DexCom, Inc. (Nasdaq: DXCM) today reported its financial results

as of and for the quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights:

- Revenue grew 2% year-over-year to $994.2 million on a reported

basis and 3% year-over-year on an organic1 basis.

- U.S. revenue declined 2% and international revenue grew 12% on

a reported basis and 16% on an organic1 basis, all on a

year-over-year basis.

- GAAP operating income of $152.0 million or 15.3% of revenue, a

decrease of 580 basis points compared to the third quarter of 2023.

Non-GAAP operating income* of $212.0 million or 21.3% of reported

revenue, a decrease of 320 basis points compared to the third

quarter of 2023.

Third Quarter 2024 Strategic Highlights:

- Launched Stelo, Dexcom’s new biosensor designed for adults with

prediabetes and type 2 diabetes who are not on insulin therapy, as

the first over-the-counter glucose biosensor in the U.S.

- Advanced international product portfolio with the launches of

Dexcom G7 in Australia and Dexcom ONE+ in France

- Executed $750 million share repurchase program, in-line with

strategy discussed on the company’s second quarter earnings

call

- Subsequent to the end of the quarter, submitted Dexcom G7

15-day CGM system to the FDA for review

“Dexcom’s third quarter results were in line with our

expectations as our team responded quickly to the business dynamics

that emerged earlier this year,” said Kevin Sayer, Dexcom’s

chairman, president and CEO. “We made significant progress over the

quarter to drive improved execution, leaving the company on track

to continue on our momentum in the fourth quarter and into

2025.”

2024 Annual Guidance

Dexcom is reiterating fiscal year 2024 guidance for Revenue,

Non-GAAP Gross Profit Margin, Non-GAAP Operating Margin, and

Adjusted EBITDA Margin at the following levels:

- Revenue of approximately $4.00 - 4.05 billion (11 - 13% organic

growth2)

- Non-GAAP Gross Profit Margin of approximately 63%

- Non-GAAP Operating Margin of approximately 20%

- Adjusted EBITDA Margin of approximately 29%

_________________________

1

Third quarter 2024 organic revenue was

$994.7 million and excludes $0.5 million of foreign exchange

impact. Third quarter 2023 reported revenue included $8.0 million

of non-CGM revenue subsequently divested in the following twelve

months.

2

Organic growth excludes non-CGM revenue

acquired or divested in the trailing twelve months, as well as the

impact of foreign exchange. Dexcom's 2024 organic growth

expectation excludes approximately $30 million of fiscal year 2023

revenue related to the divestiture of certain non-CGM assets.

Commercial Leadership Update

Dexcom also announced today that Teri Lawver, Executive Vice

President and Chief Commercial Officer, will retire at the end of

the year. She will continue as a special advisor to Dexcom through

early 2025 and Kevin Sayer, chairman, president and CEO, will

assume leadership of the commercial organization as the company

conducts a global search for a new chief commercial officer.

“I want to personally thank Teri for her strong leadership and

dedication, as seen most clearly through the successful launches of

G7 and Stelo,” said Kevin Sayer. “I look forward to guiding us

through this transition phase as we capitalize on the incredible

opportunity ahead.”

Third Quarter 2024 Financial Results

Revenue: In the third quarter of 2024, worldwide revenue

grew 2% to $994.2 million on a reported basis, up from $975.0

million in the third quarter of 2023.

Gross Profit: GAAP gross profit totaled $593.8 million or

59.7% of revenue for the third quarter of 2024, compared to $623.3

million or 63.9% of revenue in the third quarter of 2023.

Non-GAAP gross profit* totaled $625.9 million or 63.0% of

reported revenue for the third quarter of 2024, compared to $630.4

million or 64.7% of reported revenue in the third quarter of

2023.

Operating Income: GAAP operating income for the third

quarter of 2024 was $152.0 million or 15.3% of revenue, compared to

GAAP operating income of $205.5 million or 21.1% of revenue for the

third quarter of 2023.

