UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: May 23, 2024

(Commission File No. 001-39308)

CALLIDITAS THERAPEUTICS AB

(Translation of registrant’s name into

English)

Kungsbron 1, D5

SE-111 22

Stockholm, Sweden

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Company Announcement and Interim Report

On May 23, 2024, the Company announced its unaudited results for the

three months ended March 31, 2024, which are further described in the Company’s Interim Report Q1 2024 and press release, copies

of which are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated by reference herein.

The information contained in this Form 6-K, including Exhibits 99.1

and 99.2 is hereby incorporated by reference into the registrant’s Registration Statements on Form F-3 (File No. 333-265881) and

Form S-8 (File Nos. 333-240126 and 333-272594).

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CALLIDITAS THERAPEUTICS AB |

| |

|

|

| Date: May 23, 2024 |

By: |

/s/ Fredrik Johansson |

| |

|

Fredrik Johansson |

| |

|

Chief Financial Officer |

Exhibit 99.1

| INTERIM REPORT

JANUARY – MARCH

2024

Q1 |

| Calliditas Therapeutics | Interim Report 2024: January – March 2

278 50% 810

Key takeaways from Q1, 2024

Outlook 2024: Unchanged

JANUARY – MARCH 2024

(COMPARED TO JANUARY – MARCH 2023)

“In Q1 we generated another record JAN – MAR 2024

quarter in terms of demand with 705

enrollments and 354 new prescribers.

We are very excited over this positive

trend and we continue to see strong

demand in Q2.”

JAN – MAR 2024 31 MAR 2024

MSEK

TARPEYO net sales

Renée Aguiar-Lucander / CEO

TARPEYO net sales

growth in SEK (vs Q1

2023)

MSEK

Cash position

Interim report

January – March 2024

• Net sales amounted to SEK 295.5 million, of which

TARPEYO® net sales amounted to SEK 278.3 million, for

the three months ended March 31, 2024. For the three

months ended March 31, 2023 net sales amounted to SEK

191.4 million, of which TARPEYO net sales amounted to

SEK 185.7 million.

• Operating loss amounted to SEK 203.8 million and SEK

180.1 million for the three months ended March 31, 2024

and 2023, respectively.

• Calliditas had a record quarter with 705 enrollments,

representing a 27% increase over Q4.

• In February, the United States Patent and Trademark

Office (USPTO) issued patent no. 11896719, entitled

“New Pharmaceutical Compositions”. This was Calliditas’

second patent for TARPEYO in the United States, and

provides product protection until 2043.

• In March, the FDA granted an orphan drug exclusivity

period of seven years for TARPEYO®, expiring in December

2030, based on when the company obtained full approval

with a new indication for this drug product.

• There was a negative impact on net TARPEYO revenues

in the quarter of approximately USD 4.7 million due to a

cyberattack on Change Health. The revenues we were not

able to record in Q1 because of this technical issue are

not lost, but are expected to roll forward over the next

several months. This is not expected to have any impact

on annual revenues.

• Preliminary net sales from TARPEYO for the second quarter

up until the date of this report amounts to USD 25.5 million.

• Positive read out of the Nefecon Open label Phase 3

extension trial.

• Positive topline results from the setanaxib Phase 2 trial in

head and neck cancer.

• Commercial launch of Nefecon in China by partner Everest

Medicines.

• Calliditas expects continued revenue growth:

Total net sales from the Nefecon franchise, including milestones, are estimated

to be USD 150-180 million for the year ending December 31, 2024.

Key events after the reporting period

• Loss per share before and after dilution amounted to SEK

4.59 and SEK 3.49 for the three months ended March 31,

2024 and 2023, respectively.

• Cash amounted to SEK 810.3 million and SEK 1,013.6

million as of March 31, 2024 and 2023, respectively.

• European Commission decision regarding a potential full

approval for Kinpeygo for Calliditas’ partner STADA.

• Full data read out of setanaxib Phase 2 trial in Primary

Biliary Cholangitis.

• Updated KDIGO guidelines.

Key events in upcoming 6 months |

| Calliditas Therapeutics | Interim Report 2024: January – March 3

Calliditas

– pioneering new

treatments for rare

diseases

Our values

Calliditas Therapeutics leverages scientific expertise and disease

specific insights to help improve the lives of patients. We are a

commercial-stage biopharma company that researches, develops

and commercializes novel therapies that seek to address significant

unmet needs in relation to the treatment of rare diseases. We are

committed to expanding treatment options and establishing new

standards of care for patients with rare diseases, reflected by our

pipeline of innovative medicines that target unmet medical needs.

Our lead product provides a treatment option that has been demon-strated to be disease-modifying for IgA nephropathy (IgAN) – also

known as Berger’s Disease – a progressive autoimmune disease of

the kidney that for many patients leads to end-stage renal disease

(ESRD), requiring dialysis or organ transplantation. This drug product,

developed under the name Nefecon®, was granted accelerated

approval by the FDA in 2021 and full approval in December 2023,

and is today marketed in the US under the brand name TARPEYO®.

TARPEYO is now the first and only fully approved treatment for

IgAN and is approved based on a measure of kidney function.

Nefecon has also been granted conditional marketing authorisation

by the European Commission under the brand name Kinpeygo®

in the European Economic Area (EEA) and in the UK. Kinpeygo is

currently being reviewed for full marketing authorization by the

European Commission and the MHRA.

Nefecon has been granted conditional approval in China, Singa-pore, and Macau, and is being reviewed by regulators in Hong Kong

and South Korea. Nefecon was launched commercially by Everest

AGILITY

We are flexible and able to rapidly pivot and adapt to

changing situations and requirements.

EXPERTISE

We leverage our strong internal experience and com-petencies while complementing our strengths through

knowledge sharing and external collaborations as

needed.

INTEGRITY

We take responsibility for our actions and hold ourselves

to the highest ethical standards, guided by our moral

principles to make the right decisions.

PIONEER

We explore novel approaches and empower each other

to find new ways of operating in a compliant, innovative

and pragmatic manner.

Medicines in China in May 2024. Calliditas has also entered into a

partnership to develop and commercialize Nefecon in Japan.

IgA nephropathy is the most common primary glomerulonephritis

worldwide, so the market potential for Nefecon is substantial, as

evidenced by our early commercial success and out-licensing deals

with potential payments exceeding USD 300 million, encompassing

upfront payments and predefined milestones, as well as ongoing

royalty obligations.

Our late-stage pipeline is based on a first-in-class platform of NOX

inhibitors. Our lead compound, setanaxib, inhibits enzymes involved

in inflammation and fibrosis pathways and is the first drug of this

class to reach the clinical stage. Setanaxib is currently undergoing

clinical trials targeting rare diseases characterized by inflammation

and fibrosis, including Primary Biliary Cholangitis (PBC) and Alport

syndrome, and there is also an investigator led trial ongoing in idio-pathic pulmonary fibrosis (IPF). Calliditas read out positive data from

a Phase 2 proof-of-concept trial with setanaxib in head and neck

cancer in May 2024.

