Filed Pursuant to Rule 424(b)(3)

Registration No. 333-271703

PROSPECTUS SUPPLEMENT NO. 3

(to Prospectus dated May 12, 2023)

4,448,713 Shares of Common Stock

This prospectus supplement

updates, amends, and supplements the prospectus dated May 12, 2023 (as amended and supplemented, the “Prospectus”),

which forms a part of our Registration Statement on Form S-1 (Registration No. 333-271703).

This prospectus supplement

is being filed to update, amend, and supplement the information in the Prospectus with the information contained in our Quarterly Report

on Form 10-Q for the quarter ended September 30, 2023, filed with the Securities and Exchange Commission (the “SEC”)

on November 9, 2023 (the “Quarterly Report”) and our Current Reports on Form 8-K, filed with the SEC on September 7,

2023, September 8, 2023, September 22, 2023, September 28, 2023, October 13, 2023, October 18, 2023, November 16, 2023, November 28, 2023

and November 29, 2023 (collectively, the “Current Reports”). Accordingly, we have attached the Quarterly Report and

Current Reports to this prospectus supplement.

This prospectus supplement

is not complete without the Prospectus. This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered

with this prospectus supplement, and is qualified by reference thereto, except to the extent that the information in this prospectus supplement

updates or supersedes the information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future

reference.

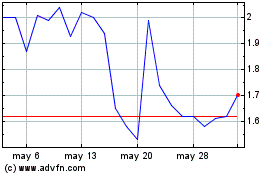

Our common stock is traded

on the Nasdaq Capital Market (“Nasdaq”) under the symbol “ATNF”. On November 30, 2023, the last reported

sale price for our common stock as reported on Nasdaq was $0.271 per share.

INVESTING IN OUR SECURITIES

INVOLVES SUBSTANTIAL RISKS. SEE THE SECTION TITLED “RISK FACTORS” BEGINNING ON PAGE 5 OF THE PROSPECTUS TO READ ABOUT FACTORS

YOU SHOULD CONSIDER BEFORE BUYING OUR SECURITIES.

NEITHER THE SECURITIES

AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY

OR ACCURACY OF THE PROSPECTUS OR THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is November

30, 2023.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended September 30, 2023

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

file number: 001-38105

180

LIFE SCIENCES CORP

(Exact

name of registrant as specified in its charter)

| Delaware |

|

90-1890354 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

3000

El Camino Real

Bldg.

4, Suite 200

Palo

Alto, CA 94306 |

|

94306 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(650)

507-0669

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

ATNF |

|

The

NASDAQ Stock Market LLC

(The NASDAQ Capital Market) |

| Warrants

to purchase Common Stock |

|

ATNFW |

|

The

NASDAQ Stock Market LLC

(The NASDAQ Capital Market) |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller

reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of November 9, 2023, 7,475,455 shares of common stock, par value $0.0001 per share, were issued and outstanding.

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

FORM

10-Q

FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash | |

$ | 2,662,520 | | |

$ | 6,970,110 | |

| Prepaid expenses and other current assets | |

| 708,377 | | |

| 1,958,280 | |

| Total Current Assets | |

| 3,370,897 | | |

| 8,928,390 | |

| Intangible assets, net | |

| 1,587,188 | | |

| 1,658,858 | |

| In-process research and development | |

| - | | |

| 9,063,000 | |

| Total Assets | |

$ | 4,958,085 | | |

$ | 19,650,248 | |

| Liabilities and Stockholders’

(Deficit) Equity | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,713,164 | | |

$ | 1,801,210 | |

| Accounts payable – related parties | |

| 51,227 | | |

| - | |

| Accrued expenses | |

| 2,375,660 | | |

| 2,284,516 | |

| Accrued expenses - related parties | |

| 328,303 | | |

| 188,159 | |

| Loans payable - current portion | |

| 332,885 | | |

| 1,308,516 | |

| Derivative liabilities | |

| 5,605 | | |

| 75,381 | |

| Total Current Liabilities | |

| 4,806,844 | | |

| 5,657,782 | |

| | |

| | | |

| | |

| Loans payable – noncurrent portion | |

| 22,216 | | |

| 31,189 | |

| Deferred tax liability | |

| 278,352 | | |

| 2,617,359 | |

| Total Liabilities | |

| 5,107,412 | | |

| 8,306,330 | |

| Commitments and contingencies (Note 8) | |

| | | |

| | |

| Stockholders’ (Deficit) Equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par value; 5,000,000 shares authorized; (see designations and shares authorized for Series A, Class C and Class K preferred stock) | |

| | | |

| | |

| Class C Preferred Stock; 1 share authorized, issued and outstanding at September 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Class K Preferred Stock; 1 share authorized, issued and outstanding at September 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Common stock, $0.0001 par value; 100,000,000 shares authorized; 6,738,456 and 3,746,906 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively | |

| 674 | | |

| 375 | |

| Additional paid-in capital | |

| 128,815,362 | | |

| 121,637,611 | |

| Accumulated other comprehensive income | |

| (2,848,811 | ) | |

| (2,885,523 | ) |

| Accumulated deficit | |

| (126,116,552 | ) | |

| (107,408,545 | ) |

| Total

Stockholders’ (Deficit) Equity | |

| (149,327 | ) | |

| 11,343,918 | |

| Total Liabilities

and Stockholders’ (Deficit) Equity | |

$ | 4,958,085 | | |

$ | 19,650,248 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

| | |

For the Three Months Ended | | |

For the Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Operating Expenses: | |

| | |

| | |

| | |

| |

| Research and development | |

$ | 972,113 | | |

$ | 583,177 | | |

$ | 2,339,863 | | |

$ | 1,688,474 | |

| Research and development - related parties | |

| 132,881 | | |

| 53,347 | | |

| 481,027 | | |

| 158,401 | |

| General and administrative | |

| 2,433,193 | | |

| 3,418,628 | | |

| 9,204,122 | | |

| 10,405,933 | |

| General and administrative - related parties | |

| - | | |

| - | | |

| - | | |

| 5,261 | |

| Total Operating Expenses | |

| 3,538,187 | | |

| 4,055,152 | | |

| 12,025,012 | | |

| 12,258,069 | |

| Loss From Operations | |

| (3,538,187 | ) | |

| (4,055,152 | ) | |

| (12,025,012 | ) | |

| (12,258,069 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (11,634 | ) | |

| (7,348 | ) | |

| (34,796 | ) | |

| (22,117 | ) |

| Interest (expense) income – related parties | |

| - | | |

| (1,536 | ) | |

| - | | |

| 1,495 | |

| Loss on goodwill impairment | |

| - | | |

| (18,872,850 | ) | |

| - | | |

| (18,872,850 | ) |

| Loss on IP R&D asset impairment | |

| (9,063,000 | ) | |

| - | | |

| (9,063,000 | ) | |

| - | |

| Change in fair value of derivative liabilities | |

| 2,036 | | |

| 1,449,908 | | |

| 69,776 | | |

| 14,167,560 | |

| Total Other Expense, Net | |

| (9,072,598 | ) | |

| (17,431,826 | ) | |

| (9,028,020 | ) | |

| (4,725,912 | ) |

| Net Loss Before Income Taxes | |

| (12,610,785 | ) | |

| (21,486,978 | ) | |

| (21,053,032 | ) | |

| (16,983,981 | ) |

| Income tax benefit | |

| 2,345,025 | | |

| - | | |

| 2,345,025 | | |

| - | |

| Net Loss | |

| (10,265,760 | ) | |

| (21,486,978 | ) | |

| (18,708,007 | ) | |

| (16,983,981 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Comprehensive (Loss) Income: | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| 51,316 | | |

| (1,871,072 | ) | |

| 36,712 | | |

| (4,507,204 | ) |

| Total Comprehensive Loss | |

$ | (10,214,444 | ) | |

$ | (23,358,050 | ) | |

$ | (18,671,295 | ) | |

$ | (21,491,185 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted Net Loss per Common Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (1.29 | ) | |

