Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 Noviembre 2024 - 8:04AM

Edgar (US Regulatory)

| Sprott Focus Trust |

September 30, 2024 (unaudited) |

Schedule of Investments

| Security Description | |

Shares | | |

Value | |

| COMMON STOCKS (94.09%) | |

| | | |

| | |

| Consumer Discretionary (6.34%) | |

| | | |

| | |

| Automobiles (2.06%) | |

| | | |

| | |

| Thor Industries, Inc.(a) | |

| 50,000 | | |

$ | 5,494,500 | |

| Specialty Retail (4.28%) | |

| | | |

| | |

| Buckle, Inc. (The) | |

| 260,000 | | |

| 11,432,200 | |

| Total Consumer Discretionary (Cost $8,210,120) | |

| | | |

| 16,926,700 | |

| | |

| | | |

| | |

| Consumer Staples (3.36%) | |

| | | |

| | |

| Food Products (3.36%) | |

| | | |

| | |

| Cal-Maine Foods, Inc. | |

| 120,000 | | |

| 8,980,800 | |

| Total Consumer Staples (Cost $3,976,908) | |

| | | |

| 8,980,800 | |

| | |

| | | |

| | |

| Energy (12.92%) | |

| | | |

| | |

| Energy Equipment & Services (8.31%) | |

| | | |

| | |

| Helmerich & Payne, Inc. | |

| 330,000 | | |

| 10,038,600 | |

| Pason Systems, Inc.(a) | |

| 1,080,000 | | |

| 10,644,682 | |

| Smart Sand, Inc.(b) | |

| 750,000 | | |

| 1,477,500 | |

| | |

| | | |

| 22,160,782 | |

| Oil, Gas & Consumable Fuels (4.61%) | |

| | | |

| | |

| Exxon Mobil Corp. | |

| 105,000 | | |

| 12,308,100 | |

| Total Energy (Cost $27,159,100) | |

| | | |

| 34,468,882 | |

| | |

| | | |

| | |

| Financials (14.87%) | |

| | | |

| | |

| Capital Markets (11.85%) | |

| | | |

| | |

| Artisan Partners Asset Management, Inc.(a) | |

| 280,000 | | |

| 12,129,600 | |

| Ashmore Group PLC | |

| 2,750,000 | | |

| 7,537,057 | |

| Federated Hermes, Inc. | |

| 325,000 | | |

| 11,950,250 | |

| | |

| | | |

| 31,616,907 | |

| Financial Services (3.02%) | |

| | | |

| | |

| Berkshire Hathaway, Inc.(b) | |

| 17,500 | | |

| 8,054,550 | |

| Total Financials (Cost $28,570,268) | |

| | | |

| 39,671,457 | |

| | |

| | | |

| | |

| Industrials (5.77%) | |

| | | |

| | |

| Aerospace & Defense (0.19%) | |

| | | |

| | |

| AerSale Corp.(b) | |

| 100,000 | | |

| 505,000 | |

| Commercial Services & Supplies (2.26%) | |

| | | |

| | |

| Societe BIC SA | |

| 90,000 | | |

| 6,051,080 | |

| Marine Transportation (3.32%) | |

| | | |

| | |

| Clarkson PLC | |

| 180,000 | | |

| 8,855,958 | |

| Total Industrials (Cost $12,661,850) | |

| | | |

| 15,412,038 | |

| | |

| | | |

| | |

| Information Technology (3.06%) | |

| | | |

| | |

| Electronic Equipment, Instruments & Components (2.13%) | |

| | | |

| | |

| Vishay Intertechnology, Inc.(a) | |

| 300,000 | | |

| 5,673,000 | |

| Semiconductors & Semiconductor Equipment (0.93%) | |

| | | |

| | |

| Cirrus Logic, Inc.(b) | |

| 20,000 | | |

| 2,484,200 | |

| Total Information Technology (Cost $6,894,556) | |

| | | |

| 8,157,200 | |

| | |

| | | |

| | |

| Materials (38.70%) | |

| | | |

| | |

| Chemicals (6.07%) | |

| | | |

| | |

| CF Industries Holdings, Inc. | |

| 75,000 | | |

| 6,435,000 | |

| Sprott Focus Trust |

September 30, 2024 (unaudited) |

| Westlake Corp. | |

| 65,000 | | |

$ | 9,768,850 | |

| | |

| | | |

| 16,203,850 | |

| Metals & Mining (32.63%) | |

| | | |

| | |

| Agnico Eagle Mines Ltd. | |

| 150,000 | | |

| 12,084,000 | |

| Alamos Gold, Inc. | |

| 300,000 | | |

| 5,982,000 | |

| Gemfields Group Ltd.(a) | |

| 11,999,943 | | |

| 1,875,263 | |

| Major Drilling Group International, Inc.(b) | |

| 1,680,000 | | |

| 10,397,131 | |

| Nucor Corp. | |

| 75,000 | | |

| 11,275,500 | |

| Osisko Gold Royalties Ltd. | |

| 340,000 | | |

| 6,293,400 | |

| Pan American Silver Corp. | |

| 240,000 | | |

| 5,008,800 | |

| Radius Recycling, Inc. | |

| 300,000 | | |

| 5,562,000 | |

| Reliance, Inc. | |

| 40,000 | | |

| 11,568,400 | |

| Seabridge Gold, Inc.(b) | |

| 300,000 | | |

| 5,037,000 | |

| Steel Dynamics, Inc. | |

| 95,000 | | |

| 11,977,600 | |

| | |

| | | |

| 87,061,094 | |

| Total Materials (Cost $73,100,261) | |

| | | |

| 103,264,944 | |

| | |

| | | |

| | |

| Real Estate (9.07%) | |

| | | |

| | |

| Real Estate Management & Development (9.07%) | |

| | | |

| | |

| FRP Holdings, Inc.(b) | |

| 270,000 | | |

| 8,062,200 | |

| Kennedy-Wilson Holdings, Inc. | |

| 850,000 | | |

| 9,392,500 | |

| Marcus & Millichap, Inc. | |

| 170,000 | | |

| 6,737,100 | |

| | |

| | | |

| 24,191,800 | |

| Total Real Estate (Cost $20,472,557) | |

| | | |

| 24,191,800 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS (Cost $181,045,620) | |

