0001058290False00010582902024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 31, 2024 Cognizant Technology Solutions Corporation

(Exact Name of Registrant as Specified in Charter) | | | | | | | | |

| | |

| Delaware | 0-24429 | 13-3728359 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| |

| |

| | |

| |

300 Frank W. Burr Blvd.

Teaneck, New Jersey 07666

(Address of Principal Executive Offices including Zip Code)

(201) 801-0233

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report) Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, $0.01 par value per share | CTSH | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2024, Cognizant Technology Solutions Corporation (the “Company”), issued a press release to report the Company’s financial results for the quarter ended June 30, 2024. The full text of the press release and the infographic embedded in and part of such press release are attached to this current report on Form 8-K as Exhibits 99.1 and 99.2, respectively.*

Item 7.01. Regulation FD Disclosure.

The Company’s investor presentation containing additional financial information for the quarter ended June 30, 2024 is attached to this current report on Form 8-K as Exhibit 99.3.*

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document). |

| | | | | |

| * | The information in Item 2.02, Item 7.01, Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 of this current report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION |

| |

By: | /s/ Jatin Dalal |

Name: | Jatin Dalal |

Title: | Chief Financial Officer |

Date: July 31, 2024

Exhibit 99.1

Cognizant Reports Second Quarter 2024 Results

•Revenue of $4.9 billion, above the high end of our guidance range; sequentially increased 1.9%, or 2.1% in constant currency1

•Operating margin of 14.6%, up from 11.8% in the second quarter of 2023, and Adjusted Operating Margin1 of 15.2%, which expanded 100 basis points year-over-year

•Trailing 12-month bookings of $26.2 billion; book-to-bill of 1.4x

•Third quarter of 2024 revenue guidance of flat to 1.5% year-over-year growth in constant currency

•Full-year 2024 revenue guidance narrowed to a decline of 0.5% to growth of 1.0% in constant currency, an increase at the midpoint

•Full-year 2024 Adjusted Operating Margin guidance unchanged at 15.3-15.5%, representing year-over-year expansion of 20 to 40 basis points

TEANECK, N.J., July 31, 2024 - Cognizant (Nasdaq: CTSH), one of the world’s leading professional services companies, today announced its second quarter 2024 financial results.

“In the second quarter, we delivered revenue above the high end of our guidance range, expanded adjusted operating margin, and maintained our large deal momentum,” said Ravi Kumar S, Chief Executive Officer. “Progress against our strategic priorities is opening new opportunities with clients and allowing us to operate with greater agility. We believe our performance this quarter and the improved organic growth outlook for the full year demonstrate how our execution against these priorities is beginning to translate to our results and support long-term shareholder value."

| | | | | | | | | | | | | | | | | | |

| $ in billions, except per share data | Q2 2024 | | Q2 2023 | | | | | | | |

Revenue | $4.85 | | | $4.89 | | | | | | | | |

| Y/Y Change | (0.7 | %) | | (0.4 | %) | | | | | | | |

Y/Y Change CC1 | (0.5 | %) | | (0.1 | %) | | | | | | |

| GAAP Operating Margin | 14.6 | % | | 11.8 | % | | | | | | | |

Adjusted Operating Margin1 | 15.2 | % | | 14.2 | % | | | | | | | |

| GAAP Diluted EPS | $1.14 | | $0.91 | | | | | | | |

Adjusted Diluted EPS1 | $1.17 | | $1.10 | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

"Sequential revenue growth of 2.1% in constant currency, driven by our Financial Services and Health Sciences segments, was the strongest in two years,” said Jatin Dalal, Chief Financial Officer. “Our NextGen program has helped us fund investments in support of revenue growth and deliver 70 basis points of adjusted operating margin expansion in the first half of 2024. We enter the third quarter with improved revenue momentum and remain committed to driving operational excellence."

1 Constant currency ("CC") revenue growth, Adjusted Operating Margin, and Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") are not measures of financial performance prepared in accordance with GAAP. A full reconciliation of Adjusted Operating Margin guidance to the corresponding GAAP measure on a forward-looking basis cannot be provided without unreasonable efforts. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and, as applicable, reconciliations to the most directly comparable GAAP financial measures.

Bookings

Bookings in the second quarter increased 5% year-over-year. On a trailing-twelve-month basis, bookings declined 1% year-over-year to $26.2 billion, which represented a book-to-bill of approximately 1.4x.

Employee Metrics

Voluntary attrition - Tech Services on a trailing-twelve months basis was 13.6% as compared to 19.9% for the period ended June 30, 2023. Total headcount at the end of the second quarter was 336,300, a decrease of 8,100 from Q1 2024 and a decrease of 9,300 from Q2 2023.

Return of Capital to Shareholders

The Company repurchased 0.9 million shares for $63 million during the second quarter under its share repurchase program. As of June 30, 2024, there was $1.6 billion remaining under the share repurchase authorization. In July 2024, the Company declared a quarterly cash dividend of $0.30 per share for shareholders of record on August 20, 2024. This dividend will be payable on August 28, 2024.

Third Quarter and Full-Year 2024 Guidance2

(all growth rates year-over-year; excludes the impact of the Belcan transaction, which is expected to close in the third quarter 2024)

•Third quarter revenue is expected to be $4.89 - $4.96 billion, a decline of 0.2% to an increase of 1.3%, or flat to an increase of 1.5% in constant currency.

•Full-year 2024 revenue is expected to be $19.3 - $19.5 billion, a decline of 0.5% to an increase of 1.0% as reported and on a constant currency basis. This assumes approximately 70 basis points of inorganic contribution.

•Full-year 2024 Adjusted Operating Margin3 is expected to be in the range of 15.3% to 15.5%, or 20 to 40 basis points of expansion.

•Full-year 2024 Adjusted EPS3 is expected to be in the range of $4.62 to $4.70.

2 Guidance as of July 31, 2024

3 A full reconciliation of Adjusted Operating Margin and Adjusted Diluted EPS guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts. See “About Non-GAAP Financial Measures and Performance Metrics” for more information and a partial reconciliation at the end of this release.

