Eagle Bancorp Montana, Inc. (NASDAQ: EBMT), (the “Company,”

“Eagle”), the holding company of Opportunity Bank of Montana (the

“Bank”), today reported net income of $3.6 million, or $0.47

per diluted share, in the fourth quarter of 2022, compared to $3.1

million, or $0.40 per diluted share, in the preceding quarter, and

$1.7 million, or $0.26 per diluted share, in the fourth quarter a

year ago. For the year 2022, net income was $10.7 million, or $1.45

per diluted share, compared to $14.4 million, or $2.17 per diluted

share, in 2021. Results for 2022 included $2.3 million in

acquisition costs associated with the merger of First Community

Bancorp, Inc., and its subsidiary, First Community Bank (“First

Community”), compared to $761,000 in acquisition related expenses

in 2021.

Eagle’s board of directors declared a quarterly

cash dividend of $0.1375 per share on January 19, 2023. The

dividend will be payable March 3, 2023 to shareholders of record

February 10, 2023. The current dividend represents an annualized

yield of 3.24% based on recent market prices.

“Eagle’s fourth quarter operating results

reflect another quarter of growth in the loan portfolio and the

resulting net interest margin expansion,” said Laura F. Clark,

President and CEO. “Fourth quarter loan growth totaled $41.5

million and was well diversified across our loan categories.

Additionally, our fourth quarter net interest margin improved

year-over-year as we took advantage of interest rate increases

enacted by the Federal Reserve. One of the highlights of 2022 was

the acquisition of First Community, which was completed during the

second quarter of 2022 and has already contributed nicely to

operating results. I am excited about the opportunities this new

market provides for continued long-term growth.”

Eagle closed its acquisition of First Community

on April 30, 2022, in a transaction valued at approximately $38.6

million. The acquisition added approximately $370 million in

assets, $321 million in deposits and $191 million in loans.

Fourth Quarter 2022 Highlights

(at or for the three-month period ended December 31, 2022, except

where noted):

- Net income was $3.6 million, or

$0.47 per diluted share, in the fourth quarter of 2022, compared to

$3.1 million, or $0.40 per diluted share, in the preceding quarter,

and $1.7 million, or $0.26 per diluted share, in the fourth quarter

a year ago.

- Net interest margin (“NIM”) was

4.10% in the fourth quarter of 2022, compared to 4.18% in the

preceding quarter, and 3.75% in the fourth quarter a year ago.

- Revenues (net interest income

before the loan loss provision, plus noninterest income) decreased

modestly to $25.1 million in the fourth

quarter of 2022, compared to $25.3 million in the preceding quarter

and increased 15.2% compared to $21.8 million

in the fourth quarter a year ago.

- The Company recorded a discount on

loans acquired from First Community of $5.4 million at April 30,

2022 of which $4.1 million remained as of December 31, 2022.

- Remaining discount on loans from

acquisitions prior to 2022 totaled $728,000 as of

December 31, 2022.

- The accretion of the loan purchase

discount into loan interest income from the First Community, and

previous acquisitions, was $267,000 in the fourth quarter of 2022,

compared to accretion on purchased loans from acquisitions of

$392,000 in the preceding quarter.

- The allowance for loan losses

represented 180.0% of nonperforming loans at December 31, 2022,

compared to 177.1% a year earlier.

- Total loans increased 45.1% to

$1.35 billion, at December 31, 2022, compared to $933.1 million a

year earlier, and increased 3.2% compared to $1.31 billion at

September 30, 2022.

- Total deposits increased 33.8% to

$1.64 billion at December 31, 2022, from $1.22 billion a year ago,

and decreased 2.3% compared to $1.67 billion at September 30,

2022.

- The Company paid a quarterly cash

dividend in the fourth quarter of $0.1375 per share on December 2,

2022 to shareholders of record

November 10, 2022.

Balance Sheet Results

Eagle’s total assets increased 35.7% to $1.95

billion at December 31, 2022, compared to $1.44 billion a year ago,

and increased 1.3% from $1.92 billion three months earlier. The

year over year increase was primarily due to the First Community

acquisition that closed during the second quarter of 2022.

The investment securities portfolio totaled

$349.5 million at December 31, 2022, compared to $271.3

million a year ago, and $351.9 million at

September 30, 2022.

Eagle originated $95.3 million in new

residential mortgages during the quarter and sold $107.1 million in

residential mortgages, with an average gross margin on sale of

mortgage loans of approximately 2.77%. This production compares to

residential mortgage originations of $142.0 million in the

preceding quarter with sales of $121.3 million and an average gross

margin on sale of mortgage loans of approximately 3.46%.

Total loans increased $420.5 million or 45.1%

compared to a year ago, and $41.5 million or 3.2% from three months

earlier. Commercial real estate loans increased 31.3% to $539.1

million at December 31, 2022, compared to $410.6 million a year

earlier. Agricultural and farmland loans increased 112.1% to $240.4

million at December 31, 2022, compared to $113.3 million a

year earlier. Commercial construction and development loans

increased 63.6% to $151.1 million, compared to $92.4 million a

year ago. Residential mortgage loans increased 34.4% to $135.9

million, compared to $101.2 million a year earlier. Commercial

loans increased 25.3% to $127.3 million, compared to $101.5 million

a year ago. Home equity loans increased 43.5% to $74.3 million,

residential construction loans increased 30.9% to

$59.8 million, and consumer loans increased 49.6% to $27.6

million, compared to a year ago.

Total deposits increased 33.8% to $1.64 billion

at December 31, 2022, compared to $1.22 billion at December 31,

2021, and decreased 2.3% from $1.67 billion at September 30, 2022.

