false

0001478454

0001478454

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

_________________

Date of Report (Date of earliest event reported): November 7, 2024

Eagle

Bancorp Montana, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

1-34682 |

|

27-1449820 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1400 Prospect Ave.

Helena, MT 59601

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (406) 442-3080

____________________________________________________________

Check the appropriate box if the Form 8-K filing is intended to simultaneously

satisfy the reporting obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange

on which registered |

| Common Stock, par value $0.01 per share |

EBMT |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure |

Executive officers of Eagle Bancorp Montana, Inc.,

a Delaware corporation (the “Company”) will make presentations to institutional investors at various meetings during the second

week of November 2024. The foregoing description of information contained in the presentation is qualified by reference to such presentation

materials attached as Exhibit 99.1. The Company is not undertaking to update this presentation or the information contained therein.

The information contained in and accompanying this

Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 hereto) is being furnished pursuant to Item 7.01 of Form 8-K and

shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended.

| Item 9.01 | Financial Statements and Exhibits |

(d) The following exhibit is being furnished herewith and this list shall

constitute the exhibit index:

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EAGLE BANCORP MONTANA, INC. |

| |

|

| |

|

| Date: November 7, 2024 |

By: : |

/s/ Miranda J. Spaulding |

| |

|

Miranda J. Spaulding

Senior Vice President & CFO |

Exhibit 99.1

Hovde Financial Services Conference November 7 - 8, 2024

2 Cautionary Notice Regarding Forward - Looking Statements This presentation includes “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amen ded, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward - looking statements are based on current expectations, estimates and projections about Eagle Bancorp Montana, I nc.’s business, beliefs of its management and assumptions made by its management. Any statement that does not describe historical or current facts is a forward - looking statement, including stat ements related to our projected growth, our anticipated future financial performance, and management’s long - term performance goals, as well as statements relating to the anticipated effects on results of operations and financial condition from expected developments or events, or business and growth strategies, including projections of future amortization and accretion, the impact of the anti cip ated internal growth and plans to establish or acquire banks. Forward - looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “cont inu e,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could,” or “may,” or by variations of such words or by similar expressions. These statements are not gua ran tees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expres sed or forecasted in such forward - looking statements. Potential risks and uncertainties include the following: ▪ the difficulties and risks inherent with entering new markets; ▪ general economic conditions and political events, either nationally or in our market areas that are worse than expected, whic h c ould result in, among other things, a continued deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values; ▪ our ability to raise additional capital may be impaired if markets are disrupted or become more volatile; ▪ turmoil in the financial markets and related efforts of government agencies to stabilize the financial system; ▪ the ability to promptly and effectively integrate businesses we acquire, including unexpected transaction costs, such as the cos ts of integrating operations, severance, professional fees, inherited litigation and other expenses; ▪ restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals ; ▪ governmental monetary and fiscal polices as well as legislative or regulatory changes, including changes in accounting standa rds and compliance requirements, may adversely affect us; ▪ competitive pressures among depository and other traditional and non - traditional financial services providers may increase signi ficantly; ▪ changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; ▪ other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; ▪ war or terrorist activities may cause further deterioration in the economy or cause instability in credit markets; ▪ the emergence or continuation of widespread health emergencies or pandemic including the magnitude and duration of the COVID - 19 pandemic, including but not limited to vaccine efficacy and immunization rates, new variants, steps taken by governmental and other authorities to contain, mitigate and combat the pande mic , adverse effects on our employees, customers and third - party service providers; ▪ changes or volatility in the securities markets that lead to impairment in the value of our investment securities and goodwil l; ▪ cyber incidents, or theft or loss of Company or customer data or money; ▪ the impact of continuing adverse developments affecting the U.S. banking industry, including the associated impact of any reg ula tory changes or other mitigation efforts taken by governmental agencies in response thereto; ▪ economic, governmental or other factors may prevent the projected population, residential and commercial growth in the market s i n which we operate; and ▪ we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the SEC, in clu ding our Form 10 - K for the fiscal year ended December 31, 2023. For these forward - looking statements, we claim the protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on the forward - looking statements, which speak only as of the date of this presentation. All subsequent written a nd oral forward - looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. W e u ndertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Repo rt on Form 10 - K for the year ended December 31, 2023, and otherwise in our SEC reports and filings, for a description of some of the important factors that may affect actual outcomes.

