UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: May 28, 2024

(Commission File No. 001-39308)

CALLIDITAS THERAPEUTICS AB

(Translation of registrant’s name into

English)

Kungsbron 1, D5

SE-111 22

Stockholm, Sweden

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

Proposal by Asahi Kasei Corporation

On

May 28, 2024, Calliditas Therapeutics AB (publ), a public limited company organized under the laws of Sweden (“Calliditas,”

or the “Company”), issued a press release announcing an offer from Asahi Kasei Corporation (“Asahi Kasei”)

to acquire all the Company’s common shares, quota value of SEK 0.04 per share (the “Shares”) for SEK 208 in

cash per Share (the “Offer”). The Offer also includes a concurrent offer by Asahi Kasei to acquire all outstanding

American Depositary Shares of Calliditas, each representing two Shares (the “ADSs”) for SEK 416 in cash per ADS, which

will be conducted pursuant to the securities rules of the United States. The total value of the Offer corresponds to approximately

SEK 11.164 billion. The Board of Directors of Calliditas unanimously recommends that shareholders and holders of the ADSs accept

the public tender offer by Asahi Kasei.

Pursuant to the Offer, Asahi Kasei is expected

to commence a tender offer on or around July 18, 2024 to acquire all of the outstanding Shares and ADSs of Calliditas.

Consideration for the ADSs will be paid in cash

in U.S. dollars in an amount to be determined based on the SEK/USD exchange rate on the business day before the date on which Asahi Kasei

makes the Offer consideration available to the settlement agent for settlement of the ADSs tendered pursuant to the Offer.

Press Release

Furnished herewith as Exhibit 99.1 is a

copy of the press release of the Company, dated May 28, 2024, announcing the anticipated Offer.

The information contained in this Report on Form 6-K,

including Exhibit 99.1, is hereby incorporated by reference into the Company’s Registration Statements on Form F-3 (File No. 333-265881) and Form S-8 (File Nos. 333-272594 and 333-240126).

EXHIBIT INDEX

Additional Information

and Where to Find It

The

Offer for the outstanding registered common shares and ADSs of the Company has not yet been commenced. This Report on

Form 6-K is for informational purposes only and does not constitute a recommendation, an offer to purchase or a

solicitation of an offer to sell the Company’s securities. At the time the Offer is commenced, Asahi Kasei will file a Tender

Offer Statement on Schedule TO (including an Offer to Purchase) with the Securities and Exchange Commission (the “SEC”)

and thereafter, the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC, in each

case, with respect to the Offer. The solicitation and the offer by Asahi Kasei to purchase the common shares and ADSs of the Company

will only be made pursuant to such Offer to Purchase and related materials. Once filed, investors and security holders are urged to

read these materials (including the Offer to Purchase, a related Letter of Transmittal and certain other Offer documents, as each

may be amended or supplemented from time to time) carefully since they will contain important information that the Company’s

investors and security holders should consider before making any decision regarding tendering their common shares and ADSs,

including the terms and conditions of the Offer. The Tender Offer Statement, Offer to Purchase, Solicitation/Recommendation

Statement and related materials will be filed with the SEC, and the Company’s investors and security holders may obtain a free

copy of these materials (when available) and other documents filed by Asahi Kasei and the Company with the SEC at the website

maintained by the SEC at www.sec.gov. In addition, the Tender Offer Statement and other documents that Asahi Kasei and

the Company file with the SEC will be made available to all investors and security holders of the Company free of charge at Asahi

Kasei's website at www.asahi-kasei.com/announcement/01.html or by contacting Asahi Kasei, through Georgeson, at

asahi-kasei@georgeson.com. Investors may also obtain, at no charge, the documents filed with or furnished to the SEC by the Company

from the Company’s website at https://www.calliditas.se/en/investors/ or by contacting the Company’s investor

relations department at ir@calliditas.com.

No Offer or Solicitation

This report is not intended

to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe

for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer

of securities in any jurisdiction in contravention of applicable law.