Noninterest-bearing checking accounts represented 28.7%,

interest-bearing checking accounts represented 15.5%, savings

accounts represented 16.7%, money market accounts comprised 23.7%

and time certificates of deposit made up 15.4% of the total deposit

portfolio at December 31, 2022. The average cost of funds was

0.85% in the fourth quarter of 2022, compared to 0.47% in the

preceding quarter and 0.35% in the fourth quarter of 2021.

Shareholders’ equity was $158.4 million at

December 31, 2022, compared to $156.7 million a year earlier and

$151.3 million three months earlier. Book value per share was

$19.79 at December 31, 2022, compared to $23.07 a year earlier and

$18.94 three months earlier. Tangible book value per share, a

non-GAAP financial measure calculated by dividing shareholders’

equity, less goodwill and core deposit intangible, by common shares

outstanding, was $14.52 at December 31, 2022, compared to $19.74 a

year earlier and $13.60 three months earlier.

Operating Results

“Higher yields on interest earning assets

contributed to NIM expanding 35 basis points during the fourth

quarter of 2022, compared to the fourth quarter a year ago.

Compared to the preceding quarter, NIM contracted eight basis

points, largely due to an uptick in funding costs,” said Clark.

Eagle’s NIM was 4.10% in the fourth quarter of

2022, compared to 4.18% in the preceding quarter, and 3.75% in the

fourth quarter a year ago. The interest accretion on acquired loans

totaled $267,000 and resulted in a six basis-point increase in the

NIM during the fourth quarter of 2022, compared to $392,000 and a

nine basis-point increase in the NIM during the preceding quarter.

Average yields on interest earning assets for the fourth quarter

increased to 4.72% from 3.99% a year ago. For the year, the NIM

expanded 18 basis points to 4.03%, compared to the same period one

year earlier.

Eagle’s fourth quarter revenues decreased

modestly to $25.1 million, compared to $25.3 million in the

preceding quarter and increased 15.2% compared to $21.8 million in

the fourth quarter a year ago. For the year, revenues were $93.8

million, compared to $94.3 million in 2021.

Net interest income, before the loan loss

provision, decreased 1.5% to $17.6 million in the fourth quarter,

compared to $17.9 million in the third quarter of 2022, and

increased 46.2% compared to $12.0 million in the fourth quarter of

2021. For the year, net interest income, before the loan loss

provision, increased 36.0% to $63.3 million, compared to $46.5

million in 2021.

Eagle’s total noninterest income was $7.4

million in the fourth quarter of 2022, which was unchanged compared

to the preceding quarter, and a 23.3% decrease compared to $9.7

million in the fourth quarter a year ago. Net mortgage banking, the

largest component of noninterest income, totaled $3.3 million in

the fourth quarter of 2022, compared to $4.4 million in the

preceding quarter and $7.7 million in the fourth quarter a year

ago. Noninterest income includes $2.1 million for the fourth

quarter of 2022, compared to $624,000 for the fourth quarter of

2021 related to commodity sales income from Eagle’s subsidiary

Western Financial Services (“WFS”). WFS facilitates deferred

payment contracts for customers that produce agricultural products.

The corresponding commodity sales expense is included in

noninterest expense. For the year 2022, noninterest income

decreased 36.2% to $30.5 million, compared to $47.8 million in

2021. Net mortgage banking decreased 52.5% to $19.5 million in

2022, compared to $41.0 million in 2021. Decreases in net mortgage

banking were largely driven by reduced mortgage volumes.

Noninterest income includes $4.3 million for 2022, compared to $1.6

million for 2021 related to commodity sales income for WFS.

Fourth quarter noninterest expense decreased

1.7% to $20.3 million, compared to $20.7 million in the preceding

quarter and increased 6.2% compared to $19.1 million in the fourth

quarter a year ago. Noninterest expense includes commodity sales

expense for WFS of $2.1 million for the fourth quarter of 2022,

compared to $624,000 for the fourth quarter of 2021. For the year,

noninterest expense increased to $78.0 million, compared to $74.2

million in 2021. Salaries and employee benefits expense were down

overall due to lower commissions for residential mortgage

originations. However, acquisition costs were $2.3 million in 2022

compared to $761,000 in 2021. In addition, noninterest expense

includes commodity sales expense for WFS of $4.3 million for 2022,

compared to $1.6 million for 2021.

For the fourth quarter of 2022, the income tax

provision totaled $787,000, for an effective tax rate of 17.8%,

compared to $1.0 million in the preceding quarter, and $632,000 in

the fourth quarter of 2021.

Credit Quality

The loan loss provision was $347,000 in the

fourth quarter of 2022, compared to $517,000 in the preceding

quarter and $285,000 in the fourth quarter a year ago. The

allowance for loan losses represented 180.0% of nonperforming loans

at December 31, 2022, compared to 306.4% three months earlier and

177.1% a year earlier. Nonperforming loans were $7.8 million at

December 31, 2022, compared to $4.5 million at

September 30, 2022, and $7.1 million a year

earlier.

Eagle had no other real estate owned and other

repossessed assets on its books at December 31, 2022, or at

September 30, 2022. This compared to $4,000 at

December 31, 2021.

Net loan charge-offs totaled $197,000 in the

fourth quarter of 2022, compared to net loan recoveries of $8,000

in the preceding quarter and net loan recoveries of $15,000 in the

fourth quarter a year ago. The allowance for loan losses was $14.0

million, or 1.03% of total loans, at December 31, 2022, compared to

$13.9 million, or 1.06% of total loans, at September 30, 2022, and

$12.5 million, or 1.34% of total loans, a year ago.

Capital Management

The ratio of tangible common shareholders’

equity (shareholders’ equity, less goodwill and core deposit

intangible) to tangible assets (total assets, less goodwill and

core deposit intangible) decreased to 6.10% at December 31, 2022

from 9.49% a year ago and increased from 5.77% three months

earlier. Shareholders’ equity has been impacted by an accumulated

other comprehensive loss related to securities available-for-sale.

