Delivered record revenue and cash flow,

improved adjusted EBITDA, advanced pipeline

Third quarter highlights

- Total third quarter revenue of $709 million, an increase of 13%

on a reported and core revenue basis, including Screening revenue

of $545 million and Precision Oncology revenue of $164 million

- Net loss was $38 million, adjusted EBITDA was $99 million, and

adjusted EBITDA margin increased 500 basis points to 14%

- Operating cash flow was $139 million with free cash flow of

$113 million

- Received FDA approval for the Cologuard Plus™ test, the

Company's next-generation Cologuard® test

- Presented data showing potential of its blood-based colorectal

cancer screening test, with sensitivities of 88% for colorectal

cancer and 31% for advanced precancerous lesions at 90%

specificity

- Secured acceptance from a peer reviewed journal for the first

publication on the Oncodetect™ test, its molecular residual disease

and recurrence monitoring test

Exact Sciences Corp. (Nasdaq: EXAS), a leading provider of

cancer screening and diagnostic tests, today announced that the

Company generated revenue of $709 million for the third quarter

ended September 30, 2024, compared to $628 million for the same

period of 2023.

“The Exact Sciences’ team is helping eradicate cancer while

strengthening our platform and growing our business efficiently,”

said Kevin Conroy, chairman and CEO. “During the third quarter, we

delivered test results to more patients than ever before, improved

profitability, and achieved key milestones in our pipeline of

innovative cancer diagnostics. While we have made progress, our

execution during the third quarter and updated outlook for the full

year don’t reflect our full potential. We plan to accelerate growth

in 2025, and our long-term outlook remains strong.”

Third-quarter 2024 financial results

For the three-month period ended September 30, 2024, as compared

to the same period of 2023 (where applicable):

- Total revenue was $709 million, an increase of 13 percent on a

reported and core revenue basis

- Screening revenue was $545 million, an increase of 15

percent

- Precision Oncology revenue was $164 million, an increase of 5

percent on a reported and core revenue basis

- Gross margin including amortization of acquired intangible

assets was 69 percent, and non-GAAP gross margin excluding

amortization of acquired intangible assets was 72 percent

- Other operating income was $3 million compared to $72 million,

which included a gain related to the sale of the Oncotype DX

Genomic Prostate Score Test in third-quarter 2023

- Net loss was $38 million, or $0.21 per basic and diluted share,

a reduction of $39 million, or $0.21 per basic and diluted

share

- Adjusted EBITDA was $99 million an increase of $42 million, and

adjusted EBITDA margin was 14 percent, an increase of 500 basis

points

- Operating cash flow was $139 million and free cash flow was

$113 million, increases of $114 million and $113 million,

respectively

- Cash, cash equivalents, and marketable securities were $1.02

billion at the end of the quarter

Screening primarily includes laboratory service revenue from

Cologuard tests and PreventionGenetics. Precision Oncology includes

laboratory service revenue from global Oncotype DX and therapy

selection tests.

Platform and pipeline advancements

The Company's ExactNexus™ technology platform allows Exact

Sciences to connect electronically with patients, health systems,

healthcare professionals, and payers. The digital tools and data

embedded within the ExactNexus platform enable personalized

customer experiences, creating a streamlined process for accessing

information, enhancing patient engagement, and improving health

outcomes. This approach contributed to strong growth in Cologuard

test utilization among rescreen patients and within care gap

programs during the third quarter.

Exact Sciences received FDA approval for the Cologuard Plus

test, its next-generation Cologuard test. The Cologuard Plus test

detects cancers and precancerous polyps with even greater

sensitivity than the Cologuard test while reducing false positives

by more than 30 percent. This advancement enhances the Company’s

screening capabilities and reinforces its commitment to delivering

high-quality, non-invasive options for patients. With the Cologuard

Plus test, the Company expects to secure a higher price through an

established Medicare pathway.

In the third quarter, the Company also presented data for its

blood-based colorectal cancer screening test, showcasing a

sensitivity of 88% for colorectal cancer and 31% for advanced

precancerous lesions at 90% specificity. These results show the

potential of the Company's novel marker panel to detect advanced

precancerous lesions and cancers at an attractive cost profile.

