BrightSpring Health Services, Inc. (“BrightSpring” or the

“Company”) (NASDAQ: BTSG), a leading provider of home and

community-based health services for complex populations, today

announced financial results for the second quarter ended June 30,

2024, and increases 2024 revenue and Adjusted EBITDA1 guidance.

Financial Highlights

- Net Revenue of $2,730 million, up 26.0% compared to $2,167

million in the second quarter of 2023.

- Net income of $19.4 million, compared to net income of $2.8

million in the second quarter of 2023.

- Adjusted EBITDA1 of $139 million, down 6.9% versus $149 million

in the second quarter of 2023

- When excluding a certain $30 million Quality Incentive Payment

in 2023, Adjusted EBITDA1 was up 16.7% compared to $119 million in

the second quarter of 2023. This certain vendor Quality Incentive

Payment (QIP) program has reached its conclusion, as previously

disclosed.

- Increased 2024 Revenue and Adjusted EBITDA Guidance:

- Revenue: $10,450 - $10,900 million

- Adjusted EBITDA1: $570 - $580 million

“We are very pleased to report another quarter

of strong revenue and earnings growth across both segments,” said

Jon Rousseau, Chairman, President and Chief Executive Officer of

the Company. “Our Pharmacy Solutions business delivered impressive

growth, while our Provider Services business saw margin expansion

and revenue growth afforded by our operational excellence, scale,

and efficiencies. We remain very confident in our ability execute

on driving the most compassionate, low-cost, and efficient care

right to our patients, and believe that BrightSpring remains in a

great position for the remainder of the year and as we enter

2025.”

Second Quarter 2024 Financial

Results

Net revenue of $2,730 million, up 26.0% compared

to $2,167 million in the second quarter of 2023. Net revenue growth

was driven by broad-based strength across both segments, with

particular strength in Specialty and Infusion Pharmacy.

Gross profit of $389 million, up 4.6% compared

to $372 million in the second quarter of 2023. Excluding a certain

$30 million receipt of QIP in 2023, gross profit growth rate was

13.8%.

Net income of $19.4 million, compared to net

income of $2.8 million in the second quarter of 2023.

Adjusted EBITDA1 of $139 million, down 6.9%

compared to $149 million in the second quarter of 2023.

- When excluding a certain $30

million Quality Incentive Payment in 2023, Adjusted EBITDA1 was up

16.7% compared to $119 million in the second quarter of 2023. This

certain vendor Quality Incentive Payment program has reached its

conclusion, as previously disclosed.

1Adjusted EBITDA is a non-GAAP financial measure. Please see

“Non-GAAP Financial Information” and the end of this press release

for a reconciliation of Adjusted EBITDA to net income (loss), the

most directly comparable financial measure prepared in accordance

with GAAP.

Key Financials:

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

| |

|

June 30, (Unaudited) |

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

% |

|

| ($ in millions) |

|

|

|

|

|

|

|

|

|

|

Pharmacy Solutions Revenue |

|

$ |

2,114 |

|

|

$ |

1,597 |

|

|

32 |

% |

|

| Provider Services Revenue |

|

|

616 |

|

|

|

570 |

|

|

8 |

% |

|

| Total

Revenue |

|

$ |

2,730 |

|

|

$ |

2,167 |

|

|

26 |

% |

|

| |

|

Three Months Ended |

|

|

|

| |

|

June 30, (Unaudited) |

|

|

|

| |

|

2024 |

|

|

2023 |

|

|

% |

|

| ($ in millions) |

|

|

|

|

|

|

|

|

|

| Pharmacy Solutions segment

EBITDA |

|

$ |

94 |

|

|

$ |

110 |

|

|

(14 |

%) |

|

| Provider Services segment

EBITDA |

|

|

86 |

|

|

|

74 |

|

|

16 |

% |

|

| Total Segment Adjusted

EBITDA |

|

$ |

180 |

|

|

$ |

184 |

|

|

(2 |

%) |

|

| Corporate Costs |

|

|

(41 |

) |

|

|

(35 |

) |

|

- |

|

|

| Total Company Adjusted

EBITDA |

|

$ |

139 |

|

|

$ |

149 |

|

|

(7 |

%) |

|

Full Year 2024 Financial

Guidance

For the full year 2024, BrightSpring is

increasing guidance, which excludes the effects of any future

closed acquisitions.