Non-GAAP operating income* for the third quarter of 2024 was

$212.0 million or 21.3% of reported revenue, compared to non-GAAP

operating income of $238.9 million or 24.5% of reported revenue for

the third quarter of 2023.

Net Income and Diluted Net Income Per Share: GAAP net

income was $134.6 million, or $0.34 per diluted share, for the

third quarter of 2024, compared to GAAP net income of $120.7

million, or $0.29 per diluted share, for the third quarter of

2023.

Non-GAAP net income* was $179.9 million, or $0.45 per diluted

share, for the third quarter of 2024, compared to non-GAAP net

income of $202.8 million, or $0.50 per diluted share, for the third

quarter of 2023. The third quarter 2024 non-GAAP net income

excludes $8.3 million of amortization of intangible assets, $26.0

million of business transition and other significant items, $25.7

million of intellectual property litigation costs, $0.4 million of

income from equity investments, and $14.3 million of tax

adjustments.

Cash and Liquidity: As of September 30, 2024, Dexcom held

$2.49 billion in cash, cash equivalents and marketable securities

and our revolving credit facility remains undrawn. The cash balance

represents significant financial and strategic flexibility as

Dexcom continues to expand production capacity and explore new

market opportunities.

* See Table E below for a reconciliation of these GAAP and

non-GAAP financial measures.

Conference Call

Management will hold a conference call today starting at 4:30

p.m. (Eastern Time). The conference call will be concurrently

webcast. The link to the webcast will be available on the Dexcom

Investor Relations website at investors.dexcom.com by navigating to

“Events and Presentations,” and will be archived for future

reference. To listen to the conference call, please dial (877)

344-3040 (U.S./Canada) or (646) 475-1647 (International) and use

the confirmation ID “9430114” approximately five minutes prior to

the start time.

Statement Regarding Use of Non-GAAP Financial

Measures

This press release and the accompanying tables include non-GAAP

financial measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and

reconciliations of these non-GAAP financial measures to the most

directly comparable financial measures prepared in accordance with

generally accepted accounting principles in the United States

(GAAP), please see the section titled “About Non-GAAP Financial

Measures” below as well as the related Table E. We have not

reconciled our organic revenue growth, Non-GAAP Gross Profit

Margin, Non-GAAP Operating Margin and Adjusted EBITDA Margin

estimates for fiscal year 2024 because certain items that impact

these figures are uncertain or out of our control and cannot be

reasonably predicted. Accordingly, reconciliations of our organic

revenue growth, Non-GAAP Gross Profit Margin, Non-GAAP Operating

Margin and Adjusted EBITDA Margin estimates are not available

without unreasonable effort.

About DexCom, Inc.

DexCom, Inc. empowers people to take real-time control of health

through innovative continuous glucose monitoring (CGM) systems.

Headquartered in San Diego, Calif., and with operations across

Europe and select parts of Asia/Oceania, Dexcom has emerged as a

leader of diabetes care technology. By listening to the needs of

users, caregivers, and providers, Dexcom works to simplify and

improve diabetes management around the world. For more information

about Dexcom CGM, visit www.dexcom.com.

Category: IR

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements that are

not purely historical regarding Dexcom’s or its management’s

intentions, beliefs, expectations and strategies for the future,

including those related to Dexcom’s future operating results and

financial position, including estimated Revenue, Non-GAAP Gross

Profit Margin, Non-GAAP Operating Margin, and Adjusted EBITDA

Margin for fiscal year 2024, and expected growth rates as compared

to the year ended December 31, 2023; future expenses and

investments; and potential business opportunities. All

forward-looking statements included in this press release are made

as of the date of this press release, based on information

currently available to Dexcom as of the date hereof.

Forward-looking statements deal with future events and are

therefore subject to various risks and uncertainties. Actual

results could differ materially from those anticipated in these

forward-looking statements. The risks and uncertainties that may

cause actual results to differ materially from Dexcom’s current

expectations are more fully described in the sections titled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in Dexcom’s most recently

filed periodic reports on Form 10-K and Form 10-Q and subsequent

filings filed with the Securities and Exchange Commission. Except

as required by law, Dexcom assumes no obligation to update any such

forward-looking statement after the date of this communication or

to conform these forward-looking statements to actual results.