While our headquarter is in Stockholm, Sweden, we maintain a

significant presence in the United States, with offices in New York

and New Jersey. We also have offices in France and Switzerland,

where our discovery team is based. Calliditas Therapeutics ordinary

shares were listed on NASDAQ Stockholm in 2018 (CALTX) and

subsequently American Depositary Shares representing our ordinary

shares were listed on the NASDAQ Global Select Market in the

United States in 2020 (CALT). |

| Calliditas Therapeutics | Interim Report 2024: January – March 4

Key figures

Investment highlights

Three Months Ended 31 March Year Ended 31 December

SEK in thousands, except per share amount or as otherwise indicated 2024 2023 2023

Net sales 295,481 191,352 1,206,888

Of which TARPEYO product sales 278,276 185,691 1,075,829

Operating income (loss) (203,826) (180,074) (373,055)

Income (loss) before Income tax for the period (247,324) (208,019) (457,017)

Earnings (loss) per share before and after dilution (SEK) (4.59) (3.49) (8.69)

Cash flow from (used in) operating activities (198,205) (231,940) (434,655)

March 31 December 31

(SEK in thousands, except per share amount or as otherwise indicated) 2024 2023 2023

Total registered shares, including shares held by Calliditas, at the end of the period 59,580,087 59,580,087 59,580,087

Equity attributable to equity holders of the Parent Company at the end of the period 120,151 589,403 334,806

Equity ratio at the end of the period in % 7% 33% 18%

Cash at the end of the period 810,317 1,013,600 973,733

RECENT AND ANTICIPATED DRIVERS

NEFECON

Setanaxib

Topline data readout of Ph2

trial in Solid Tumors (SCCHN)

Topline data

readout of Ph2 IPF

trial (ILS)

Topline data readout

of Ph2b trial in PBC

Potential positive opinion

from EMA for partner STADA

H1 2024 H2 2024

Explore partnering

opportunities in Oncology

Growth of commercial

franchise in China & Europe

Open label extension

study data readout

Update

to KDIGO

guidelines

Commercial

launch in China

Consolidating market leadership

of TARPEYO in US following full

approval |

| Calliditas Therapeutics | Interim Report 2024: January – March 5

CEO STATEMENT

Following the full approval of TARPEYO by the FDA in December of

2023, we were poised to bring the message of the disease modifying

potential of TARPEYO to nephrologists. New marketing materials and

training of everyone in the field to reflect the new indication and label

were initiated, and in February we rolled out the new program. In Q3

of 2023 we had made the decision to expand the US field force and

increase key field functions such as thought leader liaisons, medical

directors and field reimbursement managers to address the larger mar-ket potential. Our new indication – reduction of kidney loss in patients

with primary IgAN at risk of disease progression – now enables us to

address the full adult IgAN population at risk, an important change for

both patients and physicians. The potential that the drug has to pro-vide a clinically meaningful delay in the need for dialysis or transplanta-tion can now be discussed in interactions with treating nephrologists,

as we now can share the exciting and important eGFR data from

the Phase 3 trial. It was important to us that we invested in the best

possible team with the right focus in order to continue our important

pioneering work for IgAN patients. In January we also announced the

addition of an experienced senior executive, Maria Törnsén as Presi-dent North America, who brings over a decade of expertise from the

US rare disease market as well as a wealth of experience from account

management, optimization of field resources, and franchise building.

This was a key complement to our expanded field presence and we are

delighted to already see the benefits of her expertise.

This timely expansion leverages the expertise we have built over the

last two years and was instrumental in generating another record

quarter in terms of enrollments. The 705 enrollments received in Q1

2024 represent a 27% increase over Q4, which in turn was a 51%

increase over Q3. This continued strong growth in demand we believe

is the result of our strong data and the positive patient and physician

experiences with using the drug in a real-world setting, a key leading

indicator of expected revenue growth in 2024. We are very excited

about this positive trend and are continuing to see strong demand

in Q2. We believe that TARPEYO is poised to become the backbone

treatment in IgAN as the only disease specific and disease modifying

medication on the market, providing eGFR stabilization during

treatment which is durable post treatment. The ability to treat when

necessary to provide disease management without the high cost and

potential safety-related issues of many chronic treatments is important

both for patients and physicians dealing with this progressive disease,

especially if it potentially can keep patients out of dialysis or transplan-tation in their lifetime.

Total net revenues for the quarter from TARPEYO amounted to USD

26.8 million (SEK 278 million). Revenues in Q1 were impacted by

two important factors. The first was already communicated in our

Q4 presentation: namely, that Q1 is typically a somewhat slower

quarter due to the insurance reverification process taking place.

The second was completely unexpected, namely the cyberattack in

Target market

expansion following

full approval in the US

February on Change Health, a division of United Health, which is one

of three major claims processors in the US. This significant event had

a profound effect on the industry generally, and on our hub’s ability to

verify insurance coverage during the time that the system was down,

as our specialty pharmacy exclusively utilizes Change Health. This led

to a negative revenue impact of approximately USD 4.7 million for

the period. The revenues we were not able to record in Q1 because

of this technical issue are not lost, but are expected to roll forward

over the next several months, and this is not expected to have an

impact on annual revenues, which is also borne out by a strong start

to Q2 in terms of TARPEYO net sales, which quarter to date already

amount to approximately USD 25.5 million1 with an additional 5 weeks

remaining in the quarter. Our hub manager, Biologics by McKesson,

has subsequently implemented routines to better deal with this type of

unexpected situation in the future.

Our interactions with payors have continued as planned, and we have

had many interactions with P&T committees already. We expect the

updated rules to come into effect for many of the larger plans in their

next update cycle, which is slated for June/July.

Q1 also saw a significant strengthening of the product protection of

TARPEYO as we received seven years of orphan drug status for the

new indication, ending in late December of 2030. In addition, we com-plemented our existing TARPEYO patent portfolio with a new patent,

expiring in 2043. We will continue to work to both broaden the patent

portfolio as well as achieve greater geographical coverage.

Post period we were also very excited to report out topline data from

our setanaxib Phase 2 head and neck cancer trial. The highly relevant

and clinically meaningful measures of progression free survival and

overall survival came out as statistically significant in the patients who

received setanaxib and pembrolizumab, compared to the group receiv-ing placebo and pembrolizumab, and in addition we could see clinical

evidence of setanaxib’s anti fibrotic effect given the statistical signifi-cance on T cell activity in the tumors treated with setanaxib. This was

beyond our initial expectations for the trial and we are looking forward

to engaging in discussions with potential partners, as well as seeing the

results from the other Phase 2 trials from our rare disease pipeline.

Our cash position remains strong with SEK 810 million on the balance

sheet at the end of the quarter, which we believe is sufficient to take

us to profitability based on expected revenue growth of TARPEYO. We

reiterate our guidance of USD 150 – 180 million of net revenues for

the Nefecon franchise in 2024.

Renée Aguiar-Lucander, CEO

1Net sales for TARPEYO are preliminary, unaudited and refer to the period April 1 – May 23. |

| Calliditas Therapeutics | Interim Report 2024: January – March 6

BUSINESS OVERVIEW

Our pipeline

Exciting journey ahead

Calliditas’ lead product has been fully approved in the US, and has conditional approval in Europe and

China. Our pipeline consists of development programs derived from a first-in-class NOX inhibitor plat-form. The lead compound, setanaxib, was designed to be a selective NOX 1 and NOX 4 inhibitor and is

the first product candidate to reach the clinical stage. Calliditas read out topline data from its trial with

setanaxib in squamous cell carcinoma of the head & neck (SCCHN) in May 2024, and is also presently

running trials with setanaxib in primary biliary cholangitis (PBC) and Alport syndrome. There is also an

ongoing investigator-led trial in idiopathic pulmonary fibrosis (IPF).

Expected commercial ramp

following full approval of

TARPEYO in primary IgA

nephropathy for patients at

risk of progression

2H 2024: Topline data read-out of Phase 2b trial with

setanaxib in PBC, following

positive data from head and

neck cancer trial

Potential full approval of

Kinpeygo in EU and UK

NEFECON* Setanaxib

Preclinical Phase 1 Phase 2 Phase 3 Marketed Rights Commercial region

* Approved in the US under the tradename TARPEYO® to reduce the loss of kidney function in adults with primary IgAN at risk for disease progression, and granted condi-tional marketing authorization in the EEA and UK under the tradename Kinpeygo® for the treatment of primary IgAN in adults at risk of rapid disease progression with a urine

protein-to-creatinine ratio (UPCR) ≥1.5 g/gram, and granted conditional approval in China under the tradename Nefecon®.

Commercial Ongoing Trial Planned Trial Investigator Led Trial

IgAN Japan

IgAN United States

ROW ex partnered

IgAN

China, Hong Kong, Macau,

Taiwan, Singapore,

South Korea

IgAN KINPEYGO 4 mg Modified-release hard capsules

budesonide

Europe, UK, Switzerland

Global

SCCHN Global

IPF Global

Alport Global

PBC |

| Calliditas Therapeutics | Interim Report 2024: January – March 7

BUSINESS OVERVIEW

Our commercial product

On December 20, 2023, Calliditas’ lead

product, TARPEYO, became the first and

only drug granted full approval by the US

Food and Drug Administration for patients

affected by IgA nephropathy (IgAN). It is

the only treatment specifically designed to

target the origin of IgAN and to be disease-modifying.

