UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section

14(a) of the Securities

Exchange Act of 1934 (Amendment No.

)

| |

|

|

|

| þ |

Filed by the Registrant |

o |

Filed by a Party other than the Registrant |

| Check the appropriate box: |

| o |

Preliminary Proxy Statement |

| o |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| o |

Definitive Proxy Statement |

| þ |

Definitive Additional Materials |

| o |

Soliciting Material Under Rule 14a-12 |

eBay

Inc.

(Name of Registrant as Specified In

Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| |

|

| Payment of Filing Fee (Check the appropriate box): |

| þ |

No fee required. |

| o |

Fee paid previously with preliminary materials. |

| o |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2024 Investor Presentation June 2024

Disclosures © 2024 eBay. All rights reserved. Confidential and proprietary. This presentation contains non-GAAP measures relating to our performance. You can find the reconciliation of these measures, except for FX-Neutral (“FXN”) basis, to the nearest comparable GAAP measures in the appendix at the end of this presentation. All growth rates represent year-over-year comparisons, except as otherwise noted. For numbers in this presentation provided on an FXN basis, we calculate the year-over-year impact of foreign currency movements using prior period foreign currency rates applied to current year transactional currency amounts excluding hedging activity.

This presentation contains forward-looking statements relating to, among other things, the future performance of eBay Inc. and its consolidated subsidiaries that are based on our current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding the future performance of eBay Inc. and its consolidated subsidiaries, including management’s vision for the future of eBay and our ability to accomplish our vision, the future growth in our business, market opportunities and anticipated growth thereof, the effects and potential of current and contemplated strategic initiatives and offerings, our stockholder engagement activities, our corporate governance and risk oversight activities, our executive compensation priorities and our ability to attract, retain and motivate employees, our environmental, social and governance commitments and priorities, operating efficiency and margins, reinvestments, capital allocation, dividends and share repurchases. Actual results could differ materially from those expressed or implied and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to fluctuations in, and our ability to predict, our results of operations and cash flows; our ability to convert visits into sales for our sellers, attract and retain buyers and execute on our business strategy; our ability to compete in the markets in which we participate; our ability to generate revenue from our foreign operations and expand into international markets; the impact of inflationary pressure, fluctuations in foreign currency exchange rates, increasing interest rates and geopolitical events such as the ongoing wars in Ukraine and in Israel and Gaza, including the related disruptions to international shipping in the Red Sea; our ability to keep pace with rapid technological developments or continue to innovate and create new initiatives to provide new programs, products and services; our ability to operate and continuously develop our payments system and financial services offerings; the impact of evolving domestic and foreign government laws, regulations, rules and standards that affect our company, our business and/or our industry; our reliance on third-party providers; our ability to protect or enforce our intellectual property rights; our ability to deal effectively with fraudulent activities on our platforms; the impact of any security breaches, cyberattacks or system failures and resulting interruptions; our ability to attract, retain and develop highly skilled employees; our ability to accomplish or accurately track our disclosures related to our environmental, social and governance goals; current and potential litigation and regulatory and government inquiries, investigations and disputes involving our company or our industry; our ability to generate sufficient cash flow to service our indebtedness; the impact of evolving sales and other tax regimes in various jurisdictions and anticipated tax liabilities; and the success of our pending or potential acquisitions, dispositions, joint ventures, strategic partnerships and strategic investments.

The forward-looking statements in this presentation do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof.

More information about factors that could affect our operating results is included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, copies of which may be obtained by visiting our Investor Relations website at https://investors.ebayinc.com or the SEC’s website at www.sec.gov. All information in this presentation is as of June 5, 2024. Undue reliance should not be placed on the forward-looking statements in this presentation, which are based on information available to us on the date hereof. We assume no obligation to update such statements.

References in this presentation to our website and additional reports or information contained on our website are for information purposes only and are intended to provide inactive, textual references only. The information on our website, including the information contained in our reports, is not part of this presentation and is not incorporated by reference into this presentation.