$ | (10.97 | ) | |

$ | (3.31 | ) | |

$ | (9.49 | ) |

| Diluted | |

$ | (1.29 | ) | |

$ | (10.97 | ) | |

$ | (3.31 | ) | |

$ | (9.49 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Common Shares Outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 7,951,954 | | |

| 1,959,087 | | |

| 5,658,831 | | |

| 1,790,176 | |

| Diluted | |

| 7,951,954 | | |

| 1,959,087 | | |

| 5,658,831 | | |

| 1,790,176 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(DEFICIT)

(unaudited)

| | |

For The Three and Nine Months Ended September 30, 2023 | |

| | |

| | |

| | |

Additional | | |

Accumulated

Other | | |

| | |

Total

Stockholders’ | |

| | |

Common Stock | | |

Paid-in | | |

Comprehensive | | |

Accumulated | | |

Equity | |

| | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

(Deficit) | |

| Balance - January 1, 2023 | |

| 3,746,906 | | |

$ | 375 | | |

$ | 121,637,611 | | |

$ | (2,885,523 | ) | |

$ | (107,408,545 | ) | |

$ | 11,343,918 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 557,421 | | |

| - | | |

| - | | |

| 557,421 | |

| Comprehensive (loss) income: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,762,078 | ) | |

| (4,762,078 | ) |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| 663 | | |

| - | | |

| 663 | |

| Balance - March 31, 2023 | |

| 3,746,906 | | |

| 375 | | |

| 122,195,032 | | |

| (2,884,860 | ) | |

| (112,170,623 | ) | |

| 7,139,924 | |

| Issuance of April 2023 pre-funded and common warrants, net(a) | |

| - | | |

| - | | |

| 2,337,706 | | |

| - | | |

| - | | |

| 2,337,706 | |

| Shares issued from exercise of April 2023 pre-funded warrants(a) | |

| 1,170,680 | | |

| 117 | | |

| - | | |

| - | | |

| - | | |

| 117 | |

| Share issued in connection with April 2023 Offering, net(a) | |

| 400,000 | | |

| 40 | | |

| 382,142 | | |

| - | | |

| - | | |

| 382,182 | |

| Stock based compensation | |

| - | | |

| - | | |

| 551,310 | | |

| - | | |

| - | | |

| 551,310 | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,680,169 | ) | |

| (3,680,169 | ) |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (15,267 | ) | |

| - | | |

| (15,267 | ) |

| Balance - June 30, 2023 | |

| 5,317,586 | | |

| 532 | | |

| 125,466,190 | | |

| (2,900,127 | ) | |

| (115,850,792 | ) | |

| 6,715,803 | |

| Shares issued for professional services to directors | |

| 90,485 | | |

| 9 | | |

| 60,615 | | |

| - | | |

| - | | |

| 60,624 | |

| Issuance of August 2023 pre-funded and common warrants, net(b) | |

| - | | |

| - | | |

| 2,459,282 | | |

| - | | |

| - | | |

| 2,459,282 | |

| Shares issued from exercise of August 2023 pre-funded warrants(b) | |

| 663,460 | | |

| 66 | | |

| - | | |

| - | | |

| - | | |

| 66 | |

| Shares issued in connection with August 2023 Offering, net(b) | |

| 666,925 | | |

| 67 | | |

| 245,281 | | |

| - | | |

| - | | |

| 245,348 | |

| Stock based compensation | |

| - | | |

| - | | |

| 583,994 | | |

| - | | |

| - | | |

| 583,994 | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (10,265,760 | ) | |

| (10,265,760 | ) |

| Other comprehensive income | |

| - | | |

| - | | |

| - | | |

| 51,316 | | |

| - | | |

| 51,316 | |

| Balance – September 30, 2023 | |

| 6,738,456 | | |

$ | 674 | | |

$ | 128,815,362 | | |

$ | (2,848,811 | ) | |

$ | (126,116,552 | ) | |

$ | (149,327 | ) |

| (a) | Consists of $2,999,882 of gross proceeds from the April

2023 Offering; gross proceeds of $421,527 are related to common shares issued (with related placement agent fees of $39,343), gross

proceeds of $1,233,564 are related to pre-funded warrants issued (with related placement agent fees of $115,134) and gross proceeds of

$1,344,791 are related to common warrants issued (with related placement agent fees of $125,516). At the end of the current period, all

1,170,680 April 2023 pre-funded warrants were exercised for proceeds of $117. |

| (b) | Consists of $2,999,605 of gross proceeds from the August

2023 Offering; gross proceeds of $272,106 are related to common shares issued (with related placement agent fees of $26,758), gross proceeds

of $1,449,470 are related to pre-funded warrants issued (with related placement agent fees of $142,538) and gross proceeds of $1,278,029

are related to common warrants issued (with related placement agent fees of $125,679). At the end of the period, 663,460 August 2023

pre-funded warrants were exercised for proceeds of $66. |

| | |

For The Three and Nine Months Ended September 30, 2022 | |

| | |

| | |

| | |

Additional | | |

Accumulated

Other | | |

| | |

Total | |

| | |

Common Stock | | |

Paid-in | | |

Comprehensive | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| Balance - January 1, 2022 | |

| 1,701,799 | | |

$ | 170 | | |

$ | 107,187,371 | | |

$ | 817,440 | | |

$ | (68,682,286 | ) | |

$ | 39,322,695 | |

| Shares issued for professional services to directors | |

| 2,566 | | |

| 1 | | |

| 149,717 | | |

| - | | |

| - | | |

| 149,718 | |

| Stock based compensation | |

| - | | |

| - | | |

| 596,467 | | |

| - | | |

| - | | |

| 596,467 | |

| Comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,563,713 | | |

| 1,563,713 | |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (728,081 | ) | |

| - | | |

| (728,081 | ) |

| Balance - March 31, 2022 | |

| 1,704,365 | | |

| 171 | | |

| 107,933,555 | | |

| 89,359 | | |

| (67,118,573 | ) | |

| 40,904,512 | |

| Shares issued for professional services to directors | |

| 2,229 | | |

| - | | |

| 60,627 | | |

| - | | |

| - | | |

| 60,627 | |

| Stock based compensation | |

| 600 | | |

| - | | |

| 795,052 | | |

| - | | |

| - | | |

| 795,052 | |

| Comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,939,284 | | |

| 2,939,284 | |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (1,908,051 | ) | |

| - | | |

| (1,908,051 | ) |

| Balance – June 30, 2022 | |

| 1,707,194 | | |

| 171 | | |

| 108,789,234 | | |

| (1,818,692 | ) | |

| (64,179,289 | ) | |

| 42,791,424 | |

| Shares issued for professional services to directors | |

| 2,756 | | |

| - | | |

| 60,622 | | |

| - | | |

| - | | |

| 60,622 | |

| Issuance of pre-funded warrants (c) | |

| - | | |

| - | | |

| 2,562,265 | | |

| - | | |

| - | | |

| 2,562,265 | |

| Shares issued from exercise of pre-funded warrants (c) | |

| 77,354 | | |

| 8 | | |

| 147 | | |

| - | | |

| - | | |

| 155 | |

| Shares issued in connection with July 2022 Offering (c) | |

| 175,000 | | |

| 17 | | |

| 3,407,473 | | |

| - | | |

| - | | |

| 3,407,490 | |

| Stock based compensation | |

| - | | |

| - | | |

| 611,461 | | |

| - | | |

| - | | |

| 611,461 | |

| Comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (21,486,978 | ) | |

| (21,486,978 | ) |

| Other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (1,871,072 | ) | |

| - | | |

| (1,871,072 | ) |

| Balance September 30, 2022 | |

| 1,962,304 | | |

$ | 196 | | |

$ | 115,431,202 | | |

$ | (3,689,764 | ) | |

$ | (85,666,267 | ) | |

$ | 26,075,367 | |

| (c) | Consists

of $6,499,737 of gross proceeds from the July 2022 Offering; gross proceeds of $3,710,000 are related to the common shares and common