This innovation is expected to provide average-risk patients with

another screening option, reinforcing the power of the Company’s

unique scientific approach.

Exact Sciences secured acceptance from a peer-reviewed journal

for its first publication on the Oncodetect test, its molecular

residual disease and recurrence monitoring test. These data are

currently under embargo and are expected to be shared in January

2025. With nearly 6 million cancer survivors in the U.S. who could

benefit from residual and recurrent disease testing, the need is

urgent - yet less than 5% are currently receiving the vital testing

today. This recognition highlights the scientific rigor behind the

product and positions the Oncodetect test as a leading solution for

monitoring residual disease and cancer recurrence.

The Company also shared evidence supporting its blood-based

multi-cancer screening test, assessing organ-specific performance

of methylation and protein biomarkers in a prospectively collected

cohort of samples from its ASCEND 2 study. The analysis indicated

an overall sensitivity of 55% in cancers without standard-of-care

screening options (excluding lung), and 64% in the six most

aggressive cancers with the shortest survival rates, with a

specificity of 98.5%. These findings highlight the potential

clinical value of using multiple biomarkers to detect various

cancer types, including the most aggressive and those without

recommended screening options.

2024 outlook

The Company has updated its full-year 2024 revenue and adjusted

EBITDA guidance:

Prior guidance

November 5 update

Total revenue

$2.810 - $2.850 billion

$2.730 - $2.750 billion

Screening

$2.155 - $2.175 billion

$2.080 - $2.095 billion

Precision Oncology

$655 - $675 million

$650 - $655 million

Adjusted EBITDA

$335 - $355 million

$310 - $320 million

Third-quarter 2024 conference call & webcast

Company management will host a conference call and webcast on

Tuesday, November 5, 2024, at 5 p.m. ET to discuss third-quarter

2024 results. The webcast will be available at exactsciences.com.

Domestic callers should dial 888-330-2384 and international callers

should dial +1-240-789-2701. The access code for both domestic and

international callers is 4437608. A replay of the webcast will be

available at exactsciences.com. The webcast, conference call, and

replay are open to all interested parties.

Non-GAAP disclosure

In addition to the Company’s financial results determined in

accordance with U.S. GAAP, the Company provides non-GAAP measures

that it determines to be useful in evaluating its operating

performance and liquidity. The Company presents core revenue,

non-GAAP gross margin, non-GAAP gross profit, adjusted EBITDA,

adjusted EBITDA margin, adjusted cost of sales (exclusive of

amortization of acquired intangible assets), adjusted research and

development expenses, adjusted sales and marketing expenses,

adjusted general and administrative expenses, adjusted amortization

of acquired intangible assets, adjusted impairment of long-lived

assets, adjusted other operating income (loss), adjusted operating

income (loss), and free cash flow. Core revenue is calculated to

adjust for recent acquisitions and divestitures, COVID-19 testing

revenue and foreign currency exchange rate fluctuations. To exclude

the impact of change in foreign currency exchange rates from the

prior period under comparison, the Company converts the current

period non-U.S. dollar denominated revenue using the prior year

comparative period exchange rates. The Company defines non-GAAP

gross profit and non-GAAP gross margin as GAAP gross profit and

GAAP gross margin, respectively, excluding amortization of acquired

intangible assets. The amortization of acquisition-related

intangible assets used in the calculation of non-GAAP gross profit

and non-GAAP gross margin pertain only to the amortization

associated with developed technology acquired and recorded through

purchase accounting transactions. The amortization of these

intangible assets will recur in future periods until such

intangible assets have been fully amortized. Adjusted EBITDA,

adjusted cost of sales (exclusive of amortization of acquired

intangible assets), adjusted research and development expenses,

adjusted sales and marketing expenses, adjusted general and

administrative expenses, adjusted amortization of acquired

intangible assets, adjusted impairment of long-lived assets,

adjusted other operating income (loss), and adjusted operating

income (loss) consist of the applicable GAAP measure after

adjustment for those items shown in the reconciliations below.

