- Third quarter revenue increased 16% YoY to a record level;

gross profit rose 18% and adjusted EBITDA grew by 7%

- Special Committee concludes strategic review; ongoing execution

of Bragg’s strategy best option to maximize shareholder value

- 40% proprietary online content revenue growth YoY, fueled by

expanded distribution of content in the US

- Well positioned to maintain momentum under new leadership

team

Bragg Gaming Group (NASDAQ: BRAG, TSX: BRAG) ("Bragg" or the

"Company"), a global B2B content-driven iGaming technology

provider, today reported record revenue for the third quarter of

2024.

Summary of 3Q24 Financial and

Operational Highlights

Euros (millions)(1)

3Q24

3Q23

Change

Revenue

€

26.2

€

22.6

15.9

%

Gross profit

€

14.0

€

11.9

18.1

%

Gross profit margin

53.5

%

52.5

%

99

bps

Adjusted EBITDA(2)

€

4.1

€

3.8

7.1

%

Adjusted EBITDA margin

15.6

%

16.9

%

(129

) bps

Operating Income (Loss)

€

(0.4)

€

(2.1)

(81.0

)%

(1)

Bragg’s reporting currency is Euros. The

exchange rate provided is EUR 1.00 = USD 1.12. Due to fluctuating

currency exchange rates, this reference rate is provided for

convenience only.

(2)

“Adjusted EBITDA” is a non-IFRS measure.

For important information on the Company’s non-IFRS measures, see

“Non-IFRS Financial Measures” below.

Chief Executive Officer Commentary

Matevž Mazij, Chief Executive Officer for Bragg, commented, “The

third quarter marked another period of strong growth and record

results for Bragg. Revenue grew 16% year-over-year, gross profit

increased 18%, and Adjusted EBITDA rose 7%. In the U.S., strong

third quarter revenue gains from content distribution helped drive

a 40% global increase in proprietary online content revenue

year-over-year.

“Additionally, we announced today that the Board of Directors

has unanimously decided to conclude its review of strategic

alternatives for Bragg. After extensive evaluation and

deliberation, the Board determined that the ongoing execution of

the Company’s strategic plan is the best way to maximize value for

shareholders at this time.

“Since stepping in as Chairman 16 months ago and then as CEO 14

months ago, we’ve transformed our executive team, restructured

commercial operations, and sharpened our sales strategy with a

targeted, jurisdictional approach. These decisive actions position

us to drive growth and capture market opportunities with greater

precision and impact. Under new leadership, we’ve built a strong

pipeline of tier 1 opportunities across key markets and key

products, positioning Bragg for accelerated top- and bottom-line

growth.

“With the strategic review process now complete, Bragg is now

fully focused on commercialization and unlocking profitable growth,

without the need for significant new investment in product

development. Our decade-long investments in technology and talent,

combined with a robust leadership team, have built a scalable

platform that uniquely positions us for aggressive growth in 2025

and beyond. With significant operating leverage now within reach,

we’re poised for an exciting, high-growth, and profitable

future.”

Third Quarter 2024 and Recent Business Highlights

- Launched its newest games and Remote Gaming Server (RGS)

technology with Caesars Digital in Pennsylvania and Ontario. The

launch marked the expansion of Bragg’s existing partnership with

Caesars Digital, following earlier launches in New Jersey and

Michigan respectively, doubling the number of states/provinces in

which Bragg content is offered on Caesars Palace Online Casino and

Caesars Sportsbook & Casino.

- Launched its newest games and RGS technology with FanDuel in

New Jersey, adding to its existing distribution with the leading

North American operator in Michigan, Pennsylvania, Connecticut and

Ontario

- Post-quarter end, the Company additionally launched its newest

games and RGS technology with bet365 in New Jersey, following on

from its second quarter launch in Pennsylvania, and an earlier

launch in Ontario with the major global iGaming operator

- Launched HardRockCasino.nl in the Dutch market, supplying its

cutting-edge player account management (PAM) software to the brand.

The agreement is Bragg’s 6th PAM customer in the Netherlands,

reinforcing Bragg’s status as the leading technology and content

supplier in the Dutch market

- Launched the Kambi sportsbook on 711.nl, adding an additional

revenue-generating product stream to a key PAM customer in the

Netherlands

- Management is pleased to announce the appointment of Robbie

Bressler to CFO of Bragg, effective immediately. Robbie had been

serving as Bragg’s interim CFO since July 1, 2024.

