false

0001485003

0001485003

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2024

Carisma Therapeutics Inc.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

|

001-36296 |

|

26-2025616 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

3675 Market Street, Suite 401

Philadelphia, PA |

|

|

|

19104 |

| (Address of Principal Executive Offices) |

|

|

|

( Zip Code) |

Registrant’s telephone number, including

area code: (267) 491-6422

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of exchange

on which registered |

| Common Stock, $0.001 par value |

|

CARM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, Carisma Therapeutics Inc. (the “Company”)

announced its financial results for the quarter ended June 30, 2024. The full text of the press release issued in connection with

the announcement is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1 attached

hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by

specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CARISMA THERAPEUTICS INC. |

| |

|

|

| |

By: |

/s/ Steven Kelly |

| Date: August 8, 2024 |

|

Steven Kelly |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

Carisma Therapeutics

Reports Second Quarter 2024 Financial Results and Recent Business Highlights

Initial data for CT-0525,

lead product candidate for anti-HER2 program, expected by year-end 2024

Nomination of a development

candidate for liver fibrosis program expected in the first quarter of 2025

Nominated first in

vivo CAR-M development candidate targeting Glypican-3 to treat hepatocellular carcinoma under the Moderna Collaboration in the second

quarter of 2024

Cash and cash equivalents

of $40.4 million and $2.0 million received in July under the Moderna Collaboration expected to fund the Company into the third quarter

of 2025

PHILADELPHIA,

PA – August 8, 2024 – Carisma Therapeutics Inc. (Nasdaq: CARM) (“Carisma” or the “Company”),

a clinical-stage biopharmaceutical company focused on discovering and developing innovative immunotherapies, today reported financial

results for the quarter ended June 30, 2024, and highlighted recent business updates.

“We've achieved

considerable clinical and research advancements this year, and I'm excited about our strong momentum and clear focus for the next 12 months,”

said Steven Kelly, President and Chief Executive Officer of Carisma. "The CT-0508 program has provided us with invaluable insights.

Looking ahead, we are dedicating our efforts to our lead asset, CT-0525, which is actively enrolling patients with initial data expected

by the end of 2024. We have also made significant progress in our in vivo oncology and fibrosis programs. The nomination of a development

candidate in collaboration with Moderna marks a significant step forward. We believe our robust development pipeline offers multiple potential

value drivers in both the near and long term."

Second Quarter 2024

Highlights and Upcoming Milestones

Ex Vivo Oncology

| · | CT-0525 (Anti-HER2 chimeric antigen receptor

monocyte (CAR-Monocyte)) |

| o | On May 16, 2024, Carisma announced that the first patient was dosed in its Phase 1 clinical trial

evaluating CT-0525, an ex vivo gene-modified autologous CAR-Monocyte cellular therapy, for the treatment of patients with solid

tumors that overexpress human epidermal growth factor receptor 2 (HER2). |

| o | On June 25, 2024, Carisma announced the U.S. Food and Drug Administration granted Fast Track designation

for CT-0525. |

| o | Carisma expects to report initial data from its Phase 1 clinical trial by year-end 2024. |

| · | CT-0508 (Anti-HER2 chimeric antigen receptor

macrophage (CAR-Macrophage)) |

| o | As of July 2024, all clinical activities related to the clinical trial of CT-0508 and its sub-study

utilizing CT-0508 in combination with pembrolizumab, have been completed. |

| o | On July 9, 2024, the Company announced a new analysis of circulating tumor DNA (ctDNA) from 13 patients

enrolled in Groups 1 and 2 of the Phase 1 clinical trial of CT-0508. Although preliminary and limited, the data showed that 75% (n=6/8)

of evaluable HER2 3+ patients experienced a decrease in ctDNA, indicating anti-tumor activity. |

| o | On August 8, 2024, Carisma updated the results of the open label Phase 1 sub-study evaluating the

co-administration of CT-0508 and pembrolizumab, a programmed cell death protein 1 checkpoint inhibitor to include data from Regimen Level

2 (RL2) data (n=3 patients). The study met its primary endpoints of safety, tolerability and manufacturing feasibility of CT-0508. The

pembrolizumab sub-study data from Regimen Level 1 and RL2 (n=6 patients) demonstrate that the combination therapy was generally well-tolerated

with no dose-limiting toxicities. The best overall response was stable disease (n=1/6 patients), with corticosteroid administration and

