0000946673false00009466732024-07-172024-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 17, 2024

Banner Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Washington | | 000-26584 | | 91-1691604 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

10 S. First Avenue, Walla Walla, Washington 99362

(Address of principal executive offices) (Zip Code)

Registrant's telephone number (including area code) (509) 527-3636

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

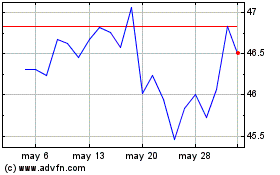

| Common Stock, par value $.01 per share | | BANR | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.*

On July 17, 2024, Banner Corporation issued its earnings release for the quarter ended June 30, 2024. A copy of the earnings release is furnished herewith as Exhibit 99.1, and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.*

Banner Corporation intends to review the investor presentation attached as Exhibit 99.2 to this Current Report on Form 8-K in conjunction with its earnings release conference call on July 17, 2024, and from time to time in presentations to investors and other stakeholders.

Item 8.01 Other Events.

On July 17, 2024, Banner Corporation announced its Board of Directors declared a regular quarterly cash dividend on Banner Corporation common stock of $0.48 per share, payable on August 16, 2024 to stockholders of record as of the close of business on August 6, 2024.

Item 9.01 Financial Statements and Exhibits.*

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

* The information furnished under Item 2.02, Item 7.01 and Item 9.01 of this Current Report on Form 8-K, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of Banner Corporation under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| BANNER CORPORATION |

| |

| |

| |

| Date: July 17, 2024 | By: /s/ Robert G Butterfield |

| Robert G Butterfield |

| Executive Vice President, Treasurer and

Chief Financial Officer |

| |

| | | | | | | | | | | |

| | CONTACT: | MARK J. GRESCOVICH, |

| PRESIDENT & CEO |

| ROBERT G. BUTTERFIELD, CFO |

| (509) 527-3636 |

|

| NEWS RELEASE |

| | | |

| | | |

| | | |

Banner Corporation Reports Net Income of $39.8 Million, or $1.15 Per Diluted Share, for Second Quarter 2024;

Declares Quarterly Cash Dividend of $0.48 Per Share

Walla Walla, WA - July 17, 2024 - Banner Corporation (NASDAQ GSM: BANR) (“Banner”), the parent company of Banner Bank, today reported net income of $39.8 million, or $1.15 per diluted share, for the second quarter of 2024, compared to $37.6 million, or $1.09 per diluted share, for the preceding quarter and $39.6 million, or $1.15 per diluted share, for the second quarter of 2023. Net interest income was $132.5 million in the second quarter of 2024, compared to $133.0 million in the preceding quarter and $142.5 million in the second quarter a year ago. The decrease in net interest income compared to the preceding quarter and prior year quarter reflects an increase in funding costs, partially offset by an increase in yields on earning assets. Banner’s second quarter 2024 results included a $562,000 net loss on the sale of securities, compared to a $4.9 million net loss on the sale of securities in the preceding quarter and a $4.5 million net loss on the sale of securities in the second quarter of 2023. Banner’s second quarter 2024 results also included a $2.4 million provision for credit losses, compared to a $520,000 provision for credit losses in the preceding quarter and a $6.8 million provision for credit losses in the second quarter of 2023. Net income was $77.4 million, or $2.24 per diluted share, for the six months ended June 30, 2024, compared to net income of $95.1 million, or $2.76 per diluted share, for the six months ended June 30, 2023. Banner’s results for the six months ended June 30, 2024 include a $2.9 million provision for credit losses, a $5.5 million net loss on the sale of securities and a $1.2 million net decrease in the fair value adjustments on financial instruments carried at fair value, compared to a $6.2 million provision for credit losses, an $11.8 million net loss on the sale of securities and a $3.7 million net decrease in the fair value adjustments on financial instruments carried at fair value during the same period in 2023.

Banner announced that its Board of Directors declared a regular quarterly cash dividend of $0.48 per share. The dividend will be payable August 16, 2024, to common shareholders of record on August 6, 2024.

“Banner’s second quarter operating results reflect the continued successful execution of our super community bank strategy, which emphasizes strong relationship banking and a moderate risk profile,” said Mark Grescovich, President and CEO. “Our earnings for the second quarter of 2024 benefited from solid growth in loans and higher yields on interest-earning assets. The continued high interest rate environment and its effect on funding costs, however, resulted in moderate compression in our net interest margin during the quarter. We continue to maintain strong credit quality metrics and a solid reserve for potential credit losses. Additionally, we continue to benefit from a strong core deposit base that has been resilient in a highly competitive environment, with core deposits representing 88% of total deposits at quarter end. Banner has upheld its core values for the past 133 years, which are to do the right thing for our clients, communities, colleagues, company and shareholders; and to provide consistent and reliable strength through all economic cycles and change events.”

At June 30, 2024, Banner, on a consolidated basis, had $15.82 billion in assets, $10.99 billion in net loans and $13.08 billion in deposits. Banner operates 135 full-service branch offices, including branches located in eight of the top 20 largest western Metropolitan Statistical Areas by population.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 2

Second Quarter 2024 Highlights

•Revenue was $149.7 million for the second quarter of 2024, compared to $144.6 million in the preceding quarter and $150.9 million in the second quarter a year ago.

•Adjusted revenue* (the total of net interest income and total non-interest income adjusted for the net gain or loss on the sale of securities and the net change in valuation of financial instruments) was $150.5 million in the second quarter of 2024, compared to $150.4 million in the preceding quarter and $158.6 million in the second quarter a year ago.

•Net interest income was $132.5 million in the second quarter of 2024, compared to $133.0 million in the preceding quarter and $142.5 million in the second quarter a year ago.

•Net interest margin, on a tax equivalent basis, was 3.70%, compared to 3.74% in the preceding quarter and 4.00% in the second quarter a year ago.

•Mortgage banking operations revenue was $3.0 million for the second quarter of 2024, compared to $2.3 million in the preceding quarter and $1.7 million in the second quarter a year ago.

•Return on average assets was 1.02%, compared to 0.97% in the preceding quarter and 1.02% in the second quarter a year ago.

•Net loans receivable increased 3% to $10.99 billion at June 30, 2024, compared to $10.72 billion at March 31, 2024, and increased 6% compared to $10.33 billion at June 30, 2023.

•Non-performing assets were $33.3 million, or 0.21% of total assets, at June 30, 2024, compared to $29.9 million, or 0.19% of total assets, at March 31, 2024 and $28.7 million, or 0.18% of total assets, at June 30, 2023.

•The allowance for credit losses - loans was $152.8 million, or 1.37% of total loans receivable, as of June 30, 2024, compared to $151.1 million, or 1.39% of total loans receivable, as of March 31, 2024 and $144.7 million, or 1.38% of total loans receivable, as of June 30, 2023.

•Total deposits decreased to $13.08 billion at June 30, 2024, compared to $13.16 billion at March 31, 2024 and $13.10 billion at June 30, 2023.

•Core deposits represented 88% of total deposits at June 30, 2024.

•Available borrowing capacity was $4.73 billion at June 30, 2024, compared to $5.05 billion at March 31, 2024.

•On-balance sheet liquidity was $2.83 billion at June 30, 2024, compared to $2.77 billion at March 31, 2024.

•Dividends paid to shareholders were $0.48 per share in the quarter ended June 30, 2024.

•Common shareholders’ equity per share increased 1% to $49.07 at June 30, 2024, compared to $48.39 at the preceding quarter end, and increased 9% from $44.91 at June 30, 2023.

•Tangible common shareholders’ equity per share* increased 2% to $38.12 at June 30, 2024, compared to $37.40 at the preceding quarter end, and increased 13% from $33.83 at June 30, 2023.

*Non-GAAP (Generally Accepted Accounting Principles) financial measure; See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures.

Income Statement Review

Net interest income was $132.5 million in the second quarter of 2024, compared to $133.0 million in the preceding quarter and $142.5 million in the second quarter a year ago. Net interest margin on a tax equivalent basis decreased four basis points to 3.70% for the second quarter of 2024, compared to 3.74% in the preceding quarter, and decreased compared to 4.00% in the second quarter a year ago. Net interest margin for the current quarter was impacted by increased funding costs reflecting the persistent high interest rate environment, partially offset by increased yields on loans due to new loans being originated at higher interest rates and adjustable rate loans repricing higher.

Average yields on interest-earning assets increased nine basis points to 5.25% for the second quarter of 2024, compared to 5.16% for the preceding quarter, and increased compared to 4.80% in the second quarter a year ago. Average loan yields increased nine basis points to 5.96%, compared to 5.87% in the preceding quarter, and increased compared to 5.51% in the second quarter a year ago. The increase in average yields, especially loans, during the current quarter reflects the benefit of originating new loans at higher interest rates as well as adjustable rate loans repricing higher. Total deposit costs increased 13 basis points to 1.50% in the second quarter of 2024, compared to 1.37% in the preceding quarter, and compared to 0.64% in the second quarter a year ago. The increase in deposit costs was due to a larger percentage of core deposits being in interest bearing accounts as well as an increase in the mix of higher cost retail CDs. The average rate paid on borrowings increased nine basis points to 5.07% in the second quarter of 2024, compared to 4.98% in the preceding quarter, and compared to 4.60% in the second quarter a year ago. The total cost of funding liabilities increased 13 basis points to 1.66% during the second quarter of 2024, compared to 1.53% in the preceding quarter, and compared to 0.86% in the second quarter a year ago.

