Continued Profitable Growth

Vertical integration drives gross profit

margin improvement

Launch of proprietary clinical decision

support software to strengthen competitive advantages

Biote (NASDAQ: BTMD), a leading solutions provider in preventive

health care through the delivery of personalized hormone

optimization and therapeutic wellness, today announced financial

results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial

Highlights (All financial result comparisons made are

against the prior-year period)

- Revenue of $51.4 million

- Procedure revenue of $37.9 million

- Gross profit margin of 70.5%

- Net income of $12.7 million and diluted earnings per share

attributable to biote Corp. stockholders of $0.33, compared to net

income of $19.6 million and diluted earnings per share attributable

to biote Corp. stockholders of $0.24

- Adjusted EBITDA1 of $16.2 million and Adjusted EBITDA margin1

of 31.5%

“Biote’s third quarter revenue increased 12.8% from the

prior-quarter period, driven by continued growth in procedure

revenue and a strong return to growth in our dietary supplements

business,” said Terry Weber, Biote’s Chief Executive Officer.

“Consistent with our strategic objectives, we achieved a solid

improvement in gross profit margin, primarily reflecting cost

savings from the vertical integration of manufacturing. Even as we

continued to invest in strengthening our capabilities, we generated

15.4% growth in Adjusted EBITDA as compared to the third quarter of

2023.”

Ms. Weber continued, “In September 2024, we introduced several

major enhancements to the Biote Method, expanding our

evidence-based approach to hormone optimization and therapeutic

wellness. We believe these enhancements will enable our extensive

nationwide network of Biote-certified practitioners to provide an

even higher level of holistic, personalized treatments for

patients. By leveraging our proprietary patient dataset and

algorithms, we believe we have further strengthened Biote’s

competitive advantages in the marketplace. As we implemented

targeted enhancements to our clinical decision support software in

the third quarter of 2024, we experienced a temporary disruption in

procedure volume as practitioners adjusted to the new workflow in

their offices. Additionally, we experienced some disruption to

procedure volume from hurricane-related clinic closures in several

of our core states. Although we expect some residual impact from

these headwinds in the fourth quarter of 2024, we anticipate

procedure revenue growth will reaccelerate in 2025.”

_____________________________ Adjusted EBITDA and Adjusted

EBITDA margin are non-GAAP financial measures. Please see

“Discussion of non-GAAP Financial Measures” for additional

information on non-GAAP financial measures and a reconciliation to

the most comparable GAAP measure.

2024 Third Quarter Financial Review (All financial result

comparisons made are against the prior-year period unless otherwise

noted)

Revenue for the third quarter of 2024 was $51.4 million compared

to $45.6 million for the third quarter of 2023. Procedure revenue

grew 7.1%, reflecting growth at established clinics and the

addition of new clinics, partially offset by a temporary slowdown

in procedure volume related to the introduction of enhanced

clinical decision support software. In addition, Hurricane Helene

impacted procedure volume from clinic closures in our core states.

Dietary supplement revenue grew 21.7%, benefiting from the

transition of a portion of this business as we continue to drive

improvements in our Amazon business.

Gross profit margin for the third quarter of 2024 was 70.5%

compared to 68.9% for the third quarter of 2023. The increase in

gross profit margin was primarily due to increased vertical

integration of manufacturing and effective cost management, which

more than offset a revenue mix shift to dietary supplements.

Operating income for the third quarter of 2024 was $12.2

million, compared to $7.6 million for the third quarter of 2023.

Operating income in the third quarter of 2024 increased primarily

due to increased sales and gross profit margin, as well as a

moderation in operating expense growth.

Net income for the third quarter of 2024 was $12.7 million and

diluted earnings per share attributable to biote Corp. stockholders

of $0.33, compared to net income of $19.6 million and diluted

earnings per share attributable to biote Corp. stockholders of

$0.24 for the third quarter of 2023. Net income for the third

quarter of 2024 and 2023 included gains of $7.2 million and $17.5

million, respectively, due to a change in the fair value of the

earnout liabilities.

