Form 8-K/A - Current report: [Amend]

10 Diciembre 2024 - 3:15PM

Edgar (US Regulatory)

false000107553100010755312024-11-082024-11-080001075531us-gaap:CommonStockMember2024-11-082024-11-080001075531bkng:A0100SeniorNotesDue2025Member2024-11-082024-11-080001075531bkng:A4000SeniorNotesDue2026Member2024-11-082024-11-080001075531bkng:A1.8SeniorNotesDueMarch2027Member2024-11-082024-11-080001075531bkng:A05SeniorNotesDueMarch2028Member2024-11-082024-11-080001075531bkng:A3625SeniorNotesDue2028Member2024-11-082024-11-080001075531bkng:A4250SeniorNotesDue2029Member2024-11-082024-11-080001075531bkng:A3.500SeniorNotesDueMarch2029Member2024-11-082024-11-080001075531bkng:A450SeniorNotesDue2031Member2024-11-082024-11-080001075531bkng:A3.625SeniorNotesDueMarch2032Member2024-11-082024-11-080001075531bkng:A3.250SeniorNotesDue2032Member2024-11-082024-11-080001075531bkng:A4125SeniorNotesDue2033Member2024-11-082024-11-080001075531bkng:A4750SeniorNotesDue2034Member2024-11-082024-11-080001075531bkng:A3.750SeniorNotesDueMarch2036Member2024-11-082024-11-080001075531bkng:A3.750SeniorNotesDue2037Member2024-11-082024-11-080001075531bkng:A4.000SeniorNotesDueMarch2044Member2024-11-082024-11-080001075531bkng:A3.875SeniorNotesDueMarch2045Member2024-11-082024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 8, 2024

Booking Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-36691 | | 06-1528493 |

(State or other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 800 Connecticut Avenue | Norwalk | Connecticut | | 06854 |

| (Address of principal executive offices) | | (zip code) |

Registrant's telephone number, including area code: (203) 299-8000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class: | | Trading Symbol | | Name of Each Exchange on which Registered: |

| Common Stock par value $0.008 per share | | BKNG | | The NASDAQ Global Select Market |

| | | | |

| 0.100% Senior Notes Due 2025 | | BKNG 25 | | The NASDAQ Stock Market LLC |

| 4.000% Senior Notes Due 2026 | | BKNG 26 | | The NASDAQ Stock Market LLC |

| 1.800% Senior Notes Due 2027 | | BKNG 27 | | The NASDAQ Stock Market LLC |

| 0.500% Senior Notes Due 2028 | | BKNG 28 | | The NASDAQ Stock Market LLC |

| 3.625% Senior Notes Due 2028 | | BKNG 28A | | The NASDAQ Stock Market LLC |

| 4.250% Senior Notes Due 2029 | | BKNG 29 | | The NASDAQ Stock Market LLC |

| 3.500% Senior Notes Due 2029 | | BKNG 29A | | The NASDAQ Stock Market LLC |

| 4.500% Senior Notes Due 2031 | | BKNG 31 | | The NASDAQ Stock Market LLC |

| 3.625% Senior Notes Due 2032 | | BKNG 32 | | The NASDAQ Stock Market LLC |

| 3.250% Senior Notes Due 2032 | | BKNG 32A | | The NASDAQ Stock Market LLC |

| 4.125% Senior Notes Due 2033 | | BKNG 33 | | The NASDAQ Stock Market LLC |

| 4.750% Senior Notes Due 2034 | | BKNG 34 | | The NASDAQ Stock Market LLC |

| 3.750% Senior Notes Due 2036 | | BKNG 36 | | The NASDAQ Stock Market LLC |

| 3.750% Senior Notes Due 2037 | | BKNG 37 | | The NASDAQ Stock Market LLC |

| 4.000% Senior Notes Due 2044 | | BKNG 44 | | The NASDAQ Stock Market LLC |

| 3.875% Senior Notes Due 2045 | | BKNG 45 | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

Booking Holdings Inc. (the “Company”) is filing this Current Report on Form 8-K/A to amend its Current Report on Form 8-K filed with the Securities and Exchange Commission on November 8, 2024 (the “Original Report”) to supplement the Company’s disclosure under Item 2.05 of the Original Report. The Original Report otherwise remains unchanged.

