Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Mayo 2024 - 8:51AM

Edgar (US Regulatory)

| Sprott Focus Trust |

March 31, 2024 (unaudited) |

Schedule of Investments

| Security Description | |

Shares | | |

Value | |

| COMMON STOCKS (94.99%) |

| Consumer Discretionary (6.60%) | |

| |

| Automobiles (2.62%) |

| Thor Industries, Inc.(a) | |

| 60,000 | | |

$ | 7,040,400 | |

| Specialty Retail (3.98%) |

| Buckle, Inc. (The) | |

| 265,000 | | |

| 10,671,550 | |

| Total Consumer Discretionary (Cost $8,753,426) | |

| | | |

| 17,711,950 | |

| | |

| | | |

| | |

| Consumer Staples (3.73%) | |

| | | |

| | |

| Food Products (3.73%) |

| Cal-Maine Foods, Inc. | |

| 170,000 | | |

| 10,004,500 | |

| Total Consumer Staples (Cost $5,895,925) | |

| | | |

| 10,004,500 | |

| | |

| | | |

| | |

| Energy (14.43%) | |

| | | |

| | |

| Energy Equipment & Services (9.88%) |

| Helmerich & Payne, Inc. | |

| 300,000 | | |

| 12,618,000 | |

| Pason Systems, Inc.(a) | |

| 1,080,000 | | |

| 12,469,971 | |

| Smart Sand, Inc.(b) | |

| 750,000 | | |

| 1,432,500 | |

| | |

| | | |

| 26,520,471 | |

| Oil, Gas & Consumable Fuels (4.55%) |

| Exxon Mobil Corp. | |

| 105,000 | | |

| 12,205,200 | |

| Total Energy (Cost $26,120,031) | |

| | | |

| 38,725,671 | |

| | |

| | | |

| | |

| Financials (13.60%) | |

| | | |

| | |

| Capital Markets (10.47%) |

| Artisan Partners Asset Management, Inc.(a) | |

| 280,000 | | |

| 12,815,600 | |

| Ashmore Group plc | |

| 1,800,000 | | |

| 4,446,049 | |

| Federated Hermes, Inc. | |

| 300,000 | | |

| 10,836,000 | |

| | |

| | | |

| 28,097,649 | |

| Financial Services (3.13%) |

| Berkshire Hathaway, Inc.(b) | |

| 20,000 | | |

| 8,410,400 | |

| Total Financials (Cost $25,887,581) | |

| | | |

| 36,508,049 | |

| | |

| | | |

| | |

| Industrials (5.07%) | |

| | | |

| | |

| Aerospace & Defense (0.99%) |

| AerSale Corp.(a),(b) | |

| 370,000 | | |

| 2,656,600 | |

| Commercial Services & Supplies (1.06%) |

| Societe BIC SA | |

| 40,000 | | |

| 2,856,794 | |

| Marine Transportation (3.02%) |

| Clarkson plc | |

| 160,000 | | |

| 8,097,953 | |

| Total Industrials (Cost $11,480,118) | |

| | | |

| 13,611,347 | |

| | |

| | | |

| | |

| Information Technology (4.58%) | |

| | | |

| | |

| Electronic Equipment, Instruments & Components (3.55%) |

| Vishay Intertechnology, Inc.(a) | |

| 420,000 | | |

| 9,525,600 | |

| Semiconductors & Semiconductor Equipment (1.03%) |

| Cirrus Logic, Inc.(b) | |

| 30,000 | | |

| 2,776,800 | |

| Total Information Technology (Cost $10,116,267) | |

| | | |

| 12,302,400 | |

| | |

| | | |

| | |

| Materials (38.94%) | |

| | | |

| | |

| Chemicals (5.38%) |

| CF Industries Holdings, Inc. | |

| 45,000 | | |

| 3,744,450 | |

| Westlake Corp.(a) | |

| 70,000 | | |

| 10,696,000 | |

| | |

| | | |

| 14,440,450 | |

|

| Sprott Focus Trust |

March 31, 2024 (unaudited) |

| Security Description | |

Shares | | |

Value | |

| Metals & Mining (33.56%) |

| Agnico Eagle Mines Ltd. | |

| 160,000 | | |

$ | 9,544,000 | |

| Barrick Gold Corp. | |

| 200,000 | | |

| 3,328,000 | |

| Centamin plc | |

| 3,200,000 | | |

| 4,559,895 | |

| Gemfields Group Ltd.(a) | |

| 11,999,945 | | |

| 1,837,373 | |

| Major Drilling Group International, Inc.(b) | |

| 1,500,000 | | |

| 9,966,409 | |

| Nucor Corp. | |

| 65,000 | | |

| 12,863,500 | |

| Osisko Gold Royalties Ltd. | |

| 320,000 | | |

| 5,254,400 | |

| Pan American Silver Corp. | |

| 240,000 | | |

| 3,619,200 | |

| Perenti Ltd. | |

| 3,500,000 | | |

| 2,235,160 | |

| Radius Recycling, Inc. | |

| 320,000 | | |

| 6,761,600 | |

| Reliance, Inc. | |

| 35,000 | | |

| 11,696,300 | |

| Seabridge Gold, Inc.(b) | |

| 360,000 | | |

| 5,443,200 | |

| Steel Dynamics, Inc. | |

| 87,500 | | |

| 12,970,125 | |

| | |

| | | |

| 90,079,162 | |

| Total Materials (Cost $72,907,546) | |

| | | |

| 104,519,612 | |

| | |

| | | |

| | |

| Real Estate (8.04%) | |

| | | |

| | |

| Real Estate Management & Development (8.04%) |

| FRP Holdings, Inc.(b) | |

| 135,000 | | |

| 8,289,000 | |

| Kennedy-Wilson Holdings, Inc. | |

| 850,000 | | |

| 7,293,000 | |

| Marcus & Millichap, Inc.(a) | |

| 175,000 | | |

| 5,979,750 | |

| | |

| | | |

| 21,561,750 | |

| Total Real Estate (Cost $20,702,807) | |

| | | |