Adjusted EBITDA for the third quarter of 2024 was $16.2 million,

with an Adjusted EBITDA margin of 31.5%. In the third quarter of

2023, Adjusted EBITDA was $14.0 million, with an Adjusted EBITDA

margin of 30.8%. The increase in 2024 third quarter Adjusted EBITDA

and Adjusted EBITDA margin reflected improved sales, higher gross

profit margin and effective operating cost management.

Fourth Quarter and Full Year 2024 Financial Outlook

Ms. Weber commented, “Biote continues to make solid progress in

driving growth in our top-tier clinics and further expanding our

practitioner network. Our quick-start program that accelerates the

revenue ramp from new clinics also remains an important contributor

to growth.”

Ms. Weber continued, “We are confident that our advanced

clinical decision support software, launched toward the end of the

third quarter of 2024, represents a key competitive differentiator

for Biote and further advances our commitment to enhancing patient

health. Our updated software follows the latest evidence-based

publications and makes recommendations across the expanded range of

our portfolio of products. Additionally, we expect our software to

strengthen our providers’ capabilities to serve a broader range of

patients.

“As we continue to support our practitioners with additional

workflow guidance and software training, we expect some residual

impact to procedure revenue in the fourth quarter of 2024.

Additionally, both Hurricanes Helene and Milton caused extended

clinic closures in several of our core states in October,

temporarily impacting procedure revenue in the fourth quarter of

2024.

“As a result, we are adjusting our 2024 financial guidance to

$197-$201 million in revenue and $58-$61 million in Adjusted

EBITDA1, as compared to our prior forecast of $200-$204 million in

revenue and $60-$63 million in Adjusted EBITDA1,” Ms. Weber

concluded.

1 Please see “Forward-Looking Non-GAAP Financial Measures" below

for additional information about forward-looking Adjusted

EBITDA.

Conference Call:

Biote management will host a conference call to review these

results and provide a business update beginning at 5:00 p.m. ET on

Tuesday, November 12, 2024. To access the conference call by

telephone, please dial (844) 481-2820 (U.S toll-free) or (412)

317-0679 (International). To access a live webcast of the call,

interested parties may use the following link: biote Corp. Third

Quarter Earnings Call. A replay of the webcast will be available on

the Events page of the Biote Investor Relations website, found

here, shortly after the event concludes.

Discussion of Non-GAAP Financial Measures

To provide investors with additional information regarding our

financial results, Biote has disclosed Adjusted EBITDA, a non-GAAP

financial measure that it calculates as net income before interest,

taxes and depreciation and amortization, further adjusted to

exclude stock-based compensation, litigation expenses, legal

settlements, transaction-related expenses, merger and acquisition

expenses, fair value adjustments to certain equity instruments

classified as liabilities and other expenses. Below we have

provided a reconciliation of Adjusted EBITDA to net income, the

most directly comparable GAAP financial measure.

We present Adjusted EBITDA and Adjusted EBITDA margin because it

is a key measure used by our management to evaluate our operating

performance, generate future operating plans and determine payments

under compensation programs. Accordingly, we believe that Adjusted

EBITDA and Adjusted EBITDA margin provide useful information to

investors and others in understanding and evaluating our operating

results in the same manner as our management.

Adjusted EBITDA and Adjusted EBITDA margin have limitations as

analytical tools, and you should not consider them in isolation or

as a substitute for analysis of our results as reported under GAAP.

Some of these limitations are as follows:

- Although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and Adjusted EBITDA and Adjusted EBITDA margin do

not reflect cash capital expenditure requirements for such

replacements of our assets;

- Adjusted EBITDA and Adjusted EBITDA margin do not reflect

changes in, or cash requirements for, our working capital needs;

and

- Adjusted EBITDA and Adjusted EBITDA margin do not reflect tax

payments that may represent a reduction in cash available to

us.

In addition, Adjusted EBITDA and Adjusted EBITDA margin are

subject to inherent limitations as it reflects the exercise of

judgment by Biote’s management about which expenses are excluded or

included. A reconciliation is provided in the financial statement

tables included below in this press release for each non-GAAP

financial measure to the most directly comparable financial measure

stated in accordance with GAAP. Because of these limitations, you

should consider Adjusted EBITDA and Adjusted EBITDA margin

alongside other financial performance measures, including net

income and our other GAAP results.