Table of Contents © 2024 eBay. All rights reserved. Confidential and proprietary. Business, Strategy and Capital Allocation

Our Purpose & Strategy

Our Scale & Market Opportunity

Recent Performance

Capital Allocation

Board and Corporate Governance Practices

Board Composition, Tenure and Refreshment

Active Risk Oversight

Stockholder Engagement and Commitment to Governance

Executive Compensation

Compensation Program Overview

Compensation Program Metrics and Rationales

Human Capital, DE&I, and Impact

Workforce Culture & Employee Engagement

Diversity, Equity & Inclusion Update

Impact Update

Business, Strategy & Capital Allocation

Our Purpose & Strategy

We Connect People & Build Communities to Create Economic Opportunity for All

Our unique scale, relentless focus on supporting the environment and the communities that we serve, and long track record of success make eBay one of the world’s most trusted and sustainable marketplaces.

Reinventing the Future of Ecommerce for Enthusiasts

We have maintained a world-class leadership team with a vision for the future and uncompromising focus on customer centricity.

Our growth strategy is focused on categories where we’re uniquely positioned to win, prioritizing non-new-in-season inventory, which makes up ~90% of Gross Merchandise Volume.

We are focused on delivering Relevant Experiences for customers across all shopping occasions. Through our Focus Category playbook, we have seen a meaningful improvement in our growth relative to the market in every category we’ve invested in to-date.

Our Scalable Solutions like first-party advertising, payments / financial services offerings, and eBay International Shipping have improved velocity, reduced transactional friction for customers, and generated incremental revenue for eBay.

Our commitment to delivering Magical Innovations for customers is aided by recent advancements in Artificial Intelligence, including Generative AI, allowing us to fundamentally change the customer experience on eBay and drive meaningful efficiency and productivity improvements across our organization.

Focused on Delivering Long-Term, Sustainable Growth

Focus Category GMV grew 4% Y/Y on an FX-neutral (FXN) basis in FY’23 and outpaced the remainder of our marketplace by ~7 points, as our investments in trust, user experience, and marketing are driving higher customer satisfaction (CSAT) rates.

We significantly improved the consumer selling (C2C) experience in Germany in FY’23, which improved C2C seller and buyer Net Promoter Scores (NPS) by double-digits.

We generated over $1.4B of total advertising revenue in FY’23, up 25% Y/Y FXN and more than double our ad revenue in FY’19.

We continued to innovate in financial services, as our investments in the eBay checkout experience and in-house risk modeling have measurably improved conversion on our marketplace and contributed nearly $1B in incremental GMV in 2023.

We launched compelling AI-powered products, such as the first version of our Magical Listing experience for sellers. More recently, we have introduced features like Gen AI background enhancements for listing photos and beta versions of engaging buyer features like Shop the Look / Explore.

Our Scale & Market Opportunity eBay Key Metrics as of FY’23 Note: Active Buyers & Enthusiasts are trailing 12 - month measures as of 12/31/23 , Listings is as of 12/31/23 ; all other figures are FY’23 annuals. TAM estimates are based on 2021 estimates and include Top 3 markets (US, UK, DE). Non - NIS = Non - New - In - Season. Total TAM = NNIS + Branded New - In - Season. * Reconciliations of Non - GAAP measures are included in the Appendix of this presentation. ** Our Top 5 Categories are Motors Parts & Accessories, Electronics, Collectibles, Home & Garden, and Fashion 132M Active Buyers 16M Enthusiasts $1.1T Total TAM $575B Non - NIS TAM $ 10.1 Billion Total Revenue $73.2 Billion GMV ~2B Listings Across 190+ Global Markets 27.4 % Non - GAAP Operating Margin* $4.24 Non - GAAP Earnings per Share* $10B+ of GMV In Each of Our Top 5 Categories**

