0001065088False00010650882024-07-312024-07-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

eBay Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | |

| Delaware | 001-37713 | 77-0430924 |

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer |

| of incorporation) | | Identification No.) |

2025 Hamilton Avenue

San Jose, California 95125

(Address of principal executive offices)

(408) 376-7108

(Registrant's telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of exchange on which registered |

| Common stock | EBAY | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The information in this report, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not to be incorporated by reference into any filing by eBay Inc. (the “Company”, the "company" or “eBay”), under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language contained in such filing, unless otherwise expressly stated in such filing.

Item 2.02. Results of Operations and Financial Condition.

On July 31, 2024, the company announced its financial results for the quarter ended June 30, 2024. A copy of the company's press release announcing its financial results and certain other information is attached as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this report:

| | | | | |

| 99.1 | Press release dated July 31, 2024 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

INDEX TO EXHIBITS | | | | | |

| Exhibit Number | Description |

| Press release dated July 31, 2024 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | eBay Inc. |

| | (Registrant) |

| | |

| Date: July 31, 2024 | /s/ Molly Finn |

| Name: Molly Finn |

| | Title: Vice President & Deputy General Counsel, Corporate & Assistant Secretary |

| | |

| | |

Exhibit 99.1

eBay Inc. Reports Second Quarter 2024 Results

•Revenue of $2.6 billion, up 1% on an as-reported basis and up 2% on an FX-Neutral basis

•Gross Merchandise Volume of $18.4 billion, up 1% on an as-reported and FX-Neutral basis

•GAAP and Non-GAAP earnings per diluted share of $0.45 and $1.18, respectively

•GAAP and Non-GAAP operating margin of 21.3% and 27.9%, respectively

•Returned $1.1 billion to stockholders in Q2, including $1.0 billion of share repurchases and $135 million paid in cash dividends

San Jose, California, July 31, 2024 – eBay Inc. (Nasdaq: EBAY), a global commerce leader that connects millions of buyers and sellers around the world, today reported financial results for its second quarter ended June 30, 2024.

“eBay’s strong Q2 results mark another step toward achieving sustainable, long-term growth,” said Jamie Iannone, Chief Executive Officer at eBay. “The continued momentum in Focus Categories contributed to our increase in GMV, while new AI capabilities are driving innovation across the platform and transforming the experience for eBay customers around the world.”

“Q2 was another strong quarter for eBay as we exceeded expectations across our key financial metrics,” said Steve Priest, Chief Financial Officer at eBay. “We achieved positive year-over-year GMV growth, driven by our execution against strategic initiatives, despite an uneven discretionary demand environment in our major markets.”

Second Quarter Financial Highlights

•Revenue was $2.6 billion, up 1% on an as-reported basis and up 2% on a foreign exchange (FX) neutral basis.

•Gross Merchandise Volume (GMV) was $18.4 billion, up 1% on an as-reported and FX-Neutral basis.

•GAAP net income from continuing operations was $226 million, or $0.45 per diluted share.

•Non-GAAP net income from continuing operations was $602 million, or $1.18 per diluted share.

•GAAP and Non-GAAP operating margin was 21.3% and 27.9%, respectively.

•Generated $367 million of operating cash flow and $278 million of free cash flow.

•We completed the previously announced sale of Adevinta shares in exchange for $2.4 billion in cash and shares of a newly privatized entity, Aurelia, which are valued at $1.9 billion at the closing of the transactions.

•Returned $1.1 billion to stockholders, including $1.0 billion of share repurchases and $135 million paid in cash dividends.

Business Highlights

•eBay closed a series of transactions with Collectors, including the acquisition of Goldin from Collectors, the sale of the eBay vault, and a commercial agreement for more streamlined grading, storage and selling experiences.

•eBay enabled Venmo as an additional payment method during the quarter. Known for its popularity among Gen Z and Millennials, Venmo gives eBay buyers in the U.S. even more choice and flexibility during the checkout experience.

•The company expanded its eBay Refurbished program to include refurbished golf clubs, bringing warranties and hassle-free returns to thousands of previously owned clubs from the world's top brands.

•In June, the company announced a sustainability collaboration with Seagate, a global leader in data storage solutions. Seagate’s official storefront on eBay now offers direct sales of factory recertified hard drives, which can eliminate a significant amount of e-waste by extending the lifecycles of these products.

•The company launched a number of innovative product features to simplify and enhance the buying and selling experience for customers. In the U.S. and U.K., eBay introduced Shop the look, a generative-AI powered discovery feature for fashion buyers. The company also launched its AI-powered background enhancement tool to 100% of iOS and Android users in the U.S., U.K. and Germany, enabling even more sellers to apply a variety of backgrounds to their listing images.