Forward-Looking Non-GAAP Financial Measures

The Company does not provide a reconciliation of forward-looking

non-GAAP financial measures to their comparable GAAP financial

measures because it could not do so without unreasonable effort due

to the unavailability of certain information needed to calculate

reconciling items. For example, the Company has not included a

reconciliation of projected Adjusted EBITDA to GAAP net income

(loss), which is the most directly comparable GAAP measure, for the

periods presented in reliance on the unreasonable efforts exception

provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company’s

projected Adjusted EBITDA excludes certain items that are

inherently uncertain and difficult to predict including, but not

limited to, share-based compensation expense, income taxes, due

diligence expenses and legal expenses. Due to the variability,

complexity and limited visibility of the adjusting items that would

be excluded from projected Adjusted EBITDA in future periods,

management does not forecast them for internal use and therefore

cannot create a quantitative projected Adjusted EBITDA to GAAP net

income (loss) reconciliation for the periods presented without

unreasonable efforts. A quantitative reconciliation of projected

Adjusted EBITDA to GAAP net income (loss) for the periods presented

would imply a degree of precision and certainty as to these future

items that does not exist and could be confusing to investors. From

a qualitative perspective, it is anticipated that the differences

between projected Adjusted EBITDA to GAAP net income (loss) for the

periods presented will consist of items similar to those described

in the financial tables later in this release, including, for

example and without limitation, share-based compensation expense,

income taxes, due diligence expenses and legal expenses. The timing

and amount of any of these excluded items could significantly

impact the Company’s GAAP net income (loss) for a particular

period. When planning, forecasting and analyzing future periods,

the Company does so primarily on a non-GAAP basis without preparing

a GAAP analysis.

About Biote

Biote is transforming healthy aging through innovative,

personalized hormone optimization and therapeutic wellness

solutions delivered by Biote-certified medical providers. Biote

trains practitioners to identify and treat early indicators of

aging conditions, an underserved global market, providing

affordable symptom relief for patients and driving clinic success

for practitioners.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Some of the forward-looking statements can be identified

by the use of forward-looking words. Statements that are not

historical in nature, including the words “may,” “can,” “should,”

“will,” “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “hope,” “anticipate,” “believe,” “seek,” “target,”

“continue,” “could,” “might,” “ongoing,” “potential,” “predict,”

“would” and other similar expressions, are intended to identify

forward-looking statements. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual results or developments to differ materially from

those expressed or implied by such forward-looking statements,

including but not limited to: the success of our dietary

supplements to attain significant market acceptance among clinics,

practitioners and their patients; our customers’ reliance on

certain third parties to support the manufacturing of bio-identical

hormones for prescribers; our and our customers’ sensitivity to

regulatory, economic, environmental and competitive conditions in

certain geographic regions; our ability to maintain and increase

the use by practitioners and clinics of the Biote Method at the

rate that we anticipate or at all; our ability to grow our

business; the significant competition we face in our industry; the

impact of strategic acquisitions and the implementation of our

growth strategies; our limited operating history; our ability to

protect our intellectual property; the heavy regulatory oversight

in our industry; changes in applicable laws or regulations; the

inability to profitably expand in existing markets and into new

markets; the possibility that we may be adversely impacted by other

economic, business and/or competitive factors, including the impact

of hurricane and other natural disasters; and future exchange and

interest rates. The foregoing list of factors is not exhaustive.

You should carefully consider the foregoing factors and other risks

and uncertainties described in the “Risk Factors” section of

Biote’s Quarterly Report on Form 10-Q for the fiscal quarter ended

June 30, 2024, filed with the Securities and Exchange Commission on

August 9, 2024, and other documents filed by Biote from time to

time with the Securities and Exchange Commission. These filings

identify and address other important risks and uncertainties that

could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Biote assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise. Biote does not give any

assurance that it will achieve its expectations.