Recent Performance GMV ( $ B) & Y/Y Growth (FXN ) Revenue ($B) & Y/Y Growth (FXN) In Q1’24, GMV, Revenue, and Non - GAAP EPS came in ahead of our respective guidance ranges . GMV was roughly flat Y/Y on an FXN basis, as macro headwinds were offset by strategic execution. Revenue grew +2% Y/Y FXN, primarily due to first - party advertising revenue growth. Non - GAAP operating margin was 30.3%. Non - GAAP EPS grew +13% Y/Y to $1.25. Non - GAAP EPS & Y/Y Growth* EBAY TSR Performance Since 2019 $1.07 $1.11 $1.03 $1.03 $1.07 $1.25 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 0% 3% 2 % 5% 5% 2.51 2.51 2.54 2.50 2.56 2.56 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 2 % 5% 4% 3% 2% (1)% 18.2 18.4 18.2 18.0 18.6 18.6 Q4 22 Q1 23 Q2 23 Q3 23 Q4 23 Q1 24 (3) % (1)% (1)% 0 % 0 % ( 6 )% Note: GMV = Gross Merchandise Volume under current definition. GMV & Revenue growth shown on an organic FX - neutral basis; EPS sh own as reported. * Reconciliations of Non - GAAP measures are included in the Appendix of this presentation. **TSR = Total Stockholder Return (incl. dividends) cumulative till 6/4/2024. 13%

Thoughtful Capital Allocation Our balanced approach to capital allocation enables us to invest in strategic initiatives and deliver significant returns to stockholders. 5.0 5.1 7.0 3.1 1.4 0.5 0.5 0.4 0.5 0.5 0.5 0.1 2019 2020 2021 2022 2023 Q1 2024 Shares Repurchased Dividends Capital Allocation Tenets Key Investments valued at $5B+ as of 3/31/24 * Preserve financial flexibility to execute on our strategy and drive long - term stockholder value Prioritize investments in organic growth while balancing profitability Evaluate inorganic investments in a disciplined manner alongside organic opportunities using our build / buy / partner framework Optimize our access to debt and cost of capital, and look to return excess capital to stockholders through repurchases and dividends Share Repurchases & Dividends ($B) ~$25B Since 2019 * Investments valuation as of 03/31/2024. Includes: Adevinta $4.2B (pre - Permira & Blackstone deal), Adyen $0.5B, GMarket $0.3B, and other $0.2B JL0

Board & Corporate Governance Practices © 2024 eBay. All rights reserved. Confidential and proprietary.

Highly Qualified & Independent Board of Directors Director Experience & Skill Sets Board Refreshment Process • The Board regularly reviews the skills, professional experience, background, age, and diversity of its members to ensure the Board is positioned to provide effective oversight of the Company's business and strategy. • The Board and each committee perform an annual self - assessment to evaluate effectiveness. • Directors have complementary experiences, backgrounds, and skill sets, which contribute to strong Board dynamics and effective strategic oversight of management, including: 9 of 10 Director Nominees are Independent Product, Marketing & Media Leadership Strategy Transactions/M&A Management Investment/Finance Retail/E - Commerce Technology Industry Government/Public Policy Entrepreneurship Sustainable Practices Financial Expertise

Experienced Board Nominees with Robust Leadership Adriane Brown Managing Partner, Flying Fish Partners Director Since 2017 Chair Comp. & HC Committee E. Carol Hayles Former CFO, CIT Group Inc. Director Since 2020 Chair Audit Committee Mohak Shroff Head of Engineering, LinkedIn Director Since 2020 Paul Pressler Operating Advisor, Clayton, Dubilier & Rice Director Since 2015 Chair of the Board Chair Corp. Gov. & Nom. Committee Logan Green Chair, Co - Founder & former CEO, Lyft Director Since 2016 Shripriya Mahesh General Partner, Spero Ventures Director Since 2023 Perry Traquina Former Chairman & CEO, Wellington Management Company Director Since 2015 Chair Risk Committee Jamie Iannone President & Chief Executive Officer, eBay Director Since 2020 Aparna Chennapragada Corporate VP, Generative AI, Microsoft Corporation Director Since 2022 Zane Rowe Chief Financial Officer, Workday, Inc. Director Since 2024