A $2.4 million provision for credit losses was recorded in the current quarter (comprised of a $2.0 million provision for credit losses - loans, a $430,000 provision for credit losses - unfunded loan commitments and a $14,000 recapture of provision for credit losses - held-to-maturity debt securities). This compares to a $520,000 provision for credit losses in the prior quarter (comprised of a $1.4 million provision for credit losses - loans, an $887,000 recapture of provision for credit losses - unfunded loan commitments and a $17,000 recapture of provision for credit losses - held-to-maturity debt securities) and a $6.8 million provision for credit losses in the second quarter a year ago (comprised of a $3.6 million provision for credit losses - loans, a $1.2 million provision for credit losses - unfunded loan commitments, a $2.0 million provision for credit losses - available for sale securities and a $16,000 recapture of provision for credit losses - held-to-maturity debt securities). The provision for credit losses for the current quarter primarily reflected loan growth and an increase in the reserve for collateral dependent loans. The provision for credit losses for the preceding quarter primarily reflected loan growth in the construction and one- to four-family loan portfolios and was partially offset by a reduction in unfunded loan commitments in the construction portfolio.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 3

Total non-interest income was $17.2 million in the second quarter of 2024, compared to $11.6 million in the preceding quarter and $8.4 million in the second quarter a year ago. The increase in non-interest income during the current quarter compared to the preceding quarter was primarily due to a $4.3 million decrease in the net loss recognized on the sale of securities. The increase in non-interest income during the current quarter compared to the prior year quarter was primarily due to a $1.3 million increase in mortgage banking operations revenue, a $4.0 million decrease in the net loss recognized on the sale of securities and a $3.0 million decrease in the net loss recognized for fair value adjustments on financial instruments carried at fair value. Total non-interest income was $28.8 million for the six months ended June 30, 2024, compared to $17.7 million for the same period a year earlier.

Mortgage banking operations revenue was $3.0 million in the second quarter of 2024, compared to $2.3 million in the preceding quarter and $1.7 million in the second quarter a year ago. The volume of one- to four-family loans sold during the current quarter increased compared to the prior year quarter, although overall volumes remained low due to reduced refinancing and purchase activity in the current rate environment. The increase from the preceding quarter included a $284,000 gain related to the sale of $19.8 million of one- to four-family portfolio loans during the second quarter of 2024. The increase from the preceding quarter also reflects an increase in the percentage of loan sold servicing retained. Home purchase activity accounted for 89% of one- to four-family mortgage loan originations in both the second quarter of 2024 and the preceding quarter and 93% in the second quarter of 2023.

During the second quarter of 2024, non-interest income included a $190,000 net loss for fair value adjustments as a result of changes in the valuation of financial instruments carried at fair value, principally comprised of limited partnership investments, and a $562,000 net loss on the sale of securities, related to a security with a premium that was called early. In the preceding quarter, non-interest income included a $992,000 net loss for fair value adjustments and a $4.9 million net loss on the sale of securities. In the second quarter a year ago, non-interest income included a $3.2 million net loss for fair value adjustments and a $4.5 million net loss on the sale of securities.

Total non-interest expense was $98.1 million in the second quarter of 2024, compared to $97.6 million in the preceding quarter and $95.4 million in the second quarter of 2023. The increase in non-interest expense for the current quarter compared to the prior quarter reflects a $1.5 million increase in salary and employee benefits, primarily resulting from normal annual salary and wage increases and an increase in loan production related commission expense, partially offset by a $963,000 increase in capitalized loan origination costs, primarily due to increased loan production. The increase in non-interest expense for the current quarter compared to the same quarter a year ago primarily reflects increases in salary and employee benefits and payment and card processing services expense, partially offset by a decrease in professional and legal expenses. For the six months ended June 30, 2024, total non-interest expense was $195.8 million, compared to $190.0 million for the six months ended June 30, 2023. Banner’s efficiency ratio was 65.53% for the second quarter of 2024, compared to 67.55% in the preceding quarter and 63.21% in the same quarter a year ago. Banner’s adjusted efficiency ratio, a non-GAAP financial measure, was 63.60% for the second quarter of 2024, compared to 63.70% in the preceding quarter and 58.58% in the year ago quarter. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a discussion and reconciliation of non-GAAP financial measures.

Federal and state income tax expense totaled $9.5 million for the second quarter of 2024 resulting in an effective tax rate of 19.2%, reflecting the benefits from tax exempt income. Banner’s statutory income tax rate for the quarter ended June 30, 2024, was 23.7%, representing a blend of the statutory federal income tax rate of 21.0% and apportioned effects of the state income tax rates.

Balance Sheet Review

Total assets increased to $15.82 billion at June 30, 2024, compared to $15.52 billion at March 31, 2024, and $15.58 billion at June 30, 2023. Securities and interest-bearing deposits held at other banks totaled $3.27 billion at June 30, 2024, compared to $3.32 billion at March 31, 2024 and $3.64 billion at June 30, 2023. The decrease compared to the prior quarter was primarily due to normal cash flows from the securities portfolio. The average effective duration of the securities portfolio was approximately 6.5 years at June 30, 2024, compared to 6.8 years at June 30, 2023.

Total loans receivable increased to $11.14 billion at June 30, 2024, compared to $10.87 billion at March 31, 2024, and $10.47 billion at June 30, 2023. One- to four-family residential loans increased 2% to $1.60 billion at June 30, 2024, compared to $1.57 billion at March 31, 2024, and increased 20% compared to $1.34 billion at June 30, 2023. The increase in one- to four-family residential loans was the result of one- to four-family construction loans converting to one- to four-family portfolio loans upon the completion of the construction phase and new loan production, partially offset by the sale of $19.8 million of one- to four-family portfolio loans. Multifamily real estate loans decreased 11% to $717.1 million at June 30, 2024, compared to $809.1 million at March 31, 2024, and increased 2% compared to $699.8 million at June 30, 2023. The decrease in multifamily real estate compared to March 31, 2024 was primarily due to certain affordable housing loans transferring to small balance commercial real estate. The increase in multifamily real estate loans from June 30, 2023 was primarily the result of the conversion of affordable housing multifamily construction loans to the multifamily portfolio upon the completion of the construction phase as well as the transfer of $43.5 million of multifamily loans held for sale to the held for investment loan portfolio in the fourth quarter of 2023, partially offset by the transfer of certain affordable housing loans to small balance commercial real estate. Construction, land and land development loans increased 7% to $1.68 billion at June 30, 2024, compared to $1.57 billion at March 31, 2024, and increased 11% compared to $1.51 billion at June 30, 2023. The increase in construction, land and land development loans was primarily the result of new loan production and advances on multifamily construction loans, primarily related to affordable housing projects. Agricultural business loans increased 5% to $334.6 million at June 30, 2024, compared to $318.0 million at March 31, 2024 and increased 8% compared to $310.1 million at June 30, 2023, primarily due to new loan production and advances on agricultural lines of credit.

Loans held for sale were $13.4 million at June 30, 2024, compared to $9.4 million at March 31, 2024 and $60.6 million at June 30, 2023. One- to four- family residential mortgage held for sale loans sold in the current quarter totaled $75.0 million, compared to $65.9 million in the preceding quarter and $62.6 million in the second quarter a year ago. The decrease in loans held for sale compared to June 30, 2023 was due to the previously mentioned transfer of multifamily loans held for sale to the held for investment loan portfolio in the fourth quarter of 2023. There were no multifamily loans held for sale at June 30, 2024 or March 31, 2024.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 4

Total deposits decreased to $13.08 billion at June 30, 2024, compared to $13.16 billion at March 31, 2024 and $13.10 billion a year ago. Core deposits decreased 1% to $11.55 billion at June 30, 2024, compared to $11.67 billion at March 31, 2024, and decreased 2% compared to $11.74 billion at June 30, 2023. The decrease in core deposits primarily reflects clients using deposits for seasonal tax payments. Core deposits were 88% of total deposits at June 30, 2024, compared to 89% of total deposits at March 31, 2024 and 90% of total deposits at June 30, 2023. Certificates of deposit increased 3% to $1.53 billion at June 30, 2024, compared to $1.49 billion at March 31, 2024, and increased 12% compared to $1.36 billion a year earlier. The increase in certificates of deposit during the current quarter compared to the preceding quarter and second quarter a year ago was principally due to clients seeking higher yields moving funds from core deposit accounts to higher yielding certificates of deposit. The increase in certificates of deposit from the second quarter a year ago was partially offset by a $98.3 million decrease in brokered deposits.

Banner Bank’s estimated uninsured deposits were $4.09 billion or 31% of total deposits at June 30, 2024, compared to $4.18 billion or 31% of total deposits at March 31, 2024. The uninsured deposit calculation includes $326.5 million and $316.6 million of collateralized public deposits at June 30, 2024 and March 31, 2024, respectively. Uninsured deposits also include cash held by the holding company of $63.9 million and $113.9 million at June 30, 2024 and March 31, 2024, respectively. Banner Bank’s estimated uninsured deposits, excluding collateralized public deposits and cash held at the holding company, were 28% of total deposits at both June 30, 2024 and March 31, 2024.