Financial Tables

Biote Corp. Condensed

Consolidated Balance Sheets (Unaudited)

September 30,

December 31,

(in thousands)

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

38,225

$

89,002

Accounts receivable, net

8,493

6,809

Inventory, net

16,200

17,307

Other current assets

7,065

9,225

Total current assets

69,983

122,343

Property and equipment, net

5,813

1,218

Capitalized software, net

4,974

4,973

Goodwill

5,516

—

Intangible assets, net

5,666

—

Operating lease right-of-use assets

3,376

1,877

Deferred tax asset

5,924

24,884

Total assets

$

101,252

$

155,295

Liabilities and Stockholders’

Deficit

Current liabilities:

Accounts payable

$

4,374

$

4,155

Accrued expenses

8,185

8,497

Term loan, current

6,250

6,250

Deferred revenue, current

2,927

3,002

Earnout liabilities, current

100

—

Operating lease liabilities, current

482

311

Share repurchase liabilities, current

24,192

—

Total current liabilities

46,510

22,215

Term loan, net of current portion

102,548

106,630

Revolving loans

10,000

—

Deferred revenue, net of current

portion

1,603

1,322

Operating lease liabilities, net of

current portion

3,026

1,680

Share repurchase liabilities, net of

current portion

43,610

—

TRA liability

4,424

18,894

Earnout liabilities, net of current

portion

16,355

41,100

Total liabilities

228,076

191,841

Commitments and contingencies

Stockholders’ Deficit

Preferred stock

—

—

Class A common stock

3

3

Class V voting stock

1

3

Additional paid-in capital

—

—

Accumulated deficit

(124,717

)

(29,391

)

Accumulated other comprehensive loss

(29

)

(12

)

Treasury stock, at cost

(5,600

)

—

biote Corp.’s stockholders’ deficit

(130,342

)

(29,397

)

Noncontrolling interest

3,518

(7,149

)

Total stockholders’ deficit

(126,824

)

(36,546

)

Total liabilities and stockholders’

deficit

$

101,252

$

155,295

Biote Corp. Condensed

Consolidated Statements of Operations and Comprehensive Income

(Loss) (Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

(in thousands, except share and per

share amounts)

2024

2023

2024

2023

Revenue:

Product revenue

$

49,806

$

44,831

$

143,952

$

137,638

Service revenue

1,578

726

3,405

2,019

Total revenue

51,384

45,557

147,357

139,657

Cost of revenue

Cost of products

14,431

13,070

41,659

41,089

Cost of services

741

1,097

2,167

2,783

Cost of revenue

15,172

14,167

43,826

43,872

Selling, general and administrative

24,028

23,791

74,687

72,636

Income from operations

12,184

7,599

28,844

23,149

Other income (expense), net:

Interest expense, net

(3,542

)

(1,530

)

(7,779

)

(4,821

)

Loss from change in fair value of warrant

liability

—

—

—

(13,411

)

Gain (loss) from change in fair value of

earnout liabilities

7,213

17,450

(18,825

)

(14,360

)

Other income (expense)

—

(3

)

(4

)

(14

)

Total other income (expense), net

3,671

15,917

(26,608

)

(32,606

)

Income (loss) before provision for income

taxes

15,855

23,516

2,236

(9,457

)

Income tax expense

3,198

3,874

5,673

5,426

Net Income (loss)

12,657

19,642

(3,437

)

(14,883

)

Less: Net income (loss) attributable to

noncontrolling interest

1,955

12,112

(2,891

)

(10,465

)

Net income (loss) attributable to biote

Corp. stockholders

$

10,702

$

7,530

$

(546

)

$

(4,418

)

Other comprehensive income (loss):

Foreign currency translation

adjustments

(8

)

8

(10

)

8

Other comprehensive income (loss)

(8

)

8

(10

)

8

Comprehensive income (loss)

$

12,649

$

19,650

$

(3,447

)

$

(14,875

)

Net income (loss) per common share

Basic

$

0.34

$

0.25

$

(0.02

)

$

(0.19

)

Diluted

$

0.33

$

0.24

$

(0.02

)

$

(0.19

)

