false

--09-30

0001506251

0001506251

2024-11-25

2024-11-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 25, 2024

Citius Pharmaceuticals,

Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-38174 |

|

27-3425913 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 11 Commerce Drive, 1st Floor, Cranford, NJ |

|

07016 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (908) 967-6677

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par value |

|

CTXR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03. Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 herein is incorporated by reference into this Item

3.03.

Item 5.03. Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

Citius

Pharmaceuticals, Inc. (the “Company”) filed a Certificate of Change (the “Certificate of Change”) with the Secretary

of State of the State of Nevada to (i) effect a 1-for-25 reverse stock split (the “Reverse Stock Split”) of the Company’s

issued and outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), and (ii) decrease the number

of total authorized shares of Common Stock from 400,000,000 shares to 16,000,000 shares. The Reverse Stock Split is intended for the Company

to regain compliance with the minimum bid price requirement of $1.00 per share of common stock for continued listing on the Nasdaq Capital

Market. The Reverse Stock Split became effective at 5:00 p.m., Eastern Time, on November 25, 2024, and the Company’s Common Stock

began trading on a Reverse Stock Split-adjusted basis on the Nasdaq Capital Market at the opening of the market on November 26, 2024.

The trading symbol for the common stock remains “CTXR,” and the new CUSIP number of the Company’s common stock following

the Reverse Stock Split is 17322U306.

As

a result of the Reverse Stock Split, every twenty-five (25) shares of the Company’s pre-Reverse Stock Split Common Stock will be

combined into one (1) share of the Company’s post-Reverse Stock Split Common Stock, without any change in par value per share. Proportionate

voting rights and other rights of holders of Company Common Stock will not be affected by the Reverse Stock Split. No fractional shares

will be issued in connection with the Reverse Stock Split, and fractional shares resulting from the Reverse Stock Split will be rounded

up to the nearest whole share at the participant level.

The Company’s transfer

agent, VStock Transfer, LLC, is acting as the exchange agent for the Reverse Stock Split.

In

addition, the Reverse Stock Split will apply to the Company’s Common Stock issuable upon the exercise of the Company’s outstanding

warrants and stock options, with proportionate adjustments to be made to the exercise prices thereof, as applicable. Furthermore, the

number of shares of common stock available for issuance under the Company’s equity incentive plans will be proportionately adjusted

for the Reverse Stock Split ratio, such that fewer shares will be subject to such plans.

The

summary of the Certificate of Change does not purport to be complete and is qualified in its entirety by reference to the full text of

the Certificate of Change, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 8.01. Other Events.

On

November 22, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is furnished herewith

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Citius Pharmaceuticals, Inc. |

| |

|

| Date: November 26, 2024 |

By: |

/s/ Leonard Mazur |

| |

|

Name: Leonard Mazur |

| |

|

Title: Chief Executive Officer |

3

Exhibit 3.1

Exhibit 99.1

Citius Pharmaceuticals, Inc. Announces 1-for-25

Reverse Stock Split

CRANFORD, N.J., November 22, 2024 -- Citius

Pharmaceuticals, Inc. (“Citius Pharma” or the “Company”) (Nasdaq: CTXR) announced today that it will be executing

a reverse stock split of its common stock, par value $0.001 per share, at a ratio of 1-for-25 (“Reverse Stock Split”). Pursuant

to the laws of the State of Nevada and subject to prior approval by the Company’s Board of Directors, Citius Pharma was not required

to obtain shareholder approval to effectuate the Reverse Stock Split. The Reverse Stock Split will become effective at 5:00 pm Eastern

Time on November 25, 2024. The Company’s common stock will begin trading on the Nasdaq Capital Market on a split-adjusted basis

beginning upon market open on November 26, 2024, under the Company’s existing trading symbol “CTXR” with the new CUSIP

number 17322U306.

The Reverse Stock Split is intended to increase

the per share trading price of Citius Pharma’s common stock to regain compliance with the minimum bid price requirement of $1.00

per share of common stock for continued listing on the Nasdaq Capital Market. Under Section 78.207 of the Nevada Revised Statutes, the

Company may decrease its authorized shares of Common Stock and correspondingly decrease the number of issued and outstanding shares of

Common Stock by resolution adopted by the Board of Directors, without obtaining the approval of the stockholders. The Reverse Stock Split

was approved by the Company’s Board of Directors pursuant to the Nevada Revised Statutes and was effectuated by the filing of a

Certificate of Change with office of the Nevada Secretary of State.

At the effective time of the Reverse Stock Split,

every twenty-five (25) issued and outstanding shares of the Company's common stock will be combined automatically into one (1) share of

the Company's common stock without any change in the par value per share. No fractional shares will be issued in connection with the reverse

stock split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share at the participant

level.

The reverse stock split will reduce the number

of authorized shares of the Company's common stock from 400 million shares to 16 million shares and the ownership percentage of each stockholder

will remain unchanged other than as a result of the rounding of fractional shares. The Reverse Stock Split will reduce the number of issued

and outstanding shares of the Company’s common stock from approximately 193 million to approximately 7.7 million.

