Faraday Future Intelligent Electric Inc. (Nasdaq: FFIE) (“FF”,

“Faraday Future”, or “Company”), a California-based global shared

intelligent electric mobility ecosystem company, has released the

following notice according to THE UNITED STATES DISTRICT COURT,

CENTRAL DISTRICT OF CALIFORNIA, WESTERN DIVISION:

UNITED STATES DISTRICT

COURT

CENTRAL DISTRICT OF

CALIFORNIA

WESTERN DIVISION

IN RE FARADAY FUTURE INTELLIGENT ELECTRIC

INC. DERIVATIVE LITIGATION,

Lead Case No. 2:22-cv-01570-CAS-JC

vs.

Consolidated with

Case No. 2:22-cv-01852-CAS-JC

This Document Relates to:

EXHIBIT D

ALL ACTIONS,

SUMMARY NOTICE OF PENDENCY AND

PROPOSED SETTLEMENT

OF

STOCKHOLDER DERIVATIVE ACTIONS

TO:

ALL RECORD HOLDERS AND BENEFICIAL

OWNERS OF FARADAY FUTURE INTELLIGENT ELECTRIC INC. (“FARADAY” OR

THE “COMPANY”) COMMON STOCK AS OF JULY 19, 2024 (“CURRENT FARADAY

STOCKHOLDERS”).

PLEASE READ THIS NOTICE CAREFULLY AND

IN ITS ENTIRETY. THIS NOTICE RELATES TO A PROPOSED SETTLEMENT AND

DISMISSAL WITH PREJUDICE OF STOCKHOLDER DERIVATIVE LITIGATION AND

CONTAINS IMPORTANT INFORMATION REGARDING YOUR RIGHTS.

IF THE COURT APPROVES THE SETTLEMENT OF

THE DERIVATIVE MATTERS, CURRENT FARADAY STOCKHOLDERS WILL BE

FOREVER BARRED FROM CONTESTING THE APPROVAL OF THE PROPOSED

SETTLEMENT AND DISMISSAL WITH PREJUDICE, AND FROM PURSUING RELEASED

CLAIMS.

THIS ACTION IS NOT A “CLASS ACTION.”

THUS, THERE IS NO COMMON FUND UPON WHICH YOU CAN MAKE A CLAIM FOR A

MONETARY PAYMENT.

YOU ARE HEREBY NOTIFIED that the following stockholder

derivative actions (the “Derivative Actions”), are being settled on

the terms set forth in a Stipulation and Agreement of Settlement

dated July 19, 2024 (the “Stipulation”): (i) the above-captioned

action, titled In re Faraday Future Intelligent Electric Inc.

Derivative Litigation, Lead Case No. 2:22-cv-01570-CAS-JC; (ii)

Wang v. Breitfeld et al., C.A. No. 1:22-cv-00525-GBW (D. Del.);

(iii) Moubarak v. Breitfeld et al., C.A. No. 1:22-cv-00467-GBW (D.

Del.); (iv) Wallace v. Krolicki et al., C.A. No. 2023-0639-LWW

(Del. Ch.); and (v) Farazmand v. Breitfeld et al., C.A. No.

2023-1283-LWW (Del. Ch.).

The Derivative Actions allege that, inter alia, between January

28, 2021 through April 14, 2022, at least, the Individual

Defendants1 breached their fiduciary duties by issuing and/or

causing the Company to issue materially false and misleading

statements (including by soliciting a materially false and

misleading proxy statement allegedly in violation of Section 14(a)

of the Securities Exchange Act of 1934). Plaintiffs allege that the

Individual Defendants failed to disclose material facts to the

public regarding, among other things, the extent of Defendant

Yueting Jia’s involvement within the Company following the Merger,

and the number of reservations the Company had received for the FF

91, its flagship vehicle, and failed to maintain adequate internal

controls. The Derivative Actions allege that, as a result of the

foregoing, the Company experienced reputational and financial harm.

Defendants have denied and continue to deny each and all of the

claims and allegations of wrongdoing asserted in the Derivative

Actions.