Board Succession, Refreshment and Diversity • Zane Rowe joined the Board in February 2024, bringing skills and expertise complementary to eBay’s strategic vision, with his extensive experience in corporate finance, investor relations, and strategy. • Two of four committees are chaired by women: Adriane Brown, Compensation & Human Capital Committee; and Carol Hayles , Audit Committee. • The Board has a commitment to refreshment and proactively evaluates opportunities to diversify its membership. Our directors have an average tenure of 4.8 years. Recent Board Updates Current Board Tenure and Diversity 30% 40% 30% <50 years 50-64 years 65+ years 30% 30% 40% 0-2 years 3-5 years 6+ years 40% are women 40% identify as an underrepresented minority 50% of Committee Chairs are women 60% added since 2020 55 average age

Active Risk Oversight Management is responsible for the day - to - day management of the risks that we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. • Responsible for the risk management framework and ensuring the supporting processes as implemented by management are adequate and functioning as designed • Direct oversight of major risks, including management succession planning, strategic and competitive, operational planning and execution, and key enterprise risks • Determines risk oversight responsibilities of its committees Full Board Risk Committee Audit Committee Compensation & Human Capital Committee CG&N Committee • Assists the Board in its oversight of the Enterprise Risk Management program for key risks such as cybersecurity, data management, and applicable regulatory compliance (including privacy, anti - money laundering, and foreign assets control) • Oversight of financial risks, including tax, credit, market, liquidity, and investment policy risk • Oversight of ethics and compliance program and responsibility for review of related party transactions • Promotes appropriate level of risk taking by management through the design and administration of our compensation programs • Oversight of management’s global compensation and employee retention strategies • Oversight of human capital management strategy and practices • Oversight of the composition and size of the Board and Board committees, as well as member qualifications and independence • Oversight of eBay sustainability initiatives, including eBay Impact

Separate Chair and CEO roles Independent Chair with robust responsibilities Simple majority vote standard for bylaw/charter amendments and transactions Clawback policy Stock ownership requirements for our executive officers and directors Anti - hedging and anti - pledging policies Strong Board independence (9 of 10 director nominees are independent) Annually elected Board with all members standing for election each year Majority vote standard for uncontested director elections with a director resignation policy Stockholder right to request eBay to call a special meeting Proxy access bylaws Strong stockholder engagement practices Stockholder Engagement and Commitment to Governance • We maintain a robust dialogue with stockholders and routinely engage with stockholders to seek feedback, which is thoughtfull y c onsidered and in recent years has led management and our Board to make modifications to our governance, executive compensation, and disclosure practices. • Since January 2023, we have offered to meet on sustainability, governance, compensation, capital allocation, and other matter s w ith approximately 53 investors representing approximately 68% of our outstanding shares, which resulted in approximately 18 conference calls with investors rep resenting more than 36% of our outstanding shares. • We are committed to being responsive to stockholders to promote strong governance and compensation practices.

Executive Compensation © 2024 eBay. All rights reserved. Confidential and proprietary.

Compensation Program Aligned with Business Goals & Culture Our compensation program is heavily performance and equity - based and aligns management with stockholders. *Performance - based restricted stock unit awards (PBRSUs) and performance - based stock option awards (PBSOs) Limited perquisites to executive officers Emphasize pay - for - performance Majority of compensation is performance - based Multiple performance measures, caps on incentive payments, and overlapping long - term performance periods for PBRSUs* and PBSOs* Meaningful stock ownership requirements for executive officers Maintain a robust clawback policy Engage an independent compensation consultant Prohibit hedging and pledging by executive officers and directors …the goals of our executive pay program Align compensation with our business objectives, performance, and stockholder interests Motivate executive officers to enhance short - term results and long - term stockholder value Position us competitively among the companies against which we recruit and compete for talent Enable us to attract, reward, and retain executive officers and other key employees who contribute to our long - term success 1 2 3 4 Pay practices align with and support…

Performance - Based Compensation Program Drives Long - Term Stockholder Returns Rigorous Goal and Target Setting Process • In the first quarter of the year, the Compensation and Human Capital Committee approves Company performance measures based on business criteria and target levels of performance for the annual bonus program ( eIP ), performance - based restricted stock unit awards (PBRSUs), and performance - based stock option awards (PBSOs). • For eIP and PBRSUs, targets are set based primarily on the Company’s Board - approved budget for the year. For PBSOs granted in 2023, targets were set based on achievable goals with strong management performance that delivers on our Payments and Ads Revenue G oal s. • For 2023, we selected financial metrics and targets that the Compensation and Human Capital Committee believes incentivize ou r management team to achieve our strategic objectives and drive eBay’s financial performance and long - term stock performance. • 2023 financial metrics included FX - neutral revenue, non - GAAP operating margin dollars, return on invested capital, non - GAAP net income, relative total shareholder return (S&P 500), and revenue from Payments and Advertising. EJ0