Select Company, Client and Partnership Announcements

•Signed definitive agreement to acquire Belcan, a leading global supplier of Engineering Research & Development (ER&D) services for a long-standing customer base across the commercial aerospace, defense, space, marine and industrial verticals, for $1.3 billion in cash and stock. The acquisition is expected to significantly expand Cognizant's ER&D capabilities, building upon the Company's leadership in the Internet of Things (IoT) and Digital Engineering practice areas. Belcan will bring a highly accredited and skilled workforce of approximately 6,500 engineers and technical consultants, primarily based in North America. The acquisition is expected to close in Q3 2024.

•Announced the launch of Cognizant Moment™, the next evolution of Cognizant's digital experience practice area, designed to help clients leverage the power of AI to reimagine customer experience and engineer innovative strategies aimed at driving growth. The new practice builds on the digital experience expertise and solutions Cognizant has delivered for clients over the last 20+ years and advanced through a series of key acquisitions in the digital experience space. Now, as the ways consumers interact with technology are shifting to include multi-modal experiences, Cognizant aims to give clients the tools and insights they need to drive differentiation, cultivate customer loyalty and become future-ready.

•Introduced Cognizant Neuro® Edge, a new platform in the Cognizant Neuro® suite, designed to empower businesses across industries to leverage artificial intelligence and generative AI at the edge. Edge computing enables enterprises to access computing power via sensors and devices on their networks, reducing dependency on centralized servers and the cloud. The platform facilitates real-time interactions with devices, helping businesses to accelerate decision-making, reduce data costs and privacy risks and maintain operational stability even in low bandwidth scenarios.

•Launched our first set of healthcare large language model (LLM) solutions on Google Cloud's generative AI (gen AI) technology, including the company's Vertex AI platform and Gemini models, aimed at redesigning healthcare administrative processes and improving experiences. The suite of healthcare LLM solutions addresses four high-cost workflows: marketing operations, call center operations (including appeals and grievances), provider management and contracting.

•Signed an agreement to provide engineering services to Gentherm, the global market leader of innovative thermal management and pneumatic comfort technologies for the automotive industry and a leader in medical patient temperature management systems. Cognizant is providing systems engineering, validation and model-based development services from Hyderabad, India, and has created a test facility to conduct research and development for Gentherm products.

•Signed a five-year strategic agreement with Victory Capital Holdings, Inc, a diversified global asset management firm. Cognizant will provide IT infrastructure, security, and data and analytics support to Victory Capital's next phase of digital transformation.

•Agreement with Texas Dow Employees Credit Union (TDECU), the largest credit union in Houston and the fourth largest in Texas, to accelerate its 'Run the Business' transformation journey. Cognizant will be leveraging its Neuro® IT Operations platform to help transform TDECU's enterprise infrastructure and technology, enhance the credit union's operational efficiency and resilience, and increase TDECU's ability to achieve cost savings over the next five years.

•Expanded relationship with Cengage Group, a global educational technology company that supports millions of students each year, from middle school through graduate school and skills education, with quality content and technology. Under this seven-year agreement, Cognizant will provide advanced technology services that are designed to enhance operational efficiency, reduce the total cost of ownership, and continue to support Cengage Group's digital transformation.

•Announced an agreement with Nexthink under which Cognizant will apply its deep expertise in digital workplace services and its portfolio of tools with Nexthink's flagship product, Nexthink Infinity, to create a new joint offering - Cognizant WorkNEXT™ Workplace Intelligence. The new joint offering aims to provide seamless, reliable experiences across the devices, applications and connectivity provided by workplace IT to reduce operational costs and improve user productivity.

•Partnered to support Kohler Co. in establishing its energy business – Kohler Energy – as a standalone entity with independent operations. As Kohler’s existing strategic partner, Cognizant worked hand-in-hand with Kohler to evaluate the right approach for the carve-out, devise an optimal plan, and execute the separation of systems within a challenging six-month timeframe.

•Expanded relationship with Whitbread, the owner of Premier Inn, the UK’s biggest hotel brand. The three-year digital innovation agreement will see Cognizant support Whitbread’s ongoing digital transformation with product design, product management and engineering as Whitbread expands its operations in the UK and Germany. This follows a major modernization program where Cognizant helped Whitbread replace its legacy property management system.

•Announced a five-year agreement with Unitywater, a leading water utility in Queensland, for Unitywater's ICT Support Managed Services. The new relationship aims to support Unitywater’s digital infrastructure, enhancing operational efficiency and productivity, in alignment with Unitywater's strategic ambition of healthy and thriving communities.

•Announced a deal with Hays, the world’s leading specialist in workforce solutions and recruitment, to become its global technology partner. Cognizant is expected to manage Hays' IT operations globally by overseeing its IT service desk, business applications, and infrastructure and operations with the goal of enhancing Hays' operational efficiency and innovation capabilities.

Select Analyst Ratings, Company Recognition and Announcements

•Released a companion analysis to our comprehensive 2023 study with Oxford Economics and the related report – titled "New Work, New World" – that provides a detailed analysis outlining the current market adoption of generative AI across various industries and geographies. Key findings from the survey reveal that the greatest strategic priority for generative AI adoption is enhancing productivity. Additionally, the study found that 76% of businesses are looking to leverage the technology to create new revenue streams, while 58% are incorporating revenue increases into their business cases.

•Named one of “America’s Greatest Workplaces” and “Greatest Workplaces for Job Starters” by Newsweek, a global media organization that recognized us for our engaging workplace culture and proficiency at helping early talent launch their careers.

•Salesforce named Cognizant their 2024 UKI Partner of the Year and Google Cloud awarded us their 2024 Industry Solution Services Partner of the Year - Healthcare and Life Sciences in recognition of our success driving digital transformations with customers utilizing Google Cloud technologies, including AI.

•Singapore’s Digital for Life movement, a pivotal national initiative to foster a digitally empowered and inclusive society, recognized Cognizant as a Digital for Life – Champion. This award highlights our commitment to advancing tech-enabled livelihoods for women, enhancing Gen AI skills within our community, and creating pathways in technology through our collaboration with schools.