3 □ Eagle Bancorp Montana, Inc . is the holding company for Opportunity Bank of Montana ; established in 1922 , the Bank is the 4 th largest bank headquartered in Montana with 29 banking offices and has deeply embedded itself as the bank of choice within the community □ Continued execution on commercial bank model following the transition from a thrift ▪ Established commercial bank charter in 2014 ; rebranded as Opportunity Bank of Montana ▪ Diversified loan mix with higher yielding agricultural credits and increasing commercial loans ▪ Strong deposit mix : non - CDs, at 72 % of total deposits as of September 30 , 2024 ▪ Positioned for NIM expansion and improved profitability ▪ Core lines of business include : retail lending, commercial and agricultural lending, deposit products and services and mortgage origination ▪ Interest rate risk profile showing slightly liability sensitive balance sheet prepared for a decreasing rate environment □ Continuation of strong credit culture ; excellent credit quality with NPAs of 22 bps as of September 30 , 2024 □ Track record of execution on strategic initiatives : ▪ Announced Acquisition of First Community Bank in October 2021 , completed April 30 , 2022 ▪ Announced Acquisition of Western Bank of Wolf Point in August 2019 , completed January 2020 ▪ Announced Acquisition of State Bank of Townsend in August 2018 , completed January 2019 ▪ Announced Acquisition of Ruby Valley Bank in September 2017 , completed January 2018 ▪ Successful acquisition and integration of seven branches from Sterling Financial in 2012 Community Focused Institution

4 Company Overview □ 29 branches in Montana operating under the Company’s banking subsidiary – Opportunity Bank of Montana □ Balance Sheet (9/30/24): ▪ Assets $2.145 billion ▪ Gross Loans $1.535 billion ▪ Deposits $1.651 billion ▪ Total equity $177.7 million □ Asset Quality (9/30/24): ▪ NPAs/assets – 0.22% □ Profitability for YTD 2024: ▪ Net income of $6.3 million ▪ NIM – 3.36% ▪ ROAA – 0.41% ▪ ROAE – 5.19% EBMT Branches

5 Chantelle Nash SVP and Chief Risk Officer and Chief Administrative Officer 1 7 years with the Company 1 7 years in banking Mark O’Neill SVP and Chief Lending Officer 8 years with the Company 2 8 years in banking Darryl Rensmon SVP and Chief Operating Officer 8 years with the Company 38 years in IT Linda Chilton SVP and Chief Retail Officer 10 years with the Company 40 years in banking Alana Binde SVP and Chief Human Resource Officer 15 years with the Company 15 years in banking Laura Clark President and CEO 10 years with the Company 50 years in banking Rachel Amdahl SVP and Chief Operations Officer 3 7 years with the Company 3 7 years in banking Dale Field SVP and Chief Credit Officer 22 years with the Company 2 6 years in banking Miranda Spaulding SVP and Chief Financial Officer 11 years with the Company 24 years in accounting Experienced Executive Management