Forward-Looking Statements

This

communication contains forward-looking statements concerning the Company, Asahi Kasei and the Offer that involve a number of risks and

uncertainties. Words such as “believes,” “anticipates,” “plans,” “expects,” “seeks,”

“estimates,” and similar expressions are intended to identify forward-looking statements, but other statements that are not

historical facts may also be deemed to be forward-looking statements. In this communication, the Company’s forward-looking statements

include statements about the parties’ ability to satisfy the conditions to the consummation of the Offer; statements about the

expected timetable for the consummation of the Offer; the Company’s plans, objectives, expectations and intentions; and the financial

condition, results of operations and business of the Company and Asahi Kasei. The forward-looking statements contained in this communication

represent the judgment of the Company as of the date of this communication and involve known and unknown risks and uncertainties, which

might cause the actual results, financial condition and liquidity, performance or achievements of the Company, or industry results, to

be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed

or implied by such forward-looking statements. In addition, even if the Company’s results, performance, financial condition and

liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not

be predictive of results or developments in future periods. Important factors that could cause actual results to differ materially from

those indicated by forward-looking statements include risks and uncertainties relating to: the inherent uncertainties associated with

competitive developments, clinical trial and product development activities and regulatory approval requirements; expectations for the

Company’s commercial product and product pipeline, including addressable market size and growth, market adoption and revenue expectations;

the Company’s reliance on collaborations with third parties; estimating the commercial potential of the Company’s development

programs; the need to develop new products and adapt to significant technological change; implementation of strategies for improving

growth; general economic conditions and related uncertainties; dependence on customers’ capital spending policies and government

funding policies; the effect of economic and political conditions and exchange rate fluctuations on international operations; use and

protection of intellectual property; the effect of changes in governmental regulations; any natural disaster, public health crisis or

other catastrophic event; the effect of laws and regulations governing government contracts, as well as the possibility that expected

benefits related to recent or pending acquisitions, including the Offer, may not materialize as expected; the possibility that the Offer

may not be completed, or if it is completed, that it will close in a timely manner, uncertainty surrounding how many of our shareholders

and ADS holders will participate in the Offer; the possibility of regulatory approvals required for the Offer not being timely obtained,

if obtained at all, or being obtained subject to conditions; the possibility that any or all of the various conditions to the consummation

of the Offer may not be satisfied or waived; the possibility that no compulsory redemption of the non-tendered Shares and ADSs may occur,

in which case the non-tendering holders would own securities of a subsidiary of Asahi Kasei; the possibility that competing offers will

be made; prior to the completion of the Offer, the Company’s business experiencing disruptions due to Offer-related uncertainty

or other factors making it more difficult to maintain relationships with employees, customers, licensees, other business partners or

governmental entities; difficulty retaining key employees; the outcome of any legal proceedings related to the Offer; and the parties

being unable to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the

expected time-frames or at all. Additional important factors that could cause actual results to differ materially from those indicated

by such forward-looking statements are set forth in the Company’s Annual Report on Form 20-F and subsequent interim reports

on Form 6-K, which are on file with the SEC and available in the “Investors” section of the Company’s website,

https://www.calliditas.se/en/investors/, under the heading “SEC Filings”, and in any subsequent documents Calliditas

files or furnishes with the SEC. While Calliditas may elect to update forward-looking statements at some point in the future, the Company

specifically disclaims any obligation to do so, even if estimates change and, therefore, you should not rely on these forward-looking

statements as representing the Company’s views as of any date subsequent to today.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CALLIDITAS

THERAPEUTICS AB |

| |

|

|

| Date:

May 28, 2024 |

By: |

/s/

Fredrik Johansson |

| |

|

Fredrik Johansson

Chief Financial Officer |

Exhibit 99.1

| Stockholm,

Sweden |

May

28, 2024 |

Statement

by the Board of Directors of Calliditas Therapeutics AB (publ) in relation to the public offer by Asahi Kasei Corporation

The Board of Directors of Calliditas Therapeutics

AB (publ) unanimously recommends that the shareholders and holders of American Depositary Shares (“ADS”) of Calliditas

Therapeutics AB (publ) (jointly the “Securityholders”) accept the public tender offer by Asahi Kasei Corporation.