warrants issued and includes $302,510 in related placement agent fees and other offering costs, and $2,789,737 in gross proceeds are

in connection with the pre-funded warrants and includes $227,472 in related placement agent fees and other offering costs. At the end

of the period, 1,547,076 July 2022 pre-funded warrants were exercised for proceeds of $155. |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash Flows From Operating Activities | |

| | |

| |

| Net Loss | |

$ | (18,708,007 | ) | |

$ | (16,983,981 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation: | |

| | | |

| | |

| Shares issued for services | |

| 60,624 | | |

| 270,967 | |

| Amortization of stock options and restricted stock units | |

| 1,692,725 | | |

| 2,002,980 | |

| Amortization of intangibles | |

| 83,015 | | |

| 71,396 | |

| Loss on IP R&D asset impairment | |

| 9,063,000 | | |

| - | |

| Loss on goodwill impairment | |

| - | | |

| 18,872,850 | |

| Change in fair value of derivative liabilities | |

| (69,776 | ) | |

| (14,167,560 | ) |

| Deferred tax benefit | |

| (2,345,025 | ) | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 1,273,033 | | |

| 36,340 | |

| Accounts payable | |

| (99,169 | ) | |

| 428,632 | |

| Accounts payable – related parties | |

| 51,227 | | |

| - | |

| Accrued expenses | |

| 94,778 | | |

| 127,449 | |

| Accrued expenses – related parties | |

| 141,366 | | |

| 140,097 | |

| Total adjustments | |

| 9,945,798 | | |

| 7,783,151 | |

| Net Cash Used In Operating Activities | |

| (8,762,209 | ) | |

| (9,200,830 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities | |

| | | |

| | |

| Proceeds from sale of July 2022 Offering stock and warrants | |

| - | | |

| 6,499,737 | |

| Proceeds from sale of April 2023 Offering stock and warrants | |

| 2,999,882 | | |

| - | |

| Proceeds from sale of August 2023 Offering stock and warrants | |

| 2,999,606 | | |

| - | |

| Proceeds from exercise of July 2022 Offering pre-funded warrants | |

| - | | |

| 155 | |

| Proceeds from exercise of April 2023 Offering pre-funded warrants | |

| 117 | | |

| - | |

| Proceeds from exercise of August 2023 Offering pre-funded warrants | |

| 66 | | |

| - | |

| Payment of offering costs in connection with July 2022 Offering stock and warrants | |

| - | | |

| (529,982 | ) |

| Payment of offering costs in connection with April 2023 Offering stock and warrants | |

| (279,994 | ) | |

| - | |

| Payment of offering costs in connection with August 2023 Offering stock and warrants | |

| (294,976 | ) | |

| - | |

| Repayment of loans payable | |

| (985,175 | ) | |

| (1,491,986 | ) |

| Net Cash Provided By Financing Activities | |

| 4,439,526 | | |

| 4,477,924 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS, continued

(unaudited)

| | |

| | | |

| | |

| Effect of Exchange Rate Changes on Cash | |

| 15,093 | | |

| 87,037 | |

| | |

| | | |

| | |

| Net Decrease In Cash | |

| (4,307,590 | ) | |

| (4,635,869 | ) |

| Cash - Beginning of Period | |

| 6,970,110 | | |

| 8,224,508 | |

| Cash - End of Period | |

$ | 2,662,520 | | |

$ | 3,588,639 | |

| | |

| | | |

| | |

| Supplemental Disclosures of Cash Flow Information: | |

| | | |

| | |

| Cash paid during the period for income taxes | |

$ | - | | |

$ | - | |

| Cash paid during the period for interest expense | |

$ | 21,722 | | |

$ | 13,423 | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

180

LIFE SCIENCES CORP. AND SUBSIDIARIES

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts

in US Dollars)

(unaudited)

NOTE

1 - BUSINESS ORGANIZATION AND NATURE OF OPERATIONS

180

Life Sciences Corp., formerly known as KBL Merger Corp. IV (“180LS”, or together with its subsidiaries, the “Company”),

was a blank check company organized under the laws of the State of Delaware on September 7, 2016. The Company was formed for the purpose

of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or

more businesses. On November 6, 2020, a business combination was consummated following a special meeting of stockholders, where the stockholders

of the Company considered and approved, among other matters, a proposal to adopt a Business Combination Agreement. Pursuant to the Business

Combination Agreement, KBL Merger Sub, Inc. merged with 180 Life Corp. (f/k/a 180 Life Sciences Corp.) (“180”), with

180 continuing as the surviving entity and becoming a wholly-owned subsidiary of the Company (the “Business Combination”).

References to “KBL” refer to the Company prior to the November 6, 2020 Business Combination.

The

Company is a clinical stage biotechnology company focused on the development of therapeutics for unmet medical needs in chronic pain,

inflammation, fibrosis and other inflammatory diseases, where anti-TNF therapy will provide a clear benefit to patients, by employing

innovative research, and, where appropriate, combination therapy. We have three product development platforms:

| |

● |

fibrosis

and anti-tumor necrosis factor (“TNF”); |

| |

● |

drugs

which are derivatives of cannabidiol (“CBD”); and |

| |

● |

alpha

7 nicotinic acetylcholine receptor (“α7nAChR”). |

NOTE

2 - GOING CONCERN AND MANAGEMENT’S PLANS

The Company has not generated any revenues and has incurred significant

losses since inception. As of September 30, 2023, the Company had an accumulated deficit of $126,116,552 and a working capital deficit

of $1,435,947, and for the three and nine months ended September 30, 2023, net losses of $10,265,760 and $18,708,007, respectively, and

for the nine months ended September 30, 2023, cash used in operating activities of $8,762,209. The Company expects to invest a significant

amount of capital to fund research and development. As a result, the Company expects that its operating expenses will increase significantly,

and consequently will require significant revenues to become profitable. Even if the Company does become profitable, it may not be able

to sustain or increase profitability on a quarterly or annual basis. The Company cannot predict when, if ever, it will be profitable.

There can be no assurance that the intellectual property of the Company, or other technologies it may acquire, will meet applicable regulatory

standards, obtain required regulatory approvals, be capable of being produced in commercial quantities at reasonable costs, or be successfully

marketed. The Company plans to undertake additional laboratory studies with respect to the intellectual property, and there can be no

assurance that the results from such studies or trials will result in a commercially viable product or will not identify unwanted side

effects.

The

Company’s ability to continue its operations is dependent upon obtaining new financing for its ongoing operations. On April 5,

2023, the Company entered into a Securities Purchase Agreement with a certain purchaser in which the Company agreed to sell an aggregate

of 400,000 shares of common stock, pre-funded warrants to purchase up to an aggregate of approximately 1.2 million shares of common stock

(“April 2023 Pre-Funded Warrants”), and common stock warrants to purchase up to an aggregate of approximately 1.6 million

shares of common stock (the “April 2023 Common Warrants”), for gross proceeds of approximately $3.0 million (see Note 9 –

Stockholders’ Equity for additional information).