6 Experienced Board Year Elected Experience Director 2007 Retired President and CEO of Opportunity Bank and the Company Peter J. Johnson 2007 Retired President of a Montana telecommunications company Rick F. Hays 1998 Retired Vice President of Carroll College Thomas J. McCarvel 2010 Retired Executive Director of Montana Homeownership Network/NeighborWorks Montana Maureen J. Rude 2015 Co - founder of JWT Capital, LLC, a real estate development and operating company Shavon R. Cape 2015 Retired President of Abatement Contractors of Montana, LLC, specializing in environmental remediation Tanya J. Chemodurow 2018 Retired Market President of Opportunity Bank, former CEO of Ruby Valley Bank Kenneth M. Walsh 2018 Chief Operating Officer of Jeffery Contracting Corey I. Jensen 2019 Vice President, Agricultural Division, of Opportunity Bank, former President of The State Bank of Townsend Benjamin G. Ruddy 2019 Principal at Pinion Cynthia A. Utterback 2022 President & CEO of Opportunity Bank and the Company Laura F. Clark 2022 Retired Business Development Officer for Opportunity Bank, Former President of First Community Bank Samuel D. Waters

7 □ Continue to diversify our loan portfolio into commercial (C&I), commercial real estate and agriculture □ Attract and retain lower - cost core deposits □ Continue to expand our franchise through selective acquisitions and branch additions □ Maintain high asset quality levels □ Continue to operate as a community oriented financial institution Business Strategy

Key Montana Markets – Helena, Missoula, Great Falls Lewis and Clark County (Helena) Cascade County (Great Falls) Missoula County (Missoula) • Helena is the state capital of Montana. • Stable economy supported by state government, healthcare, education, and small business. • Government positions account for 70% of Helena's workforce. • Home to Carroll College, a top - ranked private liberal arts college. • Great Falls MSA is the 3rd largest metropolitan area in Montana by population. • Relatively new market for EBMT - Bank formally entered the Great Falls market in 2017. • Diverse regional economy is anchored by agriculture, military, manufacturing and tourism. • Trade hub for the Golden Triangle region, an area known for high quality agriculture production. • Missoula MSA is the 2nd largest metropolitan area in Montana by population. • Home to the University of Montana (Approximately 11,000 students). • Regional hub for a wide range of retail, professional and service activities. Source(s): S&P Global Market Intelligence as of June 30, 2024 8 MT Rank Institution (State) Branches Deposits Market Share 1Glacier Bancorp Inc. (MT) 5 561,280$ 24.3% 2First Interstate BancSystem (MT) 4 423,102 18.3% 3Eagle Bancorp Montana Inc. (MT) 4 344,275 14.9% 4Wells Fargo & Co. (CA) 2 299,876 13.0% 5Stockman Financial Corp. (MT) 2 284,986 12.4% 6U.S. Bancorp (MN) 1 195,097 8.5% 7Ascent Bancorp (MT) 2 85,663 3.7% 8Forstrom Bancorp. Inc. (MN) 1 38,013 1.7% 9JPMorgan Chase & Co. (NY) 1 25,821 1.1% 10Countricorp (MT) 1 23,502 1.0% Total For Institutions In Market 25 2,306,436$ MT Rank Institution (State) Branches Deposits Market Share 1Glacier Bancorp Inc. (MT) 8 843,551$ 23.2% 2First Interstate BancSystem (MT) 3 826,868 22.8% 3Stockman Financial Corp. (MT) 3 466,928 12.9% 4Wells Fargo & Co. (CA) 2 364,559 10.0% 5U.S. Bancorp (MN) 2 338,013 9.3% 6Bitterroot Holding Co. (MT) 7 290,662 8.0% 7Bancorp of Montana Holding Co. (MT) 1 268,393 7.4% 8Farmers State Financial Corp. (MT) 3 63,565 1.8% 9First National Bancorp Inc. (MT) 2 58,388 1.6% 10Eagle Bancorp Montana Inc. (MT) 1 56,534 1.6% Total For Institutions In Market 33 3,629,134$ MT Rank Institution (State) Branches Deposits Market Share 1First Interstate BancSystem (MT) 3 520,773$ 25.8% 2Stockman Financial Corp. (MT) 3 463,289 23.0% 3U.S. Bancorp (MN) 3 404,113 20.0% 4Wells Fargo & Co. (CA) 2 319,725 15.9% 5Bravera Holdings Corp. (ND) 2 85,878 4.3% 6Belt Valley Bank (MT) 1 62,569 3.1% 7Forstrom Bancorp. Inc. (MN) 1 51,403 2.6% 8Stockmens Bank (MT) 1 37,539 1.9% 9Eagle Bancorp Montana Inc. (MT) 1 31,003 1.5% 10Montana Security Inc. (MT) 1 29,807 1.5% Total For Institutions In Market 21 2,038,135$