Additional September 30, 2024 Key Financial Metrics

- For the nine-month period ended September 30, 2024, Cash flow

generated from operations was EUR 8.4 million (USD 9.4 million),

compared to EUR 6.2 million (USD 6.9 million) for the nine-month

period ended September 30, 2023.

- Cash and cash equivalents as of September 30, 2024 was EUR 11.6

million (USD 13.0 million) and net working capital, excluding

deferred consideration, loans payable, and convertible debt, was

EUR 11.3 million (USD 12.7 million)

Strategic Alternatives Process Concluded

The Bragg Board announced the strategic alternatives process in

March 2024 with the formation of a Special Committee, comprised

solely of independent members of the Board. The Committee, together

with its advisors Oakvale Capital LLP and Blake, Cassels &

Graydon LLP, evaluated a wide range of strategic alternatives for

maximizing shareholder value including a potential sale or merger

of the Company. Bragg solicited interest from a significant number

of potential counterparties and received multiple non-binding

proposals.

After careful consideration, the Board, on recommendation from

the special committee, unanimously determined that none of the

proposals received reflect the Company’s intrinsic value or current

and projected financial performance, and therefore elected to

conclude its review and disband the Special Committee.

Don Robertson, independent Board member and Chair of the Special

Committee, said, “After a comprehensive and exhaustive process, the

Committee recommended, and the Board unanimously agreed, that

continuing to execute Bragg’s strategic plan as an independent

public company is the best approach for maximizing shareholder

value. Although the process has now concluded, Bragg’s Board will

continue to be open to and consider all opportunities for enhancing

shareholder value.”

“Over the past year, our financial performance, cashflow

generation and revenue outlook have significantly improved. We

remain extremely confident about our business plan, operating

strategy, and financial prospects” said Matevz Mazij, Chairman and

CEO of Bragg.

Reiterates Full Year 2024 Guidance and 2025 Outlook

Bragg reiterates its 2024 full year revenue guidance range of

EUR 102.0-109.0 million (USD 114.2-122.1 million) and its full year

Adjusted EBITDA range of EUR 15.2-18.5 million (USD 17.0-20.7

million), noting that the Company is currently tracking to the

lower end of guidance.

Bragg is actively advancing a robust pipeline of opportunities

that is anticipated to drive strong momentum as we enter 2025. The

outlook for 2025 remains positive, with expectations of sustained

double-digit top line growth, expanding bottom line margins, and

increased operational leverage, further strengthening Bragg’s

position in the market. The preceding guidance and outlook

constitute forward-looking information within the meaning of

applicable securities laws, and is based on a number of assumptions

and subject to a number of risks.

Investor Conference Call

The Company will host a conference call today, November 14,

2024, at 8:30 a.m. Eastern Time, to discuss its third quarter 2024

results. During the call, management will review a presentation

that will be made available to download at

https://investors.bragg.group/financials/quarterly-results/default.aspx.

To join the call, please use the below dial-in information:

Participant Toll-Free Dial-In Number (US and Canada): 1 (800)

715-9871 Participant Toll Dial-In Number (International): 1 (646)

307-1963 UK Toll Free: +44 800 358 0970 Conference ID: 2654367

A webcast of the call and presentation may also be viewed at:

https://investors.bragg.group/events-and-presentations/events/default.aspx

A replay of the call will be available until November 21, 2024,

following the conclusion of the live call. To access the replay,

dial + 1 (647) 362-9199 or +1 (800) 770-2030 (toll-free) or +44 20

3433 3849 (UK) and use the passcode 2654367.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains forward-looking statements or

“forward-looking information” within the meaning of applicable

Canadian securities laws (“forward-looking statements”), including,

without limitation, statements with respect to the following: the

Company’s strategic growth initiatives and corporate vision and

strategy; financial guidance for 2024, expected performance of the

Company’s business; expansion into new markets, our strategy for

customer retention, growth, product development, and market

position; expected future growth and expansion opportunities;

expected benefits of transactions; expected future actions and

decisions of regulators and the timing and impact thereof.

Forward-looking statements are provided for the purpose of

presenting information about management’s current expectations and

plans relating to the future and allowing readers to get a better

understanding of the Company’s anticipated financial position,

results of operations, and operating environment. Often, but not

always, forward-looking statements can be identified by the use of

words such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or describes a “goal”, or variation of such words and phrases or

state that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved.