On August 9, 2023, the Company entered into a Securities Purchase Agreement

with an accredited investor, in addition to certain purchasers who relied on the Company’s registration statement filed with the

SEC on July 25, 2023, which became effective on August 9, 2023, in which the Company agreed to sell an aggregate of approximately 667,000

shares of common stock, pre-funded warrants to purchase up to an aggregate of approximately 3.9 million shares of common stock (“August

2023 Pre-Funded Warrants”), and common stock warrants to purchase up to an aggregate of approximately 4.6 million shares of common

stock (the “August 2023 Common Warrants”), for gross proceeds of approximately $3.0 million (see Note 9 – Stockholders’

Equity for additional information).

The

Company plans to continue to fund its losses from operations through future equity offerings, debt financing or other third-party fundings,

which may be dilutive to existing stockholders. There can be no assurance that additional funds will be available when needed from any

source or, if available, will be available on terms that are acceptable to the Company. If the Company is unable to obtain such additional

financing, the Company may have to curtail its development, marketing and promotional activities, which would have a material adverse

effect on its business, financial condition and results of operations, and it could ultimately be forced to discontinue its operations

and liquidate. These matters raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable

period of time, which is defined as within one year after the date that the condensed consolidated financial statements are issued.

These

condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets

and the satisfaction of liabilities in the normal course of business. The condensed consolidated financial statements do not include

any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification

of liabilities that may result from uncertainty related to our ability to continue as a going concern.

NOTE

3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Significant

Accounting Policies

There

have been no material changes to the Company’s significant accounting policies as set forth in the Company’s audited consolidated

financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2022 under Note 3 - Summary of Significant

Accounting Policies, except as disclosed in this note.

Basis

of Presentation

The

accompanying unaudited condensed consolidated financial statements of the Company have been prepared on a going concern basis in accordance

with accounting principles generally accepted in the United States of America (GAAP) for interim financial reporting and as required

by Regulation S-X, Rule 10-01. Accordingly, they do not include all of the information and footnotes required by

GAAP for complete financial statements. In the opinion of management, all adjustments (including those which are normal and recurring)

considered necessary for a fair presentation of the interim financial information have been included. When preparing financial statements

in conformity with GAAP, the Company must make estimates and assumptions that affect the reported amounts of assets, liabilities,

revenues, expenses and related disclosures at the date of the financial statements. Actual results could differ from those estimates.

Additionally, operating results for the three and nine months ended September 30, 2023 are not necessarily indicative of the results

that may be expected for any other interim period or for the fiscal year ending December 31, 2023. For further information, refer

to the financial statements and footnotes included in the Company’s annual financial statements for the fiscal year ended December 31,

2022, which are included in the Company’s annual report on Form 10-K filed with the Securities and Exchange Commission

(“SEC”) on March 31, 2023.

Use

of Estimates

The preparation of financial statements in conformity with U.S. GAAP

requires management to make estimates, judgments, and assumptions that affect the reported amounts of assets, liabilities, revenues and

expenses, together with amounts disclosed in the related notes to the condensed consolidated financial statements. The Company’s

significant estimates and assumptions used in these condensed consolidated financial statements include, but are not limited to, the fair

value of financial instruments warrants, options and equity shares, as well as the valuation of stock-based compensation and the estimates

and assumptions related to impairment analysis of in-process research and development assets.

Certain

of the Company’s estimates could be affected by external conditions, including those unique to the Company and general economic

conditions. It is reasonably possible that these external factors could have an effect on the Company’s estimates and may cause

actual results to differ from those estimates.

Foreign

Currency Translation

The Company’s reporting currency is the United States dollar.

The functional currency of certain subsidiaries was the British Pound (“GBP”) (1.2386 and 1.2098 GBP to 1 US dollar, each

as of September 30, 2023 and December 31, 2022, respectively) for balance sheet accounts, while expense accounts are translated at the

weighted average exchange rate for the period (1.2655 and 1.1772 GBP to 1 US dollar for each of the three months ended September 30, 2023

and 2022, respectively, and 1.2442 and 1.2597 GBP to 1 US dollar each for the nine months ended September 30, 2023 and 2022, respectively).

Equity accounts are translated at historical exchange rates. The resulting translation adjustments are recognized in stockholders’

(deficit) equity as a component of accumulated other comprehensive (loss) income.

Comprehensive (loss) income is defined as the change in equity of an

entity from all sources other than investments by owners or distributions to owners and includes foreign currency translation adjustments

as described above. During the three months ended September 30, 2023 and 2022, the Company recorded other comprehensive income (loss)

of $51,316 and ($1,871,072), respectively, as a result of foreign currency translation adjustments. During the nine months ended September

30, 2023 and 2022, the Company recorded other comprehensive income (loss) of $36,712 and ($4,507,204), respectively, as a result of foreign

currency translation adjustments.

Foreign

currency gains and losses resulting from transactions denominated in foreign currencies, including intercompany transactions, are included

in results of operations. The Company recognized ($2,952) and ($1,485) of foreign currency transaction losses for the three and nine

months ended September 30, 2023, respectively, and recognized ($14,031) and ($14,151) of foreign currency transaction losses for the

three and nine months ended September 30, 2022, respectively. Such amounts have been classified within general and administrative expenses

in the accompanying condensed consolidated statements of operations and comprehensive (loss) income.

In-Process Research and Development (“IP

R&D”)

IP R&D assets represent the fair value assigned to technologies that

were acquired on July 16, 2019 in connection with the transaction whereby the Company acquired each of Katexco Pharmaceuticals Corp.,

CBR Pharma (defined below) and 180 LP (defined below), which have not reached technological feasibility and have no alternative future

use. IP R&D assets are considered to be indefinite-lived until the completion or abandonment of the associated research and development

projects. During the period that the IP R&D assets are considered indefinite-lived, they are tested for impairment on an annual basis,

or more frequently if the Company becomes aware of any events occurring or changes in circumstances that indicate that the fair value

of the IP R&D assets are less than their carrying amounts. If and when development is complete, which generally occurs upon regulatory

approval, and the Company is able to commercialize products associated with the IP R&D assets, these assets are then deemed definite-lived

and are amortized based on their estimated useful lives at that point in time. If development is terminated or abandoned, the Company

may record a full or partial impairment charge related to the IP R&D assets, calculated as the excess of the carrying value of the

IP R&D assets over their estimated fair value.

As of December 31, 2022, the carrying amount of the IP R&D assets

on the balance sheet was $12,405,084 (which consists of carrying amounts of $1,462,084 and $10,943,000 related to the Company’s

CannBioRex Pharmaceuticals Corp. (“CBR Pharma”) subsidiary and its 180 Therapeutics L.P. (“180 LP”) subsidiary,

respectively). Per the valuation obtained from a third party as of year-end, the fair market value of the Company’s IP R&D assets

was determined to be $9,063,000 (which consisted of fair values of $0 and $9,063,000 related to the Company’s CBR Pharma subsidiary

and 180 LP subsidiary, respectively). As of that measurement date, the carrying values of the CBR Pharma and 180 LP subsidiaries’

assets exceeded their fair market values by $1,462,084 and $1,880,000, respectively. As such, management determined that the consolidated

IP R&D assets were impaired by $3,342,084 and, in order to recognize the impairment, the Company recorded a loss for this amount during

the fourth quarter of 2022, which appeared as a loss on IP R&D asset impairment on the income statement. This reduced the IP R&D

asset balances of its CBR Pharma subsidiary and its 180 LP subsidiary to zero and $9,063,000, respectively, as of December 31, 2022; and

the total consolidated IP R&D asset balance was $9,063,000 after impairment.

