FTAI Aviation Announces Expiration and Results of Cash Tender Offer for Any and All of Its Outstanding 6.50% Senior Notes Due 2025

11 Abril 2024 - 5:00AM

FTAI Aviation Ltd. (NASDAQ: FTAI), a Cayman Islands exempted

company (the “Company” or “FTAI”) is announcing today the

expiration and results of Fortress Transportation and

Infrastructure Investors LLC’s (“FTAI LLC”), a wholly owned

subsidiary of the Company, offer to purchase for cash (the “Tender

Offer”) any and all of the $650.0 million outstanding principal

amount of its 6.50% Senior Notes due 2025 (the “2025 Senior Notes”)

on the terms and conditions described in FTAI LLC’s Offer to

Purchase, dated April 2, 2024 (the “Offer to Purchase”).

Capitalized terms used but not defined in this announcement have

the meanings given to them in the Offer to Purchase.

The Tender Offer expired at 5:00 p.m., New York

City time, on April 8, 2024 (such date and time, the "Expiration

Date"). For holders who delivered a Notice of Guaranteed Delivery

and all other required documentation at or prior to the Expiration

Date, upon the terms and subject to the conditions set forth in the

Offer to Purchase and Notice of Guaranteed Delivery, the deadline

to validly tender 2025 Senior Notes using the guaranteed delivery

procedures set forth in the Offer to Purchase (the "Guaranteed

Delivery Procedures") was 5:00 p.m., New York City time, on April

10, 2024. The Settlement Date for the Offer is April 11, 2024 (the

"Settlement Date").

According to the information received from D.F.

King & Co., Inc., the Tender Agent and Information Agent for

the Tender Offer, as of the Expiration Date, $324,630,000.00

aggregate principal amount of the 2025 Senior Notes were validly

tendered and not validly withdrawn (including 2025 Senior Notes

tendered pursuant to the Guaranteed Delivery Procedures). The table

below provides certain information about the tender offer,

including the aggregate principal amount of the 2025 Senior Notes

validly tendered and not validly withdrawn.

|

Series of Notes |

CUSIP Number |

Aggregate Principal Amount Outstanding |

Aggregate Principal Amount Tendered and Accepted for

Purchase |

Tender Consideration(1) |

|

6.50%Senior Notes due 2025 |

34960P AB7 (144A) U3458L AD3 (Reg S) |

$650,000,000 |

$324,630,000.00 |

$1,000 |

(1) Per $1,000 principal amount of Notes validly

tendered (and not validly withdrawn) and accepted for purchase by

us. Does not include accrued but unpaid interest, which will also

be payable as provided in the Offer to Purchase.

FTAI LLC plans to accept for purchase

$324,630,000.00 aggregate principal amount of 2025 Senior Notes

under the Tender Offer (including 2025 Senior Notes delivered

pursuant to the Guaranteed Delivery Procedures).

In addition to the Tender Consideration, Holders

whose 2025 Senior Notes are accepted for purchase will also receive

a cash payment representing the accrued and unpaid interest on such

2025 Senior Notes from the last interest payment date up to, but

not including, the Settlement Date. Interest will cease to accrue

on the Settlement Date for all accepted 2025 Senior Notes,

including those tendered through the Guaranteed Delivery

Procedures.

Morgan Stanley & Co. LLC is acting as the

sole Dealer Manager for the Tender Offer. D.F. King & Co., Inc.

has been retained to serve as the Tender and Information Agent for

the Tender Offer. Questions regarding the Tender Offer may be

directed to Morgan Stanley & Co. LLC at: (800) 624-1808

(toll-free) or (212) 761-1057 (collect).

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy, or an offer to

purchase or a solicitation of an offer to sell any securities.

Neither this press release nor the Offer to Purchase is an offer to

sell or a solicitation of an offer to buy any securities. The

Tender Offer is being made only pursuant to the Offer to Purchase

and only in such jurisdictions as is permitted under applicable

law. In any jurisdiction in which the Tender Offer is required to

be made by a licensed broker or dealer, the Tender Offer will be

deemed to be made on behalf of FTAI LLC by the Dealer Manager, or

one or more registered brokers or dealers that are licensed under

the laws of such jurisdiction.About FTAI Aviation

Ltd.

FTAI owns and maintains commercial jet engines

with a focus on CFM56 and V2500 engines. FTAI’s propriety portfolio

of products, including The Module Factory and a joint venture to

manufacture engine PMA, enables it to provide cost savings and

flexibility to our airline, lessor, and maintenance, repair, and

operations customer base. Additionally, FTAI owns and leases jet

aircraft which often facilitates the acquisition of engines at

attractive prices. FTAI invests in aviation assets and aerospace

products that generate strong and stable cash flows with the

potential for earnings growth and asset appreciation.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements in this press release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

are based on management’s current expectations and beliefs and are

subject to a number of trends and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements, many of which are beyond the Company’s

control, and include, but are not limited to our ability to

complete the offering of a new series of senior notes and our

ability to complete the Tender Offer on the terms contemplated, or

at all. The Company can give no assurance that its expectations

will be attained and such differences may be material. Accordingly,

you should not place undue reliance on any forward-looking

statements contained in this press release. For a discussion of

some of the risks and important factors that could affect such

forward-looking statements, see the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

which are available on the Company’s website

(www.ftaiaviation.com). In addition, new risks and uncertainties

emerge from time to time, and it is not possible for the Company to

predict or assess the impact of every factor that may cause its

actual results to differ from those contained in any

forward-looking statements. Such forward-looking statements speak

only as of the date of this press release. The Company expressly

disclaims any obligation to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with regard

thereto or change in events, conditions or circumstances on which

any statement is based. This release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities.

For further information, please

contact:

Alan AndreiniInvestor RelationsFTAI Aviation

Ltd.(646) 734-9414

Source: FTAI Aviation Ltd.

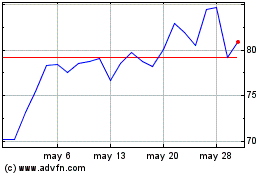

FTAI Aviation (NASDAQ:FTAI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

FTAI Aviation (NASDAQ:FTAI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025