| | | |

| 251,073,821 | |

| Repurchase Agreement (5.90%) | |

| | | |

| | |

Fixed Income Clearing Corporation, 1.52% dated 09/30/24, due 10/01/24, maturity value $15,755,909

(collateralized by obligations of various U.S. Treasury Note, 3.75% due 12/31/28, valued at $16,070,379) | |

| | | |

| 15,755,243 | |

| Total Repurchase Agreements (Cost $15,755,243) | |

| | | |

| 15,755,243 | |

| | |

| | | |

| | |

| Securities Lending Collateral (0.01%) | |

| | | |

| | |

| State Street Navigator Securities Lending Government Money Market Portfolio(c) | |

| 21,528 | | |

| 21,528 | |

| Total Securities Lending Collateral (Cost $21,528) | |

| | | |

| 21,528 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS - 100.00% (Cost $196,822,391) | |

| | | |

| 266,850,592 | |

| | |

| | | |

| | |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.00% | |

| | | |

| 380 | |

| NET ASSETS - 100.00% | |

| | | |

$ | 266,850,972 | |

| (a) | Security (or a portion of the security) is on loan. As of September

30, 2024, the market value of securities loaned was $15,442,583. The loaned securities were secured with cash collateral of $21,528 and

non-cash collateral with a value of $15,766,455. The non-cash collateral received consists of equity securities, and is held for the

benefit of the Fund at or in an account in the name of the Fund’s custodian. The Fund cannot repledge or resell this collateral. Collateral is calculated based

on prior day’s prices. |

| (c) | Represents an investment of securities purchased from cash collateral

received from lending of portfolio securities. |

Sprott Focus Trust

September 30,

2024 (unaudited)

Portfolio Valuation and Methodologies:

Securities are valued as of the close of trading

on the New York Stock Exchange (NYSE) (generally 4:00 p.m. Eastern time) on the valuation date. All exchange traded securities are valued

using the last trade or closing sale price from the primary publicly recognized exchange. If no current closing sale price is available,

the mean of the closing bid and ask price is used. If no current day price quotation is available, the previous business day’s closing

sale price is used. Investments in open-end mutual funds such as money market funds are valued at the closing NAV. Repurchase agreements

are valued at contract amount plus accrued interest, which approximates market value. The Fund values its non-U.S. dollar denominated

securities in U.S. dollars daily at the prevailing foreign currency exchange rates as quoted by a major bank. If events (e.g., market

volatility, company announcement or a natural disaster) occur that are expected to materially affect the value of the Fund’s investment,

or in the event that it is determined that valuation results in a price for an investment that is deemed not to be representative of the

market value of such investment, or if a price is not available, the investment will be valued in accordance with the Sprott Asset Management USA, Inc. (the “Adviser”)

policies and procedures as reflecting fair value (“Fair Value Policies and Procedures”). U.S. GAAP defines fair value as the

price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the

measurement date. The Board of Directors of the Fund (the “Board”) has approved the designation of the Adviser of the Fund

as the valuation designee for the Fund. If a security’s market price is not readily available or does not otherwise accurately represent

the fair value of the security, the security will be valued in accordance with the Fair Value Policies and Procedures as reflecting fair

value. The Adviser has formed a committee (the “Valuation Committee”) to develop pricing policies and procedures and to oversee

the pricing function for all financial instruments.

Fair Value Hierarchy:

The fair valuation approaches that may be used

by the Valuation Committee include market approach, income approach and cost approach. Valuation techniques such as discounted cash flow,

use of market comparables and matrix pricing are types of valuation approaches and are typically used in determining fair value. When

determining the price for fair valued investments, the Valuation Committee seeks to determine the price that the Fund might reasonably

expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value

determinations shall be based upon all available factors that the Valuation Committee deems relevant and consistent with the principles

of fair value measurement.