Banner had $398.0 million of FHLB advances at June 30, 2024, compared to $52.0 million at March 31, 2024 and $270.0 million a year ago. At June 30, 2024, Banner’s off-balance sheet liquidity included additional borrowing capacity of $3.02 billion at the FHLB and $1.59 billion at the Federal Reserve as well as federal funds line of credit agreements with other financial institutions of $125.0 million.

At June 30, 2024, total common shareholders’ equity was $1.69 billion, or 10.69% of total assets, compared to $1.66 billion or 10.73% of total assets at March 31, 2024, and $1.54 billion or 9.90% of total assets at June 30, 2023. The increase in total common shareholders’ equity at June 30, 2024 compared to March 31, 2024 was primarily due to a $23.1 million increase in retained earnings as a result of $39.8 million in net income, partially offset by the accrual of $16.7 million of cash dividends during the second quarter of 2024. At June 30, 2024, tangible common shareholders’ equity, a non-GAAP financial measure, was $1.31 billion, or 8.51% of tangible assets, compared to $1.29 billion, or 8.50% of tangible assets, at March 31, 2024, and $1.16 billion, or 7.64% of tangible assets, a year ago. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures.

Banner and Banner Bank continue to maintain capital levels in excess of the requirements to be categorized as “well-capitalized.” At June 30, 2024, Banner’s estimated common equity Tier 1 capital ratio was 12.02%, its estimated Tier 1 leverage capital to average assets ratio was 10.80%, and its estimated total capital to risk-weighted assets ratio was 14.62%. These regulatory capital ratios are estimates, pending completion and filing of Banner’s regulatory reports.

Credit Quality

The allowance for credit losses - loans was $152.8 million, or 1.37% of total loans receivable and 498% of non-performing loans, at June 30, 2024, compared to $151.1 million, or 1.39% of total loans receivable and 513% of non-performing loans, at March 31, 2024, and $144.7 million, or 1.38% of total loans receivable and 513% of non-performing loans, at June 30, 2023. In addition to the allowance for credit losses - loans, Banner maintains an allowance for credit losses - unfunded loan commitments, which was $14.0 million at June 30, 2024, compared to $13.6 million at March 31, 2024, and $14.7 million at June 30, 2023. Net loan charge-offs totaled $245,000 in the second quarter of 2024, compared to net loan recoveries of $73,000 in the preceding quarter and net loan charge-offs of $336,000 in the second quarter a year ago. Non-performing loans were $30.7 million at June 30, 2024, compared to $29.5 million at March 31, 2024, and $28.2 million a year ago.

Substandard loans were $122.0 million at June 30, 2024, compared to $116.1 million at March 31, 2024 and $145.0 million a year ago. The increase from the prior quarter reflects downgrades of loans, partially offset by paydowns and payoffs of substandard loans. The decrease from the prior year quarter primarily reflects paydowns and payoffs of substandard loans as well as risk rating upgrades.

Total non-performing assets were $33.3 million, or 0.21% of total assets, at June 30, 2024, compared to $29.9 million, or 0.19% of total assets, at March 31, 2024, and $28.7 million, or 0.18% of total assets, a year ago.

Conference Call

Banner will host a conference call on Thursday July 18, 2024, at 8:00 a.m. PDT, to discuss its second quarter results. Interested investors may listen to the call live at www.bannerbank.com. Investment professionals are invited to dial (833) 470-1428 using access code 005428 to participate in the call. A replay of the call will be available at www.bannerbank.com.

About the Company

Banner Corporation is a $15.82 billion bank holding company operating a commercial bank in four Western states through a network of branches offering a full range of deposit services and business, commercial real estate, construction, residential, agricultural and consumer loans. Visit Banner Bank on the Web at www.bannerbank.com.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 5

Forward-Looking Statements

When used in this press release and in other documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “may,” “believe,” “will,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” “potential,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date such statements are made and based only on information then actually known to Banner. Banner does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These statements may relate to future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial information. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements and could negatively affect Banner’s operating and stock price performance.

Factors that could cause Banner’s actual results to differ materially from those described in the forward-looking statements, include but are not limited to, the following: (1) potential adverse impacts to economic conditions in our local market areas, other markets where the Company has lending relationships, or other aspects of the Company’s business operations or financial markets, including, without limitation, as a result of employment levels, labor shortages and the effects of inflation, a potential recession or slowed economic growth, or increased political instability due to acts of war; (2) changes in the interest rate environment, including past increases in the Board of Governors of the Federal Reserve System (the “Federal Reserve”) benchmark rate and duration at which such increased interest rate levels are maintained, which could adversely affect our revenues and expenses, the value of assets and obligations, and the availability and cost of capital and liquidity; (3) the impact of continuing elevated inflation and the current and future monetary policies of the Federal Reserve in response thereto; (4) the effects of any federal government shutdown; (5) the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor sentiment; (6) expectations regarding key growth initiatives and strategic priorities; (7) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for credit losses, which could necessitate additional provisions for credit losses, resulting both from loans originated and loans acquired from other financial institutions; (8) results of examinations by regulatory authorities, including the possibility that any such regulatory authority may, among other things, require increases in the allowance for credit losses or writing down of assets or impose restrictions or penalties with respect to Banner’s activities; (9) competitive pressures among depository institutions; (10) the effect of inflation on interest rate movements and their impact on client behavior and net interest margin; (11) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (12) fluctuations in real estate values; (13) the ability to adapt successfully to technological changes to meet clients’ needs and developments in the market place; (14) the ability to access cost-effective funding; (15) disruptions, security breaches or other adverse events, failures or interruptions in, or attacks on, information technology systems or on the third-party vendors who perform critical processing functions; (16) changes in financial markets; (17) changes in economic conditions in general and in Washington, Idaho, Oregon and California in particular; (18) the costs, effects and outcomes of litigation; (19) legislation or regulatory changes, including but not limited to changes in regulatory policies and principles, or the interpretation of regulatory capital or other rules, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (20) changes in accounting principles, policies or guidelines; (21) future acquisitions by Banner of other depository institutions or lines of business; (22) future goodwill impairment due to changes in Banner’s business or changes in market conditions; (23) effects of critical accounting policies and judgments, including the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; (24) environmental, social and governance goals and targets; (25) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services; and (26) other risks detailed from time to time in Banner’s other reports filed with and furnished to the Securities and Exchange Commission including Banner’s Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RESULTS OF OPERATIONS | | Quarters Ended | | Six Months Ended |

| (in thousands except shares and per share data) | | Jun 30, 2024 | | Mar 31, 2024 | | Jun 30, 2023 | | Jun 30, 2024 | | Jun 30, 2023 |

| INTEREST INCOME: | | | | | | | | | | |

| Loans receivable | | $ | 161,191 | | | $ | 156,475 | | | $ | 140,848 | | | $ | 317,666 | | | $ | 274,105 | |

| Mortgage-backed securities | | 16,708 | | | 16,934 | | | 18,285 | | | 33,642 | | | 37,263 | |

| Securities and cash equivalents | | 11,239 | | | 11,279 | | | 12,676 | | | 22,518 | | | 27,402 | |

| Total interest income | | 189,138 | | | 184,688 | | | 171,809 | | | 373,826 | | | 338,770 | |

| INTEREST EXPENSE: | | | | | | | | | | |

| Deposits | | 48,850 | | | 44,613 | | | 20,539 | | | 93,463 | | | 29,783 | |

| Federal Home Loan Bank (FHLB) advances | | 3,621 | | | 2,972 | | | 5,157 | | | 6,593 | | | 6,421 | |

| Other borrowings | | 1,160 | | | 1,175 | | | 771 | | | 2,335 | | | 1,152 | |

Subordinated debt | | 2,961 | | | 2,969 | | | 2,824 | | | 5,930 | | | 5,584 | |

| Total interest expense | | 56,592 | | | 51,729 | | | 29,291 | | | 108,321 | | | 42,940 | |

| Net interest income | | 132,546 | | | 132,959 | | | 142,518 | | | 265,505 | | | 295,830 | |

| PROVISION FOR CREDIT LOSSES | | 2,369 | | | 520 | | | 6,764 | | | 2,889 | | | 6,240 | |

| Net interest income after provision for credit losses | | 130,177 | | | 132,439 | | | 135,754 | | | 262,616 | | | 289,590 | |

| NON-INTEREST INCOME: | | | | | | | | | | |

| Deposit fees and other service charges | | 10,590 | | | 11,022 | | | 10,600 | | | 21,612 | | | 21,162 | |

| Mortgage banking operations | | 3,006 | | | 2,335 | | | 1,686 | | | 5,341 | | | 4,377 | |

| Bank-owned life insurance | | 2,367 | | | 2,237 | | | 2,386 | | | 4,604 | | | 4,574 | |

| Miscellaneous | | 1,988 | | | 1,892 | | | 1,428 | | | 3,880 | | | 3,068 | |

| | | 17,951 | | | 17,486 | | | 16,100 | | | 35,437 | | | 33,181 | |

| Net loss on sale of securities | | (562) | | | (4,903) | | | (4,527) | | | (5,465) | | | (11,779) | |

| | | | | | | | | | |

| Net change in valuation of financial instruments carried at fair value | | (190) | | | (992) | | | (3,151) | | | (1,182) | | | (3,703) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total non-interest income | | 17,199 | | | 11,591 | | | 8,422 | | | 28,790 | | | 17,699 | |