IgAN is a serious progressive disease, in which up to 50% of

patients end up at risk of developing end-stage renal disease

(ESRD) within ten to twenty years. This product, which was

developed under the name Nefecon®, is approved under the

brand name TARPEYO® in the United States. It was also granted

conditional approval by the European Commission under the

brand name Kinpeygo® in July 2022 and by the MHRA for the

UK in February 2023. Nefecon received conditional approval in

China by the China NMPA in November 2023.

Disease background

Although IgAN manifests in the kidney, the evidence indicates

that it is a disease that starts in the distal part of the intestine,

specifically in the ileum. Peyer’s patches, which are concen-trated within the gut-associated lymphoid tissue in the ileum,

have been identified as a major source of mucosal-type IgA

antibodies. Patients with IgA nephropathy have elevated levels

of mucosal-type IgA, which – in contrast to the majority of the

IgA in the blood – are predominately dimeric or polymeric and

are galactose-deficient. In IgAN patients, a combination of a

genetic predisposition and environmental, bacterial and dietary

factors is presumed to lead to an increased production of these

galactose-deficient IgA antibodies. This increased production,

potentially in conjunction with increased intestinal permeability,

leads to these secretory antibodies appearing in the blood.

Successful Phase 3 trial readout

NefIgArd is the first Phase 3 trial in IgA nephropathy to show a

statistically significant and clinically relevant kidney protective

effect as measured by eGFR. Calliditas’ full approval for Nefecon

from the FDA was based on the strong eGFR data from this trial.

The trial confirmed that targeting the origin of the disease with

a non chronic approach had a significant long-term impact on

kidney function.

The full Phase 3 NefIgArd trial consisted of a total of 364

patients, including 200 patients from the interim analysis, based

upon which Calliditas successfully filed for accelerated approval

with the FDA and for conditional approval with the European

Commission, UK MHRA, and China NMPA. The full trial included

9 months of treatment and a 15-month post-treatment obser-vational period for all study participants to confirm long-term

renal protection. The endpoint of the full Phase 3 trial assessed

the difference in kidney function between treated and placebo

patients, as measured by eGFR, over a two-year period from the

start of dosing of each patient. The data read-out took place in

March 2023, and in August 2023 was published in The Lancet.

The primary endpoint of the Phase 3 trial was a time-weighted

average of eGFR observed at each time point over two years.

The primary endpoint was successfully met with a highly statis-tical p value of <0.0001. At 9 months the absolute difference

in eGFR of the treatment arm was an improvement of 0.7

mL/min/1.73 m2 versus a loss of 4.6 mL/min/1.73 m2 for the

placebo arm. The treatment benefit was preserved during the

period of observation, reflected by a loss of kidney function at

two years in the placebo arm of 12.0 mL/min/1.73 m2 versus

6.1 mL/min/1.73 m2 for the treatment arm. This was also

confirmed by a difference in slope of 3 mL/min/year in favor of

TARPEYO.

There was a cumulative improvement in proteinuria in patients

treated with Nefecon versus placebo during the 9-month treat-ment period, which continued to significantly improve after end

of treatment, resulting in a decline of over 50% at 12 months.

At month 24, proteinuria levels in patients who had received

Nefecon were still at a reduced level, similar to that observed

at the 9-month time point, reflecting the durability of the

proteinuria reduction of a 9-month course of treatment.

Regulatory approvals

On the basis of this positive data, Calliditas submitted an

sNDA to the FDA seeking full approval of TARPEYO for the

complete study population from the Phase 3 NeflgArd study. On

December 20, 2023, the FDA approved TARPEYO (budesonide)

delayed release capsules to reduce the loss of kidney function in

adults with primary IgAN at risk for disease progression. Marking

a significant milestone, TARPEYO is now the first fully FDA-ap-proved treatment for IgAN reflecting the impact on a measure of

kidney function.

In September 2023, Calliditas’ partner STADA filed with Euro-pean Commission for full marketing authorisation of Kinpeygo in

the EU, and in October 2023 they also filed with the UK MHRA.

Nefecon received conditional approval in China in November

2023 and approval in the Macau administrative region in

October 2023. Calliditas’ partner Everest Medicines will be

commercialising this product in these territories. |

| Calliditas Therapeutics | Interim Report 2024: January – March 8

IgA nephropathy

- a significant market opportunity

Our commercial partnerships

• While IgAN is a rare disease, it is the most common form of pri-mary glomerulonephritis. Prevalence is estimated to range from

130,000 to 150,000 patients in the US, to be around 200,000

patients in Europe and up to 5 million patients in China.

• In the United States, we estimate there are around 12,000

nephrologists, of which up to two thirds treat patients with

IgAN. The majority of patients are seen by approximately

4,000 to 5,000 specialists. About 40% of the patients are

treated in academic settings while the remaining are treated

in community settings.1

BUSINESS OVERVIEW

Europe

Nefecon® was granted conditional

marketing authorisation (CMA) by the

European Commission in July 2022,

and subsequently by the Medicines and

Healthcare products Regulatory Agency

(MHRA) of the United Kingdom in February

2023, under the brand name Kinpeygo®

for the treatment of IgAN in adults at

risk of rapid disease progression with a

urine protein-to-creatinine ratio (UPCR)

>1.5 g/gram, becoming the first approved

treatment for IgAN in the EU. Kinpeygo

is marketed in the European Economic

Area (EEA), the UK and Switzerland, if

approved in this jurisdiction, exclusively

by STADA Arzneimittel AG, with whom

Calliditas entered into a license agreement

in July 2021 to register and commercialize

Kinpeygo in Europe. STADA launched

Kinpeygo in Germany in September 2022,

with additional European countries to

follow.

Following the positive data readout from

the full NefIgArd trial and the submission of

an sNDA to the FDA, Calliditas is collabo-rating with STADA to seek full approval of

Kinpeygo by the European Commission and

the MHRA in the full study population. An

opinion from the CHMP is expected in the

first half of 2024.

Greater China

In 2019, Calliditas entered into a license

agreement with Everest Medicines (HKEX

1952.HK) for Everest to develop and

commercialize Nefecon for IgAN in Greater

China and Singapore. In March 2022, this

agreement was expanded to include South

Korea.

Everest first launched Nefecon in China’s

Hainan Boao Pilot Zone as a First-in-Dis-ease therapy for IgA nephropathy in April

2023. This program allows innovative over-seas drugs and medical devices that have

been approved in other territories to be sold

and used in real-world clinical settings in

Hainan Province before regulatory approval

by the NMPA. Several hundreds of patients

signed up for this early access program,

making it one of the most successful EAP

programs launched in China.

Nefecon® was awarded conditional

approval in IgAN by China’s National

Medical Products Administration (NMPA) in

November 2023. Everest launched Nefecon

in mainland China in May 2024.

In addition to being approved and

commercially launched in Mainland China,

Nefecon® has also received approval in

Macau, Hong Kong and Singapore, and

was successfully commercially launched

and first prescribed in Macau at the end of

• The IgAN patient population at risk of disease progression

as defined by KDIGO guidelines is estimated to amount

to between 45,000 and 60,000 patients in the US.2

• Today the majority of these patients are treated principally with

supportive care such as generic ACEs and/or ARBs to control

blood pressure, complemented with other broadly indicated

cardio and kidney protective drugs.

• As availability and familiarity of approved drugs specifically

indicated and approved for IgAN increase and physicians

consider more active intervention to preserve kidney func-tion, we estimate the global IgAN market will grow to USD

5 – 8 billion.

2023. New Drug Applications (NDA) for

Nefecon® were also successfully accepted

for review in Taiwan and South Korea at the

end of 2023.

China has the highest prevalence of primary

glomerular diseases in the world, with an

estimated five million IgAN patients. Results

from the Chinese subpopulation analysis

of the Phase 3 NefIgArd trial, presented at

the American Society of Nephrology (ASN)

Kidney Week 2023, provided evidence

that the treatment effect of Nefecon in

the Chinese cohort was greater than in

the global data set with regards to kidney

function, proteinuria and microhematuria.