Performance - Based Compensation Program Drives Long - Term Stockholder Returns Base Salary Long - term Equity Incentives PBSOs (20%) PBRSUs (40%) RSUs (40%) Reflects the scope of executives’ roles and responsibilities and compensates for expected day - to - day performance Aligns executive compensation with annual Company and individual performance, and motivates executives to enhance annual results Incentivize management to drive revenue growth in Payments & Advertising, in line with our strategic initiatives Promote retention since executives must remain with eBay to participate in equity value Hold executives accountable for the long - term performance, and a three - year rTSR modifier focuses the executive on stock performance Performance - based incentives hold executives accountable for achieving performance targets PBRSU and PBSO Timeline Three - year performance period; annual assessment of progress with time - based vesting over 3 years 2023 - 2025 Performance - Based RSUs 2023 - 2025 Performance - Based Stock Options Three, one - year financial performance periods with a three - year rTSR modifier; 100% PBRSU vesting March 15, 2026 Annual Cash Incentive 2023 Executive Compensation Program Components 2023 2024 2025 2026

Annual & Long - Term Plan Metrics Correlated to Sustained Performance and Support our Long - Term Strategy Annual cash incentive, PBRSU and PBSO awards are determined based on metrics that correlate with financial performance over one and multi - year performance periods PBSOs PBRSUs Annual Cash Incentive ( eIP ) Performance Metrics Rationale Company portion is paid based on Non - GAAP Net Income, which is the most widely followed measure of financial performance Non - GAAP Net Income Differentiate compensation based on individual performance, including ESG and DE&I goals Individual Performance FX - neutral revenue and Non - GAAP net income thresholds must be met before eIP is earned Threshold Recognizes that improved customer satisfaction is expected to lead to revenue growth; only paid if Non - GAAP net income is above target Customer satisfaction Kicker (5/10% multiplier on company component) Key drivers of our long - term success and stockholder value, and directly affected by management decisions FX - Neutral Revenue & Non - GAAP Operating Margin Dollars Evaluates performance against S&P 500 and aligns interest with stockholders in creating long - term value Relative TSR modifier (+/ - 15%) Aligns financial metrics with management's annual financial planning & the constantly changing internet retail segment; aligns rTSR performance with three - year performance period Performance Period Incentivizes profitable growth and efficient use of capital ROIC modifier (+/ - 15%) Key drivers of our growth with significant upside for the business; incentivizes management in line with our strategic initiatives Payments and Advertising Revenue Performance Period Incentivizes management to realize growth opportunities in payments and ads over 3 - year performance period Performance Metrics Rationale Performance Metrics Rationale

Human Capital Diversity, Equity & Inclusion & Impact © 2024 eBay. All rights reserved. Confidential and proprietary.

Focus on Workforce Culture Includes Board Oversight Culture & Employee Engagement CEO, Management, and the Board are intently focused on building a culture of leadership, development, and excellence at eBay. • eBay’s practice of CEO and senior leader engagement with employees continues, with frequent All - Hands meetings. • Continual learning sessions with initiative and business leaders. • Revamped executive leadership program and executive coaching to support leadership pipeline. • Continued to invest in programs supporting employee learning at scale, supporting teams to collaborate and work effectively, and continued mentorship circles. • Ongoing “Leading with Integrity” program to all Directors+ that ensures teams are discussing ethics topics each quarter. • Strong culture of 360 feedback, professional development with opportunities for stretch assignments, leader and instructor - led training, and self - directed learning. • Robust succession planning at most senior level. • Oversight of key development programs, such as People program accomplishment review, as well as Ethics programs. • Annual human capital management review with Chief People Officer and increasing cadence of engagement by Compensation and Human Capital Committee. • Participation in company - wide events for cultural moments, including International Women’s Day. Board Connection Learning & Development Management Accessibility & Engagement