| NON-INTEREST EXPENSE: | | | | | | | | | | |

| Salary and employee benefits | | 63,831 | | | 62,369 | | | 61,972 | | | 126,200 | | | 123,361 | |

| Less capitalized loan origination costs | | (4,639) | | | (3,676) | | | (4,457) | | | (8,315) | | | (7,888) | |

| Occupancy and equipment | | 12,128 | | | 12,462 | | | 11,994 | | | 24,590 | | | 23,964 | |

| Information and computer data services | | 7,240 | | | 7,320 | | | 7,082 | | | 14,560 | | | 14,229 | |

| Payment and card processing services | | 5,691 | | | 5,710 | | | 4,669 | | | 11,401 | | | 9,287 | |

| Professional and legal expenses | | 1,201 | | | 1,530 | | | 2,400 | | | 2,731 | | | 4,521 | |

| Advertising and marketing | | 1,198 | | | 1,079 | | | 940 | | | 2,277 | | | 1,746 | |

| Deposit insurance | | 2,858 | | | 2,809 | | | 2,839 | | | 5,667 | | | 4,729 | |

| State and municipal business and use taxes | | 1,394 | | | 1,304 | | | 1,229 | | | 2,698 | | | 2,529 | |

| Real estate operations, net | | 297 | | | (220) | | | 75 | | | 77 | | | (202) | |

| Amortization of core deposit intangibles | | 724 | | | 723 | | | 991 | | | 1,447 | | | 2,041 | |

| | | | | | | | | | |

| Miscellaneous | | 6,205 | | | 6,231 | | | 5,671 | | | 12,436 | | | 11,709 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total non-interest expense | | 98,128 | | | 97,641 | | | 95,405 | | | 195,769 | | | 190,026 | |

| Income before provision for income taxes | | 49,248 | | | 46,389 | | | 48,771 | | | 95,637 | | | 117,263 | |

| PROVISION FOR INCOME TAXES | | 9,453 | | | 8,830 | | | 9,180 | | | 18,283 | | | 22,117 | |

| NET INCOME | | $ | 39,795 | | | $ | 37,559 | | | $ | 39,591 | | | $ | 77,354 | | | $ | 95,146 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Earnings per common share: | | | | | | | | | | |

| Basic | | $ | 1.15 | | | $ | 1.09 | | | $ | 1.15 | | | $ | 2.25 | | | $ | 2.77 | |

| Diluted | | $ | 1.15 | | | $ | 1.09 | | | $ | 1.15 | | | $ | 2.24 | | | $ | 2.76 | |

| Cumulative dividends declared per common share | | $ | 0.48 | | | $ | 0.48 | | | $ | 0.48 | | | $ | 0.96 | | | $ | 0.96 | |

| Weighted average number of common shares outstanding: | | | | | | | | | | |

| Basic | | 34,488,163 | | | 34,391,564 | | | 34,373,434 | | | 34,439,863 | | | 34,306,853 | |

| Diluted | | 34,537,012 | | | 34,521,105 | | | 34,409,024 | | | 34,539,620 | | | 34,435,221 | |

| Increase in common shares outstanding | | 60,531 | | | 46,852 | | | 36,087 | | | 107,383 | | | 150,609 | |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 7

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL CONDITION | | | | | | | | | | Percentage Change |

| (in thousands except shares and per share data) | | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 | | Prior Qtr | | Prior Yr Qtr |

| | | | | | | | | | | | |

| ASSETS | | | | | | | | | | | | |

| Cash and due from banks | | $ | 195,163 | | | $ | 168,427 | | | $ | 209,634 | | | $ | 229,918 | | | 15.9 | % | | (15.1) | % |

| Interest-bearing deposits | | 52,295 | | | 40,849 | | | 44,830 | | | 51,407 | | | 28.0 | % | | 1.7 | % |

Total cash and cash equivalents | | 247,458 | | | 209,276 | | | 254,464 | | | 281,325 | | | 18.2 | % | | (12.0) | % |

| Securities - trading | | — | | | — | | | — | | | 25,659 | | | nm | | (100.0) | % |

Securities - available for sale, amortized cost $2,572,544, $2,617,986, $2,729,980 and $2,879,179, respectively | | 2,197,693 | | | 2,244,939 | | | 2,373,783 | | | 2,465,960 | | | (2.1) | % | | (10.9) | % |

Securities - held to maturity, fair value $852,709, $869,097, $907,514 and $933,116, respectively | | 1,023,028 | | | 1,038,312 | | | 1,059,055 | | | 1,098,570 | | | (1.5) | % | | (6.9) | % |

Total securities | | 3,220,721 | | | 3,283,251 | | | 3,432,838 | | | 3,590,189 | | | (1.9) | % | | (10.3) | % |

| | | | | | | | | | | | |

| FHLB stock | | 27,311 | | | 11,741 | | | 24,028 | | | 20,800 | | | 132.6 | % | | 31.3 | % |

| | | | | | | | | | | | |

| Loans held for sale | | 13,421 | | | 9,357 | | | 11,170 | | | 60,612 | | | 43.4 | % | | (77.9) | % |

| Loans receivable | | 11,143,848 | | | 10,869,096 | | | 10,810,455 | | | 10,472,407 | | | 2.5 | % | | 6.4 | % |

| Allowance for credit losses – loans | | (152,848) | | | (151,140) | | | (149,643) | | | (144,680) | | | 1.1 | % | | 5.6 | % |

Net loans receivable | | 10,991,000 | | | 10,717,956 | | | 10,660,812 | | | 10,327,727 | | | 2.5 | % | | 6.4 | % |

| Accrued interest receivable | | 67,520 | | | 66,124 | | | 63,100 | | | 57,007 | | | 2.1 | % | | 18.4 | % |

| Property and equipment, net | | 126,465 | | | 129,889 | | | 132,231 | | | 135,414 | | | (2.6) | % | | (6.6) | % |

| Goodwill | | 373,121 | | | 373,121 | | | 373,121 | | | 373,121 | | | — | % | | — | % |

| Other intangibles, net | | 4,237 | | | 4,961 | | | 5,684 | | | 7,399 | | | (14.6) | % | | (42.7) | % |

| Bank-owned life insurance | | 307,948 | | | 306,600 | | | 304,366 | | | 301,260 | | | 0.4 | % | | 2.2 | % |

| Operating lease right-of-use assets | | 39,628 | | | 40,834 | | | 43,731 | | | 45,812 | | | (3.0) | % | | (13.5) | % |

| Other assets | | 397,364 | | | 365,169 | | | 364,846 | | | 384,070 | | | 8.8 | % | | 3.5 | % |

Total assets | | $ | 15,816,194 | | | $ | 15,518,279 | | | $ | 15,670,391 | | | $ | 15,584,736 | | | 1.9 | % | | 1.5 | % |

| LIABILITIES | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | |

| Non-interest-bearing | | $ | 4,537,803 | | | $ | 4,699,553 | | | $ | 4,792,369 | | | $ | 5,369,187 | | | (3.4) | % | | (15.5) | % |

| Interest-bearing transaction and savings accounts | | 7,016,327 | | | 6,973,338 | | | 6,759,661 | | | 6,373,269 | | | 0.6 | % | | 10.1 | % |

| Interest-bearing certificates | | 1,525,133 | | | 1,485,880 | | | 1,477,467 | | | 1,356,600 | | | 2.6 | % | | 12.4 | % |

| Total deposits | | 13,079,263 | | | 13,158,771 | | | 13,029,497 | | | 13,099,056 | | | (0.6) | % | | (0.2) | % |

| Advances from FHLB | | 398,000 | | | 52,000 | | | 323,000 | | | 270,000 | | | 665.4 | % | | 47.4 | % |

| Other borrowings | | 165,956 | | | 183,341 | | | 182,877 | | | 193,019 | | | (9.5) | % | | (14.0) | % |

| Subordinated notes, net | | 89,561 | | | 89,456 | | | 92,851 | | | 92,646 | | | 0.1 | % | | (3.3) | % |

| Junior subordinated debentures at fair value | | 66,831 | | | 66,586 | | | 66,413 | | | 67,237 | | | 0.4 | % | | (0.6) | % |

| Operating lease liabilities | | 44,056 | | | 45,524 | | | 48,659 | | | 51,234 | | | (3.2) | % | | (14.0) | % |

| Accrued expenses and other liabilities | | 235,515 | | | 211,578 | | | 228,428 | | | 223,565 | | | 11.3 | % | | 5.3 | % |

| Deferred compensation | | 46,246 | | | 46,515 | | | 45,975 | | | 45,466 | | | (0.6) | % | | 1.7 | % |

| Total liabilities | | 14,125,428 | | | 13,853,771 | | | 14,017,700 | | | 14,042,223 | | | 2.0 | % | | 0.6 | % |

| SHAREHOLDERS’ EQUITY | | | | | | | | | | | | |

| Common stock | | 1,302,236 | | | 1,300,969 | | | 1,299,651 | | | 1,294,934 | | | 0.1 | % | | 0.6 | % |

| Retained earnings | | 686,079 | | | 663,021 | | | 642,175 | | | 587,027 | | | 3.5 | % | | 16.9 | % |