•The company introduced improved selling and buying experiences for pre-owned apparel in the U.K. For sellers, these changes included a new selling flow that makes it considerably easier to list on eBay, with image guidance, simpler item aspect collection, and a streamlined shipping module. For buyers, we introduced new Generative AI-powered features, like Shop the look and Explore, which offer more inspirational shopping experiences for fashion enthusiasts.

•eBay and Certilogo launched a new ‘click-to-resell’ feature, making it easier for sellers to list pre-owned clothing on eBay and verify authenticity through Certilogo’s AI-based system. Italian outerwear brand Save The Duck is the first to pilot the new feature.

•eBay’s consignment service expanded in the U.S. to include luxury watches, footwear and fine jewelry. In partnership with Linda's Stuff, this service gives casual sellers the opportunity to leverage experts to list and sell luxury items on their behalf.

•The company partnered with Condé Nast to spotlight pre-loved apparel at some of fashion’s biggest moments like the Met Gala and Vogue World in Paris.

•eBay became an Official Partner of the McLaren Formula 1 Team, enabling both brands to reach new audiences through unique storytelling opportunities with their respective fans and customers. As part of the multi-year collaboration, eBay branding is being featured on the race cars of drivers Lando Norris and Oscar Piastri for four races across the 2024 season: the Miami, British, United States and Las Vegas Grands Prix.

Impact

•In May, eBay released its 2023 Impact Report showcasing how the company has leveraged its global marketplace to create economic opportunities, promote sustainable commerce, and foster a diverse and inclusive workforce.

•eBay also published its latest Recommerce Report highlighting the many benefits of shopping pre-loved items.

•eBay launched "Rocket Man Resale," a partnership with Elton John, who released a personal collection of pre-loved fashion items exclusively on eBay through auctions and fixed-priced listings. The partnership included a pop-up shop in the West Village of New York City. All proceeds benefited the Elton John AIDS Foundation.

•During the quarter, eBay Foundation granted nearly $7 million to strategic nonprofit partners across the U.S., which are addressing and removing barriers to entrepreneurship for people who identify with historically excluded groups.

•eBay for Charity contributed more than $47 million globally in Q2, up 22% year-over-year.

Second Quarter 2024 Financial Highlights (presented in millions, except per share data and percentages) | | | | | | | | | | | | | | | | | | |

| Second Quarter | | | | | |

| 2024 | 2023 | Change | | | |

| eBay Inc. | | | | | | | | |

| | | | | | | | |

| Net revenues | $ | 2,572 | | $ | 2,540 | | $ | 32 | | 1 | % | | | | |

| GAAP – Continuing Operations | | | | | | | | |

Net income | $ | 226 | | $ | 172 | | $ | 54 | | 31 | % | | | | |

Earnings per diluted share | $ | 0.45 | | $ | 0.32 | | $ | 0.13 | | 39 | % | | | | |

| Non-GAAP – Continuing Operations | | | | | | | | |

| Net income | $ | 602 | | $ | 555 | | $ | 47 | | 8 | % | | | | |

| Earnings per diluted share | $ | 1.18 | | $ | 1.03 | | $ | 0.15 | | 15 | % | | | | |

| | | | | | | | |

Other Selected Financial and Operational Results

•Operating margin – GAAP operating margin increased to 21.3% for the second quarter of 2024, compared to 20.4% for the same period last year. Non-GAAP operating margin increased to 27.9% for the second quarter of 2024, compared to 26.9% for the same period last year.

•Taxes – The GAAP effective tax rate for continuing operations for the second quarter of 2024 was 31.1%, compared to 39.7% for the second quarter of 2023. The non-GAAP effective tax rate for continuing operations for the second quarter of 2024 was 16.5%(1).

•Cash flow – The company generated $367 million of operating cash flow and $278 million of free cash flow during the second quarter of 2024.

•Capital returns – The company repurchased $1.0 billion of its common stock, or approximately 19 million shares, in the second quarter of 2024. The company's total repurchase authorization remaining as of June 30, 2024 was approximately $1.9 billion. The company also paid cash dividends of $135 million during the second quarter of 2024.

•Cash and cash equivalents and non-equity investments – The company's cash and cash equivalents and non-equity investments portfolio totaled $6.3 billion as of June 30, 2024.

Business Outlook

eBay is providing the following guidance for the third quarter 2024.

| | | | | | | | | | | |

| In billions, except per share data and percentages | Q3 2024 Guidance | | | | | |

| Revenue | $2.50 - $2.56 | | | | | | |

| FX-Neutral Y/Y Growth | 1% - 3% | | | | | | |

| | | | | | | |

| Diluted GAAP EPS | $0.82 - $0.87 | | | | | | |

| | | | | | | |

| Diluted Non-GAAP EPS | $1.15 - $1.20 | | | | | | |

Dividend Declaration

•eBay's Board of Directors has declared a cash dividend of $0.27 per share of the company's common stock. The dividend is payable on September 13, 2024 to stockholders of record as of August 30, 2024.