- Net revenue of $10,450 million to

$10,900 million, or 18.4% to 23.5% growth over 2023

- Pharmacy Segment Revenue of $8,000

million to $8,400 million, or 22.7% to 28.8% growth over full year

2023

- Provider Segment Revenue of $2,450

million to $2,500 million, or 6.3% to 8.5% growth over full year

2023

- Adjusted EBITDA2 of $570 million to

$580 million, or 12.2% to 14.2% growth over full year 2023,

excluding the impact from a certain QIP in 2023

A copy of the Company’s second quarter earnings

presentation is available on the company’s investor relations

website, https://ir.brightspringhealth.com/

2 A reconciliation of the foregoing guidance for

the non-GAAP metric of Adjusted EBITDA to GAAP net (loss) income

cannot be provided without unreasonable effort because of the

inherent difficulty of accurately forecasting the occurrence and

financial impact of the various adjusting items necessary for such

reconciliation that have not yet occurred, are out of our control,

or cannot be reasonably predicted. For the same reasons, the

Company is unable to assess the probable significance of the

unavailable information, which could have a material impact on its

future GAAP financial results.

Webcast and Conference Call

Details

BrightSpring will host a conference call today,

August 2, 2024, at 8:30 a.m. Eastern Time. Investors interested in

listening to the conference call are required to register

online.

A live and archived webcast of the event will be

available on the “Events & Presentations” section of the

BrightSpring website at https://ir.brightspringhealth.com/. The

Company has posted supplemental financial information on the second

quarter results that it will reference during the conference call.

The supplemental information can be found under the “Events &

Presentations” on the Company’s investor relations page.

About BrightSpring Health

Services

BrightSpring Health Services is the parent

company of leading healthcare service lines that provide

complementary home- and community-based pharmacy and provider

health solutions for complex populations in need of specialized

and/or chronic care. Through the Company’s high-quality and

impactful pharmacy, primary care and home health care, and

rehabilitation and behavioral health services, and through its

skilled and dedicated employees, we provide comprehensive care and

clinical solutions in all 50 states to over 400,000 customers,

clients and patients daily. For more information,

visit www.brightspringhealth.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, our operations and financial

performance. Forward-looking statements include all statements that

are not historical facts. These forward-looking statements may

relate to matters which include, but are not limited to,

industries, business strategy, goals and expectations concerning

our market position, future operations, margins, profitability,

capital expenditures, liquidity and capital resources and other

financial and operating information. In some cases, we have used

words such as “anticipate,” “assume,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “future,” “will,” “seek,”

“foreseeable,” “target,” “guidance,” the negative version of these

words, or similar terms and phrases to identify these

forward-looking statements.

The forward-looking statements are based on management’s current

expectations and are not historical facts or guarantees of future

performance. The forward-looking statements relate to the future

and are therefore subject to various risks, uncertainties,

assumptions, or changes in circumstances that are difficult to

predict or quantify. Our expectations, beliefs, and projections are

expressed in good faith and we believe there is a reasonable basis

for them. However, there can be no assurance that management’s

expectations, beliefs, and projections will result or be achieved.

Actual results may differ materially from these expectations due to

changes in global, regional, or local economic, business,

competitive, market, regulatory, and other factors, many of which

are beyond our control. We believe that these factors include but

are not limited to the following:

- our operation in a highly competitive industry;

- our inability to maintain relationships with existing patient

referral sources or establish new referral sources;

- changes to Medicare and Medicaid rates or methods governing

Medicare and Medicaid payments for our services;

- cost containment initiatives of third-party payors, including

post-payment audits;

- the implementation of alternative payment models and the

transition of Medicaid and Medicare beneficiaries to managed care

organizations may limit our market share and could adversely affect

our revenues;

- changes in the case mix of patients, as well as payor mix and

payment methodologies, and decisions and operations of third-party

organizations;

- our reliance on federal and state spending, budget decisions,

and continuous governmental operations which may fluctuate under

different political conditions;

- changes in drug utilization and/or pricing, PBM contracts, and

Medicare Part D/Medicaid reimbursement, which may negatively impact

our profitability;

- changes in our relationships with pharmaceutical suppliers,

including changes in drug availability or pricing;

- reliance on the continual recruitment and retention of nurses,

pharmacists, therapists, caregivers, direct support professionals,

and other qualified personnel, including senior management;

- compliance with or changes to federal, state, and local laws

and regulations that govern our employment practices, including

minimum wage, living wage, and paid time-off requirements;

- fluctuation of our results of operations on a quarterly

basis;

- harm caused by labor relation matters;

- limitations in our ability to control reimbursement rates

received for our services if we are unable to maintain or reduce

our costs to provide such services;

- delays in collection or non-collection of our accounts

receivable, particularly during the business integration

process;

- failure to manage our growth effectively, which may inhibit our

ability to execute our business plan, maintain high levels of

service and satisfaction or adequately address competitive

challenges;