Background

This statement is made by the Board of Directors (the “Board”) of Calliditas Therapeutics AB (publ) (“Calliditas”

or the “Company”) pursuant to section II.19 of the Nasdaq Stockholm takeover rules (“Section II.19”)

and Regulation 14D under the Securities Exchange Act of 1934, as amended (together with Section II.19, the “Takeover Rules”).

Asahi Kasei Corporation (“Asahi Kasei”

or the “Offeror”), today announced a public cash offer to acquire all shares in Calliditas (the “Shares”)

for SEK 208 in cash per Share (the “Offer”). The Offer will also include a concurrent offer by the Offeror to acquire

all American Depositary Shares, each representing two Shares in Calliditas, for SEK 416 in cash per ADS, which will be conducted pursuant

to the securities rules of the United States. The total value of the Offer corresponds to SEK 11,164 million.1

The Offer

represents a premium of:

| |

· |

83 per cent compared to the closing price of the Shares on Nasdaq Stockholm on May 27, 2024 of SEK 113.6, the last trading day prior to the announcement of the Offer; |

| |

· |

83 per cent compared to the volume weighted average price of the Shares on Nasdaq Stockholm during the 30 latest trading days up to and including May 27, 2024 of SEK 113.4; and |

| |

· |

74 per cent compared to the closing price of the ADS on Nasdaq Global Select Market on May 24, 2024 of USD 22.42, and 91 per cent compared to the volume weighted average price of the ADS on Nasdaq Global Select Market during the 30 latest trading days up to and including May 24, 2024 of USD 20.42.2 |

The acceptance period of the Offer is expected

to commence on or around July 18, 2024 and expire on or around August 30, 2024, subject to any extensions.

1

Based on 53,672,069 Shares, being all 59,580,087 issued shares less the 5,908,018 shares held in treasury by Calliditas at the time of

the announcement of the Offer. This also includes shares represented by ADS at the time of the announcement of the Offer.

2

Based on the USD/SEK exchange rate published by Sveriges Riksbank on May 27, 2024 of 10.64281.

Completion

of the Offer is conditional upon customary conditions including, amongst other things, Asahi Kasei becoming the owner of more than 90

per cent of the Shares in Calliditas (on a fully diluted basis) and receipt of all necessary regulatory, governmental or similar clearances,

approvals and decisions, including from competition authorities and agencies screening foreign direct investments, in each case on terms

that, in the Offeror’s opinion, are acceptable. Asahi Kasei has reserved the right to waive, in whole or in part, these and other

conditions for completion of the Offer. Asahi Kasei has also reserved the right to shorten the acceptance period and set an earlier settlement

date as well as to extend the acceptance period and to postpone the settlement date, as may be permissible under applicable laws and

regulations. Please refer to the Offeror’s press release regarding the Offer for further information.

At the written request of the Offeror, the Board

has permitted the Offeror to carry out a due diligence review of Calliditas in relation to the preparation of the Offer. In connection

with such review, Asahi Kasei has received certain information concerning the Company’s financial performance for the period up

to and ended March 31, 2024 as well as a trading update for the period until May 23, 2024. This information was subsequently included

in the Company’s quarterly report for the first quarter of 2024, which was released on May 23, 2024. Except as set out above, Asahi

Kasei has not received any inside information in connection with its due diligence review.

BVF

Partners, Linc AB (publ) and Stiftelsen Industrifonden, the three largest Securityholders of Calliditas together with other large Securityholders,

whose combined interest in the Company represents approximately 44.65 per cent3 of the total number of shares,

have entered into undertakings with the Offeror to accept the Offer, subject to certain conditions (the “Irrevocable Undertakings”).

Please refer to the Offeror’s press release regarding the Offer for more information about the Irrevocable Undertakings.

Lazard AB

(“Lazard”) is acting as financial advisor to Calliditas and Advokatfirman Vinge KB (Swedish counsel) and DLA Piper

LLP (US) (international counsel) are legal advisors to Calliditas in connection with the Offer.