/ or loss of human leukocyte antigens (HLA) expression being key limitations to potential efficacy in three of the patients who experienced

progressive disease. The correlative data concerning immune activation suggest a synergistic potential for the combination of CT-0508

with pembrolizumab based on increased peripheral blood T cell clonality, T cell activation, and frequency of effector memory CD8 T cells

compared to CT-0508 alone. Supported by these safety and translational findings, as well as other results from the clinical trial of CT-0508,

Carisma intends to explore the strategy of combining CAR-Monocyte with pembrolizumab or another checkpoint inhibitor in the CT-0525 program. |

In Vivo Oncology

| · | GPC3+ solid tumors (CAR-M + mRNA/LNP; Moderna

Collaboration) |

| o | On June 27, 2024, Carisma announced the nomination of the first development candidate under its collaboration

with ModernaTX Inc. (“Moderna”). The development candidate is an in vivo chimeric antigen receptor macrophage and monocyte,

or CAR-M, targeting Glypican-3 and is designed to treat solid tumors, including hepatocellular carcinoma, the most prevalent type of liver

cancer and the fastest-rising cause of cancer-related death in the United States. On July 3, 2024, the Company received the associated

$2.0 million milestone payment from Moderna. |

| o | The Company expects to present preclinical data from the development candidate at an upcoming medical

meeting. |

Fibrosis and Immunology

| o | On August 6, 2024, Carisma announced that additional preclinical data for liver fibrosis will be

highlighted in a poster presentation at the American Association for the Study of Liver Diseases The Liver Meeting 2024, being held November 15-19,

2024, in San Diego, CA. |

| o | Carisma expects to nominate a development candidate for its liver fibrosis program in the first quarter

of 2025. |

Corporate Updates

| · | On July 1, 2024, Carisma announced the appointment

of David Scadden, M.D., and Marella Thorell to the Company's Board of Directors, effective June 30, 2024. David Scadden,

M.D., is a renowned physician and medical researcher with extensive clinical and medical research experience. Marella Thorell brings

more than 25 years of extensive experience in finance and operations across both public and private biotech companies. The Company concurrently

announced the resignation of Regina Hodits and Björn Odlander from Carisma's Board of Directors, also effective June 30,

2024. |

| · | On August 6, 2024, Carisma announced the

appointment of Scott Friedman, M.D. and Ira Tabas, M.D., Ph.D. to its Scientific Advisory Board. Dr. Friedman and Dr. Tabas

bring extensive expertise and pioneering contributions in liver fibrosis, which will be instrumental as Carisma continues its program

to develop transformative treatments for patients. |

Second Quarter 2024 Financial Results

| · | Cash and cash equivalents as of June 30,

2024, were $40.4 million, compared to $56.5 million as of March 31, 2024. |

| · | Research and development expenses for the three

months ended June 30, 2024 were $15.3 million, compared to $18.5 million for the three months ended June 30, 2023. The decrease

of $3.2 million was primarily due to a $2.9 million decrease in our facilities and other expenses associated with a decrease in sponsored

research agreement fees, a $1.7 million decrease in direct costs associated with CT-0508, a $0.2 million decrease in direct costs associated

with the pre-clinical development related to CT-1119, a $0.1 million decrease in costs associated with a reduction in pass through studies,

partially offset by a $1.2 million increase in direct costs associated with pre-clinical development of CT-0525 and a $0.5 million increase

in personnel costs due to severance costs related to the revised operating plan. |

| · | General and administrative expenses for the

three months ended June 30, 2024 were $5.6 million, compared to $6.0 million for the three months ended June 30, 2023. The

decrease of $0.4 million was attributable to a $1.2 million decrease in professional fees as a result of non-recurring

legal costs associated with the merger with Sesen Bio, Inc. in 2023, and a $0.4 million decrease in insurance costs, partially

offset by a $0.7 million increase in facilities and supplies due to a rise in office expenditures, and a $0.5 million increase in

personnel costs which includes an increase in personnel costs which includes a raise in salaries and heacount, stock-based

compensation, and severance costs related to the revised operating plan. |

| · | Net loss was $11.2 million for the

second quarter of 2024, compared to a $19.9 million net loss for the same period in 2023. |

Outlook

Carisma anticipates that its cash and cash equivalents

of $40.4 million as of June 30, 2024 are sufficient to sustain its planned operations into the third quarter of 2025. The Company’s

cash forecast contains estimates and assumptions, and management cannot predict the timing of all cash receipts and expenditures with

certainty. Variances from management’s estimates and assumptions could impact the Company’s liquidity prior to the third quarter

of 2025.