In addition, the Reverse Stock Split will apply

to the Company’s common stock issuable upon the exercise of the Company’s outstanding warrants and stock options, with proportionate

adjustments to be made to the exercise prices thereof and under the Company's equity incentive plans, as applicable.

The Company’s transfer agent, VStock Transfer

LLC, will act as the exchange agent for the reverse stock split. Stockholders holding their shares in book-entry form or in "street

name" through a bank, broker, or other nominee will not need to take any action in connection with the reverse stock split.

About Citius Pharmaceuticals, Inc.

Citius Pharmaceuticals, Inc. is a biopharmaceutical

company dedicated to the development and commercialization of first-in-class critical care products. In August 2024, the FDA approved

LYMPHIR™, a targeted immunotherapy for an initial indication in the treatment of cutaneous T-cell lymphoma. Citius Pharma’s

late-stage pipeline also includes Mino-Lok®, an antibiotic lock solution to salvage catheters in patients with catheter-related

bloodstream infections, and CITI-002 (Halo-Lido), a topical formulation for the relief of hemorrhoids. A Pivotal Phase 3 Trial for Mino-Lok

and a Phase 2b trial for Halo-Lido were completed in 2023. Mino-Lok met primary and secondary endpoints of its Phase 3 Trial. Citius is

actively engaged with the FDA to outline next steps for both programs. Citius Pharmaceuticals owns 92% of Citius Oncology. For more information,

please visit www.citiuspharma.com.

Forward-Looking Statements

This press release may contain "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are made based on our expectations and beliefs concerning future events impacting Citius. You can identify these statements

by the fact that they use words such as "will," "anticipate," "estimate," "expect," "plan,"

"should," and "may" and other words and terms of similar meaning or use of future dates. Forward-looking statements

are based on management's current expectations and are subject to risks and uncertainties that could negatively affect our business, operating

results, financial condition and stock price. Factors that could cause actual results to differ materially from those currently anticipated,

and, unless noted otherwise, that apply to Citius Pharma and Citius Oncology, are: the potential impact of the reverse split on the bid

price of the Company's common stock; Citius Pharma’s ability to regain compliance with and continue to meet Nasdaq’s continued

listing standards; our ability to raise additional money to fund our operations for at least the next 12 months as a going concern; risks

relating to the results of research and development activities, including those from our existing and any new pipeline assets; risks related

to research using our assets but conducted by third parties; our ability to commercialize LYMPHIR and any of our other product candidates

that may be approved by the FDA; the estimated markets for our product candidates and the acceptance thereof by any market; the ability

of our product candidates to impact the quality of life of our target patient populations; our dependence on third-party suppliers; our

ability to procure cGMP commercial-scale supply; our ability to obtain, perform under and maintain financing and strategic agreements

and relationships; uncertainties relating to preclinical and clinical testing; the early stage of products under development; market and

other conditions; risks related to our growth strategy; patent and intellectual property matters; our ability to identify, acquire, close

and integrate product candidates and companies successfully and on a timely basis; government regulation; competition; as well as other

risks described in our SEC filings. These risks have been and may be further impacted by any future public health risks. Accordingly,

these forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to place undue reliance

on these forward-looking statements. Risks regarding our business are described in detail in our Securities and Exchange Commission (“SEC”)

filings which are available on the SEC’s website at www.sec.gov, including in Citius Pharma’s Annual Report on Form 10-K for

the year ended September 30, 2023, filed with the SEC on December 29, 2023, as updated by our subsequent filings with the Securities and

Exchange Commission. These forward-looking statements speak only as of the date hereof, and we expressly disclaim any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations

or any changes in events, conditions or circumstances on which any such statement is based, except as required by law.

Investor Relations for Citius Pharmaceuticals:

Investor Contact:

Ilanit Allen

ir@citiuspharma.com

908-967-6677 x113

Media Contact:

STiR-communications

Greg Salsburg

Greg@STiR-communications.com

v3.24.3

Cover

|

Nov. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 25, 2024

|

| Current Fiscal Year End Date |

--09-30

|

| Entity File Number |

001-38174

|

| Entity Registrant Name |

Citius Pharmaceuticals,

Inc.

|

| Entity Central Index Key |

0001506251

|

| Entity Tax Identification Number |

27-3425913

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

11 Commerce Drive

|

| Entity Address, Address Line Two |

1st Floor

|

| Entity Address, City or Town |

Cranford

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07016

|

| City Area Code |

908

|

| Local Phone Number |

967-6677

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

CTXR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

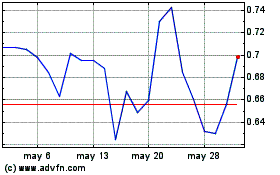

Citius Pharmaceuticals (NASDAQ:CTXR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Citius Pharmaceuticals (NASDAQ:CTXR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024