Adjusted EBITDA margin is calculated as adjusted EBITDA divided by

total revenue. The Company considers free cash flow to be a

liquidity measure and is calculated as net cash used in or provided

by operating activities, reduced by purchases of property, plant

and equipment. Management believes that presentation of non-GAAP

financial measures provides useful supplemental information to

investors and facilitates the analysis of the Company’s core

operating results and comparison of operating results across

reporting periods. The Company uses this non-GAAP financial

information to establish budgets, manage the Company’s business,

and set incentive and compensation arrangements. The Company

believes free cash flow provides useful information to management

and investors since it measures our ability to generate cash from

business operations. Non-GAAP financial information, when taken

collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance.

However, non-GAAP financial information is presented for

supplemental information purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

U.S. GAAP. For example, non-GAAP gross margin and non-GAAP gross

profit exclude the amortization of acquired intangible assets

although such measures include the revenue associated with the

acquisitions. Additionally, adjusted EBITDA and other adjusted

operating result metrics exclude a number of expense items that are

included in net loss. As a result, positive adjusted EBITDA or

adjusted operating income may be achieved while a significant net

loss persists. For a reconciliation of these non-GAAP measures to

GAAP, see below “Reconciliation of Core Revenue”, “Non-GAAP Gross

Profit and Non-GAAP Gross Margin Reconciliations”, “Adjusted EBITDA

Reconciliations”, “Reconciliation of U.S. GAAP to Non-GAAP

Measures”, and “Condensed Consolidated Statements of Cash Flows and

Reconciliation of Free Cash Flow”. The Company presents certain

forward-looking statements about the Company’s future financial

performance that include non-GAAP measures. These non-GAAP measures

include adjustments like stock-based compensation, acquisition and

integration costs including gains and losses on contingent

consideration, and other significant charges or gains that are

difficult to predict for future periods because the nature of the

adjustments pertain to events that have not yet occurred.

Additionally management does not forecast many of the excluded

items for internal use. Information reconciling forward-looking

non-GAAP measures to U.S. GAAP measures is therefore not available

without unreasonable effort, and is not provided. The occurrence,

timing, and amount of any of the items excluded from GAAP to

calculate non-GAAP could significantly impact the Company’s GAAP

results.

About the Cologuard® and Cologuard Plus™ tests:

Developed in collaboration with Mayo Clinic, the Cologuard and

Cologuard Plus tests are non-invasive colorectal cancer (CRC)

screening options for the 110 million U.S. adults ages 45 or older

who are at average risk for the disease.

The Cologuard test revolutionized CRC screening by detecting

specific DNA markers and blood associated with cancer and precancer

in stool, allowing patients to use the test at home without special

preparation or time off. It is covered by Medicare and included in

national screening guidelines from both the American Cancer Society

(2018) and the U.S. Preventive Services Task Force (2021). Since

its launch in 2014, the Cologuard test has been used to screen for

CRC 17 million times.

Building on this success, the FDA-approved Cologuard Plus test

raises the performance bar even further and features novel

biomarkers, improved laboratory processes, and enhanced sample

stability. The Cologuard Plus test is expected to reduce false

positives by more than 30%, to help minimize unnecessary follow-up

colonoscopies. Both tests demonstrate Exact Sciences’ commitment to

improving CRC screening access and outcomes. Exact Sciences expects

to launch the Cologuard Plus test with Medicare coverage and

guideline inclusion in 2025.

About Exact Sciences’ Precision Oncology portfolio

Exact Sciences’ Precision Oncology portfolio delivers actionable

genomic insights to inform prognosis and cancer treatment after a

diagnosis. In breast cancer, the Oncotype DX Breast Recurrence

Score® test is the only test shown to predict the likelihood of

chemotherapy benefit as well as recurrence in invasive breast

cancer. The Oncotype DX test is recognized as the standard of care

and is included in all major breast cancer treatment guidelines.

The OncoExTra® test applies comprehensive tumor profiling,

utilizing whole exome and whole transcriptome sequencing, to aid in

therapy selection for patients with advanced, metastatic,

refractory, relapsed, or recurrent cancer. With an extensive panel

of approximately 20,000 genes and 169 introns, the OncoExTra test

is one of the most comprehensive genomic (DNA) and transcriptomic

(RNA) panels available today. Exact Sciences enables patients to

take a more active role in their cancer care and makes it easy for

providers to order tests, interpret results, and personalize

medicine. To learn more, visit

precisiononcology.exactsciences.com.