Accumulated other comprehensive loss | | (297,549) | | | (299,482) | | | (289,135) | | | (339,448) | | | (0.6) | % | | (12.3) | % |

| Total shareholders’ equity | | 1,690,766 | | | 1,664,508 | | | 1,652,691 | | | 1,542,513 | | | 1.6 | % | | 9.6 | % |

| Total liabilities and shareholders’ equity | | $ | 15,816,194 | | | $ | 15,518,279 | | | $ | 15,670,391 | | | $ | 15,584,736 | | | 1.9 | % | | 1.5 | % |

| Common Shares Issued: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares outstanding at end of period | | 34,455,752 | | | 34,395,221 | | | 34,348,369 | | | 34,344,627 | | | | | |

Common shareholders’ equity per share (1) | | $ | 49.07 | | | $ | 48.39 | | | $ | 48.12 | | | $ | 44.91 | | | | | |

Common shareholders’ tangible equity per share (1) (2) | | $ | 38.12 | | | $ | 37.40 | | | $ | 37.09 | | | $ | 33.83 | | | | | |

| Common shareholders’ equity to total assets | | 10.69 | % | | 10.73 | % | | 10.55 | % | | 9.90 | % | | | | |

Common shareholders’ tangible equity to tangible assets (2) | | 8.51 | % | | 8.50 | % | | 8.33 | % | | 7.64 | % | | | | |

| Consolidated Tier 1 leverage capital ratio | | 10.80 | % | | 10.71 | % | | 10.56 | % | | 10.22 | % | | | | |

| | | | | | | | | | | | | | | | | |

| nm | Not meaningful | | | | |

| (1) | Calculation is based on number of common shares outstanding at the end of the period rather than weighted average shares outstanding. |

| (2) | Common shareholders’ tangible equity and tangible assets exclude goodwill and other intangible assets. These ratios represent non-GAAP financial measures. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures. |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | |

| | | | | | | | | | Percentage Change |

| LOANS | | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 | | Prior Qtr | | Prior Yr Qtr |

| | | | | | | | | | | | |

| Commercial real estate (CRE): | | | | | | | | | | | | |

| Owner-occupied | | $ | 950,922 | | | $ | 905,063 | | | $ | 915,897 | | | $ | 894,876 | | | 5.1 | % | | 6.3 | % |

| Investment properties | | 1,536,142 | | | 1,544,885 | | | 1,541,344 | | | 1,558,176 | | | (0.6) | % | | (1.4) | % |

| Small balance CRE | | 1,234,302 | | | 1,159,355 | | | 1,178,500 | | | 1,172,825 | | | 6.5 | % | | 5.2 | % |

| Multifamily real estate | | 717,089 | | | 809,101 | | | 811,232 | | | 699,830 | | | (11.4) | % | | 2.5 | % |

| Construction, land and land development: | | | | | | | | | | | | |

| Commercial construction | | 173,296 | | | 158,011 | | | 170,011 | | | 183,765 | | | 9.7 | % | | (5.7) | % |

| Multifamily construction | | 663,989 | | | 573,014 | | | 503,993 | | | 433,868 | | | 15.9 | % | | 53.0 | % |

| One- to four-family construction | | 490,237 | | | 495,931 | | | 526,432 | | | 547,200 | | | (1.1) | % | | (10.4) | % |

| Land and land development | | 352,184 | | | 344,563 | | | 336,639 | | | 345,053 | | | 2.2 | % | | 2.1 | % |

| Commercial business: | | | | | | | | | | | | |

| Commercial business | | 1,298,134 | | | 1,262,716 | | | 1,255,734 | | | 1,313,226 | | | 2.8 | % | | (1.1) | % |

| Small business scored | | 1,074,465 | | | 1,028,067 | | | 1,022,154 | | | 982,283 | | | 4.5 | % | | 9.4 | % |

| Agricultural business, including secured by farmland: | | | | | | | | | | | | |

| Agricultural business, including secured by farmland | | 334,583 | | | 317,958 | | | 331,089 | | | 310,120 | | | 5.2 | % | | 7.9 | % |

| One- to four-family residential | | 1,603,266 | | | 1,566,834 | | | 1,518,046 | | | 1,340,126 | | | 2.3 | % | | 19.6 | % |

| Consumer: | | | | | | | | | | | | |

| Consumer—home equity revolving lines of credit | | 611,739 | | | 597,060 | | | 588,703 | | | 577,725 | | | 2.5 | % | | 5.9 | % |

| Consumer—other | | 103,500 | | | 106,538 | | | 110,681 | | | 113,334 | | | (2.9) | % | | (8.7) | % |

| Total loans receivable | | $ | 11,143,848 | | | $ | 10,869,096 | | | $ | 10,810,455 | | | $ | 10,472,407 | | | 2.5 | % | | 6.4 | % |

| | | | | | | | | | | | |

| Loans 30 - 89 days past due and on accrual | | $ | 11,850 | | | $ | 19,649 | | | $ | 19,744 | | | $ | 6,259 | | | | | |

| Total delinquent loans (including loans on non-accrual), net | | $ | 32,081 | | | $ | 39,429 | | | $ | 43,164 | | | $ | 29,135 | | | | | |

| Total delinquent loans / Total loans receivable | | 0.29 | % | | 0.36 | % | | 0.40 | % | | 0.28 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LOANS BY GEOGRAPHIC LOCATION | | | | | | | | | | | | Percentage Change |

| | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 | | Prior Qtr | | Prior Yr Qtr |

| | Amount | | Percentage | | Amount | | Amount | | Amount | | | | |

| | | | | | | | | | | | | | |

| Washington | | $ | 5,182,378 | | | 46.5 | % | | $ | 5,091,912 | | | $ | 5,095,602 | | | $ | 4,945,074 | | | 1.8 | % | | 4.8 | % |

| California | | 2,787,190 | | | 25.0 | % | | 2,687,114 | | | 2,670,923 | | | 2,537,121 | | | 3.7 | % | | 9.9 | % |

| Oregon | | 2,072,153 | | | 18.6 | % | | 2,013,453 | | | 1,974,001 | | | 1,913,929 | | | 2.9 | % | | 8.3 | % |

| Idaho | | 641,209 | | | 5.8 | % | | 613,155 | | | 610,064 | | | 595,065 | | | 4.6 | % | | 7.8 | % |

| Utah | | 80,295 | | | 0.7 | % | | 72,652 | | | 68,931 | | | 62,720 | | | 10.5 | % | | 28.0 | % |

| Other | | 380,623 | | | 3.4 | % | | 390,810 | | | 390,934 | | | 418,498 | | | (2.6) | % | | (9.1) | % |

| Total loans receivable | | $ | 11,143,848 | | | 100.0 | % | | $ | 10,869,096 | | | $ | 10,810,455 | | | $ | 10,472,407 | | | 2.5 | % | | 6.4 | % |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 9

ADDITIONAL FINANCIAL INFORMATION

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | |

| LOAN ORIGINATIONS | Quarters Ended | | |

| Jun 30, 2024 | | Mar 31, 2024 | | Jun 30, 2023 | | | | |

| Commercial real estate | $ | 102,258 | | | $ | 67,362 | | | $ | 94,640 | | | | | |

| Multifamily real estate | 2,774 | | | 385 | | | 3,441 | | | | | |

| Construction and land | 546,675 | | | 437,273 | | | 488,980 | | | | | |

| | | | | | | | | |

| Commercial business | 167,168 | | | 154,715 | | | 128,404 | | | | | |

| Agricultural business | 22,255 | | | 34,406 | | | 28,367 | | | | | |

| One-to four-family residential | 34,498 | | | 17,568 | | | 52,618 | | | | | |

| Consumer | 120,470 | | | 66,145 | | | 112,555 | | | | | |

| Total loan originations (excluding loans held for sale) | $ | 996,098 | | | $ | 777,854 | | | $ | 909,005 | | | | | |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 10

| | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | |

| | | Quarters Ended | | |

| CHANGE IN THE | | Jun 30, 2024 | | Mar 31, 2024 | | Jun 30, 2023 | | | | |

| ALLOWANCE FOR CREDIT LOSSES – LOANS | | | | | | | | | | |

| Balance, beginning of period | | $ | 151,140 | | | $ | 149,643 | | | $ | 141,457 | | | | | |

| Provision for credit losses – loans | | 1,953 | | | 1,424 | | | 3,559 | | | | | |

| Recoveries of loans previously charged off: | | | | | | | | | | |

| Commercial real estate | | 98 | | | 1,389 | | | 74 | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| One- to four-family real estate | | 17 | | | 16 | | | 36 | | | | | |

| Commercial business | | 324 | | | 781 | | | 524 | | | | | |

| Agricultural business, including secured by farmland | | 195 | | | 106 | | | 2 | | | | | |

| Consumer | | 112 | | | 159 | | | 117 | | | | | |

| | | 746 | | | 2,451 | | | 753 | | | | | |

| Loans charged off: | | | | | | | | | | |

| Commercial real estate | | (347) | | | — | | | — | | | | | |

| | | | | | | | | | |

| Construction and land | | — | | | — | | | (156) | | | | | |

| One- to four-family real estate | | — | | | — | | | (4) | | | | | |

| Commercial business | | (137) | | | (1,809) | | | (566) | | | | | |

| | | | | | | | | | |

| Consumer | | (507) | | | (569) | | | (363) | | | | | |

| | | (991) | | | (2,378) | | | (1,089) | | | | | |

| Net (charge-offs) recoveries | | (245) | | | 73 | | | (336) | | | | | |

| Balance, end of period | | $ | 152,848 | | | $ | 151,140 | | | $ | 144,680 | | | | | |