These unrealized losses are primarily a result of rapid increases

in interest rates. As of December 31, 2022, the Bank’s regulatory

capital was in excess of all applicable regulatory requirements and

is deemed well capitalized. The Bank’s Tier 1 capital to adjusted

total average assets was 9.82% as of December 31, 2022.

About the Company

Eagle Bancorp Montana, Inc. is a bank holding

company headquartered in Helena, Montana, and is the holding

company of Opportunity Bank of Montana, a community bank

established in 1922 that serves consumers and small businesses in

Montana through 32 banking offices. Additional information is

available on the Bank’s website at www.opportunitybank.com. The

shares of Eagle Bancorp Montana, Inc. are traded on the NASDAQ

Global Market under the symbol “EBMT.”

Forward Looking Statements

This release may contain certain

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, and may be identified by the use of such

words as "believe," “will” "expect," "anticipate," "should,"

"planned," "estimated," and "potential." These forward-looking

statements include, but are not limited to statements of our goals,

intentions and expectations; statements regarding our business

plans, prospects, mergers, growth and operating strategies;

statements regarding the current global COVID-19 pandemic,

statements regarding the asset quality of our loan and investment

portfolios; and estimates of our risks and future costs and

benefits. These forward-looking statements are based on current

beliefs and expectations of our management and are inherently

subject to significant business, economic and competitive

uncertainties and contingencies, many of which are beyond our

control. In addition, these forward-looking statements are subject

to assumptions with respect to future business strategies and

decisions that are subject to change. These factors include, but

are not limited to, changes in laws or government regulations or

policies affecting financial institutions, including changes in

regulatory fees and capital requirements; general economic

conditions and political events, either nationally or in our market

areas, that are worse than expected; the duration and impact of the

COVID-19 pandemic, including but not limited to vaccine efficacy

and immunization rates, new variants, steps taken by governmental

and other authorities to contain, mitigate and combat the pandemic,

adverse effects on our employees, customers and third-party service

providers, the increase in cyberattacks in the current

work-from-home environment, the ultimate extent of the impacts on

our business, financial position, results of operations, liquidity

and prospects, continued deterioration in general business and

economic conditions could adversely affect our revenues and the

values of our assets and liabilities, lead to a tightening of

credit and increase stock price volatility, and potential

impairment charges; competition among depository and other

financial institutions; loan demand or residential and commercial

real estate values in Montana; the concentration of our business in

Montana; our ability to continue to increase and manage our

commercial real estate, commercial business and agricultural loans;

the costs and effects of legal, compliance and regulatory actions,

changes and developments, including the initiation and resolution

of legal proceedings (including any securities, bank operations,

consumer or employee litigation); inflation and changes in the

interest rate environment that reduce our margins or reduce the

fair value of financial instruments; adverse changes in the

securities markets that lead to impairment in the value of our

investment securities and goodwill; other economic, governmental,

competitive, regulatory and technological factors that may affect

our operations; our ability to implement new technologies and

maintain secure and reliable technology systems; cyber incidents,

or theft or loss of Company or customer data or money; our ability

to appropriately address social, environmental, and sustainability

concerns that may arise from our business activities; the effect of

our recent acquisitions, including the failure to achieve expected

revenue growth and/or expense savings, the failure to effectively

integrate their operations, the outcome of any legal proceedings

and the diversion of management time on issues related to the

integration.

Because of these and other uncertainties, our

actual future results may be materially different from the results

indicated by these forward-looking statements. All information set

forth in this press release is current as of the date of this

release and the company undertakes no duty or obligation to update

this information.

Use of Non-GAAP Financial

Measures

In addition to results presented in accordance

with generally accepted accounting principles utilized in the

United States, or GAAP, the Financial Ratios and Other Data

contains non-GAAP financial measures. Non-GAAP disclosures include:

1) core efficiency ratio, 2) tangible book value per share, 3)

tangible common equity to tangible assets, 4) earnings per diluted

share, excluding acquisition costs and related taxes and 5) return

on average assets, excluding acquisition costs and related taxes.

The Company uses these non-GAAP financial measures to provide

meaningful supplemental information regarding the Company’s

operational performance and performance trends, and to enhance

investors’ overall understanding of such financial performance. In

particular, the use of tangible book value per share and tangible

common equity to tangible assets is prevalent among banking

regulators, investors and analysts.

The numerator for the core efficiency ratio is

calculated by subtracting acquisition costs and intangible asset

amortization from noninterest expense. Tangible assets and tangible

common shareholders’ equity are calculated by excluding intangible

assets from assets and shareholders’ equity, respectively. For

these financial measures, our intangible assets consist of goodwill

and core deposit intangible. Tangible book value per share is

calculated by dividing tangible common shareholders’ equity by the

number of common shares outstanding. We believe that this measure

is consistent with the capital treatment by our bank regulatory

agencies, which exclude intangible assets from the calculation of

risk-based capital ratios and present this measure to facilitate

the comparison of the quality and composition of our capital over

time and in comparison, to our competitors.

Non-GAAP financial measures have inherent

limitations, are not required to be uniformly applied, and are not

audited. Because non-GAAP financial measures are not standardized,

it may not be possible to compare these financial measures with

other companies’ non-GAAP financial measures having the same or

similar names. Further, the non-GAAP financial measure of tangible

book value per share should not be considered in isolation or as a

substitute for book value per share or total shareholders’ equity

determined in accordance with GAAP, and may not be comparable to a

similarly titled measure reported by other companies.