About PreventionGenetics

Founded in 2004 and located in Marshfield, Wisconsin,

PreventionGenetics is a CLIA and ISO 15189:2012 accredited

laboratory. PreventionGenetics delivers clinical genetic testing of

the highest quality at fair prices with exemplary service to people

around the world. PreventionGenetics has 25 PhD geneticists on

staff and provides tests for nearly all clinically relevant genes

including the powerful and comprehensive germline whole genome

sequencing test, PGnome® and whole exome sequencing test, PGxome®.

PreventionGenetics was acquired by Exact Sciences in December

2021.

About Exact Sciences Corp.

A leading provider of cancer screening and diagnostic tests,

Exact Sciences gives patients and health care professionals the

clarity needed to take life-changing action earlier. Building on

the success of the Cologuard and Oncotype DX tests, Exact Sciences

is investing in its pipeline to develop innovative solutions for

use before, during, and after a cancer diagnosis. For more

information, visit ExactSciences.com, follow Exact Sciences on X

@ExactSciences, or find Exact Sciences on LinkedIn and

Facebook.

Forward-Looking Statements

This news release contains forward-looking statements concerning

our expectations, anticipations, intentions, beliefs or strategies

regarding the future. These forward-looking statements are based on

assumptions that we have made as of the date hereof and are subject

to known and unknown risks and uncertainties that could cause

actual results, conditions and events to differ materially from

those anticipated. Therefore, you should not place undue reliance

on forward-looking statements. Examples of forward-looking

statements include, among others, statements we make regarding

expected future operating results; expectations for development of

new or improved products and services and their impacts on

patients; our strategies, positioning, resources, capabilities and

expectations for future events or performance; and the anticipated

benefits of our acquisitions, including estimated synergies and

other financial impacts.

Important factors that could cause actual results, conditions

and events to differ materially from those indicated in the

forward-looking statements include, among others, the following:

our ability to successfully and profitably market our products and

services; the acceptance of our products and services by patients

and healthcare providers; our ability to meet demand for our

products and services; our reliance upon certain suppliers,

including suppliers that are the sole source of certain supplies

and products used in our tests and operations; approval and

maintenance of adequate reimbursement rates for our products and

services within and outside of the U.S.; the amount and nature of

competition for our products and services; the effects of any

judicial, executive or legislative action affecting us or the

healthcare system; recommendations, guidelines and quality metrics

issued by various organizations regarding cancer screening or our

products and services; our ability to successfully develop and

commercialize new products and services and assess potential market

opportunities; our ability to effectively enter into and utilize

strategic partnerships and acquisitions; our success establishing

and maintaining collaborative, licensing and supplier arrangements;

our ability to obtain and maintain regulatory approvals and comply

with applicable regulations; our ability to protect and enforce our

intellectual property; the results of our validation studies and

clinical trials, including the risks that the results of future

studies and trials may differ materially from the results of

previously completed studies and trials; our ability to manage an

international business and our expectations regarding our

international expansion and opportunities; our ability to raise the

capital necessary to support our operations or meet our payment

obligations under our indebtedness; the potential effects of

changing macroeconomic conditions, including the effects of

inflation, interest rate and foreign currency exchange rate

fluctuations, and geopolitical conflict; the possibility that the

anticipated benefits from our business acquisitions will not be

realized in full or at all or may take longer to realize than

expected; the possibility that costs or difficulties related to the

integration of acquired businesses’ operations or the divestiture

of business operations will be greater than expected and the

possibility that integration or divestiture efforts will disrupt

our business and strain management time and resources; the outcome

of any litigation, government investigations, enforcement actions

or other legal proceedings; and our ability to retain and hire key

personnel. The risks included above are not exhaustive. Other

important risks and uncertainties are described in the Risk Factors

sections of our most recent Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q, and in our other reports

filed with the Securities and Exchange Commission. We undertake no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Condensed Consolidated