DexCom, Inc.

Table A

Consolidated Balance

Sheets

(In millions, except par value

data)

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

621.2

$

566.3

Short-term marketable securities

1,871.1

2,157.8

Accounts receivable, net

1,002.0

973.9

Inventory

586.3

559.6

Prepaid and other current assets

182.2

168.3

Total current assets

4,262.8

4,425.9

Property and equipment, net

1,318.8

1,113.1

Operating lease right-of-use assets

67.5

71.4

Goodwill

23.8

25.2

Intangibles, net

106.2

134.5

Deferred tax assets

486.5

419.4

Other assets

88.2

75.0

Total assets

$

6,353.8

$

6,264.5

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

1,592.5

$

1,345.5

Accrued payroll and related expenses

105.8

171.0

Short-term operating lease liabilities

22.3

21.1

Deferred revenue

13.9

18.4

Total current liabilities

1,734.5

1,556.0

Long-term senior convertible notes

2,439.6

2,434.2

Long-term operating lease liabilities

71.1

80.1

Other long-term liabilities

129.6

125.6

Total liabilities

4,374.8

4,195.9

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value, 5.0

million shares authorized; no shares issued and outstanding at

September 30, 2024 and December 31, 2023

—

—

Common stock, $0.001 par value, 800.0

million shares authorized; 408.8 million and 390.6 million shares

issued and outstanding, respectively, at September 30, 2024; and

407.2 million and 385.4 million shares issued and outstanding,

respectively, at December 31, 2023

0.4

0.4

Additional paid-in capital

2,050.5

3,514.6

Accumulated other comprehensive income

(loss)

63.4

(16.7

)

Retained earnings

1,445.9

1,021.4

Treasury stock, at cost; 18.2 million

shares at September 30, 2024 and 21.8 million shares at December

31, 2023

(1,581.2

)

(2,451.1

)

Total stockholders’ equity

1,979.0

2,068.6

Total liabilities and stockholders’

equity

$

6,353.8

$

6,264.5

DexCom, Inc.

Table B

Consolidated Statements of

Operations

(In millions, except per share

data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

994.2

$

975.0

$

2,919.5

$

2,587.8

Cost of sales

400.4

351.7

1,137.1

955.5

Gross profit

593.8

623.3

1,782.4

1,632.3

Operating expenses:

Research and development

135.4

131.4

412.9

369.7

Selling, general and administrative

306.4

286.4

958.4

881.8

Total operating expenses

441.8

417.8

1,371.3

1,251.5

Operating income

152.0

205.5

411.1

380.8

Other income (expense), net

25.4

34.9

86.6

83.4

Income before income taxes

177.4

240.4

497.7

464.2

Income tax expense

42.8

119.7

73.2

179.0

Net income

$

134.6

$

120.7

$

424.5

$

285.2

Basic net income per share

$

0.34

$

0.31

$

1.08

$

0.74

Shares used to compute basic net income

per share

394.2

386.6

394.6

386.7

Diluted net income per share

$

0.34

$

0.29

$

1.04

$

0.69

Shares used to compute diluted net income

per share

410.2

426.8

414.7

428.3

DexCom, Inc.

Table C

Revenue by Geography

(Dollars in millions)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

U.S. revenue

$

701.9

$

713.6

$

2,087.0

$

1,856.2

Year over year growth

(2

)%

24

%

12

%

21

%

% of total revenue

71

%

73

%

71

%

72

%

International revenue

$

292.3

$

261.4

$

832.5

$

731.6

Year over year growth

12

%

33

%

14

%

31

%

% of total revenue

29

%

27

%

29

%

28

%

Total revenue (1)

$

994.2

$

975.0

$

2,919.5

$

2,587.8

Year over year growth

2

%

27

%

13

%

24

%

(1)

The sum of the revenue components may not

equal total revenue due to rounding.

DexCom, Inc.