(1) We use a non-GAAP effective tax rate for evaluating our operating results. Based on our current long-term projections, we are using a non-GAAP tax rate of 16.5%. This non-GAAP tax rate could change for various reasons including significant changes in our geographic earnings mix or fundamental tax law changes in major jurisdictions in which we operate.

Quarterly Conference Call and Webcast

eBay Inc. will host a conference call to discuss second quarter 2024 results at 2:30 p.m. Pacific Time today. Investors and participants can access the call by dialing (855) 761-5600 in the U.S. and (646) 307-1097 internationally. The passcode for the conference line is 7435074. A live webcast of the conference call, together with a slide presentation that includes supplemental financial information and reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, can be accessed through the company's Investor Relations website at https://investors.ebayinc.com. In addition, an archive of the webcast will be accessible for at least three months through the same link.

eBay Inc. uses its Investor Relations website at https://investors.ebayinc.com as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor this website, in addition to following our press releases, SEC filings, public conference calls and webcasts.

About eBay

eBay Inc. (Nasdaq: EBAY) is a global commerce leader that connects people and builds communities to create economic opportunity for all. Our technology empowers millions of buyers and sellers in more than 190 markets around the world, providing everyone the opportunity to grow and thrive. Founded in 1995 in San Jose, California, eBay is one of the world's largest and most vibrant marketplaces for discovering great value and unique selection. In 2023, eBay enabled more than $73 billion of gross merchandise volume. For more information about the company and its global portfolio of online brands, visit www.ebayinc.com.

Presentation

All growth rates represent year-over-year comparisons, except as otherwise noted. All amounts in tables are presented in U.S. dollars, rounded to the nearest million, except as otherwise noted. As a result, certain amounts may not sum or recalculate using the rounded dollar amounts provided. References to “revenue” refer to “net revenues” as reported in the company’s consolidated statement of income.

Non-GAAP Financial Measures

This press release includes the following financial measures defined as “non-GAAP financial measures” by the Securities and Exchange Commission (SEC): non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating income and margin, non-GAAP effective tax rate, free cash flow and FX-Neutral basis. These non-GAAP financial measures are presented on a continuing operations basis. These measures may be different from non-GAAP financial measures used by other companies. The presentation of this financial information, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation of, or as a substitute for, the financial information prepared and presented in accordance with generally accepted accounting principles (GAAP). For a reconciliation of these non-GAAP financial measures, except for figures in this press release presented on an “FX-Neutral basis,” to the nearest comparable GAAP measures, see “Business Outlook,” “Non-GAAP Measures of Financial Performance,” “Reconciliation of GAAP Operating Income to Non-GAAP Operating Income,” “Reconciliation of GAAP Net Income to Non-GAAP Net Income and Reconciliation of GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate” and “Reconciliation of Operating Cash Flow to Free Cash Flow” included in this press release. For figures in this press release reported “on an FX-Neutral basis,” we calculate the year-over-year impact of foreign currency movements using prior period foreign currency rates, excluding hedging activity, applied to current year transactional currency amounts.

Forward-Looking Statements

This press release contains forward-looking statements relating to, among other things, the future performance of eBay Inc. and its consolidated subsidiaries that are based on the company's current expectations, forecasts and assumptions and involve risks and uncertainties. These statements include, but are not limited to, statements regarding the future performance of eBay Inc. and its consolidated subsidiaries, including management's vision for the future of eBay and our ability to accomplish our vision, expected financial results for the third quarter and full year 2024 and the future growth in our business, the effects and potential of current and contemplated strategic initiatives and offerings including with respect to artificial intelligence and partnership with other companies, the effects of new product features or programs, the effects of geopolitical events, foreign currency volatility, and inflationary pressure on our business and operations and our ability to respond to such effects, operating efficiency and margins, reinvestments, dividends and share repurchases. Actual results could differ materially from those expressed or implied and reported results should not be considered as an indication of future performance. Factors that could cause or contribute to such differences include, but are not limited to: fluctuations in, and our ability to predict, our results of operations and cash flows; our ability to convert visits into sales for our sellers, attract and retain sellers and buyers and execute on our business strategy; our ability to compete in the markets in which we participate; our ability to generate revenue from our foreign operations and expand in international markets; the impact of inflationary pressure, fluctuations in foreign currency exchange rates, changing interest rates and geopolitical events such as the ongoing wars in Ukraine and in Israel and Gaza, including the related disruptions to international shipping in the Red Sea; our ability to keep pace with rapid technological developments or continue to innovate and create new initiatives to provide new programs, products and services; our ability to operate and continuously

develop our payments system and financial services offerings; the impact of evolving domestic and foreign government laws, regulations, rules and standards that affect us, our business and/or our industry; our reliance on third-party providers; our ability to protect or enforce our intellectual property rights; our ability to deal effectively with fraudulent activities on our platforms; the impact of any security breaches, cyberattacks or system failures and resulting interruptions; our ability to attract, retain and develop highly skilled employees; our ability to accomplish or accurately track and report results related to our environmental, social and governance goals; current and potential litigation and regulatory and government inquiries, investigations and disputes involving us or our industry; our ability to generate sufficient cash flow to service our indebtedness; the impact of evolving sales and other tax regimes in various jurisdictions and anticipated tax liabilities; and the success of our pending or potential acquisitions, dispositions, joint ventures, strategic partnerships and strategic investments.

