BIO-key® International, Inc. (Nasdaq: BKYI), an innovative provider

of workforce and customer Identity and Access Management (IAM)

solutions featuring passwordless, phoneless and token-less

Identity-Bound Biometric (IBB) authentication, announced

preliminary results for its fourth quarter (Q4’23) and year ended

December 31, 2023 (2023). The independent audit of BIO-key’s 2023

financial statements has not yet been completed and, therefore, the

figures included herein are subject to change. BIO-key will host an

investor call tomorrow at 10:00am ET (details below).

Preliminary Results

Highlights:

- 2023 revenue rose $2M (29%) to

$9.1M

- 2023 SG&A trimmed by $2.1M

(22%)

- Net cash used in operating

activities was reduced by $2.5M in 2023

- Q4’23 & 2023 cost of hardware

reflects $2.8M reserve against slow moving inventory for

Africa

- $1.5M cash payment received in

Q1’24 for 2-year extension/expansion of biometric technology

license

CEO CommentaryBIO-key CEO, Mike

DePasquale commented, “BIO-key made solid progress on our path to

profitability in 2023, driven by 29% revenue growth and cost

cutting initiatives that trimmed SG&A expense by $2.1M, largely

in the second half of the year. We look to build on this record in

2024, focusing on top-line growth opportunities balanced with

further efforts to reduce costs. We believe our growing global

distribution and customer base puts us in a strong position to

reach profitability over the next several quarters.

“Looking forward, we expect increased deployment

of enhanced IAM solutions as enterprises transition to the cloud

and respond to a growing array of security incidents that highlight

potential cybersecurity vulnerabilities. This trend is further

supported by regulatory requirements and increasingly stringent

Cyber Insurance underwriting standards that mandate enhanced

multi-factor authentication and/or passwordless security solutions

that are at the core of our offerings.

“As passwordless authentication gains traction,

our solutions are well positioned to provide organizations an

integrated approach to managing and securing all of their

identities with technologies they already use, while also

supporting their future needs with a cost-effective platform. We

also expect that passkey authentication, which has been embraced by

Google, Apple, Amazon and Microsoft, will continue to expand its

penetration in 2024. To capitalize on this opportunity, BIO-key

will soon launch, Passkey:YOU, a unique passwordless authentication

solution that does not require the use of phones or hardware

tokens, with planned enhancements expected later in the year.

Outlook“The current climate of

broad enterprise adoption of MFA to replace passwords presents

opportunities for us to leverage our unique differentiators and

exploit gaps in existing IAM approaches. Gaps include challenges of

authenticating users that ‘rove’ among workstations and preventing

unauthorized account sharing and delegation.

“Today BIO-key has more than 600 customers

globally. Our business is predominately SaaS or subscription based,

and most of our new business is sold through channel partners. We

remain focused on an asset light go-to-market plan that leverages

more than 150 Channel Alliance Partners, along with our targeted

internal sale team. Together, we believe these channels position

BIO-key for meaningful top- and bottom-line improvement in 2024,

building on our base of annually recurring services and license fee

revenues (ARRs) with a blended gross margin of approximately

65%.

“We will also continue to pursue cost reduction

initiatives in 2024, to help accelerate our path to positive cash

flow and profitability. Our Q4’23 bottom line included a $2.8M

non-cash reserve on slow moving hardware inventory purchased for

our Africa initiatives. We continue to explore opportunities to

convert this inventory into cash. Importantly, during the first

quarter of 2024 we enhanced our financial position with the

execution of a $1.5M, 2-year license extension for a long-time

customer and receipt the full license payment. We also continue to

pursue large enterprise opportunities through our direct sales

channel. For these and other reasons, we are particularly excited

about BIO-key’s outlook for 2024.”

Preliminary Financial

ResultsPlease note that the audit

of our 2023 financial statements has not been

completed by our independent registered public accounting firm as

of the date of this press release and are, therefore, subject to

change.

2023 revenues increased 29% to $9.1M from $7.0M

in 2022, driven by increases in license fees (of $1.1M), hardware

sales (of $0.5M); and services revenue (of $0.4M). Service revenue

benefitted from custom services for new customer installations,

Swivel Secure service fees, and conversions from on-premises

deployments of PortalGuard to our PortalGuard IDaaS cloud platform.

Hardware revenue benefitted from fourth quarter sales to an

international defense agency in 2023. Likewise, Q4’23 revenue grew

26% over Q4’22, also driven by the aforementioned hardware sales to

an international defense agency.

The Company took a $2.8M reserve on inventory

due to slow moving inventory purchased for large projects in

Nigeria in Q4’23. This reserve was included in cost of hardware,

which caused a decline in gross profit to $3.3M in 2023, from $4.6M

in 2022 and a decline in gross margin to 36.5% in 2023 from 65.2%

in 2022. BIO-key continues to explore opportunities to sell the

product, including other markets, to convert inventories to

cash.