Lazard has, in its capacity as financial advisor,

provided an opinion to the Board in connection with the Offer that, as of May 27, 2024, based upon and subject to the factors, limitations

and assumptions set forth therein, the consideration in SEK to be paid in connection with the Offer to the Securityholders of Calliditas

is fair from a financial point of view to the Securityholders of Calliditas, which was prepared in reliance on certain information as

provided in the opinion. The full text of the written opinion, which sets forth assumptions made, procedures followed, matters considered

and limitations on the review undertaken in connection with the opinion, is attached to this statement. Lazard provided its view on fairness,

from a financial point of view, and advice solely for the information and assistance of the Board in connection with its consideration

of the Offer and not to the Securityholders of Calliditas. Lazard’s opinion is not a recommendation as to whether any Securityholder

of Calliditas should tender their shares or ADS in connection with the Offer or any other matter related thereto. Lazard’s total

fee as financial advisor is contingent on the size of the Offer consideration and whether the Offer is completed. Lazard will receive

a fixed fee for providing this opinion, which is payable upon delivery of this opinion and creditable against Lazard’s total fee.

3 The ownership percentage set

out is calculated based on 53,672,069 shares in Calliditas, being all 59,580,087 issued shares less the 5,908,018 shares held in

treasury by Calliditas at the time of the announcement of the Offer. This also includes the shares that are represented by ADS at

the time of the announcement of the Offer.

The Board’s

recommendation

The Board’s

evaluation of the Offer must be made in respect of the Company’s present market position and the future opportunities available,

as well as the risks and uncertainties associated with the Company’s future developments and strategy. In that respect, the Board

has taken a number of factors into account which it has deemed relevant to the evaluation of the Offer. In addition to the aforementioned

factors, these include, but are not limited to, the Company’s present strategic and market position and its potential future development

and the thereto related opportunities and risks. The Board has considered valuation methods normally used to evaluate public

offers for listed companies, including how the Offer values Calliditas in relation to comparable listed companies and comparable transactions,

bid premiums in previous public takeover offers, the stock market’s expectations regarding the Company’s prospects and the

Board’s view of the Company’s value based on its expected future cash flows.

In the Board’s

opinion, the combination of the Offeror and Calliditas will leverage and complement the Offeror’s product offerings as well

as its ability and expertise in rare disease drug development and commercialization. With Asahi Kasei as its new strategic owner, the

Company aims to realize the benefits of being part of a larger platform and the potential opportunity to accelerate the Company’s

revenue growth trajectory as well as pipeline development.

The proposed transaction highlights the shared

commitment of the Offeror and Calliditas in addressing the significant unmet medical need in IgA nephropathy with the continued focused

development of this first to market product in IgAN.

The Board notes that the Offer implies a premium

of approximately 83 per cent compared to the closing price of SEK 113.6 for the Calliditas Shares on Nasdaq Stockholm on May 27, 2024

and a premium of approximately 83 per cent compared to the volume weighted average price for the Calliditas Shares on Nasdaq Stockholm

during the last 30 trading days prior to announcement of the Offer. Likewise, the Offer implies a premium of approximately 74 per cent

compared to the closing price of USD 22.42 for the Calliditas ADS on the Nasdaq Global Select Market on May 24, 2024 and a premium of

approximately 91 per cent compared to the volume weighted average price for the Calliditas ADS on the Nasdaq Global Select Market during

the last 30 trading days prior to announcement of the Offer.

In

its evaluation of the Offer, the Board has also taken into account the Irrevocable Undertakings from the Company’s three largest

Securityholders together with other large Securityholders, whose interest together represents approximately 44.65 per cent4

of the total number of shares in Calliditas.

The Board

has, as part of its process to evaluate the Offer and in line with its fiduciary duties, investigated other opportunities in light of

the approach by the Offeror. The Board has been in contact with other potential bidders in order to evaluate a superior offer.