Reconciliation of the GAAP and non-GAAP financial measures are

presented below.

|

Balance Sheet |

|

|

|

|

|

|

|

|

(Dollars in thousands, except per share data) |

|

|

(Unaudited) |

| |

|

|

|

|

|

December 31, |

September 30, |

December 31, |

| |

|

|

|

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

| |

Cash and due from banks |

|

|

|

$ |

19,321 |

|

$ |

22,154 |

|

$ |

10,938 |

|

| |

Interest bearing deposits in banks |

|

|

|

2,490 |

|

|

3,043 |

|

|

43,669 |

|

| |

Federal

funds sold |

|

|

|

|

|

- |

|

|

- |

|

|

6,827 |

|

| |

Total cash and cash equivalents |

|

|

|

21,811 |

|

|

25,197 |

|

|

61,434 |

|

| |

Securities available-for-sale |

|

|

|

|

349,495 |

|

|

351,949 |

|

|

271,262 |

|

| |

Federal Home Loan Bank ("FHLB") stock |

|

|

|

5,089 |

|

|

2,939 |

|

|

1,702 |

|

| |

Federal Reserve Bank ("FRB") stock |

|

|

|

4,131 |

|

|

4,206 |

|

|

2,974 |

|

| |

Mortgage loans held-for-sale, at fair value |

|

|

|

8,250 |

|

|

24,408 |

|

|

25,819 |

|

| |

Loans: |

|

|

|

|

|

|

|

| |

Real estate loans: |

|

|

|

|

|

|

| |

Residential 1-4 family |

|

|

|

|

135,947 |

|

|

137,798 |

|

|

101,180 |

|

| |

Residential 1-4 family

construction |

|

|

|

59,756 |

|

|

57,467 |

|

|

45,635 |

|

| |

Commercial real estate |

|

|

|

|

539,070 |

|

|

506,716 |

|

|

410,568 |

|

| |

Commercial construction and

development |

|

|

151,145 |

|

|

145,300 |

|

|

92,403 |

|

| |

Farmland |

|

|

|

|

|

136,334 |

|

|

129,827 |

|

|

67,005 |

|

| |

Other loans: |

|

|

|

|

|

|

|

| |

Home equity |

|

|

|

|

|

74,271 |

|

|

67,409 |

|

|

51,748 |

|

| |

Consumer |

|

|

|

|

|

27,609 |

|

|

27,703 |

|

|

18,455 |

|

| |

Commercial |

|

|

|

|

|

127,255 |

|

|

130,975 |

|

|

101,535 |

|

| |

Agricultural |

|

|

|

|

|

104,036 |

|

|

110,633 |

|

|

46,335 |

|

| |

Unearned loan fees |

|

|

|

|

(1,745 |

) |

|

(1,674 |

) |

|

(1,725 |

) |

| |

Total loans |

|

|

|

|

|

1,353,678 |

|

|

1,312,154 |

|

|

933,139 |

|

| |

Allowance for loan losses |

|

|

|

|

(14,000 |

) |

|

(13,850 |

) |

|

(12,500 |

) |

| |

Net loans |

|

|

|

|

|

1,339,678 |

|

|

1,298,304 |

|

|

920,639 |

|

| |

Accrued interest and dividends receivable |

|

|

|

11,284 |

|

|

10,778 |

|

|

5,751 |

|

| |

Mortgage servicing rights, net |

|

|

|

|

15,412 |

|

|

15,141 |

|

|

13,693 |

|

| |

Assets held-for-sale, at fair value |

|

|

|

1,305 |

|

|

2,041 |

|

|

- |

|

| |

Premises and equipment, net |

|

|

|

|

84,323 |

|

|

79,374 |

|

|

67,266 |

|

| |

Cash surrender value of life insurance, net |

|

|

|

47,724 |

|

|

45,845 |

|

|

36,474 |

|

| |

Goodwill |

|

|

|

|

|

34,740 |

|

|

34,740 |

|

|

20,798 |

|

| |

Core deposit intangible, net |

|

|

|

|

7,459 |

|

|

7,895 |

|

|

1,780 |

|

| |

Other

assets |

|

|

|

|

|

17,683 |

|

|

21,103 |

|

|

6,334 |

|

| |

Total assets |

|

|

|

|

$ |

1,948,384 |

|

$ |

1,923,920 |

|

$ |

1,435,926 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

|

|

| |

Deposit

accounts: |

|

|

|

|

|

|

|

| |

Noninterest bearing |

|

|

|

|

468,955 |

|

|

507,034 |

|

|

368,846 |

|

| |

Interest bearing |

|

|

|

|

|

1,166,317 |

|

|

1,167,216 |

|

|

853,703 |

|

| |

Total deposits |

|

|

|

|

1,635,272 |

|

|

1,674,250 |

|

|

1,222,549 |

|

| |

Accrued expenses and other liabilities |

|

|

|

26,458 |

|

|

23,748 |

|

|

21,779 |

|

| |

FHLB advances and other borrowings |

|

|

|

69,394 |

|

|

15,600 |

|

|

5,000 |

|

| |

Other long-term debt, net |

|

|

|

|

58,844 |

|

|

59,048 |

|

|

29,869 |

|

| |

Total liabilities |

|

|

|

|

1,789,968 |

|

|

1,772,646 |

|

|

1,279,197 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' Equity: |

|

|

|

|

|

|

|

| |

Preferred stock (par value $0.01 per share; 1,000,000 shares |

|

|

|

| |

authorized; no shares issued or outstanding) |

|

|

- |

|

|

- |

|

|

- |

|

| |

Common stock (par value $0.01; 20,000,000 shares authorized; |

|

|

|

| |

8,507,429, 8,507,429 and 7,110,833 shares issued; 8,006,033, |

|

|

|

| |

7,986,890 and 6,794,811 shares outstanding at December 31,

2022, |

|

|

|

| |

September 30, 2022 and December, 2021, respectively |

|

85 |

|

|

85 |

|

|

71 |

|

| |

Additional paid-in capital |

|

|

|

|

109,164 |

|