All forward-looking statements contained in this news release or

the conference call reflect the Company’s beliefs and assumptions

based on information available at the time the statements were

made. Actual results or events may differ from those predicted in

these forward-looking statements. All of the Company’s

forward-looking statements are qualified by the assumptions that

are stated or inherent in such forward-looking statements,

including the assumptions listed below. Although the Company

believes that these assumptions are reasonable, this list is not

exhaustive of factors that may affect any of the forward-looking

statements. The key assumptions that have been made in connection

with the forward-looking statements include the regulatory regime

governing the business of the Company; the operations of the

Company; the products and services of the Company; the Company’s

customers; the growth of Company’s business, meeting minimum

listing requirements of the stock exchanges on which the Company’s

shares trade; the integration of technology; and the anticipated

size and/or revenue associated with the gaming market globally.

Forward-looking statements involve known and unknown risks,

future events, conditions, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, prediction, projection,

forecast, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

following: risks related to the Company’s business and financial

position; that the Company may not be able to accurately predict

its rate of growth and profitability; risks associated with general

economic conditions; adverse industry events; future legislative

and regulatory developments; the inability to access sufficient

capital from internal and external sources; the inability to access

sufficient capital on favourable terms; realization of growth

estimates, income tax and regulatory matters; the ability of the

Company to implement its business strategies; competition; economic

and financial conditions, including volatility in interest and

exchange rates, commodity and equity prices; changes in customer

demand; disruptions to our technology network including computer

systems and software; natural events such as severe weather, fires,

floods and earthquakes; any disruptions to operations as a result

of the strategic alternatives review process; and risks related to

health pandemics and the outbreak of communicable diseases.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events, or otherwise, except in accordance with

applicable securities laws.

Non-IFRS Financial Measures

Statements in this news release make reference to “Adjusted

EBITDA”, which is a non-IFRS (as defined herein) financial measure

that the Company believes is appropriate to provide meaningful

comparison with, and to enhance an overall understanding of, the

Company’s past financial performance and prospects for the future.

The Company believes that “Adjusted EBITDA” provides useful

information to both management and investors by excluding specific

expenses and items that management believe are not indicative of

the Company’s core operating results. “Adjusted EBITDA” is a

financial measure that does not have a standardized meaning under

International Financial Reporting Standards (“IFRS”). As there is

no standardized method of calculating “Adjusted EBITDA”, it may not

be directly comparable with similarly titled measures used by other

companies. The Company considers “Adjusted EBITDA” to be a relevant

indicator for measuring trends in performance and its ability to

generate funds to service its debt and to meet its future working

capital and capital expenditure requirements. “Adjusted EBITDA” is

not a generally accepted earnings measure and should not be

considered in isolation or as an alternative to net income (loss),

cash flows or other measures of performance prepared in accordance

with IFRS. Adjusted EBITDA is more fully defined and discussed, and

reconciliation to IFRS financial measures is provided, in Company’s

Management’s Discussion and Analysis (“MD&A”) for the

three-month and six-month period ended September 30, 2024.

About Bragg Gaming Group

Bragg Gaming Group (NASDAQ: BRAG, TSX: BRAG) is an iGaming

content and turnkey technology solutions provider serving online

and land-based gaming operators with its proprietary and exclusive

content, and cutting-edge technology. Bragg Studios offer

high-performing and passionately crafted casino game titles using

the latest in data-driven insights from in-house brands including

Wild Streak Gaming, Atomic Slot Lab and Indigo Magic. Its

proprietary content portfolio is complemented by a cross section of

exclusive titles from carefully selected studio partners under the

Powered By Bragg program. Games built on Bragg’s remote games

server (Bragg RGS) technology are distributed via the Bragg Hub

content delivery platform and are available exclusively to Bragg

customers. Bragg’s flexible, modern, omnichannel Player Account

Management (PAM) platform powers multiple leading iCasino and

sportsbook brands and at all points is supported by expert in-house

managed, operational, and marketing services. Content delivered via

the Bragg Hub either exclusively or from the Bragg aggregated games

portfolio is managed from a single back-office which is supported

by powerful data analytics tools, and Bragg’s award-winning Fuze™

player engagement toolset. Bragg is licensed, certified, approved

and operational in many regulated iCasino markets globally,

including the U.S, Canada, United Kingdom, Italy, the Netherlands,

Germany, Sweden, Spain, Malta and Colombia.