Weighted average common shares

outstanding

Basic

31,045,174

30,334,193

33,235,662

22,921,401

Diluted

32,260,809

31,041,245

33,235,662

22,921,401

Biote Corp. Condensed

Consolidated Statements of Cash Flows (Unaudited)

Nine Months Ended September

30,

(in thousands)

2024

2023

Operating Activities

Net loss

$

(3,437

)

$

(14,883

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

2,436

1,484

Bad debt expense

911

624

Amortization of debt issuance costs

605

591

Provision for obsolete inventory

683

(32

)

Non-cash lease expense

685

423

Non-cash interest on share repurchase

liability

1,548

—

Shares issued in settlement of

litigation

—

1,199

Share-based compensation expense

6,849

7,060

Loss from change in fair value of warrant

liability

—

13,411

Loss from change in fair value of earnout

liabilities

18,825

14,360

Deferred income taxes

2,233

394

Changes in operating assets and

liabilities:

Accounts receivable

(2,550

)

(3,834

)

Inventory

2,179

137

Other current assets

2,189

(7,118

)

Accounts payable

156

1,582

Deferred revenue

206

853

Accrued expenses

24

4,005

Operating lease liabilities

(667

)

(329

)

Net cash provided by operating

activities

32,875

19,927

Investing Activities

Purchases of short-term investments

—

(20,000

)

Purchases of property and equipment

(4,760

)

(518

)

Purchases of capitalized software

(1,116

)

(1,191

)

Acquisitions, net of cash acquired

(11,611

)

—

Net cash used in investing activities

(17,487

)

(21,709

)

Financing Activities

Repurchases of common stock

(5,599

)

—

Borrowings on revolving loans

10,000

—

Principal repayments on term loan

(4,687

)

(4,687

)

Payments on repurchase liability

(62,162

)

—

Proceeds from exercise of stock

options

809

420

Issuance of stock under purchase plan

146

—

Distributions

(4,656

)

(7,588

)

Net cash used in financing activities

(66,149

)

(11,855

)

Effect of exchange rate changes on cash

and cash equivalents

(16

)

(19

)

Net decrease in cash and cash

equivalents

(50,777

)

(13,656

)

Cash and cash equivalents at beginning of

period

89,002

79,231

Cash and cash equivalents at end of

period

$

38,225

$

65,575

Supplemental Disclosure of Cash Flow

Information

Cash paid for interest

$

7,325

$

7,022

Cash paid for income taxes

$

2,288

$

2,789

Non-cash investing and financing

activities

Shares issued to acquire Simpatra

$

1,841

$

—

Biote Corp. Reconciliation of Adjusted EBITDA

to Net Income (Loss) (Unaudited)

The following table presents a reconciliation of net income

(loss) to Adjusted EBITDA, as well as the calculation of net income

(loss) margin and Adjusted EBITDA margin, for each of the periods

indicated.

Three Months Ended

Nine Months Ended

September 30,

September 30,

(in thousands)

2024

2023

2024

2023

Net Income (loss)

$

12,657

$

19,642

$

(3,437

)

$

(14,883

)

Interest expense, net(1)

3,542

1,530

7,779

4,821

Income tax expense

3,198

3,874

5,673

5,426

Depreciation and amortization(2)

810

416

2,436

1,484

Share-based compensation expense(3)

2,245

2,243

`

6,849

7,060

Litigation expenses-former owner(4)

122

2,738

711

4,807

Litigation-other(5)

401

112

493

480

Legal settlement loss(6)

18

50

18

1,248

Inventory fair value write-up(7)

118

—

1,324

—

Transaction-related expenses(8)

37

290

82

2,086

Other expenses(9)

67

40

1,354

649

Merger and acquisition expenses(10)

200

552

995

733

Loss from change in fair value of warrant

liability

—

—

—

13,411

(Gain) loss from change in fair value of

earnout liabilities

(7,213

)

(17,450

)

18,825

14,360

Adjusted EBITDA

$

16,202

$

14,037

$

43,102

$

41,682

Total revenue

$

51,384

$

45,557

$

147,357

$

139,657

Net income (loss) margin(11)

24.6

%

43.1

%

-2.3

%

-10.7

%

Adjusted EBITDA margin(12)

31.5

%

30.8

%

29.3

%

29.8

%

(1)

Represents cash and non-cash interest on

our debt obligations, commitment fees for our unused Revolving

Loans, net of interest income earned on our money market account

and short-term investment. For the three and nine months ended

September 30, 2024, interest expense, net included $1.1 million and

$1.5 million of accreted interest related to the share repurchase

liability.