•Recognized as a Leader by Everest Group® in:

◦Healthcare Industry Cloud Services PEAK Matrix® Assessment, 2024

◦Care Management Platforms PEAK Matrix® Assessment, 2024

◦Guidewire IT Services PEAK Matrix® Assessment, 2024

◦Capital Market IT Services PEAK Matrix® Assessment, 2024

◦Open Banking IT Services PEAK Matrix® Assessment, 2024

◦Duck Creek Services, 2024

•A Leader in IDC MarketScape:

◦Worldwide Consulting and Digital Services Providers for the Upstream Oil and Gas Industry, doc #US51004123, May 2024

◦Worldwide Consulting and Digital Services Providers for the Downstream Oil & Gas Industry, doc #US51004223, June 2024

◦Asia/Pacific Sustainability/ESG Program Management Services 2024 Vendor Assessment, doc #AP50679323, June 2024

•Market Leader in HFS Horizon 3:

◦Healthcare Provider Services, 2024

◦Industry Cloud Services, 2024

•Leadership in ISG Provider Lens™:

◦ServiceNow Ecosystem Partners, 2024

◦SAP Ecosystem, 2024

•Leading Pack in TechMarketView MRI Report 2024 - The Road to AI

•Leadership in Avasant RadarView™:

◦Internet of Things Services, 2024

◦Applied AI Services, 2024

◦Banking Process Transformation, 2024

◦Banking Digital Services, 2024

◦Clinical and Care Management Services Business Process Transformation, 2024

Conference Call

Cognizant will host a conference call on July 31, 2024, at 5:00 p.m. (Eastern) to discuss the Company’s second quarter 2024 results. To listen to the conference call, please dial (877) 810-9510 (domestic) or +1 (201) 493-6778 (international) and provide the following conference passcode: “Cognizant Call.”

The conference call will also be available live on the Investor Relations section of the Cognizant website at http://investors.cognizant.com. An earnings supplement will also be available on the Cognizant website at the time of the conference call. For those who cannot access the live broadcast, a replay will be available. To listen to the replay, please dial (877) 660-6853 (domestically) or +1 (201) 612-7415 (internationally) and enter 13747233 beginning two hours after the end of the call until 11:59 p.m. (Eastern) on Tuesday, August 14, 2024. The replay will also be available at Cognizant’s website www.cognizant.com for 60 days following the call.

About Cognizant

Cognizant (Nasdaq: CTSH) engineers modern businesses. We help our clients modernize technology, reimagine processes and transform experiences so they can stay ahead in our fast-changing world. Together, we’re improving everyday life. See how at www.cognizant.com or @cognizant.

Forward-Looking Statements

This press release includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our strategy, strategic partnerships and collaborations, competitive position and opportunities in the marketplace, investment in and growth of our business, the anticipated closing of the pending Belcan acquisition, the pace and magnitude of change and client needs related to generative AI, the effectiveness of our recruiting and talent efforts and related costs, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs and ultimate benefits of such plans, our ability to successfully use AI-based technologies, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration and taxes, matters relating to the acquisition of Belcan and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

About Non-GAAP Financial Measures and Performance Metrics

Non-GAAP Financial Measures

To supplement our financial results presented in accordance with GAAP, this press release includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, net cash and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated.

Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income from Operations excludes unusual items, such as NextGen charges. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as NextGen charges, net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Net cash is defined as cash and cash equivalents and short-term investments less short-term and long-term debt. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues.

Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations.

A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures.

Performance Metrics

Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time.

| | | | | | | | | | | | | | |

| Investor Relations Contact: | | | | Media Contact: |

| Tyler Scott | | | | Jeff DeMarrais |

| VP, Investor Relations | | | | VP, Corporate Communications |

| +1 551-220-8246 | | | | +1 475-223-2298 |

| Tyler.Scott@cognizant.com | | | | Jeff.DeMarrais@cognizant.com |

- tables to follow -

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share data) | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 4,850 | | | $ | 4,886 | | | $ | 9,610 | | | $ | 9,698 | |

| Operating expenses: | | | | | | | |

| Cost of revenues (exclusive of depreciation and amortization expense shown separately below) | 3,204 | | | 3,231 | | | 6,350 | | | 6,374 | |

| Selling, general and administrative expenses | 781 | | | 830 | | | 1,546 | | | 1,665 | |

| Restructuring charges | 29 | | | 117 | | | 52 | | | 117 | |

| Depreciation and amortization expense | 128 | | | 131 | | | 259 | | | 263 | |

| Income from operations | 708 | | | 577 | | | 1,403 | | | 1,279 | |

| Other income (expense), net: | | | | | | | |

| Interest income | 30 | | | 30 | | | 60 | | | 60 | |

| Interest expense | (10) | | | (10) | | | (21) | | | (19) | |

| Foreign currency exchange gains (losses), net | 1 | | | (9) | | | 7 | | | 3 | |

| Other, net | (1) | | | (1) | | | 1 | | | 2 | |

| Total other income (expense), net | 20 | | | 10 | | | 47 | | | 46 | |

| Income before provision for income taxes | 728 | | | 587 | | | 1,450 | | | 1,325 | |

| Provision for income taxes | (165) | | | (124) | | | (344) | | | (282) | |

| Income (loss) from equity method investment | 3 | | | — | | | 6 | | | — | |

| Net income | $ | 566 | | | $ | 463 | | | $ | 1,112 | | | $ | 1,043 | |

| Basic earnings per share | $ | 1.14 | | | $ | 0.92 | | | $ | 2.24 | | | $ | 2.05 | |

| Diluted earnings per share | $ | 1.14 | | | $ | 0.91 | | | $ | 2.23 | | | $ | 2.05 | |

| Weighted average number of common shares outstanding - Basic | 497 | | | 506 | | | 497 | | | 508 | |

| Dilutive effect of shares issuable under stock-based compensation plans | 1 | | | 1 | | | 1 | | | — | |

| Weighted average number of common shares outstanding - Diluted | 498 | | | 507 | | | 498 | | | 508 | |