The Board

also notes that the Offer is not subject to any financing condition and the Offer is financed by Asahi Kasei’s cash on hand.

Having concluded

this assessment, the Board believes that the terms of the Offer reflect the Company’s present position and growth prospects, including

the risks and uncertainties associated with those prospects.

4 The ownership

percentage set out is calculated based on 53,672,069 shares, being all 59,580,087 issued shares less the 5,908,018 shares held in treasury

by Calliditas at the time of the announcement of the Offer. This also includes the shares that are represented by ADS at the time of

the announcement of the Offer.

On

this basis, the Board unanimously recommends that the Securityholders of Calliditas accept the Offer.

Under the

Takeover Rules, the Board is required, on the basis of the Offeror’s statements in the announcement of the Offer, to make public

its opinion of the effects the implementation of the Offer may have on Calliditas, specifically employment, and its views on the Offeror’s

strategic plans for the Company and the effect these may be expected to have on employment and the places where Calliditas conducts its

business. The Offeror has in this respect communicated:

“Asahi Kasei recognizes the exceptional

capabilities and skills of Calliditas’ dedicated management and employees and looks forward to welcoming these individuals to Asahi

Kasei. Further, Calliditas has infrastructure in a number of markets where Asahi Kasei currently has limited resources, including Sweden.

Asahi Kasei has not made any decisions involving any changes to Calliditas’ business, the locations where Calliditas conducts its

business or Calliditas’ management and employees, including their terms of employment. However, to realize efficiencies, the integration

of Asahi Kasei and Calliditas will likely entail some changes to the organization, operations and employees of the combined group. In

the period following the completion of the Offer and following careful review of the needs of the combined business, Asahi Kasei will

determine the optimal structure of the combined company to continue to deliver success in the future.”

The Board

has no reason to question these statements regarding employment, the Offeror’s strategic plans for Calliditas or the impact these

could be expected to have on employment and on the Company’s business locations.

This statement

shall in all respects be governed by and construed in accordance with Swedish law. Any dispute arising out of or in connection with this

statement shall be settled exclusively by Swedish courts.

Stockholm on May 28, 2024

Calliditas

Therapeutics AB (publ)

The Board

of Directors

Cautionary

Note Regarding Forward-Looking Statements

This communication contains forward-looking statements

concerning the Company, Asahi Kasei and the Offer that involve a number of risks and uncertainties. Words such as “believes,”

“anticipates,” “plans,” “expects,” “seeks,” “estimates,” and similar expressions

are intended to identify forward-looking statements, but other statements that are not historical facts may also be deemed to be forward-looking

statements. In this communication, the Company’s forward-looking statements include statements about the parties’ ability

to satisfy the conditions to the consummation of the Offer; statements about the expected timetable for the consummation of the Offer;

the Company’s plans, objectives, expectations and intentions; and the financial condition, results of operations and business of

the Company and Asahi Kasei. The forward-looking statements contained in this communication represent the judgment of the Company as

of the date of this communication and involve known and unknown risks and uncertainties, which might cause the actual results, financial

condition and liquidity, performance or achievements of the Company, or industry results, to be materially different from any historic

or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements.

In addition, even if the Company’s results, performance, financial condition and liquidity, and the development of the industry

in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future

periods. Important factors that could cause actual results to differ materially from those indicated by forward-looking statements include

risks and uncertainties relating to: the inherent uncertainties associated with competitive developments, clinical trial and product

development activities and regulatory approval requirements; expectations for the Company’s product pipeline, including addressable

market size and growth; the Company’s reliance on collaborations with third parties; estimating the commercial potential of the

Company’s development programs; the need to develop new products and adapt to significant technological change; implementation

of strategies for improving growth; general economic conditions and related uncertainties; dependence on customers’ capital spending

policies and government funding policies; the effect of economic and political conditions and exchange rate fluctuations on international

operations; use and protection of intellectual property; the effect of changes in governmental regulations; any natural disaster, public

health crisis or other catastrophic event; and the effect of laws and regulations governing government contracts, as well as the possibility

that expected benefits related to recent or pending acquisitions, including the proposed acquisition, may not materialize as expected;

the proposed acquisition not being timely completed, if completed at all; regulatory approvals required for the transaction not being

timely obtained, if obtained at all, or being obtained subject to conditions; the number of the Company’s stockholders that will

tender their stock in the Offer; the possibility that competing offers will be made; the possibility that various conditions for the