- our ability to identify, successfully complete and manage

acquisitions, joint ventures, and other strategic initiatives;

- our ability to continue to provide consistently high quality of

care;

- maintenance of our corporate reputation or the emergence of

adverse publicity, including negative information on social media

or changes in public perception of our services;

- contract continuance, expansion and renewal with our existing

customers, including renewals at lower fee levels, customers

declining to purchase additional services from us, or reduction in

the services received from us pursuant to those contracts;

- effective investment in, implementation of improvements to and

proper maintenance of the uninterrupted operation and data

integrity of our information technology and other business

systems;

- security breaches, loss of data, and other disruptions, which

could compromise sensitive business or patient information; cause a

loss of confidential patient data, employee data or personal

information; or prevent access to critical information and thereby

expose us to liability, litigation, and federal and state

governmental inquiries and damage our reputation and brand;

- risks related to credit card payments and other payment methods

including adverse impacts from the cyber attack of Change

Healthcare, one of the largest providers of healthcare payment

systems in the United States;

- potential substantial malpractice or other similar claims;

- various risks related to governmental inquiries, regulatory

actions, and whistleblower and other lawsuits, which may not be

entirely covered by insurance;

- our current insurance program, which may expose us to

unexpected costs, particularly if we incur losses not covered by

our insurance or if claims or losses differ from our

estimates;

- factors outside of our control, including those listed, which

have required and could in the future require us to record an asset

impairment of goodwill;

- a pandemic, epidemic, or outbreak of an infectious disease,

including the ongoing effects of COVID-19;

- inclement weather, natural disasters, acts of terrorism, riots,

civil insurrection or social unrest, looting, protests, strikes, or

street demonstrations;

- our inability to adequately protect our intellectual property

rights

The forward-looking statements included in this press release

are made only as of the date of this press release, and we

undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future developments, or otherwise, except as required by law. These

factors should not be construed as exhaustive, and should one or

more of these risks or uncertainties materialize, or should any of

our assumptions prove incorrect, our actual results may vary in

material respects from those projected in these forward-looking

statements. Factors or events that could cause our actual results

to differ may emerge from time to time, and it is not possible for

us to predict all of them. We may not actually achieve the plans,

intentions, or expectations disclosed in our forward-looking

statements and you should not place undue reliance on our

forward-looking statements. Our forward- looking statements do not

reflect the potential impact of any future acquisitions, mergers,

dispositions, joint ventures, investments, or other strategic

transactions we may make.

For additional information on these and other factors that could

cause BrightSpring’s actual results to differ materially from

expected results, please see our filings with the Securities and

Exchange Commission (the “SEC”), which are accessible on the SEC’s

website at www.sec.gov.

Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures,”

including “EBITDA” and “Adjusted EBITDA,” which are financial

measures that either exclude or include amounts that are not

excluded or included in the most directly comparable measures

calculated and presented in accordance with accounting principles

generally accepted in the United States, or GAAP.

EBITDA and Adjusted EBITDA have been presented in this release

as supplemental measures of financial performance that are not

required by, or presented in accordance with, GAAP, because we

believe they assist investors and analysts in comparing our

operating performance across reporting periods on a consistent

basis by excluding items that we do not believe are indicative of

our core operating performance. Management also believes that these

measures are useful to investors in highlighting trends in our

operating performance, while other measures can differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which we operate and

capital investments. Management uses EBITDA and Adjusted EBITDA to

supplement GAAP measures of performance in the evaluation of the

effectiveness of our business strategies, to make budgeting

decisions, to establish and award discretionary annual incentive

compensation, and to compare our performance against that of other

peer companies using similar measures.

Management supplements GAAP results with non-GAAP financial

measures to provide a more complete understanding of the factors

and trends affecting the business than GAAP results alone. EBITDA

and Adjusted EBITDA are not GAAP measures of our financial

performance and should not be considered as an alternative to net

income (loss) as a measure of financial performance or any other

performance measures derived in accordance with GAAP. Additionally,

these measures are not intended to be a measure of free cash flow

available for management’s discretionary use as they do not

consider certain cash requirements such as tax payments, debt

service requirements, total capital expenditures, and certain other

cash costs that may recur in the future.

Management defines EBITDA as net income (loss) before income tax

benefit, interest expense, and depreciation and amortization.

Management also defines Adjusted EBITDA as EBITDA, further adjusted

to exclude non-cash share-based compensation, acquisition,

integration and transaction-related costs, restructuring and

divestiture-related and other costs, goodwill impairment, legal

costs associated with certain historical matters for PharMerica and

settlement costs, significant projects, management fees, and

unreimbursed COVID-19 related costs.