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited)

| | | | | | | | | | | |

(in millions, except par values) | June 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,193 | | | $ | 2,621 | |

| Short-term investments | 12 | | | 14 | |

| Trade accounts receivable, net | 3,973 | | | 3,849 | |

| Other current assets | 1,067 | | | 1,022 | |

| Total current assets | 7,245 | | | 7,506 | |

| Property and equipment, net | 1,009 | | | 1,048 | |

| Operating lease assets, net | 553 | | | 611 | |

| Goodwill | 6,395 | | | 6,085 | |

| Intangible assets, net | 1,129 | | | 1,149 | |

| Deferred income tax assets, net | 1,095 | | | 993 | |

| Long-term investments | 86 | | | 435 | |

| Other noncurrent assets | 1,068 | | | 656 | |

| Total assets | $ | 18,580 | | | $ | 18,483 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 298 | | | $ | 337 | |

| Deferred revenue | 391 | | | 385 | |

| Short-term debt | 33 | | | 33 | |

| Operating lease liabilities | 148 | | | 153 | |

| Accrued expenses and other current liabilities | 2,076 | | | 2,425 | |

| Total current liabilities | 2,946 | | | 3,333 | |

| Deferred revenue, noncurrent | 29 | | | 42 | |

| Operating lease liabilities, noncurrent | 466 | | | 523 | |

| Deferred income tax liabilities, net | 203 | | | 226 | |

| Long-term debt | 590 | | | 606 | |

| Long-term income taxes payable | — | | | 157 | |

| Other noncurrent liabilities | 448 | | | 369 | |

| Total liabilities | 4,682 | | | 5,256 | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.10 par value, 15 shares authorized, none issued | — | | | — | |

Class A common stock, $0.01 par value, 1,000 shares authorized, 497 and 498 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 5 | | | 5 | |

| Additional paid-in capital | 15 | | | 15 | |

| Retained earnings | 14,028 | | | 13,301 | |

| Accumulated other comprehensive income (loss) | (150) | | | (94) | |

| Total stockholders’ equity | 13,898 | | | 13,227 | |

| Total liabilities and stockholders’ equity | $ | 18,580 | | | $ | 18,483 | |

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Reconciliations of Non-GAAP Financial Measures

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions, except per share amounts) | Three Months Ended

June 30, | | Six Months Ended

June 30, | | | | Guidance |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | Full Year 2024 (1) |

| GAAP income from operations | $ | 708 | | | $ | 577 | | | $ | 1,403 | | | $ | 1,279 | | | | | |

NextGen charges(a) | 29 | | | 117 | | | 52 | | | 117 | | | | | |

| Adjusted Income From Operations | $ | 737 | | | $ | 694 | | | $ | 1,455 | | | $ | 1,396 | | | | | |

| | | | | | | | | | | |

| GAAP operating margin | 14.6 | % | | 11.8 | % | | 14.6 | % | | 13.2 | % | | | | |

| NextGen charges | 0.6 | | | 2.4 | | | 0.5 | | | 1.2 | | | | | 0.4% - 0.5% |

Adjusted Operating Margin | 15.2 | % | | 14.2 | % | | 15.1 | % | | 14.4 | % | | | | 15.3% - 15.5% |

| | | | | | | | | | | |

| GAAP diluted earnings per share | $ | 1.14 | | | $ | 0.91 | | | $ | 2.23 | | | $ | 2.05 | | | | | |

| Effect of NextGen charges, pre-tax | 0.06 | | | 0.23 | | | 0.10 | | | 0.23 | | | | | $0.17 - $0.19 |

Non-operating foreign currency exchange (gains) losses, pre-tax(b) | — | | | 0.02 | | | (0.01) | | | (0.01) | | | | | (b) |

Tax effect of above adjustments(c) | (0.03) | | | (0.06) | | | (0.02) | | | (0.06) | | | | | (a) (b) |

| Adjusted Diluted Earnings Per Share | $ | 1.17 | | | $ | 1.10 | | | $ | 2.30 | | | $ | 2.21 | | | | | $4.62 - $4.70 |

(1) A full reconciliation of Adjusted Operating Margin and Adjusted Diluted Earnings Per Share guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses and the tax effects of these adjustments, and such adjustments may be significant.

Notes:

(a)NextGen charges include:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Employee separation costs | $ | 18 | | | $ | 78 | | | $ | 26 | | | $ | 78 | |

Facility exit costs | 11 | | | 37 | | | 25 | | | 37 | |

Third party and other costs | — | | | 2 | | | 1 | | | 2 | |

Total NextGen charges | $ | 29 | | | $ | 117 | | | $ | 52 | | | $ | 117 | |

The costs related to the NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. We expect to incur approximately $95 million of costs in 2024 in connection with the NextGen program. Our guidance anticipates pre-tax charges of approximately $0.17 to $0.19 per diluted share for the full year 2024. The tax effect of these charges is expected to be approximately $0.04 to $0.05 per diluted share for the full year 2024.

(b)Non-operating foreign currency exchange gains and losses, inclusive of gains and losses on related foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts.

(c)Presented below are the tax impacts of our non-GAAP adjustment to pre-tax income for the:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Non-GAAP income tax benefit (expense) related to: | | | | | | | |

| NextGen charges | $ | 8 | | | $ | 31 | | | $ | 13 | | | $ | 31 | |

| Foreign currency exchange gains and losses | 1 | | | — | | | — | | | 5 | |

The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our unaudited consolidated statements of operations.