In the Chinese cohort, the mean absolute

change from baseline in eGFR at 24 months

showed an approximately 66% reduction in

loss of this measure of kidney function with

Nefecon compared with a 50% reduction in

loss of eGFR in the global data set.

Japan

At the end of 2022, Calliditas entered into

a partnership to commercialize Nefecon in

Japan with Viatris Pharmaceuticals Japan,

a subsidiary of Viatris Inc. (Nasdaq: VTRS).

Viatris is a global healthcare company which

is headquartered in the United States and

has a presence in over 165 countries.

1Veeva OpenData for 2023, including all active HCPs where the primary specialty is Nephrology

2Spherix RealWorld Dynamix |

| Calliditas Therapeutics | Interim Report 2024: January – March 9

TARPEYO: Moving from

supportive care to treating IgAN

BUSINESS OVERVIEW

Targeted B cell

immunomodulator

designed to local-ly target origin of

disease

In combination with

optimized RASi ther-apy; option of inter-mittent, rather than

chronic treatment

Durable eGFR benefit

and sustained pro-teinuria disease-mod-ifying effects in IgAN

Well characterized

active ingredient and

safety profile

Mechanism of action Patient focus Efficacy Safety

TARPEYO and Kinpeygo were the first-ever medications approved for IgAN by the FDA and

European Commission, respectively, and the only treatments specifically designed to target

the origin of IgAN and to be disease-modifying. TARPEYO is the only fully FDA-approved

treatment for IgAN and the only treatment approved based on protection of kidney function.

• A genetic predisposition is required

but not sufficient; most patients

are diagnosed in their 20s and 30s

• More than 50% are at risk of

developing ESRD within 10-20

years, leading to kidney transplant

• The treatment goal is to preserve

eGFR – kidney function

• Recently published longitudinal

data imply that disease progression

is faster and outlook worse than

previously thought1

IgAN Patients:

1 Pitcher D, Braddon F, Hendry B, et al. Long-Term Outcomes in IgA Nephropathy. Clin J Am Soc Nephrol. 2023;18(6):727-738. doi:10.2215/CJN.000000000000013

Kwon CS, Daniele P, Forsythe A, Ngai C. A Systematic Literature Review of the Epidemiology, Health-Related Quality of Life Impact, and Economic Burden of Immunoglobulin A Nephropathy. J Health Econ Outcomes Res. 2021 Sep 1;8(2):36-45. doi: 10.36469/001c.26129. PMID: 34692885; PMCID:

PMC8410133. |

| Calliditas Therapeutics | Interim Report 2024: January – March 10

Strong Demand for TARPEYO in Q1

BUSINESS OVERVIEW

During the first quarter, the Calliditas US team focused on leveraging TARPEYO’s full FDA

approval and new label to inform and engage nephrology healthcare professionals, payors and

patient communities regarding the latest clinical data.

In Q1 2024, TARPEYO set another quarterly record with 705

new patient enrollments, marking a substantial 27% quarter-over-quarter increase, following the 51% quarterly increase seen in

Q4. The increase in new prescribers of 354 was also a quarterly

record, which is another clear indicator of market acceptance and

demand for TARPEYO. The positive momentum is expected to

persist throughout 2024, supported by the new label and indica-tion, further reinforcing TARPEYO’s positioning as the backbone

treatment option in IgAN.

New Label Promotional Launch

First and only product FDA-approved

to reduce the loss of kidney function.

Patient Educational Webinar with

IgAN

Foundation & TARPEYO

Patient Ambassadors.

4 Presentations at WCN with analysis

from NeflgArd

Phase 3 trial and QoL data.

QUARTERLY HIGHLIGHTS Q1

New Patients enrolled in Q1

27% QoQ growth

New Prescribers in Q1

LTD Prescribers: 1,993

17% QoQ growth

Net sales of TARPEYO in Q1

2024

KEY METRICS Q1 2024

705 354 $26.8M

EXCITING JOURNEY AHEAD

The Q1 revenue was impacted by two factors: the seasonal

effect of the open enrollment period in the US, with insurance

changes for many patients, and a cyber-attack on the IT network

of our exclusive specialty pharmacy’s insurance claims processor

in the US, Change Healthcare. The estimated negative impact

on Q1 revenues of this unexpected disruption is ~$4.7m, which

we anticipate will be recorded over the next several months.

Importantly, this does not impact our revenue guidance for 2024.

We are also highly encouraged by a strong start to Q2 in terms

of TARPEYO net sales, which to the date of this report already

amount to approximately $25.5m with an additional 5 weeks

remaining in the quarter.

Continue US promotional

efforts to drive TARPEYO´s

positioning as a disease

modifying foundational

therapy in IgAN.

Drive scientific exchange

and data dissemination at

major scientific congress

and programs (e.g. ERA,

NKF,ASN).

Leverage KDIGO guidelines

expected in 2024.

Educate and inform US

payors on the full approval

to ensure TARPEYO payor

policies are reflecting new

label. |

| Calliditas Therapeutics | Interim Report 2024: January – March 11

BUSINESS OVERVIEW

Calliditas’ pipeline consists of development

programs based on a first-in-class NOX inhib-itor platform. Calliditas is presently running

clinical trials with lead compound setanaxib in

squamous cell carcinoma of the head & neck

(SCCHN), which read out positive topline data

data in May 2024, as well as in primary biliary

cholangitis (PBC) and Alport syndrome.

NOX Enzyme Inhibitors

NOX enzymes, also known as nicotinamide adenine dinucleotide

phosphate (NADPH) oxidases, are the only known enzymes

that are solely dedicated to producing reactive oxygen species

(ROS). At appropriate concentrations, ROS help regulate cell

proliferation, differentiation, and migration, as well as modulate

the innate immune response, inflammation, and fibrosis.

The disruption of redox homeostasis has been implicated in

multiple disease pathways, with oxidative stress caused by excess

ROS being a likely underlying mechanism for many disorders,

including cardiovascular diseases, neurodegenerative disorders,

and cancer. As such, NOX enzyme inhibitors emerged as

promising novel experimental drugs in a new therapeutic class.

Setanaxib, which is the first NOX inhibitor to reach the clinical

stage, inhibits NOX1 and NOX4, enzymes that are implicated in

fibrosis and inflammation pathways and that represent a high-potential therapeutic target.

Alport syndrome

Alport syndrome is a genetic disorder arising from the muta-tions in the genes that code for type IV collagen. The type IV

collagen alpha chains are primarily located in the kidneys, eyes,

and cochlea, and thus the condition is characterized by kidney

disease, loss of hearing, and eye abnormalities. Eventually,

patients present with proteinuria, hypertension, progressive loss

of kidney function (gradual decline in GFR), and ESRD.

It is estimated that approximately 67,000 people in the United

States have this disorder, and it is a significant cause of chronic

kidney disease (CKD), leading to ESRD in adolescents and young

adults and accounting for 1.5% to 3.0% of children on renal

replacement therapies in EU and the US.

Pipeline: NOX Inhibitor platform

Based on supportive pre-clinical work, Calliditas launched

a randomized, placebo-controlled Phase 2 study in Alport

syndrome including around 20 patients. The study will eval-uate overall safety as well as impact on proteinuria. The study

was initiated in November 2023 and on the basis of the data

readout we will decide on a full regulatory program in Alport.

Calliditas was granted orphan drug designation for the

treatment of Alport syndrome with setanaxib by the FDA in

September 2023, and by the EMA in November 2023.

Primary biliary cholangitis

PBC is a progressive and chronic autoimmune disease of the

liver that causes immune injury to biliary epithelial cells, resulting

in cholestasis and fibrosis. It is an orphan disease and, based on

its known prevalence rates, we estimate that there are approxi-mately 140,000 patients in the United States, where the annual

incidence ranges from 0.3 to 5.8 cases per 100,000. Calliditas

received FDA Fast Track Designation for setanaxib in PBC in

August 2021.