The forward-looking statements in this release do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof.

More information about factors that could affect the company's operating results is included under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, copies of which may be obtained by visiting the company's Investor Relations website at https://investors.ebayinc.com or the SEC's website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to the company on the date hereof. The company assumes no obligation to update such statements.

| | | | | | | | |

| | |

| Investor Relations Contact: | John Egbert | ir@ebay.com |

| Media Relations Contact: | Karly Tokioka | press@ebay.com |

| Company News: | https://www.ebayinc.com/stories/news/ | |

| Investor Relations website: | https://investors.ebayinc.com | |

eBay Inc.

Unaudited Condensed Consolidated Balance Sheet

| | | | | | | | | | | |

| | June 30,

2024 | | December 31,

2023 |

| | (In millions) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,963 | | | $ | 1,985 | |

| Short-term investments | 3,203 | | | 2,533 | |

| Equity investment in Adevinta | — | | | 4,474 | |

| Customer accounts and funds receivable | 1,071 | | | 1,013 | |

| Other current assets | 1,032 | | | 1,011 | |

| | | |

| | | |

| Total current assets | 7,269 | | | 11,016 | |

| Long-term investments | 1,722 | | | 1,129 | |

Equity investment in Aurelia | 1,910 | | | — | |

| Property and equipment, net | 1,285 | | | 1,243 | |

| Goodwill | 4,285 | | | 4,267 | |

| Operating lease right-of-use assets | 439 | | | 493 | |

| Deferred tax assets | 3,011 | | | 3,089 | |

| | | |

| | | |

| Other assets | 457 | | | 383 | |

| | | |

| | | |

| Total assets | $ | 20,378 | | | $ | 21,620 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Short-term debt | $ | 1,551 | | | $ | 750 | |

| Accounts payable | 319 | | | 267 | |

| Customer accounts and funds payable | 1,113 | | | 1,054 | |

| Accrued expenses and other current liabilities | 2,004 | | | 2,196 | |

| Income taxes payable | 812 | | | 253 | |

| | | |

| | | |

| Total current liabilities | 5,799 | | | 4,520 | |

| Operating lease liabilities | 332 | | | 387 | |

| Deferred tax liabilities | 1,814 | | | 2,408 | |

| Long-term debt | 6,174 | | | 6,973 | |

| Other liabilities | 734 | | | 936 | |

| | | |

| | | |

| Total liabilities | 14,853 | | | 15,224 | |

| Total stockholders' equity | 5,525 | | | 6,396 | |

| Total liabilities and stockholders' equity | $ | 20,378 | | | $ | 21,620 | |

eBay Inc.

Unaudited Condensed Consolidated Statement of Income

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In millions, except per share amounts) |

| Net revenues | $ | 2,572 | | | $ | 2,540 | | | $ | 5,128 | | | $ | 5,050 | |

Cost of net revenues (1) | 735 | | | 718 | | | 1,435 | | | 1,418 | |

| Gross profit | 1,837 | | | 1,822 | | | 3,693 | | | 3,632 | |

| Operating expenses: | | | | | | | |

Sales and marketing (1) | 577 | | | 566 | | | 1,118 | | | 1,077 | |

Product development (1) | 379 | | | 392 | | | 730 | | | 744 | |

General and administrative (1) | 241 | | | 251 | | | 479 | | | 548 | |

| Provision for transaction losses | 86 | | | 90 | | | 177 | | | 174 | |

| Amortization of acquired intangible assets | 5 | | | 5 | | | 9 | | | 13 | |

| Total operating expenses | 1,288 | | | 1,304 | | | 2,513 | | | 2,556 | |

| Income from operations | 549 | | | 518 | | | 1,180 | | | 1,076 | |

Interest and other: | | | | | | | |

Loss on equity investments and warrant, net | (222) | | | (214) | | | (319) | | | (16) | |

Interest expense | (65) | | | (65) | | | (131) | | | (133) | |

Interest income and other, net | 66 | | | 46 | | | 134 | | | 88 | |

Income from continuing operations before income taxes | 328 | | | 285 | | | 864 | | | 1,015 | |