Offer may not be satisfied or waived; prior to the completion of the transaction, the Company’s business experiencing disruptions

due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers,

licensees, other business partners or governmental entities; difficulty retaining key employees; the outcome of any legal proceedings

related to the proposed acquisition; and the parties being unable to successfully implement integration strategies or to achieve expected

synergies and operating efficiencies within the expected time-frames or at all. Additional important factors that could cause actual

results to differ materially from those indicated by such forward-looking statements are set forth in the Company’s Annual Report

on Form 20-F and subsequent interim reports on Form 6-K, which are on file with the SEC and available in the “Investors”

section of the Company’s website, https://www.calliditas.se/en/investors/, under the heading “SEC Filings”, and in

any subsequent documents that Calliditas files or furnishes with the SEC. The Company specifically disclaims any obligation to update

forward-looking statements, even if estimates change and, therefore, you should not rely on these forward-looking statements as representing

the Company’s views as of any date subsequent to today.

Additional

Information and Where to Find it

The tender

offer referenced herein has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase

nor a solicitation of an offer to sell any Shares, ADS or any other securities of Calliditas, nor is it a substitute for the tender

offer materials that Asahi Kasei will file with the SEC. The terms and conditions of the tender offer will be published in, and the offer

to purchase Securities of Calliditas will be made only pursuant to, the offer document and related offer materials prepared by Asahi

Kasei and filed with the SEC in a tender offer statement on Schedule TO at the time the tender offer is commenced. Calliditas intends

to file a solicitation/recommendation statement on Schedule 14D-9 with the SEC with respect to the tender offer.

THE TENDER

OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION

STATEMENT ON SCHEDULE 14D-9, AS THEY MAY BE AMENDED FROM TIME TO TIME, WILL CONTAIN IMPORTANT INFORMATION. INVESTORS AND SECURITYHOLDERS

OF CALLIDITAS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY, AND NOT THIS DOCUMENT, WILL GOVERN

THE TERMS AND CONDITIONS OF THE TENDER OFFER, AND BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SUCH PERSONS SHOULD CONSIDER BEFORE

MAKING ANY DECISION REGARDING TENDERING THEIR SHARES AND AMERICAN DEPOSITARY SHARES.

The tender offer materials, including the offer

to purchase and the related letter of transmittal and certain other tender offer documents, and the solicitation/recommendation statement

(when they become available) and other documents filed with the SEC by Asahi Kasei or Calliditas, may be obtained free of charge at the

SEC’s website at www.sec.gov or the Company’s website at https://www.calliditas.se/en/investors/ or at Asahi Kasei’s

website at www.asahi-kasei.com/announcement/01.html or by contacting Asahi Kasei, through Georgeson, at asahi-kasei@georgeson.com. In

addition, Asahi Kasei’s tender offer statement and other documents it will file with the SEC will be available at www.sec.gov. For

further information, please contact:

Elmar Schnee,

Chairman of the Board of Directors at Calliditas

Åsa Hillsten, Head of IR & Sustainability,

Calliditas

Phone: +46 76 403 35 43

Email: asa.hillsten@calliditas.com

This information is information that Calliditas Therapeutics AB

(publ) is obliged to make public pursuant to the EU Market Abuse Regulation and the Takeover Rules. The information was submitted for

publication, through the agency of the contact person set out above, on May 28, 2024, at 08:30 CEST.

About

Calliditas

Calliditas is a

biopharma company headquartered in Stockholm, Sweden, focused on identifying, developing, and commercializing novel treatments in orphan

indications with significant unmet medical needs. The Company’s Shares are listed on Nasdaq Stockholm (CALTX) and its American

Depositary Shares are listed on the Nasdaq Global Select Market (Nasdaq: CALT). Visit https://www.calliditas.se/en/ for further information.