Ursodeoxycholic acid, a generic drug also known as ursodiol or

UDCA, and obeticholic acid, known as Ocaliva, are the only treat-ments for PBC approved by the FDA. However, despite these

treatment options, there is still an unmet medical need among

PBC patients, in particular when it comes to important quality of

life outcomes.

Phase 2 data from a trial with setanaxib in 111 patients with PBC

demonstrated that setanaxib had a more pronounced effect on

fibrosis and ALP reduction (alkaline phosphatase, an established

independent predictor of prognosis in PBC) in patients with

an estimated liver fibrosis stage of F3 or higher. Patients with

elevated liver stiffness are at greater risk of disease progression.

Calliditas is conducting a randomized, placebo-controlled, double-blind Phase 2b trial in PBC patients with elevated liver stiffness

We are expecting to read out data from approximately 75

patients in Q3 2024. |

| Calliditas Therapeutics | Interim Report 2024: January – March 12

BUSINESS OVERVIEW

No significant difference in the primary endpoint of best

percentage change from baseline in tumor size was observed.

Transcriptomic analysis of tumor biopsy samples showed a

statistically significant increase in CD8+ T-cells in tumor tissue

from patients treated with setanaxib, indicating an increase in

tumor immunological activity consistent with the mechanism of

action of setanaxib. The tolerability of setanaxib when given with

pembrolizumab was generally good, with no new safety signals

identified.

Setanaxib in squamous cell carcinoma of the head

and neck

In May 2024, Calliditas read out topline data from its proof-of-concept Phase 2 trial evaluating setanaxib in combination

with pembrolizumab in patients with recurrent or metastatic

squamous cell carcinoma of the head and neck (SCCHN). The

trial is a randomized, placebo-controlled, double-blind Phase 2

study investigating the effect of setanaxib 800mg twice daily in

conjunction with pembrolizumab 200mg IV, administered every

3 weeks, (a standard treatment regimen for SCCHN) with the

full dataset reflecting all patients having had the opportunity

to complete at least 15 weeks of treatment. The basis for the

analysis consisted of 55 enrolled patients with recurrent or

metastatic SCCHN and moderate or high CAF-density tumors.

A tumor biopsy was taken prior to randomization and then again

after at least 9 weeks of treatment.

Pipeline: NOX Inhibitor platform

Phase 2 data readout

The treatment groups were well-balanced with no clinically

relevant differences between the groups observed at baseline.

Patients treated with pembrolizumab and setanaxib showed

statistically significant improvements in the key secondary

endpoints of progression-free survival, (PFS median 5 months

versus 2.9 months; Hazard ratio= 0.58) and overall survival (OS

at 6 months 92% vs 68%; OS at 9 months 88% vs 58%; Hazard

ratio=0.45) compared to patients treated with pembrolizumab

and placebo.

There was also an improvement in disease-control rate in seta-naxib-treated patients, with 70% in the setanaxib arm showing a

best response of at least stable disease compared to 52% in the

placebo arm.

Expanded patent protection

In April 2024, Calliditas received a Notice of Allowance from the

United States Patent and Trademark Office (USPTO) for patent

application no. 16/760,910 entitled “Use of NOX Inhibitors for

Treatment of Cancer”. This Notice of Allowance is expected

to result in the issuance of a U.S. patent once administrative

processes are completed. The allowed claims cover a method

of treating a solid tumor presenting resistance to PD-1 inhibitor

immunotherapy by administering setanaxib in combination with

a PD-1 inhibitor. The patent, when issued, will have an antici-pated expiration date in 2038.

“It is very encouraging to see statistical significance on

important clinical outcomes in this relatively small study,

which provides an excellent basis for advancing setanaxib

in this hard-to-treat population.”

Kevin Harrington, Professor in Biological Cancer Therapies at

The Institute of Cancer Research (ICR) London, Consultant Clinical

Oncologist at The Royal Marsden NHS Foundation, London, and

Investigator on the trial. |

| Calliditas Therapeutics | Interim Report 2024: January – March 13

INTERVIEW WITH MARIA TÖRNSÉN

Calliditas President North America Maria Törnsén

You have joined Calliditas with over 20 years of experience in the

pharmaceutical industry. Can you talk about your career and your

experiences in the industry thus far?

I started my career as a sales representative in the north of Sweden.

Looking back, I would say this was a bit of by luck, as I met represen-tatives from Eli Lilly Sweden at a career day at Lund University as I

was finishing up my Master’s degree. Little did I know that this initial

meeting would bring me the career I have enjoyed over the last 22

years and the majority spent outside my home country of Sweden.

From early days of sales and marketing with Eli Lilly and Merck Serono

in Sweden, I emigrated in 2008 when I got the opportunity to move

into a global role with Merck Serono in Switzerland. Since 2011, I have

almost exclusively spent my career in rare diseases at organizations

such as Shire, Sanofi Genzyme and Sarepta in global, European and US

roles. I have had the opportunity to work in diseases where there is no

therapy available, in areas with several approved therapies and with

programs at all stages of development and commercialization.

What experiences from your previous positions do you think have

been most valuable as you have taken over as President, North

America at Calliditas?

While all rare diseases are unique, I have through working on over

fifteen different rare diseases learned that there are many similarities,

which I have been able to bring from one organization to the next one.

First, patients with rare diseases typically face a long journey to diag-nosis which sometimes includes a misdiagnosis and seeing multiple

specialists. This is why understanding the patient journey is critical,

to ensure we put in place the right type of education, to the right

stakeholders, at the right time to shorten time to diagnosis and raise

the urgency to treat.

Second, once a patient has received a diagnosis, there are in most

cases no treatments available, or access is challenging. More than 95%

of rare diseases have no treatments available today, so the healthcare

provider may be limited to offering supportive care. At Calliditas, we

can provide a treatment for one of the rare diseases, TARPEYO for

IgA nephropathy (IgAN) and we also have an experienced access team

who can help ensure eligible patients gain access to TARPEYO.

Finally, I would also highlight the aspect of community support and

how important that is for someone living with a rare disease. As rare

diseases are not well known to most people, a person diagnosed with

a rare disease may be challenged with finding accurate information

and get the support they need. That’s why the patient organizations

play such a critical role for rare disease patients, and I am proud that

Calliditas is working with multiple patient organizations supporting

people living with IgAN and other kidney diseases.

What excited you about the prospect of leading

Calliditas’ commercial efforts in the US?

In December 2023, we gained full approval for TARPEYO for the

treatment of IgAN. This was a pivotal moment for Calliditas, but most

importantly for the IgAN community. This is the first time a product

has proven to reduce the loss of kidney function in IgAN, which is

something the community has been waiting for, for a long time. I am

excited about the opportunity to engage with healthcare providers,

patient organizations and payors to educate on the new indication

for TARPEYO and ensure appropriate patients can have access to our

therapy.

I am equally excited about our clinical

programs and our NOX enzyme inhib-itors platform. Over the next twelve

months, we will have multiple data read-outs in disease areas with high unmet

need. This may allow us an opportunity

to potentially help other patients in the

future.

What do you think the full approval

and expanded label will mean for

TARPEYO in the context of standard

of care?

For many years, the IgAN community

has not had an approved therapy which has shown to reduce the

loss of kidney function. Since the full approval of TARPEYO, they

now have that. We can not underestimate the importance of this full

approval, as it gives healthcare providers an opportunity to not only

manage proteinuria, but also tell their patients it can help preserve

their kidney function. It will also facilitate discussions with payors and

improve patient access. This is a benefit for IgAN patients, as many are

diagnosed before the age of 40 and will live with this disease for many

decades.

What key events and milestones in the upcoming year

do you think might drive TARPEYO sales and profile?

The full approval in December 2023 was the most important

milestone for Calliditas. This full approval provides access to a broader

IgAN population. During the first half of 2024, our focus is on

educating payors and healthcare providers on the new label, to ensure

broader access to TARPEYO.

The data from our open label extension (OLE) study is also important

in helping us better understand the potential benefit of providing a

second 9-month treatment of TARPEYO.