Statements of Operations

(Amounts in thousands, except

per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

708,655

$

628,338

$

2,045,443

$

1,852,881

Operating expenses

Cost of sales (exclusive of amortization

of acquired intangible assets)

196,070

168,526

556,019

482,383

Research and development

100,101

111,446

331,593

310,960

Sales and marketing

194,653

173,159

572,288

536,613

General and administrative

217,201

217,393

662,174

672,653

Amortization of acquired intangible

assets

24,435

22,992

71,057

68,849

Impairment of long-lived assets

18,698

—

31,296

621

Total operating expenses

751,158

693,516

2,224,427

2,072,079

Other operating income

3,100

72,027

6,632

72,027

Income (loss) from operations

(39,403

)

6,849

(172,352

)

(147,171

)

Other income (expense)

Investment income, net

11,582

2,065

29,596

7,383

Interest expense

(9,607

)

(7,871

)

(17,439

)

(11,582

)

Total other income (expense)

1,975

(5,806

)

12,157

(4,199

)

Net income (loss) before tax

(37,428

)

1,043

(160,195

)

(151,370

)

Income tax expense

(808

)

(249

)

(4,077

)

(3,013

)

Net income (loss)

$

(38,236

)

$

794

$

(164,272

)

$

(154,383

)

Net income (loss) per share—basic

$

(0.21

)

$

0.00

$

(0.89

)

$

(0.86

)

Net income (loss) per share—diluted

$

(0.21

)

$

0.00

$

(0.89

)

$

(0.86

)

Weighted average common shares

outstanding—basic

184,795

180,649

183,823

179,817

Weighted average common shares

outstanding—diluted

184,795

184,075

183,823

179,817

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Condensed Consolidated Balance

Sheets

(Amounts in thousands)

September 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

588,830

$

605,378

Marketable securities

432,301

172,266

Accounts receivable, net

264,819

203,623

Inventory

136,987

127,475

Prepaid expenses and other current

assets

110,180

85,627

Property, plant and equipment, net

690,332

698,354

Operating lease right-of-use assets

122,452

143,708

Goodwill

2,367,450

2,367,120

Intangible assets, net

1,864,399

1,890,396

Other long-term assets, net

170,821

177,387

Total assets

$

6,748,571

$

6,471,334

Liabilities and stockholders’

equity

Convertible notes, net, current

portion

$

249,038

$

—

Current liabilities

474,624

514,701

Convertible notes, net, less current

portion

2,319,490

2,314,276

Other long-term liabilities

332,213

335,982

Operating lease liabilities, less current

portion

162,695

161,070

Total stockholders’ equity

3,210,511

3,145,305

Total liabilities and stockholders’

equity

$

6,748,571

$

6,471,334

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Reconciliation of Core

Revenue

(Amounts in thousands)

GAAP

Three Months Ended September

30,

2024

2023

% Change

Screening

$

544,901

$

472,013

15

%

Precision Oncology

163,754

156,325

5

%

Total

$

708,655

$

628,338

13

%

Non-GAAP

Three Months Ended September

30,

2024 (1)

2023 (1)

% Change

Foreign Currency Impact

(2)

Core Revenue (3)

% Change (3)

Screening

$

544,901

$

472,013

15

%

$

—

$

544,901

15

%

Precision Oncology

162,819

154,451

5

%

(810

)

162,009

5

%

Total

$

707,720

$

626,464

13

%

$

(810

)

$

706,910

13

%

GAAP

Nine Months Ended September

30,

2024

2023

% Change

Screening

$

1,551,305

$

1,377,995

13

%

Precision Oncology

494,138

468,931

5

%

COVID-19 Testing

—

5,955

(100

)%

Total

$

2,045,443

$

1,852,881

10

%

Non-GAAP

Nine Months Ended September

30,

2024 (1)

2023 (1)

% Change

Foreign Currency Impact

(2)

Core Revenue (3)

% Change (3)

Screening

$

1,551,305

$

1,377,995

13

%

$

—

$

1,551,305

13

%

Precision Oncology

486,518

462,725

5

%

(672

)

485,846

5

%

Total

$

2,037,823

$

1,840,720

11

%

$

(672

)

$

2,037,151

11

%

(1) Excludes revenue from COVID-19 testing, the divested

Oncotype DX Genomic Prostate Score test, and the Resolution

Bioscience acquisition.