About CT-0525

CT-0525 is a first-in-class, ex vivo gene-modified

autologous chimeric antigen receptor-monocyte (CAR-Monocyte) cellular therapy intended to treat solid tumors that overexpress human epidermal

growth factor receptor 2 (HER2). It is being studied in a multi-center, open label, Phase 1 clinical trial for patients with advanced/metastatic

HER2-overexpressing solid tumors that have progressed on available therapies. The CAR-Monocyte approach has the potential to address some

of the challenges of treating solid tumors with cell therapies, including tumor infiltration, immunosuppression within the tumor microenvironment,

and antigen heterogeneity. CT-0525 has the potential to enable significant dose escalation, enhance tumor infiltration, increase persistence,

and reduce manufacturing time compared to macrophage therapy.

About Carisma Therapeutics

Carisma Therapeutics

Inc. is a clinical-stage biopharmaceutical company focused on utilizing our proprietary macrophage and monocyte cell engineering platform

to develop transformative immunotherapies to treat cancer and other serious diseases. We have created a comprehensive, differentiated

proprietary cell therapy platform focused on engineered macrophages and monocytes, cells that play a crucial role in both the innate

and adaptive immune response. Carisma is headquartered in Philadelphia, PA. For more information, please visit www.carismatx.com.

Cautionary Note on Forward-Looking Statements

Statements in this press

release about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts,

may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These

statements include, but are not limited to, statements relating to Carisma’s business, strategy, future operations, cash runway,

the advancement of Carisma’s product candidates and product pipeline, and clinical development of Carisma’s product candidates,

including expectations regarding timing of initiation and results of clinical trials. The words “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “goals,”

“intend,” “may,” “might,” “outlook,” “plan,” “project,” “potential,”

“predict,” “target,” “possible,” “will,” “would,” “could,” “should,”

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words.

Any forward-looking

statements are based on management’s current expectations of future events and are subject to a number of risks and uncertainties

that could cause actual results to differ materially and adversely from those set forth in, or implied by, such forward-looking statements.

These risks and uncertainties include, but are not limited to, (i) Carisma’s ability to realize the anticipated benefits of

its pipeline reprioritization and corporate restructuring, (ii) Carisma’s ability to obtain, maintain and protect its

intellectual property rights related to its product candidates; (iii) Carisma’s ability to advance the development of its product

candidates under the timelines it anticipates in planned and future clinical trials and with its current financial and human resources;

(iv) Carisma’s ability to replicate in later clinical trials positive results found in preclinical studies and early-stage

clinical trials of its product candidates; (v) Carisma’s ability to realize the anticipated benefits of its research and development

programs, strategic partnerships, research and licensing programs and academic and other collaborations; (vi) regulatory requirements

or developments and Carisma’s ability to obtain and maintain necessary approvals from the U.S. Food and Drug Administration and

other regulatory authorities related to its product candidates; (vii) changes to clinical trial designs and regulatory pathways;

(viii) risks associated with Carisma’s ability to manage expenses; (ix) changes in capital resource requirements; (x) risks

related to the inability of Carisma to obtain sufficient additional capital to continue to advance its product candidates and its preclinical

programs; and (xi) legislative, regulatory, political and economic developments.

For a discussion of these risks and uncertainties,

and other important factors, any of which could cause Carisma’s actual results to differ from those contained in the forward-looking

statements, see the “Risk Factors” set forth in the Company’s Annual Report on Form 10-K for the year ended December 31,

2023, its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, as well as discussions of potential risks, uncertainties,

and other important factors in Carisma’s other recent filings with the Securities and Exchange Commission. Any forward-looking statements

that are made in this press release speak as of the date of this press release. Carisma undertakes no obligation to revise the forward-looking

statements or to update them to reflect events or circumstances occurring after the date of this press release, whether as a result of

new information, future developments or otherwise, except as required by the federal securities laws.