Another important milestone we are anticipating this year is the

update of the KDIGO guidelines. These guidelines were last updated

in 2021, prior to the full approval of TARPEYO. We know that many

nephrologists use these guidelines as they make decisions on how to

treat their patients with IgAN. We are anticipating that the updated

guidelines will include TARPEYO, and that they may also expand the

definition of the “at risk” population who should be treated.

What can you share with regards to progress related to payor

interactions on the new label in the first quarter of the year?

Our focus in Q1 has been on educating payors on the new label for

TARPEYO. We have invested in our field-based team, both in terms of

national account managers, whose focus is commercial and govern-ment payors, and our field reimbursement managers, who are focused

on educating nephrology offices on the prior authorization process

and facilitating patient access.

Our national account team, alongside our field based medical team,

have been engaging with payors since the full approval was granted.

This has included multiple scientific presentations on the new label,

providing payors with a summary of the differences compared to the

previous label, and answering their questions. With this information in

hand, we are expecting the major payors to update their policies over

the next six months, which should facilitate access to TARPEYO. |

| Calliditas Therapeutics | Interim Report 2024: January – March 14

Continued focus on

CSRD implementation

Calliditas Therapeutics | Interim Report 2024: January – March

During the first quarter, Calliditas took

further steps in the implementation of

the upcoming legal requirement, CSRD,

by establishing a roadmap for the project

and preparing several key performance

indicators to ensure progress in its

sustainability work.

During the first quarter, Calliditas continued the efforts to

develop its sustainability work with a focus on the issues that,

in accordance with the double materiality assessment, will guide

the strategic sustainability work and reporting going forward.

Based on current sustainability reporting, an analysis was made

to get a clear picture of the information and data that is avail-able, and what needs to be added to comply with CSRD and its

associated standards.

To ensure that the right priorities are set in the long-term

sustainability work, a roadmap was developed during the first

quarter. It defines what Calliditas needs to work on in order to

drive its sustainability work forward, together with how the work

is to be done, the timeline, as well as who, alternatively which

function, is responsible.

SUSTAINABILITY

Key figures for continuous follow-up

With the ambition to increase the pace of sustainability work

and data collection, several selected key performance indicators

were developed during the first quarter to continuously monitor

the progress of some of Calliditas’ material sustainability matters.

The selection was made based on the metrics and targets

included in a number of the ESRS on which Calliditas will report

starting in fiscal year 2025. An overview:

Environment

• Share of all purchased electricity from renewable sources

Social

• Number of incidents linked to work-related injuries, ill health

cases and fatalities

• Number of days lost due to work-related ill health

• Number of employees who left Calliditas/Employee turnover

Governance

• Percentage of employees trained in Calliditas’ Code of

Conduct

• Percentage of business partners who have signed Calliditas’

Code of Conduct

Continued work to drive transition

For Calliditas, the long-term work to develop policies, processes,

targets, and activities continues. In addition, Calliditas will grad-ually add key performance indicators to increase progress in the

sustainability work and the implementation of CSRD.

14

Environmental matters

• Climate change mitigation and adaptation

• Circular economy and waste

Social matters

• Employee health and safety

• Access to products

• Health and safety of end-users

Governance matters

• Anti-corruption and anti-bribery

• Animal protection

Calliditas’ material sustainability areas

The sustainability matters that are most important

for Calliditas to work with, monitor and report

on are gathered in seven main areas divided as

follows: |

| Calliditas Therapeutics | Interim Report 2024: January – March 15

January – March 2024

FINANCIAL OVERVIEW

Revenue

Net sales amounted to SEK 295.5 million and SEK 191.4

million for the three months ended March 31, 2024 and 2023,

respectively. Net sales primarily originated from net sales of

TARPEYO® in the US, which amounted to SEK 278.3 million and

SEK 185.7 million for the three months ended March 31, 2024

and 2023, respectively. Royalty income from our partnerships

amounted to SEK 13.0 million and SEK 4.4 million for the three

months ended March 31, 2024 and 2023, respectively.

For additional information see Note 4.

Cost of Sales

Cost of sales amounted to SEK 14.0 million and SEK 9.0 million for

the three months ended March 31, 2024 and 2023, respectively.

Total Operating Expenses

Total operating expenses amounted to SEK 485.3 million and SEK

362.4 million for the three months ended March 31, 2024 and

2023, respectively.

Research and Development Expenses

Research and development expenses amounted to SEK 150.6

million and SEK 126.7 million for the three months ended March

31, 2024 and 2023, respectively. The increase of SEK 23.9 million

for the period was primarily due to increased clinical activities for

the Nox-platform, including the ongoing setanaxib trials.

Marketing and Selling Expenses

Marketing and selling expenses amounted to SEK 240.1 million

and SEK 167.2 million for the three months ended March 31,

2024 and 2023, respectively. The increase of SEK 72.9 million was

primarily related to intensified marketing activities of TARPEYO

and increased US salesforce due to the TARPEYO full approval in

the US.

Administrative Expenses

Administrative expenses amounted to SEK 102.0 million and SEK

72.5 million for the three months ended March 31, 2024 and

2023, respectively. The increase of SEK 29.5 million for the period

was primarily related to increased costs from a larger organization

and increased regulatory requirements.

Other Operating Incomes/Expenses, net

Other operating income (expenses), net amounted to SEK 7.5

million and SEK 4.0 million for the three months ended March

31, 2024 and 2023, respectively. The improvement was primarily

attributable to movements in exchange rates related to operating

receivables and liabilities.

Net Financial Income and Expenses

Net financial income (expenses) amounted to (SEK 43.5 million)

and (SEK 27.9 million) for the three months ended March 31,

2024 and 2023, respectively. The change in the net amount of

(SEK 15.5 million) was primarily derived from interest expenses

and currency effects primarily related to translation effects.

Tax

Total income tax (expense) amounted to SEK 1.2 million and

SEK 20.5 million for the three months ended March 31, 2024

and 2023, respectively. The change in income tax was primarily

explained by carried-forward losses recognized regarding U.S.

subsidiaries in the first quarter of 2023. The Group’s tax losses

carried-forward have not been recognized as deferred tax assets,

other than to the extent such tax losses can be used to offset

temporary differences.

Result for the period

For the three months ended March 31, 2024 and 2023, loss

for the period amounted to SEK 246.2 million and SEK 187.5

million, and the corresponding loss per share before and after

dilution amounted to SEK 4.59 and SEK 3.49, respectively.

Cash Flow and Cash Position

Cash flow used in operating activities amounted to SEK 198.2

million and SEK 231.9 million for the three months ended March

31, 2024 and 2023, respectively. The decrease is mainly attrib-utable to the change in current receivables.

Cash flow used in investing activities amounted to SEK 3.9

million and SEK 2.9 million for the three months ended March

31, 2024 and 2023, respectively. The change was primarily

explained by acquisition of equipment.

Cash flow used in financing activities amounted to SEK 5.5

million and SEK 3.0 million for the three months ended March

31, 2024 and 2023, respectively.

Net decrease in cash amounted to SEK 207.5 million and SEK

237.8 million for the three months periods ended March 31,

2024 and 2023, respectively. Cash amounted to SEK 810.3

million and SEK 1,013.6 million as of March 31, 2024 and 2023,

respectively.

Personnel

The average number of employees were 219 and 170 for the

three months ended March 31, 2024 and 2023, respectively. |

| Calliditas Therapeutics | Interim Report 2024: January – March 16

FINANCIAL OVERVIEW

Changes in Shareholders’ Equity and Number of

Shares

Equity attributable to equity holders of the Parent Company

amounted to SEK 120.2 million and SEK 589.4 million as of

March 31, 2024 and 2023, respectively. The number of regis-tered shares amounted to 59,580,087 and 59,580,087 as of

March 31, 2024 and 2023, respectively.

Treasury Shares

As of March 31, 2024, Calliditas had 5,908,018 ordinary shares

held as treasury shares by the Parent Company. At the Annual

General Meeting 2023, authorization was given that Calliditas

can transfer (sale) these ordinary shares with the purpose to

finance an acquisition of operations, to procure capital to finance

the development of projects, repayment of loans or to commer-cialize Calliditas’ products. No transfer (sale) of treasury shares

have occurred as of March 31, 2024. See Note 7 and 8 for

further information.