Table D

Revenue by Component

(Dollars in millions)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Sensor and other revenue (1) (2)

$

951.8

$

873.8

$

2,753.1

$

2,303.7

Year over year growth

9

%

31

%

20

%

27

%

% of total revenue

96

%

90

%

94

%

89

%

Hardware revenue (1) (3)

$

42.4

$

101.2

$

166.4

$

284.1

Year over year growth

(58

)%

(2

)%

(41

)%

(1

)%

% of total revenue

4

%

10

%

6

%

11

%

Total revenue (4)

$

994.2

$

975.0

$

2,919.5

$

2,587.8

Year over year growth

2

%

27

%

13

%

24

%

(1)

Includes allocated subscription

revenue.

(2)

Includes services, freight, accessories,

non-CGM revenue, etc.

(3)

Includes transmitter and receiver

revenue.

(4)

The sum of the revenue components may not

equal total revenue due to rounding.

DexCom, Inc.

Table E

Itemized Reconciliation

Between GAAP and Non-GAAP Financial Measures

(In millions, except per share

data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP gross profit

$

593.8

$

623.3

$

1,782.4

$

1,632.3

Amortization of intangible assets (1)

7.1

7.1

21.4

21.4

Business transition and other significant

items (2)

25.0

—

32.3

—

Credits related to COVID-19 (3)

—

—

(3.0

)

—

Non-GAAP gross profit

$

625.9

$

630.4

$

1,833.1

$

1,653.7

GAAP operating income

$

152.0

$

205.5

$

411.1

$

380.8

Amortization of intangible assets (1)

8.3

8.8

27.1

26.6

Business transition and other significant

items (2)

26.0

1.1

39.4

2.9

Credits related to COVID-19 (3)

—

—

(3.2

)

—

Intellectual property litigation costs

(4)

25.7

23.5

73.2

65.6

Non-GAAP operating income

$

212.0

$

238.9

$

547.6

$

475.9

GAAP net income

$

134.6

$

120.7

$

424.5

$

285.2

Business transition and other significant

items (2)

26.0

1.0

39.2

2.6

Credits related to COVID-19 (3)

—

—

(3.2

)

—

Depreciation and amortization

55.3

48.2

159.9

133.5

Intellectual property litigation costs

(4)

25.7

23.5

73.2

65.6

(Income) loss from equity investments

(5)

(0.4

)

(1.0

)

1.4

(1.0

)

Share-based compensation

43.4

39.0

127.1

113.9

Interest expense and interest income

(27.3

)

(36.6

)

(90.4

)

(85.8

)

Income tax expense

42.8

119.7

73.2

179.0

Adjusted EBITDA

$

300.1

$

314.5

$

804.9

$

693.0

GAAP net income

$

134.6

$

120.7

$

424.5

$

285.2

Amortization of intangible assets (1)

8.3

8.8

27.1

26.6

Business transition and other significant

items (2)

26.0

1.1

39.4

2.9

Credits related to COVID-19 (3)

—

—

(3.2

)

—

Intellectual property litigation costs

(4)

25.7

23.5

73.2

65.6

(Income) loss from equity investments

(5)

(0.4

)

(1.0

)

1.4

(1.0

)

Adjustments related to taxes (6)

(14.3

)

49.7

(80.0

)

31.4

Non-GAAP net income

$

179.9

$

202.8

$

482.4

$

410.7

DexCom, Inc.

Table E (Continued)

Itemized Reconciliation

Between GAAP and Non-GAAP Financial Measures

(In millions, except per share

data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net income

$

134.6

$

120.7

$

424.5

$

285.2

Interest expense on senior convertible

notes, net of tax

2.9

3.0

8.7

9.6

GAAP net income used for diluted EPS,

if-converted (7)

$

137.5

$

123.7

$

433.2

$

294.8

Non-GAAP net income

$

179.9

$

202.8

$

482.4

$

410.7

Interest expense on senior convertible

notes, net of tax

1.3

1.2

3.7

3.7

Non-GAAP net income used for diluted

EPS, if-converted (7)

$

181.2

$

204.0

$

486.1

$

414.4

GAAP diluted net income per share

(7)