(2) Foreign currency impact is calculating the change in current

period non-U.S. dollar denominated revenue using the prior year

comparative period exchange rates.

(3) Excludes revenue from COVID-19 testing, the divested

Oncotype DX Genomic Prostate Score test, the impact of foreign

currency exchange rate fluctuations, and the Resolution Bioscience

acquisition.

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Non-GAAP Gross Profit and

Non-GAAP Gross Margin Reconciliations

(Amounts in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

708,655

$

628,338

$

2,045,443

$

1,852,881

Cost of sales (exclusive of amortization

of acquired intangible assets)

196,070

168,526

556,019

482,383

Amortization of acquired intangible assets

(1)

21,100

20,781

63,300

62,216

Gross profit

$

491,485

$

439,031

$

1,426,124

$

1,308,282

Gross margin

69

%

70

%

70

%

71

%

Amortization of acquired intangible assets

(1)

21,100

20,781

63,300

62,216

Non-GAAP gross profit

$

512,585

$

459,812

$

1,489,424

$

1,370,498

Non-GAAP gross margin

72

%

73

%

73

%

74

%

(1) Includes only amortization of intangible assets identified

as developed technology assets through purchase accounting

transactions, which otherwise would have been allocated to cost of

sales.

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Adjusted EBITDA

Reconciliations

(Amounts in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income (loss)

$

(38,236

)

$

794

$

(164,272

)

$

(154,383

)

Interest expense (1)

9,607

7,871

17,439

11,582

Income tax expense

808

249

4,077

3,013

Investment income

(11,582

)

(2,065

)

(29,596

)

(7,383

)

Depreciation and amortization

54,771

52,254

161,712

152,436

Stock-based compensation (2)

57,219

72,089

197,143

204,752

Acquisition and integration costs (3)

5,310

(4,395

)

2,836

(8,146

)

Impairment of long-lived assets (4)

18,698

—

31,296

621

Gain on sale of asset and divestiture

related costs (5)

(3,100

)

(70,522

)

(6,632

)

(70,522

)

Restructuring and business transformation

(6)

8,736

—

11,671

907

License agreement termination (7)

—

—

25,843

—

Legal settlement (8)

(3,500

)

—

(3,500

)

36,186

Adjusted EBITDA

$

98,731

$

56,275

$

248,017

$

169,063

Adjusted EBITDA margin

14

%

9

%

12

%

9

%

Refer below the Reconciliations of U.S. GAAP to Non-GAAP

Measures section for endnote descriptions.

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Reconciliation of U.S. GAAP to

Non-GAAP Measures

(Amounts in thousands)

Three Months Ended September

30, 2024

Cost of Sales (9)

Research & Development

Expenses

Sales & Marketing

Expenses

General & Administrative

Expenses

Amortization of acquired

intangible assets

Impairment of Long- Lived

Assets

Other Operating Income

Income (Loss) from

Operations

Reported

$

196,070

$

100,101

$

194,653

$

217,201

$

24,435

$

18,698

$

3,100

$

(39,403

)

Amortization of acquired intangible

assets

—

—

—

—

(24,435

)

—

—

24,435

Acquisition and integration costs (3)

—

—

—

(5,310

)

—

—

—

5,310

Impairment of long-lived assets (4)

—

—

—

—

—

(18,698

)

—

18,698

Gain on sale of asset and divestiture

related costs (5)

—

—

—

—

—

—

(3,100

)

(3,100

)

Restructuring and business transformation

(6)

—

(4,181

)

—

(4,555

)

—

—

—

8,736

Legal settlement (8)

—

—

—

3,500

—

—

—

(3,500

)

Adjusted

$

196,070

$

95,920

$

194,653

$

210,836

$

—

$

—

$

—

$

11,176

Nine Months Ended September

30, 2024

Cost of Sales (9)