Privileged & Confidential

May 27, 2024

The Board of Directors

Calliditas Therapeutics AB

Kungsbron 1, D5

SE-111 22

Stockholm, Sweden

Dear Members of the Board:

We

understand that Asahi Kasei Corporation, a Japanese corporation ( “Asahi Kasei”), proposes a public cash offer (the “Offer”)

to acquire all of the ordinary shares (“Calliditas Common Shares”), of Calliditas Therapeutics AB (publ), a Swedish corporation

(“ Calliditas”) and all of the American depositary shares, each of which represents two Calliditas Common Shares (the “ADS”,

and together with the Calliditas Common Shares, the “Securities”) pursuant to which Asahi Kasei will pay SEK 208 in cash

per Calliditas Common Share and SEK 416 in cash per ADS (the “Consideration”) to the holders thereof.

You

have requested our opinion as of the date hereof as to the fairness, from a financial point of view, to holders of the Securities of

the Consideration to be paid to such holders in the Offer.

In

connection with this opinion, we have, among other things, reviewed a draft of the press release describing the Offer (including the

terms and conditions of the Offer set out therein) (the “Draft Press Release”); reviewed a final draft of the Statement of

the Board of Directors of Calliditas in relation to the Offer to be issued on May 28, 2024; reviewed certain historical business and

financial information relating to Calliditas, forecasts relating to the business and financial prospects of Calliditas based on publicly

available analyst research and additional extrapolations and guidance from management of Calliditas, in each case, as approved for our

use by Calliditas (collectively, the “Forecasts”). We have also held discussions with members of the senior management of

Calliditas with respect to the business and prospects of Calliditas; reviewed public information with respect to certain other companies

in lines of business we believe to be generally relevant in evaluating the business of Calliditas; reviewed the financial terms of certain

business combinations involving companies in lines of business we believe to be generally relevant in evaluating the business of Calliditas;

reviewed historical share prices and trading volumes of the Securities; and conducted such other financial studies, analyses and investigations

as we deemed appropriate.

We

have assumed and relied upon the accuracy and completeness of the foregoing information, without independent verification of such information.

We have not conducted any independent valuation or appraisal of any of the assets or liabilities (contingent or otherwise) of Calliditas

or concerning the solvency or fair value of Calliditas, and we have not been furnished with any such valuation or appraisal. As you know,

we have not received financial forecasts prepared by management and approved by the Board of Directors of Calliditas in connection with

our engagement or this opinion. Senior management of Calliditas has approved the Forecasts and advised us that the Forecasts, including

the assumptions underlying the Forecasts, are a reasonable basis upon which to evaluate the future financial performance of Calliditas.

At your direction, our analysis relating to the business and financial prospects for Calliditas for purposes of this opinion has

been made on the basis of the Forecasts. With respect to the Forecasts, we have assumed, with your consent, that they have been reasonably

prepared on bases reflecting the best currently available estimates and judgments as to the future financial performance of Calliditas.

We assume no responsibility for and express no view as to any such forecasts or the assumptions on which they are based.

The Board of Directors

Calliditas Therapeutics AB

May 27, 2024

Page 2

Further,

our opinion is necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available

to us as of, the date hereof. We further note that volatility in the credit, commodities and financial markets, may have an effect on

Calliditas or the Offer and we are not expressing an opinion as to the effects of such volatility on Calliditas or the Offer. We assume

no responsibility for updating or revising our opinion based on circumstances or events occurring after the date hereof. We do not express

any opinion as to the price at which the Securities may trade at any time subsequent to the announcement of the Offer. In addition, our

opinion does not address the relative merits of the Offer as compared to any other transaction or business strategy in which Calliditas

might engage or the merits of the underlying decision by Calliditas to engage in the Offer.