|

109,488 |

|

|

80,832 |

|

| |

Unallocated common stock held by Employee Stock Ownership Plan |

|

(5,156 |

) |

|

(5,300 |

) |

|

(5,729 |

) |

| |

Treasury stock, at cost (501,396, 520,539, and 316,022 shares

at |

|

|

|

| |

December 31, 2022, September 30, 2022 and December 31, 2021,

respectively) |

|

|

|

|

|

(11,343 |

) |

|

(11,627 |

) |

|

(7,321 |

) |

| |

Retained

earnings |

|

|

|

|

|

92,023 |

|

|

89,502 |

|

|

85,383 |

|

| |

Accumulated other comprehensive (loss) income, net of tax |

|

(26,357 |

) |

|

(30,874 |

) |

|

3,493 |

|

| |

Total shareholders' equity |

|

|

|

158,416 |

|

|

151,274 |

|

|

156,729 |

|

| |

Total liabilities and shareholders' equity |

|

$ |

1,948,384 |

|

$ |

1,923,920 |

|

$ |

1,435,926 |

|

| |

|

|

|

|

|

|

|

|

|

Income Statement |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

(Dollars in thousands, except per share data) |

|

|

Three Months Ended |

|

Years Ended |

| |

|

|

|

|

|

|

December 31, |

September 30, |

December 31, |

|

December 31, |

| |

|

|

|

|

|

|

|

2022 |

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

| |

Interest and fees on loans |

|

|

$ |

17,420 |

$ |

16,665 |

$ |

11,474 |

|

$ |

60,353 |

$ |

45,134 |

| |

Securities available-for-sale |

|

|

|

2,716 |

|

2,555 |

|

1,249 |

|

|

8,579 |

|

4,238 |

| |

FRB and FHLB dividends |

|

|

|

142 |

|

63 |

|

61 |

|

|

302 |

|

255 |

| |

Other interest income |

|

|

|

22 |

|

59 |

|

30 |

|

|

228 |

|

120 |

| |

|

Total interest and dividend income |

|

|

|

20,300 |

|

19,342 |

|

12,814 |

|

|

69,462 |

|

49,747 |

|

Interest expense: |

|

|

|

|

|

|

|

|

|

| |

Interest expense on deposits |

|

|

|

1,673 |

|

717 |

|

356 |

|

|

3,124 |

|

1,474 |

| |

FHLB advances and other borrowings |

|

|

|

357 |

|

136 |

|

23 |

|

|

514 |

|

175 |

| |

Other long-term debt |

|

|

|

657 |

|

602 |

|

390 |

|

|

2,512 |

|

1,558 |

| |

|

Total interest expense |

|

|

|

2,687 |

|

1,455 |

|

769 |

|

|

6,150 |

|

3,207 |

|

Net interest income |

|

|

|

|

17,613 |

|

17,887 |

|

12,045 |

|

|

63,312 |

|

46,540 |

|

Loan loss provision |

|

|

|

|

347 |

|

517 |

|

285 |

|

|

2,001 |

|

861 |

| |

|

Net interest income after loan loss provision |

|

|

17,266 |

|

17,370 |

|

11,760 |

|

|

61,311 |

|

45,679 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

| |

Service charges on deposit accounts |

|

|

|

445 |

|

498 |

|

329 |

|

|

1,668 |

|

1,213 |

| |

Mortgage banking, net |

|

|

|

3,306 |

|

4,447 |

|

7,675 |

|

|

19,489 |

|

41,035 |

| |

Interchange and ATM fees |

|

|

|

707 |

|

594 |

|

493 |

|

|

2,375 |

|

1,982 |

| |

Appreciation in cash surrender value of life insurance |

|

|

287 |

|

291 |

|

209 |

|

|

1,035 |

|

721 |

| |

Commodity sales income |

|

|

|

2,147 |

|

1,171 |

|

624 |

|

|

4,279 |

|

1,586 |

| |

Other noninterest income |

|

|

|

555 |

|

416 |

|

385 |

|

|

1,653 |

|

1,232 |

| |

|

Total noninterest income |

|

|

|

7,447 |

|

7,417 |

|

9,715 |

|

|

30,499 |

|

47,769 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense: |

|

|

|

|

|

|

|

|

| |

Salaries and employee benefits |

|

|

|

11,010 |

|

11,699 |

|

11,673 |

|

|

44,521 |

|

48,766 |

| |

Occupancy and equipment expense |

|

|

|

2,160 |

|

1,946 |

|

1,702 |

|

|

7,601 |

|

6,448 |

| |

Data processing |

|

|

|

1,367 |

|

1,964 |

|

1,369 |

|

|

5,995 |

|

5,035 |

| |

Advertising |

|

|

|

|

367 |

|

464 |

|

426 |

|

|

1,419 |

|

1,276 |

| |

Amortization |

|

|

|

|

439 |

|

333 |

|

142 |

|

|

1,334 |

|

573 |

| |

Loan costs |

|

|

|

|

412 |

|

491 |

|

610 |

|

|

2,036 |

|

2,736 |

| |

FDIC insurance premiums |

|

|

|

229 |

|

93 |

|

89 |

|

|

559 |

|

332 |

| |

Professional and examination fees |

|

|

|

371 |

|

420 |

|

356 |

|

|

1,469 |

|

1,756 |

| |

Acquisition costs |

|

|

|

- |

|

103 |

|

726 |

|

|

2,296 |

|

761 |

| |

Commodity sales expense |

|

|

|

2,147 |

|

1,171 |

|

624 |

|

|

4,279 |

|

1,586 |

| |

Other noninterest expense |

|

|

|

1,802 |

|

1,980 |

|

1,399 |

|

|

6,453 |

|

4,897 |

| |

|

Total noninterest expense |

|

|

|

20,304 |

|

20,664 |

|

19,116 |

|

|

77,962 |

|

74,166 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before provision for income taxes |

