Centessa Pharmaceuticals Announces Pricing of $100 Million Public Offering of American Depositary Shares

23 Abril 2024 - 8:36PM

Centessa Pharmaceuticals plc (Nasdaq: CNTA), a clinical-stage

pharmaceutical company that aims to discover and develop medicines

that are transformational for patients, today announced the pricing

of an underwritten public offering of 10,810,810 American

Depositary Shares (“ADSs”), each representing one ordinary share,

at a price to the public of $9.25 per ADS. The aggregate

gross proceeds to Centessa from this offering are expected to be

approximately $100 million, before deducting underwriting

discounts and commissions and offering expenses payable by

Centessa. All ADSs sold in the offering were offered by Centessa.

The offering is expected to close on or about April 26, 2024,

subject to customary closing conditions. Centessa has also granted

the underwriters a 30-day option to purchase up to an additional

1,621,621 ADSs at the public offering price, less underwriting

discounts and commissions.

Goldman Sachs, Leerink Partners, Evercore ISI,

Guggenheim Securities and BMO Capital Markets are acting as joint

book-running managers for the offering.

The ADSs are being offered pursuant to a

registration statement on Form S-3 that was previously filed with,

and subsequently declared effective on July 12, 2022 by, the

Securities and Exchange Commission (“SEC”). A preliminary

prospectus supplement and accompanying prospectus relating to the

offering have been filed, and a final prospectus supplement

and accompanying prospectus related to the offering will be filed,

with the SEC and are or will be available on the SEC's website

located at http://www.sec.gov. Copies of the final prospectus

supplement and the accompanying prospectus relating to the

offering, when available, may be obtained from: Goldman Sachs &

Co. LLC, Attn: Prospectus Department, 200 West

Street, New York, New York 10282, telephone:

1-866-471-2526, email: prospectus-ny@ny.email.gs.com; Leerink

Partners LLC, Syndicate Department, 53 State Street, 40th Floor,

Boston, MA 02109, or by telephone at (800) 808-7525 ext. 6105, or

by email at syndicate@leerink.com; Evercore Group L.L.C.,

Attention: Equity Capital Markets, 55 East 52nd Street, 35th Floor,

New York, NY 10055, by telephone at (888) 474-0200, or by email at

ecm.prospectus@evercore.com; Guggenheim Securities, LLC,

Attention: Equity Syndicate Department, 330 Madison

Avenue, 8th Floor, New York, NY 10017, by telephone

at (212) 518-9544, or by email

at GSEquityProspectusDelivery@guggenheimpartners.com; or BMO

Capital Markets Corp., Attention: Equity Syndicate Department, 151

W 42nd Street, 32nd Floor, New York, New York 10036, by telephone

at (800) 414-3627 or by email at: bmoprospectus@bmo.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Centessa

Pharmaceuticals Centessa Pharmaceuticals plc is a

clinical-stage pharmaceutical company that aims to discover and

develop transformational medicines for patients. Our most advanced

programs include a hemophilia program, an orexin agonist program

for the treatment of narcolepsy and other sleep-wake disorders and

an immuno-oncology program focused on our LockBody® technology

platform. We operate with the conviction that each of our programs

has the potential to change the current treatment paradigm and

establish a new standard of care.

Forward Looking StatementsThis

press release contains forward-looking statements. Any such

statements in this press release that are not statements of

historical fact may be deemed to be forward-looking statements,

including those relating to Centessa’s expectations with respect to

the completion and timing of the public offering. Any

forward-looking statements in this press release are based on our

current expectations, estimates and projections only as of the date

of this release and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

and adversely from those set forth in or implied by such

forward-looking statements. These risks and uncertainties related

to completion of the proposed public offering and the satisfaction

of customary closing conditions related to the public

offering. Risks concerning our programs and operations are

described in additional detail in our Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and our other reports, which are on

file with the U.S. Securities and Exchange

Commission (SEC). We explicitly disclaim any obligation to

update any forward-looking statements except to the extent required

by law.

Contact:Kristen K. Sheppard, Esq.SVP of

Investor Relationsinvestors@centessa.com

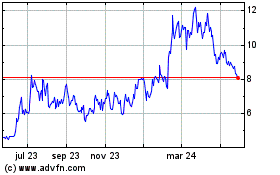

Centessa Pharmaceuticals (NASDAQ:CNTA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

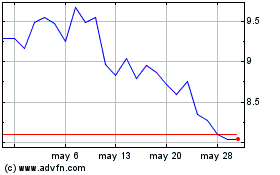

Centessa Pharmaceuticals (NASDAQ:CNTA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024