In

rendering our opinion, we have assumed, with the consent of Calliditas, that the Offer will be consummated on the terms described in

the Draft Press Release, in compliance with all applicable laws, documents and other requirements and without any waiver or modification

of any material terms or conditions. We also have assumed, with the consent of Calliditas, that obtaining the necessary governmental,

regulatory or third party approvals and consents for the Offer will not have an adverse effect on Calliditas or the Offer and no delay,

limitation, restriction or condition, nor divestiture requirements, amendments or modifications, will be imposed or occur that would

have an effect in any way meaningful to our analyses or this opinion. Representatives of Calliditas have advised us, and we have assumed,

that the final terms and conditions of the Offer will not vary materially from those set forth in the Draft Press Release. We do not

express any opinion as to any tax or other consequences that might result from the Offer, nor does our opinion address any legal, tax,

regulatory or accounting matters, as to which we understand that Calliditas obtained such advice as it deemed necessary from qualified

professionals. We do not address any terms (other than, from a financial point of view and as of the date hereof, the Consideration proposed

to be paid to those holders of the Securities that tender their Securities pursuant to the Offer) or other aspects or implications of

the Offer, including, without limitation, the form or structure of the Offer, the form of the Consideration or any terms, aspects or

implications of any holders’ agreement, arrangement or understanding to be entered into in connection with or contemplated by the

Offer or otherwise. In addition, we express no view or opinion as to the fairness of the amount or nature of, or any other aspects relating

to, the compensation to any officers, directors or employees of Asahi Kasei, Calliditas or their affiliates, or class of such persons,

relative to the Consideration or otherwise.

Lazard

AB (“Lazard”) is acting as financial advisor to Calliditas in connection with the Offer. Lazard’s total fee as financial

advisor is contingent on the size of the Offer consideration and whether the Offer is completed. Lazard will receive a fixed fee for

providing this opinion, which is payable upon delivery of this opinion and creditable against Lazard’s total fee. We in the past

have provided, currently are providing and in the future may provide certain investment banking services to Calliditas, for which we

have received and may receive compensation, including, having advised on Calliditas’ term loan facility agreement in 2021. In addition,

in the ordinary course, Lazard and its affiliates and employees may trade securities of Calliditas, Asahi Kasei and certain of their

respective affiliates for their own accounts and for the accounts of their customers, may at any time hold a long or short position in

such securities, and may also trade and hold securities on behalf of Calliditas, Asahi Kasei and certain of their respective affiliates.

The issuance of this opinion was approved by the Opinion Committee of Lazard.

The Board of Directors

Calliditas Therapeutics AB

May 27, 2024

Page 3

Our

engagement and the opinion expressed herein are for the benefit of the Board of Directors of Calliditas (in its capacity as such) and

our opinion is rendered to the Board of Directors of Calliditas in connection with its evaluation of the Offer. Our opinion is not intended

to and does not constitute a recommendation to any holder of the Securities as to how such holder should act with respect to the Offer

or any matter relating thereto.

Based

on and subject to the foregoing, we are of the opinion that, as of the date hereof, the Consideration to be paid to holders of the Securities

in the Offer is fair, from a financial point of view, to such holders of the Securities.

| |

Very truly yours, |

| |

|

| |

LAZARD AB |

| |

|

| |

By |

/s/ Victor Kastensson |

| |

|

Victor Kastensson |

| |

|

Managing Director |

| |

|

Head of Lazard Nordics |

| |

|

| |

By |

/s/ Dale Raine |

| |

|

Dale Raine |

| |

|

Managing Director |

| |

|

Global Co-Head Biopharma |

| |

|

Co-Head European |

| |

|

Healthcare |

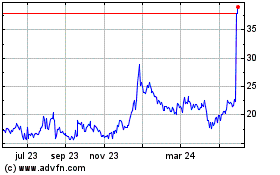

Calliditas Therapeutics AB (NASDAQ:CALT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

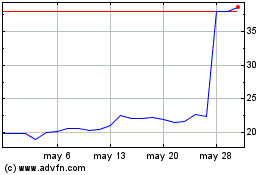

Calliditas Therapeutics AB (NASDAQ:CALT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025