$

0.34

$

0.29

$

1.04

$

0.69

Amortization of intangible assets (1)

0.02

0.02

0.07

0.07

Business transition and other significant

items (2)

0.06

—

0.10

0.01

Credits related to COVID-19 (3)

—

—

(0.01

)

—

Intellectual property litigation costs

(4)

0.06

0.06

0.18

0.16

(Income) loss from equity investments

(5)

—

—

—

—

Adjustments related to taxes (6)

(0.04

)

0.12

(0.20

)

0.08

Impact of adjustment to GAAP diluted

shares (8)

—

0.01

—

0.01

Non-GAAP diluted net income per share

(7) (9)

$

0.45

$

0.50

$

1.19

$

1.02

GAAP diluted weighted-average shares

outstanding

410.2

426.8

414.7

428.3

Non-GAAP diluted weighted-average shares

outstanding

402.5

407.2

407.0

407.6

Reconciliation of non-GAAP diluted

weighted-average shares outstanding:

GAAP diluted weighted-average shares

outstanding

410.2

426.8

414.7

428.3

Adjustment for dilutive impact of senior

convertible notes due 2023 (10)

—

(11.9

)

—

(16.5

)

Adjustment for dilutive impact of senior

convertible notes due 2028 (10)

(7.7

)

(7.7

)

(7.7

)

(4.2

)

Non-GAAP diluted weighted-average shares

outstanding

402.5

407.2

407.0

407.6

(1)

Represents amortization of acquired

intangible assets.

(2)

For the three months ended September 30,

2024, business transition and other significant items are primarily

related to a non-recurring $24.6 million non-cash inventory build

charge and rent for vacated office space in San Diego, California.

For the nine months ended September 30, 2024, business transition

and other significant items are primarily related to a non-cash

inventory build charge, the divestiture of certain non-CGM assets,

workforce reduction costs, and rent for vacated office space in San

Diego, California. For the three and nine months ended September

30, 2023, business transition and other significant items are

primarily related to rent for vacated office space in San Diego,

California.

(3)

Represents a credit received related to

employment of personnel during the COVID-19 pandemic.

(4)

We have excluded third-party attorney’s

fees, costs, and expenses incurred by Dexcom exclusively in

connection with Dexcom’s patent infringement litigation against

Abbott Diabetes Care, Inc., as further described in the section

titled “Legal Proceedings” in Dexcom’s Quarterly Report on Form

10-Q for the quarter ended September 30, 2024.

(5)

Represents income and losses from equity

investments.

(6)

For the three months ended September 30,

2024, tax adjustments are primarily related to the tax effect of

non-GAAP adjustments. For the nine months ended September 30, 2024,

tax adjustments are primarily related to the tax effect of the

Verily milestone payment, non-GAAP adjustments, and excess tax

benefits from share-based compensation for employees. For the three

and nine months ended September 30, 2023, tax adjustments are

primarily related to the tax effect of non-GAAP adjustments,

including the intra-entity transfer of certain intellectual

property and excess tax benefits from share-based compensation for

employees.

(7)

When our senior convertible notes are

dilutive on a GAAP or non-GAAP basis, net income used for

calculating GAAP and non-GAAP diluted net income per share includes

an interest expense add back, net of tax, under the if-converted

method. In loss periods, basic and diluted net loss per share are

the same since the effect of potential common shares is

anti-dilutive and therefore excluded.

(8)

The adjustments are for the transition

from GAAP diluted net income per share to non-GAAP diluted net

income per share due to our senior convertible notes.

(9)

The sum of the non-GAAP per share

components may not equal the totals due to rounding.

(10)

We adjust for the dilutive effect of our

senior convertible notes when the effect is not the same on a GAAP

and non-GAAP basis for a given period.

ABOUT NON-GAAP FINANCIAL MEASURES

The accompanying press release dated October 24, 2024 contains

non-GAAP financial measures. These non-GAAP financial measures

include organic revenue, non-GAAP gross profit margin, non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income,

non-GAAP diluted net income per share, and non-GAAP diluted

weighted average shares outstanding, as well as Adjusted

EBITDA.