|

|

|

4,409 |

|

4,123 |

|

2,359 |

|

|

13,848 |

|

19,282 |

|

Provision for income taxes |

|

|

|

787 |

|

1,031 |

|

632 |

|

|

3,147 |

|

4,863 |

|

Net income |

|

|

|

|

$ |

3,622 |

$ |

3,092 |

$ |

1,727 |

|

$ |

10,701 |

$ |

14,419 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

|

$ |

0.47 |

$ |

0.40 |

$ |

0.26 |

|

$ |

1.45 |

$ |

2.17 |

|

Diluted earnings per share |

|

|

$ |

0.47 |

$ |

0.40 |

$ |

0.26 |

|

$ |

1.45 |

$ |

2.17 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic weighted average shares outstanding |

|

|

|

7,776,145 |

|

7,793,485 |

|

6,543,192 |

|

|

7,376,275 |

|

6,653,935 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding |

|

|

|

7,777,552 |

|

7,808,050 |

|

6,563,512 |

|

|

7,386,253 |

|

6,655,735 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONAL FINANCIAL INFORMATION |

|

(Unaudited) |

|

|

(Dollars in thousands, except per share data) |

Three Months Ended or Years Ended |

| |

|

|

December 31, |

September 30, |

December 31, |

| |

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

Mortgage Banking Activity (For the quarter): |

|

|

|

| |

Net gain on sale of mortgage loans |

$ |

2,965 |

|

$ |

4,192 |

|

$ |

9,825 |

|

| |

Net change in fair value of loans held-for-sale and

derivatives |

|

(509 |

) |

|

(378 |

) |

|

(2,439 |

) |

| |

Mortgage servicing income, net |

|

850 |

|

|

633 |

|

|

289 |

|

| |

Mortgage banking, net |

$ |

3,306 |

|

$ |

4,447 |

|

$ |

7,675 |

|

| |

|

|

|

|

|

|

Mortgage Banking Activity (Year-to-date): |

|

|

|

| |

Net gain on sale of mortgage loans |

$ |

18,610 |

|

|

$ |

46,086 |

|

| |

Net change in fair value of loans held-for-sale and

derivatives |

|

(1,842 |

) |

|

|

(5,443 |

) |

| |

Mortgage servicing income, net |

|

2,721 |

|

|

|

392 |

|

| |

Mortgage banking, net |

$ |

19,489 |

|

|

$ |

41,035 |

|

| |

|

|

|

|

|

|

Performance Ratios (For the quarter): |

|

|

|

| |

Return on average assets |

|

0.75 |

% |

|

0.65 |

% |

|

0.48 |

% |

| |

Return on average equity |

|

9.38 |

% |

|

7.51 |

% |

|

4.37 |

% |

| |

Yield on average interest earning assets |

|

4.72 |

% |

|

4.52 |

% |

|

3.99 |

% |

| |

Cost of

funds |

|

|

0.85 |

% |

|

0.47 |

% |

|

0.35 |

% |

| |

Net interest margin |

|

4.10 |

% |

|

4.18 |

% |

|

3.75 |

% |

| |

Core efficiency ratio* |

|

79.27 |

% |

|

79.94 |

% |

|

83.86 |

% |

| |

|

|

|

|

|

|

Performance Ratios (Year-to-date): |

|

|

|

| |

Return on average assets |

|

0.60 |

% |

|

|

1.06 |

% |

| |

Return on average equity |

|

6.87 |

% |

|

|

9.18 |

% |

| |

Yield on average interest earning assets |

|

4.42 |

% |

|

|

4.11 |

% |

| |

Cost of

funds |

|

|

0.54 |

% |

|

|

0.39 |

% |

| |

Net interest margin |

|

4.03 |

% |

|

|

3.85 |

% |

| |

Core efficiency ratio* |

|

79.24 |

% |

|

|

77.23 |

% |

| |

|

|

|

|

|

| * The core efficiency

ratio is a non-GAAP ratio that is calculated by dividing

non-interest expense, exclusive of acquisition |

|

costs and intangible asset amortization, by the sum of net interest

income and non-interest income. |

|

|

| |

|

|

|

|

|

|

ADDITIONAL FINANCIAL INFORMATION |

|

|

|

|

(Dollars in thousands, except per share data) |

|

|

|

| |

|

|

|

|

|

|

Asset Quality Ratios and Data: |

As of or for the Three Months Ended |

| |

|

|

December 31, |

September 30, |

December 31, |

| |

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

| |

Nonaccrual

loans |

|

$ |

2,200 |

|

$ |

2,534 |

|

$ |

4,835 |

|

| |

Loans 90 days past due and still accruing |

|

1,076 |

|

|

874 |

|

|

- |

|

| |

Restructured loans, net |

|

4,502 |

|

|

1,112 |

|

|

2,224 |

|

| |

Total nonperforming loans |

|

7,778 |

|

|

4,520 |

|

|

7,059 |

|

| |

Other real estate owned and other repossessed assets |

|

- |

|

|

- |

|

|

4 |

|

| |

Total nonperforming assets |

$ |

7,778 |

|

$ |

4,520 |

|

$ |

7,063 |

|

| |

|

|

|

|

|

| |

Nonperforming loans / portfolio loans |

|

0.57 |

% |

|

0.34 |

% |

|

0.76 |

% |

| |

Nonperforming assets / assets |

|

0.40 |

% |

|

0.23 |

% |

|

0.49 |

% |

| |

Allowance for loan losses / portfolio loans |