The presentations of these measures have limitations as

analytical tools and should not be considered in isolation, or as a

substitute for analysis of our results as reported under GAAP.

Because not all companies use identical calculations, the

presentations of these measures may not be comparable to other

similarly titled measures of other companies and can differ

significantly from company to company. Please see the end of this

press release for reconciliations of non-GAAP financial measures to

the most directly comparable financial measure prepared in

accordance with GAAP.

BrightSpring Contact:

Investor Relations:David Deuchler, CFAGilmartin

Group LLCir@brightspringhealth.com

Media Contact:Leigh

Whiteleigh.white@brightspringhealth.com502.630.7412

|

BrightSpring Health Services, Inc. and

SubsidiariesCondensed Consolidated Balance

SheetsJune 30, 2024 and December 31,

2023(In thousands, except share and per share

data)(Unaudited) |

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

|

|

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,027 |

|

|

$ |

13,071 |

|

|

Accounts receivable, net of allowance for credit losses |

|

|

984,758 |

|

|

|

881,627 |

|

|

Inventories |

|

|

374,289 |

|

|

|

402,776 |

|

|

Prepaid expenses and other current assets |

|

|

137,805 |

|

|

|

159,167 |

|

|

Total current assets |

|

|

1,521,879 |

|

|

|

1,456,641 |

|

| Property and equipment, net of

accumulated depreciation of $406,233 and $368,089 atJune 30, 2024

and December 31, 2023, respectively |

|

|

245,569 |

|

|

|

245,908 |

|

| Goodwill |

|

|

2,626,353 |

|

|

|

2,608,412 |

|

| Intangible assets, net of

accumulated amortization |

|

|

851,297 |

|

|

|

881,476 |

|

| Operating lease right-of-use

assets, net |

|

|

258,647 |

|

|

|

267,446 |

|

| Deferred income taxes, net |

|

|

22,000 |

|

|

|

— |

|

| Other assets |

|

|

79,336 |

|

|

|

72,838 |

|

|

Total assets |

|

$ |

5,605,081 |

|

|

$ |

5,532,721 |

|

| Liabilities, Redeemable

Noncontrolling Interests, and Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

669,401 |

|

|

$ |

641,607 |

|

|

Accrued expenses |

|

|

346,740 |

|

|

|

492,363 |

|

|

Current portion of obligations under operating leases |

|

|

68,253 |

|

|

|

71,053 |

|

|

Current portion of obligations under financing leases |

|

|

11,972 |

|

|

|

11,141 |

|

|

Current portion of long-term debt |

|

|

48,670 |

|

|

|

32,273 |

|

|

Total current liabilities |

|

|

1,145,036 |

|

|

|

1,248,437 |

|

| Obligations under operating

leases, net of current portion |

|

|

195,507 |

|

|

|

201,655 |

|

| Obligations under financing

leases, net of current portion |

|

|

24,160 |

|

|

|

22,528 |

|

| Long-term debt, net of current

portion |

|

|

2,563,536 |

|

|

|

3,331,941 |

|

| Deferred income taxes, net |

|

|

— |

|

|

|

23,668 |

|

| Long-term liabilities |

|

|

70,973 |

|

|

|

91,943 |

|

|

Total liabilities |

|

|

3,999,212 |

|

|

|

4,920,172 |

|

| Redeemable noncontrolling

interests |

|

|

5,936 |

|

|

|

27,139 |

|

| Shareholders'

equity: |

|

|

|

|

|

|

|

Common stock, $0.01 par value, 1,500,000,000 and 137,398,625 shares

authorized,171,397,030 and 117,857,055 shares issued and

outstanding at June 30, 2024 andDecember 31, 2023,

respectively |

|

|

1,714 |

|

|

|

1,179 |

|

|

Preferred stock, $0.01 par value, 250,000,000 authorized, no shares

issued andoutstanding at June 30, 2024; no shares authorized,

issued or outstanding atDecember 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