Key Montana Markets – Bozeman, Billings, Butte Gallatin County (Bozeman) Silver Bow (Butte) Yellowstone County (Billings) • Fastest growing area in Montana, and one of the fastest growing counties in the Western U.S. • Home to Montana State University, the largest university in the state (16,000+ students). • Local economy is tied to technology, healthcare, education and tourism. • High - tech center of Montana. • Originally one of the largest industrial mining and smelting regions in the country, Butte has now evolved into a diverse regional economy. • Local economy is tied to mining, agriculture processing, healthcare, business services, tourism and education. • Home to Montana Tech, a public engineering and technical university (~2,500 students). • The Billings MSA is the largest metropolitan area in Montana by population. • Serves as the regional hub for more than 500,000 people across a four state region. • Diverse economy supported by transportation, manufacturing, hospitality, medical, energy and other business and consumer services. Source(s): S&P Global Market Intelligence as of June 30, 2024 9 MT Rank Institution (State) Branches Deposits Market Share 1Glacier Bancorp Inc. (MT) 10 1,761,115$ 36.6% 2First Interstate BancSystem (MT) 4 686,658 14.3% 3Stockman Financial Corp. (MT) 5 556,478 11.6% 4Wells Fargo & Co. (CA) 2 457,361 9.5% 5Guaranty Dev. Co. (MT) 3 338,572 7.0% 6U.S. Bancorp (MN) 2 305,011 6.3% 7MSB Financial Inc. (MT) 4 227,335 4.7% 8Eagle Bancorp Montana Inc. (MT) 3 225,332 4.7% 9Bozeman Bancorp Inc. (MT) 1 89,731 1.9% 10Yellowstone Holding Co. (MT) 1 56,718 1.2% Total For Institutions In Market 42 4,817,209$ MT Rank Institution (State) Branches Deposits Market Share 1Wells Fargo & Co. (CA) 1 206,440$ 23.8% 2Glacier Bancorp Inc. (MT) 3 191,754 22.1% 3First National Bancorp Inc. (MT) 1 116,390 13.4% 4Eagle Bancorp Montana Inc. (MT) 1 113,657 13.1% 5U.S. Bancorp (MN) 1 98,404 11.4% 6Forstrom Bancorp. Inc. (MN) 1 60,311 7.0% 7Butte Bank Shares Inc. (MT) 2 54,650 6.3% 8Bridger Co. (MT) 1 24,924 2.9% Total For Institutions In Market 11 866,530$ MT Rank Institution (State) Branches Deposits Market Share 1First Interstate BancSystem (MT) 9 1,658,385$ 23.8% 2U.S. Bancorp (MN) 4 1,511,991 21.7% 3Stockman Financial Corp. (MT) 6 1,147,242 16.5% 4Glacier Bancorp Inc. (MT) 9 897,774 12.9% 5Wells Fargo & Co. (CA) 4 874,938 12.6% 6Yellowstone Holding Co. (MT) 5 585,707 8.4% 7Eagle Bancorp Montana Inc. (MT) 3 76,976 1.1% 8Bitterroot Holding Co. (MT) 1 72,055 1.0% 9Bravera Holdings Corp. (ND) 2 66,447 1.0% 10JPMorgan Chase (NY) 2 37,549 0.5% Total For Institutions In Market 47 6,966,174$