We report non-GAAP financial measures in addition to, and not as

a substitute for or as superior to, measures of financial

performance prepared in accordance with GAAP. We use these non-GAAP

financial measures for financial and operational decision making

and period-to-period comparisons. We believe that these non-GAAP

financial measures provide useful information about operating

results, enhance the overall understanding of our operating

performance and future prospects, and allow for greater

transparency with respect to key metrics used by senior management

in our financial and operational decision making. Our non-GAAP

financial measures exclude amounts that we do not consider part of

ongoing operating results when planning and forecasting and when

assessing the performance of the organization and our senior

management. While we compute non-GAAP financial measures using a

consistent method from quarter to quarter and year to year, we may

consider whether other significant items that arise in the future

should be excluded from our non-GAAP financial measures.

These non-GAAP financial measures are not based on any

comprehensive set of accounting rules or principles, differ from

GAAP measures with the same names, and may differ from non-GAAP

financial measures with the same or similar names that are used by

other companies.

We believe that non-GAAP measures have limitations in that they

do not reflect all of the amounts associated with our results of

operations as determined in accordance with GAAP and that these

financial measures should only be used to evaluate our results of

operations in conjunction with the corresponding GAAP financial

measures. We encourage investors to carefully consider our results

under GAAP, as well as our supplemental non-GAAP information and

the reconciliations between these presentations, to more fully

understand our business.

Management believes organic revenue is a meaningful metric to

investors as it provides a more consistent comparison of Dexcom’s

revenue to prior periods as well as to industry peers. We exclude

the following items from organic revenue:

- The effect of non-CGM revenue acquired or divested in the

trailing twelve months; and

- The effect of foreign currency fluctuations

Management believes that the presentation of operating results

that exclude these items provides useful supplemental information

to investors and facilitates the analysis of our core operating

results and comparison of operating results across reporting

periods. Management believes that this supplemental non-GAAP

information is therefore useful to investors in analyzing and

assessing our past and future operating performance.

Table E reconciles the non-GAAP financial measures included in

this press release to the most directly comparable financial

measures prepared in accordance with GAAP.

Our policy is to exclude the following items from non-GAAP

financial measures for non-GAAP gross profit, non-GAAP operating

income, non-GAAP operating margin, non-GAAP net income, and

non-GAAP diluted net income per share:

- Amortization of acquired intangible assets;

- Business transition and related costs associated with

acquisition and divestiture, integration and business transition

activities, including severance, relocation, consulting, leasehold

exit costs, third-party merger and acquisition costs, and other

non-recurring significant items;

- Credits related to the employment of personnel during the

COVID-19 pandemic;

- Income or loss from equity investments;

- Third-party intellectual property litigation costs in

connection with Dexcom’s patent infringement litigation against

Abbott Diabetes Care, Inc.;

- Litigation settlement costs;

- Gain or loss on extinguishment of debt; and

- Adjustments related to taxes for the excluded items above, as

well as excess benefits or tax deficiencies from share-based

compensation, and the quarterly impact of other discrete items

Adjusted EBITDA excludes non-cash operating charges for

share-based compensation, depreciation and amortization as well as

non-operating items such as interest income, interest expense, gain

or loss on extinguishment of debt, income or loss from equity

investments, and income tax expense or benefit. For the reasons

explained above, Adjusted EBITDA also excludes business transition

and other significant items, COVID-19 credits, litigation

settlement costs, and intellectual property litigation costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024954739/en/

INVESTOR RELATIONS CONTACT: Sean Christensen Vice President -

Finance and Investor Relations investor-relations@dexcom.com (858)

203-6657

MEDIA CONTACT: James McIntosh (619) 884-2118

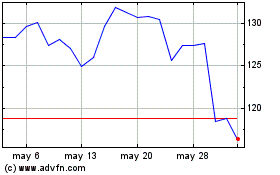

DexCom (NASDAQ:DXCM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

DexCom (NASDAQ:DXCM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024