are qualified in their entirety by reference to the full text, which will be filed as exhibits to the Company’s

Quarterly Report on Form 10-Q for the period ended June 30, 2024.

In

connection with his appointment as Chief Executive Officer and a director, Mr. O’Grady entered into the Company’s

standard form of indemnification agreement, a copy of which has been filed as Exhibit 10.2 to the Company’s Current Report

on Form 8-K12B filed with the Securities and Exchange Commission on May 19, 2020.

There are no arrangements or understandings

between Mr. O’Grady and any other person pursuant to which he was selected as an officer or director of the Company. There

are no family relationships between Mr. O’Grady and any of the executive officers or directors of the Company. There is no

information that is required to be disclosed with respect to Mr. O’Grady pursuant to Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure

On May 29, 2024, the Company issued a

press release announcing Mr. O’Grady’s appointment. A copy of the press release is furnished as Exhibit 99.1 to

this Current Report on Form 8-K and incorporated by reference herein.

The information in this Item 7.01, including

Exhibit 99.1 attached hereto, is furnished pursuant to Item 7.01 of this Current Report on Form 8-K and shall not be deemed

to be “filed” for purposes of Section 18 of Exchange Act, or otherwise subject to the liabilities of that section, nor

shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended.

| Item 9.01 |

|

Financial Statements and Exhibits |

| |

|

|

| (d) Exhibits |

|

|

| |

|

|

Exhibit

Number |

|

Description |

| 99.1 |

|

Press Release, dated May 29, 2024 |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ASSERTIO HOLDINGS, INC. |

| |

|

|

| Date: May 29, 2024 |

By: |

/s/ Sam Schlessinger |

| |

|

Sam Schlessinger |

| |

|

Senior Vice President, General Counsel |

Exhibit 99.1

Assertio Announces

the Appointment of Brendan P. O’Grady as New CEO

LAKE FOREST, IL. – May 29,

2024 – Assertio Holdings, Inc. (“Assertio” or the “Company”) (Nasdaq: ASRT), a pharmaceutical company

with comprehensive commercial capabilities offering differentiated products to patients, announced today that its Board of Directors

has appointed Brendan P. O’Grady, a highly accomplished pharmaceutical executive, as the Company’s new Chief Executive Officer

and a member of the board, effective today, May 29, 2024.

Mr. O’Grady, a senior healthcare

executive with more than 30 years of experience accelerating sales growth and profitability, brings to Assertio a demonstrated understanding

of multiple commercial models and a track record of market access success. Most recently, Mr. O’Grady was CEO of the Global

Formulations business at Glenmark Pharmaceuticals, driving new product launches and focused on growing profitability in key markets.

Prior, he was Chief Commercial and Growth Officer at Amwell, building a go-to-market strategy at the digital telehealth provider. He

previously spent 21 years at Teva Pharmaceuticals, rising to CEO of Teva USA and EVP North America Commercial while scaling profitability,

growth and productivity. Earlier in his Teva career, he was the Chief Commercial Officer for Global Specialty Medicines as well as Interim

Head of Europe Specialty Medicines, Head of North American Generic Medicines, and Head of US Market Access. Mr. O’Grady holds

a Bachelor of Science degree from State University of New York and Master of Business Administration degree from Baker University.

Peter Staple, Chairman of the Board,

said, “The Board is delighted to welcome Brendan to Assertio as our new CEO. His exceptional leadership skills, strategic insights

and track record of commercial and financial execution make him an ideal choice to lead Assertio forward.”

“I am truly honored to join the

Assertio team as CEO,” said O’Grady. “I look forward to executing and building on the Company’s strategy, further

diversifying our asset base and demonstrating ways to drive growth.”

Mr. Staple added, “On behalf

of the Board, I want to thank Heather Mason for her invaluable leadership and guidance over the last several months as Interim CEO.

We also look forward to Heather’s continuing contributions as she transitions back to her role as an independent director.”

About Assertio

Assertio is a commercial pharmaceutical

company offering differentiated products to patients. We have built our commercial portfolio through acquisition or licensing of approved

products. Our comprehensive commercial capabilities include marketing through both a sales force and a non-personal promotion model,

market access through payor contracting, and trade and distribution. To learn more about Assertio, visit www.assertiotx.com.

Forward Looking Statements

Statements in this communication that

are not historical facts are forward-looking statements that reflect Assertio’s current expectations, assumptions and estimates

of future performance and economic conditions. These forward-looking statements are made in reliance on the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements relate to, among other things, future events or the future performance or operations of Assertio, including

risks related to our ability to realize the benefits from our operating model, deliver or execute on our business strategy, including

to expand or diversify our asset base and market reach and drive cash flows and growth, successfully integrate new assets, and explore

new business development initiatives. All statements other than historical facts may be forward-looking statements and can be identified

by words such as “anticipate,” “believe,” “could,” “design,” “estimate,”

“expect,” “forecast,” “goal,” “guidance,” “imply,” “intend,”

“may,” “objective,” “opportunity,” “outlook,” “plan,” “position,”

“potential,” “predict,” “project,” “prospective,” “pursue,” “seek,”

“should,” “strategy,” “target,” “would,” “will,” “aim,” “lead,”

“forward,” “look” or other similar expressions that convey the uncertainty of future events or outcomes and are

used to identify forward-looking statements. Such forward-looking statements are not guarantees of future performance and are subject

to risks, uncertainties and other factors, some of which are beyond the control of Assertio, including the risks described in Assertio’s

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”)

and in other filings Assertio makes with the SEC from time to time. Investors and potential investors are urged not to place undue reliance

on forward-looking statements in this communication, which speak only as of this date. While Assertio may elect to update these forward-looking

statements at some point in the future, it specifically disclaims any obligation to update or revise any forward-looking-statements contained

in this press release whether as a result of new information or future events, except as may be required by applicable law.

Investor Contact

Matt Kreps, Managing Director

Darrow Associates

M: 214-597-8200

mkreps@darrowir.com

v3.24.1.1.u2

Cover

|

May 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 16, 2024

|

| Entity File Number |

01-39294

|

| Entity Registrant Name |

ASSERTIO HOLDINGS, INC.

|

| Entity Central Index Key |

0001808665

|

| Entity Tax Identification Number |

85-0598378

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100

S. Saunders Road

|

| Entity Address, Address Line Two |

Suite

300

|

| Entity Address, City or Town |

Lake Forest

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60045

|

| City Area Code |

224

|

| Local Phone Number |

419-7106

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value

|

| Trading Symbol |

ASRT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

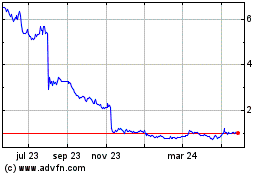

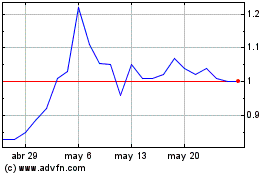

Assertio (NASDAQ:ASRT)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Assertio (NASDAQ:ASRT)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024