10 □ On April 30, 2022, completed purchase of First Community Bancorp, Inc. and its subsidiary, First Community Bank. □ On January 21, 2022, issued and sold $40 million in aggregate principal amount of its 3.50% fixed - to - floating rate subordinated notes to certain institutional accredited investors and qualified institutional buyers through a private placement offering. □ On June 10, 2020, sold $15 million in subordinated notes to certain qualified institutional accredited investors through a private placement offering. On January 1, 2020, completed purchase of Western Bank of Wolf Point, in Wolf Point, Montana. □ On January 1, 2019, completed purchase of The State Bank of Townsend, in Townsend, Montana. □ On January 31, 2018, completed purchase of Ruby Valley Bank, in Twin Bridges, Montana. Company Developments

11 $200 $213 $238 $251 $287 $306 $333 $332 $508 $516 $560 $630 $674 $717 $854 $1,054 $1,258 $1,436 $1,880 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 Non-Acquired Assets Acquired Assets April 2022 Assets: $370M Loans: $191M Deposits: $321M Acquired An Expanding Franchise Source: S&P Capital IQ Pro, Company filings and call report data Note: Bank level financial information for acquired companies and branches at closing or most recent quarter ▪ EBMT has successfully executed on it’s growth strategy, through both organic growth and acquisitions, and has produced results ▪ Strong track record of successfully integrating acquisitions - EBMT has been the most active acquiror of Montana banks over the last four years ▪ Complementary combinations have provided increased scale and diversification November 2012 Loans: $41M Deposits: $181M Acquired 7 Montana Branches from January 2020 Assets: $100M Loans: $41M Deposits: $77M Acquired January 2019 Assets: $108M Loans: $92M Deposits: $92M Acquired January 2018 Assets: $90M Loans: $55M Deposits: $78M Acquired

FINANCIAL HIGHLIGHTS

13 Net Interest Income & Net Interest Margin $ 2 , 0 $ 3 , 0 $ 4 , 0 $ 5 , 0 $ 6 , 0 $ 7 , 0 $ 8 , 0 $ 9 , 0 $ 1 0 , 2 . 8 0 3 . 0 0 3 . 2 0 3 . 4 0 3 . 6 0 3 . 8 0 4 . 0 0 4 . 2 0 4 . 4 0 4 . 6 0 Net Interest Income Net Interest Margin 4.03% 3.97% 3.81% 3.87% 3.75% 3.64% 4.09% 4.18% 4.10% 3.86% 3.47% 3.41% 3.32% 3.33% 3.41% 3.34% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 $20,000 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Net Interest Income Net Interest Margin Net interest income in 000’s

14 Provision for Credit Losses $2,627 $3,130 $861 $2,001 $1,456 $554 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2019 2020 2021 2022 2023 YTD 2024 Provision for credit losses on loans starting in 2023, provision for loan losses for prior periods $ in 000’s

15 Balance Sheet Expansion $1,054 $1,258 $1,436 $1,948 $2,076 $2,145 $779 $841 $933 $1,354 $1,484 $1,535 $809 $1,033 $1,223 $1,635 $1,635 $1,651 $0 $500 $1,000 $1,500 $2,000 $2,500 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 9/30/2024 Assets Total Loans Deposits $ in millions

16 Loan Portfolio Composition – 9/30/2024 □ 38 Commercial/Ag lenders □ 17 Mortgage lenders □ C&I accounts for 8% of loan portfolio □ Owner - occupied CRE loans represent 13% of total loans Excludes loans held for sale Commercial & Industrial , 8% Commercial Real Estate , 42% Construction & Land Development , 8% Residential 1 - 4 and Construction , 14% Home Equity , 6% Agriculture & Farm , 19% Consumer , 3% Loan Portfolio Detail