Various inputs are used in determining the value

of the Fund’s investments, as noted above. These inputs are summarized in the three broad levels below:

Level 1 – quoted prices in active markets

for identical securities.

Level 2 – other significant observable

inputs.

Level 3 – significant unobservable inputs.

The inputs or methodology used for valuing securities

are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the Fund’s investments

as of September 30, 2024 based on the inputs used to value them. For a detailed breakout of common stocks by sector classification, please

refer to the Schedule of Investments.

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks | |

$ | 251,073,821 | | |

$ | — | | |

$ | — | | |

$ | 251,073,821 | |

| Repurchase Agreements | |

| — | | |

| 15,755,243 | | |

| — | | |

| 15,755,243 | |

| Securities Lending Collateral | |

| 21,528 | | |

| — | | |

| — | | |

| 21,528 | |

| Total | |

$ | 251,095,349 | | |

$ | 15,755,243 | | |

$ | — | | |

$ | 266,850,592 | |

There were no transfers between levels for investments

held at the end of the period.

Sprott Focus Trust

September 30,

2024 (unaudited)

Common Stock:

The Fund invests a significant amount of assets

in common stock. The value of common stock held by the Fund will fluctuate, sometimes rapidly and unpredictably, due to general market

and economic conditions, perceptions regarding the industries in which the issuers of common stock held by the Fund participate or factors

relating to specific companies in which the Fund invests.

Repurchase Agreements:

The Fund may enter into repurchase agreements

with institutions that the Fund’s investment adviser has determined are creditworthy. The Fund restricts repurchase agreements to

maturities of no more than seven days. Securities pledged as collateral for repurchase agreements, which are held until maturity of the

repurchase agreements, are marked-to-market daily and maintained at a value at least equal to the principal amount of the repurchase agreement

(including accrued interest). Repurchase agreements could involve certain risks in the event of default or insolvency of the counter-party,

including possible delays or restrictions upon the ability of the Fund to dispose of its underlying securities. The maturity associated

with these securities is considered continuous.

Lending of Portfolio Securities:

The Fund, using State Street Bank and Trust

Company (“State Street”) as its lending agent, may loan securities to qualified brokers and dealers in exchange for

negotiated lenders’ fees. The Fund receives cash collateral, which may be invested by the lending agent in short-term

instruments. Collateral for securities on loan is at least equal to 102% (for loans of U.S. securities) or 105% (for loans of

non-U.S. securities) of the market value of the loaned securities at the inception of each loan. The market value of the loaned

securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the

next business day. As of September 30, 2024, the cash collateral received by the Fund was invested in the State Street Navigator

Securities Lending Government Money Market Portfolio, which is a 1940 Act registered money market fund. To the extent that advisory

or other fees paid by the State Street Navigator Securities Lending Government Money Market Portfolio are for the same or similar

services as fees paid by the Fund, there will be a layering of fees, which would increase expenses and decrease returns. Information

regarding the value of the securities loaned and the value of the collateral at period end is included in the Schedule of

Investments. The Fund could experience a delay in recovering its securities, a possible loss of income or value and record realized

gain or loss on securities deemed sold due to a borrower’s inability to return securities on loan. These loans involve the

risk of delay in receiving additional collateral in the event that the collateral decreases below the value of the securities loaned

and the risks of the loss of rights in the collateral should the borrower of the securities experience financial difficulties.

Pursuant to the current securities lending agreement,

the Fund retains 80% of securities lending income (which excludes collateral investment expenses). Securities lending income is generally

equal to the total of income earned from the reinvestment of cash collateral (and excludes collateral investment fees), and any fees or

other payments to and from borrowers of securities. State Street bears all operational costs directly related to securities lending.

As of September 30, 2024, the Fund had outstanding

loans of securities to certain approved brokers for which the Fund received collateral:

Market Value of

Loaned Securities | | |

Market Value of

Cash Collateral | | |

Market Value of

Non-Cash

Collateral | | |

Total

Collateral | |

| $ | 15,442,583 | | |

$ | 21,528 | | |

$ | 15,766,455 | | |

$ | 15,787,983 | |

All securities on loan are classified as Common Stock in the Fund’s Schedule of Investments as of September 30, 2024, with a contractual

maturity of overnight and continuous.

Other information regarding the Fund is available

in the Fund’s most recent Report to Stockholders. This information is available through Sprott Asset Management’s website (www.sprottfocustrust.com)

and on the Securities and Exchange Commission’s website (www.sec.gov).

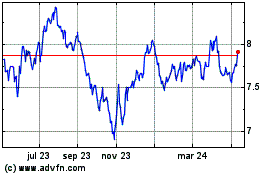

Sprott Focus (NASDAQ:FUND)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

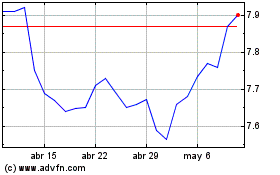

Sprott Focus (NASDAQ:FUND)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024