Diversity, Equity & Inclusion is Strategic and Comprehensive Be for Everyone We remain committed to becoming a richly diverse, truly equitable, and fearlessly inclusive place to work, grow, buy, and sel l. • Published our eighth Global Diversity, Equity & Inclusion report. As of December 31, 2023, women comprise 42% of our global workforce and underrepresented minorities (Black, Hispanic/Latinx, Other) comprise 16% of our U.S. workforce. • We continue to make progress towards our four strategic DE&I objectives; increase representation, cultivate a sense of belonging, engage our communities and allies, and build inclusive technology. • Business Unit specific DE&I strategic plans continue to evolve based changes to business drivers and macro environment factors. • We continue to focus on diversifying leadership roles from a gender perspective globally and racial/ethnic diversity in the United State. Between 2020 and end of 2023, we've delivered a 5% increase in women Directors and above and a 2% increase in racial/ethnic Directors and above. • We continue to deliver and enhance core infrastructure to deliver self - service as well as immersive educational experiences, globally. • We launched our first ever Self - Identification (Self - ID) program that allows our employees to own their identities in more depth, which helps us create a more inclusive environment for everyone. • Continued growth in participation and velocity of events hosted by our Communities of Inclusion, which are the cornerstone of our DE&I efforts. • Expanded external partnerships globally to widen candidate pipeline and to aid in talent retention. On - going investing in communities, organizations, and partnerships to drive more inclusive entrepreneurship. • We are committed to pay parity and completed a global study of our gender pay equity for the eighth consecutive year, reviewing the total compensation of women and men, including salary, bonus, and annual stock award value, in the same job in the same location, as of April 1, 2024. • U.S.: Women earn 100.5% of what men earn in terms of total compensation. • Global: Women earn 100.3% of what men earn in terms of total compensation. • To maintain results, we provide regular training sessions for recruiters and senior leaders. We also share data - driven insights to those recruiters and leaders to guide compensation decisions and reviews for new hires, transfers, and promoted employees. Gender Pay Equity Diversity, Equity & Inclusion

Impact Update • Guided by the Chief Sustainability Officer and eBay’s Impact team, ESG is integrated into our business, with oversight from t he Corporate Governance and Nominating Committee of the Board. • The Impact team works across the organization to help our business groups and functions prioritize ESG as part of the Company ’s strategy. • We maintain a cross - functional and global ESG Council of senior leaders to further integrate sustainability into our business, s ponsored by our CEO. In 2019, we set our second iteration of eBay Impact goals that align with how eBay does business ( see ebayinc.com/impact ). Our targets consider and help advance the UN Sustainable Development Goals. Impact Team Governance Awards & Recognition Economic Empowerment Goal progress through 2023 : 78%

Impact Update Sustainable Commerce Trusted Marketplace blocked or removed item listings prohibited under our Animal and Wildlife Products Policy active intellectual property rights owners registered through eBay’s Verified Rights Owner Program Culture & Workforce Our Responsible AI principles of Accountability, Fairness, Transparency, Privacy, Reliability, Safety, and Security help to ensure eBay remains a responsible steward of this emerging technology

Appendix © 2024 eBay. All rights reserved. Confidential and proprietary.

Reconciliation of FY 2023 Non - GAAP Operating Margin

Reconciliation of FY 2023 Non - GAAP Net Income / EPS

Reconciliation of Q1 2024 Non - GAAP Operating Margin

Quarterly Reconciliation of Non - GAAP Net Income / EPS

Quarterly Reconciliation of Organic FX - Neutral Revenue

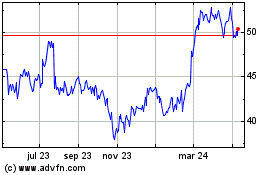

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

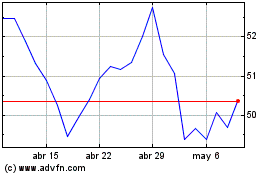

De May 2024 a Jun 2024

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024