As of December 31, 2022, the

carrying amount of the IP R&D assets on the balance sheet was $9,063,000 (which consists of a balance related to the Company’s

180 LP subsidiary); the Company typically assesses asset impairment on an annual basis unless a triggering event or other facts or circumstances

indicate that an evaluation should be performed at an earlier date. As of September 30, 2023, the Company assessed the most recent delays

in its commercialization timeline, general economic conditions, industry and market considerations, the Company’s financial performance

and all relevant legal, regulatory, and political factors that might indicate the possibility of impairment and concluded that, when these

factors were collectively evaluated, it is more likely than not that the asset is impaired. The Company recorded a loss in the amount

of $9,063,000, which appears as a loss on impairment to IP R&D assets on the income statement. As a result, as of September 30, 2023,

the carrying amount of the IP R&D assets on the balance sheet became $0 (nil).

As a result of the write-off of

the IP R&D assets on the balance sheet and the loss on impairment to IP R&D assets on the income statement, the Company recorded

a decrease in its deferred tax liability relating to the impairment of the IP R&D assets of $2.3 million as income tax benefit relating

to impairment of the IP R&D assets in the same amount on the income statement for the period ended September 30, 2023.

Net Loss Per Common Share

Basic net loss per common share is computed by dividing net loss by

the weighted average number of common shares outstanding during the period. Diluted net loss per common share is computed by dividing

net loss by the weighted average number of common shares outstanding, plus the number of additional common shares that would have been

outstanding if the common share equivalents had been issued (computed using the treasury stock or if converted method), if dilutive.

The following table details the net loss per share calculation, reconciles

between basic and diluted weighted average shares outstanding, and presents the potentially dilutive shares that are excluded from the

calculation of the weighted average diluted common shares outstanding, because their inclusion would have been anti-dilutive:

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Numerator: | |

| | |

| | |

| | |

| |

| Net loss | |

$ | (10,265,760 | ) | |

$ | (21,486,978 | ) | |

$ | (18,708,007 | ) | |

$ | (16,983,981 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding (denominator for basic earnings per share) | |

| 7,951,954 | | |

| 1,959,087 | | |

| 5,658,831 | | |

| 1,790,176 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares and assumed potential common shares (denominator for diluted earnings per share, treasury method) | |

| 7,951,954 | | |

| 1,959,087 | | |

| 5,658,831 | | |

| 1,790,176 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic loss per share | |

$ | (1.29 | ) | |

$ | (10.97 | ) | |

$ | (3.31 | ) | |

$ | (9.49 | ) |

| Diluted loss per share | |

$ | (1.29 | ) | |

$ | (10.97 | ) | |

$ | (3.31 | ) | |

$ | (9.49 | ) |

The following common share equivalents are excluded from the calculation

of weighted average common shares outstanding, because their inclusion would have been dilutive:

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Options | |

| - | | |

| 162,957 | | |

| - | | |

| 162,957 | |

| Warrants | |

| 3,284,483 | | |

| 864,300 | | |

| 3,284,483 | | |

| 864,300 | |

| Total potentially dilutive shares | |

| 3,284,483 | | |

| 1,027,257 | | |

| 3,284,483 | | |

| 1,027,257 | |

Subsequent

Events

The

Company has evaluated events that have occurred after the balance sheet date but before these condensed consolidated financial statements

were issued. Based upon that evaluation, the Company did not identify any recognized or non-recognized subsequent events that would have

required adjustment or disclosure in the financial statements, except as disclosed in Note 11 - Subsequent Events.

Recently

Issued Accounting Pronouncements

Management

does not believe that any recently issued, but not yet effective, accounting pronouncements, if currently adopted, would have a material

effect on the Company’s unaudited condensed consolidated financial statements.

NOTE

4 - PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid

expenses and other current assets consist of the following as of September 30, 2023 and December 31, 2022:

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Insurance | |

$ | 208,064 | | |

$ | 1,027,292 | |

| Research and development expense tax credit receivable | |

| 51,639 | | |

| 546,563 | |

| Professional fees | |

| 369,906 | | |

| 310,017 | |

| Value-added tax receivable | |

| 53,134 | | |

| 48,774 | |

| Income taxes | |

| 25,634 | | |

| 25,634 | |

| | |

$ | 708,377 | | |

$ | 1,958,280 | |

NOTE

5 - ACCRUED EXPENSES

Accrued

expenses consist of the following as of September 30, 2023 and December 31, 2022:

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Consulting

fees |

|

$ |

582,476 |

|

|

$ |

531,829 |

|

| Professional

fees |

|

|

125,000 |

|

|

|

3,945 |

|

| Litigation

accrual (1) |

|

|

49,999 |

|

|

|

125,255 |

|

| Employee

and director compensation |

|

|

1,367,453 |

|

|

|

1,558,024 |

|

| Research

and development fees |

|

|

175,165 |

|

|

|

22,023 |

|

| Interest |

|

|

66,415 |

|

|

|

36,422 |

|

| Other |

|

|

9,152 |

|

|

|

7,018 |

|

| |

|

$ |

2,375,660 |

|

|

$ |

2,284,516 |

|

| (1) |

See

Note 8 - Commitments and Contingencies, Legal Matters. |

As

of September 30, 2023 and December 31, 2022, accrued expenses - related parties were $328,303 and $188,159, respectively. See Note 10

- Related Parties for details.

NOTE

6 - DERIVATIVE LIABILITIES

The

following table sets forth a summary of the changes in the fair value of Level 3 derivative liabilities (except the Public SPAC Warrants

as defined below, which are Level 1 derivative liabilities) that are measured at fair value on a recurring basis:

| | |

Warrants | | |

| |

| | |

Public | | |

Private | | |

| | |

| | |

| |

| | |

SPAC | | |

SPAC | | |

PIPE | | |

Other | | |

Total | |

| Balance as of January 1, 2023 | |

$ | 31,625 | | |

$ | 1,256 | | |

$ | 42,100 | | |

$ | 400 | | |

$ | 75,381 | |

| Change in fair value of derivative liabilities | |

| (21,390 | ) | |

| (1,005 | ) | |

| (30,600 | ) | |

| (328 | ) | |

| (53,323 | ) |

| Balance as of March 31, 2023 | |

$ | 10,235 | | |

$ | 251 | | |

$ | 11,500 | | |

$ | 72 | | |

$ | 22,058 | |

| Change in fair value of derivative liabilities | |

| (4,600 | ) | |

| (251 | ) | |

| (9,500 | ) | |

| (66 | ) | |

| (14,417 | ) |

| Balance as of June 30, 2023 | |

$ | 5,635 | | |

$ | - | | |

$ | 2,000 | | |

$ | 6 | | |

$ | 7,641 | |

| Change in fair value of derivative liabilities | |

| (230 | ) | |

| - | | |

| (1,800 | ) | |

| (6 | ) | |

| (2,036 | ) |

| Balance as of September 30, 2023 | |

$ | 5,405 | | |

$ | - | | |

$ | 200 | | |

$ | - | | |

$ | 5,605 | |

The

fair value of the derivative liabilities as of September 30, 2023, and December 31, 2022 was estimated using the Black Scholes option

pricing model, with the following assumptions used:

| | |

September 30,

2023 | |

| Risk-free interest rate | |

4.94% - 5.50% | |

| Expected term in years | |

0.84 – 2.40 | |

| Expected volatility | |

100.0% - 110.0% | |

| Expected dividends | |

0% | |

| Market Price | |

$0.61 | |

| | |

December 31,

2022 | |

| Risk-free interest rate | |

2.30% - 4.50% | |

| Expected term in years | |

1.59 – 3.90 | |

| Expected volatility | |

76.0% - 105.0% | |

| Expected dividends | |

0% | |

| Market Price | |

$3.39 | |

SPAC

Warrants

Public

SPAC Warrants

Participants

in KBL’s initial public offering received an aggregate of 11,500,000 Public SPAC Warrants (“Public SPAC Warrants”),

all of which are outstanding as of September 30, 2023. Each Public SPAC Warrant entitles the holder to purchase one-fortieth of one share

of the Company’s common stock at an exercise price of $5.75 per 1/40th of one share, or $230.00 per whole share, subject

to adjustment. No fractional shares will be issued upon exercise of the Public SPAC Warrants; the Public SPAC Warrants are currently

exercisable and will expire on November 6, 2025, or earlier upon redemption or liquidation. Management has determined that the Public