| Net (charge-offs) recoveries / Average loans receivable | | (0.002) | % | | 0.001 | % | | (0.003) | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| ALLOCATION OF | | | | | | | | |

| ALLOWANCE FOR CREDIT LOSSES – LOANS | | Jun 30, 2024 | | Mar 31, 2024 | | | | Jun 30, 2023 |

| | | | | | | | |

| Commercial real estate | | $ | 39,064 | | | $ | 43,555 | | | | | $ | 43,636 | |

| Multifamily real estate | | 8,253 | | | 9,293 | | | | | 8,039 | |

| Construction and land | | 31,597 | | | 28,908 | | | | | 29,844 | |

| One- to four-family real estate | | 20,906 | | | 20,432 | | | | | 16,737 | |

| Commercial business | | 38,835 | | | 35,544 | | | | | 33,880 | |

| Agricultural business, including secured by farmland | | 4,045 | | | 3,890 | | | | | 3,573 | |

| Consumer | | 10,148 | | | 9,518 | | | | | 8,971 | |

| Total allowance for credit losses – loans | | $ | 152,848 | | | $ | 151,140 | | | | | $ | 144,680 | |

| Allowance for credit losses - loans / Total loans receivable | | 1.37 | % | | 1.39 | % | | | | 1.38 | % |

| Allowance for credit losses - loans / Non-performing loans | | 498 | % | | 513 | % | | | | 513 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Quarters Ended | | |

| CHANGE IN THE | | Jun 30, 2024 | | Mar 31, 2024 | | Jun 30, 2023 | | | | |

| ALLOWANCE FOR CREDIT LOSSES - UNFUNDED LOAN COMMITMENTS | | | | | | | | | | |

| Balance, beginning of period | | $ | 13,597 | | | $ | 14,484 | | | $ | 13,443 | | | | | |

| | | | | | | | | | |

| Provision/(recapture) for credit losses - unfunded loan commitments | | 430 | | | (887) | | | 1,221 | | | | | |

| | | | | | | | | | |

| Balance, end of period | | $ | 14,027 | | | $ | 13,597 | | | $ | 14,664 | | | | | |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 11

| | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | |

| (dollars in thousands) | | | | | | | |

| NON-PERFORMING ASSETS | | | | | | | |

| | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 |

| Loans on non-accrual status: | | | | | | | |

| Secured by real estate: | | | | | | | |

| Commercial | $ | 2,326 | | | $ | 2,753 | | | $ | 2,677 | | | $ | 2,478 | |

| | | | | | | |

| Construction and land | 3,999 | | | 5,029 | | | 3,105 | | | 2,280 | |

| One- to four-family | 8,184 | | | 7,750 | | | 5,702 | | | 7,605 | |

| Commercial business | 8,694 | | | 7,355 | | | 9,002 | | | 8,439 | |

| Agricultural business, including secured by farmland | 1,586 | | | 2,496 | | | 3,167 | | | 3,997 | |

| Consumer | 3,380 | | | 3,411 | | | 3,204 | | | 3,272 | |

| | 28,169 | | | 28,794 | | | 26,857 | | | 28,071 | |

| Loans more than 90 days delinquent, still on accrual: | | | | | | | |

| Secured by real estate: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Construction and land | — | | | 286 | | | 1,138 | | | — | |

| One- to four-family | 1,861 | | | 409 | | | 1,205 | | | 60 | |

| Commercial business | — | | | — | | | 1 | | | — | |

| | | | | | | |

| Consumer | 692 | | | — | | | 401 | | | 49 | |

| | 2,553 | | | 695 | | | 2,745 | | | 109 | |

| Total non-performing loans | 30,722 | | | 29,489 | | | 29,602 | | | 28,180 | |

| | | | | | | |

| REO | 2,564 | | | 448 | | | 526 | | | 546 | |

| | | | | | | |

| Total non-performing assets | $ | 33,286 | | | $ | 29,937 | | | $ | 30,128 | | | $ | 28,726 | |

| Total non-performing assets to total assets | 0.21 | % | | 0.19 | % | | 0.19 | % | | 0.18 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| LOANS BY CREDIT RISK RATING | | | | | | | |

| | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 |

| Pass | $ | 10,971,850 | | | $ | 10,731,015 | | | $ | 10,671,281 | | | $ | 10,315,687 | |

| Special Mention | 50,027 | | | 22,029 | | | 13,732 | | | 11,745 | |

| Substandard | 121,971 | | | 116,052 | | | 125,442 | | | 144,975 | |

| | | | | | | |

| Total | $ | 11,143,848 | | | $ | 10,869,096 | | | $ | 10,810,455 | | | $ | 10,472,407 | |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| DEPOSIT COMPOSITION | | | | | | | | | | Percentage Change |

| | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 | | Prior Qtr | | Prior Yr Qtr |

| Non-interest-bearing | | $ | 4,537,803 | | | $ | 4,699,553 | | | $ | 4,792,369 | | | $ | 5,369,187 | | | (3.4) | % | | (15.5) | % |

| Interest-bearing checking | | 2,208,742 | | | 2,112,799 | | | 2,098,526 | | | 1,908,402 | | | 4.5 | % | | 15.7 | % |

| Regular savings accounts | | 3,192,036 | | | 3,171,933 | | | 2,980,530 | | | 2,588,298 | | | 0.6 | % | | 23.3 | % |

| Money market accounts | | 1,615,549 | | | 1,688,606 | | | 1,680,605 | | | 1,876,569 | | | (4.3) | % | | (13.9) | % |

| Total interest-bearing transaction and savings accounts | | 7,016,327 | | | 6,973,338 | | | 6,759,661 | | | 6,373,269 | | | 0.6 | % | | 10.1 | % |

| Total core deposits | | 11,554,130 | | | 11,672,891 | | | 11,552,030 | | | 11,742,456 | | | (1.0) | % | | (1.6) | % |

| Interest-bearing certificates | | 1,525,133 | | | 1,485,880 | | | 1,477,467 | | | 1,356,600 | | | 2.6 | % | | 12.4 | % |

| Total deposits | | $ | 13,079,263 | | | $ | 13,158,771 | | | $ | 13,029,497 | | | $ | 13,099,056 | | | (0.6) | % | | (0.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GEOGRAPHIC CONCENTRATION OF DEPOSITS | | | | | | | | |

| | Jun 30, 2024 | | Mar 31, 2024 | | Dec 31, 2023 | | Jun 30, 2023 | | Percentage Change |

| | Amount | | Percentage | | Amount | | Amount | | Amount | | Prior Qtr | | Prior Yr Qtr |

| Washington | | $ | 7,171,699 | | | 54.8 | % | | $ | 7,258,785 | | | $ | 7,247,392 | | | $ | 7,255,731 | | | (1.2) | % | | (1.2) | % |

| Oregon | | 2,909,838 | | | 22.3 | % | | 2,914,605 | | | 2,852,677 | | | 2,914,267 | | | (0.2) | % | | (0.2) | % |

| California | | 2,331,793 | | | 17.8 | % | | 2,316,515 | | | 2,269,557 | | | 2,257,247 | | | 0.7 | % | | 3.3 | % |

| Idaho | | 665,933 | | | 5.1 | % | | 668,866 | | | 659,871 | | | 671,811 | | | (0.4) | % | | (0.9) | % |

| | | | | | | | | | | | | | |

| Total deposits | | $ | 13,079,263 | | | 100.0 | % | | $ | 13,158,771 | | | $ | 13,029,497 | | | $ | 13,099,056 | | | (0.6) | % | | (0.2) | % |

| | | | | | | | | | | | | | | | | | | | | | |

| INCLUDED IN TOTAL DEPOSITS | | | | | | | | |

| | Jun 30, 2024 | | Mar 31, 2024 | | | | Jun 30, 2023 |

| Public non-interest-bearing accounts | | $ | 149,012 | | | $ | 140,477 | | | | | $ | 191,591 | |

| Public interest-bearing transaction & savings accounts | | 250,136 | | | 251,161 | | | | | 189,140 | |

| Public interest-bearing certificates | | 29,101 | | | 28,821 | | | | | 45,840 | |

| Total public deposits | | $ | 428,249 | | | $ | 420,459 | | | | | $ | 426,571 | |

| Collateralized public deposits | | $ | 326,524 | | | $ | 316,554 | | | | | $ | 309,665 | |

| Total brokered deposits | | $ | 105,309 | | | $ | 107,527 | | | | | $ | 203,649 | |

| | | | | | | | |

| AVERAGE ACCOUNT BALANCE PER DEPOSIT ACCOUNT | | | | | | | | |

| | Jun 30, 2024 | | Mar 31, 2024 | | | | Jun 30, 2023 |

| Number of deposit accounts | | 460,107 | | | 461,399 | | | | | 467,490 | |

| Average account balance per account | | $ | 29 | | | $ | 29 | | | | | $ | 28 | |