Item 2.05. Costs Associated with Exit or Disposal Activities.

On November 8, 2024, the Company announced its intention to implement certain organizational changes that are expected to improve operating expense efficiency, increase organizational agility, free up resources that can be reinvested into further improving its offering to travelers and partners, and better position the Company for the long term (the “Program”). We estimate that the Program will, over the coming three years, ultimately reduce annual run rate expenses by approximately $400 to $450 million versus our 2024 expense base. We expect the majority of these savings to come from changes across our brands such as modernizing processes and systems, optimizing procurement, and reducing real estate footprint, as well as approximately one-third from expected workforce reductions. We expect the majority of the estimated savings to be realized after 2025, and the annualized run rate savings do not reflect the aggregate expected costs to implement the Program. We believe these actions will help us towards our goal of growing fixed expenses (Personnel, General & Administrative, and IT expenses) slower than revenue in 2025 and improving efficiency across other operating expenses.

We currently expect that restructuring costs and accelerated investments related to the Program will be incurred in the next two to three years and are estimated to be, in the aggregate, approximately one times the expected annual run rate saving. We anticipate these costs to primarily relate to expected workforce reductions, technology investments, and professional fees. Because the details of the Program are not yet final and remain subject to consultation with works councils, employee representative bodies, and other relevant organizations, legal requirements in multiple jurisdictions, and the Company completing its analysis of overall Program costs, the charges associated with the Program could change in the future.

Forward-Looking Statements

This Current Report contains forward-looking statements, which reflect our views regarding current expectations and projections about future events and conditions and are based on currently available information. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions that are difficult to predict, including, among others, the ability of the Company to manage works council and other consultation processes, potential operational disruptions as a result of the Program, the ability of the Company to achieve the expected benefits from the Program, the ability of the Company to identify the categories and estimated magnitude of costs expected to be incurred, and the other Risk Factors identified in our most recently filed annual report on Form 10-K; therefore, our actual results could differ materially from those expressed, implied, or forecast in any such forward-looking statements. Expressions of future goals and expectations and similar expressions, including “may,” “will,” “should,” “could,” “aims,” “seeks,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “predicts,” “potential,” “targets,” and “continue,” reflecting something other than historical fact are intended to identify forward-looking statements. Unless required by law, the Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. However, readers should carefully review the reports and documents the Company files or furnishes from time to time with the Securities and Exchange Commission, particularly our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOOKING HOLDINGS INC. |

| | |

| | | |

| | By: | /s/ Ewout L. Steenbergen |

| | | Name: | Ewout L. Steenbergen |

| | | Title: | Executive Vice President and Chief Financial Officer |

Date: December 10, 2024

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A0100SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4000SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A1.8SeniorNotesDueMarch2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A05SeniorNotesDueMarch2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3625SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4250SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.500SeniorNotesDueMarch2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A450SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.625SeniorNotesDueMarch2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4125SeniorNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4750SeniorNotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.750SeniorNotesDueMarch2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4.000SeniorNotesDueMarch2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.250SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.750SeniorNotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.875SeniorNotesDueMarch2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

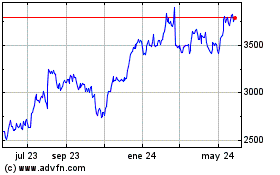

Booking (NASDAQ:BKNG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

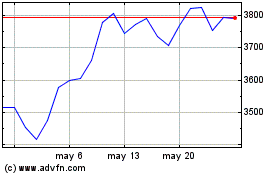

Booking (NASDAQ:BKNG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025