SPAC Warrants contain a tender offer provision which could result in the Public SPAC Warrants settling for the tender offer consideration

(including potentially cash) in a transaction that didn’t result in a change-in-control. This feature results in the Public SPAC

Warrants being precluded from equity classification. Accordingly, the Public SPAC Warrants are classified as liabilities measured at

fair value, with changes in fair value each period reported in earnings. The Public SPAC Warrants were revalued on September 30, 2023

at $5,405, which resulted in decreases of $230 and $26,220 in the fair value of the derivative liabilities during the three and nine

months ended September 30, 2023, respectively. The Public SPAC Warrants were revalued on September 30, 2022 at $592,250, which resulted

in decreases of $1,246,600 and $7,456,600 in the fair value of the derivative liabilities during the three and nine months ended September

30, 2022, respectively.

Private

SPAC Warrants

Participants

in KBL’s initial private placement received an aggregate of 502,500 Private SPAC Warrants (“Private SPAC Warrants”),

all of which are outstanding as of September 30, 2023. Each Private SPAC Warrant entitles the holder to purchase one-fortieth of one

share of the Company’s common stock at an exercise price of $5.75 per 1/40th of one share, or $230.00 per whole share,

subject to adjustment. No fractional shares will be issued upon exercise of the Private SPAC Warrants; the Private SPAC Warrants are

currently exercisable and will expire on November 6, 2025, or earlier upon redemption or liquidation. Management has determined that

the Private SPAC Warrants contain a tender offer provision which could result in the Private SPAC Warrants settling for the tender offer

consideration (including potentially cash) in a transaction that didn’t result in a change-in-control. This feature (amongst others)

results in the Private SPAC Warrants being precluded from equity classification. Accordingly, the Private SPAC Warrants are classified

as liabilities measured at fair value, with changes in fair value each period reported in earnings. The Private SPAC Warrants were revalued

on September 30, 2023 at $0, which resulted in decreases of $0 and $1,256 in the fair value of the derivative liabilities during the

three and nine months ended September 30, 2023, respectively. The Private SPAC Warrants were revalued on September 30, 2022 at $20,100,

which resulted in decreases of $10,050 and $447,225 in the fair value of the derivative liabilities during the three and nine months

ended September 30, 2022, respectively.

PIPE

Warrants

On

February 23, 2021, the Company issued five-year warrants (the “PIPE Warrants”) to purchase 128,200 shares of common stock

at an exercise price of $100.00 per share in connection with the private offering (see Note 9 – Stockholders’ Equity, Common

Stock). The PIPE Warrants did not meet the requirements for equity classification due to the existence of a tender offer provision that

could potentially result in cash settlement of the PIPE Warrants that didn’t meet the limited exception in the case of a change-in-control.

Accordingly, the PIPE Warrants are liability-classified and are recorded as derivative liabilities. The PIPE Warrants were revalued on

September 30, 2023 at $200, which resulted in decreases of $1,800 and $41,900 in the fair value of the derivative liabilities during

the three and nine months ended September 30, 2023, respectively. The PIPE Warrants were revalued on September 30, 2022 at $433,600,

which resulted in decreases of $188,000 and $6,082,700 in the fair value of the derivative liabilities during the three and nine months

ended September 30, 2022, respectively.

Other

Warrants

AGP

Warrants

On March 12, 2021, the Company issued warrants to Alliance Global Partners

(“AGP” and the “AGP Warrants”) to purchase up to an aggregate of 3,183 shares of the Company’s common stock

at a purchase price of $105.60 per share, subject to adjustment, in full satisfaction of the existing AGP Warrant Liability. The exercise

of the AGP Warrants is limited at any given time to prevent AGP from exceeding beneficial ownership of 4.99% of the then total number

of issued and outstanding shares of the Company’s common stock upon such exercise. The warrants are exercisable at any time between

May 2, 2021 and May 2, 2025. The AGP Warrants do not meet the requirements for equity classification due to the existence of a tender

offer provision that could potentially result in cash settlement of the AGP Warrants that do not meet the limited exception in the case

of a change-in-control. Accordingly, the AGP Warrants will continue to be liability-classified. The AGP Warrants were revalued on September

30, 2023 at $0, which resulted in decreases of $6 and $400 in the fair value of the derivative liabilities during the three and nine months

ended September 30, 2023, respectively. The AGP Warrants were revalued on September 30, 2022 at $6,633, which resulted in decreases of

$3,762 and $137,698 in the fair value of the derivative liabilities during the three and nine months ended September 30, 2022, respectively.

Alpha

Warrants

In

connection with that certain Mutual Release and Settlement Agreement dated July 31, 2021 (agreed to on July 29, 2021) between the Company

and Alpha Capital Anstal (“Alpha” and the “Alpha Settlement Agreement”), the Company issued three-year warrants

for the purchase of 1,250 shares of the Company’s common stock at an exercise price of $141.40 per share (the “Alpha Warrant

Liability” and the “Alpha Warrants”). The exercise of shares of the Alpha Warrants is limited at any given time to

prevent Alpha from exceeding a beneficial ownership of 4.99% of the then total number of issued and outstanding shares of the Company’s

common stock upon such exercise. The warrants are exercisable until August 2, 2024. The Alpha Warrants do not meet the requirements for

equity classification due to the existence of a tender offer provision that could potentially result in cash settlement of the Alpha

Warrants that do not meet the limited exception in the case of a change-in-control. Accordingly, the Alpha Warrants are liability-classified

and are recorded as a warrant liability. The Alpha Warrants were revalued on September 30, 2023 at $0, which did not result in any change

in the fair value of the derivative liabilities during the three and nine months ended September 30, 2023. The Alpha Warrants were revalued

on September 30, 2022 at $224, which resulted in decreases of $1,496 and $43,337 in the fair value of the derivative liabilities during

the three and nine months ended September 30, 2022, respectively.

Warrant

Activity

As

the number of liability-classified warrants are less than 10% of the total outstanding warrants as of September 30, 2023, the summary

of warrant activity is included in Note 9 – Stockholders’ Equity.