Investors:

Shveta Dighe

Head of Investor Relations

investors@carismatx.com

Media Contact:

Julia Stern

(763) 350-5223

jstern@realchemistry.com

CARISMA THERAPEUTICS INC.

Unaudited Consolidated Balance Sheets

(in thousands, except share and par value)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 40,362 | | |

$ | 77,605 | |

| Prepaid expenses and other assets | |

| 10,359 | | |

| 2,866 | |

| Total current assets | |

| 50,721 | | |

| 80,471 | |

| Property and equipment, net | |

| 6,531 | | |

| 6,764 | |

| Right of use assets – operating leases | |

| 1,945 | | |

| 2,173 | |

| Deferred financing costs | |

| 142 | | |

| 146 | |

| Total assets | |

$ | 59,339 | | |

$ | 89,554 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,033 | | |

$ | 3,933 | |

| Accrued expenses | |

| 9,241 | | |

| 7,662 | |

| Deferred revenue | |

| 659 | | |

| 1,413 | |

| Operating lease liabilities | |

| 1,179 | | |

| 1,391 | |

| Finance lease liabilities | |

| 1,283 | | |

| 544 | |

| Other current liabilities | |

| 1,222 | | |

| 965 | |

| Total current liabilities | |

| 15,617 | | |

| 15,908 | |

| Deferred revenue | |

| 41,250 | | |

| 45,000 | |

| Operating lease liabilities | |

| 795 | | |

| 860 | |

| Finance lease liabilities | |

| 502 | | |

| 328 | |

| Other long-term liabilities | |

| 815 | | |

| 926 | |

| Total liabilities | |

| 58,979 | | |

| 63,022 | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock $0.001 par value, 5,000,000 shares authorized, none issued or outstanding | |

| — | | |

| — | |

| Common stock $0.001 par value, 350,000,000 shares authorized, 41,544,975 and 40,609,915 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | |

| 41 | | |

| 40 | |

| Additional paid-in capital | |

| 275,561 | | |

| 271,594 | |

| Accumulated deficit | |

| (275,242 | ) | |

| (245,102 | ) |

| Total stockholders’ equity | |

| 360 | | |

| 26,532 | |

| Total liabilities and stockholders’ equity | |

$ | 59,339 | | |

$ | 89,554 | |

CARISMA THERAPEUTICS INC.

Unaudited Consolidated Statements of Operations

and Comprehensive Loss

(in thousands, except share and per share data)

| | |

Three Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Collaboration revenues | |

$ | 9,197 | | |

$ | 3,560 | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 15,307 | | |

| 18,518 | |

| General and administrative | |

| 5,560 | | |

| 6,007 | |

| Total operating expenses | |

| 20,867 | | |

| 24,525 | |

| Operating loss | |

| (11,670 | ) | |

| (20,965 | ) |

| Interest income (expense), net | |

| 508 | | |

| 1,177 | |

| Pre-tax loss | |

| (11,162 | ) | |

| (19,788 | ) |

| Income tax expense | |

| — | | |

| (88 | ) |

| Net loss | |

$ | (11,162 | ) | |

$ | (19,876 | ) |

| | |

| | | |

| | |

| Share information: | |

| | | |

| | |

| Net loss per share of common stock, basic and diluted | |

$ | (0.27 | ) | |

$ | (0.49 | ) |

| Weighted-average shares of common stock outstanding, basic and diluted | |

| 41,543,553 | | |

| 40,258,107 | |

| Comprehensive loss | |

| | | |

| | |

| Net loss | |

$ | (11,162 | ) | |

$ | (19,876 | ) |

| Unrealized gain on marketable securities | |

| — | | |

| 129 | |

| Comprehensive loss | |

$ | (11,162 | ) | |

$ | (19,747 | ) |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

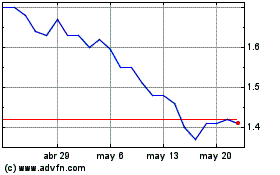

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024