1,804,965 |

|

|

|

771,336 |

|

|

Accumulated deficit |

|

|

(226,150 |

) |

|

|

(200,319 |

) |

|

Accumulated other comprehensive income |

|

|

19,025 |

|

|

|

12,544 |

|

|

Total shareholders' equity |

|

|

1,599,554 |

|

|

|

584,740 |

|

|

Noncontrolling interest |

|

|

379 |

|

|

|

670 |

|

|

Total equity |

|

|

1,599,933 |

|

|

|

585,410 |

|

|

Total liabilities, redeemable noncontrolling interests, and

equity |

|

$ |

5,605,081 |

|

|

$ |

5,532,721 |

|

|

BrightSpring Health Services, Inc. and

SubsidiariesCondensed Consolidated Statements of

OperationsFor the three months and six months

ended June 30, 2024 and 2023(In thousands, except per

share amounts) (Unaudited) |

|

|

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Products |

|

$ |

2,114,491 |

|

|

$ |

1,596,839 |

|

|

$ |

4,091,526 |

|

|

$ |

3,063,841 |

|

|

Services |

|

|

615,719 |

|

|

|

569,885 |

|

|

|

1,215,322 |

|

|

|

1,131,261 |

|

| Total revenues |

|

|

2,730,210 |

|

|

|

2,166,724 |

|

|

|

5,306,848 |

|

|

|

4,195,102 |

|

| Cost of goods |

|

|

1,931,760 |

|

|

|

1,409,249 |

|

|

|

3,738,860 |

|

|

|

2,716,230 |

|

| Cost of services |

|

|

409,417 |

|

|

|

385,405 |

|

|

|

809,564 |

|

|

|

772,089 |

|

| Gross profit |

|

|

389,033 |

|

|

|

372,070 |

|

|

|

758,424 |

|

|

|

706,783 |

|

| Selling, general, and

administrative expenses |

|

|

326,619 |

|

|

|

292,454 |

|

|

|

687,943 |

|

|

|

575,612 |

|

| Operating income |

|

|

62,414 |

|

|

|

79,616 |

|

|

|

70,481 |

|

|

|

131,171 |

|

| Loss on extinguishment of

debt |

|

|

— |

|

|

|

— |

|

|

|

12,726 |

|

|

|

— |

|

| Interest expense, net |

|

|

52,439 |

|

|

|

79,684 |

|

|

|

117,459 |

|

|

|

157,861 |

|

| Income (loss) before income

taxes |

|

|

9,975 |

|

|

|

(68 |

) |

|

|

(59,704 |

) |

|

|

(26,690 |

) |

| Income tax benefit |

|

|

(9,466 |

) |

|

|

(2,834 |

) |

|

|

(32,760 |

) |

|

|

(7,180 |

) |

| Net income (loss) |

|

|

19,441 |

|

|

|

2,766 |

|

|

|

(26,944 |

) |

|

|

(19,510 |

) |

| Net loss attributable to

noncontrolling interests |

|

|

(478 |

) |

|

|

(1,222 |

) |

|

|

(1,113 |

) |

|

|

(2,116 |

) |

| Net income (loss) attributable to

BrightSpring Health Services,Inc. and subsidiaries |

|

$ |

19,919 |

|

|

$ |

3,988 |

|

|

$ |

(25,831 |

) |

|

$ |

(17,394 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) per share -

basic |

|

$ |

0.10 |

|

|

$ |

0.03 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

| Income (loss) per share -

diluted |

|

$ |

0.10 |

|

|

$ |

0.03 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

197,515 |

|

|

|

117,883 |

|

|

|

186,523 |

|

|

|

117,875 |

|

| Diluted |

|

|

208,987 |

|

|

|

126,449 |

|

|

|

186,523 |

|

|

|

117,875 |

|

|