Income tax provision | (102) | | | (113) | | | (199) | | | (274) | |

Income from continuing operations | 226 | | | 172 | | | 665 | | | 741 | |

Loss from discontinued operations, net of income taxes | (2) | | | (1) | | | (3) | | | (3) | |

Net income | $ | 224 | | | $ | 171 | | | $ | 662 | | | $ | 738 | |

| | | | | | | |

| | | | | | | |

Income per share – basic: | | | | | | | |

| Continuing operations | $ | 0.45 | | | $ | 0.32 | | | $ | 1.31 | | | $ | 1.38 | |

| Discontinued operations | — | | | — | | | (0.01) | | | (0.01) | |

Net income per share – basic | $ | 0.45 | | | $ | 0.32 | | | $ | 1.30 | | | $ | 1.37 | |

| | | | | | | |

Income per share – diluted: | | | | | | | |

| Continuing operations | $ | 0.45 | | | $ | 0.32 | | | $ | 1.30 | | | $ | 1.37 | |

| Discontinued operations | — | | | — | | | (0.01) | | | (0.01) | |

Net income per share – diluted | $ | 0.45 | | | $ | 0.32 | | | $ | 1.29 | | | $ | 1.36 | |

| | | | | | | |

| Weighted average shares: | | | | | | | |

| Basic | 503 | | | 534 | | | 509 | | | 536 | |

| Diluted | 507 | | | 537 | | | 513 | | | 539 | |

| | | | | | | |

| (1) Includes stock-based compensation as follows: | | | | | | | |

| Cost of net revenues | $ | 14 | | | $ | 14 | | | $ | 27 | | | $ | 27 | |

| Sales and marketing | 25 | | | 25 | | | 48 | | | 45 | |

| Product development | 77 | | | 74 | | | 141 | | | 133 | |

| General and administrative | 38 | | | 41 | | | 84 | | | 77 | |

| $ | 154 | | | $ | 154 | | | $ | 300 | | | $ | 282 | |

eBay Inc.

Unaudited Condensed Consolidated Statement of Cash Flows | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In millions) |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 224 | | | $ | 171 | | | $ | 662 | | | $ | 738 | |

| Loss from discontinued operations, net of income taxes | 2 | | | 1 | | | 3 | | | 3 | |

| Adjustments: | | | | | | | |

| Provision for transaction losses | 86 | | | 90 | | | 177 | | | 174 | |

| Depreciation and amortization | 77 | | | 101 | | | 153 | | | 208 | |

| Stock-based compensation | 154 | | | 154 | | | 300 | | | 282 | |

| | | | | | | |

| | | | | | | |

Loss on investments and other, net | 132 | | | 34 | | | 138 | | | 44 | |

| Deferred income taxes | (563) | | | (111) | | | (523) | | | (78) | |

| Change in fair value of warrant | 174 | | | (31) | | | 25 | | | (69) | |

| Change in fair value of equity investment in Adevinta | (84) | | | 210 | | | 156 | | | 36 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Changes in assets and liabilities, net of acquisition effects | 165 | | | (14) | | | (109) | | | 108 | |

| Net cash provided by continuing operating activities | 367 | | | 605 | | | 982 | | | 1,446 | |

| Net cash used in discontinued operating activities | — | | | (4) | | | — | | | (4) | |

| Net cash provided by operating activities | 367 | | | 601 | | | 982 | | | 1,442 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property and equipment | (89) | | | (113) | | | (232) | | | (245) | |

| Purchases of investments | (4,601) | | | (4,144) | | | (7,913) | | | (7,687) | |

Maturities of investments | 2,996 | | | 3,978 | | | 6,699 | | | 8,382 | |

| Proceeds from sale of shares in Adevinta | 2,417 | | | — | | | 2,417 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | (71) | | | 2 | | | (69) | | | (26) | |

| | | | | | | |

| | | | | | | |

Net cash provided (used in) by investing activities | 652 | | | (277) | | | 902 | | | 424 | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds from issuance of common stock | 55 | | | 48 | | | 55 | | | 48 | |

| Repurchases of common stock | (1,030) | | | (250) | | | (1,483) | | | (492) | |

| Payments for taxes related to net share settlements of restricted stock units and awards | (45) | | | (68) | | | (96) | | | (160) | |

| Payments for dividends | (135) | | | (133) | | | (274) | | | (267) | |

| | | | | | | |

| Repayment of debt | — | | | — | | | — | | | (1,150) | |

| | | | | | | |

| | | | | | | |

| Net funds receivable and payable activity | 35 | | | 333 | | | 7 | | | 563 | |

| Other | 1 | | | — | | | (14) | | | — | |

| | | | | | | |

| | | | | | | |

| Net cash used in financing activities | (1,119) | | | (70) | | | (1,805) | | | (1,458) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (6) | | | (11) | | | (17) | | | (6) | |

| | | | | | | |

Net increase (decrease) in cash, cash equivalents and restricted cash | (106) | | | 243 | | | 62 | | | 402 | |

| Cash, cash equivalents and restricted cash at beginning of period | 2,661 | | | 2,431 | | | 2,493 | | | 2,272 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 2,555 | | | $ | 2,674 | | | $ | 2,555 | | | $ | 2,674 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

eBay Inc.