|

1.03 |

% |

|

1.06 |

% |

|

1.34 |

% |

| |

Allowance / nonperforming loans |

|

179.99 |

% |

|

306.42 |

% |

|

177.08 |

% |

| |

Gross loan charge-offs for the quarter |

$ |

216 |

|

$ |

6 |

|

$ |

2 |

|

| |

Gross loan recoveries for the quarter |

$ |

19 |

|

$ |

14 |

|

$ |

17 |

|

| |

Net loan charge-offs (recoveries) for the quarter |

$ |

197 |

|

$ |

(8 |

) |

$ |

(15 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

December 31, |

September 30, |

December 31, |

| |

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

Capital Data (At quarter end): |

|

|

|

| |

Book value per share |

$ |

19.79 |

|

$ |

18.94 |

|

$ |

23.07 |

|

| |

Tangible book value per share** |

$ |

14.52 |

|

$ |

13.60 |

|

$ |

19.74 |

|

| |

Shares outstanding |

|

8,006,033 |

|

|

7,986,890 |

|

|

6,794,811 |

|

| |

Tangible common equity to tangible assets*** |

|

6.10 |

% |

|

5.77 |

% |

|

9.49 |

% |

| |

|

|

|

|

|

|

Other Information: |

|

|

|

|

| |

Average investment securities for the quarter |

$ |

348,267 |

|

$ |

378,680 |

|

$ |

262,736 |

|

| |

Average investment securities year-to-date |

$ |

336,779 |

|

$ |

332,950 |

|

$ |

215,978 |

|

| |

Average loans for the quarter **** |

$ |

1,345,776 |

|

$ |

1,301,358 |

|

$ |

942,783 |

|

| |

Average loans year-to-date **** |

$ |

1,194,788 |

|

$ |

1,144,459 |

|

$ |

914,804 |

|

| |

Average earning assets for the quarter |

$ |

1,705,349 |

|

$ |

1,699,027 |

|

$ |

1,274,817 |

|

| |

Average earning assets year-to-date |

$ |

1,572,106 |

|

$ |

1,527,692 |

|

$ |

1,209,715 |

|

| |

Average total assets for the quarter |

$ |

1,934,002 |

|

$ |

1,913,710 |

|

$ |

1,433,003 |

|

| |

Average total assets year-to-date |

$ |

1,768,919 |

|

$ |

1,713,892 |

|

$ |

1,357,249 |

|

| |

Average deposits for the quarter |

$ |

1,655,298 |

|

$ |

1,656,228 |

|

$ |

1,215,046 |

|

| |

Average deposits year-to-date |

$ |

1,514,158 |

|

$ |

1,467,111 |

|

$ |

1,138,608 |

|

| |

Average equity for the quarter |

$ |

154,409 |

|

$ |

164,592 |

|

$ |

158,208 |

|

| |

Average equity year-to-date |

$ |

155,655 |

|

$ |

156,071 |

|

$ |

157,014 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

** The tangible book value per share is a non-GAAP ratio that is

calculated by dividing shareholders' equity, |

|

|

less goodwill and core deposit intangible, by common shares

outstanding. |

|

|

|

|

*** The tangible common equity to tangible assets is a non-GAAP

ratio that is calculated by dividing shareholders' |

|

|

equity, less goodwill and core deposit intangible, by total assets,

less goodwill and core deposit intangible. |

|

|

**** Includes loans held for sale |

|

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Core Efficiency Ratio |

|

(Unaudited) |

|

|

(Unaudited) |

|

(Dollars in thousands) |

Three Months Ended |

|

Years Ended |

| |

|

|

|

|

December 31, |

September 30, |

December 31, |

|

December 31, |

| |

|

|

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

|

|

Calculation of Core Efficiency Ratio: |

|

|

|

|

|

|

| |

Noninterest expense |

$ |

20,304 |

|

$ |

20,664 |

|

$ |

19,116 |

|

|

$ |

77,962 |

|

$ |

74,166 |

|

| |

Acquisition costs |

|

- |

|

|

(103 |

) |

|

(726 |

) |

|

|

(2,296 |

) |

|

(761 |

) |

| |

Intangible asset amortization |

|

(439 |

) |

|

(333 |

) |

|

(142 |

) |

|

|

(1,334 |

) |

|

(573 |

) |

| |

|

Core efficiency ratio numerator |

|

19,865 |

|

|

20,228 |

|

|

18,248 |

|

|

|

74,332 |

|

|

72,832 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Net interest income |

|

17,613 |

|

|

17,887 |

|

|

12,045 |

|

|

|

63,312 |

|

|

46,540 |

|

| |

Noninterest income |

|

7,447 |

|

|

7,417 |

|

|

9,715 |

|

|

|

30,499 |

|

|

47,769 |

|

| |

|

Core efficiency ratio denominator |

|

25,060 |

|

|

25,304 |

|

|

21,760 |

|

|

|

93,811 |

|

|

94,309 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Core efficiency ratio (non-GAAP) |

|

79.27 |

% |

|

79.94 |

% |

|

83.86 |

% |

|

|

79.24 |

% |

|

77.23 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Tangible Book Value and Tangible Assets |