17 Non Interest Checking 25% Interest Bearing Checking 13% Savings 13% Money Market 21% Time Certificates 28% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Time Certificates Money Market Savings Interest Checking Non Interest Checking September 30, 2024 Deposit Mix – Rolling 8 Quarters □ Deposit costs were 176 basis points for 3Q24 □ Non - Interest Bearing accounts represent 25% of total deposits at 3Q24 □ MMDA & Checking accounts represent 59% of total deposits at 3Q24 (000's) 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Non Interest Checking 468,955$ 460,195$ 432,463$ 435,655$ 418,727$ 408,781$ 400,113$ 419,760$ Interest Bearing Checking 252,922 237,365 224,690 225,573 211,101 217,654 210,277 209,061 Savings 273,790 258,225 245,316 233,181 230,711 229,248 220,136 212,239 Money Market 387,947 334,746 320,361 326,718 330,274 339,796 359,752 351,097 Time Certificates 251,658 317,007 355,537 394,351 444,382 440,120 428,587 458,355 Total 1,635,272$ 1,607,538$ 1,578,367$ 1,615,478$ 1,635,195$ 1,635,599$ 1,618,865$ 1,650,512$ Funding Overview – Deposit Composition

18 0.52% 0.68% 0.49% 0.40% 0.41% 0.22% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 9/30/2024 Nonperforming Assets/Total Assets Disciplined Credit Culture Effective January 1, 2023, the Company adopted ASU No. 2022 - 02, Financial Instruments - Credit Losses (Topic 326) Troubled Debt Restructurings ("TDRs") and Vintage Disclosures. The update eliminated the recognition and measurement of TDRs, therefore, TDRs are not included in nonpe rfo rming assets starting in 2023.

19 Yield and Cost of Funds 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2019Y 2020Y 2021Y 2022Y 2023Y YTD 2024 Yield on Average Earning Assets EBMT Peer Group 0.00% 2.00% 4.00% 6.00% 8.00% 2019Y 2020Y 2021Y 2022Y 2023Y YTD 2024 Yield on Loans EBMT Peer Group 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 2019Y 2020Y 2021Y 2022Y 2023Y YTD 2024 Cost of Funds EBMT *Peer Group data as of the quarter ended June 30, 2024. Peer group includes PFLC, RVSB, CSHX, FSBW, TSBK, SFBC, OVLY, CVCY, N RIM , CZBC, SSBI, & FNRN Source: S&P Global Market Intelligence * *

20 Capital Strength Total Assets 1,257,634$ 1,435,926$ 1,948,384$ 2,075,666$ 2,145,113$ Total Common Stockholders' Equity 152,938$ 156,729$ 158,416$ 169,273$ 177,730$ Total Regulatory Capital 156,897$ 164,639$ 219,595$ 229,171$ 234,240$ Tier 1 Leverage Ratio 10.61% 9.75% 7.78% 7.57% 7.64% Tier 1 Risk Based Capital Ratio 14.17% 12.64% 9.67% 9.29% 9.34% Total Risk Based Capital Ratio 17.04% 15.18% 14.10% 13.61% 13.59% Common Equity Tier 1 (CETI) Ratio 13.62% 12.18% 9.35% 8.99% 9.05% Tangible Common Equity Ratio 10.51% 9.49% 6.10% 6.32% 6.56% 3Q24($ in 000s) 2021Y 2022Y 2023Y2020Y

Laura Clark President and CEO Office: (406) 442 - 3080 Direct: (406) 457 - 4007 lclark@oppbank.com www.opportunitybank.com 1400 Prospect Avenue P.O. Box 4999 Helena, MT 59604 Miranda Spaulding SVP and Chief Financial Officer Office: (406) 442 - 3080 Direct: (406) 441 - 5010 mspaulding@oppbank.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

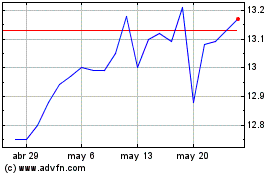

Eagle Bancorp Montana (NASDAQ:EBMT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Eagle Bancorp Montana (NASDAQ:EBMT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024