Research & Development

Expenses

Sales & Marketing

Expenses

General & Administrative

Expenses

Amortization of acquired

intangible assets

Impairment of Long- Lived

Assets

Other Operating Income

Income (Loss) from

Operations

Reported

$

556,019

$

331,593

$

572,288

$

662,174

$

71,057

$

31,296

$

6,632

$

(172,352

)

Amortization of acquired intangible

assets

—

—

—

—

(71,057

)

—

—

71,057

Acquisition and integration costs (3)

—

—

—

(2,836

)

—

—

—

2,836

Impairment of long-lived assets (4)

—

—

—

—

—

(31,296

)

—

31,296

Gain on sale of asset and divestiture

related costs (5)

—

—

—

—

—

—

(6,632

)

(6,632

)

Restructuring and business transformation

(6)

(200

)

(6,574

)

(222

)

(4,675

)

—

—

—

11,671

License agreement termination (7)

—

(25,843

)

—

—

—

—

—

25,843

Legal settlement (8)

—

—

—

3,500

—

—

—

(3,500

)

Adjusted

$

555,819

$

299,176

$

572,066

$

658,163

$

—

$

—

$

—

$

(39,781

)

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Reconciliation of U.S. GAAP to

Non-GAAP Measures

(Amounts in thousands)

Three Months Ended September

30, 2023

Cost of Sales (9)

Research & Development

Expenses

Sales & Marketing

Expenses

General & Administrative

Expenses

Amortization of acquired

intangible assets

Impairment of Long- Lived

Assets

Other Operating Income

Income (Loss) from

Operations

Reported

$

168,526

$

111,446

$

173,159

$

217,393

$

22,992

$

—

$

72,027

$

6,849

Amortization of acquired intangible

assets

—

—

—

—

(22,992

)

—

—

22,992

Acquisition and integration costs (3)

—

(492

)

—

4,887

—

—

—

(4,395

)

Gain on sale of asset and divestiture

related costs (5)

—

—

—

(1,505

)

—

—

(72,027

)

(70,522

)

Adjusted

$

168,526

$

110,954

$

173,159

$

220,775

$

—

$

—

$

—

$

(45,076

)

Nine Months Ended September

30, 2023

Cost of Sales (9)

Research & Development

Expenses

Sales & Marketing

Expenses

General & Administrative

Expenses

Amortization of acquired

intangible assets

Impairment of Long- Lived

Assets

Other Operating Income

Income (Loss) from

Operations

Reported

$

482,383

$

310,960

$

536,613

$

672,653

$

68,849

$

621

$

72,027

$

(147,171

)

Amortization of acquired intangible

assets

—

—

—

—

(68,849

)

—

—

68,849

Acquisition and integration costs (3)

—

(492

)

—

8,638

—

—

—

(8,146

)

Impairment of long-lived assets (4)

—

—

—

—

—

(621

)

—

621

Gain on sale of asset and divestiture

related costs (5)

—

—

—

(1,505

)

—

—

(72,027

)

(70,522

)

Restructuring and business transformation

(6)

—

(723

)

—

(184

)

—

—

—

907

Legal settlement (8)

—

—

—

(36,186

)

—

—

—

36,186

Adjusted

$

482,383

$

309,745

$

536,613

$

643,416

$

—

$

—

$

—

$

(119,276

)

(1) Interest expense includes net gains recorded of $10.3

million and $10.3 million for the nine months ended September 30,

2024 and September 30, 2023, respectively, from the settlement of

convertible notes. The gains represent the difference between (i)

the fair value of the consideration transferred and (ii) the sum of

the carrying value of the debt at the time of the exchange.

(2) Represents stock-based compensation expense and 401(k) match

expense. The Company matches a portion of Exact Sciences employees’

contributions annually in the form of the Company’s common

stock.

(3) Represents acquisition and related integration costs

incurred as a result of the Company’s business combinations.