(2)

Represents depreciation expense on

property and equipment, amortization expense on capitalized

software and amortization expense on purchased intangible assets.

Depreciation expense of $0.01 million and $0.03 million was

included in cost of products for the three and nine months ended

September 30, 2024, respectively.

(3)

Represents employee compensation expense

associated with equity-based stock awards. This includes expense

associated with equity incentive instruments including phantom

stock awards, stock options and restricted stock units.

(4)

Represents legal expenses to defend the

Company against claims asserted by the Company’s former owner.

(5)

Represents litigation expenses other than

those incurred in connection with claims asserted by the Company’s

former owner that are not related to the Company’s ongoing

business.

(6)

Represents settlements of legal

matters.

(7)

Represents the fair market value write-up

of inventory accounted for under ASC 805 related to the acquisition

of Asteria Health.

(8)

Represents transaction costs including

legal fees of $0.04 million and $0.08 million during the three and

nine months ended September 30, 2024, respectively, and legal fees

of $0.07 million and filing fees of $0.2 million during the three

months ended September 30, 2023 and legal fees of $0.9 million,

filing fees of $0.2 million and professional services fees of $1.0

million for the nine months ended September 30, 2023 that were

incurred in connection with the filing of, and transactions

contemplated by, the Company’s securities offerings.

(9)

Represents professional services fees of

$0.07 million incurred related to the accounting treatment of the

share repurchase liability and a realized foreign currency loss of

less than $0.01 million during the three months ended September 30,

2024, and $0.2 million incurred related to the accounting treatment

of the share repurchase liability, strategic consulting and

advisory services of $0.6 million, executive severance costs of

$0.3 million, excise tax related to repurchases of Class A common

stock of $0.2 million and a realized foreign currency loss of less

than $0.01 million for the nine months ended September 30, 2024,

and executive severance costs of $0.04 million and a realized

foreign currency loss of less than $0.01 for the three months ended

September 30, 2023 and for the nine months ended September 30,

2023, executive severance costs of $0.3 million, a realized foreign

currency loss of $0.02 million, costs related to recruiting

executive level management, including the former Chief Commercial

Officer of $0.2 million, and legal fees of $0.1 million and

professional services fees of $0.1 million associated with the

restatement of the Company’s financial statements for the quarters

ended June 30, 2022 and September 30, 2022.

(10)

Represents legal fees of $0.2 million

incurred during the three months ended September 30, 2024 and legal

fees of $0.7 million and professional services fees of $0.3 million

incurred during the nine months ended September 30, 2024,

respectively, related to our recent acquisitions and other

strategic opportunities. For the three and nine months ended

September 30, 2023, the amount represents professional services

fees of $0.05 million, consulting fees of $0.1 million and legal

fees of $0.3 million incurred during the three months ended

September 30, 2023 and professional fees of $0.05 million,

consulting fees of $0.3 million and legal fees of $0.4 million

incurred during the nine months ended September 30, 2023 all of

which were associated with strategic opportunities to expand the

business.

(11)

Net loss margin is defined as net loss

divided by total revenue.

(12)

Adjusted EBITDA margin is defined as

adjusted EBITDA divided by total revenue.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112245870/en/

Investor Relations: Eric Prouty AdvisIRy Partners

eric.prouty@advisiry.com Media: Press@biote.com

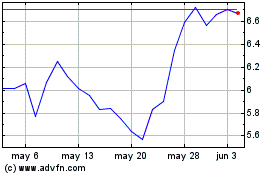

Biote (NASDAQ:BTMD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Biote (NASDAQ:BTMD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024