Join Bragg Gaming Group on Social Media

Twitter LinkedIn Facebook Instagram

Financial tables follow:

BRAGG GAMING GROUP

INC.

INTERIM UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(In thousands, except share

and per share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

26,169

22,574

74,841

70,162

Cost of revenue

(12,167

)

(10,718

)

(36,558

)

(32,260

)

Gross Profit

14,002

11,856

38,283

37,902

Selling, general and administrative

expenses

(14,829

)

(13,047

)

(40,918

)

(38,035

)

Gain (Loss) on remeasurement of derivative

liability

46

(82

)

(94

)

(261

)

Gain on settlement of convertible debt

104

231

169

435

Gain (Loss) on remeasurement of deferred

consideration

271

(1,095

)

(329

)

(387

)

Operating Loss

(406

)

(2,137

)

(2,889

)

(346

)

Net interest expense and other financing

charges

(848

)

(450

)

(2,370

)

(1,414

)

Loss Before Income Taxes

(1,254

)

(2,587

)

(5,259

)

(1,760

)

Income taxes

1,089

(364

)

790

(1,290

)

Net Loss

(165

)

(2,951

)

(4,469

)

(3,050

)

Items to be reclassified to net loss:

Cumulative translation adjustment

(1,002

)

(611

)

(998

)

(1,754

)

Net Comprehensive Loss

(1,167

)

(3,562

)

(5,467

)

(4,804

)

Basic Loss Per Share

(0.01

)

(0.13

)

(0.19

)

(0.14

)

Diluted Loss Per Share

(0.01

)

(0.13

)

(0.19

)

(0.14

)

Millions

Millions

Millions

Millions

Weighted average number of shares -

basic

25.0

23.3

24.0

22.3

Weighted average number of shares -

diluted

25.0

23.3

24.0

22.3

BRAGG GAMING GROUP

INC.

INTERIM UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION PRESENTED IN

EUROS (THOUSANDS, EXCEPT SHARE AND PER SHARE

AMOUNTS)

As at

As at

September 30,

December 31,

2024

2023

Cash and cash equivalents

11,569

8,796

Trade and other receivables

18,650

18,641

Prepaid expenses and other assets

2,743

1,655

Total Current Assets

32,962

29,092

Property and equipment

1,057

640

Right-of-use assets

2,781

3,233

Intangible assets

34,769

38,133

Goodwill

31,764

31,921

Other assets

314

348

Total Assets

103,647

103,367

Trade payables and other liabilities

19,683

21,846

Income taxes payable

1,260

917

Lease obligations on right of use

assets

722

709

Deferred consideration

1,549

1,513

Derivative liability

—

471

Convertible debt

—

2,445

Loans payable

6,495

—

Total Current Liabilities

29,709

27,901

Deferred income tax liabilities

723

852

Lease obligations on right of use

assets

2,193

2,568

Deferred consideration

—

1,426

Other non-current liabilities

373

373

Total Liabilities

32,998

33,120

Share capital

131,706

120,015

Shares to be issued

—

3,491

Contributed surplus

17,556

19,887

Accumulated deficit

(80,532

)

(76,063

)

Accumulated other comprehensive income

1,919

2,917

Total Equity

70,649

70,247

Total Liabilities and Equity

103,647

103,367

BRAGG GAMING GROUP

INC.

UNAUDITED SELECTED FINANCIAL

GAAP AND NON-GAAP MEASURES

(in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

EUR 000

2024

2023

2024

2023

Revenue

26,169

22,574

74,841

70,162

Operating loss

(406

)

(2,137

)

(2,889

)

(346

)

EBITDA

3,924

1,209

9,312

8,963

Adjusted EBITDA

4,083

3,814

11,109

12,450

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114956792/en/

For media enquiries or interview requests, please contact:

Robert Simmons, Head of Communications at Bragg Gaming Group

press@bragg.group

Investors: James Carbonara Hayden IR +1 (646)-755-7412

james@haydenir.com

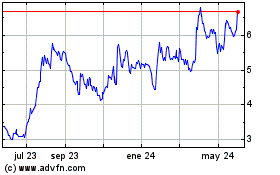

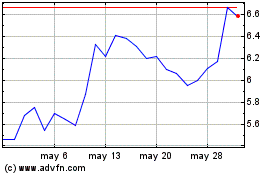

Bragg Gaming (NASDAQ:BRAG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Bragg Gaming (NASDAQ:BRAG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025