Reconciliations of Net Cash

(Unaudited)

| | | | | | | | | | | | | | |

(in millions) | | June 30, 2024 | | December 31, 2023 |

Cash and unrestricted cash equivalents | | $ | 2,193 | | | $ | 2,621 | |

| Short-term investments | | 12 | | | 14 | |

| Less: | | | | |

| Short-term debt | | 33 | | | 33 | |

| Long-term debt | | 590 | | | 606 | |

| Net cash | | $ | 1,582 | | | $ | 1,996 | |

The above tables serve to reconcile the Non-GAAP financial measures to the most directly comparable GAAP measures. Refer to the “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information on the use of these Non-GAAP measures.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

Revenue by Business Segment and Geography

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in millions) | Three Months Ended June 30, 2024 |

| | | | | Year over Year |

| | $ | | % of total | | % Change | | Constant Currency % Change (a) |

| Revenues by Segment: | | | | | | | |

| Financial Services | $ | 1,447 | | | 29.9 | % | | (1.1) | % | | (0.8) | % |

| Health Sciences | 1,461 | | | 30.1 | % | | 1.5 | % | | 1.7 | % |

| Products and Resources | 1,126 | | | 23.2 | % | | (4.3) | % | | (4.1) | % |

| Communications, Media and Technology | 816 | | | 16.8 | % | | 1.2 | % | | 1.4 | % |

| Total Revenues | $ | 4,850 | | | | | (0.7) | % | | (0.5) | % |

| Revenues by Geography: | | | | | | | |

| North America | $ | 3,620 | | | 74.6 | % | | 0.9 | % | | 0.9 | % |

| United Kingdom | 444 | | | 9.2 | % | | (6.1) | % | | (6.5) | % |

| Continental Europe | 470 | | | 9.7 | % | | (4.9) | % | | (4.0) | % |

Europe - Total | 914 | | | 18.9 | % | | (5.5) | % | | (5.2) | % |

| Rest of World | 316 | | | 6.5 | % | | (4.2) | % | | (2.0) | % |

| Total Revenues | $ | 4,850 | | | | | (0.7) | % | | (0.5) | % |

| | | | | | | |

| | Six Months Ended June 30, 2024 |

| | | | | Year over Year |

| | $ | | % of total | | % Change | | Constant Currency % Change (a) |

| Revenues by Segment: | | | | | | | |

| Financial Services | $ | 2,832 | | | 29.5 | % | | (3.6) | % | | (3.7) | % |

| Health Sciences | 2,877 | | | 29.9 | % | | 0.1 | % | | 0.2 | % |

| Products and Resources | 2,259 | | | 23.5 | % | | (1.6) | % | | (1.6) | % |

| Communications, Media and Technology | 1,642 | | | 17.1 | % | | 3.2 | % | | 3.1 | % |

| Total Revenues | $ | 9,610 | | | | | (0.9) | % | | (0.9) | % |

| Revenues by Geography: | | | | | | | |

| North America | $ | 7,141 | | | 74.3 | % | | 0.1 | % | | 0.1 | % |

| United Kingdom | 900 | | | 9.4 | % | | (5.4) | % | | (7.1) | % |

| Continental Europe | 953 | | | 9.9 | % | | (0.2) | % | | (0.6) | % |

| Europe - Total | 1,853 | | | 19.3 | % | | (2.8) | % | | (3.8) | % |

| Rest of World | 616 | | | 6.4 | % | | (6.4) | % | | (3.9) | % |

| Total Revenues | $ | 9,610 | | | | | (0.9) | % | | (0.9) | % |

Notes:

(a)Constant currency revenue growth is not a measure of financial performance prepared in accordance with GAAP. See “About Non-GAAP Financial Measures and Performance Metrics” section of our press release for further information.

COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

(in millions) | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 566 | | | $ | 463 | | | $ | 1,112 | | | $ | 1,043 | |

| Adjustments for non-cash income and expenses | 81 | | | 88 | | | 262 | | | 275 | |

| Changes in assets and liabilities | (385) | | | (515) | | | (1,017) | | | (553) | |

| Net cash provided by operating activities | 262 | | | 36 | | | 357 | | | 765 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property and equipment | (79) | | | (68) | | | (158) | | | (166) | |

Net maturities of investments | — | | | (17) | | | 262 | | | 275 | |

| | | | | | | |

| Payments for business combinations, net of cash acquired | — | | | — | | | (421) | | | (409) | |

| Net cash (used in) investing activities | (79) | | | (85) | | | (317) | | | (300) | |

| Cash flows from financing activities: | | | | | | | |

| Issuance of common stock under stock-based compensation plans | 15 | | | 18 | | | 35 | | | 41 | |

| Repurchases of common stock | (76) | | | (214) | | | (209) | | | (436) | |

Net change in term loan borrowings and earnout and finance lease obligations | (10) | | | (10) | | | (50) | | | (11) | |

| | | | | | | |

| Dividends paid | (150) | | | (148) | | | (301) | | | (298) | |

| Net cash (used in) financing activities | (221) | | | (354) | | | (525) | | | (704) | |

Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents | — | | | — | | | (39) | | | — | |

(Decrease) in cash, cash equivalents and restricted cash and cash equivalents | (38) | | | (403) | | | (524) | | | (239) | |

Cash, cash equivalents and restricted cash and cash equivalents, beginning of period | 2,231 | | | 2,458 | | | 2,717 | | | 2,294 | |

Cash, cash equivalents, end of period | $ | 2,193 | | | $ | 2,055 | | | $ | 2,193 | | | $ | 2,055 | |

SUPPLEMENTAL CASH FLOW INFORMATION

| | | | | | | | | | | | |

| (in millions) | | Three Months Ended

June 30, |

| Stock Repurchases under Board of Directors' authorized stock repurchase program: | | 2024 | | 2023 |

| Number of shares repurchased | | 0.9 | | | 3.2 | |

| | | | |

Remaining authorized balance as of June 30, 2024 | | $ | 1,605 | | | |

Reconciliation of Free Cash Flow Non-GAAP Financial Measure

| | | | | | | | | | | | | | | | | | | | | | | |

(in millions) | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 262 | | | $ | 36 | | | $ | 357 | | | $ | 765 | |