Incentive Programs

During the three months ended March 31, 2024, 555,000

options have been allocated for the ESOP 2023 Program. For

more information on incentive programs, see Note 9.

Parent Company

Net sales for the Parent Company, Calliditas Therapeutics AB,

amounted to SEK 138.2 million and SEK 168.4 million for the

three months ended March 31, 2024 and 2023, respectively.

The decrease is primarily attributable to change in the price mix of

product sales compared to previous year.

Operating loss amounted to SEK 174.0 million and SEK 46.6

million for the three months ended March 31, 2024 and 2023,

respectively. The decrease of SEK 127.4 million was primarily

related to higher costs related to intensified marketing activities,

increased regulatory requirements, and the larger organization.

Executive Management

The Executive Management of Calliditas Therapeutics

AB consists of: CEO Renée Aguiar-Lucander, CFO Fredrik

Johansson, CMO Richard Philipson, Group General Counsel

Brian Gorman, President North America Maria Törnsén, Vice

President Regulatory Affairs Frank Bringstrup, Head of Technical

Operations Lars Stubberud and Head of Human Resources

Sandra Frithiof.

Nomination Committee AGM 2024

The nomination committee for the AGM 2024 consists of:

Patrick Sobocki, appointed by Stiftelsen Industrifonden, Karl

Tobieson, appointed by Linc AB and Spike Loy, appointed by

BVF.

Annual General Meeting 2024

The 2024 Annual General Meeting will be held 17 June at 14.00

p.m. CET, Klarabergsviadukten 90, Stockholm, Sweden. All docu-mentation will be published on the company’s website.

Unchanged Outlook 2024

For 2024, Calliditas expects continued revenue growth: Total

net sales from the Nefecon franchise, including milestones, are

estimated to be USD 150-180 million for the year ending 31

December, 2024.

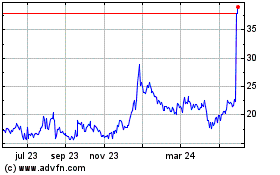

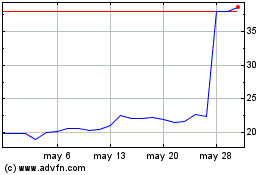

The Share

As of 31 March 2024, the number of shares amounted to

59,580,087 ordinary shares, of which, 5,908,018 are held as

treasury shares by the Parent Company. As of 28 March, 2024,

the closing price for the Calliditas Therapeutics share CALTX was

SEK 113.4. The total number of shareholders as of 31 March,

2024 was approximately 18,000.

Shareholder Structure

Ten largest shareholders as of March, 2024 %

BVF Partners LP 10,51

Linc AB 10,01

Stiftelsen Industrifonden 5,28

Polar Capital 3,94

Unionen 3,60

Avanza Pension 3,24

Handelsbanken Fonder 2,95

Fjärde AP-fonden 2,94

Sofinnova Partners 2,36

Öhman Fonder 2,23

Subtotal, 10 largest shareholders 47,06

Treasury shares 9,92

Other shareholders 43,02

Total 100.00

Calliditas R&D Day

On 30 May Calliditas will hold an R&D Day at Inderes

Event Studio, Västra Trädgårdsgatan 19, Stockholm at 15.00

p.m CET. The event is available online and also possible

to attend live. To attend, live or online, please register at:

https://financialhearings.com/event/49948/register/live_event

Auditor’s Review

This interim report has not been subject to review by the

company’s auditors.

Stockholm 23 May, 2024

Renée Aguiar-Lucander

CEO |

| Calliditas Therapeutics | Interim Report 2024: January – March 17

Significant Events

FINANCIAL COMMENTS

Significant Events During the Period

1 January – 31 March, 2024

• On 7 January, Calliditas announced that Maria Törnsén

was appointed to the position of President North America.

Ms. Törnsén is responsible for all US based operations and

reports to the CEO.

• On 13 February, Calliditas announced that the United States

Patent and Trademark Office (USPTO) issued patent no.

11896719, entitled “New Pharmaceutical Compositions”, on 24

January, 2024 with validity 13 February, 2024. This is Calliditas’

second patent for TARPEYO in the United States, and provides

product protection until 13 February 2043.

• On 6 March, Calliditas announced that the FDA granted an

orphan drug exclusivity period of seven years for TARPEYO®,

expiring in December 2030, based on when the company

obtained full approval with an expanded indication for this drug

product.

Significant Events After the end of the Period

• On 8 April, Calliditas announced that the Company received a

Notice of Allowance from the United States Patent and Trade-mark Office (USPTO) for patent application no. 16/760,910

entitled “Use of NOX Inhibitors for Treatment of Cancer”. This

Notice of Allowance is expected to result in the issuance of a U.S.

patent once administrative processes are completed.

• On 24 April, Calliditas announced that the global open-label

extension (OLE) study to the Phase 3 NefIgArd study showed a

treatment response consistent with the NefIgArd study across

endpoints of urine protein to creatinine ration (UPCR) and

estimated glomerular filtration rate (eGFR) at 9 months across

all IgAN patients, including those who had previously received

Nefecon in the NefIgArd study.

• On 6 May, Calliditas announced topline data from the proof-of-concept Phase 2 trial evaluating setanaxib, its lead NOX enzyme

inhibitor, in combination with pembrolizumab, in patients with

squamous cell carcinoma of the head and neck (SCCHN). The

analysis showed statistically significant improvements in progres-sion-free survival (PFS), as well as in overall survival (OS), with

statistically significant changes in tumor biology consistent with

the mechanism of action of setanaxib.

• On 14 May, Calliditas announced that its partner Everest

Medicines launched Nefecon® in China, which is estimated

to have up to 5 million patients suffering from the progressive

autoimmune disease.

• Preliminary net sales from TARPEYO for the second quarter up

until the date of this report amounts to USD 25.5 million. |

| Calliditas Therapeutics | Interim Report 2024: January – March 18

Presentation to investors,

analysts and press

For further information

please contact

Upcoming events

• Calliditas invites investors, analysts and press to a presentation of the

Q1 Report 2024 at 14:30 p.m. CET on 23 May, 2024. The report was

published on 23 May at 7:00 a.m. CET.

• Calliditas’ CEO Renée Aguiar-Lucander will present the report together

with CFO Fredrik Johansson, CMO Richard Philipson and President

North America Maria Törnsén. The presentations will be given in English.

• Time: Thursday 14:30 p.m. CET on 23 May, 2024

• Link to webcast

https://ir.financialhearings.com/calliditas-therapeutics-q1-report-2024

• To participate via conference call register via this link:

https://conference.financialhearings.com/teleconference/?id=50047214

After registration, you will receive a phone number and a conference ID

to log in to the conference call. Via the telephone conference, there is an

opportunity to ask oral questions.

Calliditas R&D Day 2024

Västra Trädgårdsgatan 19, Stockholm

30 May

ANNUAL GENERAL MEETING 2024

Klarabergsviadukten 90, Stockholm

17 June

INTERIM REPORT Q2

January – June 2024

13 August

INTERIM REPORT Q3

January – September 2024

11 November

Renée Aguiar-Lucander / CEO

+46 (0)8 411 30 05

renee.lucander@calliditas.com

Åsa Hillsten / Head of IR & Sustainability

+46 (0) 764 03 35 43

asa.hillsten@calliditas.com

Supplemental Information

This interim report has not been reviewed or audited by the Company’s auditors.

The information in the report is information that Calliditas is obliged to make public pursuant to the EU

Market Abuse Regulation. The information was sent for publication, through the agency of the contact

persons set out above, on May 23, 2024, at 7:00 a.m. CET.