NOTE

7 - LOANS PAYABLE

Loans

Payable

The

following table summarizes the activity of loans payable during the nine months ended September 30, 2023:

| | |

Principal

balance at

December 31,

2022 | | |

Principal

repaid in

cash | | |

Effect of

foreign

exchange

rates | | |

Principal

balance at

September 30,

2023 | |

| | |

| | |

| | |

| | |

| |

| Bounce Back Loan | |

$ | 43,129 | | |

$ | (9,155 | ) | |

$ | 508 | | |

$ | 34,482 | |

| First Insurance - 2022 | |

| 1,060,890 | | |

| (976,020 | ) | |

| - | | |

| 84,870 | |

| Other loans payable | |

| 235,686 | | |

| - | | |

| 63 | | |

| 235,749 | |

| Total loans payable | |

$ | 1,339,705 | | |

$ | (985,175 | ) | |

$ | 571 | | |

$ | 355,101 | |

| Less: loans payable – current portion | |

| 1,308,516 | | |

| | | |

| | | |

| 332,885 | |

| Loans payable – noncurrent portion | |

$ | 31,189 | | |

| | | |

| | | |

$ | 22,216 | |

Interest

Expense on Loans Payable

For the three months ended September 30, 2023 and 2022, the Company

recognized interest expense associated with loans payable of $11,633 and $7,348, respectively, and interest expense — related parties

associated, with loans payable of $0 and $1,536, respectively. For the nine months ended September 30, 2023 and 2022, the Company recognized

interest expense associated with loans payable of $34,796 and $22,117, respectively, and interest income — related parties associated

with loans payable of $0 and $1,495, respectively.

As of September 30, 2023, the Company had accrued interest and accrued

interest — related parties, associated with loans payable of $66,415 and $0, respectively. As of December 31, 2022, the Company

had accrued interest and accrued interest — related parties associated with loans payable of $37,960 and $16,770, respectively.

Accrued interest is recorded within accrued expenses and appears under that caption on the balance sheet; accrued interest – related

parties is recorded within accrued expenses – related parties and appears under that caption on the balance sheet. See Note 10 —

Related Parties for additional details.

NOTE

8 - COMMITMENTS AND CONTINGENCIES

Litigation

and Other Loss Contingencies

The

Company records liabilities for loss contingencies arising from claims, assessments, litigation, fines, penalties and other sources when

it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. The Company has no liabilities

recorded for loss contingencies as of December 31, 2022 and September 30, 2023.

Legal

Matters

Action

Against Former Executive of KBL

On

September 1, 2021, the Company initiated legal action in the Chancery Court of Delaware against Dr. Marlene Krauss, the Company’s

former Chief Executive Officer and director (“Dr. Krauss”) and two of her affiliated companies, KBL IV Sponsor, LLC and KBL

Healthcare Management, Inc. (collectively, the “KBL Affiliates”) for, among other things, engaging in unauthorized monetary

transfers of the Company’s assets, non-disclosure of financial liabilities within the Company’s Consolidated Financial Statements,

issuing shares of stock without proper authorization; and improperly allowing stockholder redemptions to take place. The Company’s

complaint alleges causes of action against Dr. Krauss and/or the KBL Affiliates for breach of fiduciary duties, ultra vires acts, unjust

enrichment, negligence and declaratory relief, and seeks compensatory damages in excess of $11,286,570, together with interest, attorneys’

fees and costs. There can be no assurance that the Company will be successful in its legal actions.

On

October 5, 2021, Dr. Krauss and the KBL Affiliates filed an Answer, Counterclaims and Third-Party Complaint (the “Krauss Counterclaims”)

against the Company and twelve individuals who are, or were, directors and/or officers of the Company, i.e., Marc Feldmann, Lawrence

Steinman, James N. Woody, Teresa DeLuca, Frank Knuettel II, Pamela Marrone, Lawrence Gold, Donald A. McGovern, Jr., Russell

T. Ray, Richard W. Barker, Shoshana Shendelman and Ozan Pamir (collectively, the “Third-Party Defendants”). On

October 27, 2021, the Company and Ozan Pamir filed an Answer to the Krauss Counterclaims, and all of the other Third-Party Defendants

filed a Motion to Dismiss as to the Third-Party Complaint.

On

January 28, 2022, in lieu of filing an opposition to the Motion to Dismiss, Dr. Krauss and the KBL Affiliates filed a Motion for leave

to file amended counterclaims and third-party complaint, and to dismiss six of the current and former directors previously named, i.e.,

to dismiss Teresa DeLuca, Frank Knuettel II, Pamela Marrone, Russell T. Ray, Richard W. Barker and Shoshana Shendelman. The

Motion was granted by stipulation and, on February 24, 2022, Dr. Krauss filed an amended Answer, Counterclaims and Third-Party Complaint

(the “Amended Counterclaims”). In essence, the Amended Counterclaims allege (a) that the Company and the remaining

Third-Party Defendants breached fiduciary duties to Dr. Krauss by making alleged misstatements against Dr. Krauss in SEC filings and

failing to register her shares in the Company so that they could be traded, and (b) the Company breached contracts between the Company

and Dr. Krauss for registration of such shares, and also failed to pay to Dr. Krauss the amounts alleged to be owing under a promissory

note in the principal amount of $371,178, plus an additional $300,000 under Dr. Krauss’s resignation agreement. The

Amended Counterclaims seek unspecified amounts of monetary damages, declaratory relief, equitable and injunctive relief, and attorney’s

fees and costs.

On

March 16, 2022, Donald A. McGovern, Jr. and Lawrence Gold filed a Motion to Dismiss the Amended Counterclaims against them, and

the Company and the remaining Third-Party Defendants filed an Answer to the Amended Counterclaims denying the same. On April 19,

2022, Dr. Krauss stipulated to dismiss all of her counterclaims and allegations against both Donald A. McGovern, Jr. and Lawrence Gold,

thereby mooting their Motion to Dismiss the Amended Counterclaims against them. The Company and the Third-Party Defendants intend

to continue to vigorously defend against all of the Amended Counterclaims, however, there can be no assurance that they will be successful

in the legal defense of such Amended Counterclaims. In April 2022, Donald A. McGovern, Jr. and Lawrence Gold were dismissed from the

lawsuit as parties. Discovery has not yet commenced in the case. The Company and the Third-Party Defendants intend to continue to

vigorously defend against all of the Amended Counterclaims, however, there can be no assurance that they will be successful in the legal

defense of such Amended Counterclaims.

Action

Against the Company by Dr. Krauss

On

August 19, 2021, Dr. Krauss initiated legal action in the Chancery Court of Delaware against the Company. The original Complaint

sought expedited relief and made the following two claims: (1) it alleged that the Company is obligated to advance expenses including,

attorney’s fees, to Dr. Krauss for the costs of defending against the SEC and certain Subpoenas served by the SEC on Dr. Krauss;

and (2) it alleged that the Company is also required to reimburse Dr. Krauss for the costs of bringing this lawsuit against the Company. On

or about September 3, 2021, Dr. Krauss filed an Amended and Supplemental Complaint (the “Amended Complaint”) in this action,

which added the further claims that Dr. Krauss is also allegedly entitled to advancement by the Company of her expenses, including attorney’s

fees, for the costs of defending against the Third-Party Complaint in the Tyche Capital LLC action referenced below, and the costs of

defending against the Company’s own Complaint against Dr. Krauss as described above. On or about September 23, 2021,

the Company filed its Answer to the Amended Complaint in which the Company denied each of Dr. Krauss’ claims and further raised

numerous affirmative defenses with respect thereto.

On

November 15, 2021, Dr. Krauss filed a Motion for Summary Adjudication as to certain of the issues in the case, which was opposed by the

Company. A hearing on such Motion was held on December 7, 2021, and, on March 7, 2022, the Court issued a decision in

the matter denying the Motion for Summary Adjudication in part and granting it in part. The Court then issued an Order implementing

such a decision on March 29, 2022. The parties are now engaging in proceedings set forth in that implementing Order. The Court

granted Dr. Krauss’s request for advancement of some of the legal fees which Dr. Krauss requested in her Motion, and the Company

was required to pay a portion of those fees while it objects to the remaining portion of disputed fees.