Purchases of property and equipment | (79) | | | (68) | | | (158) | | | (166) | |

| Free cash flow | $ | 183 | | | $ | (32) | | | $ | 199 | | | $ | 599 | |

In the second quarter, we delivered revenue above the high end of our guidance range, expanded adjusted operating margin, and maintained our large deal momentum. Progress against our strategic priorities is opening new opportunities with clients and allowing us to operate with greater agility. We believe our performance this quarter and the improved organic growth outlook for the full-year demonstrate how our execution against these priorities is beginning to translate to our results and support long-term shareholder value. Q2 2024 Ravi Kumar S | Chief Executive Officer ” Revenue $4.9 billion Reported YoY ê 0.7% Constant Currency YoY ê 0.5% GAAP Operating Margin | 14.6% GAAP EPS | $1.14 $3.6$1.0 $0.3 Rest of World 4.2% Revenue by Geography ($ In billions) Reported YoY | Constant Currency YoY Q2 2024 Cash Flow Cash Flow From Operations $262M Free Cash Flow $183M Q2 2024 Capital Return Dividends $150M Share Repurchases $76M $0.30/share Revenue by Segment ($ In billions) Reported YoY | Constant Currency YoY Europe North America 2.0% $1.4 $1.5$1.1 $0.9 Products & Resources Health Sciences Financial Services Communications, Media & Technology 5.5% 5.2% 0.9% 0.9% 1.2% 1.4% 4.3% 4.1% 1.1% 0.8% 1.5% 1.7% Total Employees 336,300 ” (8,100) QoQ (9,300) YoY Voluntary - Tech Services Attrition (Trailing 12-Month) 13.6% é é é é é é é é é é é Adjusted Diluted EPS | $1.17 Employee Metrics Down 6.3 percentage points YoY Adjusted Operating Margin | 15.2% é é For non-GAAP financial reconciliations refer to Cognizant's 2024 second quarter earnings release issued on July 31, 2024, which accompanies this presentation and is available at investors.cognizant.com. Exhibit 99.2 é Acquisition Announced A leading global supplier of Engineering Research & Development (ER&D) services across the commercial aerospace, defense, space, marine and industrial verticals

Exhibit 99.3 Second Quarter 2024 Financial Results and Highlights © 2024 Cognizant July 31, 2024

© 2024 Cognizant 1 Forward-looking statements This earnings supplement includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our expectations regarding our strategy, competitive position and opportunities in the marketplace, investment in and growth of our business, the anticipated closing of the pending Belcan acquisition, the pace and magnitude of change and client needs related to generative AI, the effectiveness of our recruiting and talent efforts and related costs, labor market trends, the anticipated amount of capital to be returned to shareholders and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs and ultimate benefits of such plans, our ability to successfully use AI- based technologies, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration and taxes, matters relating to the acquisition of Belcan and the other factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

© 2024 Cognizant 2 $36M $262M Results Summary: Q2 2024 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. 2 The decrease in free cash flow in Q2 2023 was primarily driven by an increase in income tax payments. In the second quarter of 2023, we made tax payments related to the mandatory capitalization of research and experimental expenditures for the 2022 tax year as well as the estimated tax payment for the six months ended June 30, 2023. Revenue Decline of 0.7% Y/Y as reported, and a decline of 0.5% Y/Y in constant currency1 GAAP and Adjusted Operating Margin1 Cash Flow2 $4,886M $4,850M Q2 '23 Q2 '24 11.8% 14.6% Q2 '23 Q2 '24 14.2% 15.2% Q2 '23 Q2 '24 ($32M) $183M Q2 '23 Q2 '24 $0.91 $1.14 Q2 '23 Q2 '24 $1.10 $1.17 Q2 '23 Q2 '24 Adjusted Operating Margin1 GAAP Diluted EPS Adjusted Diluted EPS1 Operating Cash Flow Free Cash Flow1 GAAP Operating Margin Adjusted Operating Margin1 Diluted Earnings Per Share (EPS) Q2 '23 Q2 '24

© 2024 Cognizant 3 $4,812 $4,886 $4,897 $4,758 $4,760 $4,850 $1.11 $1.10 $1.16 $1.18 $1.12 $1.17 Revenue Adjusted Diluted EPS Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 $ in millions except per share amounts Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Revenue Y/Y (0.3%) (0.4%) 0.8% (1.7%) (1.1%) (0.7%) Revenue Y/Y CC 1.5% (0.1%) (0.2%) (2.4%) (1.2%) (0.5%) GAAP Operating Margin 14.6% 11.8% 14.0% 15.2% 14.6% 14.6% Adjusted Operating Margin 14.6% 14.2% 15.5% 16.1% 15.1% 15.2% GAAP Diluted EPS $1.14 $0.91 $1.04 $1.11 $1.10 $1.14 Adjusted Diluted EPS $1.11 $1.10 $1.16 $1.18 $1.12 $1.17 Revenue, Operating Margin and EPS 1

© 2024 Cognizant 4 $3,620 $914 $316 $1,447 $1,461 $1,126 $816 Revenue Performance: Q2 2024 Products & Resources Communications, Media & Technology Health Sciences Financial Services North America Europe Rest of World Segments $ in millions Geography $ in millions +1.2% Y/Y +1.4% Y/Y CC (4.3%) Y/Y (4.1%) Y/Y CC +1.5% Y/Y +1.7% Y/Y CC (1.1%) Y/Y (0.8%) Y/Y CC (5.5%) Y/Y (5.2%) Y/Y CC (4.2%) Y/Y (2.0%) Y/Y CC +0.9% Y/Y and Y/Y CC

© 2024 Cognizant 5 $1,039 $288 $120 Financial Services North America Europe Rest of World Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Y/Y (3.4%) (5.1%) (3.0%) (5.8%) (6.2%) (1.1%) Y/Y CC (1.4%) (4.8%) (4.0%) (6.6%) (6.5%) (0.8%) (4.8%) Y/Y (2.8%) Y/Y CC (7.1%) Y/Y (6.9%) Y/Y CC Revenue Change in Revenue $ in millions $ in millions Q2 2024 Geography +1.2% Y/Y +1.3% Y/Y CC $1,476 $1,463 $1,475 $1,395 $1,385 $1,447 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24