BrightSpring Health Services, Inc. and

SubsidiariesCondensed Consolidated Statements of

Cash Flows For the three months and six months

ended June 30, 2024 and 2023(In thousands)(Unaudited) |

|

|

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

19,441 |

|

|

$ |

2,766 |

|

|

$ |

(26,944 |

) |

|

$ |

(19,510 |

) |

|

Adjustments to reconcile net income (loss) to cash (used

in)provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

50,071 |

|

|

|

50,205 |

|

|

|

98,993 |

|

|

|

100,550 |

|

|

Impairment of long-lived assets |

|

|

211 |

|

|

|

3,905 |

|

|

|

1,980 |

|

|

|

6,114 |

|

|

Provision for credit losses |

|

|

6,496 |

|

|

|

5,958 |

|

|

|

13,118 |

|

|

|

12,174 |

|

|

Amortization of deferred debt issuance costs |

|

|

2,490 |

|

|

|

5,312 |

|

|

|

6,937 |

|

|

|

10,509 |

|

|

Share-based compensation |

|

|

15,136 |

|

|

|

825 |

|

|

|

39,984 |

|

|

|

1,275 |

|

|

Deferred income taxes, net |

|

|

(17,528 |

) |

|

|

(12,434 |

) |

|

|

(49,260 |

) |

|

|

(25,755 |

) |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

12,726 |

|

|

|

— |

|

|

(Gain) loss on disposition of fixed assets |

|

|

(98 |

) |

|

|

(19 |

) |

|

|

24 |

|

|

|

519 |

|

|

Other |

|

|

(1,126 |

) |

|

|

(235 |

) |

|

|

(1,438 |

) |

|

|

372 |

|

|

Change in operating assets and liabilities, net of acquisitions and

dispositions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

3,054 |

|

|

|

(51,367 |

) |

|

|

(112,522 |

) |

|

|

(105,402 |

) |

|

Prepaid expenses and other current assets |

|

|

12,821 |

|

|

|

(8,966 |

) |

|

|

21,737 |

|

|

|

22,110 |

|

|

Inventories |

|

|

(765 |

) |

|

|

(32,505 |

) |

|

|

29,720 |

|

|

|

36,708 |

|

|

Trade accounts payable |

|

|

19,724 |

|

|

|

(22,700 |

) |

|

|

41,329 |

|

|

|

(89,666 |

) |

|

Accrued expenses |

|

|

(110,462 |

) |

|

|

35,711 |

|

|

|

(153,892 |

) |

|

|

69,682 |

|

|

Other assets and liabilities |

|

|

(14,690 |

) |

|

|

(1,660 |

) |

|

|

(16,576 |

) |

|

|

(4,988 |

) |

|

Net cash (used in) provided by operating activities |

|

$ |

(15,225 |

) |

|

$ |

(25,204 |

) |

|

$ |

(94,084 |

) |

|

$ |

14,692 |

|

| Investing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

$ |

(23,743 |

) |

|

$ |

(20,948 |

) |

|

$ |

(45,559 |

) |

|

$ |

(38,794 |

) |

|

Acquisitions of businesses, net of cash acquired |

|

|

(34,217 |

) |

|

|

(25,464 |

) |

|

|

(43,611 |

) |

|

|

(25,464 |

) |

|

Other |

|

|

268 |

|

|

|

1,111 |

|

|

|

540 |

|

|

|

1,494 |

|

|

Net cash used in investing activities |

|

$ |

(57,692 |

) |

|

$ |

(45,301 |

) |

|

$ |

(88,630 |

) |

|

$ |

(62,764 |

) |

| Financing

activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt borrowings |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