| 21,561,750 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS (Cost $181,863,701) | |

| | | |

| 254,945,279 | |

| Repurchase Agreement (5.27%) | |

| | | |

| | |

| Fixed Income Clearing Corporation, 1.60% dated 03/28/24, due 04/01/24, maturity value $14,155,345 (collateralized by obligations of various U.S. Treasury Note, 0.50% due 02/28/26, valued at $14,435,957) | |

| | | |

| 14,152,829 | |

| Total Repurchase Agreements (Cost $14,152,829) | |

| | | |

| 14,152,829 | |

| | |

| | | |

| | |

| Securities Lending Collateral (0.06%) | |

| | | |

| | |

| State Street Navigator Securities Lending Government Money Market Portfolio(c) | |

| 156,916 | | |

| 156,916 | |

| Total Securities Lending Collateral (Cost $156,916) | |

| | | |

| 156,916 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS - 100.32% (Cost $196,173,446) | |

| | | |

| 269,255,024 | |

| | |

| | | |

| | |

| LIABILITIES IN EXCESS OF OTHER ASSETS – (-0.32%) | |

| | | |

| (867,379 | ) |

| NET ASSETS - 100.00% | |

| | | |

$ | 268,387,645 | |

| (a) | Security

(or a portion of the security) is on loan. As of March 31, 2024, the market value of securities loaned was $38,101,444. The loaned securities

were secured with cash collateral of $156,916 and non-cash collateral with a value of $38,762,758. The non-cash collateral received consists

of equity securities, and is held for the benefit of the Fund at the Fund’s custodian. The Fund cannot repledge or resell this

collateral. Collateral is calculated based on prior day’s prices. |

| (c) | Represents

an investment of securities purchased from cash collateral received from lending of portfolio securities. |

Sprott Focus Trust

March 31, 2024 (unaudited)

Portfolio

Valuation and Methodologies:

Securities

are valued as of the close of trading on the New York Stock Exchange (NYSE) (generally 4:00 p.m. Eastern time) on the valuation date.

All exchange traded securities are valued using the last trade or closing sale price from the primary publicly recognized exchange. If

no current closing sale price is available, the mean of the closing bid and ask price is used. If no current day price quotation is available,

the previous business day’s closing sale price is used. Investments in open-end mutual funds such as money market funds are valued

at the closing NAV. Repurchase agreements are valued at contract amount plus accrued interest, which approximates market value. The Fund

values its non-U.S. dollar denominated securities in U.S. dollars daily at the prevailing foreign currency exchange rates as quoted by

a major bank. If events (e.g., market volatility, company announcement or a natural disaster) occur that are expected to materially affect

the value of the Fund’s investment, or in the event that it is determined that valuation results in a price for an investment that

is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued

in accordance with the Adviser’s policies and procedures as reflecting fair value (“Fair Value Policies and Procedures”).

U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction

between market participants at the measurement date. The Board of Directors of the Fund (the “Board”) has approved the designation

of the Adviser of the Fund as the valuation designee for the Fund. If a security’s market price is not readily available or does

not otherwise accurately represent the fair value of the security, the security will be valued in accordance with the Fair Value Policies

and Procedures as reflecting fair value. The Adviser has formed a committee (the “Valuation Committee”) to develop pricing

policies and procedures and to oversee the pricing function for all financial instruments.

Fair

Value Hierarchy:

The

fair valuation approaches that may be used by the Valuation Committee include market approach, income approach and cost approach. Valuation

techniques such as discounted cash flow, use of market comparables and matrix pricing are types of valuation approaches and are typically

used in determining fair value. When determining the price for fair valued investments, the Valuation Committee seeks to determine the

price that the Fund might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length

transaction. Fair value determinations shall be based upon all available factors that the Valuation Committee deems relevant and consistent

with the principles of fair value measurement.