© 2024 Cognizant 6 $1,252 $182 $27 Health Sciences North America Europe Rest of World (3.6%) Y/Y +3.3% Y/Y CC +1.7% Y/Y +2.3% Y/Y CC +1.5% Y/Y and Y/Y CC Revenue $ in millions Q1 '23 Q2 '23 Q3'23 Q4 '23 Q1 '24 Q2 '24 Y/Y 2.9% 2.3% —% (2.1%) (1.2%) 1.5% Y/Y CC 3.5% 2.1% (0.8%) (2.7%) (1.3%) 1.7% $1,433 $1,440 $1,405 $1,396 $1,416 $1,461 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Change in Revenue $ in millions Q2 2024 Geography

© 2024 Cognizant 7 $761 $275 $90 North America Europe Products & Resources (2.4%) Y/Y and Y/Y CC (7.4%) Y/Y (7.2%) Y/Y CC (10.0%) Y/Y (8.1%) Y/Y CC Rest of World Revenue $ in millions Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Y/Y (1.1%) 3.2% 1.9% 1.3% 1.3% (4.3%) Y/Y CC 1.4% 3.7% 0.6% 0.3% 0.9% (4.1%) $1,118 $1,177 $1,170 $1,163 $1,133 $1,126 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Change in Revenue $ in millions Q2 2024 Geography

© 2024 Cognizant 8 $568 $169 $79 $785 $806 $847 $804 $826 $816 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Communications, Media & Technology North America Rest of World +3.9% Y/Y +5.6% Y/Y CC (6.6%) Y/Y and Y/Y CC +3.5% Y/Y and Y/Y CC Europe Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Y/Y 1.2% (1.2%) 8.2% 2.6% 5.2% 1.2% Y/Y CC 3.9% (0.4%) 7.3% 2.0% 5.7% 1.4% Change in Revenue Revenue $ in millions $ in millions Q2 2024 Geography

© 2024 Cognizant 9 $26.4 $26.9 $26.3 $25.9 $26.2 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Trailing Twelve Month Bookings1 Trailing twelve month bookings of $26.2 billion represented a book-to-bill of 1.4x Q2 2024 bookings increased 5% year-over-year $ in billions 1 See “About Non-GAAP Financial Measures and Performance Metrics” at the end of this earnings supplement for more information.

© 2024 Cognizant 10 Employee Metrics 351.5 345.6 346.6 347.7 344.4 336.3 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Trailing 12-Month Voluntary Attrition - Tech Services 23.1% 19.9% 16.2% 13.8% 13.1% 13.6% Additional Employee Metrics Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Blended Utilization, Excluding Trainees1 84% 84% 84% 81% 82% 83% Utilization Headcount in thousands 1 In Q1 2024, we introduced a new metric, Blended Utilization, Excluding Trainees, which includes, among other changes, a blended calculation for onsite and offshore employees. This new metric replaces our prior utilization disclosure of Onsite and Offshore, Excluding Trainees.

© 2024 Cognizant 11 $564 $591 $594 $367 $409 $421 $1,422 $1,064 $837 FY 2022 FY 2023 Trailing 12-Months Acquisitions Share Repurchases $148 $147 $146 $151 $150 $421 $214 $315 $313 $133 $76 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Cash Flow, Balance Sheet & Capital Allocation Q1 '23 Q2 '231 Q3 '23 Q4 '23 Q1 '242 Q2 '24 Operating Cash Flow $729 $36 $828 $737 $95 $262 Free Cash Flow $631 ($32) $755 $659 $16 $183 Cash and Short-Term Investments $2,481 $2,095 $2,368 $2,635 $2,243 $2,205 Total Debt $646 $646 $647 $639 $631 $623 Annual Quarterly Dividends $ in millions $ in millions 1 The decrease in Operating Cash Flow and Free Cash Flow in Q2 2023 was primarily driven by an increase in income tax payments. In the second quarter of 2023, we made tax payments related to the mandatory capitalization of research and experimental expenditures for the 2022 tax year as well as the estimated tax payment for the six months ended June 30, 2023. 2 Q1 2024 Operating Cash Flow and Free Cash Flow include the negative impact from a previously disclosed $360 million payment made to the India tax authorities in connection with our ongoing appeal of a 2016 tax matter.

© 2024 Cognizant 12 Full-year 2024 and Q3 2024 Guidance1 1 Guidance is as of July 31, 2024 2 A full reconciliation of Adjusted Operating Margin, Net Interest Income, Adjusted Diluted EPS and Adjusted effective tax rate guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses, and the tax effects of these adjustments. See “About Non-GAAP Financial Measures and Performance Metrics” for more information, the definition of Adjusted effective tax rate and Net Interest Income as well as a partial reconciliation to the most directly comparable GAAP financial measures at the end of this earnings supplement. Q3 2024 Guidance Assumptions Revenue $4.89 to $4.96B (0.2%)-1.3% Y/Y or 0.0%-1.5% Y/Y CC 2024 Guidance Assumptions Revenue $19.3 to $19.5B (0.5%) to +1.0% Y/Y and Y/Y CC Includes ~70 bps of inorganic contribution versus prior guidance of "up to ~100 bps" Adjusted Operating Margin2 15.3% to 15.5% Represents 20 to 40 basis points expansion Y/Y Net Interest Income2 ~$80M Adjusted effective tax rate2 24% to 25% Share Count 497M Adjusted Diluted EPS2 $4.62 to $4.70 Guidance does not include any impact from the pending acquisition of Belcan