BANR - Second Quarter 2024 Results

July 17, 2024

Page 13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | |

| ESTIMATED REGULATORY CAPITAL RATIOS AS OF JUNE 30, 2024 | | Actual | | Minimum to be categorized as "Adequately Capitalized" | | Minimum to be

categorized as

"Well Capitalized" |

| | Amount | | Ratio | | Amount | | Ratio | | Amount | | Ratio |

| | | | | | | | | | | | |

| Banner Corporation-consolidated: | | | | | | | | | | | | |

| Total capital to risk-weighted assets | | $ | 1,955,333 | | | 14.62 | % | | $ | 1,069,904 | | | 8.00 | % | | $ | 1,337,380 | | | 10.00 | % |

| Tier 1 capital to risk-weighted assets | | 1,693,543 | | | 12.66 | % | | 802,428 | | | 6.00 | % | | 802,428 | | | 6.00 | % |

| Tier 1 leverage capital to average assets | | 1,693,543 | | | 10.80 | % | | 627,282 | | | 4.00 | % | | n/a | | n/a |

| Common equity tier 1 capital to risk-weighted assets | | 1,607,043 | | | 12.02 | % | | 601,821 | | | 4.50 | % | | n/a | | n/a |

| Banner Bank: | | | | | | | | | | | | |

| Total capital to risk-weighted assets | | 1,833,271 | | | 13.70 | % | | 1,070,354 | | | 8.00 | % | | 1,337,943 | | | 10.00 | % |

| Tier 1 capital to risk-weighted assets | | 1,671,481 | | | 12.49 | % | | 802,766 | | | 6.00 | % | | 1,070,354 | | | 8.00 | % |

| Tier 1 leverage capital to average assets | | 1,671,481 | | | 10.66 | % | | 627,468 | | | 4.00 | % | | 784,335 | | | 5.00 | % |

| Common equity tier 1 capital to risk-weighted assets | | 1,671,481 | | | 12.49 | % | | 602,074 | | | 4.50 | % | | 869,663 | | | 6.50 | % |

These regulatory capital ratios are estimates, pending completion and filing of Banner’s regulatory reports.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | | | | | | | |

| (rates / ratios annualized) | | | | | | | | | | | | | | | | | |

| ANALYSIS OF NET INTEREST SPREAD | Quarters Ended |

| Jun 30, 2024 | | Mar 31, 2024 | | Jun 30, 2023 |

| Average Balance | | Interest and Dividends | | Yield / Cost (3) | | Average Balance | | Interest and Dividends | | Yield / Cost (3) | | Average Balance | | Interest and Dividends | | Yield / Cost (3) |

| Interest-earning assets: | | | | | | | | | | | | | | | | | |

Held for sale loans | $ | 11,665 | | | $ | 206 | | | 7.10 | % | | $ | 9,939 | | | $ | 167 | | | 6.76 | % | | $ | 56,073 | | | $ | 738 | | | 5.28 | % |

Mortgage loans | 9,006,857 | | | 129,230 | | | 5.77 | % | | 8,892,561 | | | 125,284 | | | 5.67 | % | | 8,413,392 | | | 112,097 | | | 5.34 | % |

Commercial/agricultural loans | 1,874,039 | | | 31,761 | | | 6.82 | % | | 1,830,095 | | | 30,847 | | | 6.78 | % | | 1,768,511 | | | 27,683 | | | 6.28 | % |

Consumer and other loans | 132,661 | | | 2,156 | | | 6.54 | % | | 133,854 | | | 2,196 | | | 6.60 | % | | 138,902 | | | 2,137 | | | 6.17 | % |

Total loans (1) | 11,025,222 | | | 163,353 | | | 5.96 | % | | 10,866,449 | | | 158,494 | | | 5.87 | % | | 10,376,878 | | | 142,655 | | | 5.51 | % |

Mortgage-backed securities | 2,672,187 | | | 16,850 | | | 2.54 | % | | 2,728,640 | | | 17,076 | | | 2.52 | % | | 2,958,700 | | | 18,429 | | | 2.50 | % |

Other securities | 958,809 | | | 11,181 | | | 4.69 | % | | 984,639 | | | 11,501 | | | 4.70 | % | | 1,184,503 | | | 12,932 | | | 4.38 | % |

| | | | | | | | | | | | | | | | | |

Interest-bearing deposits with banks | 58,022 | | | 578 | | | 4.01 | % | | 45,264 | | | 459 | | | 4.08 | % | | 44,922 | | | 557 | | | 4.97 | % |

FHLB stock | 21,080 | | | 365 | | | 6.96 | % | | 19,073 | | | 209 | | | 4.41 | % | | 25,611 | | | 157 | | | 2.46 | % |

| Total investment securities | 3,710,098 | | | 28,974 | | | 3.14 | % | | 3,777,616 | | | 29,245 | | | 3.11 | % | | 4,213,736 | | | 32,075 | | | 3.05 | % |

Total interest-earning assets | 14,735,320 | | | 192,327 | | | 5.25 | % | | 14,644,065 | | | 187,739 | | | 5.16 | % | | 14,590,614 | | | 174,730 | | | 4.80 | % |

| Non-interest-earning assets | 926,411 | | | | | | | 943,725 | | | | | | | 939,100 | | | | | |

Total assets | $ | 15,661,731 | | | | | | | $ | 15,587,790 | | | | | | | $ | 15,529,714 | | | | | |

| Deposits: | | | | | | | | | | | | | | | | | |

Interest-bearing checking accounts | $ | 2,156,214 | | | 7,621 | | | 1.42 | % | | $ | 2,104,242 | | | 6,716 | | | 1.28 | % | | $ | 1,870,605 | | | 2,331 | | | 0.50 | % |

Savings accounts | 3,147,522 | | | 17,200 | | | 2.20 | % | | 3,066,448 | | | 15,279 | | | 2.00 | % | | 2,536,713 | | | 4,895 | | | 0.77 | % |

Money market accounts | 1,659,327 | | | 9,124 | | | 2.21 | % | | 1,674,159 | | | 8,388 | | | 2.02 | % | | 1,957,553 | | | 6,007 | | | 1.23 | % |

Certificates of deposit | 1,503,597 | | | 14,905 | | | 3.99 | % | | 1,500,429 | | | 14,230 | | | 3.81 | % | | 1,126,647 | | | 7,306 | | | 2.60 | % |

Total interest-bearing deposits | 8,466,660 | | | 48,850 | | | 2.32 | % | | 8,345,278 | | | 44,613 | | | 2.15 | % | | 7,491,518 | | | 20,539 | | | 1.10 | % |

Non-interest-bearing deposits | 4,634,738 | | | — | | | — | % | | 4,711,922 | | | — | | | — | % | | 5,445,960 | | | — | | | — | % |

Total deposits | 13,101,398 | | | 48,850 | | | 1.50 | % | | 13,057,200 | | | 44,613 | | | 1.37 | % | | 12,937,478 | | | 20,539 | | | 0.64 | % |

| Other interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

FHLB advances | 259,549 | | | 3,621 | | | 5.61 | % | | 212,989 | | | 2,972 | | | 5.61 | % | | 390,705 | | | 5,157 | | | 5.29 | % |

Other borrowings | 175,518 | | | 1,160 | | | 2.66 | % | | 180,692 | | | 1,175 | | | 2.62 | % | | 188,060 | | | 771 | | | 1.64 | % |

Junior subordinated debentures and subordinated notes | 179,178 | | | 2,961 | | | 6.65 | % | | 181,579 | | | 2,969 | | | 6.58 | % | | 185,096 | | | 2,824 | | | 6.12 | % |

Total borrowings | 614,245 | | | 7,742 | | | 5.07 | % | | 575,260 | | | 7,116 | | | 4.98 | % | | 763,861 | | | 8,752 | | | 4.60 | % |

Total funding liabilities | 13,715,643 | | | 56,592 | | | 1.66 | % | | 13,632,460 | | | 51,729 | | | 1.53 | % | | 13,701,339 | | | 29,291 | | | 0.86 | % |

Other non-interest-bearing liabilities (2) | 294,794 | | | | | | | 303,412 | | | | | | | 279,232 | | | | | |

Total liabilities | 14,010,437 | | | | | | | 13,935,872 | | | | | | | 13,980,571 | | | | | |

| Shareholders’ equity | 1,651,294 | | | | | | | 1,651,918 | | | | | | | 1,549,143 | | | | | |

| Total liabilities and shareholders’ equity | $ | 15,661,731 | | | | | | | $ | 15,587,790 | | | | | | | $ | 15,529,714 | | | | | |

| Net interest income/rate spread (tax equivalent) | | | $ | 135,735 | | | 3.59 | % | | | | $ | 136,010 | | | 3.63 | % | | | | $ | 145,439 | | | 3.94 | % |

| Net interest margin (tax equivalent) | | | | | 3.70 | % | | | | | | 3.74 | % | | | | | | 4.00 | % |

| Reconciliation to reported net interest income: | | | | | | | | | | | | | | | | | |

| Adjustments for taxable equivalent basis | | | (3,189) | | | | | | | (3,051) | | | | | | | (2,921) | | | |

| Net interest income and margin, as reported | | | $ | 132,546 | | | 3.62 | % | | | | $ | 132,959 | | | 3.65 | % | | | | $ | 142,518 | | | 3.92 | % |

| Additional Key Financial Ratios: | | | | | | | | | | | | | | | | | |

| Return on average assets | | | | | 1.02 | % | | | | | | 0.97 | % | | | | | | 1.02 | % |

Adjusted return on average assets (4) | | | | | 1.04 | % | | | | | | 1.08 | % | | | | | | 1.18 | % |

| Return on average equity | | | | | 9.69 | % | | | | | | 9.14 | % | | | | | | 10.25 | % |

Adjusted return on average equity (4) | | | | | 9.83 | % | | | | | | 10.24 | % | | | | | | 11.80 | % |

| Average equity/average assets | | | | | 10.54 | % | | | | | | 10.60 | % | | | | | | 9.98 | % |

| Average interest-earning assets/average interest-bearing liabilities | | | | | 162.27 | % | | | | | | 164.16 | % | | | | | | 176.74 | % |

| Average interest-earning assets/average funding liabilities | | | | | 107.43 | % | | | | | | 107.42 | % | | | | | | 106.49 | % |

| Non-interest income/average assets | | | | | 0.44 | % | | | | | | 0.30 | % | | | | | | 0.22 | % |

| Non-interest expense/average assets | | | | | 2.52 | % | | | | | | 2.52 | % | | | | | | 2.46 | % |

| Efficiency ratio | | | | | 65.53 | % | | | | | | 67.55 | % | | | | | | 63.21 | % |

Adjusted efficiency ratio (4) | | | | | 63.60 | % | | | | | | 63.70 | % | | | | | | 58.58 | % |

(1)Average balances include loans accounted for on a nonaccrual basis and accruing loans 90 days or more past due. Amortization of net deferred loan fees/costs is included with interest on loans.