Pursuant to the terms of the Settlement, Faraday agrees to

implement and maintain certain corporate governance reforms that

are outlined in Exhibit A to the Stipulation (the “Reforms”). The

Reforms shall be maintained for three (3) years. The independent

members of Faraday’s Board approved a resolution reflecting its

determination that the Settlement, and separately, the Reforms, are

in the best interest of Faraday. Faraday and its Board acknowledge

and agree that Plaintiffs’ efforts, including investigating,

preparing, commencing, and prosecuting the Derivative Actions, were

the cause of the adoption, implementation, and maintenance of the

Reforms. Faraday and its Board also acknowledge and agree that the

Reforms confer substantial benefits on the Company and its

stockholders.

After negotiating the principal terms of the Stipulation,

counsel for the Parties, with the assistance of the Mediator,

negotiated the attorneys’ fees and expenses to be paid to

Plaintiffs’ Counsel, subject to Court approval (the “Fee and

Expense Amount”). In light of the substantial benefits conferred

upon the Company and its stockholders, Defendants’ insurers shall

pay to Plaintiffs’ Counsel seven hundred and seventy-five thousand

dollars ($775,000.00) for their attorneys’ fees and expenses,

subject to Court approval. Defendants also agreed not to object to

the request for the Court to approve Service Awards of up to two

thousand dollars ($2,000.00) for each of the five Plaintiffs, to be

paid from the Fee and Expense Amount.

On November 4, 2024 at 10:00 a.m., a hearing (the

“Settlement Hearing”) will be held before the Honorable Christina

A. Snyder at the United States District Court for the Central

District of California, Western Division, United States Courthouse,

350 W. First Street, Courtroom 8D, 8th Floor, Los Angeles,

California 90012, for the purpose of determining whether the

Settlement should be approved as fair, reasonable, and adequate and

whether the Court should approve the agreed-to Fee and Expense

Amount and the Service Awards for Plaintiffs. Because this is

not a class action, except as otherwise provided for in the

Stipulation with respect to the Plaintiffs, no Current Faraday

Stockholder has the right to receive any individual compensation as

a result of the Settlement. Upon final approval of the

Settlement, the Plaintiffs will voluntarily dismiss their

respective complaints in the Derivative Actions with prejudice.

This Summary Notice provides a condensed overview of certain

provisions of the Stipulation and the full Notice of Pendency and

Proposed Settlement of Stockholder Derivative Actions (the

“Notice”). It is not a complete statement of the events of the

Derivative Actions or the terms set forth in the Stipulation. This

summary should be read in conjunction with, and is qualified in its

entirety by reference to, the text of the Stipulation and its

exhibits. For additional information about the claims asserted in

the Derivative Actions, and the terms of the proposed Settlement,

you may inspect the full Notice and the Stipulation and its

exhibits and other papers at the Clerk’s office in the Court at any

time during regular business hours. In addition, copies of the

Stipulation and its exhibits and the Notice are available on the

Investor Relations page of the Company’s website,

https://investors.ff.com/.

The Court may, in its discretion, change the date, time, or

format of the Settlement Hearing without further notice to you. If

you intend to attend the Settlement Hearing, please consult the

Court’s calendar or Investor Relations page of the Company’s

website, https://investors.ff.com/, for any change in the date,

time, or format of the Settlement Hearing.

Inquiries about the Derivative Actions or the Settlement may be

made to: Timothy Brown, The Brown Law Firm, P.C., 767 Third Avenue,

Suite 2501, New York, NY 10017, Telephone: (516) 922-5427, Email:

tbrown@thebrownlawfirm.net.

You may enter an appearance before the Court, at your own

expense, individually or through counsel of your choice. If you

want to object at the Settlement Hearing, you must be a Current

Faraday Stockholder and you must first comply with the procedures

for objecting that are set forth in the Notice. Any objection to

any aspect of the Settlement must be filed with the Clerk of the

Court and sent to Plaintiffs’ Counsel and Defendants’ Counsel no

later than October 14, 2024 (21 days before the Settlement

Hearing), in accordance with the procedures set forth in the

Stipulation and the Notice. Any Current Faraday Stockholder who

fails to object in accordance with such procedures will be bound by

the Order and Final Judgment of the Court granting final approval

to the Settlement and the releases of claims therein, and shall be

deemed to have waived the right to object (including the right to

appeal) and forever shall be barred, in this proceeding or in any

other proceeding, from raising such objection.

PLEASE DO NOT CALL THE COURT OR DEFENDANTS WITH QUESTIONS

ABOUT THE SETTLEMENT.