Unaudited Summary of Consolidated Net Revenues

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| (In millions, except percentages) |

Total net revenues (1)(2) | $ | 2,572 | | | $ | 2,556 | | | $ | 2,562 | | | $ | 2,500 | | | $ | 2,540 | |

| Current quarter vs prior year quarter | 1 | % | | 2 | % | | 2 | % | | 5 | % | | 5 | % |

| Percent from international | 50 | % | | 49 | % | | 50 | % | | 50 | % | | 50 | % |

| | | | | | | | | |

| (1) Hedge gain/(loss) | $ | (10) | | | $ | (10) | | | $ | 11 | | | $ | 2 | | | $ | 14 | |

| (2) Foreign currency impact | $ | (11) | | | $ | 14 | | | $ | 63 | | | $ | 43 | | | $ | (9) | |

eBay Inc.

Unaudited Supplemental Operating Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| (In millions, except percentages) |

Active Buyers (1) | 132 | | | 132 | | | 132 | | | 132 | | | 132 | |

| Current quarter vs prior year quarter | 0 | % | | (1) | % | | (2) | % | | (3) | % | | (4) | % |

Active Buyers excluding GittiGidiyor, TCGplayer and Goldin (2) | 131 | | | 131 | | | 131 | | | 131 | | | 131 | |

| Current quarter vs prior year quarter | 0 | % | | 0 | % | | (1) | % | | (1) | % | | (3) | % |

| | | | | | | | | |

Gross Merchandise Volume (3) | | | | | | | | | |

| U.S. | $ | 8,798 | | | $ | 8,974 | | | $ | 8,891 | | | $ | 8,638 | | | $ | 8,702 | |

| Current quarter vs prior year quarter | 1 | % | | 0 | % | | 0 | % | | (1) | % | | (3) | % |

| International | $ | 9,620 | | | $ | 9,649 | | | $ | 9,700 | | | $ | 9,353 | | | $ | 9,512 | |

| Current quarter vs prior year quarter | 1 | % | | 3 | % | | 4 | % | | 4 | % | | (1) | % |

| Total Gross Merchandise Volume | $ | 18,418 | | | $ | 18,623 | | | $ | 18,591 | | | $ | 17,991 | | | $ | 18,214 | |

| Current quarter vs prior year quarter | 1 | % | | 1 | % | | 2 | % | | 2 | % | | (2) | % |

(1)Active Buyers consist of all buyers who paid for a transaction on our platforms within the previous 12-month period. Buyers may register more than once, and as a result, may have more than one account.

(2)On June 20, 2022 we announced the closure of our marketplace business in Turkey, GittiGidiyor. On October 31, 2022, we completed the acquisition of TCGplayer. On May 16, 2024, we completed the acquisition of Goldin.

(3)Gross Merchandise Volume consists of the total value of all paid transactions between users on our platforms during the applicable period inclusive of shipping fees and taxes.

eBay Inc.

Business Outlook

The guidance figures provided below and elsewhere in this press release are forward-looking statements, reflect a number of estimates, assumptions and other uncertainties, and are approximate in nature because the company's future performance is difficult to predict. Such guidance is based on information available on the date of this press release, and the company assumes no obligation to update it.

The company's future performance involves risks and uncertainties, and the company's actual results could differ materially from the information below and elsewhere in this press release. Some of the factors that could affect the company's operating results are set forth under the caption “Forward-Looking Statements” above in this press release. More information about factors that could affect the company's operating results is included under the captions “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, copies of which may be obtained by visiting eBay's investor relations website at https://investors.ebayinc.com or the SEC's website at www.sec.gov.

eBay Inc. | | | | | | | | | | | |

| Three Months Ending |

| September 30, 2024 |

| (In billions, except per share amounts) | GAAP | | Non-GAAP (a) |

| Net revenues | $2.50 - $2.56 | | $2.50 - $2.56 |

Diluted EPS | $0.82 - $0.87 | | $1.15 - $1.20 |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

(a) Estimated non-GAAP amounts above for the three months ending September 30, 2024 reflect adjustments that exclude the estimated amortization of acquired intangible assets of approximately $9 - $11 million, estimated stock-based compensation expense and associated employer payroll tax expense of approximately $140 - $150 million, and estimated adjustment between our GAAP and non-GAAP tax rate of approximately $25 - $35 million. The estimated GAAP diluted EPS above does not assume any gains or losses on our equity investments. |

eBay Inc.