|

(Unaudited) |

|

(Dollars in thousands, except per share data) |

|

December 31, |

September 30, |

December 31, |

| |

|

|

|

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

Tangible Book Value: |

|

|

|

|

|

|

| |

Shareholders' equity |

|

|

$ |

158,416 |

|

$ |

151,274 |

|

$ |

156,729 |

|

| |

Goodwill and core deposit intangible, net |

|

|

(42,199 |

) |

|

(42,635 |

) |

|

(22,578 |

) |

| |

|

Tangible common shareholders' equity (non-GAAP) |

$ |

116,217 |

|

$ |

108,639 |

|

$ |

134,151 |

|

| |

|

|

|

|

|

|

|

|

| |

Common shares outstanding at end of period |

|

8,006,033 |

|

|

7,986,890 |

|

|

6,794,811 |

|

| |

|

|

|

|

|

|

|

|

| |

Common shareholders' equity (book value) per share (GAAP) |

$ |

19.79 |

|

$ |

18.94 |

|

$ |

23.07 |

|

| |

|

|

|

|

|

|

|

|

| |

Tangible common shareholders' equity (tangible book value) |

|

|

|

| |

|

per share (non-GAAP) |

|

|

$ |

14.52 |

|

$ |

13.60 |

|

$ |

19.74 |

|

| |

|

|

|

|

|

|

|

|

|

Tangible Assets: |

|

|

|

|

|

|

| |

Total assets |

|

|

|

$ |

1,948,384 |

|

$ |

1,923,920 |

|

$ |

1,435,926 |

|

| |

Goodwill and core deposit intangible, net |

|

|

(42,199 |

) |

|

(42,635 |

) |

|

(22,578 |

) |

| |

|

Tangible assets (non-GAAP) |

|

$ |

1,906,185 |

|

$ |

1,881,285 |

|

$ |

1,413,348 |

|

| |

|

|

|

|

|

|

|

|

| |

Tangible common shareholders' equity to tangible assets |

|

|

|

| |

|

(non-GAAP) |

|

|

|

|

6.10 |

% |

|

5.77 |

% |

|

9.49 |

% |

| |

|

|

|

|

|

|

|

|

|

Earnings Per Diluted Share, Excluding Acquisition Costs and

Related Taxes |

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Dollars in thousands, except per share data) |

Three Months Ended |

|

Years Ended |

| |

|

|

|

|

December 31, |

September 30, |

December 31, |

December 31, |

| |

|

|

|

|

|

2022 |

|

2022 |

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Net interest income after loan loss provision |

$ |

17,266 |

$ |

17,370 |

|

$ |

11,760 |

|

|

$ |

61,311 |

|

$ |

45,679 |

|

|

Noninterest income |

|

|

|

7,447 |

|

7,417 |

|

|

9,715 |

|

|

|

30,499 |

|

|

47,769 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense |

|

|

|

20,304 |

|

20,664 |

|

|

19,116 |

|

|

|

77,962 |

|

|

74,166 |

|

|

Acquisition costs |

|

|

|

|

- |

|

(103 |

) |

|

(726 |

) |

|

|

(2,296 |

) |

|

(761 |

) |

|

Noninterest expense, excluding acquisition costs (non-GAAP) |

|

20,304 |

|

20,561 |

|

|

18,390 |

|

|

|

75,666 |

|

|

73,405 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes, excluding acquisition costs |

|

4,409 |

|

4,226 |

|

|

3,085 |

|

|

|

16,144 |

|

|

20,043 |

|

|

Provision for income taxes, excluding acquisition costs |

|

|

|

|

|

|

|

related taxes (non-GAAP) |

|

|

|

787 |

|

1,057 |

|

|

827 |

|

|

|

3,669 |

|

|

5,055 |

|

|

Net Income, excluding acquisition costs and related taxes

(non-GAAP) |

$ |

3,622 |

$ |

3,169 |

|

$ |

2,258 |

|

|

$ |

12,475 |

|

$ |

14,988 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share (GAAP) |

|

$ |

0.47 |

$ |

0.40 |

|

$ |

0.26 |

|

|

$ |

1.45 |

|

$ |

2.17 |

|

|

Diluted earnings per share, excluding acquisition costs and

related |

|

|

|

|

|

|

|

taxes (non-GAAP) |

|

|

$ |

0.47 |

$ |

0.41 |

|

$ |

0.34 |

|

|

$ |

1.69 |

|

$ |

2.25 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Return on Average Assets, Excluding Acquisition Costs and

Related Taxes |

(Unaudited) |

|

|

(Dollars in thousands) |

|

|

December 31, |

September 30, |

December 31, |

| |

|

|

|

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

|

For the quarter: |

|

|

|

|

|

|

| |

Net income, excluding acquisition costs and related taxes

(non-GAAP)* |

$ |

3,622 |

|

$ |

3,169 |

|

$ |

2,258 |

|

|

| |

Average total assets quarter-to-date |

|

|

$ |

1,934,002 |

|

$ |

1,913,710 |

|

$ |

1,433,003 |

|

|

| |

Return on

average assets, excluding acquisition costs and related taxes

(non-GAAP) |

|

|

|

|

0.75 |

% |

|

0.66 |

% |

|

0.63 |

% |

|

| |

|

|

|

|

|

|

|

|

|

Year-to-date: |

|

|

|

|

|

|

| |

Net income, excluding acquisition costs and related taxes

(non-GAAP)* |

$ |

12,475 |

|

$ |

8,801 |

|

$ |

14,988 |

|

|

| |

Average total assets year-to-date |

|

|

$ |

1,768,919 |

|

$ |

1,713,892 |

|

$ |

1,357,249 |

|

|

| |

Return on

average assets, excluding acquisition costs and related taxes

(non-GAAP) |

|

|

|

|

0.71 |

% |

|

0.68 |

% |

|

1.10 |

% |

|

| |

|

|

|

|

|

|

|

|

| * See Earnings Per

Diluted Share, Excluding Acquisition Costs and Related Taxes table

for GAAP to non-GAAP reconciliation. |

|

| |

|

|

|

|

|

|

|

|

| Contacts: |

|

|

Laura F. Clark, President and CEO |

| |

|

|

(406) 457-4007 |

| |

|

|

Miranda J. Spaulding, SVP and CFO |

| |

|

|

(406) 441-5010 |

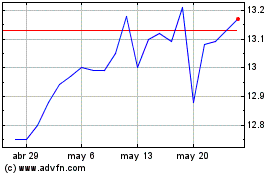

Eagle Bancorp Montana (NASDAQ:EBMT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Eagle Bancorp Montana (NASDAQ:EBMT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025