On

October 10, 2022, Dr. Krauss filed an Application to compel the Company to pay the full amount of fees requested by Dr. Krauss for May-July

2022, and to modify the Court’s Order. The Company filed its Opposition thereto. On January 18, 2023, Dr. Krauss filed

a Second Application to compel the Company to pay the full amount of fees requested by Dr. Krauss for August-October 2022, and to modify

the Court’s Order. The Company filed its Opposition thereto. On May 3, 2023, the Court issued an Order granting both of Dr.

Krauss’s Applications for payment of the full amount of requested attorney’s fees totaling $714,557 for the months of May

through October 2022, which were paid in May 2023. Notwithstanding the Order, such ruling does not constitute any final

adjudication as to whether Dr. Krauss will ultimately be entitled to permanently retain such advancements, and Dr. Krauss has

posted an undertaking with the Court affirmatively promising to repay all such amounts if she is eventually found to be liable for the

Company’s and/or the SEC’s claims against her. The Company is seeking payment for a substantial portion of such amounts from

its director and officers’ insurance policy, of which no assurance can be provided that the directors and officers insurance policy

will cover such amounts. See “Declaratory Relief Action Against the Company by AmTrust International” below.

Action

Against Tyche Capital LLC

The

Company commenced and filed an action against defendant Tyche Capital LLC (“Tyche”) in the Supreme Court of New York, in

the County of New York, on April 15, 2021. In its Complaint, the Company alleged claims against Tyche arising out of Tyche’s

breach of its written contractual obligations to the Company as set forth in a “Guarantee and Commitment Agreement” dated

July 25, 2019, and a “Term Sheet For KBL Business Combination With CannBioRex” dated April 10, 2019 (collectively, the “Subject

Guarantee”). The Company alleges in its Complaint that, notwithstanding demand having been made on Tyche to perform its obligations

under the Subject Guarantee, Tyche has failed and refused to do so, and is currently in debt to the Company for such failure in the amount

of $6,776,686, together with interest accruing thereon at the rate set forth in the Subject Guarantee.

On

or about May 17, 2021, Tyche responded to the Company’s Complaint by filing an Answer and Counterclaims against the Company alleging

that it was the Company, rather than Tyche, that had breached the Subject Guarantee. Tyche also filed a Third-Party Complaint against

six third-party defendants, including three members of the Company’s management, Sir Marc Feldmann, Dr. James Woody, and Ozan Pamir

(collectively, the “Individual Company Defendants”), claiming that they allegedly breached fiduciary duties to Tyche with

regards to the Subject Guarantee. In that regard, on June 25, 2021, each of the Individual Company Defendants filed a Motion

to Dismiss Tyche’s Third-Party Complaint against them.

On

November 23, 2021, the Court granted the Company’s request to issue an Order of attachment against all of Tyche’s shares

of the Company’s stock that had been held in escrow. In so doing, the Court found that the Company had demonstrated a likelihood

of success on the merits of the case based on the facts alleged in the Company’s Complaint.

On February 18, 2022, Tyche filed an Amended Answer, Counterclaims

and Third-Party Complaint. On March 22, 2022, the Company and each of the Individual Company Defendants filed a Motion to Dismiss

all of Tyche’s claims. A hearing on such Motion to Dismiss was held on August 25, 2022, and the Court granted the Motion

to Dismiss entirely as to each of the Individual Company Defendants, and also as to three of the four Counterclaims brought against the

Company, only leaving Tyche’s declaratory relief claim. On September 9, 2022, Tyche filed a Notice of Appeal as to the Court’s

decision, which has never been briefed or adjudicated. On August 26, 2022, Tyche filed a Motion to vacate or modify the Company’s

existing attachment Order against Tyche’s shares of the Company’s stock held in escrow. The Company filed its Opposition thereto,

and the Court summarily denied such Motion without hearing on January 3, 2023. Tyche subsequently filed a Notice of Appeal as to

that denial and filed its Opening Brief on January 30, 2023. The Company filed its opposition brief on March 2, 2023, and the

matter was taken under submission by the Appellate Court. On May 4, 2023, the Appellate Court issued its decision unanimously affirming

the ruling of the lower Court in the Company’s favor.

On January 30, 2023, the Company filed a Notice of Motion for

Summary Judgment and to Dismiss Affirmative Defenses against Tyche. Tyche filed opposition thereto, and hearings on the

Company’s Motion were ultimately held on September 11 and 19, 2023. In its ruling, the Court granted the Company’s Motion,

but referred the question as to the amount of the Company’s damages against Tyche to a special referee. The Court and the parties

are now in the process of appointing the special referee so that a determination can be made as to the amount of the Company’s damages

against Tyche. The Company intends to continue to vigorously pursue its claims against Tyche, and the Company and the Individual

Company Defendants intend to continue to vigorously defend against all of Tyche’s claims should they be appealed; however,

there can be no assurance that they will be successful in such endeavors.

Action

Against Ronald Bauer & Samantha Bauer

The Company and two of its wholly-owned subsidiaries, Katexco Pharmaceuticals

Corp. and CannBioRex Pharmaceuticals Corp. (collectively, the “Company Plaintiffs”), initiated legal action against Ronald

Bauer and Samantha Bauer, as well as two of their companies, Theseus Capital Ltd. and Astatine Capital Ltd. (collectively, the “Bauer

Defendants”), in the Supreme Court of British Columbia on February 25, 2022. The Company Plaintiffs are seeking damages against

the Bauer Defendants for misappropriated funds and stock shares, unauthorized stock sales, and improper travel expenses, in the combined

sum of at least $4,395,000 CAD [$3,257,574 USD] plus the additional sum of $2,721,036 USD (which relate to the same, aforementioned damages).

The Bauer Defendants filed an answer to the Company Plaintiffs’ claims on May 6, 2022. There can be no assurance that the Company

Plaintiffs will be successful in this legal action.

Declaratory

Relief Action Against the Company by AmTrust International

On

June 29, 2022, AmTrust International Underwriters DAC (“AmTrust”), which was the premerger directors’ and officers’

insurance policy underwriter for KBL, filed a declaratory relief action against the Company in the U.S. District Court for

the Northern District of California (the “Declaratory Relief Action”) seeking declaration of AmTrust’s obligations

under the directors’ and officers’ insurance policy. In the Declaratory Relief Action, AmTrust is claiming that

as a result of the merger the Company is no longer the insured under the subject insurance policy, notwithstanding the fact

that the fees which the Company seeks to recover from AmTrust relate to matters occurring prior to the merger.

On

September 20, 2022, the Company filed its Answer and Counterclaims against AmTrust for bad faith breach of AmTrust’s insurance

coverage obligations to the Company under the subject directors’ and officers’ insurance policy, and seeking damages of at

least $2 million in compensatory damages, together with applicable punitive damages. In addition, the Company brought a Third-Party Complaint

against its excess insurance carrier, Freedom Specialty Insurance Company (“Freedom”) seeking declaratory relief that Freedom

will also be required to honor its policy coverage as soon as the amount of AmTrust’s insurance coverage obligations to the Company

have been exhausted. On October 25, 2022, AmTrust filed its Answer to the Company’s Counterclaims and, on October 27, 2022,

Freedom filed its Answer to the Third-Party Complaint.

On

November 22, 2022, the Company filed a Motion for Summary Adjudication against both AmTrust and Freedom. The Motion was fully briefed,

and a hearing was held on March 9, 2023. The standard to prevail on a Motion for Summary Adjudication in the Court is high to prevail