Non-GAAP Measures of Financial Performance

To supplement the company's condensed consolidated financial statements presented in accordance with generally accepted accounting principles, or GAAP, the company uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating income and margin, non-GAAP effective tax rate, free cash flow and figures in this press release presented on an "FX-Neutral basis." These non-GAAP financial measures are presented on a continuing operations basis.

These non-GAAP measures are not in accordance with, or an alternative to, measures prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the company's results of operations as determined in accordance with GAAP. These measures should only be used to evaluate the company's results of operations in conjunction with the corresponding GAAP measures.

Reconciliation to the nearest GAAP measure of all non-GAAP measures included in this press release, except for figures in this press release presented on an “FX-Neutral basis,” can be found in the tables included in this press release. For figures in this press release reported on an "FX-Neutral basis,” the company calculates the year-over-year impact of foreign currency movements using prior period foreign currency rates, excluding hedging activity, applied to current year transactional currency amounts.

These non-GAAP measures are provided to enhance investors' overall understanding of the company's current financial performance and its prospects for the future. Specifically, the company believes the non-GAAP measures provide useful information to both management and investors by excluding certain expenses, gains and losses, or net purchases of property and equipment, as the case may be, that may not be indicative of its core operating results and business outlook. In addition, because the company has historically reported certain non-GAAP results to investors, the company believes that the inclusion of non-GAAP measures provides consistency in the company's financial reporting.

For its internal budgeting process, and as discussed further below, the company's management uses financial measures that do not include stock-based compensation expense, employer payroll taxes on stock-based compensation, amortization or impairment of acquired intangible assets, impairment of goodwill, amortization of deferred tax assets associated with the realignment of its legal structure and related foreign exchange effects, significant gains or losses from the disposal/acquisition of a business, certain gains and losses on investments including changes in fair value, changes in foreign currency exchange rates and the impact of any related foreign exchange derivative instruments, gains or losses associated with a warrant agreement that the company entered into with Adyen, restructuring-related charges and the income taxes associated with the foregoing. In addition to the corresponding GAAP measures, the company's management also uses the foregoing non-GAAP measures in reviewing the financial results of the company.

The company excludes the following items from non-GAAP net income, non-GAAP earnings per diluted share, non-GAAP operating income and margin and non-GAAP effective tax rate:

Stock-based compensation expense and related employer payroll taxes. This expense consists of expenses for stock options, restricted stock and employee stock purchases. The company excludes stock-based compensation expense from its non-GAAP measures primarily because they are non-cash expenses that management does not believe are reflective of ongoing operating results. The related employer payroll taxes are dependent on the company's stock price and the vesting of restricted stock by employees and the timing and size of stock option exercises, over which management has limited to no control, and as such management does not believe it correlates to the company's operation of the business.

Amortization or impairment of acquired intangible assets, impairment of goodwill, certain amortization of deferred tax assets and related foreign exchange effects, significant gains or losses and transaction expenses from the acquisition or disposal of a business and certain gains or losses on investments. The company incurs amortization or impairment of acquired intangible assets and goodwill in connection with acquisitions and may incur significant gains or losses from the acquisition or disposal of a business and therefore excludes these amounts from its non-GAAP measures. The company also excludes certain gains and losses on investments. The company excludes the non-cash amortization of deferred tax assets associated with the realignment of its legal structure, which is not reduced by the effects of the Tax Cuts and Jobs Act, and related foreign exchange effects. The company excludes these items because management does not believe they correlate to the ongoing operating results of the company's business.

Restructuring. These charges consist of expenses for employee severance and other exit and disposal costs. The company excludes significant restructuring charges primarily because management does not believe they are reflective of ongoing operating results.

Other certain significant gains, losses, or charges that are not indicative of the company’s core operating results. These are significant gains, losses, or charges during a period that are the result of isolated events or transactions which have not occurred frequently in the past and are not expected to occur regularly or be repeated in the future. The company excludes these amounts from its results primarily because management does not believe they are indicative of its current or ongoing operating results. These amounts include changes in fair value and the related change in foreign currency exchange rates of equity securities with readily determinable fair values, globally.

Change in fair market value of warrant. These are gains or losses associated with a warrant agreement that the company entered into with Adyen, which are attributable to changes in fair value during the period.

Income tax effects and adjustments. We use a non-GAAP tax rate for evaluating our operating results. Based on our current long-term projections, we are using a non-GAAP tax rate of 16.5%. This non-GAAP tax rate could change for various reasons including significant changes in our geographic earnings mix or fundamental tax law changes in major jurisdictions in which we operate.