Various

inputs are used in determining the value of the Fund’s investments, as noted above. These inputs are summarized in the three broad

levels below:

Level

1 – quoted prices in active markets for identical securities.

Level

2 – other significant observable inputs (including quoted prices for similar securities, foreign securities that may be fair

valued and repurchase agreements).

Level

3 – significant unobservable inputs.

The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing

in those securities.

The

following is a summary of the Fund’s investments as of March 31, 2024 based on the inputs used to value them. For a detailed breakout

of common stocks by sector classification, please refer to the Schedule of Investments.

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks | |

$ | 254,945,279 | | |

$ | — | | |

$ | — | | |

$ | 254,945,279 | |

| Repurchase Agreements | |

| — | | |

| 14,152,829 | | |

| — | | |

| 14,152,829 | |

| Securities Lending Collateral | |

| 156,916 | | |

| — | | |

| — | | |

| 156,916 | |

| Total | |

$ | 255,102,195 | | |

$ | 14,152,829 | | |

$ | — | | |

$ | 269,255,024 | |

There

were no transfers between levels for investments held at the end of the period.

Sprott Focus Trust

March 31, 2024 (unaudited)

Common

Stock:

The

Fund invests a significant amount of assets in common stock. The value of common stock held by the Fund will fluctuate, sometimes rapidly

and unpredictably, due to general market and economic conditions, perceptions regarding the industries in which the issuers of common

stock held by the Fund participate or factors relating to specific companies in which the Fund invests.

Repurchase Agreements:

The

Fund may enter into repurchase agreements with institutions that the Fund’s investment adviser has determined are creditworthy.

The Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase agreements,

which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at least equal to the

principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve certain risks in the event

of default or insolvency of the counter-party, including possible delays or restrictions upon the ability of the Fund to dispose of its

underlying securities. The maturity associated with these securities is considered continuous.

Lending

of Portfolio Securities:

The

Fund, using State Street Bank and Trust Company (“State Street”) as its lending agent, may loan securities to qualified brokers

and dealers in exchange for negotiated lenders’ fees. The Fund receives cash collateral, which may be invested by the lending agent

in short-term instruments. Collateral for securities on loan is at least equal to 102% (for loans of U.S. securities) or 105% (for loans

of non-U.S. securities) of the market value of the loaned securities at the inception of each loan. The market value of the loaned securities

is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business

day. As March 31, 2024, the cash collateral received by the Fund was invested in the State Street Navigator Securities Lending Government

Money Market Portfolio, which is a 1940 Act registered money market fund. To the extent that advisory or other fees paid by the State

Street Navigator Securities Lending Government Money Market Portfolio are for the same or similar services as fees paid by the Fund,

there will be a layering of fees, which would increase expenses and decrease returns. Information regarding the value of the securities

loaned and the value of the collateral at period end is included in the Schedule of Investments. The Fund could experience a delay in

recovering its securities, a possible loss of income or value and record realized gain or loss on securities deemed sold due to a borrower’s

inability to return securities on loan. These loans involve the risk of delay in receiving additional collateral in the event that the

collateral decreases below the value of the securities loaned and the risks of the loss of rights in the collateral should the borrower

of the securities experience financial difficulties.

Pursuant

to the current securities lending agreement, the Fund retains 80% of securities lending income (which excludes collateral investment

expenses). Securities lending income is generally equal to the total of income earned from the reinvestment of cash collateral (and excludes

collateral investment fees), and any fees or other payments to and from borrowers of securities. State Street bears all operational costs

directly related to securities lending.

As

of March 31, 2024, the Fund had outstanding loans of securities to certain approved brokers for which the Fund received collateral:

Market

Value of Loaned Securities | |

Market

Value of Cash

Collateral | |

Market

Value of Non-Cash Collateral | |

Total

Collateral |

| $38,101,444 | |

$156,916 | |

$38,762,758 | |

$38,919,674 |

All securities on loan are classified as Common Stock in the Fund’s Schedule of Investments as of March 31, 2024, with a contractual

maturity of overnight and continuous.

Other

information regarding the Fund is available in the Fund’s most recent Report to Stockholders. This information is available through

Sprott Asset Management’s website (www.sprottfocustrust.com) and on the Securities and Exchange Commission’s website (www.sec.gov).

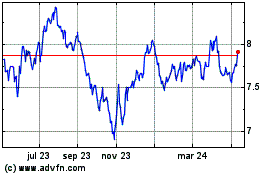

Sprott Focus (NASDAQ:FUND)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

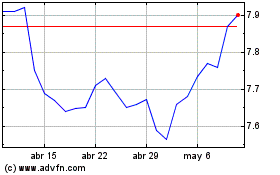

Sprott Focus (NASDAQ:FUND)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025