Acquisition costs represent legal and professional fees incurred to

execute the transaction. There were no acquisition costs incurred

for the three and nine months ended September 30, 2024 and there

was an insignificant amount incurred for the three and nine months

ended September 30, 2023 related to the acquisition of Resolution

Bioscience, Inc. Integration related costs represent expenses

incurred outside regular business operations, specifically relating

to the integration of businesses acquired through a business

combination. This includes any gain or loss on contingent

consideration liabilities, severance and accelerated vesting of

stock awards, and professional services. The remeasurement of the

contingent consideration liabilities resulted in an expense of $5.3

million and a gain of $2.3 million for the three and nine months

ended September 30, 2024, respectively. The remeasurement of the

contingent consideration liabilities resulted in a gain of $8.4

million and $13.1 million for the three and nine months ended

September 30, 2023, respectively. The Company also incurred

severance costs and professional service fees which were not

significant for the three and nine months ended September 30, 2024

and 2023. The majority of the professional service fees relate to

the integration of information technology systems.

(4) Represents impairment charges on the Company’s long-lived

assets. For the three and nine months ended September 30, 2024, the

Company recorded impairment charges related to certain of our

domestic facilities. For the nine months ended September 30, 2023,

the Company recorded an insignificant impairment to building leases

that were vacated during the year.

(5) Relates to the sale of the intellectual property and

know-how related to the Company’s Oncotype DX Genomic Prostate

Score® (“GPS”) test to MDxHealth SA (“MDxHealth”) in August 2022

and the subsequent Second Amendment to the Asset Purchase Agreement

related to the sale in August 2023. For the three and nine months

ended September 30, 2024, this represents the remeasurement of the

associated contingent consideration. For the three and nine months

ended September 30, 2023, this represents a gain of $3.1 million

from additional cash and equity consideration received, a $68.9

million contingent consideration gain, and $1.5 million in legal

and professional service fees.

(6) Includes costs associated with the Company's business

transformation program intended to consolidate operations, achieve

targeted cost reductions, and focus resources on its key strategic

priorities. For the three and nine months ended September 30, 2024,

this primarily includes severance costs and accelerated stock-based

compensation expense related to the closure of domestic facilities

and related consulting services. For the nine months ended

September 30, 2023, this primarily includes accelerated stock-based

compensation expense and severance costs related to the Company's

international workforce.

(7) The Company terminated its license and sponsored research

agreements with The Translational Genomics Research Institute

related to its Targeted Digital Sequencing technology, which

resulted in the recognition of termination related charges in the

second quarter of 2024.

(8) The Company reached settlements with counterparties related

to the Medicare Date of Service Rule Investigation and the Federal

Anti-Kickback Statute and False Claims Act qui tam lawsuit.

(9) Represents Cost of sales (exclusive of amortization of

acquired intangible assets) from the Company's condensed

consolidated statement of operations.

EXACT SCIENCES

CORPORATION

Selected Unaudited Financial

Information

Condensed Consolidated

Statements of Cash Flows and Reconciliation of Free Cash

Flow

(Amounts in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

138,719

$

24,361

$

163,473

$

86,570

Net cash provided by (used in) investing

activities

(81,716

)

(32,969

)

(400,283

)

116,446

Net cash provided by (used in) financing

activities

(226

)

92

221,375

149,729

Effects of exchange rate changes on cash

and cash equivalents

1,873

(1,235

)

427

(626

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

58,650

(9,751

)

(15,008

)

352,119

Cash, cash equivalents and restricted

cash, beginning of period

536,017

604,660

609,675

242,790

Cash, cash equivalents and restricted

cash, end of period

$

594,667

$

594,909

$

594,667

$

594,909

Reconciliation of free cash flow:

Net cash provided by operating

activities

$

138,719

$

24,361

$

163,473

$

86,570

Purchases of property, plant and

equipment

(26,158

)

(25,187

)

(99,673

)

(89,268

)

Free cash flow

$

112,561

$

(826

)

$

63,800

$

(2,698

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105076239/en/

Investor Contact: Erik Holznecht Exact Sciences Corp.

investorrelations@exactsciences.com 608-535-8659

Media Contact: Steph Spanos Exact Sciences Corp.

sspanos@exactsciences.com 608-556-4380

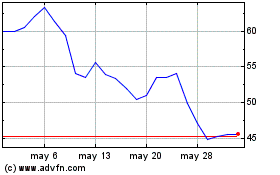

EXACT Sciences (NASDAQ:EXAS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

EXACT Sciences (NASDAQ:EXAS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024