In addition to the non-GAAP measures discussed above, the company also uses free cash flow. Free cash flow represents operating cash flows less purchases of property and equipment. The company considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after the purchases of property, buildings, and equipment, which can then be used to, among other things, invest in the company's business, make strategic acquisitions, repurchase stock and pay dividends. A limitation of the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in the company's cash balance for the period and does not exclude certain non-discretionary expenditures, such as mandatory debt service requirements.

eBay Inc.

Reconciliation of GAAP Operating Income to Non-GAAP Operating Income*

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions, except percentages) |

| GAAP operating income | $ | 549 | | | $ | 518 | | | $ | 1,180 | | | $ | 1,076 | |

| Stock-based compensation expense and related employer payroll taxes | 158 | | | 158 | | | 308 | | | 290 | |

| Amortization of acquired intangible assets within cost of net revenues and operating expenses | 9 | | | 8 | | | 17 | | | 18 | |

| Restructuring | 3 | | | — | | | (6) | | | 42 | |

Non-recurring legal matters | — | | | — | | | (6) | | | — | |

| Other general and administrative expenses | 1 | | | — | | | 1 | | | 2 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total non-GAAP operating income adjustments | 171 | | | 166 | | | 314 | | | 352 | |

| Non-GAAP operating income | $ | 720 | | | $ | 684 | | | $ | 1,494 | | | $ | 1,428 | |

| | | | | | | |

GAAP operating margin | 21.3 | % | | 20.4 | % | | 23.0 | % | | 21.3 | % |

| Non-GAAP operating margin | 27.9 | % | | 26.9 | % | | 29.1 | % | | 28.3 | % |

*Presented on a continuing operations basis

Reconciliation of GAAP Net Income to Non-GAAP Net Income and

GAAP Effective Tax Rate to Non-GAAP Effective Tax Rate

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions, except per share amounts and percentages) |

GAAP income from continuing operations before income taxes | $ | 328 | | | $ | 285 | | | $ | 864 | | | $ | 1,015 | |

GAAP provision for income taxes | (102) | | | (113) | | | (199) | | | (274) | |

GAAP net income from continuing operations | $ | 226 | | | $ | 172 | | | $ | 665 | | | $ | 741 | |

Non-GAAP adjustments to net income from continuing operations: | | | | | | | |

| Non-GAAP operating income from continuing operations adjustments (see table above) | $ | 171 | | | $ | 166 | | | $ | 314 | | | $ | 352 | |

| Change in fair value of equity investment in Adevinta | — | | | 210 | | | 234 | | | 36 | |

Realized change in fair value of shares sold in Adevinta | (84) | | | — | | | (78) | | | — | |

| Change in fair market value of warrant | 174 | | | (31) | | | 25 | | | (69) | |

| Change in fair market value of other equity investments | 23 | | | 35 | | | 29 | | | 49 | |

Fair value of Aurelia option | 109 | | | — | | | 109 | | | — | |

| Income tax effects and adjustments | (17) | | | 3 | | | (48) | | | 46 | |

| Non-GAAP net income from continuing operations | $ | 602 | | | $ | 555 | | | $ | 1,250 | | | $ | 1,155 | |

| | | | | | | |

Diluted net income from continuing operations per share: | | | | | | | |

| GAAP | $ | 0.45 | | | $ | 0.32 | | | $ | 1.30 | | | $ | 1.37 | |

| Non-GAAP | $ | 1.18 | | | $ | 1.03 | | | $ | 2.43 | | | $ | 2.14 | |

Shares used in GAAP diluted net income per share calculation | 507 | | | 537 | | | 513 | | | 539 | |

| Shares used in non-GAAP diluted net income per share calculation | 507 | | | 537 | | | 513 | | | 539 | |

| | | | | | | |

| GAAP effective tax rate – Continuing operations | 31.1 | % | | 39.7 | % | | 23.0 | % | | 27.0 | % |

Income tax effects and adjustments to net income from continuing operations | (14.6) | % | | (23.2) | % | | (6.5) | % | | (10.5) | % |

| Non-GAAP effective tax rate – Continuing operations | 16.5 | % | | 16.5 | % | | 16.5 | % | | 16.5 | % |

Reconciliation of Operating Cash Flow to Free Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In millions) |

Net cash provided by operating activities | $ | 367 | | | $ | 605 | | | $ | 982 | | | $ | 1,446 | |

| Less: Purchases of property and equipment | (89) | | | (113) | | | (232) | | | (245) | |

| Free cash flow | $ | 278 | | | $ | 492 | | | $ | 750 | | | $ | 1,201 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

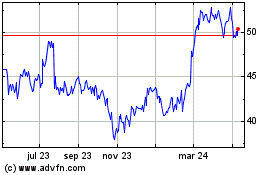

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

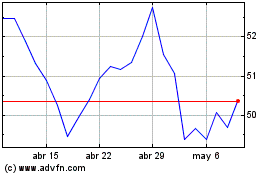

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024