ABOUT FARADAY FUTURE

Faraday Future is the pioneer of the Ultimate AI TechLuxury

ultra spire market in the intelligent EV era, and the disruptor of

the traditional ultra-luxury car civilization epitomized by Ferrari

and Maybach. FF is not just an EV company, but also a

software-driven intelligent internet company. Ultimately FF aims to

become a User Company by offering a shared intelligent mobility

ecosystem. FF remains dedicated to advancing electric vehicle

technology to meet the evolving needs and preferences of users

worldwide, driven by a pursuit of intelligent and AI-driven

mobility.

FORWARD LOOKING STATEMENTS

This press release includes “forward looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. When used in this

press release, the words “estimates,” “projected,” “expects,”

“anticipates,” “forecasts,” “plans,” “intends,” “believes,”

“seeks,” “may,” “will,” “should,” “future,” “propose” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements, which

include statements regarding co-investment in an office building

development, the timing for breaking ground on and taking occupancy

at the development, operations, sales and manufacturing in the UAE,

, are not guarantees of future performance, conditions or results,

and involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside

the Company’s control, that could cause actual results or outcomes

to differ materially from those discussed in the forward-looking

statements.

Important factors, among others, that may affect actual results

or outcomes include, among others: that the development of the

contemplated office building could be delayed or not occur at all;

the Company’s ability to continue as a going concern and improve

its liquidity and financial position; the Company’s ability to pay

its outstanding obligations; the Company's ability to remediate its

material weaknesses in internal control over financial reporting

and the risks related to the restatement of previously issued

consolidated financial statements; the Company’s limited operating

history and the significant barriers to growth it faces; the

Company’s history of losses and expectation of continued losses;

the success of the Company’s payroll expense reduction plan; the

Company’s ability to execute on its plans to develop and market its

vehicles and the timing of these development programs; the

Company’s estimates of the size of the markets for its vehicles and

cost to bring those vehicles to market; the rate and degree of

market acceptance of the Company’s vehicles; the Company’s ability

to cover future warrant claims; the success of other competing

manufacturers; the performance and security of the Company’s

vehicles; current and potential litigation involving the Company;

the Company’s ability to receive funds from, satisfy the conditions

precedent of and close on the various financings described

elsewhere by the Company; the result of future financing efforts,

the failure of any of which could result in the Company seeking

protection under the Bankruptcy Code; the Company’s indebtedness;

the Company’s ability to cover future warranty claims; the

Company’s ability to use its “at-the-market” program; insurance

coverage; general economic and market conditions impacting demand

for the Company’s products; potential negative impacts of a reverse

stock split; potential cost, headcount and salary reduction actions

may not be sufficient or may not achieve their expected results;

circumstances outside of the Company's control, such as natural

disasters, climate change, health epidemics and pandemics,

terrorist attacks, and civil unrest; risks related to the Company's

operations in China; the success of the Company's remedial measures

taken in response to the Special Committee findings; the Company’s

dependence on its suppliers and contract manufacturer; the

Company's ability to develop and protect its technologies; the

Company's ability to protect against cybersecurity risks; and the

ability of the Company to attract and retain employees, any adverse

developments in existing legal proceedings or the initiation of new

legal proceedings, and volatility of the Company’s stock price. You

should carefully consider the foregoing factors and the other risks

and uncertainties described in the “Risk Factors” section of the

Company’s Form 10-K filed with the SEC on May 28, 2024, as amended

on May 30, 2024, and June 24, 2024, as updated by the “Risk

Factors” section of the Company’s first quarter 2024 Form 10-Q

filed with the SEC on July 30, 2024, and other documents filed by

the Company from time to time with the SEC.

1 All capitalized terms that are not otherwise defined shall

have the definitions as set forth in the Stipulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240913531184/en/

Investors (English): ir@faradayfuture.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

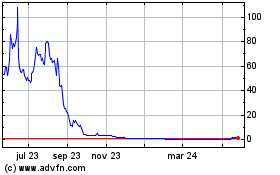

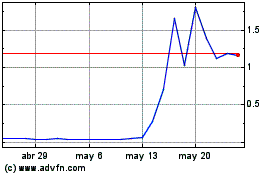

Faraday Future Intellige... (NASDAQ:FFIE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Faraday Future Intellige... (NASDAQ:FFIE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024