In terms of operating expenses, Selling, general

and administrative costs were $7.3M in 2023, representing a 22%

decrease from 2022. The decrease included lower sales and marketing

expenses, including personnel and related benefits and outside

services expenses. Research, development and engineering expenses

also declined by $0.9M or 26% to $2.4M, due to reductions in

personnel, related benefits and outside services expenses.

On a preliminary basis, reflecting higher

revenue and lower operating costs, BIO-key significantly trimmed

its 2023 net loss 48% to $(6.2M), or $(11.45) per share, from

$(12.2M), or $(27.26) per share, in 2022, even after including the

$2.8 million reserve on inventory. Likewise, in Q4’23 BIO-key

reduced its net loss more than 40% to $(4.1M), or $(5.54) per

share, from $(6.7M), or $(14.58) per share in 2023.

Preliminary Balance SheetAt

December 31, 2023, BIO-key had current assets of $5.3M, including

$0.5M of cash and cash equivalents, $3.2M of accounts receivable

and amounts due from factor, and $1.2M of inventory.

Conference Call Details

| Date /

Time: |

Tuesday, April

2nd at 10 a.m. ET |

| Call Dial In #: |

1-877-418-5460 U.S. or 1-412-717-9594 Int’l |

| Live Webcast / Replay: |

Webcast & Replay Link – Available for 3 months. |

| Audio Replay: |

1-877-344-7529 U.S. or 1-412-317-0088 Int’l; code 6114035 |

| |

|

About BIO-key International, Inc.

(www.BIO-key.com)BIO-key is revolutionizing authentication

and cybersecurity with biometric-centric, multi-factor identity and

access management (IAM) software securing access for over forty

million users. BIO-key allows customers to choose the right

authentication factors for diverse use cases, including phoneless,

tokenless, and passwordless biometric options. Its hosted or

on-premise PortalGuard IAM solution provides cost-effective,

easy-to-deploy, convenient, and secure access to computers,

information, applications, and high-value transactions.

BIO-key Safe Harbor

StatementAll statements contained in this press release

other than statements of historical facts are "forward-looking

statements" as defined in the Private Securities Litigation Reform

Act of 1995 (the "Act"). The words "estimate," "project,"

"intends," "expects," "anticipates," "believes" and similar

expressions are intended to identify forward-looking statements.

Such forward-looking statements are made based on management's

beliefs, as well as assumptions made by, and information currently

available to, management pursuant to the "safe-harbor" provisions

of the Act. These statements are not guarantees of future

performance or events and are subject to risks and uncertainties

that may cause actual results to differ materially from those

included within or implied by such forward-looking statements.

These risks and uncertainties include, without limitation, our

history of losses and limited revenue; our ability to raise

additional capital to satisfy working capital needs; our ability to

continue as a going concern; our ability to protect our

intellectual property; changes in business conditions; changes in

our sales strategy and product development plans; changes in the

marketplace; continued services of our executive management team;

security breaches; competition in the biometric technology

industry; market acceptance of biometric products generally and our

products under development; our ability to convert sales

opportunities to customer contracts; our ability to expand into

Asia, Africa and other foreign markets; our ability to integrate

the operations and personnel of Swivel Secure into our business;

fluctuations in foreign currency exchange rates; delays in the

development of products and statements of assumption underlying any

of the foregoing as well as other factors set forth under the

caption "Risk Factors" in our Annual Report on Form 10-K for the

year ended December 31, 2022 and other filings with the Securities

and Exchange Commission. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date made. Except as required by law, we undertake no

obligation to disclose any revision to these forward-looking

statements whether as a result of new information, future events,

or otherwise.

Engage with BIO-key

| Facebook –

Corporate: |

https://www.facebook.com/BIOkeyInternational/ |

| LinkedIn – Corporate: |

https://www.linkedin.com/company/bio-key-international |

| Twitter – Corporate: |

@BIOkeyIntl |

| Twitter – Investors: |

@BIO_keyIR |

| StockTwits: |

BIO_keyIR |

| |

|

Investor ContactsWilliam Jones, David

CollinsCatalyst IRBKYI@catalyst-ir.com or 212-924-9800

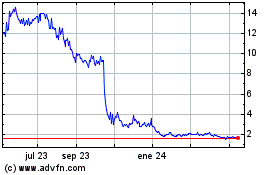

BIO key (NASDAQ:BKYI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

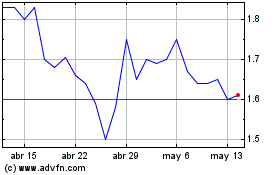

BIO key (NASDAQ:BKYI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025