APPENDIX: About Non-GAAP Financial Measures and Performance Metrics

© 2024 Cognizant 14 Non-GAAP Financial Measures To supplement our financial results presented in accordance with GAAP, this earnings supplement includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, constant currency revenue growth, Adjusted effective tax rate and net interest income. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated. Our non-GAAP financial measures Adjusted Operating Margin and Adjusted Income from Operations excludes unusual items, such as NextGen charges. Our non-GAAP financial measure Adjusted Diluted EPS excludes unusual items, such as NextGen charges, and net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item excluded from Adjusted Diluted EPS is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues. Adjusted effective tax rate reflects a tax rate commensurate with our non-GAAP Adjusted EPS. Net Interest Income is defined as interest income less interest expense. Management believes providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision-making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Accordingly, we believe that the presentation of our non-GAAP measures, which exclude certain costs, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations. A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures. Performance Metrics Bookings are defined as total contract value (or TCV) of new contracts, including new contract sales as well as renewals and expansions of existing contracts. Bookings can vary significantly quarter to quarter depending in part on the timing of the signing of a small number of large contracts. Our book-to-bill ratio is defined as bookings for the trailing twelve months divided by revenue for the same period. Measuring bookings involves the use of estimates and judgments and there are no independent standards or requirements governing the calculation of bookings. The extent and timing of conversion of bookings to revenues may be impacted by, among other factors, the types of services and solutions sold, contract duration, the pace of client spending, actual volumes of services delivered as compared to the volumes anticipated at the time of sale, and contract modifications, including terminations, over the lifetime of a contract. The majority of our contracts are terminable by the client on short notice often without penalty, and some without notice. We do not update our bookings for subsequent terminations, reductions or foreign currency exchange rate fluctuations. Information regarding our bookings is not comparable to, nor should it be substituted for, an analysis of our reported revenues. However, management believes that it is a key indicator of potential future revenues and provides a useful indicator of the volume of our business over time. About Non-GAAP Financial Measures and Performance Metrics

© 2024 Cognizant 15 Reconciliations of Non-GAAP Financial Measures Please refer to page 16 and 17 of this earnings supplement for corresponding Non-GAAP notes. (in millions, except per share amounts) Three Months Ended: Mar 31, 2023 Jun 30, 2023 Sep 30, 2023 Dec 31, 2023 Mar 31, 2024 Jun 30, 2024 Guidance Full Year 2024(1) GAAP income from operations $ 702 $ 577 $ 686 $ 724 $ 695 $ 708 NextGen charges(a) — 117 72 40 23 29 Adjusted income from operations $ 702 $ 694 $ 758 $ 764 $ 718 $ 737 GAAP operating margin 14.6 % 11.8 % 14.0 % 15.2 % 14.6 % 14.6 % NextGen charges(a) — 2.4 1.5 0.9 0.5 0.6 0.4% - 0.5% Adjusted operating margin 14.6 % 14.2 % 15.5 % 16.1 % 15.1 % 15.2 % 15.3% - 15.5% GAAP diluted earnings per share $ 1.14 $ 0.91 $ 1.04 $ 1.11 $ 1.10 $ 1.14 Effect of NextGen charges, pre-tax — 0.23 0.14 0.08 0.05 0.06 $0.17 - $0.19 Effect of non-operating foreign currency exchange (gains) loss, pre-tax(b) (0.02) 0.02 — — (0.01) — (b) Tax effect of above adjustments(c) (0.01) (0.06) (0.02) (0.01) (0.02) (0.03) (a) (b) Adjusted diluted earnings per share $ 1.11 $ 1.10 $ 1.16 $ 1.18 $ 1.12 $ 1.17 $4.62 - $4.70 (1) A full reconciliation of Adjusted Operating Margin and Adjusted Diluted Earnings Per Share guidance to the corresponding GAAP measures on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses and the tax effects of these adjustments, and such adjustments may be significant.

© 2024 Cognizant 16 Reconciliations of Non-GAAP Financial Measures Notes: (a) NextGen charges for the three months ended June 30, 2024 include $18 million of employee separation costs and $11 million of facility exit costs. In 2024, we expect to incur $95 million of expenses in connection with the NextGen program, which is expected to bring the total charges under the program to approximately $325 million. The total costs related to the NextGen program are reported in "Restructuring charges" in our unaudited consolidated statements of operations. Our guidance anticipates pre-tax charges of approximately $0.17 to $0.19 per diluted share for the full year 2024. The tax effect of these charges is expected to be approximately $0.04 to $0.05 per diluted share for the full year 2024. (b) Non-operating foreign currency exchange gains and losses, inclusive of gains and losses related to foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our unaudited consolidated statements of operations. Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts. 2023 2024 Three months ended: Mar 31 Jun 30 Sep 30 Dec 31 Mar 31 Jun 30 Non-GAAP income tax benefit (expense) related to: NextGen charges $ — $ 31 $ 18 $ 10 $ 5 $ 8 Tax impact of foreign currency exchange gain and losses 5 — (7) (4) (1) 1 (c) Presented below are the tax impacts of our non-GAAP adjustments to pre-tax income: The effective tax rate related to non-operating foreign currency exchange gains and losses varies depending on the jurisdictions in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. As such, the income tax effect of non-operating foreign currency exchange gains and losses shown in the above table may not appear proportionate to the net pre-tax foreign currency exchange gains and losses reported in our consolidated statements of operations.

© 2024 Cognizant 17 Reconciliations of Non-GAAP Financial Measures Reconciliation of free cash flow Three Months Ended (in millions) Mar 31, 2023 Jun 30, 2023 Sep 30, 2023 Dec 31, 2023 Mar 31, 2024 Jun 30, 2024 Net cash provided by operating activities $ 729 $ 36 $ 828 $ 737 $ 95 $ 262 Purchases of property and equipment (98) (68) (73) (78) (79) (79) Free cash flow $ 631 $ (32) $ 755 $ 659 $ 16 $ 183 Adjusted Effective Tax Rate Reconciliation Guidance FY 2024 GAAP effective tax rate Effect of non-operating foreign currency exchange (gains) losses (b) (b) Effect of NextGen charges (a) — Adjusted effective tax rate 24% - 25% The notes referenced in the above table are located on page 16. Net Interest Guidance FY 2024 Interest income ~$120 Interest expense (~40) Net Interest Income ~$80

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

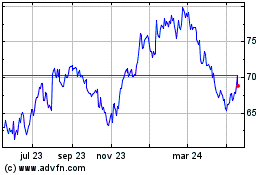

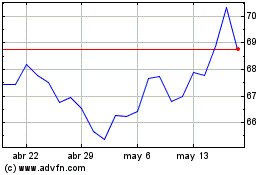

Cognizant Technology Sol... (NASDAQ:CTSH)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

Cognizant Technology Sol... (NASDAQ:CTSH)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024