Registered office

Calliditas Therapeutics AB

Kungsbron 1

SE 111 22 Stockholm, Sweden

calliditas.com / ir@calliditas.com

Forward looking statements

This Interim Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended,

including, without limitation, statements regarding Calliditas’ strategy, business plans, revenue and other financial projections, and focus. The words “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “target” and similar

expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

Any forward-looking statements in this Interim Report are based on management’s current expectations and beliefs and are subject to a number of risks,

uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking

statements contained in this Interim Report, including, without limitation, any related to Calliditas’ business, operations, commercialization of TARPEYO,

Kinpeygo and Nefecon, clinical trials, supply chain, strategy, goals and anticipated timelines for development and potential approvals, competition from

other biopharmaceutical companies, revenue and product sales projections or forecasts, including 2024 total net sales guidance and cash runway and

preliminary net sales for the second quarter of 2024 to date, and other risks identified in the section entitled “Risk Factors” in Calliditas’ reports filed with

the Securities and Exchange Commission.

Calliditas cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. Calliditas disclaims

any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which

any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

Any forward-looking statements contained in this Interim Report represent Calliditas’ views only as of the date hereof and should not be relied upon as

representing its views as of any subsequent date.

This Interim Report has been prepared in a Swedish original and has been translated into English. In case of differences between the two, the Swedish

version shall apply. |

| Calliditas Therapeutics | Interim Report 2024: January – March 19

Condensed Consolidated Statements of Income

Three Months Ended March 31, Year Ended December 31,

(SEK in thousands, except per share amounts) Notes 2024 2023 2023

Net sales 4 295,481 191,352 1,206,888

Cost of sales (14,012) (9,028) (60,463)

Gross income 281,469 182,323 1,146,425

Research and development expenses (150,613) (126,653) (502,223)

Marketing and selling expenses (240,147) (167,224) (727,740)

Administrative expenses (102,018) (72,548) (332,991)

Other operating income/(expenses), net 7,483 4,027 43,473

Operating income (loss) (203,826) (180,074) (373,055)

Net financial income/(expenses) (43,498) (27,944) (83,962)

Income (loss) before income tax (247,324) (208,019) (457,017)

Income tax 1,164 20,494 (9,168)

Net income (loss) for the period (246,160) (187,525) (466,185)

Attributable to:

Equity holders of the Parent Company (246,160) (187,525) (466,185)

(246,160) (187,525) (466,185)

Loss per share before and after dilution (SEK) 8 (4.59) (3.49) (8.69)

FINANCIAL STATEMENTS |

| Calliditas Therapeutics | Interim Report 2024: January – March 20

Condensed Consolidated Statements of Comprehensive Income

Three Months Ended March 31, Year Ended December 31,

(SEK in thousands) 2024 2023 2023

Net income (loss) for the period (246,160) (187,525) (466,185)

Other comprehensive income

Other comprehensive income (loss) that may be reclassified to income or loss in

subsequent periods:

Exchange differences on translation of foreign operations 16,351 1,159 (14,538)

Other comprehensive income (loss) that may be reclassified to income or

loss in subsequent periods

16,351 1,159 (14,538)

Other comprehensive income (loss) that will not be reclassified to income or loss

in subsequent periods:

Remeasurement gain (loss) on defined benefit plans 12 (662) (3,071)

Other comprehensive income (loss) that will not be reclassified to income

or loss in subsequent periods

12 (662) (3,071)

Other comprehensive income (loss) for the period 16,363 497 (17,609)

Total comprehensive income (loss) for the period (229,797) (187,028) (483,794)

Attributable to:

Equity holders of the Parent Company (229,797) (187,028) (483,794)

(229,797) (187,028) (483,794)

FINANCIAL STATEMENTS |

| Calliditas Therapeutics | Interim Report 2024: January – March 21

March 31, December 31,

(SEK in thousands) Notes 2024 2023 2023

ASSETS

Non-current assets

Intangible assets 424,227 439,180 430,754

Goodwill 47,848 45,911 48,584

Equipment 18,397 8,417 16,053

Right-of-use assets 46,988 34,142 38,186

Non-current financial assets 25,097 13,390 24,201

Deferred tax assets 26,835 27,970 26,315

Total non-current assets 589,392 569,010 584,093

Current assets

Inventories 29,303 12,160 20,428

Current receivables 182,824 109,551 196,666

Prepaid expenses and accrued income 76,459 84,396 84,324

Cash 810,317 1,013,600 973,733

Total current assets 1,098,903 1,219,706 1,275,152

TOTAL ASSETS 1,688,295 1,788,716 1,859,245

EQUITY AND LIABILITIES

Equity

Equity attributable to equity holders of the Parent Company 120,151 589,403 334,806

Total equity 7,8,9 120,151 589,403 334,806

Non-current liabilities

Provisions 9 30,463 24,471 36,116

Contingent consideration 6 60,458 78,816 56,561

Deferred tax liabilities 35,152 33,728 41,641

Non-current interest-bearing liabilities 986,390 723,995 939,508

Lease liabilities 30,228 22,903 27,088

Other non-current liabilities 17,282 5,320 16,381

Total non-current liabilities 1,159,973 889,233 1,117,295

Current liabilities

Accounts payable 101,384 108,000 100,564

Other current liabilities 33,383 33,158 25,953

Accrued expenses and deferred revenue 273,404 168,922 280,627

Total current liabilities 408,171 310,080 407,144

TOTAL EQUITY AND LIABILITIES 1,688,295 1,788,716 1,859,245

Condensed Consolidated Statements of Financial Position

FINANCIAL STATEMENTS |

| Calliditas Therapeutics | Interim Report 2024: January – March 22

Condensed Consolidated Statements of Changes in Equity

Three Months Ended March 31, Year Ended December 31,

(SEK in thousands) 2024 2023 2023

Opening balance equity attributable to equity holders of the Parent

Company

334,806 766,264 766,264

Loss for the period (246,160) (187,525) (466,185)

Other comprehensive income/(loss) 16,363 497 (17,609)

Total comprehensive income/(loss) for the period attributable to equity

holders of the Parent Company

(229,797) (187,028) (483,794)

Transactions with owners:

Share-based payments 15,142 10,167 52,337

Total transactions with owners 15,142 10,167 52,337

Closing balance equity attributable to equity holders of the Parent

Company

120,151 589,403 334,806

Closing balance equity 120,151 589,403 334,806

FINANCIAL STATEMENTS |

| Calliditas Therapeutics | Interim Report 2024: January – March 23

Three Months Ended March 31, Year Ended December 31,

(SEK in thousands) 2024 2023 2023

Operating activities

Operating loss (203,826) (180,074) (373,055)

Adjustment for non-cash items 16,259 27,141 102,478

Interest received 2,516 7 32,905

Interest paid (26,534) (15,460) (94,497)

Income taxes paid (244) (1,336) (22,747)

Cash flow from (used in) operating activities before changes in working

capital

(211,829) (169,722) (354,915)

Cash flow from (used in) changes in working capital 13,624 (62,218) (79,740)

Cash flow from (used in) operating activities (198,205) (231,940) (434,655)

Cash flow from (used in) investing activities (3,858) (2,913) (13,745)

New borrowings - - 962,889

Costs attributable to new loans - - (26,625)

Repayment of borrowing - - (724,479)

Repayment of lease liabilities (5,467) (2,969) (12,134)

Cash flow from (used in) financing activities (5,467) (2,969) 199,650

Net increase (decrease) in cash (207,530) (237,822) (248,750)

Cash at the beginning of the period 973,733 1,249,094 1,249,094

Net foreign exchange gains (loss) in cash 44,114 2,327 (26,611)

Cash at the end of the period 810,317 1,013,600 973,733

Condensed Consolidated Statements of Cash Flows

FINANCIAL STATEMENTS |

| Calliditas Therapeutics | Interim Report 2024: January – March 24

Condensed Parent Company Statements of Income

Three Months Ended March 31, Year Ended December 31,

(SEK in thousands) 2024 2023 2023

Net sales 138,199 168,370 805,551

Cost of sales (13,976) (9,013) (60,399)

Gross income (loss) 124,223 159,358 745,151

Research and development expenses (137,644) (118,789) (456,970)

Marketing and selling expenses (109,670) (88,671) (402,436)

Administrative expenses (84,160) (59,185) (273,359)

Other operating income/(expenses), net 33,286 60,653 219,818

Operating loss (173,965) (46,635) (167,796)

Net financial income/(expenses) 10,403 (18,333) (105,722)