2,566,000 |

|

|

$ |

— |

|

|

Long-term debt repayments |

|

|

(11,617 |

) |

|

|

(7,536 |

) |

|

|

(3,370,970 |

) |

|

|

(15,321 |

) |

|

Proceeds from issuance of common stock on initial public offering,

net |

|

|

— |

|

|

|

— |

|

|

|

656,485 |

|

|

|

— |

|

|

Proceeds from issuance of tangible equity units, net |

|

|

— |

|

|

|

— |

|

|

|

389,000 |

|

|

|

— |

|

|

Borrowings of the Revolving Credit Facility, net |

|

|

55,800 |

|

|

|

80,900 |

|

|

|

5,100 |

|

|

|

66,600 |

|

|

Payment of debt issuance costs |

|

|

(225 |

) |

|

|

— |

|

|

|

(43,188 |

) |

|

|

— |

|

|

Repurchase of shares of common stock |

|

|

(325 |

) |

|

|

— |

|

|

|

(650 |

) |

|

|

— |

|

|

Shares issued under share-based compensation plan, including tax

effects |

|

|

404 |

|

|

|

56 |

|

|

|

404 |

|

|

|

145 |

|

|

Shares issued for payment of acquisition |

|

|

1,081 |

|

|

|

— |

|

|

|

1,081 |

|

|

|

— |

|

|

Payment of acquisition earn-outs |

|

|

(2,656 |

) |

|

|

— |

|

|

|

(2,656 |

) |

|

|

— |

|

|

Purchase of redeemable noncontrolling interest |

|

|

— |

|

|

|

— |

|

|

|

(300 |

) |

|

|

— |

|

|

Payment of financing lease obligations |

|

|

(2,555 |

) |

|

|

(2,839 |

) |

|

|

(5,636 |

) |

|

|

(5,724 |

) |

|

Net cash provided by financing activities |

|

$ |

39,907 |

|

|

$ |

70,581 |

|

|

$ |

194,670 |

|

|

$ |

45,700 |

|

|

Net (decrease) increase in cash and cash equivalents |

|

|

(33,010 |

) |

|

|

76 |

|

|

|

11,956 |

|

|

|

(2,372 |

) |

|

Cash and cash equivalents at beginning of year |

|

|

58,037 |

|

|

|

11,180 |

|

|

|

13,071 |

|

|

|

13,628 |

|

|

Cash and cash equivalents at end of year |

|

$ |

25,027 |

|

|

$ |

11,256 |

|

|

$ |

25,027 |

|

|

$ |

11,256 |

|

|

BrightSpring Health Services, Inc. and

SubsidiariesReconciliation of EBITDA and Adjusted

EBITDAFor the three months and six months ended

June 30, 2024 and 2023(Unaudited) |

|

| The following

table reconciles net income (loss) to EBITDA and Adjusted

EBITDA: |

|

| ($ in thousands) |

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net income (loss) |

|

$ |

19,441 |

|

|

$ |

2,766 |

|

|

$ |

(26,944 |

) |

|

$ |

(19,510 |

) |

| Income tax benefit |

|

|

(9,466 |

) |

|

|

(2,834 |

) |

|

|

(32,760 |

) |

|

|

(7,180 |

) |

| Interest expense, net |

|

|

52,439 |

|

|

|

79,684 |

|

|

|

117,459 |

|

|

|

157,861 |

|

| Depreciation and

amortization |

|

|

50,071 |

|

|

|

50,205 |

|

|

|

98,993 |

|

|

|

100,550 |

|

| EBITDA |

|

$ |

112,485 |

|

|

$ |

129,821 |

|

|

$ |

156,748 |

|

|

$ |

231,721 |

|

| Non-cash share-based compensation

(1) |

|

|

15,136 |

|

|

|

825 |

|

|

|

39,984 |

|

|

|

1,275 |

|

| Acquisition, integration, and

transaction-related costs (2) |

|

|

5,022 |

|

|

|

5,789 |

|

|

|

13,564 |

|

|

|

7,435 |

|

| Restructuring and

divestiture-related and other costs (3) |

|

|

3,562 |

|

|

|

7,419 |

|

|

|

21,393 |

|

|

|

11,644 |

|

| Legal costs and settlements

(4) |

|

|

2,493 |

|

|

|

2,626 |

|

|

|

12,966 |

|

|

|

4,664 |

|

| Significant projects (5) |

|

|

444 |

|

|

|

1,248 |

|

|

|

1,604 |

|

|

|

4,964 |

|

| Management fee (6) |

|

|

— |

|

|

|

1,432 |

|

|

|

23,381 |

|

|

|

2,865 |

|

| Unreimbursed COVID-19 related

costs |

|

|

— |

|

|

|

266 |

|

|

|

— |

|

|

|

136 |

|

| Total adjustments |

|

$ |

26,657 |

|

|

$ |

19,606 |

|

|

$ |

112,892 |

|

|

$ |

32,984 |

|

| Adjusted EBITDA |

|

$ |

139,142 |

|

|

$ |

149,427 |

|

|

$ |

269,640 |

|

|

$ |

264,705 |

|

(1) Represents non-cash share-based compensation to certain

members of our management and full-time employees. The three and

six months ended June 30, 2024 includes $13.3 million and $21.4

million of costs, respectively, related to new equity awards

granted upon the completion of our IPO under the 2024 Equity

Incentive Plan. The six months ended June 30, 2024 includes $15.0

million of previously unrecognized share-based compensation expense

related to performance-vesting options under the 2017 Stock Plan,

which vested upon completion of the IPO.

(2) Represents transaction costs incurred in connection with

planned, completed, or terminated acquisitions, which include

investment banking fees, legal diligence and related documentation

costs, finance and accounting diligence and documentation, and

integration costs incurred including any facility consolidation,

integration travel, or severance associated with the integration of

an acquisition. These costs also included $1.1 million and $5.5

million of costs related to the IPO Offerings which were not

capitalizable for the three and six months ended June 30, 2024,

respectively, compared to $0.0 million and $0.2 million for the

three and six months ended June 30, 2023, respectively; and system

implementation costs associated with the integration of

acquisitions of $0.1 million and $0.2 million for the three and six

months ended June 30, 2024, respectively, compared to $0.5 million

and $1.5 million for the three and six months ended June 30, 2023,

respectively.

(3) Represents costs associated with restructuring-related

activities, including closure, and related license impairment, and

severance expenses associated with certain enterprise-wide or

significant business line cost-savings measures. These costs

included $12.7 million of unamortized debt issuance costs

associated with the extinguishment of our Second Lien Facility in

the six months ended June 30, 2024. These costs also included $0.1

million and $1.9 million of intangible asset and other investment

impairment for the three and six months ended June 30, 2024,

respectively, as compared to $3.8 million and $6.0 million for the

three and six months ended June 30, 2023, respectively.