(2)Average other non-interest-bearing liabilities include fair value adjustments related to junior subordinated debentures.

(3)Tax-exempt income is calculated on a tax equivalent basis. The tax equivalent yield adjustment to interest earned on loans was $2.2 million, $2.0 million and $1.8 million for the quarters ended June 30, 2024, March 31, 2024 and June 30, 2023, respectively. The tax equivalent yield adjustment to interest earned on tax exempt securities was $1.0 million for both the quarters ended June 30, 2024 and March 31, 2024 and $1.1 million for the quarter ended June 30, 2023.

(4)Represent non-GAAP financial measures. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | | | |

| (rates / ratios annualized) | | | | | | | | | | | |

| ANALYSIS OF NET INTEREST SPREAD | Six Months Ended |

| Jun 30, 2024 | | Jun 30, 2023 |

| Average Balance | | Interest and Dividends | | Yield/Cost (3) | | Average Balance | | Interest and Dividends | | Yield/Cost (3) |

| Interest-earning assets: | | | | | | | | | | | |

Held for sale loans | $ | 10,802 | | | $ | 373 | | | 6.94 | % | | $ | 54,375 | | | $ | 1,409 | | | 5.23 | % |

Mortgage loans | 8,949,709 | | | 254,514 | | | 5.72 | % | | 8,340,792 | | | 218,997 | | | 5.29 | % |

Commercial/agricultural loans | 1,852,067 | | | 62,608 | | | 6.80 | % | | 1,739,091 | | | 52,909 | | | 6.14 | % |

Consumer and other loans | 133,258 | | | 4,352 | | | 6.57 | % | | 138,004 | | | 4,252 | | | 6.21 | % |

Total loans (1) | 10,945,836 | | | 321,847 | | | 5.91 | % | | 10,272,262 | | | 277,567 | | | 5.45 | % |

Mortgage-backed securities | 2,700,413 | | | 33,926 | | | 2.53 | % | | 3,025,907 | | | 37,552 | | | 2.50 | % |

Other securities | 971,724 | | | 22,682 | | | 4.69 | % | | 1,294,743 | | | 28,027 | | | 4.37 | % |

| | | | | | | | | | | |

Interest-bearing deposits with banks | 51,643 | | | 1,037 | | | 4.04 | % | | 49,229 | | | 1,165 | | | 4.77 | % |

FHLB stock | 20,077 | | | 574 | | | 5.75 | % | | 19,955 | | | 247 | | | 2.50 | % |

| Total investment securities | 3,743,857 | | | 58,219 | | | 3.13 | % | | 4,389,834 | | | 66,991 | | | 3.08 | % |

Total interest-earning assets | 14,689,693 | | | 380,066 | | | 5.20 | % | | 14,662,096 | | | 344,558 | | | 4.74 | % |

| Non-interest-earning assets | 935,068 | | | | | | | 930,208 | | | | | |

Total assets | $ | 15,624,761 | | | | | | | $ | 15,592,304 | | | | | |

| Deposits: | | | | | | | | | | | |

Interest-bearing checking accounts | $ | 2,130,228 | | | 14,337 | | | 1.35 | % | | $ | 1,825,386 | | | 3,237 | | | 0.36 | % |

Savings accounts | 3,106,985 | | | 32,479 | | | 2.10 | % | | 2,575,726 | | | 6,779 | | | 0.53 | % |

Money market accounts | 1,666,743 | | | 17,512 | | | 2.11 | % | | 2,061,767 | | | 9,806 | | | 0.96 | % |

Certificates of deposit | 1,502,013 | | | 29,135 | | | 3.90 | % | | 969,607 | | | 9,961 | | | 2.07 | % |

Total interest-bearing deposits | 8,405,969 | | | 93,463 | | | 2.24 | % | | 7,432,486 | | | 29,783 | | | 0.81 | % |

Non-interest-bearing deposits | 4,673,330 | | | — | | | — | % | | 5,701,953 | | | — | | | — | % |

Total deposits | 13,079,299 | | | 93,463 | | | 1.44 | % | | 13,134,439 | | | 29,783 | | | 0.46 | % |

| Other interest-bearing liabilities: | | | | | | | | | | | |

FHLB advances | 236,269 | | | 6,593 | | | 5.61 | % | | 249,131 | | | 6,421 | | | 5.20 | % |

Other borrowings | 178,105 | | | 2,335 | | | 2.64 | % | | 208,645 | | | 1,152 | | | 1.11 | % |

Junior subordinated debentures and subordinated notes | 180,379 | | | 5,930 | | | 6.61 | % | | 188,142 | | | 5,584 | | | 5.99 | % |

Total borrowings | 594,753 | | | 14,858 | | | 5.02 | % | | 645,918 | | | 13,157 | | | 4.11 | % |

Total funding liabilities | 13,674,052 | | | 108,321 | | | 1.59 | % | | 13,780,357 | | | 42,940 | | | 0.63 | % |

Other non-interest-bearing liabilities (2) | 299,103 | | | | | | | 286,084 | | | | | |

Total liabilities | 13,973,155 | | | | | | | 14,066,441 | | | | | |

| Shareholders’ equity | 1,651,606 | | | | | | | 1,525,863 | | | | | |

| Total liabilities and shareholders’ equity | $ | 15,624,761 | | | | | | | $ | 15,592,304 | | | | | |

| Net interest income/rate spread (tax equivalent) | | | $ | 271,745 | | | 3.61 | % | | | | $ | 301,618 | | | 4.11 | % |

| Net interest margin (tax equivalent) | | | | | 3.72 | % | | | | | | 4.15 | % |

| Reconciliation to reported net interest income: | | | | | | | | | | | |

| Adjustments for taxable equivalent basis | | | (6,240) | | | | | | | (5,788) | | | |

| Net interest income and margin, as reported | | | $ | 265,505 | | | 3.63 | % | | | | $ | 295,830 | | | 4.07 | % |

| Additional Key Financial Ratios: | | | | | | | | | | | |

| Return on average assets | | | | | 1.00 | % | | | | | | 1.23 | % |

Adjusted return on average assets (4) | | | | | 1.06 | % | | | | | | 1.39 | % |

| Return on average equity | | | | | 9.42 | % | | | | | | 12.57 | % |

Adjusted return on average equity (4) | | | | | 10.03 | % | | | | | | 14.16 | % |

| Average equity/average assets | | | | | 10.57 | % | | | | | | 9.79 | % |

| Average interest-earning assets/average interest-bearing liabilities | | | | | 163.21 | % | | | | | | 181.50 | % |

| Average interest-earning assets/average funding liabilities | | | | | 107.43 | % | | | | | | 106.40 | % |

| Non-interest income/average assets | | | | | 0.37 | % | | | | | | 0.23 | % |

| Non-interest expense/average assets | | | | | 2.52 | % | | | | | | 2.46 | % |

| Efficiency ratio | | | | | 66.52 | % | | | | | | 60.61 | % |

Adjusted efficiency ratio (4) | | | | | 63.65 | % | | | | | | 56.33 | % |

(1)Average balances include loans accounted for on a nonaccrual basis and loans 90 days or more past due. Amortization of net deferred loan fees/costs is included with interest on loans.

(2)Average other non-interest-bearing liabilities include fair value adjustments related to junior subordinated debentures.

(3)Tax-exempt income is calculated on a tax equivalent basis. The tax equivalent yield adjustment to interest earned on loans was $4.2 million and $3.5 million for the six months ended June 30, 2024 and June 30, 2023, respectively. The tax equivalent yield adjustment to interest earned on tax exempt securities was $2.1 million and $2.3 million for the six months ended June 30, 2024 and June 30, 2023, respectively.

(4)Represent non-GAAP financial measures. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures.

BANR - Second Quarter 2024 Results

July 17, 2024

Page 16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ADDITIONAL FINANCIAL INFORMATION | | | | | | | | | |

| (dollars in thousands) | | | | | | | | | |

| | | | | | | | | |

| * Non-GAAP Financial Measures | | | | | | | | | |