(4) Represents settlement and defense costs associated with

certain PharMerica litigation matters associated with two

historical cases, which includes the Silver matter. For the six

months ended June 30, 2024, these costs included $5.0 million

associated with the settlement of the Silver matter due to a change

in estimate. See Note 10 within the unaudited condensed

consolidated financial statements and related notes in this

Quarterly Report on Form 10-Q for additional information.

(5) Represents costs associated with certain transformational

projects and for the periods presented. General ledger system

migration and related business intelligence system implementation

costs, which were capitalized as development costs and are

subsequently amortized in accordance with ASC 350-40, Internal Use

Software, were $0.2 million and $0.7 million for the three and six

months ended June 30, 2024, respectively, compared to $0.5 million

and $1.0 million for the three and six month ended June 30, 2023,

respectively. The general ledger system migration and related

business intelligence system project costs were completed during

the second fiscal quarter of 2024. Pharmacy billing system

implementation costs were $0.1 million and $0.7 million for the

three and six months ended June 30, 2024, respectively, compared to

$0.7 million and $1.1 million for the three and six months ended

June 30, 2023, respectively. The pharmacy billing system project

costs were completed in the second fiscal quarter of 2024.

Ransomware attack response costs associated with the ransomware

attack in the first half of 2023 were $0.5 million and $2.5 million

for the three and six months ended June 30, 2023.

(6) Represents annual management fees payable to the Managers

under the Monitoring Agreement through the date of the IPO, and

$22.7 million of termination fees resulting from the Monitoring

Agreement being terminated upon completion of the IPO Offerings.

All management fees have ceased following the completion of the

IPO.

|

BrightSpring Health Services, Inc. and

SubsidiariesReconciliation of Adjusted

EPSFor the three months and six months ended June

30, 2024 and 2023(Unaudited) |

|

| The following

table reconciles diluted EPS to Adjusted EPS: |

|

| (shares in thousands) |

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Diluted EPS |

|

$ |

0.10 |

|

|

$ |

0.03 |

|

|

$ |

(0.14 |

) |

|

$ |

(0.15 |

) |

| Non-cash share-based compensation

(1) |

|

|

0.07 |

|

|

|

0.01 |

|

|

|

0.20 |

|

|

|

0.01 |

|

| Acquisition, integration, and

transaction-related costs (1) |

|

|

0.02 |

|

|

|

0.05 |

|

|

|

0.07 |

|

|

|

0.06 |

|

| Restructuring and

divestiture-related and other costs (1) |

|

|

0.02 |

|

|

|

0.06 |

|

|

|

0.11 |

|

|

|

0.09 |

|

| Legal costs and settlements

(1) |

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.07 |

|

|

|

0.04 |

|

| Significant projects (1) |

|

0.00 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.04 |

|

| Management fee (1) |

|

|

— |

|

|

|

0.01 |

|

|

|

0.12 |

|

|

|

0.02 |

|

| Unreimbursed COVID-19 related

costs (1) |

|

|

— |

|

|

0.00 |

|

|

|

— |

|

|

0.00 |

|

| Income tax impact on

adjustments (2)(3) |

|

|

(0.12 |

) |

|

|

(0.04 |

) |

|

|

(0.22 |

) |

|

|

(0.07 |

) |

| Adjusted EPS |

|

$ |

0.10 |

|

|

$ |

0.15 |

|

|

$ |

0.22 |

|

|

$ |

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding used in calculating diluted U.S. GAAP net income (loss)

per common share |

|

|

208,987 |

|

|

|

126,449 |

|

|

|

186,523 |

|

|

|

117,875 |

|

| Weighted average common shares

outstanding used in calculating diluted Non-GAAP net income (loss)

per common share |

|

|

208,987 |

|

|

|

126,449 |

|

|

|

197,360 |

|

|

|

126,485 |

|

(1) This adjustment reflects the per share impact of the

adjustment reflected within the definition of Adjusted EBITDA.

(2) The income tax impact of non-GAAP adjustments is calculated

using the estimated tax rate for the respective non-GAAP

adjustment.

(3) For the three and six months ended June 30, 2024, the income

tax impact on adjustments is inclusive of a discrete tax benefit

related to the Silver matter that was finalized in connection with

the signing of the settlement agreement during the second fiscal

quarter of 2024.

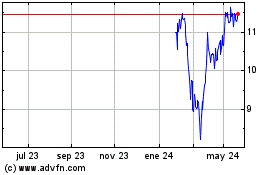

BrightSpring Health Serv... (NASDAQ:BTSG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

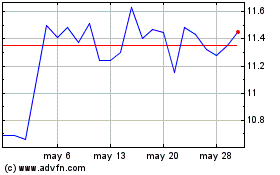

BrightSpring Health Serv... (NASDAQ:BTSG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024